Key Insights

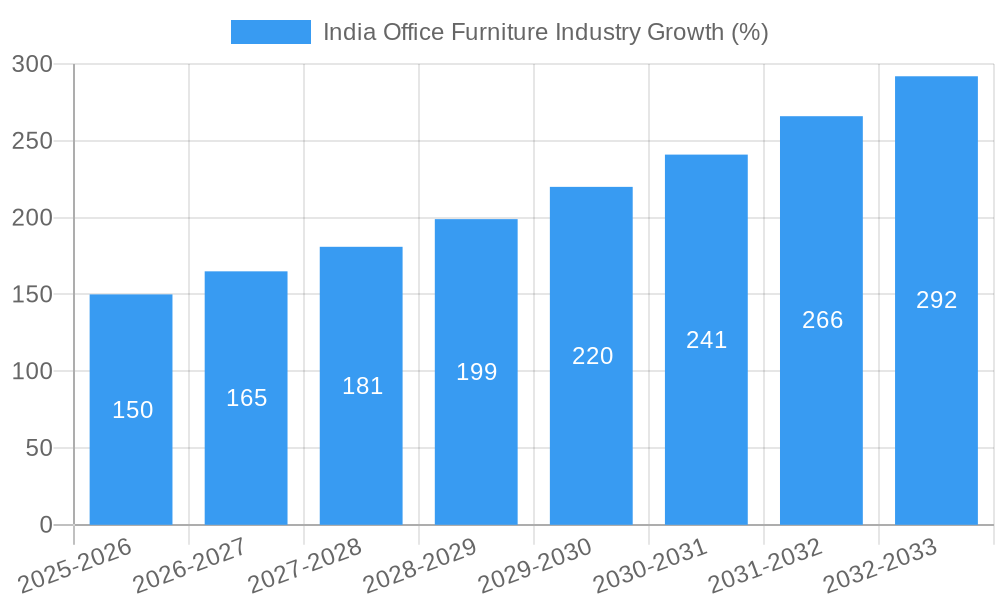

The India office furniture market, valued at approximately ₹X million in 2025 (assuming a logical value based on the provided CAGR and market size indicators), is experiencing robust growth, projected to exceed a CAGR of 10% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning IT and ITeS sectors, coupled with a growing number of startups and SMEs, fuel a significant demand for modern and functional office spaces. Furthermore, a shift towards hybrid work models necessitates investment in adaptable and ergonomic furniture solutions. Increasing urbanization and the expansion of commercial real estate contribute to the market's dynamism. The preference for modular designs, smart office technologies integration, and sustainable materials are notable trends shaping the industry. However, challenges remain, including fluctuating raw material costs (particularly wood and metal), potential supply chain disruptions, and competition from both established players and emerging manufacturers. The market is segmented by material (wood, metal, plastic, others), product type (seating, storage, workstations, tables, accessories), and distribution channel (online and offline). The diverse geographical spread, encompassing North, South, East, and West India, presents varied opportunities and localized market dynamics. Significant players include Teknion, Nilkamal, Usha Furniture, Durian, Spacewood, Herman Miller, and others, contributing to a competitive but rapidly growing market.

The projected growth trajectory signifies substantial investment potential. The market's segmentation provides numerous avenues for focused business strategies, allowing companies to target specific needs. Successful players will leverage technological advancements, prioritize sustainable practices, and adapt to evolving workspace preferences to capitalize on the sustained growth. A focus on e-commerce integration will become increasingly critical to reaching wider customer bases and optimizing distribution efficiency. By addressing the challenges proactively and adopting innovative strategies, businesses can thrive within this dynamic and expanding sector.

India Office Furniture Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the India office furniture industry, offering crucial insights for businesses, investors, and stakeholders. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils the market's structure, competitive dynamics, dominant segments, and future growth potential. The market size is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period.

India Office Furniture Industry Market Structure & Competitive Dynamics

The Indian office furniture market is characterized by a mix of established multinational players and rapidly growing domestic companies. Market concentration is moderate, with a few major players holding significant market share, while numerous smaller players cater to niche segments. The industry witnesses continuous innovation in designs, materials, and functionalities, driven by evolving workplace trends and technological advancements. Regulatory frameworks, while generally supportive of industry growth, may present certain compliance challenges. Product substitution is a factor, with increasing adoption of modular and flexible furniture systems. End-user trends are shifting towards ergonomic, sustainable, and aesthetically pleasing designs, influencing product development strategies. M&A activity in the sector has been relatively moderate in recent years, with deal values averaging around xx Million.

- Key Players Market Share (Estimated 2025): Nilkamal (xx%), Herman Miller (xx%), Spacewood Office Solutions (xx%), others (xx%).

- Recent M&A Activity: While specific deal values are not publicly available for all transactions, a few notable acquisitions have occurred, totaling approximately xx Million in the last 5 years.

India Office Furniture Industry Industry Trends & Insights

The Indian office furniture market is experiencing strong growth, propelled by factors such as a burgeoning IT sector, expanding corporate offices, and increasing government investments in infrastructure. The market is witnessing a significant shift towards ergonomic designs, smart furniture integration, and sustainable materials. Consumer preferences lean towards modular, customizable furniture that enhances productivity and workplace wellness. Technological disruptions are driving innovation with the introduction of smart office solutions and advanced manufacturing techniques. The competitive landscape remains dynamic, with existing players focusing on diversification and expansion while new entrants continuously emerge. The market penetration of online sales channels is increasing, though offline channels still dominate.

- Market Growth Drivers: Rapid urbanization, increasing disposable income, growth of the IT/ITeS sector, government initiatives promoting infrastructure development.

- Technological Disruptions: Integration of smart technologies, 3D printing, and automation in manufacturing.

- Consumer Preferences: Ergonomics, sustainability, aesthetics, and customization.

- Competitive Dynamics: Intense competition, product differentiation, and focus on brand building.

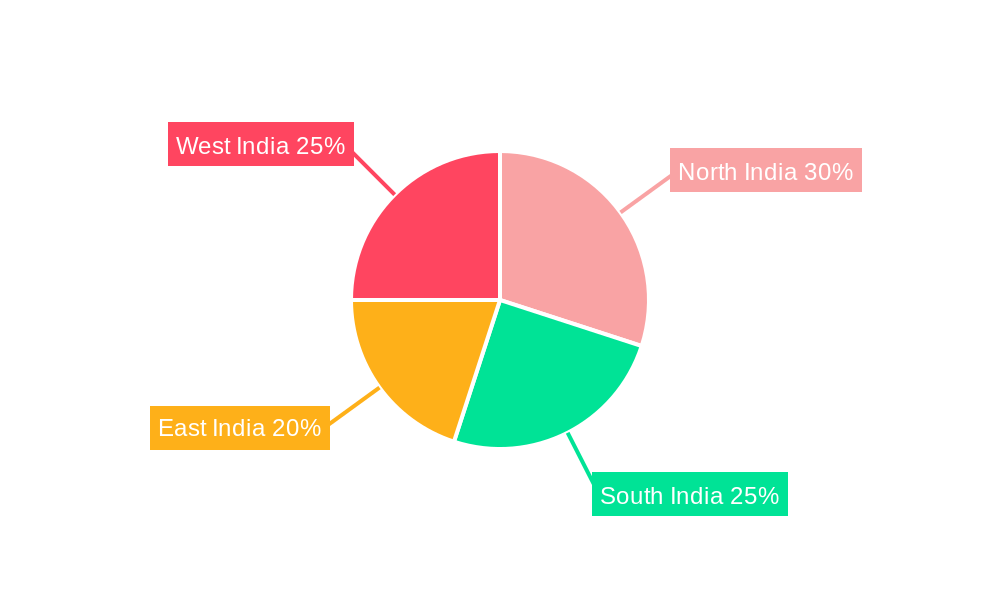

Dominant Markets & Segments in India Office Furniture Industry

The major metropolitan areas in India, particularly Mumbai, Delhi-NCR, Bangalore, and Chennai, are the most dominant markets, driven by high concentrations of corporate offices and IT/ITeS companies. Within product segments, seating (office chairs and workstations) contributes significantly to overall market revenue. The wood segment holds a prominent position, reflecting cultural preferences and the availability of raw materials. Offline distribution channels maintain a larger market share, although online sales are gradually gaining traction.

- Key Drivers of Regional Dominance: High concentration of corporate offices, robust economic activity, and developed infrastructure.

- Dominant Product Segments: Seating (xx Million), Workstations (xx Million), Storage (xx Million).

- Dominant Material Segment: Wood (xx Million), followed by Metal (xx Million).

- Dominant Distribution Channel: Offline (xx Million)

India Office Furniture Industry Product Innovations

The industry is witnessing a surge in innovative products characterized by improved ergonomics, smart features, and sustainable materials. Modular furniture systems, designed for flexibility and adaptability, are gaining popularity. The use of recycled materials and eco-friendly manufacturing processes is also gaining traction. Technological integration, such as power outlets built into desks and smart office management systems, is enhancing workplace efficiency. These innovations cater to the growing demand for functional and aesthetically pleasing office spaces.

Report Segmentation & Scope

This report segments the Indian office furniture market by material (wood, metal, plastics, others), product type (seating, storage units, workstations, tables, other accessories), and distribution channel (offline, online). Each segment’s growth trajectory, market size, and competitive dynamics are comprehensively analyzed, providing a granular understanding of the market landscape. Projections for each segment are provided for the forecast period, highlighting anticipated growth rates and market share distribution.

Key Drivers of India Office Furniture Industry Growth

The Indian office furniture market's growth is fueled by several factors: rapid urbanization and infrastructure development, the expanding IT/ITeS sector, increasing disposable incomes leading to higher spending on workplace amenities, and a growing awareness of ergonomic and sustainable office solutions. Government initiatives promoting industrial growth also positively impact the market.

Challenges in the India Office Furniture Industry Sector

Challenges include fluctuating raw material prices, supply chain disruptions, intense competition, and the need for continuous innovation to meet evolving customer preferences. Regulatory compliance and environmental concerns also pose challenges. Furthermore, the increasing popularity of co-working spaces and flexible work arrangements might alter demand patterns.

Leading Players in the India Office Furniture Industry Market

- Teknion

- Nilkamal

- Usha Furniture

- Durian

- Spacewood Office Solutions

- Herman Miller

- AFC Furniture Solutions

- Stellar Furniture

- Wipro Furniture

- FeatherLite

- Indo Innovations

- Boss Cabin

- Damro

- Sentiment Furniture Systems India

Key Developments in India Office Furniture Industry Sector

- 2022 Q4: Nilkamal launched a new line of ergonomic chairs.

- 2023 Q1: Spacewood Office Solutions expanded its online sales channel.

- 2023 Q2: Herman Miller partnered with a local manufacturer to expand its reach in the Indian market. (Further specific developments with dates to be added based on available data)

Strategic India Office Furniture Industry Market Outlook

The Indian office furniture industry is poised for sustained growth, driven by the country's economic expansion and evolving workplace dynamics. Opportunities exist for companies focusing on innovation, sustainability, and customization. Strategic partnerships, investments in technology, and expansion into new markets will be crucial for success. The increasing adoption of hybrid work models will require flexible and adaptable furniture solutions.

India Office Furniture Industry Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastics

- 1.4. Others

-

2. Products

- 2.1. Seating

- 2.2. Storage Units (Bins & Shelves, Cabinets, Others)

- 2.3. Workstat

- 2.4. Tables (

- 2.5. Other Accessories

-

3. Distribution Channel

- 3.1. Offline

- 3.2. Online

India Office Furniture Industry Segmentation By Geography

- 1. India

India Office Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Comfort and Convenience; Growing Awareness of Energy Efficiency

- 3.3. Market Restrains

- 3.3.1. Seasonal Demand Fluctuations; Safety Concerns Related to Overheating or Electrical Malfunctions

- 3.4. Market Trends

- 3.4.1. Increase in The Number of Office Furniture Imports

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastics

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Products

- 5.2.1. Seating

- 5.2.2. Storage Units (Bins & Shelves, Cabinets, Others)

- 5.2.3. Workstat

- 5.2.4. Tables (

- 5.2.5. Other Accessories

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North India India Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Office Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Teknion

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nilkamal

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Usha Furniture

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Durian

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Spacewood Office Solutions*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Herman Miller

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 AFC Furniture Solutions

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Stellar Furniture

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Wipro Furniture

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 FeatherLite

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Indo Innovations

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Boss Cabin

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Damro

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Sentiment Furniture Systems India

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.1 Teknion

List of Figures

- Figure 1: India Office Furniture Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Office Furniture Industry Share (%) by Company 2024

List of Tables

- Table 1: India Office Furniture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Office Furniture Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 3: India Office Furniture Industry Revenue Million Forecast, by Products 2019 & 2032

- Table 4: India Office Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: India Office Furniture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Office Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North India India Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South India India Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: East India India Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West India India Office Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Office Furniture Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 12: India Office Furniture Industry Revenue Million Forecast, by Products 2019 & 2032

- Table 13: India Office Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: India Office Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Office Furniture Industry?

The projected CAGR is approximately > 10.00%.

2. Which companies are prominent players in the India Office Furniture Industry?

Key companies in the market include Teknion, Nilkamal, Usha Furniture, Durian, Spacewood Office Solutions*List Not Exhaustive, Herman Miller, AFC Furniture Solutions, Stellar Furniture, Wipro Furniture, FeatherLite, Indo Innovations, Boss Cabin, Damro, Sentiment Furniture Systems India.

3. What are the main segments of the India Office Furniture Industry?

The market segments include Material, Products, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Comfort and Convenience; Growing Awareness of Energy Efficiency.

6. What are the notable trends driving market growth?

Increase in The Number of Office Furniture Imports.

7. Are there any restraints impacting market growth?

Seasonal Demand Fluctuations; Safety Concerns Related to Overheating or Electrical Malfunctions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Office Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Office Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Office Furniture Industry?

To stay informed about further developments, trends, and reports in the India Office Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence