Key Insights

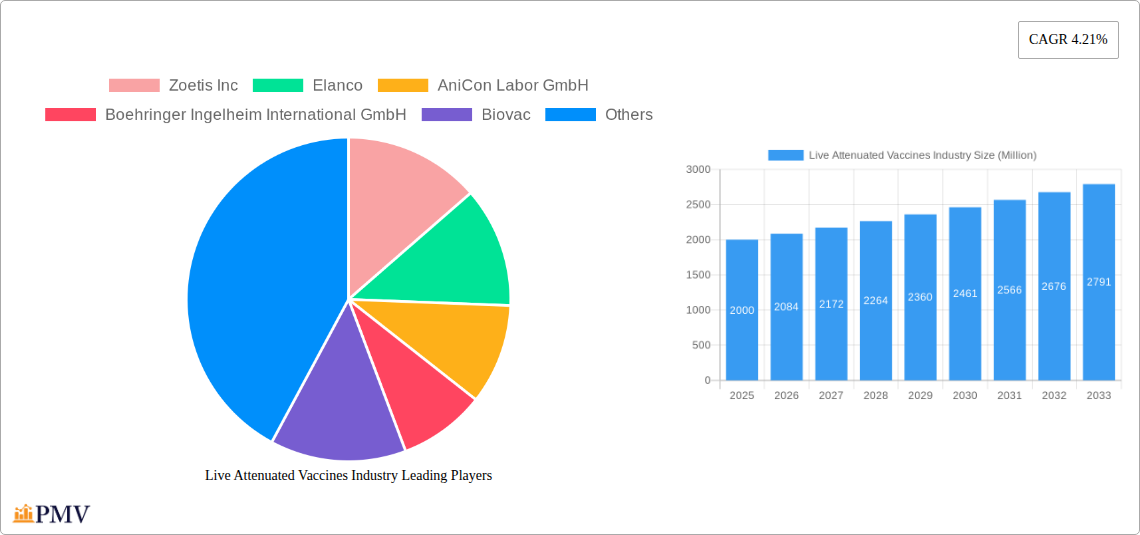

The global live attenuated vaccines market, a significant segment within the broader animal health industry, is projected to experience robust growth over the forecast period (2025-2033). Driven by increasing livestock populations globally, rising awareness of animal health and disease prevention, and the growing demand for safe and effective vaccines, the market is poised for expansion. The increasing prevalence of zoonotic diseases further fuels the demand for preventative measures, strengthening the market's trajectory. Technological advancements in vaccine development, including improved efficacy and reduced side effects, also contribute significantly to market growth. While challenges such as stringent regulatory approvals and the potential for vaccine resistance exist, the overall market outlook remains positive, with a projected CAGR exceeding the overall animal vaccine market's CAGR of 4.21%. The segment's growth is largely fueled by the increasing adoption of live attenuated vaccines in poultry and bovine segments due to their cost-effectiveness and superior immunogenicity compared to other vaccine types. This is further bolstered by the rising demand for high-quality animal protein globally.

Live Attenuated Vaccines Industry Market Size (In Billion)

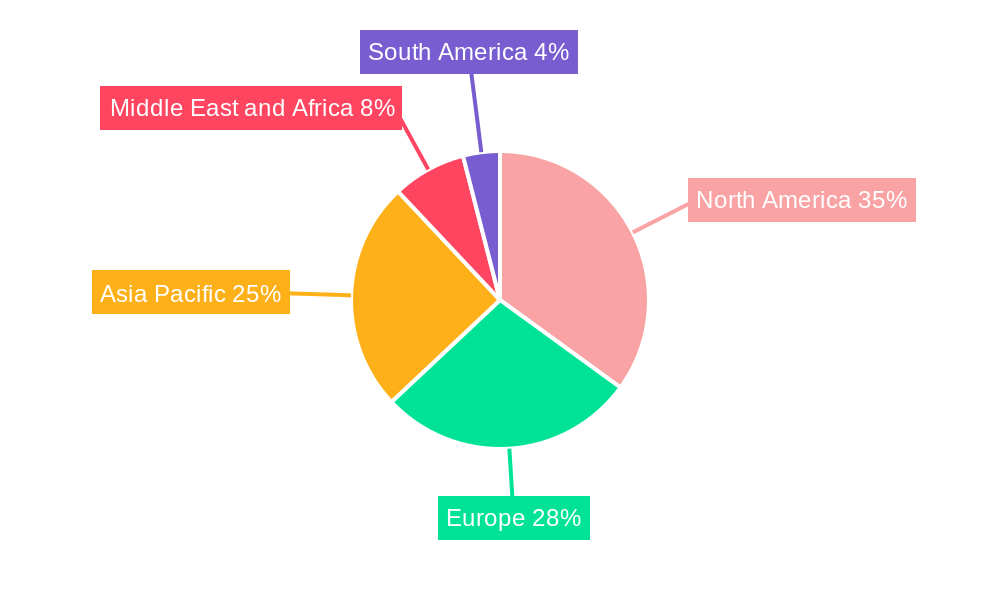

Within the live attenuated vaccine segment, the bovine and poultry vaccine sub-segments are expected to dominate, owing to the large-scale farming practices in these sectors. The geographic distribution of market growth will be uneven, with North America and Europe maintaining significant market shares due to established animal health infrastructure and high veterinary expenditure. However, the Asia-Pacific region, driven by rapid economic growth and increasing livestock farming, is expected to witness substantial growth, presenting lucrative opportunities for market players. Competition within the market is intense, with major players like Zoetis, Elanco, and Boehringer Ingelheim continuously investing in research and development to introduce innovative products and expand their market presence. Strategic collaborations, mergers, and acquisitions will also play a pivotal role in shaping the competitive landscape over the forecast period.

Live Attenuated Vaccines Industry Company Market Share

Live Attenuated Vaccines Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Live Attenuated Vaccines industry, offering valuable insights into market dynamics, competitive landscapes, and future growth prospects. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report is an essential resource for industry stakeholders, investors, and researchers seeking a clear understanding of this crucial sector. The report includes detailed segmentation by product type (Bovine Vaccine, Poultry Vaccine, Porcine Vaccine, Other Livestock Vaccines) and technology (Live Attenuated Vaccine, Inactivated Vaccine, Toxoid Vaccine, Recombinant Vaccine, Other Technologies). The global market is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Live Attenuated Vaccines Industry Market Structure & Competitive Dynamics

The Live Attenuated Vaccines industry exhibits a moderately concentrated market structure, with several key players holding significant market share. The competitive landscape is characterized by intense rivalry, driven by innovation, product differentiation, and strategic acquisitions. Market share data for 2025 estimates that Zoetis Inc. holds approximately xx% of the market, followed by Elanco at xx%, Merck & Co at xx%, and Boehringer Ingelheim International GmbH at xx%. The remaining market share is distributed amongst several smaller players, including AniCon Labor GmbH, Biovac, Animal Science Products Inc, ADL BIONATUR SOLUTIONS S A, Phibro Animal Health Corporation, and Ceva Sante Animale.

Innovation ecosystems play a vital role, with companies investing heavily in R&D to develop novel vaccines and enhance existing technologies. Regulatory frameworks, varying across geographies, significantly impact market access and product approvals. Substitutes, primarily other vaccine technologies and preventative measures, exert competitive pressure. End-user trends, particularly focusing on disease prevention and animal welfare, are driving demand for effective and safe vaccines. M&A activities have been moderately active in recent years, with deal values ranging from xx Million to xx Million, primarily focused on expanding product portfolios and geographical reach. For example, in 2023 a hypothetical merger between two smaller companies resulted in a combined market share of approximately xx%.

Live Attenuated Vaccines Industry Industry Trends & Insights

The Live Attenuated Vaccines market is witnessing robust growth, driven by several key factors. Increasing livestock populations globally, particularly in developing economies, fuel demand for effective disease control measures. Rising consumer awareness of animal health and welfare necessitates the adoption of preventive strategies, further boosting vaccine adoption. Technological advancements, including the development of more effective and safer vaccines, contribute to market expansion. The CAGR for the period 2025-2033 is projected to be xx%, indicating a strong growth trajectory. Market penetration, particularly in emerging markets, remains relatively low, offering significant growth potential. Competitive dynamics continue to shape the industry, with companies focusing on product differentiation, cost optimization, and strategic partnerships to maintain market share. Furthermore, stringent regulations concerning vaccine efficacy and safety enhance the need for continuous improvements in vaccine technology.

Dominant Markets & Segments in Live Attenuated Vaccines Industry

- Leading Region/Country: The Asia-Pacific region is projected to be the dominant market during the forecast period, driven by factors such as rapid growth in livestock production, increasing disposable incomes, and rising awareness regarding animal health management. Specifically, countries like India and China are expected to show exponential growth due to large livestock populations.

- Dominant Product Type: Poultry vaccines are predicted to maintain their leading position throughout the forecast period due to the high density of poultry farms and the vulnerability of poultry to infectious diseases. Bovine vaccines follow closely behind due to the considerable economic value associated with cattle husbandry.

- Dominant Technology: Live attenuated vaccines constitute the largest segment, driven by their efficacy in inducing long-lasting immunity. However, the recombinant vaccine technology segment is also experiencing significant growth due to its potential for higher safety and targeted antigen delivery.

Key drivers for dominance in the APAC region include supportive government policies promoting livestock health, substantial investments in veterinary infrastructure, and growing adoption of advanced vaccination strategies by farmers. Conversely, regulatory hurdles and high production costs somewhat hinder growth in certain regions.

Live Attenuated Vaccines Industry Product Innovations

Recent years have witnessed significant advancements in live attenuated vaccine technology, leading to the development of more effective, safer, and stable vaccines. These innovations leverage advancements in genetic engineering and biotechnology to enhance vaccine efficacy and reduce side effects. The focus is on developing multivalent vaccines targeting multiple diseases simultaneously, thereby improving cost-effectiveness and convenience. These innovations cater to the growing demand for advanced vaccine solutions and enhance the competitive advantages of leading companies.

Report Segmentation & Scope

Product Type: The report segments the market by product type into Bovine Vaccines, Poultry Vaccines, Porcine Vaccines, and Other Livestock Vaccines. Each segment's growth projection, market size, and competitive dynamics are comprehensively analyzed.

Technology: The report further segments the market based on technology into Live Attenuated Vaccines, Inactivated Vaccines, Toxoid Vaccines, Recombinant Vaccines, and Other Technologies. Each technology’s unique characteristics, market share, and growth potential are evaluated. The live attenuated segment currently holds the largest market share with substantial growth potential across all animal species.

Key Drivers of Live Attenuated Vaccines Industry Growth

Several factors fuel the growth of the Live Attenuated Vaccines industry. Firstly, the ever-increasing global livestock population necessitates robust disease prevention strategies. Secondly, rising awareness among farmers regarding animal health and welfare promotes increased vaccine adoption. Thirdly, technological advancements leading to safer and more efficacious vaccines are also boosting market growth. Finally, supportive government policies and initiatives in many developing nations further accelerate market expansion.

Challenges in the Live Attenuated Vaccines Industry Sector

Despite the growth potential, the industry faces challenges. Stringent regulatory approvals, high R&D costs, and complex supply chain logistics are key hurdles. Competitive pressure from generic vaccine manufacturers and the emergence of alternative disease control methods pose additional challenges. These factors, in aggregate, potentially reduce profitability and limit the market's overall growth rate.

Leading Players in the Live Attenuated Vaccines Industry Market

- Zoetis Inc

- Elanco

- AniCon Labor GmbH

- Boehringer Ingelheim International GmbH

- Biovac

- Animal Science Products Inc

- ADL BIONATUR SOLUTIONS S A

- Phibro Animal Health Corporation

- Ceva Sante Animale

- Merck & Co

Key Developments in Live Attenuated Vaccines Industry Sector

- August 2022: The SRTF's agriculture project "Support for the Recovery of Livestock Production Within Northern Aleppo- Phase II" received a third batch of livestock vaccines, indirectly benefiting 57,500 families.

- August 2022: Haryana, India, implemented a mass vaccination campaign for cattle to control the spread of lumpy skin disease, impacting cattle movement and fairs.

These developments highlight the significance of vaccination programs in disease control and the impact of governmental initiatives on market dynamics.

Strategic Live Attenuated Vaccines Industry Market Outlook

The Live Attenuated Vaccines market is poised for continued growth, driven by persistent demand for effective disease prevention and increasing livestock populations globally. Strategic opportunities lie in developing innovative vaccine technologies, expanding into emerging markets, and forging strategic partnerships to enhance market penetration. Focusing on research and development of next-generation vaccines, particularly targeting emerging diseases, will be crucial for sustained market leadership. The industry's future success hinges on navigating regulatory challenges, optimizing supply chains, and fostering collaborations to address global animal health needs.

Live Attenuated Vaccines Industry Segmentation

-

1. Product Type

- 1.1. Bovine Vaccine

- 1.2. Poultry Vaccine

- 1.3. Porcine Vaccine

- 1.4. Other Livestock Vaccines

-

2. Technology

- 2.1. Live Attenuated Vaccine

- 2.2. Inactivated Vaccine

- 2.3. Toxoid Vaccine

- 2.4. Recombinant Vaccine

- 2.5. Other Technologies

Live Attenuated Vaccines Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Live Attenuated Vaccines Industry Regional Market Share

Geographic Coverage of Live Attenuated Vaccines Industry

Live Attenuated Vaccines Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Incidences of Zoonotic Diseases; Initiatives Taken by Various Government Agencies

- 3.2.2 Animal Associations

- 3.2.3 and Leading Players; Widened Focus on Food Safety

- 3.3. Market Restrains

- 3.3.1. Lack of Veterinarians and Shortage of Skilled Farm Workers; High Storage Costs for Vaccines

- 3.4. Market Trends

- 3.4.1. Poultry Vaccine is Expected to Cover a Large Share of the Livestock Vaccines Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Live Attenuated Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bovine Vaccine

- 5.1.2. Poultry Vaccine

- 5.1.3. Porcine Vaccine

- 5.1.4. Other Livestock Vaccines

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Live Attenuated Vaccine

- 5.2.2. Inactivated Vaccine

- 5.2.3. Toxoid Vaccine

- 5.2.4. Recombinant Vaccine

- 5.2.5. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Live Attenuated Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Bovine Vaccine

- 6.1.2. Poultry Vaccine

- 6.1.3. Porcine Vaccine

- 6.1.4. Other Livestock Vaccines

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Live Attenuated Vaccine

- 6.2.2. Inactivated Vaccine

- 6.2.3. Toxoid Vaccine

- 6.2.4. Recombinant Vaccine

- 6.2.5. Other Technologies

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Live Attenuated Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Bovine Vaccine

- 7.1.2. Poultry Vaccine

- 7.1.3. Porcine Vaccine

- 7.1.4. Other Livestock Vaccines

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Live Attenuated Vaccine

- 7.2.2. Inactivated Vaccine

- 7.2.3. Toxoid Vaccine

- 7.2.4. Recombinant Vaccine

- 7.2.5. Other Technologies

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Live Attenuated Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Bovine Vaccine

- 8.1.2. Poultry Vaccine

- 8.1.3. Porcine Vaccine

- 8.1.4. Other Livestock Vaccines

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Live Attenuated Vaccine

- 8.2.2. Inactivated Vaccine

- 8.2.3. Toxoid Vaccine

- 8.2.4. Recombinant Vaccine

- 8.2.5. Other Technologies

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Live Attenuated Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Bovine Vaccine

- 9.1.2. Poultry Vaccine

- 9.1.3. Porcine Vaccine

- 9.1.4. Other Livestock Vaccines

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Live Attenuated Vaccine

- 9.2.2. Inactivated Vaccine

- 9.2.3. Toxoid Vaccine

- 9.2.4. Recombinant Vaccine

- 9.2.5. Other Technologies

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Live Attenuated Vaccines Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Bovine Vaccine

- 10.1.2. Poultry Vaccine

- 10.1.3. Porcine Vaccine

- 10.1.4. Other Livestock Vaccines

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Live Attenuated Vaccine

- 10.2.2. Inactivated Vaccine

- 10.2.3. Toxoid Vaccine

- 10.2.4. Recombinant Vaccine

- 10.2.5. Other Technologies

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Zoetis Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Elanco

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AniCon Labor GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Boehringer Ingelheim International GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Biovac

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Animal Science Products Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ADL BIONATUR SOLUTIONS S A

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Phibro Animal Health Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ceva Sante Animale

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Merck & Co

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Zoetis Inc

List of Figures

- Figure 1: Global Live Attenuated Vaccines Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Live Attenuated Vaccines Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Live Attenuated Vaccines Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 4: North America Live Attenuated Vaccines Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 5: North America Live Attenuated Vaccines Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Live Attenuated Vaccines Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Live Attenuated Vaccines Industry Revenue (Million), by Technology 2025 & 2033

- Figure 8: North America Live Attenuated Vaccines Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 9: North America Live Attenuated Vaccines Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: North America Live Attenuated Vaccines Industry Volume Share (%), by Technology 2025 & 2033

- Figure 11: North America Live Attenuated Vaccines Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Live Attenuated Vaccines Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Live Attenuated Vaccines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Live Attenuated Vaccines Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Live Attenuated Vaccines Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 16: Europe Live Attenuated Vaccines Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 17: Europe Live Attenuated Vaccines Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Live Attenuated Vaccines Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 19: Europe Live Attenuated Vaccines Industry Revenue (Million), by Technology 2025 & 2033

- Figure 20: Europe Live Attenuated Vaccines Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 21: Europe Live Attenuated Vaccines Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Europe Live Attenuated Vaccines Industry Volume Share (%), by Technology 2025 & 2033

- Figure 23: Europe Live Attenuated Vaccines Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Live Attenuated Vaccines Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Live Attenuated Vaccines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Live Attenuated Vaccines Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Live Attenuated Vaccines Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Live Attenuated Vaccines Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 29: Asia Pacific Live Attenuated Vaccines Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Pacific Live Attenuated Vaccines Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Asia Pacific Live Attenuated Vaccines Industry Revenue (Million), by Technology 2025 & 2033

- Figure 32: Asia Pacific Live Attenuated Vaccines Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 33: Asia Pacific Live Attenuated Vaccines Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 34: Asia Pacific Live Attenuated Vaccines Industry Volume Share (%), by Technology 2025 & 2033

- Figure 35: Asia Pacific Live Attenuated Vaccines Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Live Attenuated Vaccines Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Live Attenuated Vaccines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Live Attenuated Vaccines Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Live Attenuated Vaccines Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 40: Middle East and Africa Live Attenuated Vaccines Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 41: Middle East and Africa Live Attenuated Vaccines Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: Middle East and Africa Live Attenuated Vaccines Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 43: Middle East and Africa Live Attenuated Vaccines Industry Revenue (Million), by Technology 2025 & 2033

- Figure 44: Middle East and Africa Live Attenuated Vaccines Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 45: Middle East and Africa Live Attenuated Vaccines Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 46: Middle East and Africa Live Attenuated Vaccines Industry Volume Share (%), by Technology 2025 & 2033

- Figure 47: Middle East and Africa Live Attenuated Vaccines Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Live Attenuated Vaccines Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Live Attenuated Vaccines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Live Attenuated Vaccines Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Live Attenuated Vaccines Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 52: South America Live Attenuated Vaccines Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 53: South America Live Attenuated Vaccines Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: South America Live Attenuated Vaccines Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 55: South America Live Attenuated Vaccines Industry Revenue (Million), by Technology 2025 & 2033

- Figure 56: South America Live Attenuated Vaccines Industry Volume (K Unit), by Technology 2025 & 2033

- Figure 57: South America Live Attenuated Vaccines Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 58: South America Live Attenuated Vaccines Industry Volume Share (%), by Technology 2025 & 2033

- Figure 59: South America Live Attenuated Vaccines Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: South America Live Attenuated Vaccines Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Live Attenuated Vaccines Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Live Attenuated Vaccines Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Live Attenuated Vaccines Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Live Attenuated Vaccines Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Live Attenuated Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Global Live Attenuated Vaccines Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 5: Global Live Attenuated Vaccines Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Live Attenuated Vaccines Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Live Attenuated Vaccines Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Live Attenuated Vaccines Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 9: Global Live Attenuated Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 10: Global Live Attenuated Vaccines Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 11: Global Live Attenuated Vaccines Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Live Attenuated Vaccines Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Live Attenuated Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Live Attenuated Vaccines Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Live Attenuated Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Live Attenuated Vaccines Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Live Attenuated Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Live Attenuated Vaccines Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Live Attenuated Vaccines Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Global Live Attenuated Vaccines Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 21: Global Live Attenuated Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 22: Global Live Attenuated Vaccines Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 23: Global Live Attenuated Vaccines Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Live Attenuated Vaccines Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Live Attenuated Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany Live Attenuated Vaccines Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Live Attenuated Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Live Attenuated Vaccines Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Live Attenuated Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: France Live Attenuated Vaccines Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Live Attenuated Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Italy Live Attenuated Vaccines Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Live Attenuated Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Spain Live Attenuated Vaccines Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Live Attenuated Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Live Attenuated Vaccines Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Live Attenuated Vaccines Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 38: Global Live Attenuated Vaccines Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 39: Global Live Attenuated Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 40: Global Live Attenuated Vaccines Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 41: Global Live Attenuated Vaccines Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Live Attenuated Vaccines Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Live Attenuated Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: China Live Attenuated Vaccines Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Live Attenuated Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Japan Live Attenuated Vaccines Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Live Attenuated Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: India Live Attenuated Vaccines Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Live Attenuated Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Australia Live Attenuated Vaccines Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Live Attenuated Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: South Korea Live Attenuated Vaccines Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Live Attenuated Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Live Attenuated Vaccines Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Live Attenuated Vaccines Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 56: Global Live Attenuated Vaccines Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 57: Global Live Attenuated Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 58: Global Live Attenuated Vaccines Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 59: Global Live Attenuated Vaccines Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Live Attenuated Vaccines Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Live Attenuated Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: GCC Live Attenuated Vaccines Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Live Attenuated Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: South Africa Live Attenuated Vaccines Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Live Attenuated Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Live Attenuated Vaccines Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Live Attenuated Vaccines Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 68: Global Live Attenuated Vaccines Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 69: Global Live Attenuated Vaccines Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 70: Global Live Attenuated Vaccines Industry Volume K Unit Forecast, by Technology 2020 & 2033

- Table 71: Global Live Attenuated Vaccines Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Global Live Attenuated Vaccines Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Live Attenuated Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Brazil Live Attenuated Vaccines Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Live Attenuated Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Argentina Live Attenuated Vaccines Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Live Attenuated Vaccines Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Live Attenuated Vaccines Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Live Attenuated Vaccines Industry?

The projected CAGR is approximately 4.21%.

2. Which companies are prominent players in the Live Attenuated Vaccines Industry?

Key companies in the market include Zoetis Inc, Elanco, AniCon Labor GmbH, Boehringer Ingelheim International GmbH, Biovac, Animal Science Products Inc, ADL BIONATUR SOLUTIONS S A, Phibro Animal Health Corporation, Ceva Sante Animale, Merck & Co.

3. What are the main segments of the Live Attenuated Vaccines Industry?

The market segments include Product Type, Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of Zoonotic Diseases; Initiatives Taken by Various Government Agencies. Animal Associations. and Leading Players; Widened Focus on Food Safety.

6. What are the notable trends driving market growth?

Poultry Vaccine is Expected to Cover a Large Share of the Livestock Vaccines Market.

7. Are there any restraints impacting market growth?

Lack of Veterinarians and Shortage of Skilled Farm Workers; High Storage Costs for Vaccines.

8. Can you provide examples of recent developments in the market?

In August 2022, The SRTF's agriculture project 'Support for the Recovery of Livestock Production Within Northern Aleppo- Phase II' announced receiving the third batch of livestock vaccines. Indirectly, the project will benefit 57,500 estimated family members of livestock breeders in the project area populated by an estimated 250,000 people.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Live Attenuated Vaccines Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Live Attenuated Vaccines Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Live Attenuated Vaccines Industry?

To stay informed about further developments, trends, and reports in the Live Attenuated Vaccines Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence