Key Insights

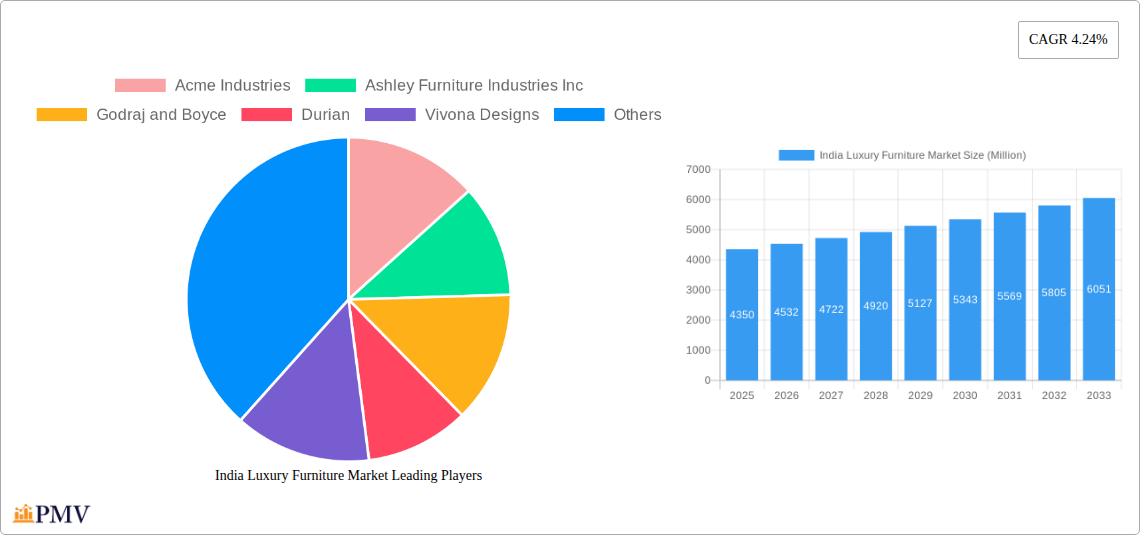

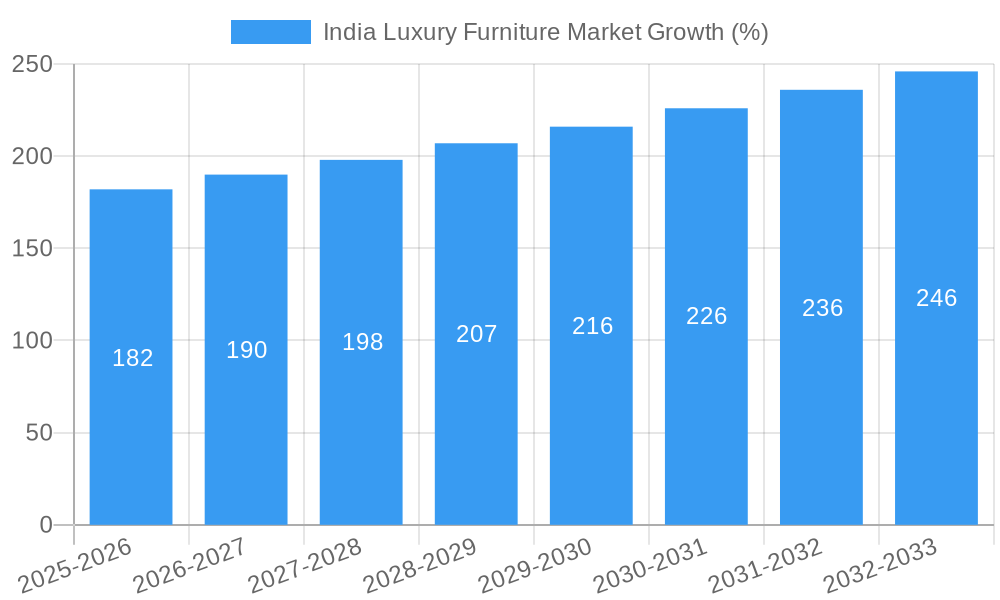

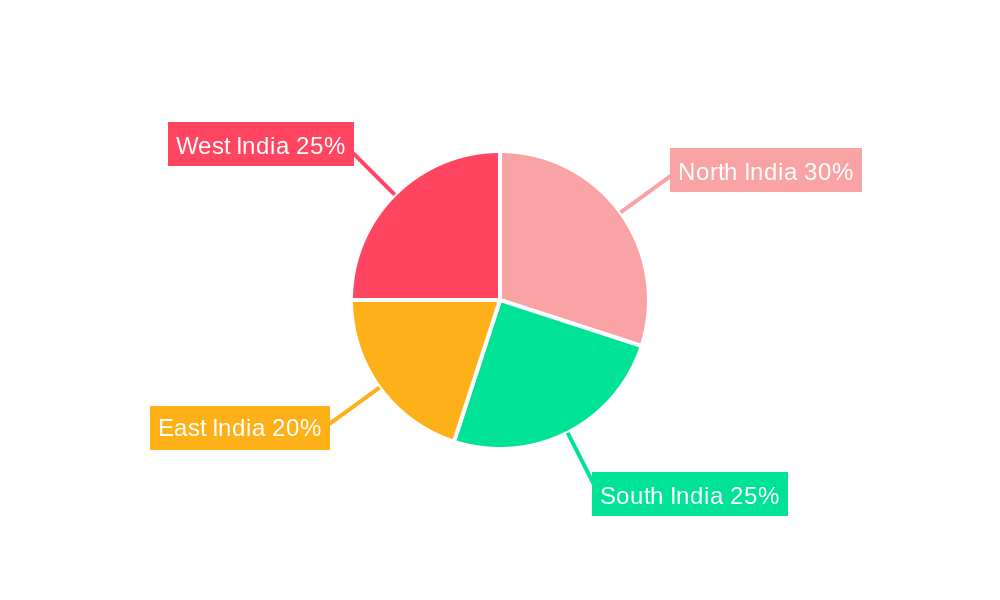

The India luxury furniture market, valued at $4.35 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.24% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes among India's burgeoning affluent class are significantly boosting demand for high-end furniture. A growing preference for sophisticated home interiors, mirroring global design trends, is further catalyzing market growth. The increasing popularity of online retail channels provides greater accessibility to luxury furniture brands, expanding the market reach beyond traditional brick-and-mortar stores. Furthermore, the presence of established international and domestic players like IKEA, Ashley Furniture Industries, and Godrej & Boyce, alongside smaller boutique brands, fosters competition and innovation, driving quality and design improvements. The market is segmented by product type (lighting, tables, chairs & sofas, accessories, bedroom sets, cabinets, and others), end-user (residential and commercial), and distribution channel (home centers, flagship stores, specialty stores, online, and others). Regional variations exist, with potential for growth across all regions (North, South, East, and West India) as affluence spreads geographically. While potential restraints like economic fluctuations could impact spending on luxury goods, the long-term outlook for the India luxury furniture market remains positive, driven by the country's expanding middle and upper-class populations and their increasing appreciation for luxury lifestyle products.

Despite the positive outlook, challenges remain. Maintaining consistent quality and craftsmanship is crucial to uphold the luxury image. Competition among established players and emerging brands necessitates continuous innovation and product differentiation. Effective marketing and brand building strategies are essential to reach the target affluent demographic. Furthermore, navigating the complexities of supply chain management, including sourcing premium materials and ensuring timely delivery, is paramount for continued success in this segment. Growth will likely be uneven across product categories, with certain segments, such as bedroom furniture and bespoke pieces, potentially outpacing others. Ultimately, the success of individual players will depend on their ability to cater to evolving consumer preferences, leverage digital platforms effectively, and provide exceptional customer service.

India Luxury Furniture Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the India luxury furniture market, covering market size, segmentation, competitive landscape, growth drivers, challenges, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report offers actionable insights for industry stakeholders, including manufacturers, distributors, and investors. The market is valued at XX Million in 2025 and is projected to reach XX Million by 2033, exhibiting a CAGR of XX% during the forecast period (2025-2033).

India Luxury Furniture Market Structure & Competitive Dynamics

The Indian luxury furniture market is characterized by a moderately concentrated structure, with a few dominant players and numerous smaller niche businesses. Key players like Acme Industries, Ashley Furniture Industries Inc, Godrej and Boyce, Durian, Vivona Designs, Natuzzi, Mobel Grace, IKEA, Molteni&C, Damro, and others compete intensely. The market exhibits a dynamic innovation ecosystem, driven by evolving consumer preferences and technological advancements. Regulatory frameworks, while generally supportive of the industry, impact material sourcing and manufacturing processes. Product substitutes, particularly in the mid-range segment, present a competitive challenge. M&A activity has been moderate, with deal values typically ranging from XX Million to XX Million, driven by the pursuit of market share expansion and diversification.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately XX% market share in 2025.

- Innovation Ecosystems: Strong focus on design innovation, material sourcing, and sustainable practices.

- Regulatory Frameworks: Compliance with safety and environmental regulations plays a significant role.

- Product Substitutes: Mid-range furniture segments pose a competitive threat.

- End-User Trends: Growing demand for customized and bespoke furniture, along with increasing preference for sustainable and ethically sourced products.

- M&A Activity: Moderate level of consolidation, primarily driven by strategic acquisitions.

India Luxury Furniture Market Industry Trends & Insights

The Indian luxury furniture market is experiencing robust growth, fueled by rising disposable incomes, increasing urbanization, and a growing preference for premium home furnishings. The market is witnessing significant technological disruptions, with the adoption of digital design tools, automated manufacturing processes, and e-commerce platforms transforming the value chain. Consumer preferences are shifting towards customized, sustainable, and technologically advanced furniture. Competitive dynamics are marked by intense competition, product differentiation, and strategic partnerships. The market penetration of luxury furniture is still relatively low, indicating significant untapped potential.

Dominant Markets & Segments in India Luxury Furniture Market

The residential segment dominates the India luxury furniture market, driven by rising disposable incomes and a growing preference for premium home furnishings. Among product types, Chairs and Sofas hold the largest market share, followed by Bedroom furniture and Cabinets. Metropolitan areas like Mumbai, Delhi, Bangalore, and Chennai are key contributors to market growth due to high concentration of affluent consumers and robust real estate development. Online distribution channels are experiencing rapid growth, driven by the increasing adoption of e-commerce.

- Key Drivers for Residential Segment: Rising disposable incomes, preference for personalized spaces, and increasing urbanization.

- Key Drivers for Chairs and Sofas Segment: Comfort, aesthetics, and functional versatility.

- Key Drivers for Online Distribution Channel: Convenience, wider product selection, and competitive pricing.

- Dominant Regions: Mumbai, Delhi, Bangalore, and Chennai.

India Luxury Furniture Market Product Innovations

Recent innovations in the Indian luxury furniture market focus on sustainable materials, ergonomic designs, and smart functionalities. Manufacturers are increasingly incorporating technology to enhance product durability, comfort, and aesthetics. The market is witnessing the launch of modular and customizable furniture, catering to diverse consumer needs. These innovations are enhancing the market appeal and generating competitive advantages for players who invest in research and development.

Report Segmentation & Scope

This report segments the India luxury furniture market based on product type (Lighting, Tables, Chairs and Sofas, Accessories, Bedroom, Cabinets, Other Product Types), end-user (Residential, Commercial), and distribution channel (Home Centers, Flagship Stores, Specialty Stores, Online, Other Distribution Channels). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. For example, the Chairs and Sofas segment is projected to grow at a CAGR of XX% during the forecast period, while the online distribution channel is expected to witness rapid growth due to increasing digital adoption.

Key Drivers of India Luxury Furniture Market Growth

Several factors are driving the growth of the India luxury furniture market: rising disposable incomes, increasing urbanization, a growing preference for premium home furnishings, technological advancements in design and manufacturing, and supportive government policies promoting domestic manufacturing and exports. The expanding middle class and increasing demand for customized and eco-friendly furniture also contribute to the market's expansion.

Challenges in the India Luxury Furniture Market Sector

Challenges include high raw material costs, fluctuating exchange rates, competition from cheaper imported products, and logistical issues associated with the delivery and installation of large furniture items. Furthermore, the complexities of India's regulatory environment and the evolving consumer preferences for sustainability create additional challenges for businesses operating in this segment.

Leading Players in the India Luxury Furniture Market Market

- Acme Industries

- Ashley Furniture Industries Inc

- Godrej and Boyce

- Durian

- Vivona Designs

- Natuzzi

- Mobel Grace

- IKEA

- Molteni&C

- Damro

Key Developments in India Luxury Furniture Market Sector

- January 2023: Durian launched its new range of sofas, the Skyler, a leather 3-seater sofa in various colors. This launch broadened Durian's product portfolio and catered to the growing demand for stylish and space-efficient sofas in urban apartments.

- March 2023: IKEA launched its new GOKVALLA collection of accessories. This expansion into complementary products strengthened IKEA's position in the home furnishing market and offered customers a more comprehensive range of products.

Strategic India Luxury Furniture Market Market Outlook

The India luxury furniture market holds significant growth potential, driven by factors such as increasing urbanization, rising disposable incomes, and evolving consumer preferences. Strategic opportunities for players include focusing on customization, sustainability, and technological integration. Expanding into smaller cities and towns, focusing on e-commerce channels, and strengthening supply chain management are key strategies for success in this evolving market.

India Luxury Furniture Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

India Luxury Furniture Market Segmentation By Geography

- 1. India

India Luxury Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.24% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Disposable Income is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Prices is Restraining the Market

- 3.4. Market Trends

- 3.4.1. The Residential Segment in India is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Luxury Furniture Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North India India Luxury Furniture Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Luxury Furniture Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Luxury Furniture Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Luxury Furniture Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Acme Industries

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Ashley Furniture Industries Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Godraj and Boyce

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Durian

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Vivona Designs

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Natuzzi

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Mobel Grace

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 IKEA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Molteni&C**List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Damro

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Acme Industries

List of Figures

- Figure 1: India Luxury Furniture Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Luxury Furniture Market Share (%) by Company 2024

List of Tables

- Table 1: India Luxury Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Luxury Furniture Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: India Luxury Furniture Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: India Luxury Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: India Luxury Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: India Luxury Furniture Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: India Luxury Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: India Luxury Furniture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: North India India Luxury Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South India India Luxury Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: East India India Luxury Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: West India India Luxury Furniture Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: India Luxury Furniture Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 14: India Luxury Furniture Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 15: India Luxury Furniture Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 16: India Luxury Furniture Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 17: India Luxury Furniture Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 18: India Luxury Furniture Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Luxury Furniture Market?

The projected CAGR is approximately 4.24%.

2. Which companies are prominent players in the India Luxury Furniture Market?

Key companies in the market include Acme Industries, Ashley Furniture Industries Inc, Godraj and Boyce, Durian, Vivona Designs, Natuzzi, Mobel Grace, IKEA, Molteni&C**List Not Exhaustive, Damro.

3. What are the main segments of the India Luxury Furniture Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Disposable Income is Driving the Market.

6. What are the notable trends driving market growth?

The Residential Segment in India is Driving the Market.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Prices is Restraining the Market.

8. Can you provide examples of recent developments in the market?

March 2023: IKEA Launched its new GOKVALLA collection, accessories to accompany client's furniture. the GOKVÄLLÅ collection can help you create the right atmosphere. It's inspired by tile patterns from the Middle East that are mixed with modern elements to make both you and your home shine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Luxury Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Luxury Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Luxury Furniture Market?

To stay informed about further developments, trends, and reports in the India Luxury Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence