Key Insights

The Italian dental chair market is poised for significant expansion, projected to reach $2.1 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.9%. This growth is underpinned by an aging demographic, heightened oral hygiene and cosmetic dentistry awareness, and increasing disposable incomes that facilitate greater dental health investment. Advancements in digital imaging and CAD/CAM technologies are further stimulating demand for sophisticated dental chairs. The market is segmented by product type (general and diagnostic equipment, dental lasers, and dental consumables), treatment type (orthodontics, endodontics, periodontics, and prosthodontics), and end-user (hospitals, clinics).

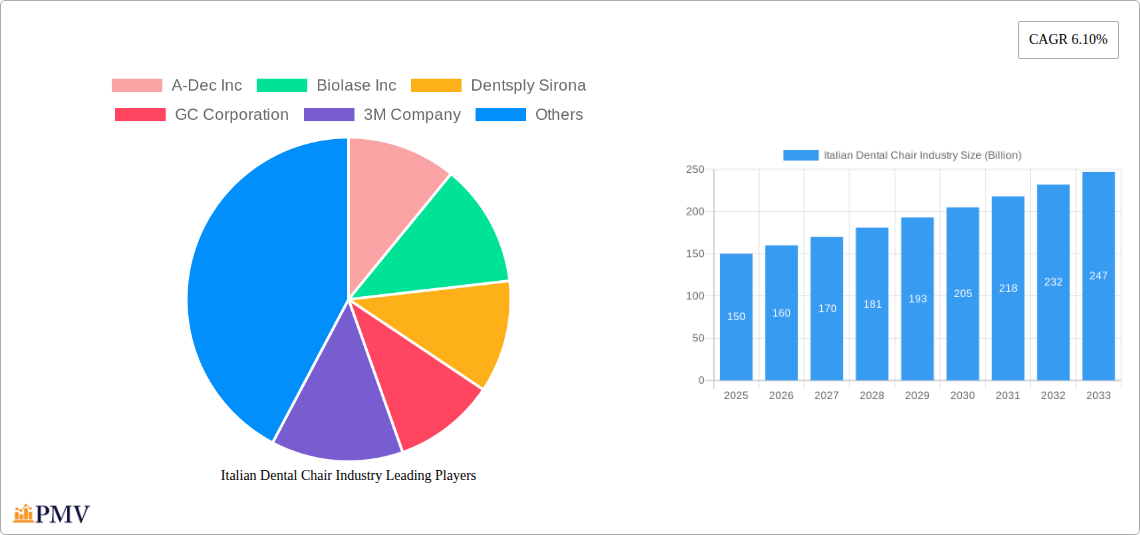

Italian Dental Chair Industry Market Size (In Billion)

Key industry players, including Dentsply Sirona, 3M Company, and Planmeca, are actively engaged in product innovation and strategic alliances to secure market share. Italy's well-established dental infrastructure provides a stable foundation for this market.

Italian Dental Chair Industry Company Market Share

Despite potential challenges such as the substantial initial investment required for advanced dental chairs and rigorous regulatory standards, the market's long-term outlook remains robust. Continuous technological innovation, the growing preference for minimally invasive procedures, and an emphasis on patient comfort will fuel sustained demand. The integration of digital technologies is expected to accelerate the adoption of advanced dental chairs, presenting substantial growth prospects for industry participants throughout the forecast period (2025-2033).

Italian Dental Chair Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the Italian dental chair industry, offering invaluable insights for stakeholders seeking to understand market dynamics, competitive landscapes, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to project future market trends. The report projects a market size exceeding €XX Billion by 2033.

Italian Dental Chair Industry Market Structure & Competitive Dynamics

The Italian dental chair market exhibits a moderately concentrated structure, with several multinational corporations and regional players vying for market share. The market's competitive intensity is fueled by ongoing product innovation, technological advancements, and strategic mergers and acquisitions (M&A). Regulatory frameworks, including those related to medical device approvals and safety standards, significantly influence market dynamics. Product substitutes, such as less expensive alternatives or digitally-driven solutions, pose a constant challenge to established players. End-user trends, particularly the increasing adoption of advanced technologies in dental clinics and hospitals, are reshaping market demands.

Key Metrics & Observations:

- Market Concentration: The top five players account for approximately XX% of the market share in 2025.

- M&A Activity: In the period 2019-2024, there were approximately XX M&A deals totaling €XX Billion in value, reflecting consolidation efforts within the industry.

- Innovation Ecosystems: Collaboration between dental equipment manufacturers, research institutions, and technology companies is driving the development of innovative products and solutions.

- Regulatory Frameworks: Stringent regulatory compliance requirements, especially concerning safety and efficacy, impact product development cycles and market entry strategies.

- Product Substitutes: The emergence of digitally-driven solutions and less-expensive alternatives puts pressure on traditional dental chair manufacturers.

- End-User Trends: The increasing demand for technologically advanced equipment from hospitals and specialized clinics is driving growth in high-end segments.

Italian Dental Chair Industry Industry Trends & Insights

The Italian dental chair market is experiencing robust growth, driven by a number of factors. Technological advancements, such as the incorporation of digital imaging and CAD/CAM technologies into dental chairs, are enhancing treatment precision and efficiency. Changing consumer preferences, including a growing demand for aesthetically pleasing and comfortable dental chair designs, are influencing market trends. Furthermore, rising disposable incomes and increasing healthcare expenditure are boosting market demand. However, factors such as economic fluctuations and the price sensitivity of some customer segments remain as challenges.

Key Market Trends:

- Technological Disruptions: The integration of AI, IoT, and robotics in dental chairs is enhancing treatment efficacy and patient comfort, leading to a shift towards minimally invasive procedures.

- Market Growth Drivers: Favorable reimbursement policies, an aging population, and improved oral healthcare awareness are driving market expansion.

- Competitive Dynamics: The market is witnessing increasing competition, with both established players and new entrants vying for market share through product innovation and strategic partnerships.

- CAGR: The market is projected to grow at a CAGR of XX% during the forecast period (2025-2033).

- Market Penetration: The penetration of advanced dental chair technologies in specialized clinics is relatively high, whereas in smaller practices penetration remains lower.

Dominant Markets & Segments in Italian Dental Chair Industry

The Italian dental chair market demonstrates regional variations in growth and market dominance. Within product segments, general and diagnostic equipment, including dental lasers (both soft tissue and hard tissue), holds the largest share. The end-user segment dominated by clinics exhibits the highest growth. Treatment segments, such as orthodontics, endodontics, periodontics, and prosthodontics, all contribute significantly, with orthodontics exhibiting particularly strong growth.

Key Drivers:

- Economic Policies: Government initiatives supporting healthcare infrastructure development and investment in dental care are major drivers.

- Infrastructure: The availability of well-equipped dental clinics and hospitals is driving market growth in specific regions.

- Technological Advancements: The adoption of advanced technologies in specific treatment segments (e.g., laser dentistry in endodontics) fuels segment growth.

Dominance Analysis:

- Product: General and diagnostic equipment, especially dental lasers, holds the largest market share due to high demand and technological advancements.

- Treatment: Orthodontics is experiencing rapid growth due to increased awareness and demand for corrective procedures.

- End User: Clinics represent the largest end-user segment owing to high treatment volumes and technological adoption.

Italian Dental Chair Industry Product Innovations

Recent innovations in the Italian dental chair industry focus on integrating advanced technologies to improve treatment efficiency, patient comfort, and dental practice workflows. This includes the development of ergonomic designs, enhanced imaging capabilities, and the incorporation of digital technologies for precise treatment planning. The market is also witnessing the increased adoption of laser technologies for various dental procedures, enhancing precision and reducing invasiveness. These innovations are driving market growth by addressing the needs of both dentists and patients.

Report Segmentation & Scope

This report segments the Italian dental chair market across multiple dimensions:

Product: General and Diagnostic Equipment (including Dental Consumables); Dental Lasers (Soft Tissue & Hard Tissue Lasers); Other General and Diagnostic Equipment (including Other Dental Consumables).

Treatment: Orthodontics; Endodontics; Periodontics; Prosthodontics.

End User: Hospitals; Clinics; Other End Users.

Each segment is analyzed in detail, considering growth projections, market size, and competitive dynamics. The report provides granular insights into each category's market share, growth drivers, and future trends. For example, the Dental Laser segment is anticipated to experience significant growth due to increased adoption of minimally invasive techniques.

Key Drivers of Italian Dental Chair Industry Growth

Several factors propel the growth of the Italian dental chair industry. Technological advancements, including the integration of digital technologies and AI, lead to improved precision and efficiency in dental procedures. Favorable economic conditions and increasing healthcare expenditure also contribute to market expansion. Furthermore, government policies promoting oral healthcare and investment in dental infrastructure play a vital role.

Challenges in the Italian Dental Chair Industry Sector

The Italian dental chair industry faces several challenges. Stringent regulatory approvals for new medical devices can slow down product launches and increase development costs. Supply chain disruptions and fluctuations in raw material prices can affect profitability. Finally, intense competition from both domestic and international players necessitates continuous innovation and strategic adaptation. These factors collectively impact the overall market growth.

Leading Players in the Italian Dental Chair Industry Market

Key Developments in Italian Dental Chair Industry Sector

- May 2021: Pearl received CE certification for its Second Opinion AI solution for radiological detection of dental pathologies. This significantly impacted the diagnostics segment.

- April 2021: BIOLASE, Inc. and EdgeEndo announced plans to develop the EdgePRO laser-assisted microfluidic irrigation device for endodontists, driving innovation within the endodontic treatment segment.

Strategic Italian Dental Chair Industry Market Outlook

The future of the Italian dental chair industry appears promising, driven by continued technological advancements, increasing healthcare awareness, and favorable economic conditions. Strategic opportunities exist for players focused on innovation, particularly in areas such as AI-powered diagnostics and minimally invasive procedures. Expanding into underserved regions and strengthening partnerships will be crucial for market leadership. The market is poised for substantial growth, presenting lucrative opportunities for both established and emerging players.

Italian Dental Chair Industry Segmentation

-

1. Product

-

1.1. General and Diagnostics Equipment

-

1.1.1. Dental Lasers

- 1.1.1.1. Soft Tissue Lasers

- 1.1.1.2. Hard Tissue Lasers

- 1.1.2. Radiology Equipment

- 1.1.3. Dental Chair and Equipment

- 1.1.4. Other General and Diagnostic Equipment

-

1.1.1. Dental Lasers

-

1.2. Dental Consumables

- 1.2.1. Dental Biomaterial

- 1.2.2. Dental Implants

- 1.2.3. Crowns and Bridges

- 1.2.4. Other Dental Consumables

- 1.3. Other Dental Devices

-

1.1. General and Diagnostics Equipment

-

2. Treatment

- 2.1. Orthodontics

- 2.2. Endodontics

- 2.3. Periodontics

- 2.4. Prosthodontics

-

3. End User

- 3.1. Hospitals

- 3.2. Clinics

- 3.3. Other End Users

Italian Dental Chair Industry Segmentation By Geography

- 1. Italia

Italian Dental Chair Industry Regional Market Share

Geographic Coverage of Italian Dental Chair Industry

Italian Dental Chair Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 As the demand for advanced dental care and cosmetic dentistry continues to rise

- 3.2.2 so does the need for high-quality equipment. Italian dental chairs are highly sought after due to their reputation for blending functionality

- 3.2.3 durability

- 3.2.4 and design.

- 3.3. Market Restrains

- 3.3.1 Italian dental chairs are often positioned in the premium segment of the market due to their high-quality materials

- 3.3.2 advanced technology

- 3.3.3 and design. This can limit their adoption in lower-income markets or smaller clinics with tight budget

- 3.4. Market Trends

- 3.4.1 The future of the Italian dental chair industry is likely to involve further integration with digital dentistry. Smart chairs that can monitor patient vitals

- 3.4.2 communicate with other dental equipment

- 3.4.3 and adjust settings automatically based on patient data are expected to become more common

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italian Dental Chair Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. General and Diagnostics Equipment

- 5.1.1.1. Dental Lasers

- 5.1.1.1.1. Soft Tissue Lasers

- 5.1.1.1.2. Hard Tissue Lasers

- 5.1.1.2. Radiology Equipment

- 5.1.1.3. Dental Chair and Equipment

- 5.1.1.4. Other General and Diagnostic Equipment

- 5.1.1.1. Dental Lasers

- 5.1.2. Dental Consumables

- 5.1.2.1. Dental Biomaterial

- 5.1.2.2. Dental Implants

- 5.1.2.3. Crowns and Bridges

- 5.1.2.4. Other Dental Consumables

- 5.1.3. Other Dental Devices

- 5.1.1. General and Diagnostics Equipment

- 5.2. Market Analysis, Insights and Forecast - by Treatment

- 5.2.1. Orthodontics

- 5.2.2. Endodontics

- 5.2.3. Periodontics

- 5.2.4. Prosthodontics

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italia

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 A-Dec Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Biolase Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dentsply Sirona

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GC Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 3M Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Envista Holdings Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Planmeca

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Carestream Health Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 A-Dec Inc

List of Figures

- Figure 1: Italian Dental Chair Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Italian Dental Chair Industry Share (%) by Company 2025

List of Tables

- Table 1: Italian Dental Chair Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Italian Dental Chair Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 3: Italian Dental Chair Industry Revenue billion Forecast, by Treatment 2020 & 2033

- Table 4: Italian Dental Chair Industry Volume K Units Forecast, by Treatment 2020 & 2033

- Table 5: Italian Dental Chair Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Italian Dental Chair Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 7: Italian Dental Chair Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Italian Dental Chair Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Italian Dental Chair Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 10: Italian Dental Chair Industry Volume K Units Forecast, by Product 2020 & 2033

- Table 11: Italian Dental Chair Industry Revenue billion Forecast, by Treatment 2020 & 2033

- Table 12: Italian Dental Chair Industry Volume K Units Forecast, by Treatment 2020 & 2033

- Table 13: Italian Dental Chair Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Italian Dental Chair Industry Volume K Units Forecast, by End User 2020 & 2033

- Table 15: Italian Dental Chair Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Italian Dental Chair Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italian Dental Chair Industry?

The projected CAGR is approximately 6.9%.

2. Which companies are prominent players in the Italian Dental Chair Industry?

Key companies in the market include A-Dec Inc, Biolase Inc, Dentsply Sirona, GC Corporation, 3M Company, Envista Holdings Corporation, Planmeca, Carestream Health Inc.

3. What are the main segments of the Italian Dental Chair Industry?

The market segments include Product, Treatment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.1 billion as of 2022.

5. What are some drivers contributing to market growth?

As the demand for advanced dental care and cosmetic dentistry continues to rise. so does the need for high-quality equipment. Italian dental chairs are highly sought after due to their reputation for blending functionality. durability. and design..

6. What are the notable trends driving market growth?

The future of the Italian dental chair industry is likely to involve further integration with digital dentistry. Smart chairs that can monitor patient vitals. communicate with other dental equipment. and adjust settings automatically based on patient data are expected to become more common.

7. Are there any restraints impacting market growth?

Italian dental chairs are often positioned in the premium segment of the market due to their high-quality materials. advanced technology. and design. This can limit their adoption in lower-income markets or smaller clinics with tight budget.

8. Can you provide examples of recent developments in the market?

In May 2021, Pearl announced that it had received CE certification for its Second Opinion AI solution. The product will help dentists in the radiological detection of dental pathologies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italian Dental Chair Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italian Dental Chair Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italian Dental Chair Industry?

To stay informed about further developments, trends, and reports in the Italian Dental Chair Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence