Key Insights

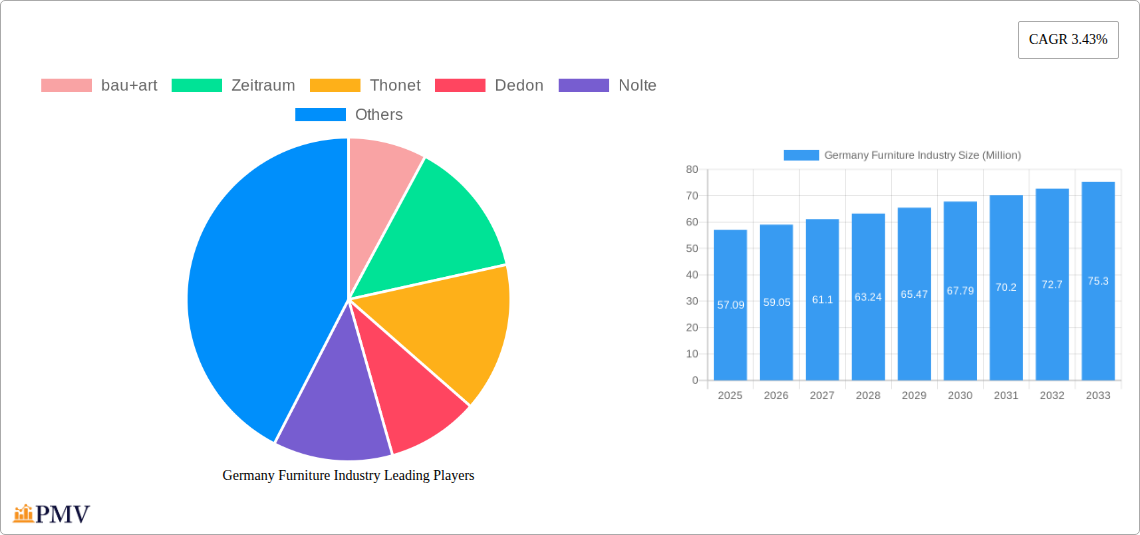

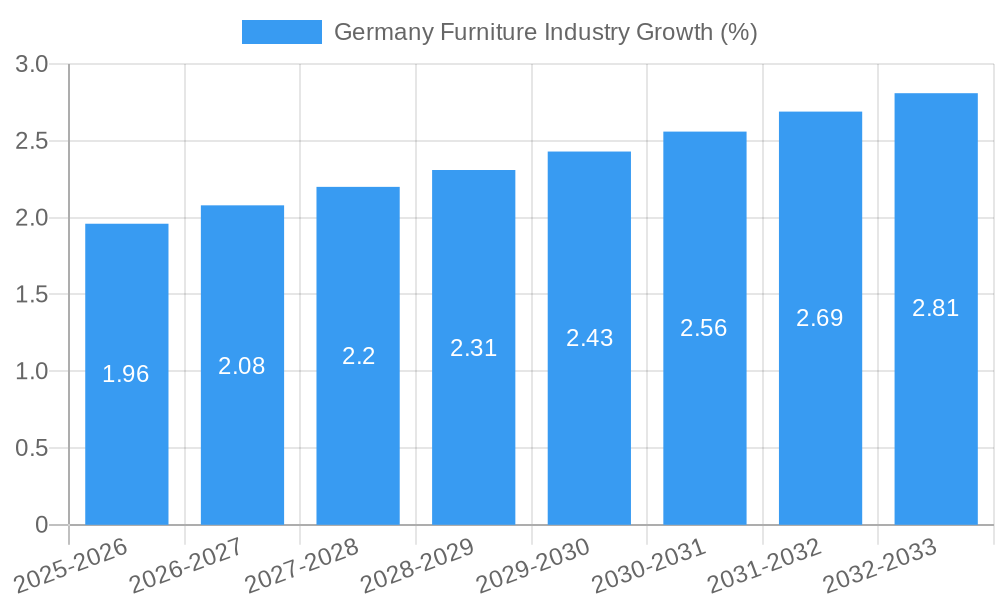

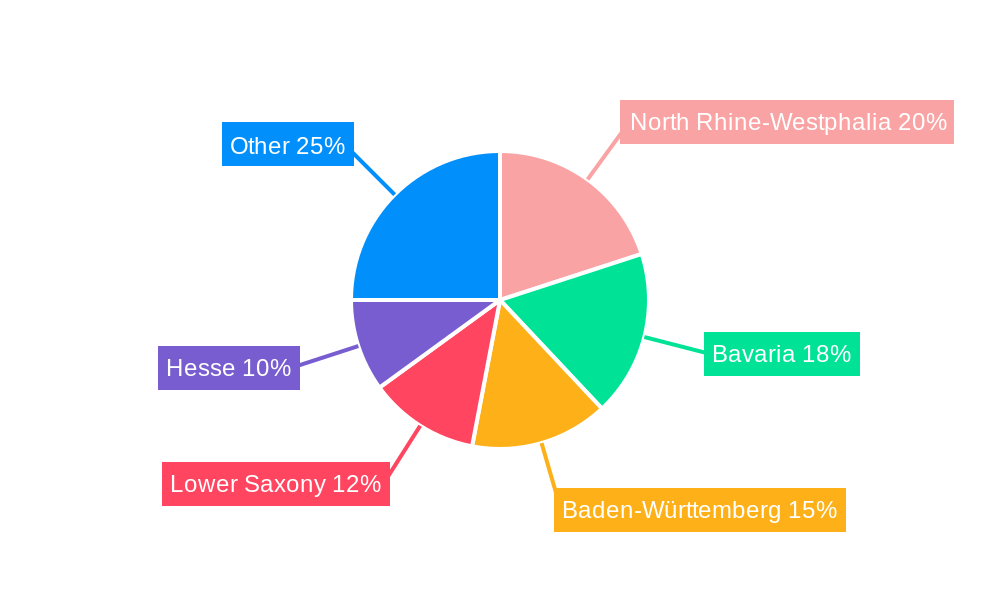

The German furniture industry, valued at €57.09 million in 2025, is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) of 3.43% from 2025 to 2033. This growth is fueled by several key drivers. A rising disposable income among German households is boosting demand for higher-quality and stylish furniture, particularly within the home furniture segment. The increasing preference for modern and minimalist designs, coupled with a growing emphasis on sustainable and eco-friendly materials, is shaping consumer choices. Furthermore, the expansion of e-commerce platforms is providing convenient access to a wider range of furniture options, driving online sales. While the industry faces challenges such as fluctuating raw material costs and intense competition, particularly from established international brands and smaller, specialized businesses, these are mitigated by the strong domestic manufacturing base and the presence of renowned German furniture brands recognized globally for their quality and craftsmanship. The market is segmented by material (wood, metal, plastic, and other), application (home, office, hospitality, and other), and distribution channel (supermarkets, specialty stores, online, and others). Regions like North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse are key contributors to the market's overall performance. The consistent growth is anticipated to be driven by ongoing investment in innovative designs, improved supply chain efficiency, and targeted marketing strategies focusing on specific customer segments.

The industry's success relies heavily on adapting to changing consumer preferences and technological advancements. The increasing popularity of modular and customizable furniture, reflecting the growing demand for personalized living spaces, presents significant opportunities. The integration of technology, like augmented reality (AR) applications allowing customers to visualize furniture in their homes before purchase, is also gaining traction. This, combined with targeted marketing campaigns that leverage social media and online influencers, helps in enhancing brand visibility and driving sales. The industry's commitment to sustainability, evident in the growing adoption of recycled and eco-friendly materials, appeals to environmentally conscious consumers, further enhancing brand reputation and driving demand. The diverse distribution channels ensure broader market reach, though maintaining a balance between online and offline presence is crucial for sustained growth.

Germany Furniture Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the German furniture industry, encompassing market structure, competitive dynamics, key trends, and future growth prospects from 2019 to 2033. The study period covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). The report leverages extensive data analysis and expert insights to deliver actionable intelligence for industry stakeholders. The German furniture market, valued at xx Million in 2025, is poised for significant growth, driven by evolving consumer preferences, technological advancements, and robust economic conditions. This report is essential for businesses seeking to navigate this dynamic market and capitalize on emerging opportunities.

Germany Furniture Industry Market Structure & Competitive Dynamics

The German furniture market exhibits a moderately concentrated structure, with a mix of large multinational corporations like IKEA and Otto, and smaller specialized players like bau+art and Zeitraum. Market share is largely distributed amongst these key players, with IKEA holding a significant lead. The industry is characterized by a dynamic innovation ecosystem, driven by ongoing R&D in materials, design, and manufacturing processes. Regulatory frameworks, primarily focused on safety and environmental standards, influence product development and supply chain management. Product substitutes, such as repurposed furniture or rental services, pose a growing challenge, particularly in the home furniture segment. End-user preferences are shifting towards sustainable, ergonomic, and multi-functional furniture. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with deal values ranging from xx Million to xx Million. Several successful M&A deals have reshaped the competitive landscape by enhancing market access and product portfolios.

- Market Concentration: Moderately concentrated, with a few dominant players and numerous smaller firms.

- Innovation Ecosystems: Active, focused on sustainable materials, smart furniture, and ergonomic designs.

- Regulatory Framework: Stringent safety and environmental regulations impacting product development and manufacturing.

- Product Substitutes: Growing presence of second-hand furniture and rental options.

- M&A Activity: Moderate, with deal values varying significantly. Examples include xx (details unavailable).

Germany Furniture Industry Industry Trends & Insights

The German furniture market is experiencing robust growth, driven by a combination of factors. Rising disposable incomes and a preference for aesthetically pleasing and functional home environments fuel demand for high-quality furniture. Technological disruptions, such as the adoption of 3D printing and automation in manufacturing, are driving efficiency and customization. Consumer preferences increasingly emphasize sustainability, with eco-friendly materials and production methods gaining popularity. The competitive landscape is characterized by continuous innovation, with companies investing in new product lines and marketing strategies. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is projected at xx%, indicating significant market expansion. Market penetration of online sales channels is steadily increasing, reflecting growing consumer adoption of e-commerce.

Dominant Markets & Segments in Germany Furniture Industry

The German furniture market shows diverse segment dominance. In terms of materials, wood furniture maintains a significant market share, driven by its aesthetic appeal and perceived value. Metal and plastic furniture segments are also growing, though at a slower pace than wood. Within application segments, home furniture remains the largest, driven by housing market dynamics and consumer spending patterns. Office furniture, particularly in urban areas, shows steady growth driven by increased corporate investments. The hospitality furniture segment, though smaller, demonstrates promising growth potential, primarily due to the tourism sector's expansion. Online distribution channels demonstrate rapid growth, surpassing traditional specialty stores in overall market share, driven by e-commerce advancements and changing consumer behaviour.

- By Material: Wood furniture maintains a dominant position.

- By Application: Home furniture is the largest segment, followed by office furniture and hospitality furniture.

- By Distribution Channel: Online sales are experiencing rapid expansion, exceeding other channels.

Key drivers for the dominant segments include robust economic conditions, increasing urbanization, and government support for sustainable infrastructure projects.

Germany Furniture Industry Product Innovations

Recent product innovations focus on sustainability, ergonomics, and smart features. Companies are incorporating recycled materials, eco-friendly finishes, and energy-efficient components. Ergonomic designs are gaining traction, driven by growing awareness of health and well-being. Smart furniture, incorporating technology for enhanced functionality and user experience, is emerging as a significant trend, although still a relatively small market segment. This innovation is critical for companies to maintain competitiveness and appeal to environmentally conscious and tech-savvy consumers.

Report Segmentation & Scope

This report segments the German furniture market across several key dimensions:

- By Material: Wood, Metal, Plastic, and Other. Each segment's growth trajectory and competitive landscape are detailed, with specific market size projections for each.

- By Application: Home Furniture, Office Furniture, Hospitality Furniture, and Other. The report analyzes market size, growth prospects, and key players within each segment.

- By Distribution Channel: Supermarkets & Hypermarkets, Specialty Stores, Online, and Other Distribution Channels. Growth projections and competitive dynamics are analyzed for each channel.

Key Drivers of Germany Furniture Industry Growth

Several factors drive the growth of the German furniture industry. A robust economy fuels consumer spending on home improvements and furnishings. Technological advancements in manufacturing enhance efficiency and product customization. Government initiatives supporting sustainable practices encourage the use of eco-friendly materials and processes. The increasing urbanization trend boosts demand for high-quality furniture across various segments.

Challenges in the Germany Furniture Industry Sector

The German furniture industry faces several challenges. Supply chain disruptions, particularly related to raw materials and transportation, can impact production and pricing. Intense competition from both domestic and international players necessitates continuous innovation and cost optimization. Environmental regulations, though necessary, can add to production costs. Fluctuations in the global economy and consumer confidence levels affect demand for non-essential items like furniture.

Leading Players in the Germany Furniture Industry Market

Key Developments in Germany Furniture Industry Sector

- April 2023: Rolf Benz unveiled its latest furniture collection called "Jackout," showcasing innovative stainless steel frame designs.

- May 2023: The Brunner Group introduced its new "Oval" upholstered furniture range, targeting the modern office market.

Strategic Germany Furniture Industry Market Outlook

The German furniture market presents significant growth potential over the next decade. Continued economic stability, coupled with technological advancements and evolving consumer preferences, will drive demand for innovative, sustainable, and technologically advanced furniture. Companies focusing on customization, sustainability, and digital marketing strategies are well-positioned to capitalize on this growth. The focus on ergonomic designs and smart home integration will further fuel market expansion.

Germany Furniture Industry Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastic & Other Furniture

-

2. Application

- 2.1. Home Furniture

- 2.2. Office Furniture

- 2.3. Hospitality Furniture

-

3. Distribution Channel

- 3.1. Supermarkets & Hypermarkets

- 3.2. Specialty Stores

- 3.3. Online

Germany Furniture Industry Segmentation By Geography

- 1. Germany

Germany Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.43% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Construction and Renovation Activities; Growing Potential in the German Online Furniture Market

- 3.3. Market Restrains

- 3.3.1. High Competition Among Players in the Market; High Price of Supply Chain and Logistics

- 3.4. Market Trends

- 3.4.1. Increasing Construction and Renovation Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastic & Other Furniture

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Home Furniture

- 5.2.2. Office Furniture

- 5.2.3. Hospitality Furniture

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets & Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North Rhine-Westphalia Germany Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany Furniture Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 bau+art

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zeitraum

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Thonet

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dedon

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nolte

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rolf Benz

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 IKEA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Otto

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Brunner

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 noah-living**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 bau+art

List of Figures

- Figure 1: Germany Furniture Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Furniture Industry Share (%) by Company 2024

List of Tables

- Table 1: Germany Furniture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Furniture Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 3: Germany Furniture Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Germany Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Germany Furniture Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Germany Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North Rhine-Westphalia Germany Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Bavaria Germany Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Baden-Württemberg Germany Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Lower Saxony Germany Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Hesse Germany Furniture Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Germany Furniture Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 13: Germany Furniture Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Germany Furniture Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Germany Furniture Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Furniture Industry?

The projected CAGR is approximately 3.43%.

2. Which companies are prominent players in the Germany Furniture Industry?

Key companies in the market include bau+art, Zeitraum, Thonet, Dedon, Nolte, Rolf Benz, IKEA, Otto, Brunner, noah-living**List Not Exhaustive.

3. What are the main segments of the Germany Furniture Industry?

The market segments include Material, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 57.09 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Construction and Renovation Activities; Growing Potential in the German Online Furniture Market.

6. What are the notable trends driving market growth?

Increasing Construction and Renovation Activities.

7. Are there any restraints impacting market growth?

High Competition Among Players in the Market; High Price of Supply Chain and Logistics.

8. Can you provide examples of recent developments in the market?

May 2023: Brunner Group has recently introduced a new upholstered furniture range named "Oval." With this launch, Brunner is at the forefront of modern office trends, offering furniture that combines style and a sense of well-being.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Furniture Industry?

To stay informed about further developments, trends, and reports in the Germany Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence