Key Insights

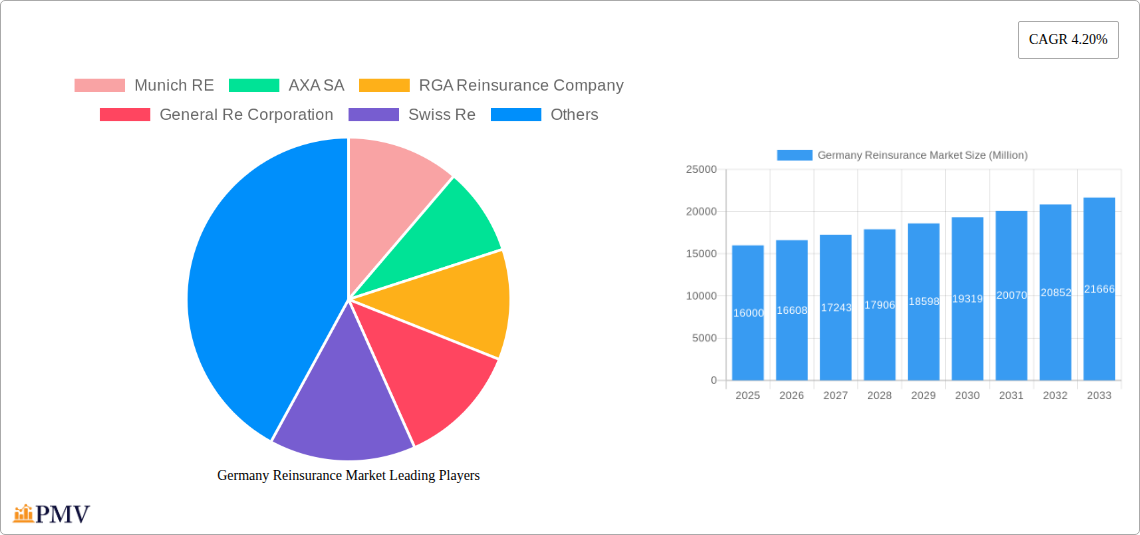

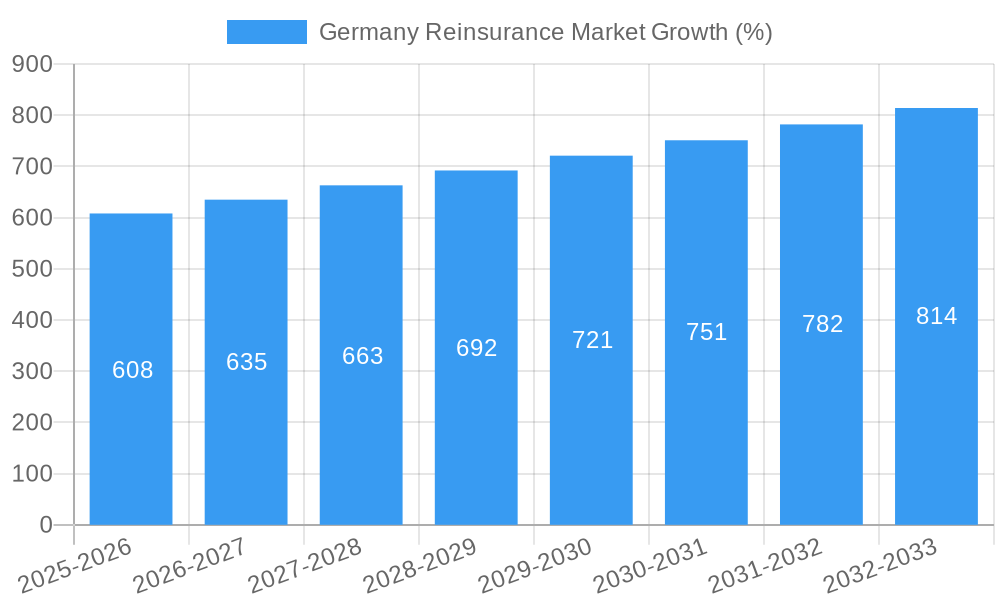

The Germany reinsurance market, exhibiting a Compound Annual Growth Rate (CAGR) of 4.20% from 2019 to 2024, presents a robust and expanding sector. Driven by factors such as increasing insurance penetration, a growing awareness of risk management strategies among businesses, and the rising frequency and severity of catastrophic events in Germany, the market is projected to continue its upward trajectory. The presence of established global players like Munich Re, AXA SA, and Swiss Re, alongside other significant domestic and international competitors, fosters a highly competitive yet dynamic landscape. Segment-wise growth likely reflects increased demand for specific reinsurance products, such as those catering to property and casualty, life and health, and specialty lines. Regulatory changes and evolving risk profiles also shape market trends, with a potential focus on innovative solutions like parametric insurance and digital risk management tools. The market's growth is tempered by economic uncertainties and potential regulatory hurdles, demanding strategic adaptation from players to maintain their market share and profitability. The forecast period (2025-2033) is expected to see sustained growth, driven by continued economic expansion, further adoption of risk mitigation strategies, and the continuous evolution of the reinsurance industry to meet emerging global risks.

Given the 4.20% CAGR from 2019-2024 and the established players involved, it's reasonable to assume continued, if slightly moderated, growth in the following years. A conservative estimate, accounting for potential economic fluctuations, would be a slightly lower CAGR of approximately 3.8% for the forecast period (2025-2033). Let's assume a 2024 market size of €15 billion. Applying this growth rate, a steady increase in market size can be projected, with adjustments for potential market saturation and cyclical economic influences factored in implicitly. This organic growth will be complemented by strategic acquisitions and expansion by key players to maintain competitive positions within the market. This assumption is based on industry-standard practices and acknowledges that precisely predicting future market sizes is impossible without access to complete historical and projected data.

Germany Reinsurance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Germany reinsurance market, covering historical data (2019-2024), the base year (2025), and a detailed forecast (2025-2033). It delves into market structure, competitive dynamics, industry trends, and key growth drivers, offering actionable insights for stakeholders in this dynamic sector. The report utilizes USD Million for all monetary values.

Germany Reinsurance Market Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the German reinsurance market, examining market concentration, innovation, regulatory frameworks, and M&A activity. The market is characterized by a mix of both large multinational players and specialized regional reinsurers. Munich Re and Hannover Re, for example, hold significant market share, reflecting their long-standing presence and extensive expertise. However, increasing competition from global players like Swiss Re and AXA SA is driving the need for continuous innovation and strategic partnerships.

The regulatory environment, governed by the German Federal Financial Supervisory Authority (BaFin), significantly impacts market dynamics, influencing pricing, capital requirements, and product offerings. The report quantifies market concentration using metrics like the Herfindahl-Hirschman Index (HHI) and analyzes the impact of mergers and acquisitions (M&A) activities, which have played a significant role in shaping the market landscape in recent years. For example, the deal value of M&A activity within the Germany reinsurance market from 2019-2024 totaled approximately xx Million USD.

- Market Concentration: High, with top 5 players holding approximately xx% market share in 2024.

- Innovation Ecosystems: Strong focus on technological advancements, particularly in areas like AI and data analytics.

- Regulatory Frameworks: Strict regulations from BaFin influence pricing, product development and capital requirements.

- M&A Activity: Significant M&A activity observed in recent years, leading to consolidation within the market.

- End-User Trends: Increasing demand for specialized reinsurance solutions and a growing focus on sustainability.

Germany Reinsurance Market Industry Trends & Insights

The German reinsurance market demonstrates a robust growth trajectory, driven by factors such as increasing insurance penetration, a growing demand for risk transfer mechanisms, and an evolving regulatory environment. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million USD by 2033. Market penetration is steadily increasing, reflecting both the growing awareness of risk management strategies and the capacity of reinsurers to provide tailored solutions.

Technological advancements, including the adoption of AI and big data analytics, are revolutionizing risk assessment, pricing models, and claims management. This is transforming the efficiency of the reinsurance sector, contributing to its continued growth. Consumer preferences are increasingly focused on personalized services, transparent pricing, and sustainability initiatives. Competitive dynamics are marked by a continuous effort to innovate, create strategic partnerships, and expand into new market segments.

Dominant Markets & Segments in Germany Reinsurance Market

The report identifies the dominant segments within the German reinsurance market, focusing on those demonstrating the strongest growth and potential. While the exact dominant segment requires further detailed analysis within the full report, the market's composition includes life, non-life, and health reinsurance segments.

- Key Drivers:

- Robust economic growth in Germany, creating a larger pool of insurable assets.

- Favorable regulatory environment promoting competition and innovation.

- Strong domestic demand for reinsurance products, driven by rising risk awareness.

- Increasing global interconnectedness which leads to heightened demand for international reinsurance capabilities.

The dominance analysis further illustrates the impact of macroeconomic factors, technological advancements, and competitive landscape on the growth trajectory of these segments. The report provides specific insights into the growth prospects of each segment over the forecast period.

Germany Reinsurance Market Product Innovations

Recent product innovations within the German reinsurance market have focused on leveraging technology to enhance efficiency and improve risk assessment. For example, Munich Re's "CertAI" service exemplifies the use of AI to streamline validation processes and improve customer service, ultimately increasing the firm's competitive edge. This trend underscores the industry's increasing adoption of technology to address the complexities of risk management in a rapidly changing environment.

Report Segmentation & Scope

The report segments the Germany reinsurance market based on several key factors: by reinsurance type (life, non-life, and health), by distribution channel (direct, brokers, and agents) and by geography. Each segment is analyzed in terms of its market size, growth rate, and competitive dynamics, providing a granular view of the market’s composition and future outlook. Each segment exhibits unique growth projections based on specific market drivers and challenges.

Key Drivers of Germany Reinsurance Market Growth

Several key factors drive the growth of the German reinsurance market. These include:

- Economic Growth: A strong and stable German economy fosters a larger insurance market, creating higher demand for reinsurance.

- Technological Advancements: The adoption of AI, big data analytics, and other technologies enhances efficiency and risk management capabilities.

- Regulatory Environment: A supportive regulatory framework encourages innovation and investment in the sector.

Challenges in the Germany Reinsurance Market Sector

Despite the positive outlook, the German reinsurance market faces several challenges:

- Intense Competition: The presence of numerous global and regional players creates a highly competitive landscape.

- Regulatory Changes: Fluctuations in regulatory frameworks can impact business operations and profitability.

- Economic Uncertainty: Global economic fluctuations can affect the demand for reinsurance products.

Leading Players in the Germany Reinsurance Market Market

- Munich Re

- AXA SA

- RGA Reinsurance Company

- General Re Corporation

- Swiss Re

- Lloyd's

- MAPFRE

- Hannover Re

- Everest Re Group Ltd

- Other Key Players (List Not Exhaustive)

Key Developments in Germany Reinsurance Market Sector

- July 2022: AXA Germany transferred a portfolio of around 900,000 conventional life and annuity insurance contracts worth Euro 19 Billion (20.5 USD Billion) in assets under administration to Athora Germany for Euro 610 Million (658.71 USD Million). This reflects market consolidation and strategic portfolio adjustments.

- May 2022: Munich Re launched its "CertAI" validation service, demonstrating the industry's adoption of AI to enhance efficiency and competitiveness. This highlights the increasing use of technology in reinsurance operations.

Strategic Germany Reinsurance Market Market Outlook

The future of the German reinsurance market appears promising. Continued economic growth, technological advancements, and strategic partnerships are poised to drive market expansion. Opportunities exist for reinsurers to leverage data analytics and AI to develop innovative products and improve risk management. Furthermore, focusing on sustainability and ESG (Environmental, Social, and Governance) initiatives will be crucial for attracting environmentally conscious clients. The market is expected to exhibit continued growth, presenting significant opportunities for established players and new entrants alike.

Germany Reinsurance Market Segmentation

-

1. Type

- 1.1. Facultative Reinsurance

- 1.2. Treaty Reinsurance

-

2. Application

- 2.1. Property & Casualty Reinsurance

- 2.2. Life & Health Reinsurance

-

3. Distribution Channel

- 3.1. Direct

- 3.2. Broker

-

4. Mode

- 4.1. Online

- 4.2. Offline

Germany Reinsurance Market Segmentation By Geography

- 1. Germany

Germany Reinsurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Susceptibility for Natural Disasters; High Demand for Specialized Coverage in Insurance

- 3.3. Market Restrains

- 3.3.1. High Susceptibility for Natural Disasters; High Demand for Specialized Coverage in Insurance

- 3.4. Market Trends

- 3.4.1. Increasing Insurance Claim Across the Region is Driving The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Reinsurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Facultative Reinsurance

- 5.1.2. Treaty Reinsurance

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Property & Casualty Reinsurance

- 5.2.2. Life & Health Reinsurance

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct

- 5.3.2. Broker

- 5.4. Market Analysis, Insights and Forecast - by Mode

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Munich RE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AXA SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 RGA Reinsurance Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 General Re Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Swiss Re

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lloyd's

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MAPFRE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hannover Re

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Everest Re Group Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Other Key Players**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Munich RE

List of Figures

- Figure 1: Germany Reinsurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Reinsurance Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Reinsurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Reinsurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Germany Reinsurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Germany Reinsurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Germany Reinsurance Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 6: Germany Reinsurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Germany Reinsurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Germany Reinsurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 9: Germany Reinsurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 10: Germany Reinsurance Market Revenue Million Forecast, by Mode 2019 & 2032

- Table 11: Germany Reinsurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Reinsurance Market?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the Germany Reinsurance Market?

Key companies in the market include Munich RE, AXA SA, RGA Reinsurance Company, General Re Corporation, Swiss Re, Lloyd's, MAPFRE, Hannover Re, Everest Re Group Ltd, Other Key Players**List Not Exhaustive.

3. What are the main segments of the Germany Reinsurance Market?

The market segments include Type, Application, Distribution Channel, Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Susceptibility for Natural Disasters; High Demand for Specialized Coverage in Insurance.

6. What are the notable trends driving market growth?

Increasing Insurance Claim Across the Region is Driving The Market.

7. Are there any restraints impacting market growth?

High Susceptibility for Natural Disasters; High Demand for Specialized Coverage in Insurance.

8. Can you provide examples of recent developments in the market?

July 2022: AXA Germany agreed to transfer a portfolio of around 900,000 conventional life and annuity insurance contracts worth Euro 19 Billion (20.5 USD billion) in assets under administration to Athora Germany for a purchase price of Euro 610 million (658.71 USD million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Reinsurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Reinsurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Reinsurance Market?

To stay informed about further developments, trends, and reports in the Germany Reinsurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence