Key Insights

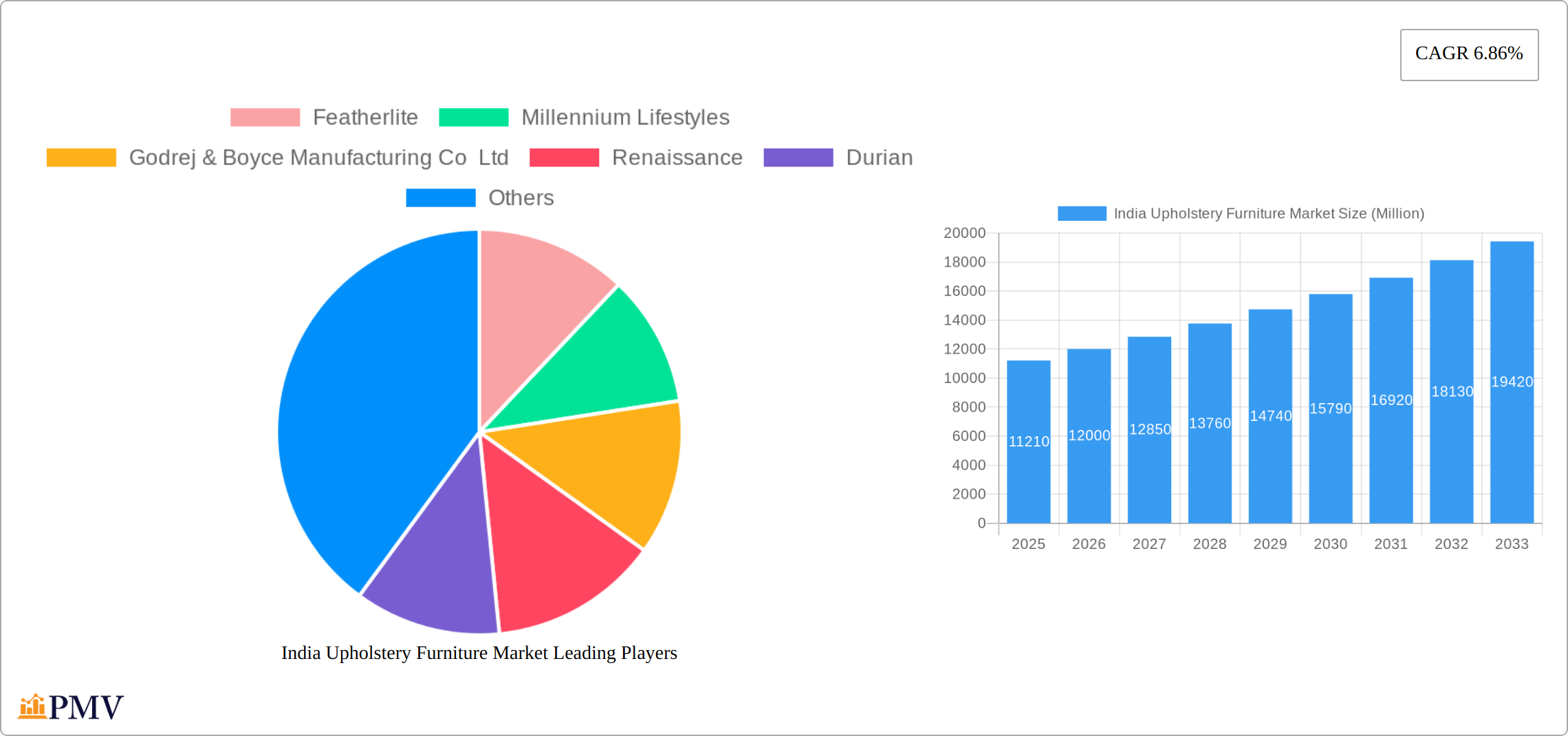

The India Upholstery Furniture Market, valued at approximately ₹11.21 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.86% from 2025 to 2033. This expansion is fueled by several key factors. Rising disposable incomes and a burgeoning middle class are driving increased demand for comfortable and stylish home furnishings, particularly in urban areas. A shift towards modern aesthetics and a preference for ergonomic designs further stimulate market growth. The increasing popularity of online shopping, coupled with the expanding reach of e-commerce platforms, facilitates convenient purchasing and wider market penetration. Furthermore, the growth of the hospitality sector and commercial spaces contribute significantly to market demand, especially within segments like office chairs and sofas. However, fluctuating raw material prices and potential supply chain disruptions pose challenges to the industry. The market is segmented by product type (chairs, sofas, beds, and others), application (residential and commercial), and distribution channel (supermarkets/hypermarkets, specialty stores, e-commerce, and others). Leading players like Featherlite, Godrej & Boyce, and Nilkamal dominate the market, competing on factors such as product quality, design, pricing, and brand reputation. Regional variations exist, with metropolitan areas and regions experiencing faster growth due to higher disposable incomes and urbanization.

The forecast period (2025-2033) anticipates continued market expansion, driven by sustained economic growth and evolving consumer preferences. The increasing focus on sustainable and eco-friendly manufacturing practices presents both an opportunity and a challenge. Companies are likely to invest in innovative designs and materials to meet the growing demand for environmentally responsible furniture. Effective marketing strategies focusing on digital channels and targeted advertising will be critical for success in this competitive landscape. The continued growth of the real estate and construction sectors will also have a positive impact on the market, creating additional opportunities for upholstery furniture manufacturers. Overall, the Indian upholstery furniture market is poised for significant growth in the coming years, with opportunities for both established players and new entrants.

India Upholstery Furniture Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India upholstery furniture market, offering invaluable insights for businesses, investors, and industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market trends, competitive dynamics, and future growth potential. The market is segmented by type (Chair, Sofa, Bed, Other Types), application (Residential, Commercial), and distribution channel (Supermarkets and Hypermarkets, Specialty Stores, E-commerce, Other Distribution Channels). Key players like Featherlite, Millennium Lifestyles, Godrej & Boyce Manufacturing Co Ltd, Renaissance, Durian, BP Ergo, Tangent, Yantra, Style Spa, Nilkamal, Haworth, and Kian are analyzed in detail. The report projects a market value of xx Million by 2033.

India Upholstery Furniture Market Market Structure & Competitive Dynamics

The Indian upholstery furniture market exhibits a moderately concentrated structure, with a few large players holding significant market share. However, a substantial number of small and medium-sized enterprises (SMEs) also contribute significantly, fostering a dynamic competitive landscape. Innovation is driven by both established players and agile startups, with a focus on incorporating sustainable materials, ergonomic designs, and technological advancements like smart furniture. The regulatory framework, while evolving, largely focuses on consumer safety and environmental standards. Product substitutes include readily available non-upholstered furniture options, presenting competitive pressures. End-user trends are increasingly shifting toward personalized, stylish, and multifunctional furniture that caters to diverse lifestyles and evolving aesthetics. M&A activity remains moderate, with deal values typically ranging from xx Million to xx Million, driven by strategic expansions and acquisitions of smaller players by larger conglomerates.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Innovation Ecosystems: Strong focus on sustainable materials, ergonomic designs, and smart furniture technologies.

- Regulatory Frameworks: Primarily focused on consumer safety and environmental standards.

- Product Substitutes: Non-upholstered furniture options present competitive pressures.

- End-User Trends: Increasing demand for personalized, stylish, and multifunctional furniture.

- M&A Activity: Moderate activity, with deal values ranging from xx Million to xx Million.

India Upholstery Furniture Market Industry Trends & Insights

The Indian upholstery furniture market is experiencing robust growth, driven by factors such as rising disposable incomes, rapid urbanization, and a burgeoning middle class with increasing spending power on home improvement and interior design. Technological advancements, such as the integration of smart features into furniture and the use of advanced manufacturing techniques, are further enhancing market appeal. Consumer preferences are shifting towards comfortable, aesthetically pleasing, and durable furniture, influencing product innovation. The market is projected to witness a CAGR of xx% during the forecast period (2025-2033), driven primarily by the residential segment. Market penetration is highest in urban areas, but there's significant growth potential in rural regions. Competitive dynamics are characterized by intense rivalry, particularly among major players competing on pricing, product quality, and brand reputation.

Dominant Markets & Segments in India Upholstery Furniture Market

The residential segment dominates the Indian upholstery furniture market, accounting for approximately xx% of total revenue, fueled by a large population and rising housing construction activities. Among product types, sofas constitute the largest segment, followed by chairs and beds. E-commerce is emerging as a significant distribution channel, experiencing substantial growth due to increased internet penetration and consumer preference for online shopping. Key drivers for market dominance include robust economic growth and government initiatives supporting infrastructure development, particularly in urban areas.

Leading Region: Urban areas across major metropolitan cities.

Dominant Segment (Type): Sofas

Dominant Segment (Application): Residential

Dominant Segment (Distribution Channel): Specialty Stores, followed by rapidly growing E-commerce.

Key Drivers (Residential Segment): Rising disposable incomes, urbanization, increasing housing construction.

Key Drivers (E-commerce): Increased internet penetration, convenience, wide product selection.

India Upholstery Furniture Market Product Innovations

Recent product innovations emphasize ergonomic designs, sustainable materials (like recycled fabrics and wood), and smart features (adjustable height, integrated lighting). Manufacturers are focusing on creating multifunctional furniture to cater to space constraints in urban areas. Competitive advantages are achieved through superior design, quality materials, and brand recognition. Technological trends involve incorporating IoT (Internet of Things) capabilities to enhance functionality and user experience.

Report Segmentation & Scope

The report segments the market by Type: Chair, Sofa, Bed, Other Types; Application: Residential, Commercial; and Distribution Channel: Supermarkets and Hypermarkets, Specialty Stores, E-commerce, Other Distribution Channels. Each segment's growth projections, market sizes, and competitive dynamics are comprehensively analyzed. For example, the "Chair" segment is projected to grow at xx% CAGR, with a market size of xx Million by 2033, while the "E-commerce" distribution channel is experiencing the fastest growth due to consumer behavior changes.

Key Drivers of India Upholstery Furniture Market Growth

The market's growth is primarily driven by rising disposable incomes, rapid urbanization leading to increased housing demand, and a growing preference for stylish and comfortable home furnishings. Government initiatives promoting affordable housing also contribute. Technological advancements in manufacturing and design contribute to improved product quality and efficiency.

Challenges in the India Upholstery Furniture Market Sector

Challenges include fluctuating raw material prices, intense competition from both domestic and international players, and the need for skilled labor. Supply chain disruptions can also impact production and delivery timelines. Furthermore, maintaining consistent quality and managing customer expectations remains a critical challenge.

Leading Players in the India Upholstery Furniture Market Market

- Featherlite

- Millennium Lifestyles

- Godrej & Boyce Manufacturing Co Ltd

- Renaissance

- Durian

- BP Ergo

- Tangent

- Yantra

- Style Spa

- Nilkamal

- Haworth

- Kian

Key Developments in India Upholstery Furniture Market Sector

- September 2023: Haworth's USD 8-10 Million investment in a new factory in Sriperumbudur, Tamil Nadu, signals significant expansion plans and a focus on high-end ergonomic seating. This development will likely increase competition and enhance product offerings.

- October 2023: Durian's new store opening in Jaipur signifies expansion into new markets and increased retail presence, strengthening its brand visibility and market share.

Strategic India Upholstery Furniture Market Market Outlook

The Indian upholstery furniture market presents substantial growth potential, fueled by sustained economic growth, increasing urbanization, and evolving consumer preferences. Strategic opportunities lie in catering to diverse consumer segments, focusing on sustainable and technologically advanced products, and expanding distribution channels, especially in less penetrated regions. Investing in research and development to meet evolving design trends and preferences is crucial for sustained success.

India Upholstery Furniture Market Segmentation

-

1. Type

- 1.1. Chair

- 1.2. Sofa

- 1.3. Bed

- 1.4. Other Types

-

2. Application

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Supermarkets and Hypermarkets

- 3.2. Specialty Stores

- 3.3. E-commerce

- 3.4. Other Distribution Channels

India Upholstery Furniture Market Segmentation By Geography

- 1. India

India Upholstery Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.86% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the Real Estate Sector

- 3.3. Market Restrains

- 3.3.1. Competition from Non-Upholstered Alternatives

- 3.4. Market Trends

- 3.4.1. Residential End User Segment is the Largest Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Upholstery Furniture Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Chair

- 5.1.2. Sofa

- 5.1.3. Bed

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets and Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. E-commerce

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Upholstery Furniture Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Upholstery Furniture Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Upholstery Furniture Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Upholstery Furniture Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Featherlite

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Millennium Lifestyles

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Godrej & Boyce Manufacturing Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Renaissance

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Durian

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 BP Ergo

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Tangent

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Yantra

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Style Spa

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Nilkamal

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Haworth

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Kian

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Featherlite

List of Figures

- Figure 1: India Upholstery Furniture Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Upholstery Furniture Market Share (%) by Company 2024

List of Tables

- Table 1: India Upholstery Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Upholstery Furniture Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: India Upholstery Furniture Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: India Upholstery Furniture Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: India Upholstery Furniture Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: India Upholstery Furniture Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: India Upholstery Furniture Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: India Upholstery Furniture Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 9: India Upholstery Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: India Upholstery Furniture Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: India Upholstery Furniture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: India Upholstery Furniture Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: North India India Upholstery Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: North India India Upholstery Furniture Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: South India India Upholstery Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South India India Upholstery Furniture Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: East India India Upholstery Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: East India India Upholstery Furniture Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: West India India Upholstery Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: West India India Upholstery Furniture Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: India Upholstery Furniture Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: India Upholstery Furniture Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 23: India Upholstery Furniture Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: India Upholstery Furniture Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 25: India Upholstery Furniture Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 26: India Upholstery Furniture Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 27: India Upholstery Furniture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: India Upholstery Furniture Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Upholstery Furniture Market?

The projected CAGR is approximately 6.86%.

2. Which companies are prominent players in the India Upholstery Furniture Market?

Key companies in the market include Featherlite, Millennium Lifestyles, Godrej & Boyce Manufacturing Co Ltd, Renaissance, Durian, BP Ergo, Tangent, Yantra, Style Spa, Nilkamal, Haworth, Kian.

3. What are the main segments of the India Upholstery Furniture Market?

The market segments include Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in the Real Estate Sector.

6. What are the notable trends driving market growth?

Residential End User Segment is the Largest Market.

7. Are there any restraints impacting market growth?

Competition from Non-Upholstered Alternatives.

8. Can you provide examples of recent developments in the market?

October 2023: Durian opened their new store in Jaipur. It is located at the prime location of Vaishali Nagar. This sprawling 4800 sq. ft. store houses a grand range of home and office furniture.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Upholstery Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Upholstery Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Upholstery Furniture Market?

To stay informed about further developments, trends, and reports in the India Upholstery Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence