Key Insights

The India Accounting Professional Services market is poised for significant expansion, propelled by India's dynamic economic growth, escalating regulatory compliance mandates, and the widespread adoption of advanced technologies such as AI and cloud computing. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.32%, indicating sustained development. This growth is further driven by the increasing complexity of accounting standards, the demand for specialized services like forensic accounting and internal audit, and the growing trend of outsourcing accounting functions to optimize operational costs and enhance efficiency. Leading global firms, including PwC India, Ernst & Young, Deloitte, and KPMG, are strategically positioned to leverage this expansion by delivering integrated solutions that span traditional accounting and specialized advisory services, catering to a broad spectrum of industries from SMEs to large corporations. Government initiatives focused on improving the ease of doing business and reinforcing corporate governance also contribute to market expansion.

India Accounting Professional Services Market Market Size (In Billion)

The market size is estimated at 534.21 billion in the base year 2025, presenting a substantial and attractive opportunity. While specific segmental data is not detailed, it is expected to encompass industry-specific accounting services (e.g., manufacturing, finance), audit, tax advisory, consulting, and forensic accounting. Geographic concentration is anticipated to align with India's economic centers, with major metropolitan areas and financial hubs capturing a larger market share. Potential challenges include intense competition among established players, the availability of qualified professionals, and evolving regulatory landscapes. Despite these factors, the India Accounting Professional Services market demonstrates a highly promising long-term growth outlook from 2025 to 2033.

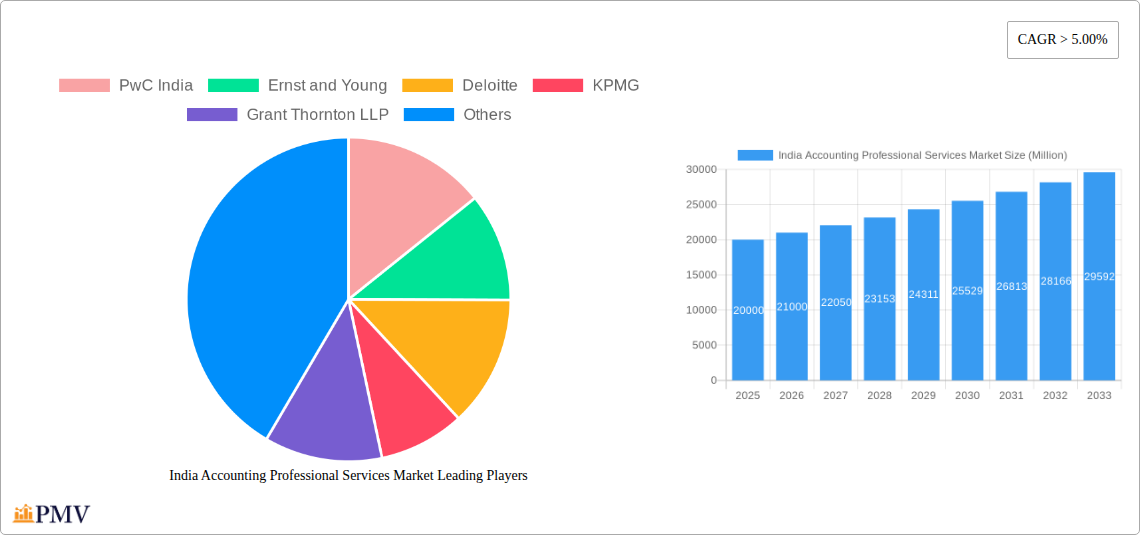

India Accounting Professional Services Market Company Market Share

India Accounting Professional Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Accounting Professional Services Market, offering invaluable insights for businesses, investors, and industry stakeholders. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. This report delves into market structure, competitive dynamics, industry trends, and growth projections, providing actionable intelligence to navigate this rapidly evolving landscape. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

India Accounting Professional Services Market Market Structure & Competitive Dynamics

The Indian accounting professional services market is characterized by a moderately concentrated structure, with major players like PwC India, Ernst and Young, Deloitte, KPMG, Grant Thornton LLP, BDO India, RSM, SS Kothari Mehta & Co, ASA and Associates, and Nangia and Co holding significant market share. However, a considerable number of smaller firms and niche players also contribute to the market's dynamism. The market is influenced by a constantly evolving regulatory framework, particularly concerning taxation and compliance. Technological advancements, like AI-powered auditing tools and cloud-based accounting software, are disrupting traditional practices, fostering innovation and creating new market segments. The market also witnesses significant M&A activity, with deals primarily driven by expansion strategies and the acquisition of specialized expertise. In recent years, M&A deal values have averaged around xx Million, contributing to market consolidation. For example, PwC India's acquisition of Venerate Solutions in August 2022 exemplifies this trend. End-user trends indicate a growing preference for integrated and technology-enabled solutions, driving demand for specialized services in areas such as data analytics and risk management.

- Market Concentration: Moderately concentrated, with top players holding xx% market share.

- M&A Activity: Significant, with average deal values around xx Million.

- Innovation Ecosystem: Driven by technological advancements and regulatory changes.

- Regulatory Framework: Constantly evolving, impacting service offerings and demand.

India Accounting Professional Services Market Industry Trends & Insights

The Indian accounting professional services market is experiencing robust growth, fueled by a burgeoning economy, increasing foreign investment, and the expanding adoption of sophisticated accounting practices. The market's CAGR during the forecast period (2025-2033) is projected at xx%, driven primarily by the rising demand for compliance services, advisory services, and outsourcing solutions. Technological disruptions, particularly the adoption of cloud computing, data analytics, and automation, are reshaping the market landscape. Consumer preferences are shifting towards customized, technologically advanced, and integrated service offerings. Competitive dynamics are marked by intense rivalry among large multinational firms and smaller, specialized players. Market penetration of cloud-based accounting software is increasing rapidly, with an estimated xx% penetration rate in 2025. The growing adoption of IFRS standards is also driving the demand for sophisticated accounting and advisory services. The increasing complexity of tax regulations and compliance requirements further fuels market growth. Challenges remain in addressing the skills gap within the industry and adapting to evolving technological trends.

Dominant Markets & Segments in India Accounting Professional Services Market

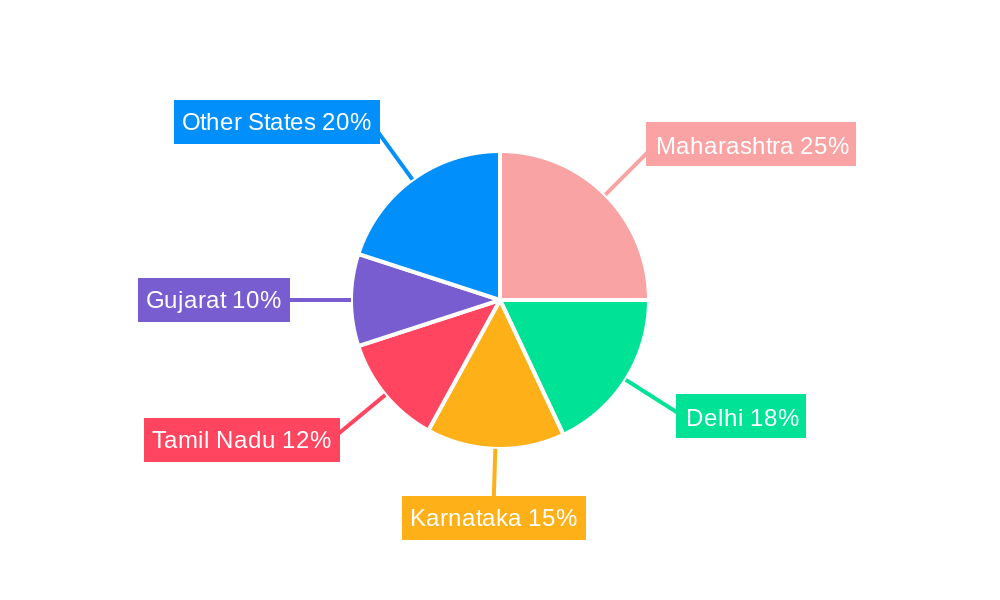

The metropolitan areas of Mumbai, Delhi, Bangalore, and Chennai are the dominant markets within India's accounting professional services sector, driven by the concentration of large businesses, multinational corporations, and a skilled workforce. These regions benefit from robust economic activity, well-developed infrastructure, and supportive government policies.

- Key Drivers for Dominant Markets:

- High concentration of businesses and multinational corporations

- Skilled workforce and availability of talent

- Well-developed infrastructure and connectivity

- Supportive government policies and initiatives

The dominance of these regions stems from a confluence of factors, including the concentration of major industries, a large pool of skilled professionals, and favorable business environments. The strong presence of multinational corporations and foreign investment also contributes significantly to the demand for high-quality accounting and advisory services within these regions. Furthermore, efficient infrastructure and reliable connectivity are crucial for the effective delivery of professional services.

India Accounting Professional Services Market Product Innovations

Recent product innovations within the Indian accounting professional services market include the development of AI-powered audit tools, cloud-based accounting software, and specialized services in areas such as data analytics and risk management. These innovations aim to enhance efficiency, improve accuracy, and provide clients with more comprehensive and valuable insights. The market is witnessing a growing integration of technology into traditional accounting practices, reflecting a broader trend towards digital transformation across the industry. This enhances service offerings, optimizes operational efficiency, and allows for a more data-driven approach to client servicing.

Report Segmentation & Scope

This report segments the Indian Accounting Professional Services Market based on service type (audit, tax, advisory, outsourcing), industry vertical (BFSI, manufacturing, IT, etc.), company size (SMEs, large enterprises), and geographic location (metropolitan areas, tier-II cities). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail. The market is expected to witness significant growth across all segments, with the advisory services segment demonstrating particularly strong growth due to increased demand for strategic guidance and risk management solutions.

Key Drivers of India Accounting Professional Services Market Growth

Several factors are driving the growth of the Indian Accounting Professional Services Market. These include the country's robust economic growth, increasing foreign direct investment (FDI), the rising adoption of advanced accounting technologies, and the growing complexity of regulatory compliance. The increasing need for robust internal controls and risk management practices across various sectors also contributes to the growth. The government's focus on improving ease of doing business and promoting digitalization further bolsters market expansion. The implementation of new accounting standards such as IFRS also drives demand for expert services.

Challenges in the India Accounting Professional Services Market Sector

The Indian accounting professional services market faces challenges including a skills gap, intense competition, particularly from global players, and the need to adapt to rapid technological advancements. Regulatory changes and compliance requirements also present ongoing challenges. Maintaining data security and privacy in an increasingly digital environment is another crucial aspect. The cost of talent acquisition and retention is also a significant hurdle, especially for smaller firms.

Leading Players in the India Accounting Professional Services Market Market

- PwC India

- Ernst and Young

- Deloitte

- KPMG

- Grant Thornton LLP

- BDO India

- RSM

- SS Kothari Mehta & Co

- ASA and Associates

- Nangia and Co

- (List Not Exhaustive)

Key Developments in India Accounting Professional Services Market Sector

- October 2022: KPMG in India and IBSFINtech formed an alliance to offer corporate treasury automation solutions.

- August 2022: PwC India acquired Venerate Solutions Private Limited, expanding its Salesforce consulting capabilities.

Strategic India Accounting Professional Services Market Market Outlook

The Indian accounting professional services market is poised for sustained growth, driven by ongoing economic expansion, technological innovation, and evolving regulatory requirements. Strategic opportunities lie in specializing in niche areas, adopting advanced technologies, and expanding into underserved markets. The focus on digital transformation, data analytics, and risk management will be key to future success. Companies that effectively leverage technology and build strong client relationships will be best positioned to capitalize on the market's potential.

India Accounting Professional Services Market Segmentation

-

1. Type Of Service

- 1.1. Tax Preperation Services

- 1.2. Book Keeping Services

- 1.3. Payroll Services

- 1.4. Others

India Accounting Professional Services Market Segmentation By Geography

- 1. India

India Accounting Professional Services Market Regional Market Share

Geographic Coverage of India Accounting Professional Services Market

India Accounting Professional Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Secure Cloud Accounting Solution is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Accounting Professional Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type Of Service

- 5.1.1. Tax Preperation Services

- 5.1.2. Book Keeping Services

- 5.1.3. Payroll Services

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type Of Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PwC India

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ernst and Young

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Deloitte

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 KPMG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Grant Thornton LLP

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BDO India

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 RSM

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SS Kothari Mehta & Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ASA and Associates

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nangia and Co **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 PwC India

List of Figures

- Figure 1: India Accounting Professional Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Accounting Professional Services Market Share (%) by Company 2025

List of Tables

- Table 1: India Accounting Professional Services Market Revenue billion Forecast, by Type Of Service 2020 & 2033

- Table 2: India Accounting Professional Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: India Accounting Professional Services Market Revenue billion Forecast, by Type Of Service 2020 & 2033

- Table 4: India Accounting Professional Services Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Accounting Professional Services Market?

The projected CAGR is approximately 3.32%.

2. Which companies are prominent players in the India Accounting Professional Services Market?

Key companies in the market include PwC India, Ernst and Young, Deloitte, KPMG, Grant Thornton LLP, BDO India, RSM, SS Kothari Mehta & Co, ASA and Associates, Nangia and Co **List Not Exhaustive.

3. What are the main segments of the India Accounting Professional Services Market?

The market segments include Type Of Service.

4. Can you provide details about the market size?

The market size is estimated to be USD 534.21 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Secure Cloud Accounting Solution is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In October 2022, In order to provide their clients with a comprehensive suite of corporate treasury automation solutions and assist them in hastening the digital transformation of their treasury department, KPMG in India and IBSFINtech today established an alliance connection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Accounting Professional Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Accounting Professional Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Accounting Professional Services Market?

To stay informed about further developments, trends, and reports in the India Accounting Professional Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence