Key Insights

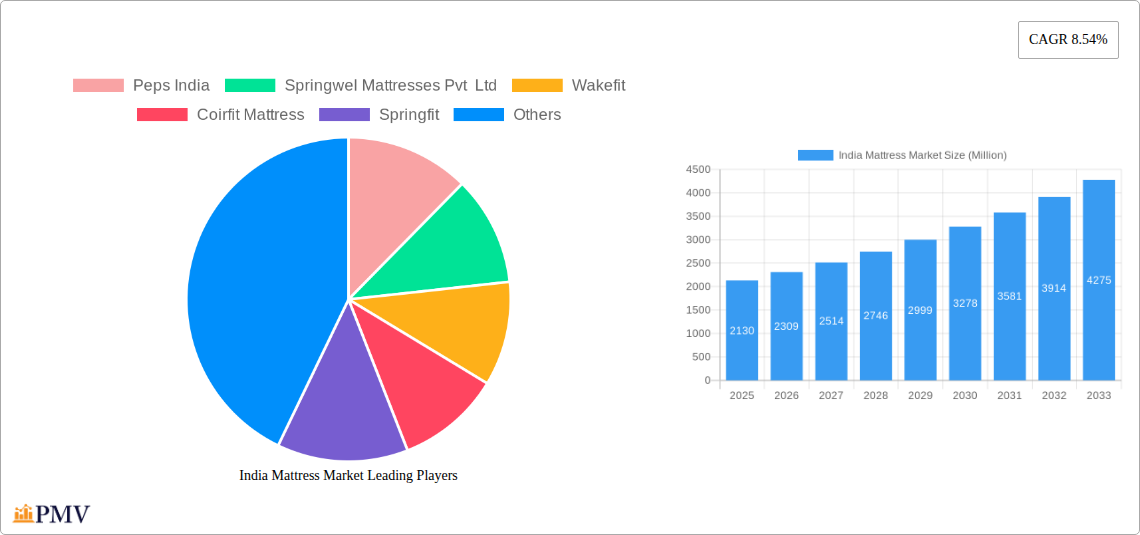

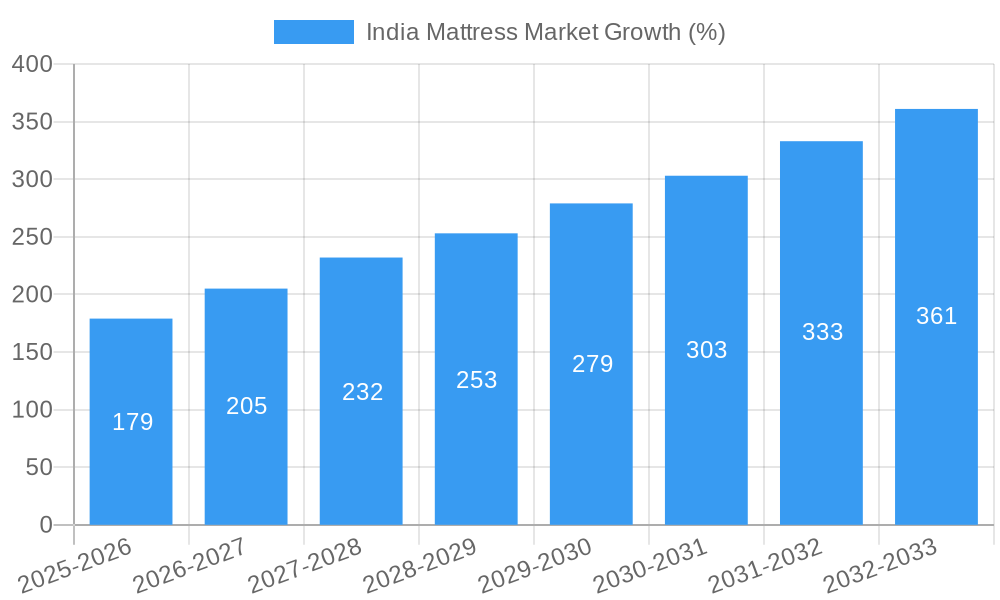

The Indian mattress market, valued at $2.13 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.54% from 2025 to 2033. This growth is fueled by several key factors. Rising disposable incomes and a growing middle class are driving increased demand for higher-quality sleep solutions, moving beyond basic bedding to embrace premium options like memory foam and latex mattresses. The increasing awareness of sleep hygiene and its impact on overall health is also significantly impacting consumer preferences. Furthermore, the burgeoning e-commerce sector is providing convenient access to a wider range of mattress types and brands, expanding market reach beyond traditional brick-and-mortar stores. The market segmentation reveals a diverse landscape, with innerspring mattresses still holding a significant share but facing increasing competition from memory foam and other specialized mattresses catering to specific comfort preferences and health concerns. The residential sector remains the dominant application area, although the commercial segment is poised for growth with increasing investment in hospitality and healthcare infrastructure.

The competitive landscape is characterized by a mix of established players like Sheela Foam and Duroflex, and newer entrants like Wakefit, who are disrupting the market with innovative products and direct-to-consumer models. Regional variations in market demand are evident, with potential for substantial growth in all regions, particularly given India's vast and diverse population. However, challenges remain. Price sensitivity among consumers and the prevalence of counterfeit products pose significant obstacles to market expansion. Overcoming these challenges requires manufacturers to strike a balance between offering high-quality products and maintaining competitive pricing. Future growth will depend on manufacturers' ability to adapt to evolving consumer preferences, leverage technological advancements, and effectively reach consumers through diverse distribution channels.

India Mattress Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the India mattress market, covering market size, segmentation, competitive landscape, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report offers valuable insights for industry stakeholders, investors, and market entrants. The forecast period extends from 2025-2033, encompassing historical data from 2019-2024. The report uses Million (M) as the unit for all monetary values.

India Mattress Market Structure & Competitive Dynamics

The Indian mattress market is characterized by a moderately concentrated landscape with several key players vying for market share. Market concentration is estimated at xx% in 2025, indicating a presence of both large established players and emerging brands. Innovation is driven by the introduction of new materials, technologies (like smart mattresses), and designs catering to evolving consumer preferences. The regulatory framework, while generally favorable, has aspects affecting production costs and materials sourcing. Product substitutes, such as traditional bedding solutions, exert some competitive pressure, though this is mitigated by the increasing awareness of the health and comfort benefits of modern mattresses. End-user trends are heavily influenced by rising disposable incomes, changing lifestyles, and increased focus on sleep quality. Mergers and acquisitions (M&A) activities are significant, reflecting consolidation efforts and expansion strategies. For instance, the recent acquisition of a 94.6% stake in Kurlon Enterprise Limited by Sheela Foam in July 2023, valued at xx Million, highlights the ongoing consolidation. Further M&A deals are expected in coming years.

- Market Share: Sheela Foam holds an estimated xx% market share, followed by Sleepwell (xx%), and Wakefit (xx%). The remaining share is distributed among other players.

- M&A Deal Values: The Sheela Foam-Kurlon deal is a prime example, highlighting the significant investment in market consolidation, expected to reach xx Million by 2033.

- Innovation Ecosystem: Several startups are introducing innovative mattress types and online-first distribution models, challenging established players.

India Mattress Market Industry Trends & Insights

The India mattress market is experiencing robust growth, driven primarily by rising disposable incomes, urbanization, increased awareness of sleep hygiene, and a burgeoning e-commerce sector. The market's Compound Annual Growth Rate (CAGR) is projected at xx% during the forecast period (2025-2033), significantly exceeding the global average. Technological disruptions, such as the introduction of smart mattresses and personalized sleep solutions, are gaining traction. Consumer preferences are shifting towards premium and specialized mattresses, with memory foam and hybrid mattresses gaining popularity. The competitive landscape is dynamic, with both established players and new entrants vying for market share through product innovation, aggressive marketing, and strategic partnerships. The market penetration of premium mattress types like memory foam is estimated at xx% in 2025, with projections of xx% by 2033.

Dominant Markets & Segments in India Mattress Market

The residential segment dominates the Indian mattress market, accounting for approximately xx% of total sales in 2025. Within the mattress types, innerspring mattresses hold the largest share in terms of volume, however, the memory foam and hybrid segments exhibit higher growth rates, reflecting changing consumer preferences. Urban areas, particularly in major metropolitan cities, contribute the most significant sales volume due to higher purchasing power and awareness. Online distribution channels are rapidly expanding and are expected to capture a substantial market share in the forecast period. The online market is particularly dominated by direct-to-consumer (DTC) brands.

Key Drivers for Residential Segment: Rising disposable incomes, urbanization, and increased focus on sleep quality.

Key Drivers for Online Distribution: Convenience, wider selection, and competitive pricing.

Key Drivers for Memory Foam: Superior comfort, ergonomic support, and enhanced sleep quality.

Regional Dominance: Major metropolitan areas like Mumbai, Delhi, Bengaluru, and Chennai are leading regional markets.

Type Dominance: Innerspring maintains the largest market share by volume but memory foam and hybrid mattresses are exhibiting the fastest growth.

Application Dominance: The residential segment remains the largest application area.

Distribution Dominance: Online sales are growing rapidly, challenging traditional retail channels.

India Mattress Market Product Innovations

Technological advancements are driving innovation in the Indian mattress market. Manufacturers are incorporating advanced materials like memory foam, latex, and hybrid combinations to enhance comfort, support, and durability. Smart mattresses with features like temperature regulation and sleep tracking are gaining popularity among consumers seeking advanced sleep solutions. This focus on improved sleep quality and personalized comfort is shaping product development strategies and competitive advantages within the market. New product launches are primarily focused on improving upon existing technologies and expanding into untapped segments like children's and senior citizen-focused mattresses.

Report Segmentation & Scope

This report segments the India mattress market by Type (Innerspring Mattress, Memory Foam Mattress, Latex Mattress, Other Types – Hybrid, Gel, Air Beds, Celliant infused mattress), Application (Residential, Commercial), and Distribution Channel (Specialty Stores, Multi-Brand Stores, Online, Other Distribution Channels – manufacturer retailers, warehouse clubs, discount retailers, distributors, and omnichannel selling companies). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail, providing a comprehensive understanding of the market's diverse components. The growth projections incorporate various factors including economic growth rates, changes in consumer preferences, and anticipated technological advancements. Competitive dynamics within each segment are assessed through the lens of market share, pricing strategies, and innovation capabilities.

Key Drivers of India Mattress Market Growth

The growth of the India mattress market is fueled by several key factors. Rising disposable incomes across various socioeconomic segments directly translates into increased spending on home furnishings, including mattresses. Increasing urbanization drives demand for comfortable and modern bedding solutions. Changing lifestyles emphasize the importance of sleep quality, making consumers more open to premium mattress offerings. The rise of online retail platforms also boosts access and affordability. Finally, favorable government policies supporting the manufacturing sector provide support.

Challenges in the India Mattress Market Sector

Despite positive growth trends, the India mattress market faces certain challenges. Supply chain disruptions, particularly with raw material sourcing, can impact production costs and product availability. Intense competition from both established players and new entrants requires manufacturers to continuously innovate and optimize their offerings to remain competitive. Regulatory compliance, including aspects around material safety, can also add complexity and cost to business operations. Finally, fluctuations in raw material prices impact profitability.

Leading Players in the India Mattress Market

- Peps India

- Springwel Mattresses Pvt Ltd

- Wakefit

- Coirfit Mattress

- Springfit

- Sheela Foam

- Duroflex

- Wink and Nod

- Coirfoam (India) Pvt Ltd

Key Developments in India Mattress Market Sector

- August 2023: Springfit Mattress announced plans to open 150-200 new showrooms, expanding its retail footprint.

- July 2023: Sheela Foam acquired a 94.6% stake in Kurlon Enterprise Limited, strengthening its market position.

- March 2023: VFI Group partnered with Setra Simmons to produce luxurious bedding in India, indicating a push towards premium offerings.

Strategic India Mattress Market Outlook

The India mattress market holds significant growth potential, driven by sustained economic growth, increasing urbanization, and evolving consumer preferences. Strategic opportunities exist for companies that focus on innovation, effective distribution channels, and catering to the growing demand for premium and specialized mattresses. Further consolidation and the emergence of niche players are likely in the years to come. Focus on sustainable and ethically sourced materials will also become increasingly crucial.

India Mattress Market Segmentation

-

1. Type

- 1.1. Innerspring Mattress

- 1.2. Memory Foam Mattress

- 1.3. Latex Mattress

- 1.4. Other Ty

-

2. Application

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Specialty Stores

- 3.2. Multi-Brand Stores

- 3.3. Online

- 3.4. Other Di

India Mattress Market Segmentation By Geography

- 1. India

India Mattress Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.54% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Residential And Commercial Space Driving The Market; Growing Awareness of Health and Wellness Trends

- 3.3. Market Restrains

- 3.3.1 Higher Prices of Luxury and Smart Mattresses; Lack of Stores and Supply chains in Tier 2

- 3.3.2 3 cities

- 3.4. Market Trends

- 3.4.1. Rising Residential Space In India is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Mattress Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Innerspring Mattress

- 5.1.2. Memory Foam Mattress

- 5.1.3. Latex Mattress

- 5.1.4. Other Ty

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Specialty Stores

- 5.3.2. Multi-Brand Stores

- 5.3.3. Online

- 5.3.4. Other Di

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

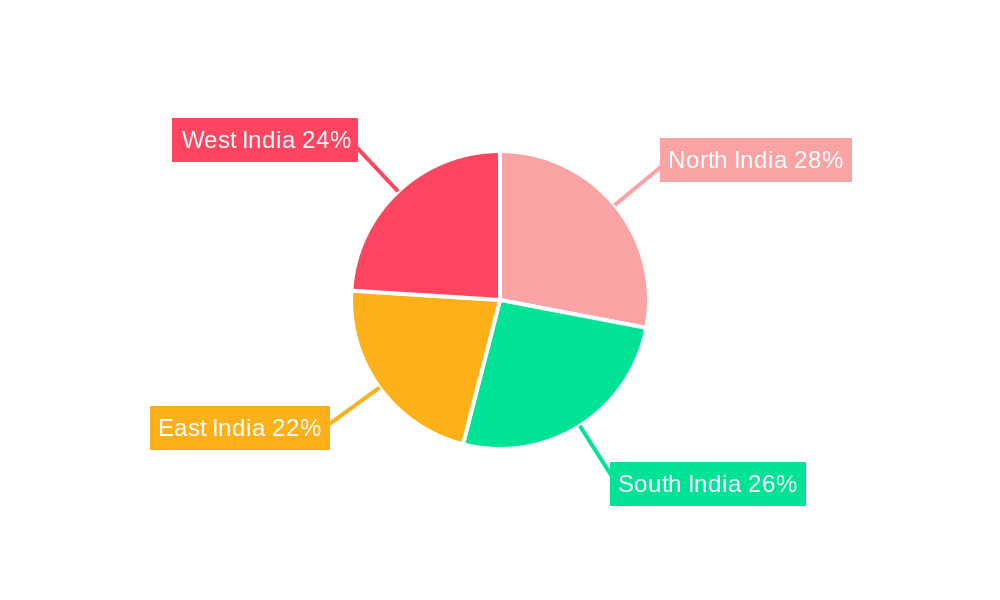

- 6. North India India Mattress Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Mattress Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Mattress Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Mattress Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Peps India

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Springwel Mattresses Pvt Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Wakefit

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Coirfit Mattress

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Springfit

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Sheela Foam

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Duroflex

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Wink and Nod

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Coirfoam (India) Pvt Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Peps India

List of Figures

- Figure 1: India Mattress Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Mattress Market Share (%) by Company 2024

List of Tables

- Table 1: India Mattress Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Mattress Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: India Mattress Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: India Mattress Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: India Mattress Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: India Mattress Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: India Mattress Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: India Mattress Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 9: India Mattress Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: India Mattress Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: India Mattress Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: India Mattress Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: North India India Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: North India India Mattress Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: South India India Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: South India India Mattress Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: East India India Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: East India India Mattress Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: West India India Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: West India India Mattress Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: India Mattress Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: India Mattress Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 23: India Mattress Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: India Mattress Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 25: India Mattress Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 26: India Mattress Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 27: India Mattress Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: India Mattress Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Mattress Market?

The projected CAGR is approximately 8.54%.

2. Which companies are prominent players in the India Mattress Market?

Key companies in the market include Peps India, Springwel Mattresses Pvt Ltd, Wakefit, Coirfit Mattress, Springfit, Sheela Foam, Duroflex, Wink and Nod, Coirfoam (India) Pvt Ltd.

3. What are the main segments of the India Mattress Market?

The market segments include Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Residential And Commercial Space Driving The Market; Growing Awareness of Health and Wellness Trends.

6. What are the notable trends driving market growth?

Rising Residential Space In India is Driving the Market.

7. Are there any restraints impacting market growth?

Higher Prices of Luxury and Smart Mattresses; Lack of Stores and Supply chains in Tier 2. 3 cities.

8. Can you provide examples of recent developments in the market?

In August 2023, Springfit Mattress announced it is planning to open 150–200 Springfit Lounge showrooms in the next year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Mattress Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Mattress Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Mattress Market?

To stay informed about further developments, trends, and reports in the India Mattress Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence