Key Insights

The Qatari printing and packaging market is projected to reach 53.44 billion by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of 4.5% from a base year of 2025. This expansion is primarily driven by the robust growth of the food and beverage sector and increasing consumer demand for premium packaging. The surge in e-commerce also fuels the label printing market, emphasizing the need for clear and informative product labeling. Key industry players, including Qatar Polymer Industrial Co, Matco Packaging LLC, and Galaxy Carton Factory, are poised to benefit from these trends. Potential challenges include raw material price volatility and economic fluctuations. The market is segmented by end-user verticals such as food and beverage, pharmaceuticals, and cosmetics, presenting significant growth opportunities. Advancements in printing technologies, including digital printing for personalized labels, will be critical for future success. Strategic adaptation and focused approaches are essential for sustained market leadership.

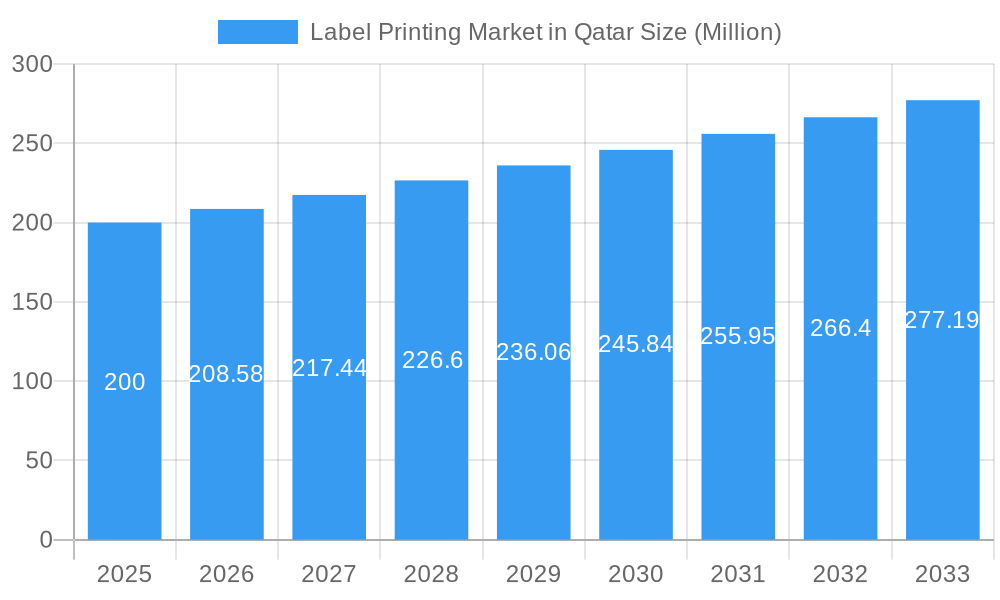

Label Printing Market in Qatar Market Size (In Billion)

The label printing sub-segment within Qatar's printing market is expected to experience growth aligned with the overall market trend, driven by the increasing importance of labeling across diverse industries. Demand for high-quality, durable labels compliant with regulatory standards is a key growth factor. Investment in advanced printing technologies for customized and personalized labels is accelerating, particularly within the food and beverage sector, where detailed nutritional information and appealing designs are paramount. Government initiatives promoting local industries and enhanced packaging standards will further influence market development. While competition exists, the relatively concentrated Qatari market favors niche specialization and targeted strategies for success. Future growth will be shaped by organic expansion within existing sectors and successful diversification into new applications and markets.

Label Printing Market in Qatar Company Market Share

Label Printing Market in Qatar: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Label Printing Market in Qatar, offering valuable insights into market structure, competitive dynamics, growth drivers, and future trends. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report is essential for businesses operating in or considering entry into this dynamic market, providing actionable intelligence to inform strategic decision-making. The total market size in 2025 is estimated at xx Million USD.

Label Printing Market in Qatar Market Structure & Competitive Dynamics

The Qatari label printing market exhibits a moderately concentrated structure, with several key players holding significant market share. The market is characterized by a mix of large, established players like Qatar National Printing Press (QNPP) and emerging companies vying for market share. Innovation is driven by the adoption of digital printing technologies and the demand for customized labels across diverse end-user verticals. The regulatory framework is relatively straightforward, with a focus on quality standards and environmental compliance. Product substitution is mainly driven by the emergence of cost-effective alternatives like digital printing methods. End-user trends, including increasing demand for sustainable packaging and personalized labels, are influencing market growth.

M&A activity in the Qatari label printing sector has been relatively limited in recent years. While precise deal values are unavailable publicly, we estimate that M&A activity contributed to a consolidation of xx Million USD in market value during the historical period (2019-2024). Market share is largely distributed amongst the top players, with the leading companies holding approximately xx% of the total market. Key players such as Qatar Polymer Industrial Co, Matco Packaging LLC, and Galaxy Carton Factory compete based on price, quality, and service differentiation.

Label Printing Market in Qatar Industry Trends & Insights

The Qatari label printing market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of **10.5%** during the forecast period (2025-2033). This expansion is propelled by the dynamic evolution of key end-user industries such as food and beverage, pharmaceuticals, and cosmetics, all of which rely heavily on high-quality, visually appealing, and informative labels. A significant trend is the accelerating adoption of digital printing technologies. This shift offers enhanced flexibility for short runs and variable data printing, drastically reduces turnaround times, and demonstrably improves cost-efficiency, thereby stimulating market growth. Furthermore, evolving consumer preferences lean towards personalized and aesthetically superior labels, fostering a climate of innovation in label design and printing techniques. The market penetration of digital printing is anticipated to reach an impressive **45%** by 2033, marking a substantial departure from traditional analog printing methods. The competitive landscape is characterized by continuous innovation in printing capabilities, strategic pricing models, and an unwavering focus on elevating customer service experiences to secure market share.

Dominant Markets & Segments in Label Printing Market in Qatar

QATAR PRINTING MARKET: Print Process: Digital printing is the fastest-growing segment, driven by its flexibility and cost-effectiveness for short-run label production. Traditional analog printing processes still hold a significant share, particularly for large-volume orders.

Other Analog Printing Processes: End-User Vertical: The food and beverage sector dominates this segment, driven by stringent labeling regulations and the high volume of products requiring labels. The pharmaceutical and cosmetic sectors also represent significant end-user verticals.

QATAR PACKAGING MARKET: Material: Paper and plastic remain the dominant materials used in label production. However, the market is witnessing increasing demand for sustainable and eco-friendly materials, creating opportunities for companies offering biodegradable and recyclable label solutions.

Metal: End-User Industry: The metal industry utilizes labels primarily for product identification and tracking. This segment's growth is linked to the expansion of related industries, such as construction and manufacturing.

The dominance of the food and beverage sector is primarily attributed to the robust growth of the retail sector and government initiatives promoting food safety and labeling standards.

Label Printing Market in Qatar Product Innovations

Recent product innovations are redefining the label printing landscape in Qatar. The introduction of advanced self-adhesive labels with superior bonding capabilities, tamper-evident labels that enhance product security and reduce counterfeiting, and labels incorporating sophisticated security features are gaining significant traction. These advancements directly address the escalating consumer and industry demand for enhanced convenience, robust product security, and effective brand protection strategies. Technological advancements are primarily focused on achieving higher printing speeds, optimizing production costs, and, critically, incorporating sustainable and eco-friendly materials. The successful market fit of these innovations is intrinsically linked to the specific, often nuanced, requirements of diverse end-user industries. A strong emphasis on customization, enabling businesses to tailor labels precisely to their brand identity and product needs, alongside an acute focus on operational efficiency, are key determinants of innovation success.

Report Segmentation & Scope

This report segments the Qatari label printing market based on print process (digital, flexographic, offset, etc.), end-user vertical (food and beverage, pharmaceuticals, cosmetics, etc.), and packaging material (paper, plastic, metal, etc.). Growth projections for each segment vary, with digital printing and the food and beverage sector demonstrating the highest growth potential. Market sizes are estimated based on revenue generated, with a detailed competitive analysis for each segment. The overall market is further analyzed based on the geographical distribution within Qatar, revealing regional variations in demand and growth patterns.

Key Drivers of Label Printing Market in Qatar Growth

Several potent factors are driving the accelerated growth of Qatar's label printing market. The burgeoning food and beverage sector, a cornerstone of Qatar's economy, coupled with increasing consumer demand for conveniently packaged goods, is creating substantial and sustained demand for a wide array of labels. Government-led initiatives aimed at fostering industrial diversification and bolstering overall economic growth are creating a remarkably favorable and supportive ecosystem for businesses operating within the label printing sector. Furthermore, the widespread adoption of advanced printing technologies, including high-resolution digital and specialized flexographic printing, is significantly enhancing operational efficiency and driving down production costs, thereby acting as a catalyst for market expansion. The growing global and local consciousness surrounding sustainable packaging solutions is also a pivotal influence, actively driving demand for eco-friendly label materials and manufacturing processes.

Challenges in the Label Printing Market in Qatar Sector

The Qatari label printing market is not without its hurdles. Key challenges include the persistent pressure of increasing raw material costs, the inherent volatility and potential disruptions within global supply chains, and the intensifying competition originating from both established domestic enterprises and agile international players. Navigating and ensuring compliance with evolving regulatory frameworks, particularly concerning stringent labeling standards and environmental protection mandates, can also present significant complexities. These multifaceted challenges have the potential to impede market growth if not proactively and effectively addressed by market participants through strategic innovation, agile adaptation, and the forging of synergistic partnerships. The estimated impact of these cumulative challenges on market growth in 2025 is projected to be approximately **35 Million USD**.

Leading Players in the Label Printing Market in Qatar Market

- Qatar Polymer Industrial Co

- Matco Packaging LLC

- Galaxy Carton Factory

- Jama Plastic Industries Factory (JPIF) (MJK Group of Companies)

- Green Print W L L

- Arabian Packaging Industries

- Qatar National Printing Press (QNPP)

- New Printing Co (Ghanem Al Thani Holding Group)

- AST Group of Companies

- Aspire Printing

- Breezpack (Anesco Trading & Services WLL)

Key Developments in Label Printing Market in Qatar Sector

- 2022 (October): A leading player in the Qatari market unveiled a state-of-the-art, high-speed digital printing press. This strategic investment significantly boosted production capacity and expanded the company's market reach, allowing for more responsive service to a growing client base.

- 2023 (March): The Qatari government successfully launched a comprehensive sustainable packaging initiative. This landmark program actively promotes and incentivizes the adoption of eco-friendly label materials and printing practices across various key industries, fostering a greener sector.

- 2024 (June): A significant strategic merger occurred between two prominent entities in the label printing sector. This consolidation resulted in substantial market share acquisition and facilitated expansion into new, high-growth product segments, demonstrating a drive for market leadership.

Strategic Label Printing Market in Qatar Market Outlook

The Qatari label printing market presents a compelling outlook for future growth, driven by continuous expansion in key end-user sectors. The ongoing adoption of advanced printing technologies, coupled with a growing focus on sustainable packaging solutions, will continue to shape market trends. Strategic opportunities exist for companies that can effectively leverage technological advancements, offer customized label solutions, and comply with increasingly stringent environmental regulations. The potential for market expansion is significant, particularly in sectors embracing e-commerce and personalized consumer products. The market is poised for sustained growth, with an overall positive outlook for future investment and expansion.

Label Printing Market in Qatar Segmentation

-

1. QATAR PRINTING MARKET

-

1.1. Print Process

- 1.1.1. Offset lithography

- 1.1.2. Flexography

- 1.1.3. Digital

- 1.1.4. Other Analog Printing Processes

-

1.2. End-User Vertical

- 1.2.1. Books & Magazines

- 1.2.2. Newspapers

- 1.2.3. Commercial Print

- 1.2.4. Labels & Packaging

- 1.2.5. Other End-User Verticals

-

1.1. Print Process

-

2. QATAR PACKAGING MARKET

-

2.1. Material

- 2.1.1. Plastic

- 2.1.2. Paper & Paperboard

- 2.1.3. Glass

- 2.1.4. Metal

-

2.2. End-User Industry

- 2.2.1. Food

- 2.2.2. Beverage

- 2.2.3. Pharmaceuticals

- 2.2.4. Personal Care & Household Care

- 2.2.5. Other End-User Industries

-

2.1. Material

Label Printing Market in Qatar Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Label Printing Market in Qatar Regional Market Share

Geographic Coverage of Label Printing Market in Qatar

Label Printing Market in Qatar REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Recyclability Rates of Metal Packaging; High Recyclability of Metal Cans

- 3.3. Market Restrains

- 3.3.1. Increasing Operational Costs

- 3.4. Market Trends

- 3.4.1. Digital Printing to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Label Printing Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 5.1.1. Print Process

- 5.1.1.1. Offset lithography

- 5.1.1.2. Flexography

- 5.1.1.3. Digital

- 5.1.1.4. Other Analog Printing Processes

- 5.1.2. End-User Vertical

- 5.1.2.1. Books & Magazines

- 5.1.2.2. Newspapers

- 5.1.2.3. Commercial Print

- 5.1.2.4. Labels & Packaging

- 5.1.2.5. Other End-User Verticals

- 5.1.1. Print Process

- 5.2. Market Analysis, Insights and Forecast - by QATAR PACKAGING MARKET

- 5.2.1. Material

- 5.2.1.1. Plastic

- 5.2.1.2. Paper & Paperboard

- 5.2.1.3. Glass

- 5.2.1.4. Metal

- 5.2.2. End-User Industry

- 5.2.2.1. Food

- 5.2.2.2. Beverage

- 5.2.2.3. Pharmaceuticals

- 5.2.2.4. Personal Care & Household Care

- 5.2.2.5. Other End-User Industries

- 5.2.1. Material

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 6. North America Label Printing Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 6.1.1. Print Process

- 6.1.1.1. Offset lithography

- 6.1.1.2. Flexography

- 6.1.1.3. Digital

- 6.1.1.4. Other Analog Printing Processes

- 6.1.2. End-User Vertical

- 6.1.2.1. Books & Magazines

- 6.1.2.2. Newspapers

- 6.1.2.3. Commercial Print

- 6.1.2.4. Labels & Packaging

- 6.1.2.5. Other End-User Verticals

- 6.1.1. Print Process

- 6.2. Market Analysis, Insights and Forecast - by QATAR PACKAGING MARKET

- 6.2.1. Material

- 6.2.1.1. Plastic

- 6.2.1.2. Paper & Paperboard

- 6.2.1.3. Glass

- 6.2.1.4. Metal

- 6.2.2. End-User Industry

- 6.2.2.1. Food

- 6.2.2.2. Beverage

- 6.2.2.3. Pharmaceuticals

- 6.2.2.4. Personal Care & Household Care

- 6.2.2.5. Other End-User Industries

- 6.2.1. Material

- 6.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 7. South America Label Printing Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 7.1.1. Print Process

- 7.1.1.1. Offset lithography

- 7.1.1.2. Flexography

- 7.1.1.3. Digital

- 7.1.1.4. Other Analog Printing Processes

- 7.1.2. End-User Vertical

- 7.1.2.1. Books & Magazines

- 7.1.2.2. Newspapers

- 7.1.2.3. Commercial Print

- 7.1.2.4. Labels & Packaging

- 7.1.2.5. Other End-User Verticals

- 7.1.1. Print Process

- 7.2. Market Analysis, Insights and Forecast - by QATAR PACKAGING MARKET

- 7.2.1. Material

- 7.2.1.1. Plastic

- 7.2.1.2. Paper & Paperboard

- 7.2.1.3. Glass

- 7.2.1.4. Metal

- 7.2.2. End-User Industry

- 7.2.2.1. Food

- 7.2.2.2. Beverage

- 7.2.2.3. Pharmaceuticals

- 7.2.2.4. Personal Care & Household Care

- 7.2.2.5. Other End-User Industries

- 7.2.1. Material

- 7.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 8. Europe Label Printing Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 8.1.1. Print Process

- 8.1.1.1. Offset lithography

- 8.1.1.2. Flexography

- 8.1.1.3. Digital

- 8.1.1.4. Other Analog Printing Processes

- 8.1.2. End-User Vertical

- 8.1.2.1. Books & Magazines

- 8.1.2.2. Newspapers

- 8.1.2.3. Commercial Print

- 8.1.2.4. Labels & Packaging

- 8.1.2.5. Other End-User Verticals

- 8.1.1. Print Process

- 8.2. Market Analysis, Insights and Forecast - by QATAR PACKAGING MARKET

- 8.2.1. Material

- 8.2.1.1. Plastic

- 8.2.1.2. Paper & Paperboard

- 8.2.1.3. Glass

- 8.2.1.4. Metal

- 8.2.2. End-User Industry

- 8.2.2.1. Food

- 8.2.2.2. Beverage

- 8.2.2.3. Pharmaceuticals

- 8.2.2.4. Personal Care & Household Care

- 8.2.2.5. Other End-User Industries

- 8.2.1. Material

- 8.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 9. Middle East & Africa Label Printing Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 9.1.1. Print Process

- 9.1.1.1. Offset lithography

- 9.1.1.2. Flexography

- 9.1.1.3. Digital

- 9.1.1.4. Other Analog Printing Processes

- 9.1.2. End-User Vertical

- 9.1.2.1. Books & Magazines

- 9.1.2.2. Newspapers

- 9.1.2.3. Commercial Print

- 9.1.2.4. Labels & Packaging

- 9.1.2.5. Other End-User Verticals

- 9.1.1. Print Process

- 9.2. Market Analysis, Insights and Forecast - by QATAR PACKAGING MARKET

- 9.2.1. Material

- 9.2.1.1. Plastic

- 9.2.1.2. Paper & Paperboard

- 9.2.1.3. Glass

- 9.2.1.4. Metal

- 9.2.2. End-User Industry

- 9.2.2.1. Food

- 9.2.2.2. Beverage

- 9.2.2.3. Pharmaceuticals

- 9.2.2.4. Personal Care & Household Care

- 9.2.2.5. Other End-User Industries

- 9.2.1. Material

- 9.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 10. Asia Pacific Label Printing Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 10.1.1. Print Process

- 10.1.1.1. Offset lithography

- 10.1.1.2. Flexography

- 10.1.1.3. Digital

- 10.1.1.4. Other Analog Printing Processes

- 10.1.2. End-User Vertical

- 10.1.2.1. Books & Magazines

- 10.1.2.2. Newspapers

- 10.1.2.3. Commercial Print

- 10.1.2.4. Labels & Packaging

- 10.1.2.5. Other End-User Verticals

- 10.1.1. Print Process

- 10.2. Market Analysis, Insights and Forecast - by QATAR PACKAGING MARKET

- 10.2.1. Material

- 10.2.1.1. Plastic

- 10.2.1.2. Paper & Paperboard

- 10.2.1.3. Glass

- 10.2.1.4. Metal

- 10.2.2. End-User Industry

- 10.2.2.1. Food

- 10.2.2.2. Beverage

- 10.2.2.3. Pharmaceuticals

- 10.2.2.4. Personal Care & Household Care

- 10.2.2.5. Other End-User Industries

- 10.2.1. Material

- 10.1. Market Analysis, Insights and Forecast - by QATAR PRINTING MARKET

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Qatar Polymer Industrial Co

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Matco Packaging LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Galaxy Carton Factory

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jama Plastic Industries Factory (JPIF) (MJK Group of Companies)*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Green Print W L L

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Arabian Packaging Industries

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Qatar National Printing Press (QNPP)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 New Printing Co (Ghanem Al Thani Holding Group)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 AST Group of Companies

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Aspire Printing

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Breezpack (Anesco Trading & Services WLL)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Qatar Polymer Industrial Co

List of Figures

- Figure 1: Global Label Printing Market in Qatar Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Label Printing Market in Qatar Revenue (billion), by QATAR PRINTING MARKET 2025 & 2033

- Figure 3: North America Label Printing Market in Qatar Revenue Share (%), by QATAR PRINTING MARKET 2025 & 2033

- Figure 4: North America Label Printing Market in Qatar Revenue (billion), by QATAR PACKAGING MARKET 2025 & 2033

- Figure 5: North America Label Printing Market in Qatar Revenue Share (%), by QATAR PACKAGING MARKET 2025 & 2033

- Figure 6: North America Label Printing Market in Qatar Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Label Printing Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Label Printing Market in Qatar Revenue (billion), by QATAR PRINTING MARKET 2025 & 2033

- Figure 9: South America Label Printing Market in Qatar Revenue Share (%), by QATAR PRINTING MARKET 2025 & 2033

- Figure 10: South America Label Printing Market in Qatar Revenue (billion), by QATAR PACKAGING MARKET 2025 & 2033

- Figure 11: South America Label Printing Market in Qatar Revenue Share (%), by QATAR PACKAGING MARKET 2025 & 2033

- Figure 12: South America Label Printing Market in Qatar Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Label Printing Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Label Printing Market in Qatar Revenue (billion), by QATAR PRINTING MARKET 2025 & 2033

- Figure 15: Europe Label Printing Market in Qatar Revenue Share (%), by QATAR PRINTING MARKET 2025 & 2033

- Figure 16: Europe Label Printing Market in Qatar Revenue (billion), by QATAR PACKAGING MARKET 2025 & 2033

- Figure 17: Europe Label Printing Market in Qatar Revenue Share (%), by QATAR PACKAGING MARKET 2025 & 2033

- Figure 18: Europe Label Printing Market in Qatar Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Label Printing Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Label Printing Market in Qatar Revenue (billion), by QATAR PRINTING MARKET 2025 & 2033

- Figure 21: Middle East & Africa Label Printing Market in Qatar Revenue Share (%), by QATAR PRINTING MARKET 2025 & 2033

- Figure 22: Middle East & Africa Label Printing Market in Qatar Revenue (billion), by QATAR PACKAGING MARKET 2025 & 2033

- Figure 23: Middle East & Africa Label Printing Market in Qatar Revenue Share (%), by QATAR PACKAGING MARKET 2025 & 2033

- Figure 24: Middle East & Africa Label Printing Market in Qatar Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Label Printing Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Label Printing Market in Qatar Revenue (billion), by QATAR PRINTING MARKET 2025 & 2033

- Figure 27: Asia Pacific Label Printing Market in Qatar Revenue Share (%), by QATAR PRINTING MARKET 2025 & 2033

- Figure 28: Asia Pacific Label Printing Market in Qatar Revenue (billion), by QATAR PACKAGING MARKET 2025 & 2033

- Figure 29: Asia Pacific Label Printing Market in Qatar Revenue Share (%), by QATAR PACKAGING MARKET 2025 & 2033

- Figure 30: Asia Pacific Label Printing Market in Qatar Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Label Printing Market in Qatar Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PRINTING MARKET 2020 & 2033

- Table 2: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PACKAGING MARKET 2020 & 2033

- Table 3: Global Label Printing Market in Qatar Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PRINTING MARKET 2020 & 2033

- Table 5: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PACKAGING MARKET 2020 & 2033

- Table 6: Global Label Printing Market in Qatar Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PRINTING MARKET 2020 & 2033

- Table 11: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PACKAGING MARKET 2020 & 2033

- Table 12: Global Label Printing Market in Qatar Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PRINTING MARKET 2020 & 2033

- Table 17: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PACKAGING MARKET 2020 & 2033

- Table 18: Global Label Printing Market in Qatar Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PRINTING MARKET 2020 & 2033

- Table 29: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PACKAGING MARKET 2020 & 2033

- Table 30: Global Label Printing Market in Qatar Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PRINTING MARKET 2020 & 2033

- Table 38: Global Label Printing Market in Qatar Revenue billion Forecast, by QATAR PACKAGING MARKET 2020 & 2033

- Table 39: Global Label Printing Market in Qatar Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Label Printing Market in Qatar Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Label Printing Market in Qatar?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Label Printing Market in Qatar?

Key companies in the market include Qatar Polymer Industrial Co, Matco Packaging LLC, Galaxy Carton Factory, Jama Plastic Industries Factory (JPIF) (MJK Group of Companies)*List Not Exhaustive, Green Print W L L, Arabian Packaging Industries, Qatar National Printing Press (QNPP), New Printing Co (Ghanem Al Thani Holding Group), AST Group of Companies, Aspire Printing, Breezpack (Anesco Trading & Services WLL).

3. What are the main segments of the Label Printing Market in Qatar?

The market segments include QATAR PRINTING MARKET, QATAR PACKAGING MARKET.

4. Can you provide details about the market size?

The market size is estimated to be USD 53.44 billion as of 2022.

5. What are some drivers contributing to market growth?

High Recyclability Rates of Metal Packaging; High Recyclability of Metal Cans.

6. What are the notable trends driving market growth?

Digital Printing to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Increasing Operational Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Label Printing Market in Qatar," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Label Printing Market in Qatar report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Label Printing Market in Qatar?

To stay informed about further developments, trends, and reports in the Label Printing Market in Qatar, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence