Key Insights

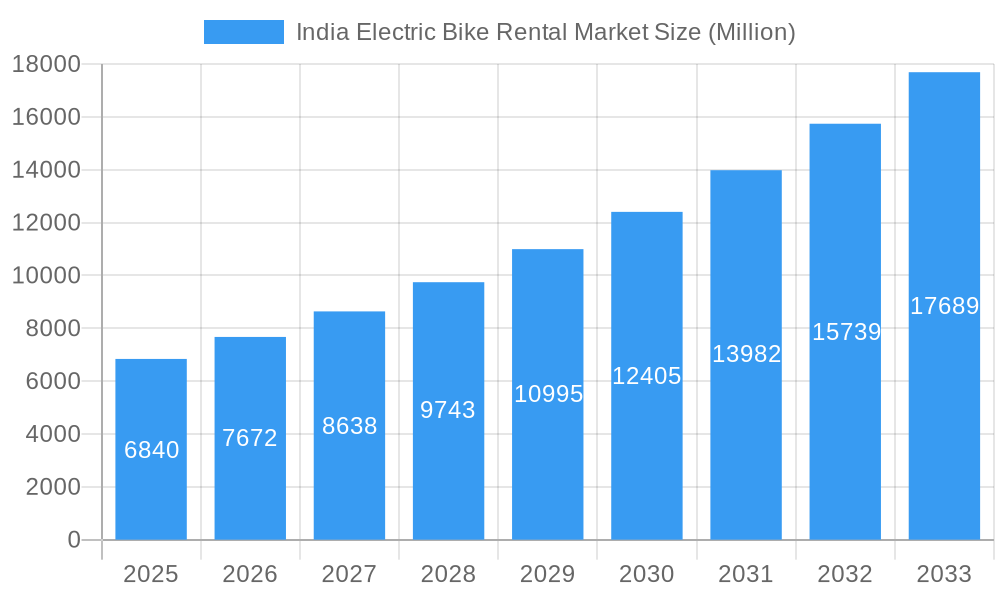

The India electric bike rental market is experiencing robust growth, projected to reach \$6.84 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 12.10% from 2025 to 2033. This expansion is driven by several key factors. Increasing environmental concerns and government initiatives promoting sustainable transportation are significantly boosting demand. Furthermore, the affordability and convenience of electric bike rentals compared to car ownership, particularly in congested urban areas, are major contributors to market growth. The rising popularity of last-mile connectivity solutions and the increasing adoption of e-commerce, which relies heavily on efficient delivery systems, also fuel the market's expansion. Technological advancements, such as improved battery technology and enhanced safety features, further contribute to market growth by increasing consumer appeal and confidence. Segmentation reveals strong demand across various applications, including urban commuting, cargo delivery, and different vehicle types like pedal-assisted and throttle-assisted e-bikes. Competition within the market is fierce, with numerous players such as Rentrip Services, Yulu Bikes, Zypp, and Bounce vying for market share through innovative business models and strategic partnerships. Regional variations exist, with higher adoption rates likely in metropolitan areas of North and South India due to higher population density and infrastructure development. The market's future trajectory suggests continued growth, driven by sustained government support for electric mobility and increasing awareness of environmental sustainability among consumers.

India Electric Bike Rental Market Market Size (In Billion)

The competitive landscape necessitates continuous innovation and strategic partnerships for companies to maintain their market position. Companies are likely focusing on expanding their fleet size, optimizing rental pricing models, and improving customer service to gain a competitive edge. Future market growth will be influenced by the availability of charging infrastructure, government policies regarding subsidies and incentives, and the evolving consumer preferences regarding electric vehicle technology. The expansion of rental services into smaller cities and towns represents a significant untapped market potential, further contributing to the market's impressive forecast. Over the next decade, the Indian electric bike rental market is poised to become a major player in the broader mobility sector, shaping the future of urban transportation within the country.

India Electric Bike Rental Market Company Market Share

India Electric Bike Rental Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the burgeoning India Electric Bike Rental Market, offering invaluable insights for investors, industry players, and market strategists. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers a granular view of historical performance (2019-2024) and future projections. The report leverages extensive data analysis and expert insights to illuminate market trends, competitive dynamics, and future growth potential, focusing on key segments including Application Type (Urban/City, Cargo) and Vehicle Type (Pedal-Assisted, Throttle-Assisted). The market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

India Electric Bike Rental Market Market Structure & Competitive Dynamics

The Indian electric bike rental market exhibits a dynamic competitive landscape, characterized by a mix of established players and emerging startups. Market concentration is currently moderate, with a few key players holding significant market share, but the landscape is rapidly evolving due to increasing investments and new entrants. The innovation ecosystem is robust, driven by advancements in battery technology, charging infrastructure, and shared mobility platforms. Regulatory frameworks are in a state of flux, with evolving policies regarding licensing, safety standards, and environmental regulations influencing market growth. Product substitutes, such as traditional bicycle rentals and ride-hailing services, exert competitive pressure. End-user trends reveal a growing preference for eco-friendly and convenient transportation solutions, particularly amongst younger demographics in urban areas. Mergers and acquisitions (M&A) activity is anticipated to increase, potentially leading to consolidation within the market. For instance, while precise M&A deal values are not publicly available for all transactions, significant investments have been witnessed in this sector. Major players like Yulu and Bounce have secured substantial funding, suggesting a trend towards consolidation and expansion. The market share of the top 5 players is estimated to be xx% in 2025, with Yulu Bikes Pvt Ltd and Bounce Infinit amongst the leading contenders.

India Electric Bike Rental Market Industry Trends & Insights

The India electric bike rental market is experiencing robust growth, driven by several key factors. Increasing environmental concerns and government initiatives promoting electric vehicles are major catalysts. The rising urbanization and associated traffic congestion are fueling demand for convenient and efficient urban transportation solutions. Technological advancements, including improvements in battery technology and charging infrastructure, are enhancing the viability and appeal of electric bikes. Consumer preferences are shifting towards eco-friendly and cost-effective transportation options. The market is characterized by intense competitive dynamics, with players vying for market share through aggressive pricing strategies, innovative product offerings, and strategic partnerships. The market penetration of electric bike rentals is currently estimated at xx% in major metropolitan areas and is projected to reach xx% by 2033. This growth is expected to be fueled by factors such as increasing smartphone penetration, growing awareness of environmental issues, and the increasing affordability of electric bikes. The CAGR for the forecast period is estimated at xx%.

Dominant Markets & Segments in India Electric Bike Rental Market

The urban/city segment dominates the India electric bike rental market, driven by high population density, increased traffic congestion, and rising disposable incomes in metropolitan areas. Key drivers in this segment include favorable government policies promoting electric mobility, expanding charging infrastructure, and a growing preference for shared mobility solutions.

- Economic Policies: Government subsidies and tax incentives for electric vehicles are significantly boosting adoption.

- Infrastructure: Investment in charging stations and improved urban planning are making electric bike rentals more convenient.

The Pedal-Assisted vehicle type currently holds a larger market share compared to Throttle-Assisted, primarily due to their lower cost and ease of use. However, the Throttle-Assisted segment is expected to witness significant growth in the coming years due to increased range and speed.

- Technological Advancements: Improvements in battery technology are enhancing the performance and range of Throttle-Assisted e-bikes.

- Consumer Preferences: Growing demand for faster and more convenient commuting options is driving the adoption of Throttle-Assisted e-bikes.

The Cargo segment, while currently smaller, presents significant growth potential, especially with the rise of e-commerce and last-mile delivery services.

India Electric Bike Rental Market Product Innovations

Recent innovations focus on enhanced battery technology, offering extended range and faster charging capabilities. Improved app-based booking and navigation systems, along with integrated safety features, are enhancing user experience. Lightweight and durable designs are improving the overall performance and reliability of rental electric bikes. The market is also witnessing the introduction of specialized e-bikes catering to specific needs, such as cargo transportation and longer-distance travel. These innovations are crucial in making electric bike rentals more attractive to a wider range of consumers.

Report Segmentation & Scope

The report segments the market by Application Type (Urban/City, Cargo) and Vehicle Type (Pedal-Assisted, Throttle-Assisted). The Urban/City segment is projected to witness significant growth due to rising urbanization and increasing demand for shared mobility solutions. The Cargo segment is expected to experience moderate growth, driven by the burgeoning e-commerce industry and last-mile delivery needs. The Pedal-Assisted segment is currently larger but the Throttle-Assisted segment is predicted to experience a higher CAGR due to technological advancements and shifting consumer preferences. Competitive dynamics vary across segments, with intense competition in the urban/city segment and emerging opportunities in the cargo segment.

Key Drivers of India Electric Bike Rental Market Growth

The growth of the India electric bike rental market is fueled by several key factors. Government initiatives promoting electric mobility, including subsidies and tax breaks, are significantly boosting adoption. Rapid urbanization and increasing traffic congestion are driving demand for convenient and eco-friendly transportation alternatives. Technological advancements in battery technology and charging infrastructure are increasing the viability and appeal of electric bikes. The rising affordability of electric bikes, coupled with the convenience of shared mobility, is making them a more accessible option for a wider range of consumers.

Challenges in the India Electric Bike Rental Market Sector

Several challenges hinder the growth of the India electric bike rental market. The lack of comprehensive charging infrastructure in many areas limits the practical use of electric bikes. Concerns regarding battery life and charging times persist, influencing consumer perception. The initial high cost of electric bikes presents a barrier to market entry for some players. Regulatory hurdles and inconsistent policy frameworks can create uncertainty for businesses operating in the sector. Competition from other modes of transportation, such as traditional bicycles and ride-hailing services, remains intense. These factors collectively pose challenges to market expansion and require strategic solutions for sustainable growth.

Leading Players in the India Electric Bike Rental Market Market

- Rentrip Services Pvt Ltd

- Yulu Bikes Pvt Ltd (Yulu Bikes)

- BycyShare Technologies Pvt Ltd (Zypp) (Zypp)

- Voltium

- Bounce Infinit (Bounce)

- EXA MOBILITY EXA RIDE

- Giant Bikes

- Zypp Electric

- Motoride Scooter Rentals

- Wheelbros

- Vogo Rental

- eBikeGo Pvt Ltd

Key Developments in India Electric Bike Rental Market Sector

- June 2023: Yulu launched the new low-speed e-bike model, Yulu Wynn, expanding its presence in Bengaluru, Delhi, and Mumbai.

- February 2023: Yulu Bikes Pvt Ltd, in partnership with Bajaj Auto Ltd, launched two new electric 2-wheelers (e2Ws), Miracle GR and DeX GR.

- December 2022: The Karnataka Transport Department licensed Wicked Ride (Bounce's parent company) to operate electric bike taxi services.

Strategic India Electric Bike Rental Market Market Outlook

The future of the India electric bike rental market appears promising, driven by sustained government support for electric mobility, rapid urbanization, and technological advancements. Strategic opportunities exist for players focused on expanding charging infrastructure, developing innovative e-bike models catering to specific needs, and leveraging data analytics to enhance operational efficiency and customer experience. Focus on sustainability and technological advancements will be key to capturing market share and driving long-term growth in this dynamic and rapidly evolving sector. Expansion into underserved markets and strategic partnerships will further enhance market penetration and profitability.

India Electric Bike Rental Market Segmentation

-

1. Application Type

- 1.1. Urban/City

- 1.2. Cargo

-

2. Vehicle Type

- 2.1. Pedal-Assisted

- 2.2. Throttle-Assisted

India Electric Bike Rental Market Segmentation By Geography

- 1. India

India Electric Bike Rental Market Regional Market Share

Geographic Coverage of India Electric Bike Rental Market

India Electric Bike Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Electric Vehicles is Anticipated to Boost the Market

- 3.3. Market Restrains

- 3.3.1. Limited EV Charging Infrastructure May Hinder the Market Growth

- 3.4. Market Trends

- 3.4.1. The Pedal-assisted Segment Holds the Highest Share by Vehicle Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Electric Bike Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Urban/City

- 5.1.2. Cargo

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Pedal-Assisted

- 5.2.2. Throttle-Assisted

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rentrip Services Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Yulu Bikes Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BycyShare Technologies Pvt Ltd (Zypp)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Voltium

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bounce Infinit

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EXA MOBILITY EXA RIDE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Giant Bikes

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zypp Electric

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Motoride Scooter Rentals

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Wheelbros

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Vogo Rental

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 eBikeGo Pvt Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Rentrip Services Pvt Ltd

List of Figures

- Figure 1: India Electric Bike Rental Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Electric Bike Rental Market Share (%) by Company 2025

List of Tables

- Table 1: India Electric Bike Rental Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 2: India Electric Bike Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: India Electric Bike Rental Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Electric Bike Rental Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 5: India Electric Bike Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: India Electric Bike Rental Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Electric Bike Rental Market?

The projected CAGR is approximately 12.10%.

2. Which companies are prominent players in the India Electric Bike Rental Market?

Key companies in the market include Rentrip Services Pvt Ltd, Yulu Bikes Pvt Ltd, BycyShare Technologies Pvt Ltd (Zypp), Voltium, Bounce Infinit, EXA MOBILITY EXA RIDE, Giant Bikes, Zypp Electric, Motoride Scooter Rentals, Wheelbros, Vogo Rental, eBikeGo Pvt Ltd.

3. What are the main segments of the India Electric Bike Rental Market?

The market segments include Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.84 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Electric Vehicles is Anticipated to Boost the Market.

6. What are the notable trends driving market growth?

The Pedal-assisted Segment Holds the Highest Share by Vehicle Type.

7. Are there any restraints impacting market growth?

Limited EV Charging Infrastructure May Hinder the Market Growth.

8. Can you provide examples of recent developments in the market?

February 2023: Joining the burgeoning electric two-wheeler space, Bengaluru-headquartered electric mobility platform Yulu Bikes Pvt Ltd, in partnership with Bajaj Auto Ltd, launched two new electric 2-wheelers (e2Ws), namely Miracle GR and DeX GR.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Electric Bike Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Electric Bike Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Electric Bike Rental Market?

To stay informed about further developments, trends, and reports in the India Electric Bike Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence