Key Insights

The Latin American jewelry market is poised for growth, with a projected Compound Annual Growth Rate (CAGR) of 6.4%. The market size was valued at $8.58 billion in the base year 2024. Increasing disposable income within the region's expanding middle class, particularly in Brazil and Mexico, is a key driver for the demand for luxury and aspirational jewelry. Deep-rooted cultural significance attached to gold and gemstone adornments further fuels demand for authentic pieces. The market encompasses a diverse range of jewelry types, including necklaces, rings, earrings, bracelets, and charms. Necklaces and earrings are anticipated to dominate market share due to their widespread appeal and accessibility across various consumer segments. The expansion of e-commerce is significantly enhancing market accessibility and convenience, presenting substantial growth opportunities, especially among younger demographics, even as the offline retail sector maintains its importance. Economic instability and fluctuations in precious metal prices represent significant market restraints. The competitive landscape is robust, featuring global luxury brands such as Pandora and Richemont alongside prominent local entities like Vivara and H Stern, emphasizing the imperative for strategic differentiation and tailored marketing initiatives.

Latin America Jewelry Industry Market Size (In Billion)

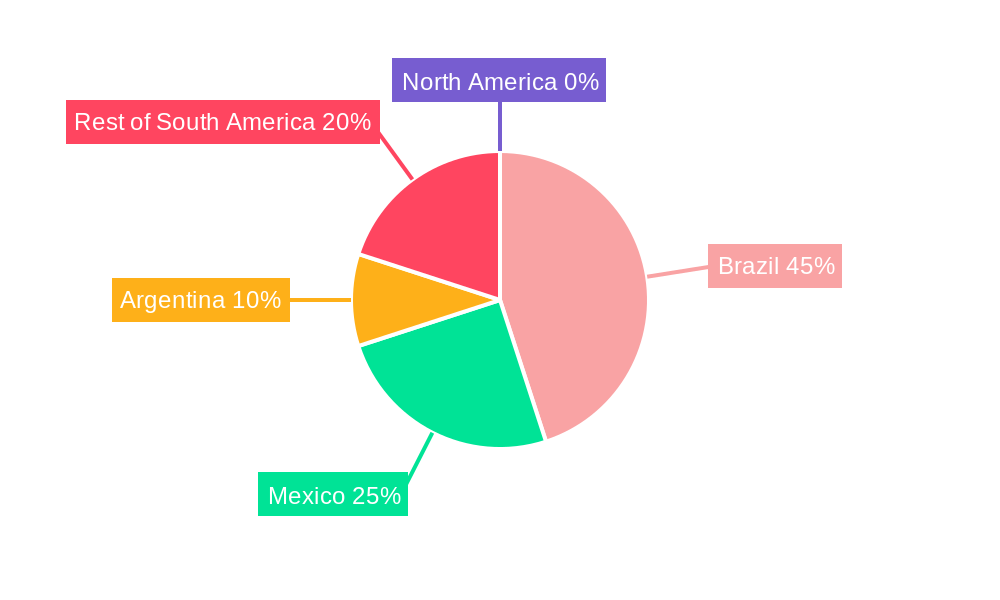

The forecast period (2025-2033) indicates sustained, moderate expansion driven by both established and emerging market participants. Collaborations with local artisans and designers offer a strategic avenue for brands to leverage unique regional aesthetics and styles. The emerging trend of sustainable and ethically sourced jewelry is expected to attract environmentally conscious consumers. Success in this varied and dynamic market will hinge on a focused approach to specific consumer segments and the customization of product offerings to align with local preferences and purchasing power. Brazil is expected to maintain its position as the largest national market within Latin America, supported by its strong economy and established jewelry production capabilities, with Mexico and Argentina following closely. The distribution channel segmentation highlights a dynamic interplay between offline and online retail, with online channels projected to exhibit accelerated growth in the upcoming years.

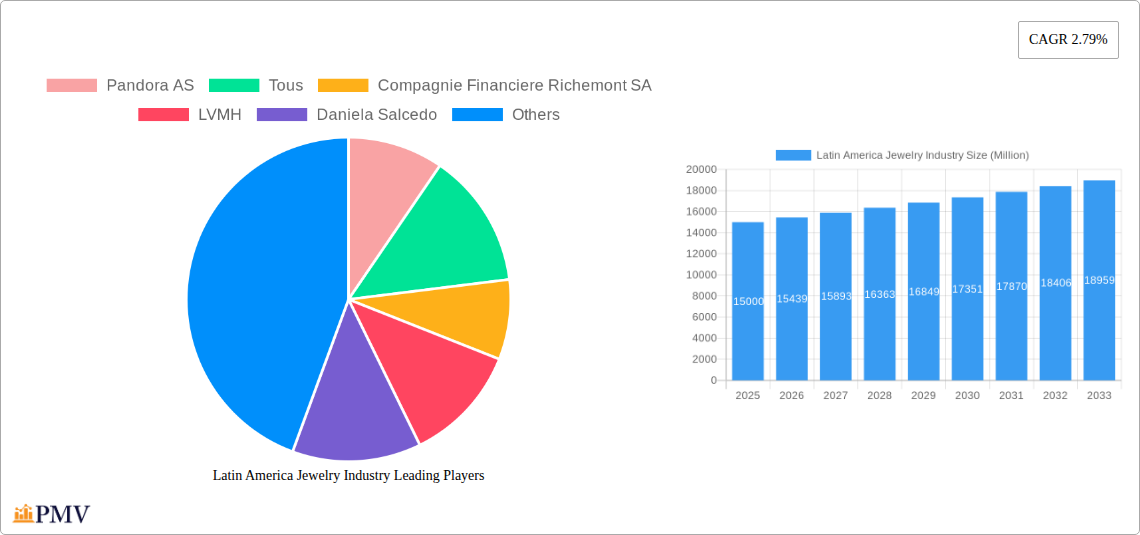

Latin America Jewelry Industry Company Market Share

Latin America Jewelry Industry: Market Analysis, Trends, and Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the Latin America jewelry industry, offering valuable insights for businesses, investors, and stakeholders seeking to understand and capitalize on the market's dynamic landscape. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously analyzes market size, growth drivers, challenges, and competitive dynamics. The study encompasses a detailed segmentation analysis by category (Real Jewelry, Costume Jewelry), type (Necklaces, Rings, Earrings, Charms & Bracelets, Others), and distribution channel (Offline Retail Stores, Online Retail Stores). The total market size in 2025 is estimated at xx Million, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

Latin America Jewelry Industry Market Structure & Competitive Dynamics

The Latin American jewelry market exhibits a moderately concentrated structure, with several multinational corporations and established local players vying for market share. Key players such as Pandora AS, Tous, Compagnie Financiere Richemont SA, LVMH, Daniela Salcedo, H Stern Jewelers Inc, Manoel Bernardes SA, Joias Vivara, Haramara Jewelry, and Daniel Espinosa Jewelry contribute significantly to the overall market value. However, the market also accommodates numerous smaller, independent businesses, particularly within the costume jewelry segment.

Market share is largely dictated by brand recognition, product quality, pricing strategies, and distribution networks. Major players leverage extensive offline retail presence and increasingly invest in online channels to reach a broader consumer base. The innovation ecosystem is active, with continuous product development and design innovation responding to evolving consumer preferences. Regulatory frameworks vary across Latin American countries, influencing production, import/export, and labeling requirements. Product substitutes, primarily imitation jewelry and fashion accessories, pose a competitive threat, particularly in the lower-price segments. M&A activity within the industry has been moderate in recent years, with deal values ranging from xx Million to xx Million, primarily focused on consolidating market presence and expanding product portfolios.

Latin America Jewelry Industry Industry Trends & Insights

The Latin American jewelry market is experiencing robust growth, driven by several key factors. Rising disposable incomes, particularly in urban centers, are fueling increased spending on luxury and semi-luxury goods, including jewelry. The increasing popularity of online retail platforms is significantly expanding market access and creating new opportunities for both established and emerging brands. Furthermore, changing consumer preferences towards personalized and unique designs are stimulating innovation in product development and customization services. Technological advancements in jewelry manufacturing, such as 3D printing and advanced material science, are enhancing production efficiency and expanding design possibilities.

The market's growth is also influenced by prevailing economic conditions, cultural trends, and seasonal demand. Consumer confidence and purchasing power significantly impact sales volumes, with periods of economic uncertainty potentially leading to a slowdown in demand. The CAGR for the market during the historical period (2019-2024) was estimated at xx%, reflecting substantial growth potential. Market penetration of online retail channels remains relatively low compared to other regions, representing a major area for future expansion.

Dominant Markets & Segments in Latin America Jewelry Industry

Leading Region: Brazil remains the dominant market in Latin America, accounting for the largest share of total revenue due to its significant population, higher disposable incomes, and established jewelry industry infrastructure. Mexico and Colombia follow, displaying substantial potential for growth.

Leading Segment (By Category): The real jewelry segment commands a larger market share compared to costume jewelry, reflecting consumer preference for durable, high-value items. However, the costume jewelry segment is experiencing faster growth, driven by affordability and diverse design options.

Leading Segment (By Type): Necklaces, earrings, and rings consistently dominate the product type segment, reflecting their versatility and widespread appeal. Charms and bracelets demonstrate steady growth potential.

Leading Segment (By Distribution Channel): Offline retail stores still dominate the distribution channels, leveraging their established presence and customer relationship. However, online retail is rapidly gaining traction, showing higher growth rates due to increased internet penetration and convenient access. Key drivers for the dominance of Brazil include its strong domestic market, established manufacturing capabilities, favorable economic policies, and growing middle class. Mexico benefits from its proximity to the US market and its burgeoning tourism sector.

Latin America Jewelry Industry Product Innovations

Recent product innovations in the Latin American jewelry market focus on sustainable materials, ethical sourcing, and personalized designs. The increased adoption of 3D printing technology allows for intricate designs and customized pieces, catering to consumer demand for unique items. Moreover, the integration of technology, such as using augmented reality (AR) apps for virtual try-ons, is improving the online shopping experience and driving sales. These innovations enhance both product aesthetics and manufacturing efficiency, offering competitive advantages in a rapidly evolving market.

Report Segmentation & Scope

This report segments the Latin American jewelry market comprehensively across three key dimensions:

By Category: The report analyzes the real jewelry and costume jewelry segments, providing insights into market size, growth rates, and competitive dynamics within each category. Real jewelry is projected to maintain a larger market share, but costume jewelry is expected to experience faster growth due to its affordability.

By Type: The report covers necklaces, rings, earrings, charms & bracelets, and others, assessing the performance and growth prospects of each type. Necklaces and earrings consistently dominate this segment.

By Distribution Channel: The report examines both offline and online retail channels, analyzing their market share, growth trajectory, and competitive landscape. Online retail is expected to demonstrate significant growth, while offline retail retains its dominant market share.

Key Drivers of Latin America Jewelry Industry Growth

Several factors fuel the growth of the Latin American jewelry industry. Rising disposable incomes in key markets, such as Brazil and Mexico, are a significant driver. Increasing urbanization is leading to higher consumer spending on discretionary items. The expansion of e-commerce provides better accessibility to customers. Moreover, the growing popularity of personalized and customized jewelry is also boosting demand. Lastly, favorable tourism and cultural factors contribute to the market's growth.

Challenges in the Latin America Jewelry Industry Sector

The Latin American jewelry industry faces challenges, including economic volatility impacting consumer spending. Supply chain disruptions and fluctuating raw material prices pose significant cost pressures. Counterfeit products and intellectual property infringement remain considerable concerns. Furthermore, regulatory complexities and diverse market conditions across different Latin American countries can create operational hurdles. These factors can negatively affect profitability and market stability.

Leading Players in the Latin America Jewelry Industry Market

- Pandora AS

- Tous

- Compagnie Financiere Richemont SA

- LVMH

- Daniela Salcedo

- H Stern Jewelers Inc

- Manoel Bernardes SA

- Joias Vivara

- Haramara Jewelry

- Daniel Espinosa Jewelry

Key Developments in Latin America Jewelry Industry Sector

- 2022 Q4: Launch of a new sustainable jewelry collection by a major player. Impact: Enhanced brand image and appeal to environmentally conscious consumers.

- 2023 Q1: Acquisition of a smaller jewelry brand by a larger corporation. Impact: Market consolidation and expansion of product portfolio.

- 2023 Q3: Introduction of a new e-commerce platform by a local brand. Impact: Increased market access and sales channels.

Strategic Latin America Jewelry Industry Market Outlook

The Latin American jewelry market presents substantial growth potential over the forecast period. Continued economic development, increasing consumer spending, and technological advancements will drive further expansion. Brands focusing on personalization, ethical sourcing, and sustainable practices will gain a competitive edge. E-commerce adoption and strategic partnerships will be crucial for market penetration. The market shows strong promise for both established and emerging players, with ample opportunities for innovation and growth.

Latin America Jewelry Industry Segmentation

-

1. Category

- 1.1. Real Jewelry

- 1.2. Costume Jewelry

-

2. Type

- 2.1. Necklaces

- 2.2. Rings

- 2.3. Earrings

- 2.4. Charms & Bracelets

- 2.5. Others

-

3. Distribution Channel

- 3.1. Offline Retail Stores

- 3.2. Online Retail Stores

-

4. Geography

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Colombia

- 4.4. Rest of Latin America

Latin America Jewelry Industry Segmentation By Geography

- 1. Brazil

- 2. Mexico

- 3. Colombia

- 4. Rest of Latin America

Latin America Jewelry Industry Regional Market Share

Geographic Coverage of Latin America Jewelry Industry

Latin America Jewelry Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Organic Baby Care Products; Increasing Product Innovation in the Market

- 3.3. Market Restrains

- 3.3.1. Possibility of Rashes and Allergic Reactions

- 3.4. Market Trends

- 3.4.1. Growing Demand for Diamond in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Jewelry Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Real Jewelry

- 5.1.2. Costume Jewelry

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Necklaces

- 5.2.2. Rings

- 5.2.3. Earrings

- 5.2.4. Charms & Bracelets

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline Retail Stores

- 5.3.2. Online Retail Stores

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Mexico

- 5.4.3. Colombia

- 5.4.4. Rest of Latin America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Mexico

- 5.5.3. Colombia

- 5.5.4. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Brazil Latin America Jewelry Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Category

- 6.1.1. Real Jewelry

- 6.1.2. Costume Jewelry

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Necklaces

- 6.2.2. Rings

- 6.2.3. Earrings

- 6.2.4. Charms & Bracelets

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Offline Retail Stores

- 6.3.2. Online Retail Stores

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Mexico

- 6.4.3. Colombia

- 6.4.4. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Category

- 7. Mexico Latin America Jewelry Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Category

- 7.1.1. Real Jewelry

- 7.1.2. Costume Jewelry

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Necklaces

- 7.2.2. Rings

- 7.2.3. Earrings

- 7.2.4. Charms & Bracelets

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Offline Retail Stores

- 7.3.2. Online Retail Stores

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Mexico

- 7.4.3. Colombia

- 7.4.4. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Category

- 8. Colombia Latin America Jewelry Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Category

- 8.1.1. Real Jewelry

- 8.1.2. Costume Jewelry

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Necklaces

- 8.2.2. Rings

- 8.2.3. Earrings

- 8.2.4. Charms & Bracelets

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Offline Retail Stores

- 8.3.2. Online Retail Stores

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Mexico

- 8.4.3. Colombia

- 8.4.4. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Category

- 9. Rest of Latin America Latin America Jewelry Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Category

- 9.1.1. Real Jewelry

- 9.1.2. Costume Jewelry

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Necklaces

- 9.2.2. Rings

- 9.2.3. Earrings

- 9.2.4. Charms & Bracelets

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Offline Retail Stores

- 9.3.2. Online Retail Stores

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. Brazil

- 9.4.2. Mexico

- 9.4.3. Colombia

- 9.4.4. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Category

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Pandora AS

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Tous

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Compagnie Financiere Richemont SA

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 LVMH

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Daniela Salcedo

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 H Stern Jewelers Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Manoel Bernardes SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Joias Vivara

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Haramara Jewelry*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Daniel Espinosa Jewelry

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Pandora AS

List of Figures

- Figure 1: Latin America Jewelry Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Jewelry Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America Jewelry Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 2: Latin America Jewelry Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Latin America Jewelry Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Latin America Jewelry Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Latin America Jewelry Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Latin America Jewelry Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 7: Latin America Jewelry Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Latin America Jewelry Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 9: Latin America Jewelry Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Latin America Jewelry Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Latin America Jewelry Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 12: Latin America Jewelry Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Latin America Jewelry Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Latin America Jewelry Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Latin America Jewelry Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Latin America Jewelry Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 17: Latin America Jewelry Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Latin America Jewelry Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Latin America Jewelry Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Latin America Jewelry Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Latin America Jewelry Industry Revenue billion Forecast, by Category 2020 & 2033

- Table 22: Latin America Jewelry Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 23: Latin America Jewelry Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 24: Latin America Jewelry Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Latin America Jewelry Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Jewelry Industry?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Latin America Jewelry Industry?

Key companies in the market include Pandora AS, Tous, Compagnie Financiere Richemont SA, LVMH, Daniela Salcedo, H Stern Jewelers Inc, Manoel Bernardes SA, Joias Vivara, Haramara Jewelry*List Not Exhaustive, Daniel Espinosa Jewelry.

3. What are the main segments of the Latin America Jewelry Industry?

The market segments include Category, Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.58 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Organic Baby Care Products; Increasing Product Innovation in the Market.

6. What are the notable trends driving market growth?

Growing Demand for Diamond in the Market.

7. Are there any restraints impacting market growth?

Possibility of Rashes and Allergic Reactions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Jewelry Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Jewelry Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Jewelry Industry?

To stay informed about further developments, trends, and reports in the Latin America Jewelry Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence