Key Insights

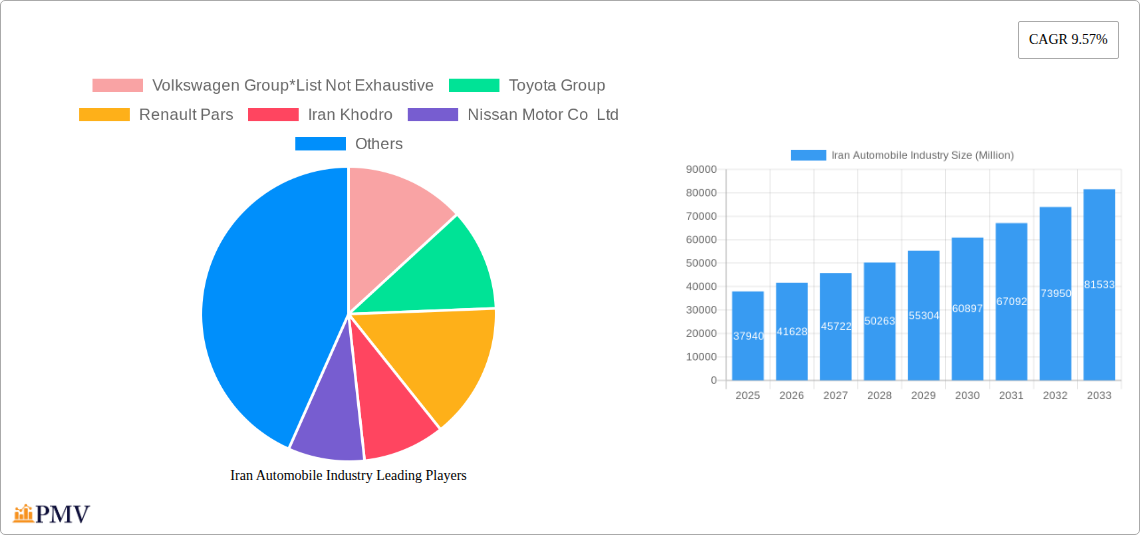

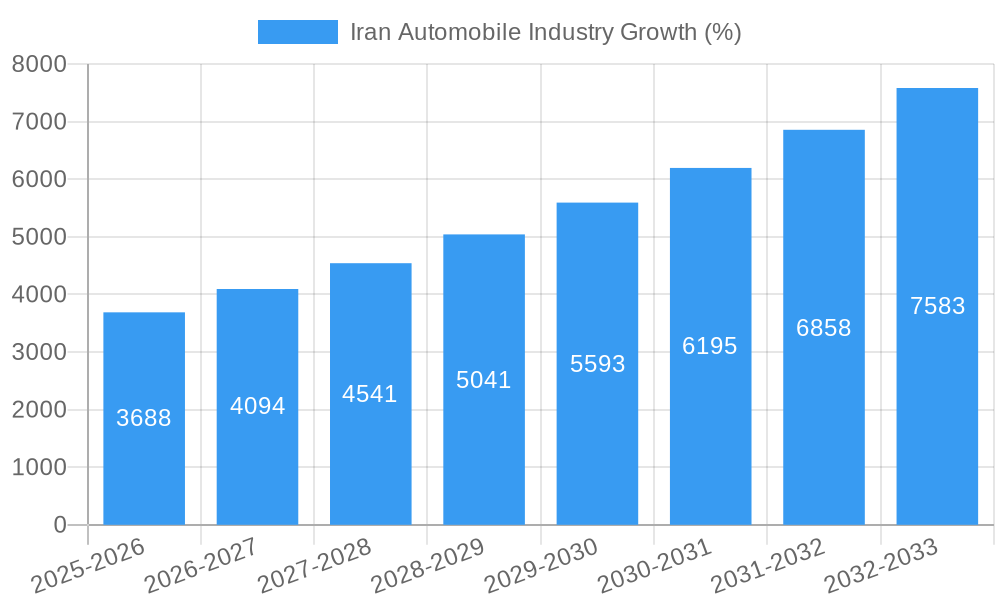

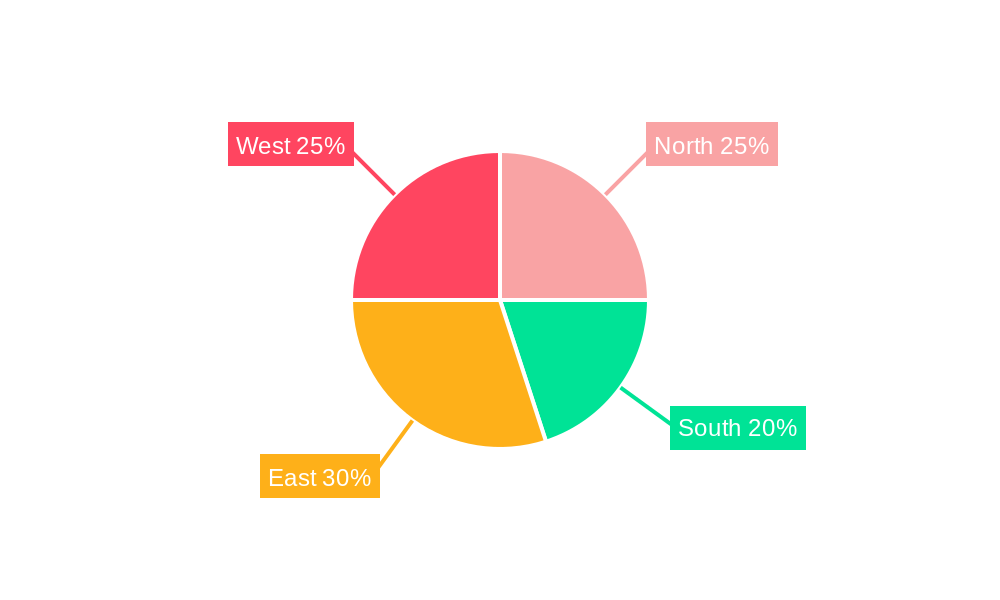

The Iranian automobile industry, valued at $37.94 billion in 2025, is projected to experience robust growth, with a compound annual growth rate (CAGR) of 9.57% from 2025 to 2033. This expansion is driven by several factors. Rising disposable incomes and a burgeoning middle class are fueling demand for personal vehicles, particularly passenger cars. Government initiatives aimed at modernizing the infrastructure and promoting domestic manufacturing also contribute significantly. Furthermore, the increasing urbanization in Iran is leading to a higher need for efficient transportation solutions, stimulating market growth. However, the industry faces challenges including the impact of international sanctions, fluctuating oil prices, and the need to adapt to global trends toward electric vehicles and stricter emission standards. While the dominance of internal combustion engine (ICE) vehicles currently persists, the market is gradually witnessing the emergence of electric vehicles, although their market share remains relatively small. Competition among major players like Volkswagen Group, Toyota Group, Renault Pars, Iran Khodro, Nissan Motor Co Ltd, Brilliance Automobile Group, Hyundai Kia Automotive Group, and SAIPA Group is intense, leading to price wars and continuous innovation. The regional distribution of the market within Iran (North, South, East, West) likely reflects varying levels of economic development and infrastructure, impacting vehicle ownership and sales patterns. The forecast period anticipates continued growth, driven by the factors mentioned above, while acknowledging potential headwinds related to economic and geopolitical uncertainties.

The strategic positioning of domestic players and the adaptability of foreign investors in navigating the regulatory landscape will significantly influence the trajectory of the Iranian automotive sector. The transition to cleaner energy vehicles presents both a challenge and an opportunity, requiring significant investments in infrastructure and technology. Successful navigation of these factors will determine the industry's overall growth potential within the next decade, with the potential for surpassing initial projections if favorable economic conditions and supportive government policies prevail. Furthermore, continued improvements in local manufacturing capabilities and the adoption of advanced technologies will be crucial for long-term sustainability and competitiveness in a globally evolving automotive landscape.

Iran Automobile Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the Iranian automobile industry, covering market structure, competitive dynamics, industry trends, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and an estimated/forecast period of 2025-2033, this report offers critical insights for industry stakeholders, investors, and policymakers. The analysis includes detailed segmentation by vehicle type (passenger and commercial vehicles) and fuel type (Internal Combustion Engine (ICE) and Electric Vehicles (EVs)), providing a granular understanding of the market's evolution. The report’s findings are based on extensive research and incorporate projected values where data is unavailable.

Iran Automobile Industry Market Structure & Competitive Dynamics

The Iranian automobile market displays a moderately concentrated structure, with a few dominant players commanding significant market share. Iran Khodro and SAIPA Group historically held the largest shares, but the entry and growth of global players like the Volkswagen Group, Toyota Group, Renault Pars, Nissan Motor Co Ltd, Brilliance Automobile Group, and Hyundai Kia Automotive Group have introduced intensified competition. The level of innovation within the ecosystem is currently moderate, constrained by sanctions and import restrictions. However, a push towards localization and technological advancements suggests future increases. The regulatory framework, while evolving, presents both opportunities and challenges, especially regarding import tariffs and emission standards. The market is witnessing increased demand for fuel-efficient vehicles, resulting in a notable rise of ICE vehicles but also increasing attention towards Electric Vehicles. Recent M&A activity has been limited due to sanctions; however, projected deal values for the forecast period sit at approximately xx Million. Future M&A activity is expected to increase with the easing of sanctions.

- Market Concentration: Iran Khodro and SAIPA Group hold a combined historical market share of approximately xx%, with the remaining share split amongst other domestic and international players.

- Innovation Ecosystem: Limited compared to global standards, driven by a necessity for localization and government policies promoting technological self-sufficiency.

- Regulatory Framework: Stringent regulations regarding imports and manufacturing standards influence both market access and pricing.

- Product Substitutes: Limited due to import restrictions, but this factor might significantly change in a future less restrictive environment.

- End-User Trends: Shifting towards more fuel-efficient vehicles and a growing preference for improved safety and comfort features.

- M&A Activity (Historical): Limited transactions due to sanctions, with deal values totaling approximately xx Million.

Iran Automobile Industry Industry Trends & Insights

The Iranian automobile industry is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Key growth drivers include rising disposable incomes, increasing urbanization, and government initiatives promoting domestic vehicle manufacturing. However, challenges such as economic sanctions, fluctuating oil prices, and currency volatility pose significant risks. The penetration of electric vehicles is still low, but government support for EV infrastructure and technology transfer agreements are likely to accelerate market penetration to approximately xx% by 2033. Technological disruptions are evident in the increasing adoption of advanced driver-assistance systems (ADAS) and connectivity features, even if at a slower pace than in global markets. Consumer preferences are leaning towards fuel-efficient and feature-rich vehicles, mirroring global automotive trends. The competitive landscape is witnessing a gradual shift from a dominance of domestic players to increased participation by international automotive giants.

Dominant Markets & Segments in Iran Automobile Industry

The passenger vehicle segment constitutes the dominant market share, holding approximately xx% of the total market, driven by high consumer demand. Geographically, the Tehran region accounts for the largest market share, reflecting the concentration of population and economic activity. The IC Engine segment maintains dominance in the fuel type category, with a share of approximately xx%, however EVs and hybrid technologies show a promising projection and are expected to grow substantially during the forecast period.

- Key Drivers for Passenger Vehicle Segment Dominance: Rising disposable incomes, increasing urbanization, and expanding credit availability.

- Key Drivers for Tehran Region Dominance: High population density, significant economic activity, and better infrastructure.

- Key Drivers for IC Engine Segment Dominance: Lower initial cost of ICE vehicles and the lack of widespread EV infrastructure.

Iran Automobile Industry Product Innovations

The Iranian automobile industry is witnessing slow but steady product development, focusing primarily on improving fuel efficiency, safety features, and incorporating basic connectivity features. While the pace is slower due to sanctions and resource limitations, there is a growing emphasis on localization and collaboration with international technology partners to integrate advanced features, such as ADAS and in-car entertainment systems. This process is aimed at improving the competitiveness and market positioning of domestic automakers.

Report Segmentation & Scope

This report segments the Iranian automobile market by vehicle type (passenger and commercial vehicles) and fuel type (ICE and electric vehicles). The passenger vehicle segment is expected to exhibit a CAGR of xx% during the forecast period, driven by rising consumer demand. The commercial vehicle segment, crucial to Iran's logistics sector, projects a CAGR of xx%. Within the fuel type category, the ICE segment is projected to dominate until 2033, while the electric vehicle segment is anticipated to exhibit significant, yet limited growth, primarily constrained by infrastructural challenges. Competitive dynamics are characterized by the presence of both domestic manufacturers and international players, leading to diverse market offerings and price ranges.

Key Drivers of Iran Automobile Industry Growth

Several factors drive the growth of the Iranian automobile industry. These include the government's focus on infrastructure development, including road networks and public transport. Furthermore, supportive economic policies aim to stimulate domestic manufacturing and attract foreign investment. Technological advancements, such as improved fuel efficiency and safety features, and the growing consumer base with increased purchasing power further contribute to this growth. Relaxation of sanctions would greatly accelerate the industry's expansion and attract more foreign investment.

Challenges in the Iran Automobile Industry Sector

The Iranian automobile industry faces multiple challenges, including economic sanctions, import restrictions that complicate sourcing of parts, and currency volatility impacting production costs. These factors lead to supply chain disruptions and increased manufacturing prices, affecting affordability. Stiff competition from established players and the need for technological upgrades are further constraints. Government regulations on emission standards also put pressure on the industry's ability to offer competitive vehicles. These constraints significantly limit growth potential.

Leading Players in the Iran Automobile Industry Market

- Volkswagen Group

- Toyota Group

- Renault Pars

- Iran Khodro

- Nissan Motor Co Ltd

- Brilliance Automobile Group

- Hyundai Kia Automotive Group

- SAIPA Group

Key Developments in Iran Automobile Industry Sector

- 2022 Q4: Iran Khodro launched a new domestically designed SUV model.

- 2023 Q1: SAIPA Group announced a joint venture with a Chinese automaker to produce electric vehicles.

- 2023 Q2: The Iranian government introduced new incentives for the production of electric vehicles.

Strategic Iran Automobile Industry Market Outlook

The Iranian automobile industry holds substantial long-term potential. Easing of sanctions and increased foreign investment could unlock significant growth. Focus on technological advancements, especially in the electric vehicle sector, will be crucial for future success. Strategic partnerships with international automotive companies and a commitment to producing high-quality, affordable vehicles, well-adapted to local conditions, will be essential to gain a greater market share. The growth will be largely contingent on the improvement of the country's economic and geopolitical situation.

Iran Automobile Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Vehicles

- 1.2. Commercial Vehicles

-

2. Fuel Type

- 2.1. IC Engines

- 2.2. Electric

Iran Automobile Industry Segmentation By Geography

- 1. Iran

Iran Automobile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.57% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Preference toward Fast Food Consumption Fosters the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Rapid Integration of Online Food Delivery Services Hampers the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Passenger Car Segment to Witness Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Vehicles

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. IC Engines

- 5.2.2. Electric

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North Iran Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 7. South Iran Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 8. East Iran Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 9. West Iran Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Volkswagen Group*List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Toyota Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Renault Pars

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Iran Khodro

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Nissan Motor Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Brilliance Automobile Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Hyundai Kia Automotive Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 SAIPA Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 Volkswagen Group*List Not Exhaustive

List of Figures

- Figure 1: Iran Automobile Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Iran Automobile Industry Share (%) by Company 2024

List of Tables

- Table 1: Iran Automobile Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Iran Automobile Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Iran Automobile Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: Iran Automobile Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Iran Automobile Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North Iran Automobile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South Iran Automobile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East Iran Automobile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West Iran Automobile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Iran Automobile Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 11: Iran Automobile Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 12: Iran Automobile Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Automobile Industry?

The projected CAGR is approximately 9.57%.

2. Which companies are prominent players in the Iran Automobile Industry?

Key companies in the market include Volkswagen Group*List Not Exhaustive, Toyota Group, Renault Pars, Iran Khodro, Nissan Motor Co Ltd, Brilliance Automobile Group, Hyundai Kia Automotive Group, SAIPA Group.

3. What are the main segments of the Iran Automobile Industry?

The market segments include Vehicle Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 37.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Preference toward Fast Food Consumption Fosters the Growth of the Market.

6. What are the notable trends driving market growth?

Passenger Car Segment to Witness Highest Growth.

7. Are there any restraints impacting market growth?

Rapid Integration of Online Food Delivery Services Hampers the Growth of the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Automobile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Automobile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Automobile Industry?

To stay informed about further developments, trends, and reports in the Iran Automobile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence