Key Insights

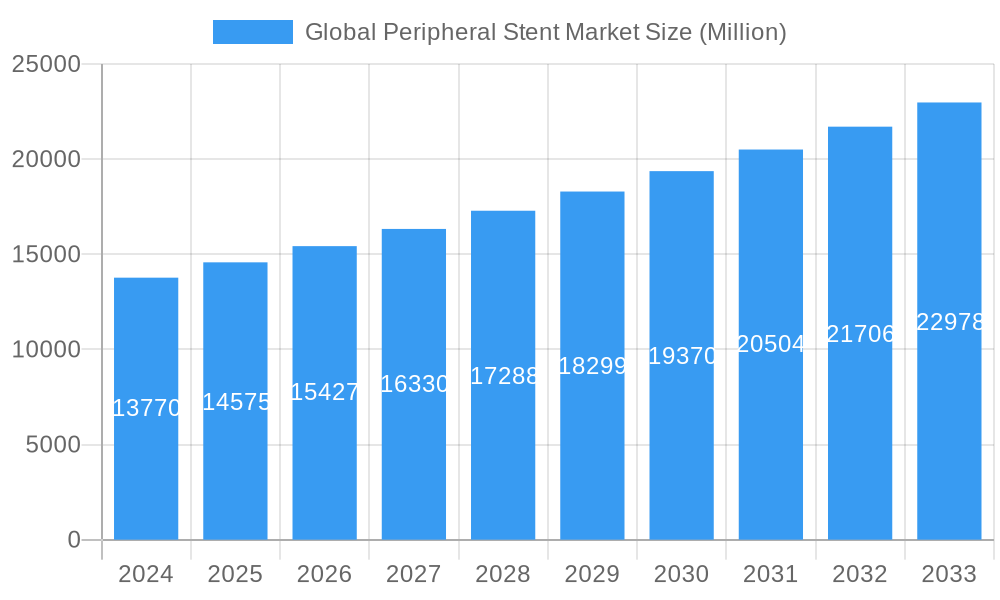

The Global Peripheral Stent Market is poised for significant expansion, driven by a growing prevalence of peripheral artery diseases (PAD) and advancements in stent technology. The market was valued at an estimated $13.77 billion in 2024, with projections indicating a robust Compound Annual Growth Rate (CAGR) of 5.73% through 2033. This growth trajectory is underpinned by several key factors, including an aging global population prone to cardiovascular conditions and increasing adoption of minimally invasive procedures for treating PAD. Drug-Eluting Stents (DES) are expected to lead segment growth due to their superior efficacy in preventing restenosis compared to Bare Metal Stents (BMS). Furthermore, the increasing incidence of diabetes and obesity, both major risk factors for PAD, further fuels market demand. Technological innovations, such as the development of bioabsorbable stents and advanced drug-eluting coatings, are also contributing to market expansion by offering improved patient outcomes and reduced long-term complications.

Global Peripheral Stent Market Market Size (In Billion)

The market landscape is characterized by a dynamic competitive environment with major players like Medtronic, Abbott Laboratories, and Boston Scientific Inc. investing heavily in research and development. Emerging economies, particularly in the Asia Pacific region, represent a significant growth opportunity due to increasing healthcare expenditure, a growing patient pool, and improving access to advanced medical technologies. While the market exhibits strong growth potential, certain restraints such as the high cost of advanced stent technologies and reimbursement challenges in some regions may pose hurdles. However, the ongoing focus on developing more cost-effective and innovative solutions, coupled with increasing awareness and diagnostic capabilities for PAD, are expected to mitigate these challenges and ensure sustained market growth in the coming years. The expanding application of peripheral stents across various artery types, including iliac, femoral-popliteal, renal, and carotid arteries, further solidifies its importance in vascular intervention.

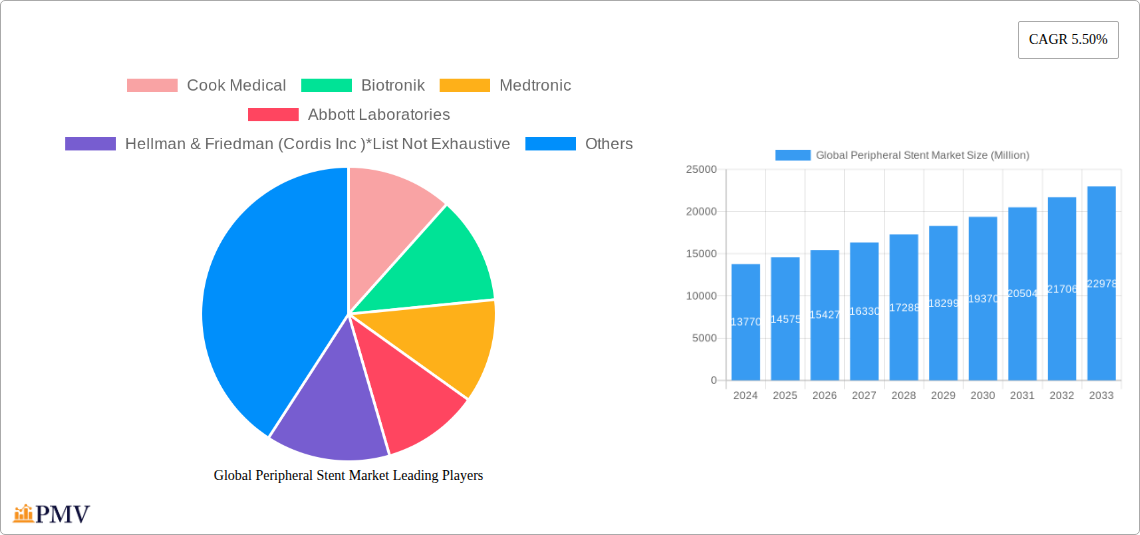

Global Peripheral Stent Market Company Market Share

Global Peripheral Stent Market Report: Unveiling Growth, Innovation, and Strategic Dynamics (2019-2033)

This comprehensive report provides an in-depth analysis of the global peripheral stent market, a critical segment within the cardiovascular devices industry. With a study period spanning from 2019 to 2033, and a robust base and forecast year of 2025, this report delivers actionable insights into market size, trends, competitive landscape, and future outlook. The market is driven by the increasing prevalence of peripheral artery disease (PAD), advancements in endovascular technologies, and a growing aging population. The global peripheral stent market is projected to reach significant valuations, exceeding $XX billion by 2033, with a compelling CAGR of XX% during the forecast period. This report is essential for stakeholders including medical device manufacturers, healthcare providers, investors, and regulatory bodies seeking to understand and capitalize on opportunities within this dynamic market.

Global Peripheral Stent Market Market Structure & Competitive Dynamics

The global peripheral stent market exhibits a moderately consolidated structure, characterized by the presence of both large, established players and agile niche manufacturers. Innovation ecosystems are thriving, fueled by ongoing research and development in drug-eluting technologies and advanced biomaterials. Regulatory frameworks, particularly from agencies like the FDA and EMA, play a pivotal role in shaping product approvals and market entry strategies. Product substitutes, such as angioplasty balloons and bypass surgery, exist but are increasingly being overshadowed by the minimally invasive benefits of peripheral stenting. End-user preferences are shifting towards less invasive procedures, shorter recovery times, and improved long-term patency rates. Mergers and acquisitions (M&A) are strategic maneuvers employed by key players to expand their product portfolios, gain market share, and access new technologies. For instance, the acquisition of Cordis Inc. by Hellman & Friedman highlights the consolidation trend within the sector. Market share distribution is influenced by factors such as product efficacy, cost-effectiveness, and established physician relationships. M&A deal values are anticipated to remain significant as companies seek to strengthen their competitive positions.

Global Peripheral Stent Market Industry Trends & Insights

The global peripheral stent market is experiencing robust growth, propelled by a confluence of significant industry trends and insightful developments. A primary growth driver is the escalating global burden of peripheral artery disease (PAD), a chronic condition affecting millions worldwide, particularly individuals with diabetes, hypertension, and obesity. The increasing prevalence of these comorbidities directly fuels the demand for effective treatment solutions like peripheral stenting. Technological disruptions are at the forefront of market evolution. The continuous innovation in drug-eluting stents (DES) is a paramount trend, offering superior efficacy in preventing restenosis compared to bare-metal stents (BMS). These DES release anti-proliferative drugs to inhibit scar tissue growth, thereby improving long-term vessel patency. Furthermore, advancements in stent design, including the development of self-expanding nitinol stents and bioresorbable vascular scaffolds, are enhancing deliverability, flexibility, and patient outcomes. Consumer preferences are increasingly aligning with minimally invasive surgical procedures due to reduced patient trauma, shorter hospital stays, and faster recovery times, all of which are hallmarks of endovascular stenting interventions. This patient-centric shift strongly favors the adoption of peripheral stents over traditional open surgical techniques. The competitive dynamics within the market are intense, with leading companies heavily investing in R&D to differentiate their offerings and secure a competitive edge. Strategic partnerships, collaborations, and mergers are common as companies aim to expand their geographical reach, broaden their product pipelines, and consolidate market influence. The development of specialized stents for specific arterial beds, such as the femoro-popliteal and iliac arteries, caters to the nuanced anatomical challenges and therapeutic needs of diverse patient populations. The estimated market penetration for peripheral stenting procedures is expected to continue its upward trajectory, driven by both technological advancements and a growing awareness of PAD treatment options. The projected CAGR of XX% underscores the significant economic opportunity and the expanding therapeutic importance of peripheral stents.

Dominant Markets & Segments in Global Peripheral Stent Market

The global peripheral stent market's dominance is a complex interplay of geographical regions, product types, artery targets, and end-user preferences, each contributing to the overall market valuation exceeding $XX billion by 2033.

Leading Regions and Countries: North America, particularly the United States, currently holds a dominant position in the global peripheral stent market. This leadership is attributed to several key drivers:

- Advanced Healthcare Infrastructure: The presence of sophisticated healthcare systems, a high concentration of specialized cardiovascular centers, and widespread access to advanced medical technologies contribute significantly to market dominance.

- High Incidence of PAD: A substantial aging population and a high prevalence of risk factors such as diabetes, obesity, and smoking in the U.S. drive a high demand for peripheral interventions.

- Favorable Reimbursement Policies: Robust reimbursement frameworks for endovascular procedures encourage the adoption of peripheral stenting.

- Aggressive R&D Investment: Leading medical device companies in the U.S. are at the forefront of innovation, consistently introducing new and improved peripheral stent technologies.

Europe also represents a significant market, driven by similar factors including an aging demographic, rising chronic disease rates, and a strong commitment to advanced healthcare solutions. Emerging economies in the Asia-Pacific region are showing rapid growth potential due to increasing healthcare expenditure, improving access to medical facilities, and a growing awareness of cardiovascular diseases.

Dominant Segments:

Product Type:

- Drug-Eluting Stents (DES): This segment is experiencing the most substantial growth and holds a dominant market share. The superior efficacy of DES in preventing restenosis and improving long-term outcomes compared to Bare Metal Stents (BMS) makes them the preferred choice for interventional cardiologists and vascular surgeons. The controlled release of antiproliferative drugs directly at the site of intervention significantly reduces the risk of re-narrowing of the artery.

- Bare Metal Stents (BMS): While still utilized, particularly in cost-sensitive markets or for specific indications, BMS represent a smaller and less rapidly growing segment due to higher rates of restenosis.

- Covered Stents: These stents, often used for treating complex lesions or aneurysms, are gaining traction but represent a niche within the broader market.

Artery Type:

- Femoral-popliteal Stents: This segment is the largest and most dominant within the peripheral stent market. The prevalence of PAD in the superficial femoral artery and popliteal artery, often leading to critical limb ischemia, necessitates frequent interventions in this region. Technological advancements in stent design specifically for the tortuous and long lesions found in this anatomy have further propelled its growth.

- Iliac Stents: The iliac arteries are also a common site for atherosclerotic disease, making iliac stents a significant segment. Interventions in this region are crucial for restoring blood flow to the lower extremities.

- Renal & Related Artery Stents: With the rising incidence of renovascular hypertension and chronic kidney disease, the demand for renal artery stents is steadily increasing.

- Carotid Stents: While primarily a segment of the cerebrovascular market, carotid stenting for stroke prevention is also a relevant application within the broader peripheral intervention landscape, albeit with a different risk-benefit profile.

End User:

- Hospitals: Hospitals remain the primary end-users of peripheral stents, performing the majority of complex endovascular procedures. Their established infrastructure, specialized surgical teams, and comprehensive patient care capabilities make them the central hubs for these interventions.

- Ambulatory Surgical Centers/Outpatients: The increasing trend towards outpatient procedures for less complex interventions is driving growth in this segment. These centers offer cost efficiencies and improved patient convenience, leading to a gradual shift in procedural volumes.

Global Peripheral Stent Market Product Innovations

The global peripheral stent market is characterized by a rapid pace of product innovation, driven by the pursuit of enhanced efficacy, improved deliverability, and better patient outcomes. Recent advancements include the development of next-generation drug-eluting stents with novel drug formulations and polymer coatings designed for sustained and targeted drug release, significantly reducing restenosis rates in challenging lesions. Innovations in stent design are focusing on increased flexibility, trackability, and radial force to navigate tortuous anatomy and maintain vessel patency. Technologies such as advanced nitinol alloys and sophisticated braiding techniques contribute to these improvements. Furthermore, the exploration of bioresorbable scaffolds continues, offering the potential for temporary support that degrades over time, eliminating long-term foreign body presence. These product developments are directly responding to the unmet clinical needs in treating complex peripheral artery disease and are crucial for maintaining a competitive edge in the market.

Report Segmentation & Scope

This report meticulously segments the global peripheral stent market to provide granular insights into its multifaceted landscape. The segmentation is structured across key dimensions, enabling a comprehensive understanding of market dynamics and growth projections.

Product Segmentation: The market is analyzed based on the type of peripheral stent, including:

- Bare Metal Stents (BMS): Basic metallic stents, analyzed for their market share and growth trajectory.

- Covered Stents: Stents with a polymeric covering, assessed for their niche applications and market penetration.

- Drug Eluting Stents (DES): Stents releasing therapeutic agents, identified as a high-growth segment with detailed projections.

Artery Type Segmentation: The report further dissects the market by the specific artery targeted by stent implantation:

- Iliac stents: Analysis of the market for stents used in the iliac arteries.

- Femoral-popliteal stents: Detailed examination of the largest segment, focusing on the femoro-popliteal region.

- Renal & related Artery stents: Insights into the growing market for renal artery interventions.

- Carotid stents: Assessment of the market for carotid artery stenting.

End User Segmentation: The market is also segmented by the primary healthcare settings where peripheral stent procedures are performed:

- Hospitals: Analysis of the dominant end-user segment.

- Ambulatory Surgical Centers/Outpatients: Evaluation of the growing importance of outpatient settings.

Each segment is accompanied by detailed market size estimates, growth projections for the forecast period (2025–2033), and an analysis of the competitive dynamics influencing their respective markets.

Key Drivers of Global Peripheral Stent Market Growth

The global peripheral stent market's expansion is propelled by several interconnected growth drivers. Firstly, the escalating global prevalence of peripheral artery disease (PAD), fueled by an aging population and rising rates of comorbidities such as diabetes, hypertension, and obesity, is a primary catalyst. Secondly, continuous technological advancements in stent design and drug delivery systems, particularly the development of more effective drug-eluting stents (DES) and improved deliverability for complex anatomies, are enhancing treatment outcomes and patient satisfaction. Thirdly, the increasing preference for minimally invasive endovascular procedures over traditional open surgery, due to shorter recovery times and reduced invasiveness, significantly boosts demand. Government initiatives aimed at improving cardiovascular healthcare access and awareness campaigns about PAD also contribute to market growth. The favorable reimbursement policies in developed economies further incentivize the adoption of these advanced medical devices.

Challenges in the Global Peripheral Stent Market Sector

Despite its robust growth trajectory, the global peripheral stent market faces several significant challenges. Stringent regulatory approval processes in various regions can lead to prolonged product launch timelines and increased R&D costs. The high cost of advanced stent technologies, particularly drug-eluting stents, can be a barrier to access in cost-sensitive markets and may lead to reimbursement challenges. Intense competition among numerous players, both established and emerging, exerts downward pressure on pricing and necessitates continuous innovation to maintain market share. Furthermore, the risk of post-procedural complications such as restenosis, thrombosis, and limb complications, although reduced with advanced technologies, remains a concern that can influence treatment choices. Supply chain disruptions and the need for skilled interventionalists to perform complex procedures also pose potential constraints to market expansion.

Leading Players in the Global Peripheral Stent Market Market

- Cook Medical

- Biotronik

- Medtronic

- Abbott Laboratories

- Hellman & Friedman (Cordis Inc )

- Stentys S A

- Stryker

- Microport Scientific Corporation

- iVascular SLU

- Terumo Medical

- Lifetech

- Boston Scientific Inc

Key Developments in Global Peripheral Stent Market Sector

- July 2022: BIOTRONIK received United States FDA approval for its innovative Pulsar-18 T3 peripheral self-expanding stent system for an improved implantation procedure for endovascular treatments. This development signifies a step forward in enhancing the ease and effectiveness of peripheral stenting procedures, potentially leading to wider adoption and better patient outcomes.

- January 2022: Cook Medical received Breakthrough Device designation from the United States FDA on a new drug-eluting stent below the knee (BTK). This new stent is designed to treat chronic limb-threatening ischemia (CLTI) patients. This designation highlights the FDA's recognition of the therapeutic potential of Cook Medical's innovative DES for a critical and underserved patient population, potentially accelerating its market entry and adoption.

Strategic Global Peripheral Stent Market Market Outlook

The strategic outlook for the global peripheral stent market remains exceptionally positive, driven by sustained innovation and increasing demand for effective PAD treatments. Future growth accelerators will be centered on the continued development and adoption of advanced drug-eluting stents (DES) with improved drug elution profiles and anti-restenotic properties. The expansion of indications for peripheral stenting into more complex lesions and challenging anatomies, coupled with the increasing utilization in outpatient settings, will further fuel market expansion. Strategic opportunities lie in emerging markets where the prevalence of PAD is rising and healthcare infrastructure is rapidly developing. Collaborations between manufacturers and healthcare providers to improve patient access and physician training will be crucial. The ongoing trend towards personalized medicine and the development of bioresorbable scaffolds offer long-term potential for market evolution, promising reduced long-term complications and improved patient quality of life.

Global Peripheral Stent Market Segmentation

-

1. Product

- 1.1. Bare Metal Stents (BMS)

- 1.2. Covered Stents

- 1.3. Drug Eluting Stents (DES)

-

2. Artery Type

- 2.1. Iliac stents

- 2.2. Femoral-popliteal stents

- 2.3. Renal & related Artery stents

- 2.4. Carotid stents

-

3. End User

- 3.1. Hospitals

- 3.2. Ambulatory Surgical Centers/Outpatients

Global Peripheral Stent Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Global Peripheral Stent Market Regional Market Share

Geographic Coverage of Global Peripheral Stent Market

Global Peripheral Stent Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Cardiac Diseases Couple With the Geriatric Population; Technological Advancements in Stent Development

- 3.3. Market Restrains

- 3.3.1. Stringent Approval Process for Stents

- 3.4. Market Trends

- 3.4.1. The Renal and Related Stents Segment is Expected to Hold Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Peripheral Stent Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Bare Metal Stents (BMS)

- 5.1.2. Covered Stents

- 5.1.3. Drug Eluting Stents (DES)

- 5.2. Market Analysis, Insights and Forecast - by Artery Type

- 5.2.1. Iliac stents

- 5.2.2. Femoral-popliteal stents

- 5.2.3. Renal & related Artery stents

- 5.2.4. Carotid stents

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals

- 5.3.2. Ambulatory Surgical Centers/Outpatients

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Global Peripheral Stent Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Bare Metal Stents (BMS)

- 6.1.2. Covered Stents

- 6.1.3. Drug Eluting Stents (DES)

- 6.2. Market Analysis, Insights and Forecast - by Artery Type

- 6.2.1. Iliac stents

- 6.2.2. Femoral-popliteal stents

- 6.2.3. Renal & related Artery stents

- 6.2.4. Carotid stents

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals

- 6.3.2. Ambulatory Surgical Centers/Outpatients

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Global Peripheral Stent Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Bare Metal Stents (BMS)

- 7.1.2. Covered Stents

- 7.1.3. Drug Eluting Stents (DES)

- 7.2. Market Analysis, Insights and Forecast - by Artery Type

- 7.2.1. Iliac stents

- 7.2.2. Femoral-popliteal stents

- 7.2.3. Renal & related Artery stents

- 7.2.4. Carotid stents

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals

- 7.3.2. Ambulatory Surgical Centers/Outpatients

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Global Peripheral Stent Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Bare Metal Stents (BMS)

- 8.1.2. Covered Stents

- 8.1.3. Drug Eluting Stents (DES)

- 8.2. Market Analysis, Insights and Forecast - by Artery Type

- 8.2.1. Iliac stents

- 8.2.2. Femoral-popliteal stents

- 8.2.3. Renal & related Artery stents

- 8.2.4. Carotid stents

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals

- 8.3.2. Ambulatory Surgical Centers/Outpatients

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Global Peripheral Stent Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Bare Metal Stents (BMS)

- 9.1.2. Covered Stents

- 9.1.3. Drug Eluting Stents (DES)

- 9.2. Market Analysis, Insights and Forecast - by Artery Type

- 9.2.1. Iliac stents

- 9.2.2. Femoral-popliteal stents

- 9.2.3. Renal & related Artery stents

- 9.2.4. Carotid stents

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals

- 9.3.2. Ambulatory Surgical Centers/Outpatients

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Global Peripheral Stent Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Bare Metal Stents (BMS)

- 10.1.2. Covered Stents

- 10.1.3. Drug Eluting Stents (DES)

- 10.2. Market Analysis, Insights and Forecast - by Artery Type

- 10.2.1. Iliac stents

- 10.2.2. Femoral-popliteal stents

- 10.2.3. Renal & related Artery stents

- 10.2.4. Carotid stents

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals

- 10.3.2. Ambulatory Surgical Centers/Outpatients

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cook Medical

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Biotronik

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Medtronic

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Abbott Laboratories

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hellman & Friedman (Cordis Inc )*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Stentys S A

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Stryker

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Microport Scientific Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 iVascular SLU

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Terumo Medical

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Lifetech

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Boston Scientific Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Cook Medical

List of Figures

- Figure 1: Global Global Peripheral Stent Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Global Peripheral Stent Market Revenue (undefined), by Product 2025 & 2033

- Figure 3: North America Global Peripheral Stent Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Global Peripheral Stent Market Revenue (undefined), by Artery Type 2025 & 2033

- Figure 5: North America Global Peripheral Stent Market Revenue Share (%), by Artery Type 2025 & 2033

- Figure 6: North America Global Peripheral Stent Market Revenue (undefined), by End User 2025 & 2033

- Figure 7: North America Global Peripheral Stent Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Global Peripheral Stent Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Global Peripheral Stent Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Global Peripheral Stent Market Revenue (undefined), by Product 2025 & 2033

- Figure 11: Europe Global Peripheral Stent Market Revenue Share (%), by Product 2025 & 2033

- Figure 12: Europe Global Peripheral Stent Market Revenue (undefined), by Artery Type 2025 & 2033

- Figure 13: Europe Global Peripheral Stent Market Revenue Share (%), by Artery Type 2025 & 2033

- Figure 14: Europe Global Peripheral Stent Market Revenue (undefined), by End User 2025 & 2033

- Figure 15: Europe Global Peripheral Stent Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Global Peripheral Stent Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Global Peripheral Stent Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Global Peripheral Stent Market Revenue (undefined), by Product 2025 & 2033

- Figure 19: Asia Pacific Global Peripheral Stent Market Revenue Share (%), by Product 2025 & 2033

- Figure 20: Asia Pacific Global Peripheral Stent Market Revenue (undefined), by Artery Type 2025 & 2033

- Figure 21: Asia Pacific Global Peripheral Stent Market Revenue Share (%), by Artery Type 2025 & 2033

- Figure 22: Asia Pacific Global Peripheral Stent Market Revenue (undefined), by End User 2025 & 2033

- Figure 23: Asia Pacific Global Peripheral Stent Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Global Peripheral Stent Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Global Peripheral Stent Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Global Peripheral Stent Market Revenue (undefined), by Product 2025 & 2033

- Figure 27: Middle East and Africa Global Peripheral Stent Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East and Africa Global Peripheral Stent Market Revenue (undefined), by Artery Type 2025 & 2033

- Figure 29: Middle East and Africa Global Peripheral Stent Market Revenue Share (%), by Artery Type 2025 & 2033

- Figure 30: Middle East and Africa Global Peripheral Stent Market Revenue (undefined), by End User 2025 & 2033

- Figure 31: Middle East and Africa Global Peripheral Stent Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East and Africa Global Peripheral Stent Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East and Africa Global Peripheral Stent Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Global Peripheral Stent Market Revenue (undefined), by Product 2025 & 2033

- Figure 35: South America Global Peripheral Stent Market Revenue Share (%), by Product 2025 & 2033

- Figure 36: South America Global Peripheral Stent Market Revenue (undefined), by Artery Type 2025 & 2033

- Figure 37: South America Global Peripheral Stent Market Revenue Share (%), by Artery Type 2025 & 2033

- Figure 38: South America Global Peripheral Stent Market Revenue (undefined), by End User 2025 & 2033

- Figure 39: South America Global Peripheral Stent Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: South America Global Peripheral Stent Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America Global Peripheral Stent Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Peripheral Stent Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Global Peripheral Stent Market Revenue undefined Forecast, by Artery Type 2020 & 2033

- Table 3: Global Peripheral Stent Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Global Peripheral Stent Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Peripheral Stent Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 6: Global Peripheral Stent Market Revenue undefined Forecast, by Artery Type 2020 & 2033

- Table 7: Global Peripheral Stent Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: Global Peripheral Stent Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Global Peripheral Stent Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Global Peripheral Stent Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Global Peripheral Stent Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Peripheral Stent Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 13: Global Peripheral Stent Market Revenue undefined Forecast, by Artery Type 2020 & 2033

- Table 14: Global Peripheral Stent Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 15: Global Peripheral Stent Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Global Peripheral Stent Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Global Peripheral Stent Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Global Peripheral Stent Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Global Peripheral Stent Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Spain Global Peripheral Stent Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Global Peripheral Stent Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Peripheral Stent Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 23: Global Peripheral Stent Market Revenue undefined Forecast, by Artery Type 2020 & 2033

- Table 24: Global Peripheral Stent Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 25: Global Peripheral Stent Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: China Global Peripheral Stent Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Japan Global Peripheral Stent Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: India Global Peripheral Stent Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Australia Global Peripheral Stent Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Korea Global Peripheral Stent Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Global Peripheral Stent Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Peripheral Stent Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 33: Global Peripheral Stent Market Revenue undefined Forecast, by Artery Type 2020 & 2033

- Table 34: Global Peripheral Stent Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 35: Global Peripheral Stent Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: GCC Global Peripheral Stent Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Africa Global Peripheral Stent Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Global Peripheral Stent Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Global Peripheral Stent Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 40: Global Peripheral Stent Market Revenue undefined Forecast, by Artery Type 2020 & 2033

- Table 41: Global Peripheral Stent Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 42: Global Peripheral Stent Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 43: Brazil Global Peripheral Stent Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Argentina Global Peripheral Stent Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Global Peripheral Stent Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Peripheral Stent Market?

The projected CAGR is approximately 5.73%.

2. Which companies are prominent players in the Global Peripheral Stent Market?

Key companies in the market include Cook Medical, Biotronik, Medtronic, Abbott Laboratories, Hellman & Friedman (Cordis Inc )*List Not Exhaustive, Stentys S A, Stryker, Microport Scientific Corporation, iVascular SLU, Terumo Medical, Lifetech, Boston Scientific Inc.

3. What are the main segments of the Global Peripheral Stent Market?

The market segments include Product, Artery Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Cardiac Diseases Couple With the Geriatric Population; Technological Advancements in Stent Development.

6. What are the notable trends driving market growth?

The Renal and Related Stents Segment is Expected to Hold Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Approval Process for Stents.

8. Can you provide examples of recent developments in the market?

In July 2022, BIOTRONIK received United Stated FDA approval for its innovative Pulsar-18 T3 peripheral self-expanding stent system for an improved implantation procedure for endovascular treatments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Peripheral Stent Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Peripheral Stent Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Peripheral Stent Market?

To stay informed about further developments, trends, and reports in the Global Peripheral Stent Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence