Key Insights

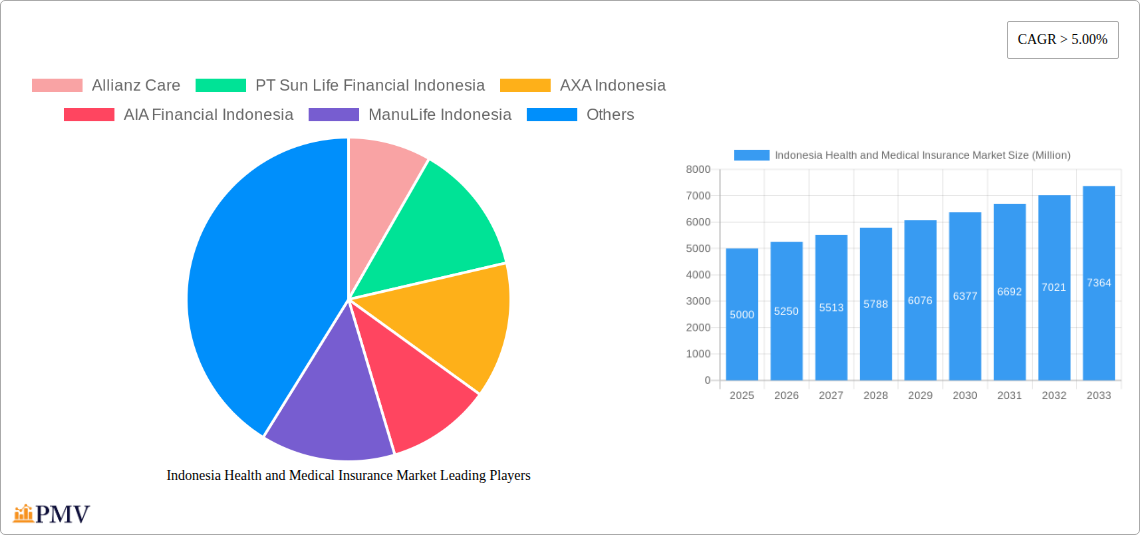

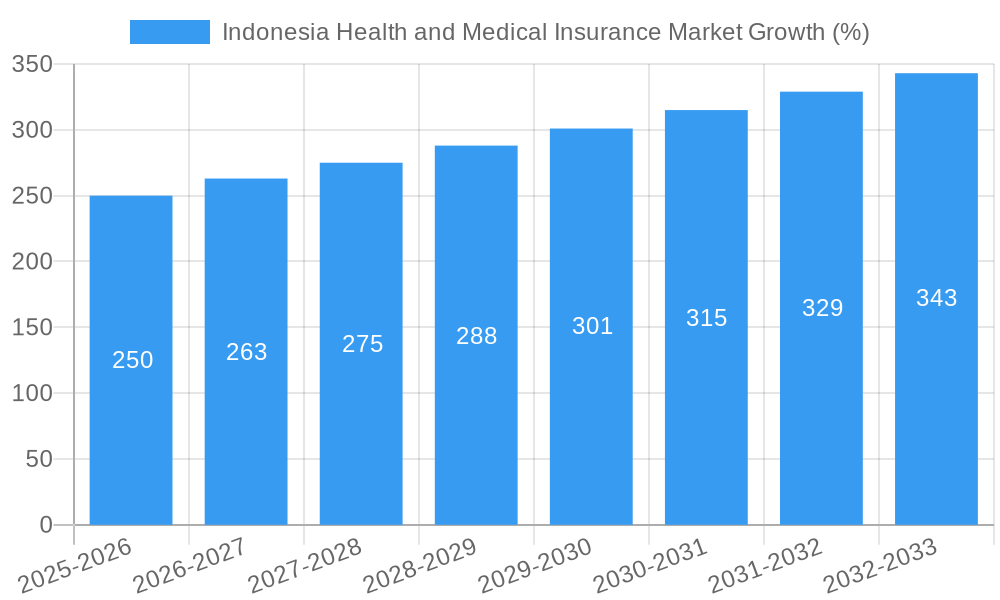

The Indonesian health and medical insurance market is experiencing robust growth, fueled by a rising middle class, increasing health awareness, and government initiatives promoting health insurance coverage. The market, valued at approximately [Estimate initial market size based on "Market size XX" and "Value Unit Million," e.g., $5 Billion] in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5% through 2033. This expansion is driven by factors such as a growing elderly population requiring more healthcare, rising incidence of chronic diseases, and improved healthcare infrastructure. The increasing affordability of health insurance plans, coupled with aggressive marketing strategies by private insurers, significantly contributes to market penetration. The segment breakdown reveals a strong presence of both individual and group health insurance products, with private health insurance providers holding a significant market share. Distribution channels are diversifying, with online sales gaining traction alongside traditional methods like agents and brokers. However, challenges such as high healthcare costs, uneven distribution of healthcare facilities, and limited health literacy in certain segments of the population pose constraints to further growth. Key players, including Allianz Care, AXA Indonesia, and AIA Financial Indonesia, are actively investing in digitalization and expanding their product portfolios to cater to evolving consumer needs.

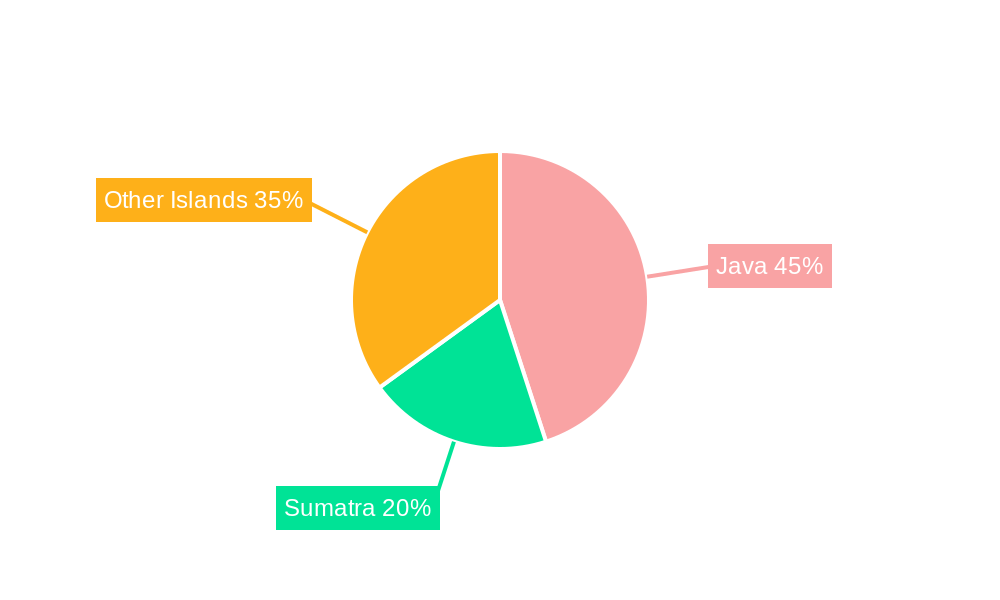

The competitive landscape is marked by a mix of established international players and domestic insurers. Government regulations aimed at improving healthcare accessibility and affordability play a vital role in shaping the market's trajectory. Looking ahead, the market is expected to witness further consolidation, with a focus on technologically advanced solutions, telemedicine integration, and personalized healthcare offerings. The shift towards preventive care and wellness programs will also drive the demand for health insurance products. The significant untapped potential in underserved rural areas presents opportunities for expansion, while addressing affordability concerns remains crucial for inclusive growth. The next decade will likely witness a dynamic interplay of technological advancements, regulatory shifts, and changing consumer preferences, ultimately defining the future landscape of Indonesia's health and medical insurance sector.

This detailed report provides a comprehensive analysis of the Indonesia health and medical insurance market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report unravels the market's structure, competitive landscape, and future trajectory. The report leverages extensive primary and secondary research, encompassing market sizing, segmentation, growth drivers, challenges, and key player analysis.

Indonesia Health and Medical Insurance Market Structure & Competitive Dynamics

The Indonesian health and medical insurance market presents a dynamic landscape characterized by a mix of established international players and domestic insurers. Market concentration is moderate, with a few dominant players holding significant market share, but a considerable number of smaller insurers also competing. The market is witnessing increased innovation, driven by technological advancements such as telehealth and digital platforms. Regulatory frameworks are evolving to enhance consumer protection and market transparency. Product substitution is limited, with significant differentiation based on coverage and service offerings. End-user trends reveal a growing preference for comprehensive coverage and digital distribution channels. Mergers and acquisitions (M&A) activity has been moderate, with deal values ranging from xx Million to xx Million in recent years. Key M&A activities include strategic partnerships aimed at expanding distribution networks and product portfolios.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share (2024).

- Innovation Ecosystem: Growing adoption of digital technologies, telehealth, and data analytics.

- Regulatory Framework: Evolving regulations focused on consumer protection and market stability.

- Product Substitutes: Limited, with differentiation primarily based on coverage and services.

- End-User Trends: Increasing demand for comprehensive coverage and convenient access via digital channels.

- M&A Activity: Moderate activity, with strategic partnerships driving market consolidation.

Indonesia Health and Medical Insurance Market Industry Trends & Insights

The Indonesian health and medical insurance market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing health awareness, and government initiatives promoting health insurance coverage. The market is projected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, including the rise of telehealth and digital health platforms, are transforming the way healthcare services are delivered and accessed, increasing market penetration among previously underserved populations. Consumer preferences are shifting towards comprehensive and affordable health plans with digital accessibility. Intense competition among insurers is driving innovation and the development of customized products. Market penetration is projected to reach xx% by 2033.

Dominant Markets & Segments in Indonesia Health and Medical Insurance Market

The Indonesian health and medical insurance market is segmented by product type (single/individual and group health insurance), provider (public/social and private health insurance), and distribution channel (agents, brokers, banks, online sales, and other channels). While precise market dominance data is not yet available for 2025, preliminary insights suggest the following:

By Product Type: Group health insurance is currently dominant, driven by employer-sponsored plans, but the individual health insurance segment is showing strong growth potential.

By Provider: Private health insurance holds a larger market share compared to public/social health insurance due to the limitations of the latter's coverage and affordability.

By Distribution Channel: Agents and brokers remain significant distribution channels, but banks and online sales are experiencing substantial growth.

Key Drivers of Segment Dominance:

- Economic Policies: Government initiatives promoting health insurance coverage are driving market growth.

- Infrastructure: Improved healthcare infrastructure, including hospitals and clinics, supports market expansion.

- Consumer Preferences: Growing demand for comprehensive coverage and convenient access.

Indonesia Health and Medical Insurance Market Product Innovations

The Indonesian health and medical insurance market is witnessing significant product innovations, including the integration of telehealth platforms, personalized health management tools, and digital distribution channels. Insurers are developing value-added services such as wellness programs and preventative care initiatives to enhance customer engagement and drive adoption. These innovations are improving accessibility, affordability, and efficiency within the health insurance ecosystem, aligning with the growing demand for cost-effective and convenient health solutions.

Report Segmentation & Scope

This report provides a granular segmentation of the Indonesian health and medical insurance market across various dimensions:

By Product Type: Single/Individual Health Insurance Products (Market size xx Million in 2025, projected growth of xx% from 2025 to 2033), and Group Health Insurance Products (Market size xx Million in 2025, projected growth of xx% from 2025 to 2033). Competitive dynamics are shaped by product differentiation and pricing strategies.

By Provider: Public/Social Health Insurance (Market size xx Million in 2025, projected growth of xx% from 2025 to 2033) and Private Health Insurance (Market size xx Million in 2025, projected growth of xx% from 2025 to 2033). The private sector is more innovative and offers wider coverage options.

By Distribution Channel: Agents, Brokers (Market size xx Million in 2025, projected growth of xx% from 2025 to 2033), Banks (Market size xx Million in 2025, projected growth of xx% from 2025 to 2033), Online Sales (Market size xx Million in 2025, projected growth of xx% from 2025 to 2033), and Other Channels of Distribution (Market size xx Million in 2025, projected growth of xx% from 2025 to 2033). Online sales show the highest growth potential.

Key Drivers of Indonesia Health and Medical Insurance Market Growth

Several factors are driving the growth of the Indonesian health and medical insurance market. The rising middle class with increased disposable income is a primary catalyst, coupled with increasing health awareness and a growing preference for preventive healthcare. Government initiatives promoting health insurance coverage are also instrumental. Technological advancements, such as telehealth and digital health platforms, improve accessibility and efficiency. Favorable regulatory environments are further fostering market expansion.

Challenges in the Indonesia Health and Medical Insurance Market Sector

Despite significant growth potential, the Indonesian health and medical insurance market faces challenges. These include the relatively low health insurance penetration rate, particularly in rural areas, and the high cost of healthcare. Regulatory complexities and the need for improved infrastructure, especially in underserved regions, pose significant obstacles. Competition among insurers, particularly from new market entrants, adds further pressure. These factors can negatively impact market growth and penetration if not addressed effectively.

Leading Players in the Indonesia Health and Medical Insurance Market Market

- Allianz Care

- PT Sun Life Financial Indonesia

- AXA Indonesia

- AIA Financial Indonesia

- ManuLife Indonesia

- Prudential Indonesia

- Cigna Insurance

- PT Reasuransi Indonesia Utama (Persero)

- AVIVA

- PT Great Eastern Life Indonesia

- BNI Life

- BCA Life

Key Developments in Indonesia Health and Medical Insurance Market Sector

June 2022: Allianz Asia Pacific and HSBC extended their strategic partnership for 15 years, expanding Allianz's distribution network through HSBC. This significantly boosts Allianz's market reach and distribution capabilities.

April 2022: PT Sun Life Financial Indonesia partnered with PT Bank CIMB Niaga Tbk, leveraging CIMB Niaga's extensive branch network to expand Sun Life's customer base significantly. This partnership expands Sun Life's access to millions of potential customers.

Strategic Indonesia Health and Medical Insurance Market Outlook

The Indonesian health and medical insurance market presents substantial opportunities for growth. The expanding middle class, rising health awareness, and supportive government policies will continue to drive demand. Technological innovations will play a pivotal role in improving accessibility and affordability. Strategic partnerships and investments in digital infrastructure are vital to unlock the market's full potential. Companies that can effectively leverage technological advancements and adapt to evolving consumer preferences are poised for significant success.

Indonesia Health and Medical Insurance Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Indonesia Health and Medical Insurance Market Segmentation By Geography

- 1. Indonesia

Indonesia Health and Medical Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Digitalization is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Economic Disparities are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Public Health Insurance is Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Health and Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. China Indonesia Health and Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Indonesia Health and Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8. India Indonesia Health and Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Indonesia Health and Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Indonesia Health and Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Indonesia Health and Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Indonesia Health and Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Allianz Care

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 PT Sun Life Financial Indonesia

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 AXA Indonesia

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 AIA Financial Indonesia

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 ManuLife Indonesia

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Prudential Indonesia

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Cigna Insurance

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 PT Reasuransi Indonesia Utama (Persero)

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 AVIVA

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 PT Great Eastern Life Indonesia**List Not Exhaustive

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 BNI Life

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 BCA Life

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Allianz Care

List of Figures

- Figure 1: Indonesia Health and Medical Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Health and Medical Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: China Indonesia Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Japan Indonesia Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Indonesia Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Korea Indonesia Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Taiwan Indonesia Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Australia Indonesia Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Asia-Pacific Indonesia Health and Medical Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 17: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 18: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 20: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 21: Indonesia Health and Medical Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Health and Medical Insurance Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Indonesia Health and Medical Insurance Market?

Key companies in the market include Allianz Care, PT Sun Life Financial Indonesia, AXA Indonesia, AIA Financial Indonesia, ManuLife Indonesia, Prudential Indonesia, Cigna Insurance, PT Reasuransi Indonesia Utama (Persero), AVIVA, PT Great Eastern Life Indonesia**List Not Exhaustive, BNI Life, BCA Life.

3. What are the main segments of the Indonesia Health and Medical Insurance Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Digitalization is Driving the Market.

6. What are the notable trends driving market growth?

Public Health Insurance is Dominating the Market.

7. Are there any restraints impacting market growth?

Economic Disparities are Restraining the Market.

8. Can you provide examples of recent developments in the market?

June 2022: Allianz Asia Pacific and HSBC have signed a 15-year extension of their strategic partnership. As part of the partnership, HSBC will be distributing Allianz insurance products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Health and Medical Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Health and Medical Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Health and Medical Insurance Market?

To stay informed about further developments, trends, and reports in the Indonesia Health and Medical Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence