Key Insights

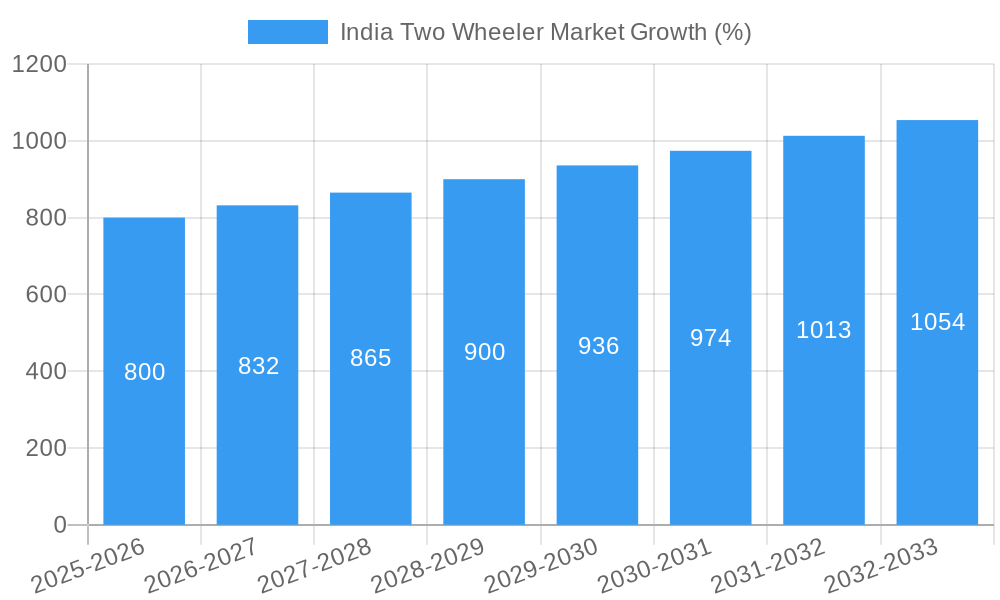

The Indian two-wheeler market, a dynamic sector characterized by a robust growth trajectory, is projected to experience significant expansion over the forecast period of 2025-2033. With a current market size exceeding [Let's assume a reasonable market size based on publicly available reports, perhaps in the range of] 20 billion USD in 2025 and a compound annual growth rate (CAGR) exceeding 4%, the market is poised for substantial growth, driven by several key factors. Rising disposable incomes, increasing urbanization, and the expanding middle class are fueling demand for personal mobility solutions. The government's initiatives promoting electric vehicles (EVs) are further stimulating market expansion, particularly within the electric two-wheeler segment. While the Internal Combustion Engine (ICE) segment continues to hold a significant market share, the shift towards EVs is accelerating, spurred by environmental concerns and the availability of government subsidies and incentives. Competition within the market remains intense, with both established players like Hero MotoCorp and Bajaj Auto, and emerging EV manufacturers like Ola Electric and Ather Energy vying for market dominance. Geographic variations exist; while urban areas drive higher demand for scooters and motorcycles, rural areas exhibit strong potential for affordable, fuel-efficient two-wheelers. Challenges remain, including infrastructure limitations for EV charging and the need for improved battery technology to address range anxiety.

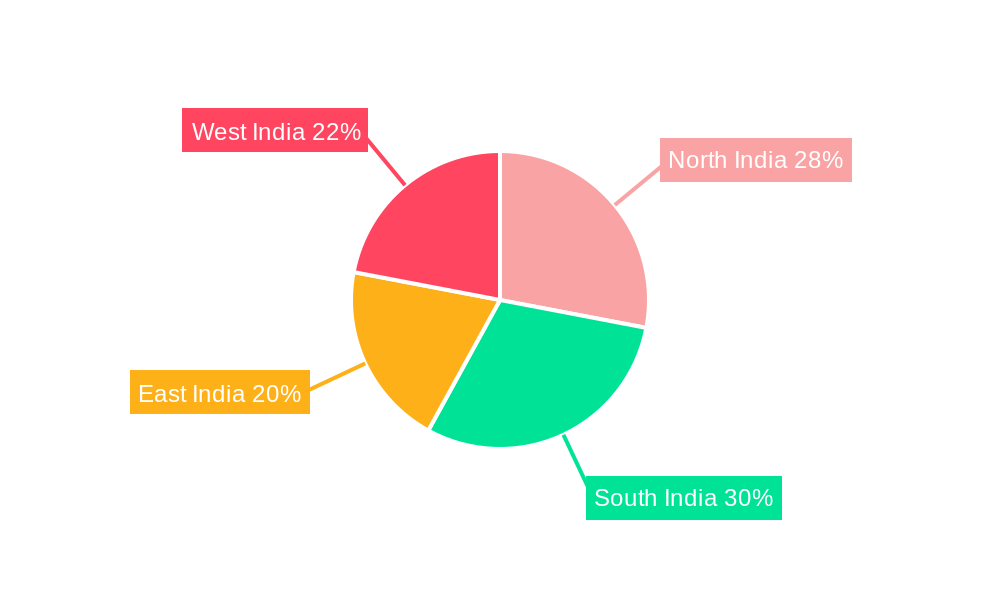

Despite challenges, the long-term outlook for the Indian two-wheeler market remains positive. The sustained growth in the economy and the government's continued push towards sustainable transportation will play a crucial role in shaping the future landscape. The increasing adoption of connected vehicle technologies and the development of advanced safety features are also expected to influence consumer preferences. The segmentation of the market into ICE and EV propelled vehicles will continue to evolve, with the latter experiencing faster growth rates. The diverse range of players, encompassing both domestic and international brands, contributes to a highly competitive and innovative market. Analyzing the regional data (North, South, East, and West India) will further reveal distinct market characteristics and opportunities. Understanding these regional nuances is crucial for strategic decision-making by industry stakeholders.

India Two Wheeler Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the India two-wheeler market, covering the period from 2019 to 2033. It offers in-depth insights into market structure, competitive dynamics, industry trends, and future growth prospects. With a focus on key players like Hero MotoCorp, Bajaj Auto, Honda Motorcycle & Scooter India, and emerging electric vehicle (EV) manufacturers such as Ola Electric and Ather Energy, this report is an essential resource for industry professionals, investors, and strategists. The report leverages a robust methodology, incorporating historical data (2019-2024), a base year of 2025, and forecasts extending to 2033.

India Two Wheeler Market Market Structure & Competitive Dynamics

The Indian two-wheeler market is characterized by a dynamic interplay of established players and emerging entrants. Market concentration is relatively high, with a few major players dominating the Internal Combustion Engine (ICE) segment. However, the electric vehicle (EV) segment is witnessing increased fragmentation, fueled by numerous startups and technology advancements. The regulatory landscape, including emission norms and government incentives for EVs, significantly influences market dynamics. Product substitutes, such as public transportation and ride-hailing services, exert some competitive pressure, particularly in urban areas. End-user preferences are shifting towards fuel efficiency, affordability, and technologically advanced features, influencing product design and marketing strategies. Mergers and acquisitions (M&A) activity has increased recently, with strategic acquisitions aimed at expanding market share and technological capabilities. For instance, the merger of Mahindra Two Wheelers with other Mahindra subsidiaries signifies a consolidation effort in the industry. The estimated total M&A deal value for the period 2019-2024 is xx Million.

- Market Concentration: High in ICE, fragmented in EV

- Innovation Ecosystems: Strong presence of both established players and startups.

- Regulatory Frameworks: Government policies significantly impact both ICE and EV segments.

- Product Substitutes: Public transport, ride-hailing services.

- End-User Trends: Increasing demand for fuel efficiency, affordability, and advanced features.

- M&A Activities: Significant consolidation expected in the coming years; total deal value xx Million (2019-2024).

India Two Wheeler Market Industry Trends & Insights

The Indian two-wheeler market is experiencing significant transformation, driven by several key trends. The market is witnessing robust growth, with a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). Technological advancements, particularly in the EV sector, are disrupting the traditional ICE-dominated landscape. Consumer preferences are shifting towards electric vehicles due to increasing environmental awareness and government incentives. However, range anxiety and charging infrastructure limitations remain challenges for EV adoption. The competitive landscape is becoming more intense, with both established players and new entrants vying for market share. Market penetration of EVs is gradually increasing, although ICE vehicles still dominate the overall market. The CAGR for the forecast period (2025-2033) is projected to be xx%, driven by increasing demand for both ICE and EV two-wheelers.

Dominant Markets & Segments in India Two Wheeler Market

The Indian two-wheeler market is geographically diverse, with significant variations in demand across different regions. Urban areas exhibit higher demand for two-wheelers due to traffic congestion and affordability factors. The ICE segment continues to dominate the market in terms of volume, despite the growing popularity of EVs. However, the EV segment is projected to experience substantial growth in the coming years.

- Leading Region: Urban areas show higher demand.

- Propulsion Type: ICE remains dominant, but EVs are rapidly gaining traction.

- ICE Key Drivers: Affordability, established infrastructure, wide availability.

- EV Key Drivers: Government incentives, environmental awareness, technological advancements. However, range anxiety and charging infrastructure remain challenges.

India Two Wheeler Market Product Innovations

The Indian two-wheeler market is witnessing a wave of product innovations, focusing on improved fuel efficiency, enhanced safety features, and advanced technologies. In the ICE segment, manufacturers are focusing on BS-VI compliant engines and advanced engine management systems. In the EV segment, there is continuous innovation in battery technology, charging infrastructure, and connected features. These innovations aim to improve the overall user experience and address the specific needs of the Indian market. The integration of smart features, such as connectivity and telematics, is also gaining traction.

Report Segmentation & Scope

This report segments the India two-wheeler market based on propulsion type: Internal Combustion Engine (ICE) and Electric Vehicles (EVs), encompassing Hybrid and Battery Electric Vehicles. The ICE segment is further categorized based on engine capacity and vehicle type (scooter, motorcycle, etc.). The EV segment is analyzed based on battery capacity, range, and charging technology. Each segment's growth projection, market size, and competitive dynamics are detailed in the report. The total market size is estimated at xx Million for the base year (2025) and is forecasted to reach xx Million by 2033.

Key Drivers of India Two Wheeler Market Growth

Several factors contribute to the growth of the India two-wheeler market. The increasing affordability of two-wheelers, particularly in rural areas, is a significant driver. Government initiatives promoting vehicle ownership and infrastructure development contribute to market expansion. Technological advancements, particularly in the EV segment, are further fueling growth. Furthermore, the rising disposable income and changing lifestyles are also contributing to the market's positive trajectory.

Challenges in the India Two Wheeler Market Sector

Despite its growth potential, the Indian two-wheeler market faces certain challenges. Regulatory hurdles, including emission norms and safety standards, can impact manufacturers' operations. Supply chain disruptions can affect production and availability. Intense competition from both established players and new entrants creates a challenging market environment. These factors can influence the pricing, product availability, and overall profitability within the industry.

Leading Players in the India Two Wheeler Market Market

- Bajaj Auto Ltd

- Hero Electric Vehicles Pvt Ltd

- Hero MotoCorp Ltd

- Honda Motorcycle & Scooter India Pvt Ltd

- India Kawasaki Motors Pvt Ltd

- Mahindra Two Wheelers Ltd

- Ola Electric Mobility Pvt Ltd

- Okinawa Autotech Pvt Ltd

- AMPERE VEHICLES PRIVATE LIMITED

- Ather Energy Pvt Ltd

- Piaggio Vehicles Pvt Ltd

- Revolt Intellicorp Pvt Ltd

- Royal Enfield

- Suzuki Motorcycle India Pvt Ltd

- TVS Motor Company Limited

- Yamaha Motor India Pvt Ltd

Key Developments in India Two Wheeler Market Sector

- August 2023: Ola Electric launched the S1X electric scooter at INR 79,999, offering two battery options (2 kWh and 3 kWh) with ranges of 91 km and 151 km, respectively. This launch expands Ola's presence in the budget-friendly EV segment.

- August 2023: Mahindra & Mahindra Ltd. approved the merger of its subsidiaries, Mahindra Heavy Engines Limited (MHEL), Mahindra Two Wheelers Limited (MTWL), and Trringo.com Limited (TCL), streamlining its operations and potentially strengthening its position in the two-wheeler market.

- July 2023: Okinawa Autotech launched an upgraded version of its ‘OKHI-90' electric scooter, incorporating an AIS-156 amendment 3 compliant battery pack and improved technology features. This highlights the ongoing advancements in EV technology and safety standards.

Strategic India Two Wheeler Market Market Outlook

The future of the India two-wheeler market is bright, driven by increasing urbanization, rising disposable incomes, and a growing preference for personal mobility. The EV segment is poised for explosive growth, fueled by government support and technological advancements. Strategic opportunities exist for manufacturers who can offer affordable, high-quality, and technologically advanced two-wheelers. The market will likely see further consolidation, with a focus on innovation and sustainability.

India Two Wheeler Market Segmentation

-

1. Propulsion Type

- 1.1. Hybrid and Electric Vehicles

- 1.2. ICE

India Two Wheeler Market Segmentation By Geography

- 1. India

India Two Wheeler Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Used Car Financing To Continue Solving Consumer Challenges In Indonesia

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Two Wheeler Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Hybrid and Electric Vehicles

- 5.1.2. ICE

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. North India India Two Wheeler Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Two Wheeler Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Two Wheeler Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Two Wheeler Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Suzuki Motorcycle India Pvt Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Bajaj Auto Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Piaggio Vehicles Pvt Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hero Electric Vehicles Pvt Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 India Kawasaki Motors Pvt Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Okinawa Autotech Pvt Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 AMPERE VEHICLES PRIVATE LIMITED

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hero MotoCorp Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Royal Enfield

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Honda Motorcycle & Scooter India Pvt Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Yamaha Motor India Pvt Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Mahindra Two Wheelers Ltd

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 TVS Motor Company Limited

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 REVOLT Intellicorp Pvt Ltd

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Ola Electric Mobility Pvt Ltd

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Ather Energy Pvt Ltd

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.1 Suzuki Motorcycle India Pvt Ltd

List of Figures

- Figure 1: India Two Wheeler Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Two Wheeler Market Share (%) by Company 2024

List of Tables

- Table 1: India Two Wheeler Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Two Wheeler Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 3: India Two Wheeler Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: India Two Wheeler Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: North India India Two Wheeler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: South India India Two Wheeler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: East India India Two Wheeler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: West India India Two Wheeler Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Two Wheeler Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 10: India Two Wheeler Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Two Wheeler Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the India Two Wheeler Market?

Key companies in the market include Suzuki Motorcycle India Pvt Ltd, Bajaj Auto Ltd, Piaggio Vehicles Pvt Ltd, Hero Electric Vehicles Pvt Ltd, India Kawasaki Motors Pvt Ltd, Okinawa Autotech Pvt Ltd, AMPERE VEHICLES PRIVATE LIMITED, Hero MotoCorp Ltd, Royal Enfield, Honda Motorcycle & Scooter India Pvt Ltd, Yamaha Motor India Pvt Ltd, Mahindra Two Wheelers Ltd, TVS Motor Company Limited, REVOLT Intellicorp Pvt Ltd, Ola Electric Mobility Pvt Ltd, Ather Energy Pvt Ltd.

3. What are the main segments of the India Two Wheeler Market?

The market segments include Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Used Car Financing To Continue Solving Consumer Challenges In Indonesia.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

August 2023: Ola Electric launched S1X for INR 79,999. Ola S1X will be offered in two battery capacities 2-kWh and 3-kWh. The 2-kWh variant will have a range of 91 km while the 3-kWh will have a 151 km range. The scooter has a 3.5-inch segmented display, the physical key unlocks and comes Without smart connectivity.August 2023: Mahindra & Mahindra Ltd. announced that its board of directors approved the scheme of merger by absorption of Mahindra Heavy Engines Limited (MHEL) and Mahindra Two Wheelers Limited (MTWL) and Trringo.com Limited (TCL), wholly owned subsidiaries of the company, with the company and their respective shareholders.July 2023: Okinawa Autotech launched the new and advanced version of its ‘OKHI-90' electric scooter with an AIS-156 amendment 3 compliant battery pack, next-gen motor, and improved technology features.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Two Wheeler Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Two Wheeler Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Two Wheeler Market?

To stay informed about further developments, trends, and reports in the India Two Wheeler Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence