Key Insights

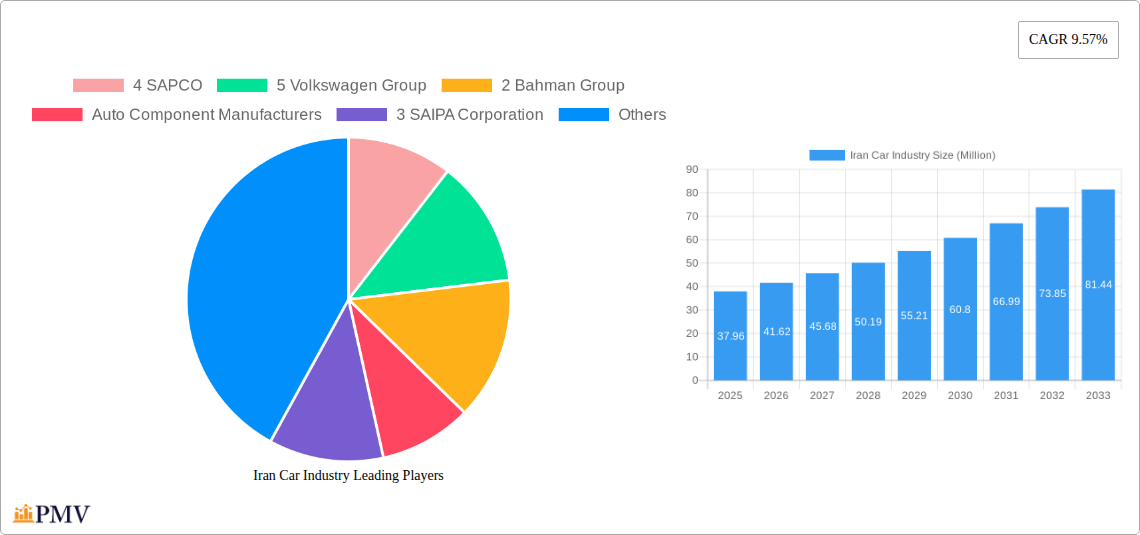

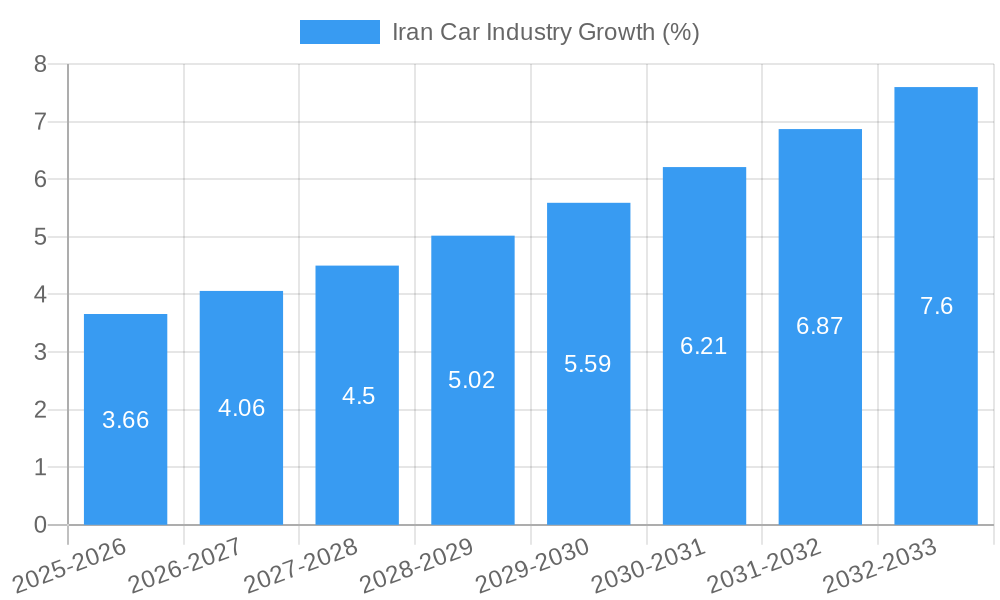

The Iranian car industry, valued at $37.96 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 9.57% from 2025 to 2033. This expansion is driven by several factors. Increasing disposable incomes and a growing young population fuel demand for personal vehicles, particularly passenger cars and motorcycles. Government initiatives aimed at infrastructure development and promoting domestic manufacturing also contribute to market expansion. Furthermore, the industry benefits from a relatively low cost of labor and proximity to key raw materials. However, the market faces challenges, including economic sanctions that limit access to advanced technologies and foreign investment, and fluctuations in oil prices impacting consumer spending. Competition among established domestic players like Iran Khodro (IKCO), SAIPA Corporation, and Bahman Group, alongside international brands like Volkswagen and Hyundai, is fierce, leading to price wars and the need for continuous innovation in vehicle design and features to retain market share. The segmentation of the market into passenger cars, commercial vehicles, and motorcycles reflects diverse consumer needs and industry capabilities. The auto ancillary and engine manufacturing segments are crucial components of the overall automotive ecosystem, directly influencing production capacity and vehicle quality.

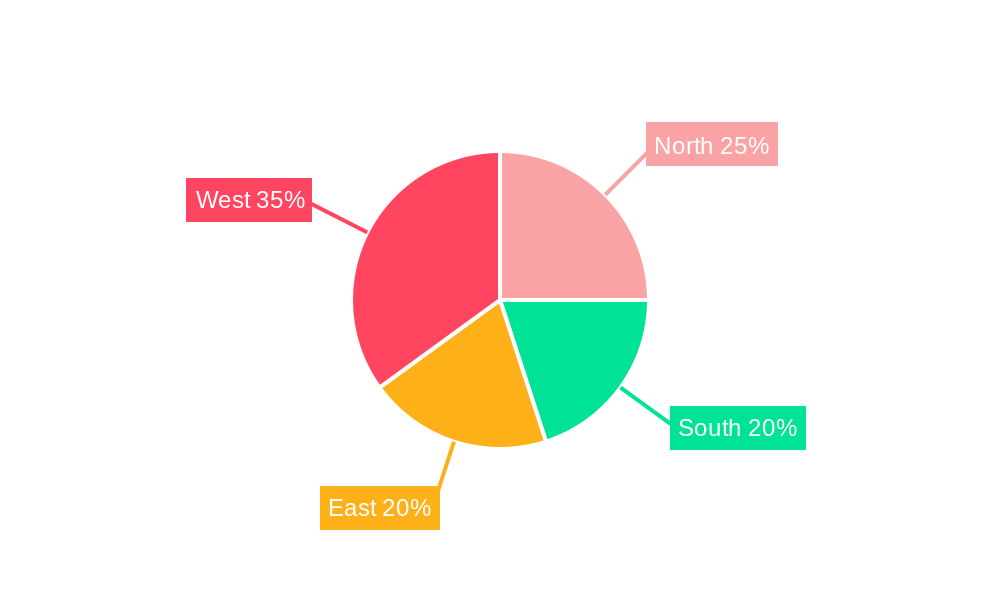

The forecast period (2025-2033) anticipates a significant increase in the market size, driven by the aforementioned growth drivers. However, the ongoing economic situation and geopolitical factors will play a pivotal role in determining the actual growth trajectory. Further market penetration could be achieved through strategic partnerships with international companies, modernization of production processes, and the development of fuel-efficient and environmentally friendly vehicles, responding to global trends toward sustainability. This strategy may mitigate existing constraints and unlock further market potential. The regional variations within Iran – North, South, East, and West – will also significantly influence demand, reflecting regional economic disparities and infrastructure development levels. Detailed analysis of these factors will enable a comprehensive understanding of future market dynamics and investment opportunities.

Iran Car Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report provides a detailed analysis of the Iranian car industry, encompassing market size, segmentation, competitive landscape, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report features data on passenger cars, commercial vehicles, and motorcycles, across various manufacturer types including auto ancillaries and engine manufacturers. The total market size in 2025 is estimated at xx Million USD, projected to reach xx Million USD by 2033.

Iran Car Industry Market Structure & Competitive Dynamics

The Iranian car industry is characterized by a complex interplay of domestic and international players, a fragmented yet concentrated market structure, and evolving regulatory frameworks. Iran Khodro (IKCO) and SAIPA Corporation dominate the market, collectively commanding a significant market share of over xx%. However, the presence of international players such as Volkswagen Group, Renault Pars, Hyundai Motor Company, and Kia Motors Corporation adds layers of complexity to the competitive landscape. The industry displays moderate innovation, primarily focused on adapting existing technologies to the local context. Recent years have witnessed a surge in M&A activities, although the total deal values remain relatively low at approximately xx Million USD over the past five years. This is primarily due to sanctions imposed on Iran and fluctuating governmental policies.

- Market Concentration: Highly concentrated, with IKCO and SAIPA dominating.

- Innovation Ecosystem: Moderate, with focus on adaptation and localization.

- Regulatory Frameworks: Evolving, with recent revisions impacting import regulations.

- Product Substitutes: Limited due to import restrictions; however, the use of second-hand cars is significant.

- End-User Trends: Shifting towards more fuel-efficient vehicles and improved safety features.

- M&A Activities: Limited, with modest deal values over the past few years, owing to sanctions and political uncertainty.

Iran Car Industry Industry Trends & Insights

The Iranian car industry is poised for significant transformation in the coming years. Market growth is driven by rising disposable incomes, increasing urbanization, and government initiatives to boost domestic manufacturing. However, challenges remain, including sanctions, fluctuating oil prices, and a lack of access to advanced technologies. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be approximately xx%, indicating strong potential but sensitivity to global and domestic factors. Market penetration of new technologies such as electric vehicles is limited but gradually increasing, due to high import costs and limited domestic production. Consumer preferences are shifting towards better fuel efficiency and safety, a trend supported by ongoing governmental regulations. Competitive dynamics are driven by both domestic players striving for market share and the entry of international brands in response to relaxed import laws.

Dominant Markets & Segments in Iran Car Industry

The passenger car segment is the dominant sector within the Iranian car industry, accounting for approximately xx% of the total market value in 2025. This is driven by increasing urbanization and a growing middle class. The Tehran region dominates the market in terms of sales and production.

By Vehicle Type:

- Passenger Cars: Dominant segment driven by rising disposable incomes and urbanization. Key drivers include government incentives for domestic car purchases and increasing demand for private transportation.

- Commercial Vehicles: Steady growth, driven by infrastructure development and logistics.

- Motorcycles: Significant market, driven by affordability and suitability for urban commuting.

By Manufacturer Type:

- Auto Ancillaries: Growing sector, supporting the expansion of domestic manufacturing.

- Engine Manufacturers: Focus on fuel efficiency and localization of production.

- Other Manufacturing Types: Diverse, reflecting the fragmented nature of the industry.

The dominance of passenger cars stems from the growing middle class and its increasing affordability. Economic policies focusing on infrastructure development further contribute to this dominance.

Iran Car Industry Product Innovations

Recent product developments focus on improving fuel efficiency, safety features, and incorporating more modern designs while keeping costs competitive. Several domestic manufacturers have launched new models featuring updated engines and technological advancements. The market fit for these innovations is positive, reflecting evolving consumer demands and regulatory pressures, though significant technological leaps remain limited.

Report Segmentation & Scope

This report segments the Iranian car industry by vehicle type (passenger cars, commercial vehicles, motorcycles) and manufacturer type (auto ancillaries, engine manufacturers, other manufacturing types). Each segment is analyzed based on historical data (2019-2024), current market size (2025), and future projections (2025-2033). Growth projections vary significantly across segments, with passenger cars expected to maintain the fastest growth rate. Competitive dynamics within each segment are assessed, highlighting key players and their market strategies.

Key Drivers of Iran Car Industry Growth

Several factors drive the growth of the Iranian car industry: increasing disposable incomes fostering demand for personal vehicles; government support for domestic manufacturing through various subsidies and incentives; and infrastructure development creating a need for more vehicles for both personal and commercial use. Furthermore, recent changes in import regulations are enabling the entry of international brands, potentially boosting competition and technology transfer.

Challenges in the Iran Car Industry Sector

The Iranian car industry faces significant challenges, including: persistent international sanctions that restrict access to advanced technologies and international financing; supply chain disruptions that impact production efficiency; and intense competition from both domestic and international players. These factors, along with ongoing political and economic uncertainties, significantly impact the industry's growth trajectory.

Leading Players in the Iran Car Industry Market

- Iran Khodro (IKCO)

- SAIPA Corporation

- Pars Khodro

- Bahman Group

- Renault Pars

- SAPCO

- Monavari Brothers Industrial Group

- IPM

- Hyundai Motor Company

- Kia Motors Corporation

- Volkswagen Group

- Sazeh Gostar

- Auto Component Manufacturers

Key Developments in Iran Car Industry Sector

- July 2023: Skoda's return to the Iranian market after a 40-year absence signals increased openness to international brands and a potential boost to competition. This follows a revision of car import regulations.

- October 2022: IKCO's launch of the TF21 model demonstrates a focus on product diversification and expansion of the domestic market.

Strategic Iran Car Industry Market Outlook

The Iranian car industry holds significant long-term potential despite current challenges. Strategic opportunities lie in leveraging government support for domestic manufacturing, attracting further international collaborations, and adapting to evolving consumer preferences. The market's resilience and potential for growth are evident, especially with ongoing adjustments to import regulations and a potential easing of international sanctions. The future success will hinge on navigating political and economic uncertainties, embracing technological advancements, and enhancing the competitiveness of domestically produced vehicles.

Iran Car Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

- 1.3. Motorcycles

-

2. Manufacturer Type

- 2.1. Auto Ancillaries

- 2.2. Engine

- 2.3. Other Manufacturing Types

Iran Car Industry Segmentation By Geography

- 1. Iran

Iran Car Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.57% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing in The Passenger Car Sales Across the Region

- 3.3. Market Restrains

- 3.3.1. Transportation Infrastructure Development

- 3.4. Market Trends

- 3.4.1. Growing Passenger Car Sales to Have Positive Impact on the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Car Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.1.3. Motorcycles

- 5.2. Market Analysis, Insights and Forecast - by Manufacturer Type

- 5.2.1. Auto Ancillaries

- 5.2.2. Engine

- 5.2.3. Other Manufacturing Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North Iran Car Industry Analysis, Insights and Forecast, 2019-2031

- 7. South Iran Car Industry Analysis, Insights and Forecast, 2019-2031

- 8. East Iran Car Industry Analysis, Insights and Forecast, 2019-2031

- 9. West Iran Car Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 4 SAPCO

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 5 Volkswagen Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 2 Bahman Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Auto Component Manufacturers

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 3 SAIPA Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Automobile Manufacturers

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 4 Renault Pars

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 5 IPM

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 6 Hyundai Motor Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 3 Monavari Brothers Industrial Group

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 1 Iran Khodro (IKCO)

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 7 Kia Motors Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 1 Sazeh Gostar

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 2 Pars Khodro

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 4 SAPCO

List of Figures

- Figure 1: Iran Car Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Iran Car Industry Share (%) by Company 2024

List of Tables

- Table 1: Iran Car Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Iran Car Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Iran Car Industry Revenue Million Forecast, by Manufacturer Type 2019 & 2032

- Table 4: Iran Car Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Iran Car Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North Iran Car Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South Iran Car Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East Iran Car Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West Iran Car Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Iran Car Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 11: Iran Car Industry Revenue Million Forecast, by Manufacturer Type 2019 & 2032

- Table 12: Iran Car Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Car Industry?

The projected CAGR is approximately 9.57%.

2. Which companies are prominent players in the Iran Car Industry?

Key companies in the market include 4 SAPCO, 5 Volkswagen Group, 2 Bahman Group, Auto Component Manufacturers, 3 SAIPA Corporation, Automobile Manufacturers, 4 Renault Pars, 5 IPM, 6 Hyundai Motor Company, 3 Monavari Brothers Industrial Group, 1 Iran Khodro (IKCO), 7 Kia Motors Corporation, 1 Sazeh Gostar, 2 Pars Khodro.

3. What are the main segments of the Iran Car Industry?

The market segments include Vehicle Type, Manufacturer Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 37.96 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing in The Passenger Car Sales Across the Region.

6. What are the notable trends driving market growth?

Growing Passenger Car Sales to Have Positive Impact on the Market.

7. Are there any restraints impacting market growth?

Transportation Infrastructure Development.

8. Can you provide examples of recent developments in the market?

July 2023: Volkswagen's wholly-owned Czech subsidiary, Skoda, was poised to make a comeback in Iran's auto market after an absence of four decades. The reintroduction of five Skoda models to Iranian showrooms follows a revision of the country's car import regulations, which now permit the importation of new and used cars.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Car Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Car Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Car Industry?

To stay informed about further developments, trends, and reports in the Iran Car Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence