Key Insights

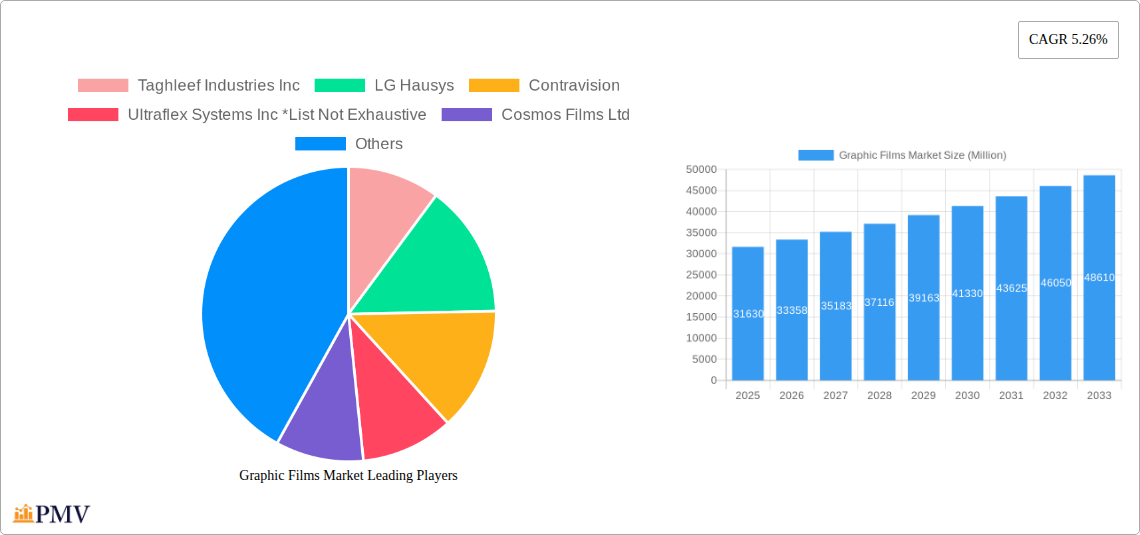

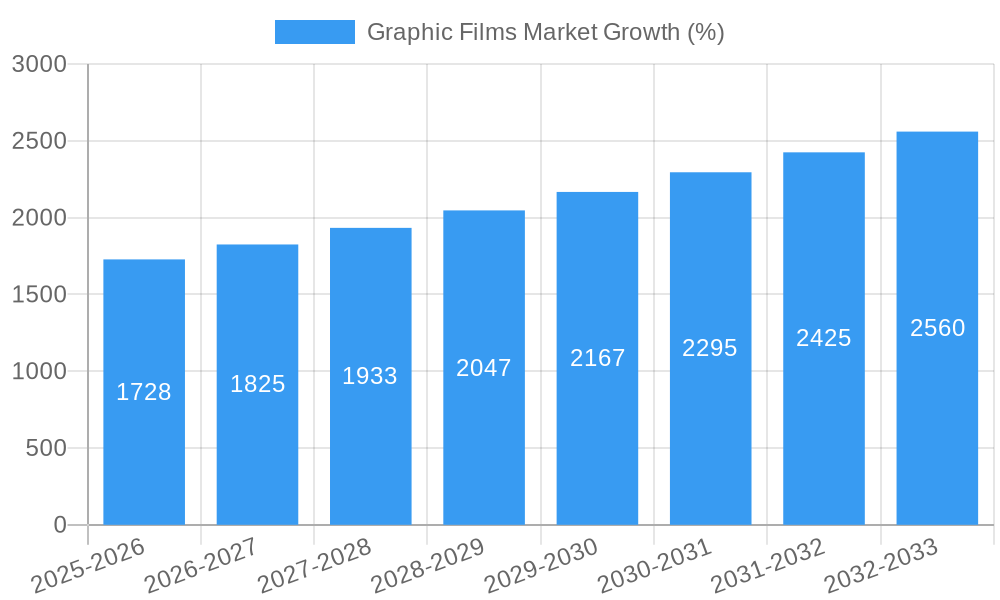

The global graphic films market, valued at $31.63 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 5.26% from 2025 to 2033. This expansion is fueled by several key factors. The automotive industry's increasing demand for high-quality, durable films for vehicle branding and aesthetics is a significant driver. Furthermore, the promotional and advertisement sectors are leveraging graphic films for eye-catching displays and signage, contributing to market growth. The institutional sector, encompassing applications in schools, hospitals, and government buildings, also presents a substantial opportunity. Technological advancements in polymer types, such as improved polypropylene (PP) and polyethylene (PE) films offering enhanced durability and print quality, are further fueling market expansion. Growth in e-commerce and the aircraft industry is also boosting demand for specialized graphic films.

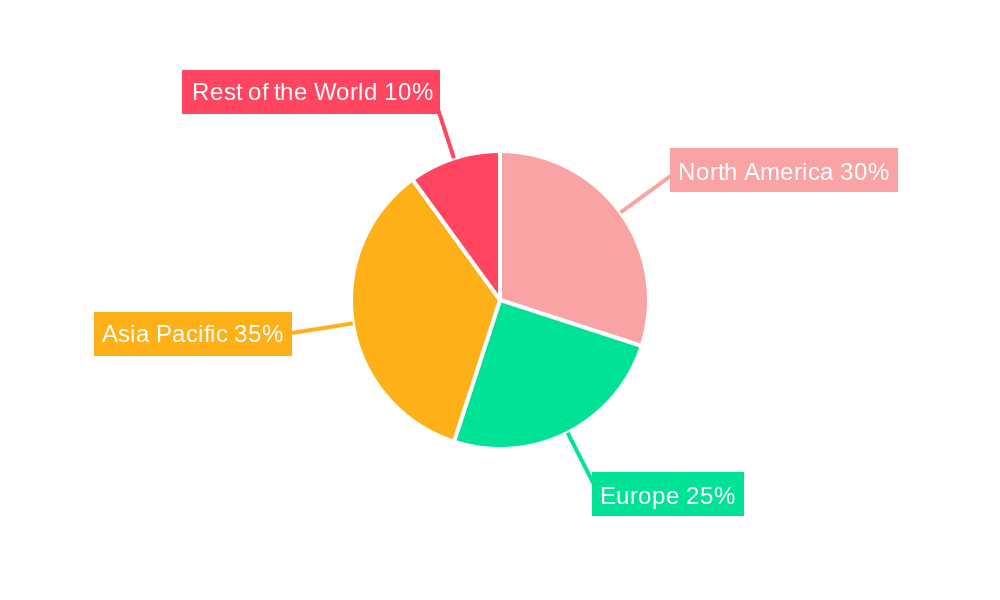

However, certain restraints exist. Fluctuations in raw material prices, particularly for polymers, can impact profitability. Environmental concerns related to film disposal and sustainability are also pushing the industry toward developing eco-friendly alternatives. Competitive pressures from a wide array of established players and new entrants necessitate continuous innovation and cost optimization strategies for market success. The market segmentation reveals a varied landscape, with polypropylene (PP) and polyethylene (PE) dominating the polymer segment, and the automotive and promotional/advertisement sectors leading in end-user applications. This dynamic interplay between drivers, restraints, and segment performance will shape the future of the graphic films market, offering both opportunities and challenges for businesses operating within this sector. Geographic growth is expected to be spread across regions, with Asia Pacific potentially showing strong growth due to rising consumer spending and industrial development.

Graphic Films Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Graphic Films Market, covering market structure, competitive dynamics, industry trends, dominant segments, product innovations, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period extends from 2025 to 2033, while the historical period encompasses 2019-2024. This report is crucial for businesses involved in the manufacturing, distribution, and application of graphic films, as well as investors seeking to understand this dynamic market.

Graphic Films Market Structure & Competitive Dynamics

The Graphic Films Market is characterized by a moderately concentrated structure, with several major players holding significant market share. However, the market also features a substantial number of smaller, specialized firms catering to niche segments. Key aspects influencing market dynamics include:

- Market Concentration: The top five players account for approximately xx% of the global market share in 2024, with Taghleef Industries Inc, LG Hausys, Contravision, and Ultraflex Systems Inc among the key players. Other significant companies include Cosmos Films Ltd, Schweitzer-Mauduit International Inc, Orafol Europe GMBH, Drytac Corporation, FDC Graphic Films Inc, 3M Company, Lintec Corporation, Avery Dennison Corporation, Graphic Image Films Ltd, Spandex AG, Arlon Graphics LLC (FLEXcon Company Inc), ACCO Brands Corporation, Hexis S A, Ritrama SpA, Innovia Films (CCL Industries Inc), and E I Du Pont De Nemours and Company.

- Innovation Ecosystems: Ongoing R&D efforts are focused on developing sustainable and high-performance graphic films. This includes the exploration of new polymers, improved printing techniques, and enhanced durability for various applications.

- Regulatory Frameworks: Environmental regulations concerning PVC and other materials are influencing product development and adoption rates. Compliance costs and the push towards sustainable alternatives shape the market landscape.

- Product Substitutes: The market faces competition from alternative materials in specific applications, impacting pricing and market share.

- End-User Trends: Growing demand from the automotive and promotional advertising sectors is driving market growth, while evolving preferences for digital signage are influencing the adoption of specific film types.

- M&A Activities: The market has witnessed xx M&A deals valued at approximately $xx Million in the last five years, primarily driven by consolidation and expansion strategies of major players. These transactions have significantly impacted market concentration and competitive dynamics.

Graphic Films Market Industry Trends & Insights

The Graphic Films Market is experiencing a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key trends:

- Rising Demand from End-Use Sectors: The automotive industry's increasing use of vehicle wraps, and the growing promotional and advertising sectors (including the e-commerce boom) are major growth drivers. The institutional sector also contributes significantly, particularly in signage and branding applications within public spaces.

- Technological Advancements: Innovations in polymer chemistry and printing technology are leading to the development of more durable, versatile, and sustainable graphic films. Advancements in digital printing techniques, in particular, are enhancing print quality and reducing production times.

- Consumer Preferences: Growing environmental awareness is driving demand for PVC-free and eco-friendly graphic films, creating opportunities for biodegradable and recyclable alternatives. Furthermore, the demand for customized and visually appealing graphics is growing, stimulating innovation in product design and application techniques.

- Competitive Dynamics: The market is characterized by intense competition, driving innovation and price optimization. Major players are investing in R&D, strategic partnerships, and acquisitions to maintain a competitive edge. Market penetration of eco-friendly options is increasing due to consumer and regulatory pressure, pushing for around xx% penetration by 2033.

Dominant Markets & Segments in Graphic Films Market

- Leading Region/Country: [Insert Dominant Region/Country based on data – e.g., North America currently holds the largest market share due to high demand from the automotive and advertising industries. Factors such as strong economic growth, developed infrastructure, and high disposable incomes contribute to this dominance].

- Dominant Polymer Segment: Polyvinyl Chloride (PVC) currently holds the largest market share due to its cost-effectiveness and versatility. However, Polypropylene (PP) is experiencing rapid growth driven by its environmental benefits and superior performance characteristics in certain applications.

- Dominant End-User Industry: The automotive industry currently dominates the graphic films market, driven by increased vehicle customization and branding. However, the promotional and advertisement segment is projected to exhibit faster growth due to the expansion of digital media and online marketing campaigns.

Key Drivers for Dominant Segments:

- Automotive: Strong automotive production, increasing vehicle customization trends, and rising demand for high-quality vehicle wraps.

- Promotional & Advertisement: Growth of digital printing, expansion of outdoor advertising, and increased branding activities across various sectors.

- Institutional: Government initiatives promoting public infrastructure development, increased adoption of signage in commercial and public spaces.

Graphic Films Market Product Innovations

Recent innovations include the development of higher-performance films with improved durability, weather resistance, and print quality. The focus is shifting towards sustainable materials like PVC-free alternatives and biodegradable options. This addresses growing environmental concerns and caters to the demand for eco-friendly solutions. Products like 3M's Print Wrap Film IJ280 exemplify this trend with their emphasis on superior performance and faster installation. These innovations offer significant competitive advantages in terms of cost-effectiveness, ease of application, and visual appeal.

Report Segmentation & Scope

The report segments the Graphic Films Market based on polymer type (Polypropylene (PP), Polyethylene (PE), Polyvinyl Chloride (PVC), Other Polymers) and end-user industry (Automotive, Promotional & Advertisement, Institutional, Other End-User Industries (Aircraft Industry and E-commerce)). Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics. For example, the PVC segment is projected to grow at a CAGR of xx% over the forecast period, while the automotive end-use segment is estimated to reach xx Million by 2033, driven by increasing demand for vehicle wraps and graphic applications. Competitive dynamics within each segment are shaped by factors such as product differentiation, pricing strategies, and technological advancements.

Key Drivers of Graphic Films Market Growth

The Graphic Films Market's growth is primarily driven by:

- Technological advancements: Improvements in polymer technology, printing techniques, and film durability are enhancing performance and expanding application possibilities.

- Economic factors: Rising disposable incomes in developing countries are fueling demand, especially in the promotional and advertising sectors.

- Regulatory factors: While some regulations restrict certain materials, others are pushing the market towards eco-friendly alternatives.

Challenges in the Graphic Films Market Sector

The Graphic Films Market faces challenges such as:

- Fluctuating raw material prices: Price volatility in raw materials like polymers can impact production costs and profitability.

- Stringent environmental regulations: Compliance with increasingly stringent environmental regulations requires significant investment and adaptation.

- Intense competition: The market's competitive landscape necessitates ongoing innovation and strategic investments to maintain market share. This translates to potentially lower profit margins for some players.

Leading Players in the Graphic Films Market Market

- Taghleef Industries Inc

- LG Hausys

- Contravision

- Ultraflex Systems Inc

- Cosmos Films Ltd

- Schweitzer-Mauduit International Inc

- Orafol Europe GMBH

- Drytac Corporation

- FDC Graphic Films Inc

- 3M Company

- Lintec Corporation

- Avery Dennison Corporation

- Graphic Image Films Ltd

- Spandex AG

- Arlon Graphics LLC (FLEXcon Company Inc)

- ACCO Brands Corporation

- Hexis S A

- Ritrama SpA

- Innovia Films (CCL Industries Inc)

- E I Du Pont De Nemours and Company

Key Developments in Graphic Films Market Sector

- April 2022: 3M Company launched 3M Print Wrap Film IJ280, a high-performance vehicle wrap film. This launch demonstrates the ongoing focus on improving product performance and efficiency.

- February 2021: Innovia Films launched Rayoart PVC-free graphic art films, highlighting the industry's shift towards sustainable and environmentally friendly materials. This reflects growing consumer and regulatory pressure for eco-conscious products.

Strategic Graphic Films Market Outlook

The Graphic Films Market presents significant growth potential driven by continued technological innovation, expansion into new applications, and increasing demand from diverse end-use sectors. Strategic opportunities lie in developing sustainable and high-performance films, catering to the growing demand for eco-friendly alternatives. Focusing on niche applications and strategic partnerships will be crucial for companies to thrive in this competitive market. The market is expected to experience continued expansion, offering significant opportunities for innovation and growth.

Graphic Films Market Segmentation

-

1. Polymer

- 1.1. Polypropylene (PP)

- 1.2. Polyethylene (PE)

- 1.3. Polyvinyl Chloride (PVC)

- 1.4. Other Polymers

-

2. End-User Industry

- 2.1. Automotive

- 2.2. Promotional & Advertisement

- 2.3. Institutional

- 2.4. Other En

Graphic Films Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Graphic Films Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the Construction Industry and Improvements in the Standard of Living; Growth in Demand for Wrap Advertisement

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Automotive Sector is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Graphic Films Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Polymer

- 5.1.1. Polypropylene (PP)

- 5.1.2. Polyethylene (PE)

- 5.1.3. Polyvinyl Chloride (PVC)

- 5.1.4. Other Polymers

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Automotive

- 5.2.2. Promotional & Advertisement

- 5.2.3. Institutional

- 5.2.4. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Polymer

- 6. North America Graphic Films Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Polymer

- 6.1.1. Polypropylene (PP)

- 6.1.2. Polyethylene (PE)

- 6.1.3. Polyvinyl Chloride (PVC)

- 6.1.4. Other Polymers

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Automotive

- 6.2.2. Promotional & Advertisement

- 6.2.3. Institutional

- 6.2.4. Other En

- 6.1. Market Analysis, Insights and Forecast - by Polymer

- 7. Europe Graphic Films Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Polymer

- 7.1.1. Polypropylene (PP)

- 7.1.2. Polyethylene (PE)

- 7.1.3. Polyvinyl Chloride (PVC)

- 7.1.4. Other Polymers

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Automotive

- 7.2.2. Promotional & Advertisement

- 7.2.3. Institutional

- 7.2.4. Other En

- 7.1. Market Analysis, Insights and Forecast - by Polymer

- 8. Asia Pacific Graphic Films Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Polymer

- 8.1.1. Polypropylene (PP)

- 8.1.2. Polyethylene (PE)

- 8.1.3. Polyvinyl Chloride (PVC)

- 8.1.4. Other Polymers

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Automotive

- 8.2.2. Promotional & Advertisement

- 8.2.3. Institutional

- 8.2.4. Other En

- 8.1. Market Analysis, Insights and Forecast - by Polymer

- 9. Rest of the World Graphic Films Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Polymer

- 9.1.1. Polypropylene (PP)

- 9.1.2. Polyethylene (PE)

- 9.1.3. Polyvinyl Chloride (PVC)

- 9.1.4. Other Polymers

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Automotive

- 9.2.2. Promotional & Advertisement

- 9.2.3. Institutional

- 9.2.4. Other En

- 9.1. Market Analysis, Insights and Forecast - by Polymer

- 10. North America Graphic Films Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Graphic Films Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Graphic Films Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Graphic Films Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Taghleef Industries Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 LG Hausys

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Contravision

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Ultraflex Systems Inc *List Not Exhaustive

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Cosmos Films Ltd

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Schweitzer-Mauduit International Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Orafol Europe GMBH

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Drytac Corporation

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 FDC Graphic Films Inc

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 3M Company

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Lintec Corporation

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Avery Dennison Corporation

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 Graphic Image Films Ltd

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 Spandex AG

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.15 Arlon Graphics LLC (FLEXcon Company Inc )

- 14.2.15.1. Overview

- 14.2.15.2. Products

- 14.2.15.3. SWOT Analysis

- 14.2.15.4. Recent Developments

- 14.2.15.5. Financials (Based on Availability)

- 14.2.16 ACCO Brands Corporation

- 14.2.16.1. Overview

- 14.2.16.2. Products

- 14.2.16.3. SWOT Analysis

- 14.2.16.4. Recent Developments

- 14.2.16.5. Financials (Based on Availability)

- 14.2.17 Hexis S A

- 14.2.17.1. Overview

- 14.2.17.2. Products

- 14.2.17.3. SWOT Analysis

- 14.2.17.4. Recent Developments

- 14.2.17.5. Financials (Based on Availability)

- 14.2.18 Ritrama SpA

- 14.2.18.1. Overview

- 14.2.18.2. Products

- 14.2.18.3. SWOT Analysis

- 14.2.18.4. Recent Developments

- 14.2.18.5. Financials (Based on Availability)

- 14.2.19 Innovia Films (CCL Industries Inc )

- 14.2.19.1. Overview

- 14.2.19.2. Products

- 14.2.19.3. SWOT Analysis

- 14.2.19.4. Recent Developments

- 14.2.19.5. Financials (Based on Availability)

- 14.2.20 E I Du Pont De Nemours and Company

- 14.2.20.1. Overview

- 14.2.20.2. Products

- 14.2.20.3. SWOT Analysis

- 14.2.20.4. Recent Developments

- 14.2.20.5. Financials (Based on Availability)

- 14.2.1 Taghleef Industries Inc

List of Figures

- Figure 1: Global Graphic Films Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Graphic Films Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Graphic Films Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Graphic Films Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Graphic Films Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Graphic Films Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Graphic Films Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Graphic Films Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Graphic Films Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Graphic Films Market Revenue (Million), by Polymer 2024 & 2032

- Figure 11: North America Graphic Films Market Revenue Share (%), by Polymer 2024 & 2032

- Figure 12: North America Graphic Films Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 13: North America Graphic Films Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 14: North America Graphic Films Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Graphic Films Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Graphic Films Market Revenue (Million), by Polymer 2024 & 2032

- Figure 17: Europe Graphic Films Market Revenue Share (%), by Polymer 2024 & 2032

- Figure 18: Europe Graphic Films Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 19: Europe Graphic Films Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 20: Europe Graphic Films Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Graphic Films Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Asia Pacific Graphic Films Market Revenue (Million), by Polymer 2024 & 2032

- Figure 23: Asia Pacific Graphic Films Market Revenue Share (%), by Polymer 2024 & 2032

- Figure 24: Asia Pacific Graphic Films Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 25: Asia Pacific Graphic Films Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 26: Asia Pacific Graphic Films Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Asia Pacific Graphic Films Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Rest of the World Graphic Films Market Revenue (Million), by Polymer 2024 & 2032

- Figure 29: Rest of the World Graphic Films Market Revenue Share (%), by Polymer 2024 & 2032

- Figure 30: Rest of the World Graphic Films Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 31: Rest of the World Graphic Films Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 32: Rest of the World Graphic Films Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Rest of the World Graphic Films Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Graphic Films Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Graphic Films Market Revenue Million Forecast, by Polymer 2019 & 2032

- Table 3: Global Graphic Films Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: Global Graphic Films Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Graphic Films Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Graphic Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Graphic Films Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Graphic Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Graphic Films Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Graphic Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Graphic Films Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Graphic Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Graphic Films Market Revenue Million Forecast, by Polymer 2019 & 2032

- Table 14: Global Graphic Films Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 15: Global Graphic Films Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Graphic Films Market Revenue Million Forecast, by Polymer 2019 & 2032

- Table 17: Global Graphic Films Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 18: Global Graphic Films Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Global Graphic Films Market Revenue Million Forecast, by Polymer 2019 & 2032

- Table 20: Global Graphic Films Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 21: Global Graphic Films Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Graphic Films Market Revenue Million Forecast, by Polymer 2019 & 2032

- Table 23: Global Graphic Films Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 24: Global Graphic Films Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Graphic Films Market?

The projected CAGR is approximately 5.26%.

2. Which companies are prominent players in the Graphic Films Market?

Key companies in the market include Taghleef Industries Inc, LG Hausys, Contravision, Ultraflex Systems Inc *List Not Exhaustive, Cosmos Films Ltd, Schweitzer-Mauduit International Inc, Orafol Europe GMBH, Drytac Corporation, FDC Graphic Films Inc, 3M Company, Lintec Corporation, Avery Dennison Corporation, Graphic Image Films Ltd, Spandex AG, Arlon Graphics LLC (FLEXcon Company Inc ), ACCO Brands Corporation, Hexis S A, Ritrama SpA, Innovia Films (CCL Industries Inc ), E I Du Pont De Nemours and Company.

3. What are the main segments of the Graphic Films Market?

The market segments include Polymer, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 31.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in the Construction Industry and Improvements in the Standard of Living; Growth in Demand for Wrap Advertisement.

6. What are the notable trends driving market growth?

Automotive Sector is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

April 2022 - 3M Company has announced the launch of 3M Print Wrap Film IJ280 - a best-in-class vehicle wrap designed for converters and installers who expect exceptional performance, print quality, and productivity. 3M Print Wrap Film IJ280 and the matching 3M Gloss Wrap Overlaminate 8428G were designed to install fast and with less re-work.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Graphic Films Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Graphic Films Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Graphic Films Market?

To stay informed about further developments, trends, and reports in the Graphic Films Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence