Key Insights

The Indian automobile industry, valued at $126.67 billion in 2025, is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of 8.20% from 2025 to 2033. This expansion is driven by several key factors. Rising disposable incomes and a burgeoning middle class are fueling demand for personal vehicles, particularly two-wheelers and passenger cars. Government initiatives promoting infrastructure development and electric vehicle adoption further stimulate market growth. Furthermore, the increasing urbanization and the expansion of the logistics and transportation sectors are boosting demand for commercial vehicles. The market is segmented by vehicle type (two-wheelers, passenger cars, commercial vehicles, three-wheelers), fuel type (diesel, petrol/gasoline, CNG & LPG, electric, others), and region (North, South, East, and West India). Competition is fierce, with established players like Maruti Suzuki, Bajaj Auto, Tata Motors, and Hero MotoCorp vying for market share alongside emerging electric vehicle manufacturers and international brands. While the growth trajectory is positive, challenges remain, including fluctuating fuel prices, stringent emission norms, and the need for improved charging infrastructure to support the growing electric vehicle segment. The industry's future hinges on navigating these challenges effectively and capitalizing on the immense growth potential presented by the expanding Indian economy and its increasingly mobile population.

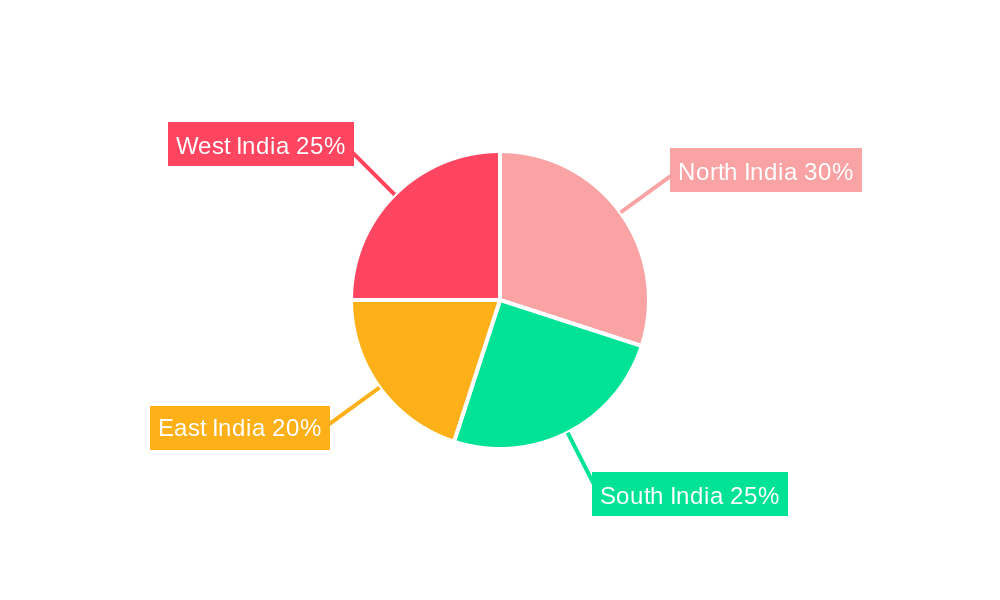

The dominance of two-wheelers in the Indian automobile market is expected to continue, although the passenger car segment is likely to experience significant growth propelled by increasing affordability and evolving consumer preferences. The government's push towards electric mobility presents both opportunities and challenges for manufacturers. While the adoption of electric vehicles is gaining momentum, the lack of widespread charging infrastructure and higher initial costs remain obstacles. The commercial vehicle segment is anticipated to benefit from robust infrastructure development and the expansion of e-commerce and logistics networks. Regional variations in market dynamics exist, with varying levels of vehicle ownership and infrastructure development across North, South, East, and West India. Strategic partnerships, technological innovation, and effective marketing strategies will be crucial for manufacturers to succeed in this dynamic and competitive market.

India Automobile Industry: 2019-2033 Market Analysis & Forecast Report

This comprehensive report provides a detailed analysis of the Indian automobile industry, covering market structure, competitive dynamics, trends, and future growth projections from 2019 to 2033. The report includes granular segmentation by vehicle type (two-wheelers, passenger cars, commercial vehicles, three-wheelers), fuel type (diesel, petrol/gasoline, CNG/LPG, electric, others), and region (North, South, East, West India). It leverages extensive primary and secondary research to offer actionable insights for industry stakeholders, investors, and policymakers. The base year for this report is 2025, with a forecast period extending to 2033 and a historical period encompassing 2019-2024. Estimated market sizes are provided in millions.

India Automobile Industry Market Structure & Competitive Dynamics

The Indian automobile industry exhibits a complex market structure, characterized by a mix of established global players and rapidly growing domestic companies. Market concentration varies significantly across segments. The two-wheeler segment, for example, is dominated by a few major players like Hero MotoCorp and Bajaj Auto, holding a combined market share of approximately xx%. However, the passenger car segment shows a more diversified landscape with companies like Maruti Suzuki, Tata Motors, Hyundai, and Mahindra & Mahindra vying for market leadership. The commercial vehicle segment also showcases a mix of established players and newcomers.

Innovation ecosystems are developing rapidly, driven by government initiatives promoting electric vehicles and advancements in connected car technology. Regulatory frameworks, while evolving, play a significant role in shaping industry dynamics. Stricter emission norms and safety regulations are pushing manufacturers to innovate and invest in cleaner and safer vehicles. The presence of product substitutes, such as public transportation and ride-sharing services, influences market demand, particularly in the passenger car segment. End-user trends, such as preference for SUVs and increasing demand for electric vehicles, are reshaping the market landscape.

Mergers and acquisitions (M&A) activity is prevalent, particularly in the electric vehicle space and among component suppliers. While precise M&A deal values are subject to confidentiality, significant investments were observed during the 2019-2024 period, with a total estimated value exceeding xx Million USD. These activities reflect the industry's consolidation trend and the strategic maneuvering of players to enhance their market position and technological capabilities.

India Automobile Industry Industry Trends & Insights

The Indian automobile industry is experiencing dynamic growth, driven by several key factors. Rising disposable incomes and a burgeoning middle class fuel demand for personal vehicles, while favorable government policies and infrastructural developments further stimulate market expansion. Technological advancements, particularly in the electric vehicle (EV) space, are disrupting traditional dynamics. The Compound Annual Growth Rate (CAGR) for the overall automobile industry during the forecast period (2025-2033) is projected to be xx%, driven primarily by the growth in the two-wheeler and passenger car segments. Market penetration of electric vehicles is expected to increase significantly, reaching xx% by 2033, driven by government incentives and increasing consumer awareness of environmental concerns. The increasing preference for SUVs and premium vehicles, particularly in urban areas, is another significant trend impacting market dynamics. The competitive dynamics are intense, with manufacturers constantly innovating to capture market share.

Dominant Markets & Segments in India Automobile Industry

By Vehicle Type: The two-wheeler segment continues to be the largest, driven by affordability and widespread use for personal and commercial purposes. Passenger cars are exhibiting rapid growth, fueled by rising disposable incomes and aspirations for personal mobility. Commercial vehicles are also growing, albeit at a slower pace, supported by infrastructure development and industrial growth. The three-wheeler segment, largely comprising auto-rickshaws, remains significant, serving last-mile connectivity needs.

By Fuel Type: Petrol/gasoline remains the dominant fuel type, but the share of diesel is declining due to stricter emission norms and higher fuel costs. CNG and LPG segments are growing steadily due to their cost-effectiveness. The electric vehicle (EV) segment is emerging as a major force, driven by government incentives and growing environmental awareness. Market size projections for each fuel type during the forecast period need more granular study.

By Region: North India and South India currently represent the largest markets, driven by higher population density and economic activity. However, East and West India are experiencing significant growth as infrastructure improves and economic opportunities expand. Specific regional factors including economic policies and infrastructure investments, play a crucial role in driving growth in these regions.

India Automobile Industry Product Innovations

Technological advancements are driving innovation in the Indian automobile industry. Manufacturers are increasingly focusing on developing fuel-efficient vehicles, electric vehicles, and connected car technologies. Features such as advanced driver-assistance systems (ADAS), infotainment systems, and safety features are gaining popularity. These innovations aim to enhance the driving experience, improve fuel efficiency, and enhance safety standards, aligning with changing consumer preferences and competitive pressures.

Report Segmentation & Scope

This report segments the Indian automobile industry by vehicle type (two-wheelers, passenger cars, commercial vehicles, three-wheelers), fuel type (diesel, petrol/gasoline, CNG/LPG, electric, others), and region (North, South, East, West India). Each segment's growth projections, market size, and competitive dynamics are analyzed. For instance, the electric vehicle segment is expected to experience the highest CAGR during the forecast period, driven by government support and increasing consumer demand. The two-wheeler segment, while maintaining its dominant position, may observe a marginal decrease in its market share due to the growth of other vehicle segments.

Key Drivers of India Automobile Industry Growth

Several key factors drive the growth of the Indian automobile industry. Government initiatives promoting electric vehicles and infrastructure development have created a favorable environment for growth. Rising disposable incomes, a growing middle class, and increasing urbanization fuel demand for personal and commercial vehicles. Moreover, technological advancements and manufacturing capabilities are key drivers for market expansion.

Challenges in the India Automobile Industry Sector

Despite its robust growth, the Indian automobile industry faces several challenges. Supply chain disruptions, rising input costs, and competition from global players impact profitability. Stricter emission norms and safety standards demand significant investments in research and development. Moreover, fluctuations in global economic conditions can significantly influence market demand.

Leading Players in the India Automobile Industry Market

- Maruti Suzuki India Limited

- Piaggio & C SpA

- MG Motor India Pvt Ltd

- Bajaj Auto Corp

- Tata Motors Limited

- Hero Moto Corp

- Atul Auto Limited

- Mercedes-Benz India Pvt Ltd

- Honda Motorcycle & Scooter India Pvt Ltd

- Terra Motors India Corp

- Renault Group

- TVS Motor Company

- Volkswagen India

- Kinetic Green Energy & Power Solutions Lt

- Mahindra & Mahindra Limited

- Suzuki Motorcycle India Private Limited

- Royal Enfield

- Scooters India Ltd

- Honda Cars India Ltd

- Lohia Auto Industries

- Hyundai Motor India Ltd

- BMW AG

- BYD Company Ltd

Key Developments in India Automobile Industry Sector

- January 2024: Maruti Suzuki India announced plans to build a new car manufacturing facility in Gujarat with an annual capacity of 1 Million vehicles and an investment of approximately INR 35,000 crore (USD 4.2 billion).

- February 2024: TVS Mobility secured a 32% stake in TVS VMS through a INR 300 crore (USD 40 million) investment from Mitsubishi Corporation.

Strategic India Automobile Industry Market Outlook

The Indian automobile industry is poised for sustained growth, driven by favorable demographic trends, increasing disposable incomes, and government support for the electric vehicle sector. Strategic opportunities exist for companies that can effectively leverage technological advancements, cater to evolving consumer preferences, and navigate regulatory changes. The focus on electric mobility, connected car technology, and sustainable manufacturing practices will shape the industry's future landscape, presenting significant growth potential for innovative and adaptable players.

India Automobile Industry Segmentation

-

1. Vehicle Type

- 1.1. Two-wheelers

- 1.2. Passenger Cars

- 1.3. Commercial Vehicles

- 1.4. Three-wheelers

-

2. Fuel Type

- 2.1. Diesel

- 2.2. Petrol/Gasoline

- 2.3. CNG and LPG

- 2.4. Electric

- 2.5. Others

India Automobile Industry Segmentation By Geography

- 1. India

India Automobile Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The Growing Economy

- 3.2.2 Coupled with Rising Disposal Incomes and Urbanization

- 3.2.3 Fuels Demand for the Market

- 3.3. Market Restrains

- 3.3.1 Various Regulatory Changes

- 3.3.2 Safety Standards

- 3.3.3 and Taxation Policies by the Government may Hamper the Market

- 3.4. Market Trends

- 3.4.1. The Two-Wheelers Segment to Register Fastest Growth over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Two-wheelers

- 5.1.2. Passenger Cars

- 5.1.3. Commercial Vehicles

- 5.1.4. Three-wheelers

- 5.2. Market Analysis, Insights and Forecast - by Fuel Type

- 5.2.1. Diesel

- 5.2.2. Petrol/Gasoline

- 5.2.3. CNG and LPG

- 5.2.4. Electric

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North India India Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Automobile Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 1 Maruti Suzuki India Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 2 Piaggio & C SpA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 5 MG Motor India Pvt Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 5 Bajaj Auto Corp

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 2 Tata Motors Limited (includes Tata and Jaguar)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 2 Hero Moto Corp

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 4 Atul Auto Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 11 Mercedes-Benz India Pvt Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 3 Honda Motorcycle & Scooter India Pvt Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 5 Terra Motors India Corp

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 7 Renault Group (Includes Nissan and Renault)

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Two-wheelers

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 1 TVS Motor Company

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Three-wheelers

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 6 Volkswagen India

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 6 Kinetic Green Energy & Power Solutions Lt

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Passenger Cars and Commercial Vehicles

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 4 Mahindra & Mahindra Limited

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 6 Suzuki Motorcycle India Private Limited

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 4 Royal Enfield

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.21 3 Scooters India Ltd

- 10.2.21.1. Overview

- 10.2.21.2. Products

- 10.2.21.3. SWOT Analysis

- 10.2.21.4. Recent Developments

- 10.2.21.5. Financials (Based on Availability)

- 10.2.22 8 Honda Cars India Ltd

- 10.2.22.1. Overview

- 10.2.22.2. Products

- 10.2.22.3. SWOT Analysis

- 10.2.22.4. Recent Developments

- 10.2.22.5. Financials (Based on Availability)

- 10.2.23 1 Lohia Auto Industries

- 10.2.23.1. Overview

- 10.2.23.2. Products

- 10.2.23.3. SWOT Analysis

- 10.2.23.4. Recent Developments

- 10.2.23.5. Financials (Based on Availability)

- 10.2.24 3 Hyundai Motor India Ltd

- 10.2.24.1. Overview

- 10.2.24.2. Products

- 10.2.24.3. SWOT Analysis

- 10.2.24.4. Recent Developments

- 10.2.24.5. Financials (Based on Availability)

- 10.2.25 10 BMW AG (includes BMW and MINI)

- 10.2.25.1. Overview

- 10.2.25.2. Products

- 10.2.25.3. SWOT Analysis

- 10.2.25.4. Recent Developments

- 10.2.25.5. Financials (Based on Availability)

- 10.2.26 9 BYD Company Ltd

- 10.2.26.1. Overview

- 10.2.26.2. Products

- 10.2.26.3. SWOT Analysis

- 10.2.26.4. Recent Developments

- 10.2.26.5. Financials (Based on Availability)

- 10.2.1 1 Maruti Suzuki India Limited

List of Figures

- Figure 1: India Automobile Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Automobile Industry Share (%) by Company 2024

List of Tables

- Table 1: India Automobile Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Automobile Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: India Automobile Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 4: India Automobile Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Automobile Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Automobile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Automobile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Automobile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Automobile Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Automobile Industry Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 11: India Automobile Industry Revenue Million Forecast, by Fuel Type 2019 & 2032

- Table 12: India Automobile Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Automobile Industry?

The projected CAGR is approximately 8.20%.

2. Which companies are prominent players in the India Automobile Industry?

Key companies in the market include 1 Maruti Suzuki India Limited, 2 Piaggio & C SpA, 5 MG Motor India Pvt Ltd, 5 Bajaj Auto Corp, 2 Tata Motors Limited (includes Tata and Jaguar), 2 Hero Moto Corp, 4 Atul Auto Limited, 11 Mercedes-Benz India Pvt Ltd, 3 Honda Motorcycle & Scooter India Pvt Ltd, 5 Terra Motors India Corp, 7 Renault Group (Includes Nissan and Renault), Two-wheelers, 1 TVS Motor Company, Three-wheelers, 6 Volkswagen India, 6 Kinetic Green Energy & Power Solutions Lt, Passenger Cars and Commercial Vehicles, 4 Mahindra & Mahindra Limited, 6 Suzuki Motorcycle India Private Limited, 4 Royal Enfield, 3 Scooters India Ltd, 8 Honda Cars India Ltd, 1 Lohia Auto Industries, 3 Hyundai Motor India Ltd, 10 BMW AG (includes BMW and MINI), 9 BYD Company Ltd.

3. What are the main segments of the India Automobile Industry?

The market segments include Vehicle Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 126.67 Million as of 2022.

5. What are some drivers contributing to market growth?

The Growing Economy. Coupled with Rising Disposal Incomes and Urbanization. Fuels Demand for the Market.

6. What are the notable trends driving market growth?

The Two-Wheelers Segment to Register Fastest Growth over the Forecast Period.

7. Are there any restraints impacting market growth?

Various Regulatory Changes. Safety Standards. and Taxation Policies by the Government may Hamper the Market.

8. Can you provide examples of recent developments in the market?

January 2024: Maruti Suzuki India intended to build a car production facility in Gujarat, India, capable of manufacturing 1 million vehicles annually, with an estimated investment of around INR 35,000 crore (USD 4.2 billion). This move is expected to bolster the Indian automobile industry significantly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Automobile Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Automobile Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Automobile Industry?

To stay informed about further developments, trends, and reports in the India Automobile Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence