Key Insights

The global forage seeds market, valued at approximately $14.6 billion in 2025, is projected to experience significant expansion, exhibiting a compound annual growth rate (CAGR) of 9.8% from 2025 to 2033. This growth is propelled by escalating global demand for animal feed, driven by population increase and rising meat consumption. The adoption of sustainable agricultural practices, including precision farming and advanced crop management, further boosts demand for high-performance, disease-resistant forage seed varieties. Supportive government policies promoting sustainable agriculture and livestock production also contribute to market expansion. The market is segmented by crop type (Alfalfa, Forage Corn, Forage Sorghum, Others), breeding technology (Hybrids, Open Pollinated Varieties & Hybrid Derivatives), and other traits. The hybrid segment leads due to its superior yield and disease resistance, with Alfalfa remaining a key crop for dairy and livestock farming. Leading companies like RAGT Group, Land O’Lakes Inc, DLF, and Bayer AG are investing in R&D for innovative forage seed varieties with advanced traits.

Forage Seeds Industry Market Size (In Billion)

Intense competition characterizes the forage seeds market, with established and emerging players actively seeking market share. Future growth hinges on continued technological advancements in seed breeding and genetics to develop varieties with improved traits such as drought tolerance, pest resistance, and enhanced nutritional value. Market demand may be influenced by fluctuations in agricultural commodity prices and global economic conditions. Regulatory changes in seed production and distribution can also impact market dynamics. Nevertheless, the long-term outlook for the forage seeds market remains positive, supported by the imperative for global food security and sustainable agriculture. The sustained focus on improving livestock productivity and securing animal feed supplies will continue to drive market growth.

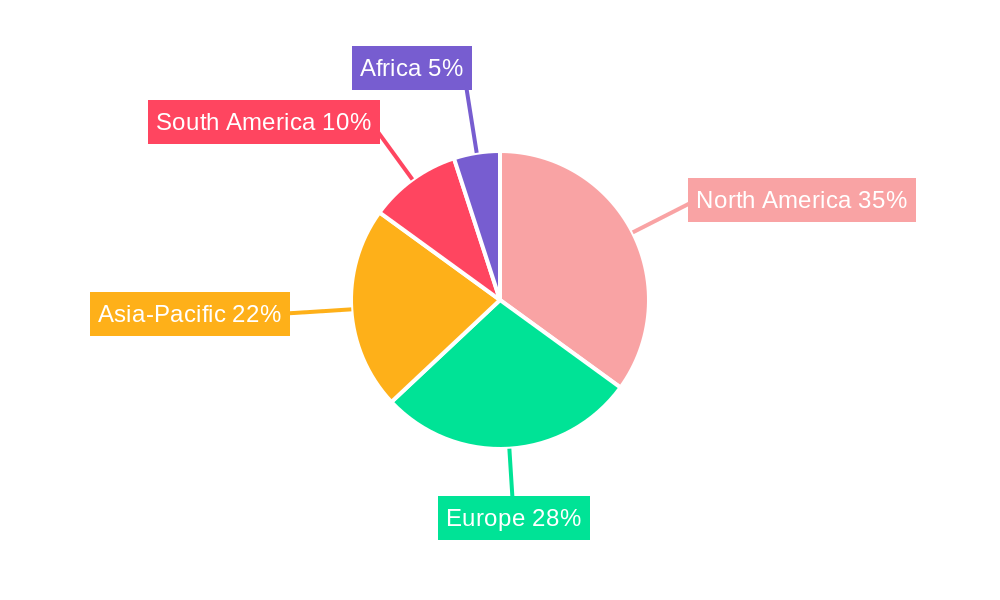

Forage Seeds Industry Company Market Share

Forage Seeds Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the global Forage Seeds industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive data analysis to project a xx Million market size by 2033, highlighting key trends, opportunities, and challenges shaping the future of this dynamic sector. The report meticulously examines various segments including Alfalfa, Forage Corn, Forage Sorghum, and other Forage Crops, analyzing both Open Pollinated Varieties & Hybrid Derivatives and exploring diverse Other Traits.

Forage Seeds Industry Market Structure & Competitive Dynamics

The Forage Seeds market exhibits a moderately consolidated structure, with key players like RAGT Group, Land O’Lakes Inc, DLF, Bayer AG, S&W Seed Co, Royal Barenbrug Group, KWS SAAT SE & Co KGaA, Advanta Seeds - UPL, Ampac Seed Company, and Corteva Agriscience holding significant market share. Market concentration is further analyzed through the Herfindahl-Hirschman Index (HHI) calculation, revealing a xx score suggesting a moderately competitive landscape. Innovation ecosystems are highly active, fueled by substantial R&D investments exceeding xx Million annually across leading companies. The industry is subject to evolving regulatory frameworks concerning seed safety and GMO regulations. Product substitutes, such as alternative feed sources, exert moderate competitive pressure. End-user trends, such as increasing demand for high-yielding, drought-resistant varieties, significantly impact market growth. Furthermore, the report details M&A activity within the industry, noting several significant transactions valued at over xx Million in recent years, including Barenbrug’s acquisition of Watson Group and the continuing investment by DLF. These mergers and acquisitions are largely driven by expansion into new markets and technological advancements.

- Market Share: Top 5 players hold approximately xx% of the global market share.

- M&A Deal Value: Total value of M&A transactions in the last 5 years exceeded xx Million.

- Regulatory Landscape: The report details key regulations and their impact on market dynamics.

Forage Seeds Industry Trends & Insights

The Forage Seeds market demonstrates a robust CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033), driven by several key factors. Growing global demand for animal feed, particularly in developing economies with expanding livestock populations, is a primary market driver. Technological advancements in breeding technologies, leading to the development of improved varieties with higher yields and enhanced stress tolerance, significantly contribute to market growth. Consumer preferences are shifting toward sustainable and environmentally friendly farming practices, resulting in increased demand for organic and bio-fortified forage seeds. The competitive landscape remains intense, with companies engaging in strategic partnerships, acquisitions, and product innovations to gain market share and meet ever-evolving consumer demands. Market penetration of hybrid varieties is expected to reach xx% by 2033, fueled by their superior yield potential.

Dominant Markets & Segments in Forage Seeds Industry

The North American region currently holds the largest market share in the forage seeds industry, driven by robust agricultural activities and significant demand from livestock producers. Within the crop segments, Forage Corn and Alfalfa dominate due to their wide adaptability and high yields. The Hybrids segment accounts for the largest share within Breeding Technologies.

Key Drivers in North America:

- Large-scale agricultural operations

- High livestock population

- Favorable government policies supporting agriculture

- Well-developed infrastructure

Dominant Segments:

- Crop: Forage Corn and Alfalfa represent the largest segments, with a combined market share exceeding xx%.

- Breeding Technology: Hybrids technology maintains a significant market share due to its enhanced yield and performance traits.

Forage Seeds Industry Product Innovations

Recent advancements in breeding technologies have led to the development of forage varieties with improved traits, including enhanced drought tolerance, disease resistance, and nutritional value. These innovations cater to the growing demand for sustainable and high-performing forage crops, leading to increased yields and improved animal feed quality. The adoption of precision agriculture techniques is further enhancing the efficiency and productivity of forage seed production. Gene editing technologies and marker-assisted selection are revolutionizing breeding programs, facilitating the development of superior varieties faster than ever before.

Report Segmentation & Scope

This report segments the Forage Seeds market across multiple dimensions:

Crop Type: Alfalfa, Forage Corn, Forage Sorghum, and Other Forage Crops. Each segment is analyzed for market size, growth projections, and competitive dynamics. Alfalfa is projected to maintain a xx% CAGR during the forecast period due to its adaptability and nutritional value.

Breeding Technology: Hybrids and Open Pollinated Varieties & Hybrid Derivatives. Hybrids are expected to dominate the market, driven by higher yields and improved performance.

Traits: The report further segments the market based on various traits, including disease resistance, stress tolerance, and nutritional characteristics.

Each segment's growth projections, market sizes, and competitive landscape are detailed within the complete report.

Key Drivers of Forage Seeds Industry Growth

Several factors propel the growth of the Forage Seeds industry. Increasing global demand for animal protein, coupled with the expanding livestock population, drives the demand for high-quality forage. Technological advancements in seed breeding and production methods enhance yields and nutritional value. Favorable government policies and subsidies in key agricultural regions support industry expansion. Finally, a growing focus on sustainable and climate-resilient agriculture boosts the adoption of improved forage varieties.

Challenges in the Forage Seeds Industry Sector

The Forage Seeds industry faces challenges like unpredictable weather patterns impacting yields, escalating input costs, and stringent regulations regarding GMOs and seed safety. Supply chain disruptions can cause production delays and price volatility. Competition from substitute feed sources and the emergence of new technologies also pose challenges to existing players. These challenges collectively influence market profitability and growth trajectories, with an estimated xx Million loss annually due to unpredictable weather patterns.

Leading Players in the Forage Seeds Industry Market

- RAGT Group

- Land O’Lakes Inc

- DLF

- Bayer AG

- S&W Seed Co

- Royal Barenbrug Group

- KWS SAAT SE & Co KGaA

- Advanta Seeds - UPL

- Ampac Seed Company

- Corteva Agriscience

Key Developments in Forage Seeds Industry Sector

- March 2023: PGG Wrightson Seeds (DLF subsidiary) launched the GT07 phalaris variety, demonstrating enhanced persistence under changing climate conditions.

- March 2023: Barenbrug acquired the Watson Group, expanding its presence in the UK grass-seed market.

- March 2023: DLF opened a new seed processing and storage facility in New Zealand, boosting its regional capacity.

Strategic Forage Seeds Industry Market Outlook

The Forage Seeds market presents significant growth potential over the forecast period. Continued innovation in breeding technologies, coupled with rising global demand for animal feed, will drive market expansion. Strategic partnerships, acquisitions, and investments in research and development will be key to success. Companies focusing on sustainable and climate-resilient solutions will gain a competitive advantage in this evolving market. The market is poised for substantial growth, with opportunities for both established players and new entrants.

Forage Seeds Industry Segmentation

-

1. Breeding Technology

-

1.1. Hybrids

- 1.1.1. Non-Transgenic Hybrids

- 1.1.2. Herbicide Tolerant Hybrids

- 1.1.3. Other Traits

- 1.2. Open Pollinated Varieties & Hybrid Derivatives

-

1.1. Hybrids

-

2. Crop

- 2.1. Alfalfa

- 2.2. Forage Corn

- 2.3. Forage Sorghum

- 2.4. Other Forage Crops

-

3. Breeding Technology

-

3.1. Hybrids

- 3.1.1. Non-Transgenic Hybrids

- 3.1.2. Herbicide Tolerant Hybrids

- 3.1.3. Other Traits

- 3.2. Open Pollinated Varieties & Hybrid Derivatives

-

3.1. Hybrids

-

4. Crop

- 4.1. Alfalfa

- 4.2. Forage Corn

- 4.3. Forage Sorghum

- 4.4. Other Forage Crops

Forage Seeds Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Forage Seeds Industry Regional Market Share

Geographic Coverage of Forage Seeds Industry

Forage Seeds Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs

- 3.3. Market Restrains

- 3.3.1. Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Forage Seeds Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 5.1.1. Hybrids

- 5.1.1.1. Non-Transgenic Hybrids

- 5.1.1.2. Herbicide Tolerant Hybrids

- 5.1.1.3. Other Traits

- 5.1.2. Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1. Hybrids

- 5.2. Market Analysis, Insights and Forecast - by Crop

- 5.2.1. Alfalfa

- 5.2.2. Forage Corn

- 5.2.3. Forage Sorghum

- 5.2.4. Other Forage Crops

- 5.3. Market Analysis, Insights and Forecast - by Breeding Technology

- 5.3.1. Hybrids

- 5.3.1.1. Non-Transgenic Hybrids

- 5.3.1.2. Herbicide Tolerant Hybrids

- 5.3.1.3. Other Traits

- 5.3.2. Open Pollinated Varieties & Hybrid Derivatives

- 5.3.1. Hybrids

- 5.4. Market Analysis, Insights and Forecast - by Crop

- 5.4.1. Alfalfa

- 5.4.2. Forage Corn

- 5.4.3. Forage Sorghum

- 5.4.4. Other Forage Crops

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. South America

- 5.5.3. Europe

- 5.5.4. Middle East & Africa

- 5.5.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 6. North America Forage Seeds Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 6.1.1. Hybrids

- 6.1.1.1. Non-Transgenic Hybrids

- 6.1.1.2. Herbicide Tolerant Hybrids

- 6.1.1.3. Other Traits

- 6.1.2. Open Pollinated Varieties & Hybrid Derivatives

- 6.1.1. Hybrids

- 6.2. Market Analysis, Insights and Forecast - by Crop

- 6.2.1. Alfalfa

- 6.2.2. Forage Corn

- 6.2.3. Forage Sorghum

- 6.2.4. Other Forage Crops

- 6.3. Market Analysis, Insights and Forecast - by Breeding Technology

- 6.3.1. Hybrids

- 6.3.1.1. Non-Transgenic Hybrids

- 6.3.1.2. Herbicide Tolerant Hybrids

- 6.3.1.3. Other Traits

- 6.3.2. Open Pollinated Varieties & Hybrid Derivatives

- 6.3.1. Hybrids

- 6.4. Market Analysis, Insights and Forecast - by Crop

- 6.4.1. Alfalfa

- 6.4.2. Forage Corn

- 6.4.3. Forage Sorghum

- 6.4.4. Other Forage Crops

- 6.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 7. South America Forage Seeds Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 7.1.1. Hybrids

- 7.1.1.1. Non-Transgenic Hybrids

- 7.1.1.2. Herbicide Tolerant Hybrids

- 7.1.1.3. Other Traits

- 7.1.2. Open Pollinated Varieties & Hybrid Derivatives

- 7.1.1. Hybrids

- 7.2. Market Analysis, Insights and Forecast - by Crop

- 7.2.1. Alfalfa

- 7.2.2. Forage Corn

- 7.2.3. Forage Sorghum

- 7.2.4. Other Forage Crops

- 7.3. Market Analysis, Insights and Forecast - by Breeding Technology

- 7.3.1. Hybrids

- 7.3.1.1. Non-Transgenic Hybrids

- 7.3.1.2. Herbicide Tolerant Hybrids

- 7.3.1.3. Other Traits

- 7.3.2. Open Pollinated Varieties & Hybrid Derivatives

- 7.3.1. Hybrids

- 7.4. Market Analysis, Insights and Forecast - by Crop

- 7.4.1. Alfalfa

- 7.4.2. Forage Corn

- 7.4.3. Forage Sorghum

- 7.4.4. Other Forage Crops

- 7.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 8. Europe Forage Seeds Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 8.1.1. Hybrids

- 8.1.1.1. Non-Transgenic Hybrids

- 8.1.1.2. Herbicide Tolerant Hybrids

- 8.1.1.3. Other Traits

- 8.1.2. Open Pollinated Varieties & Hybrid Derivatives

- 8.1.1. Hybrids

- 8.2. Market Analysis, Insights and Forecast - by Crop

- 8.2.1. Alfalfa

- 8.2.2. Forage Corn

- 8.2.3. Forage Sorghum

- 8.2.4. Other Forage Crops

- 8.3. Market Analysis, Insights and Forecast - by Breeding Technology

- 8.3.1. Hybrids

- 8.3.1.1. Non-Transgenic Hybrids

- 8.3.1.2. Herbicide Tolerant Hybrids

- 8.3.1.3. Other Traits

- 8.3.2. Open Pollinated Varieties & Hybrid Derivatives

- 8.3.1. Hybrids

- 8.4. Market Analysis, Insights and Forecast - by Crop

- 8.4.1. Alfalfa

- 8.4.2. Forage Corn

- 8.4.3. Forage Sorghum

- 8.4.4. Other Forage Crops

- 8.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 9. Middle East & Africa Forage Seeds Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 9.1.1. Hybrids

- 9.1.1.1. Non-Transgenic Hybrids

- 9.1.1.2. Herbicide Tolerant Hybrids

- 9.1.1.3. Other Traits

- 9.1.2. Open Pollinated Varieties & Hybrid Derivatives

- 9.1.1. Hybrids

- 9.2. Market Analysis, Insights and Forecast - by Crop

- 9.2.1. Alfalfa

- 9.2.2. Forage Corn

- 9.2.3. Forage Sorghum

- 9.2.4. Other Forage Crops

- 9.3. Market Analysis, Insights and Forecast - by Breeding Technology

- 9.3.1. Hybrids

- 9.3.1.1. Non-Transgenic Hybrids

- 9.3.1.2. Herbicide Tolerant Hybrids

- 9.3.1.3. Other Traits

- 9.3.2. Open Pollinated Varieties & Hybrid Derivatives

- 9.3.1. Hybrids

- 9.4. Market Analysis, Insights and Forecast - by Crop

- 9.4.1. Alfalfa

- 9.4.2. Forage Corn

- 9.4.3. Forage Sorghum

- 9.4.4. Other Forage Crops

- 9.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 10. Asia Pacific Forage Seeds Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 10.1.1. Hybrids

- 10.1.1.1. Non-Transgenic Hybrids

- 10.1.1.2. Herbicide Tolerant Hybrids

- 10.1.1.3. Other Traits

- 10.1.2. Open Pollinated Varieties & Hybrid Derivatives

- 10.1.1. Hybrids

- 10.2. Market Analysis, Insights and Forecast - by Crop

- 10.2.1. Alfalfa

- 10.2.2. Forage Corn

- 10.2.3. Forage Sorghum

- 10.2.4. Other Forage Crops

- 10.3. Market Analysis, Insights and Forecast - by Breeding Technology

- 10.3.1. Hybrids

- 10.3.1.1. Non-Transgenic Hybrids

- 10.3.1.2. Herbicide Tolerant Hybrids

- 10.3.1.3. Other Traits

- 10.3.2. Open Pollinated Varieties & Hybrid Derivatives

- 10.3.1. Hybrids

- 10.4. Market Analysis, Insights and Forecast - by Crop

- 10.4.1. Alfalfa

- 10.4.2. Forage Corn

- 10.4.3. Forage Sorghum

- 10.4.4. Other Forage Crops

- 10.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 RAGT Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Land O’Lakes Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DLF

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bayer AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 S&W Seed Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Royal Barenbrug Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 KWS SAAT SE & Co KGaA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Advanta Seeds - UPL

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ampac Seed Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Corteva Agriscience

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 RAGT Group

List of Figures

- Figure 1: Global Forage Seeds Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Forage Seeds Industry Revenue (billion), by Breeding Technology 2025 & 2033

- Figure 3: North America Forage Seeds Industry Revenue Share (%), by Breeding Technology 2025 & 2033

- Figure 4: North America Forage Seeds Industry Revenue (billion), by Crop 2025 & 2033

- Figure 5: North America Forage Seeds Industry Revenue Share (%), by Crop 2025 & 2033

- Figure 6: North America Forage Seeds Industry Revenue (billion), by Breeding Technology 2025 & 2033

- Figure 7: North America Forage Seeds Industry Revenue Share (%), by Breeding Technology 2025 & 2033

- Figure 8: North America Forage Seeds Industry Revenue (billion), by Crop 2025 & 2033

- Figure 9: North America Forage Seeds Industry Revenue Share (%), by Crop 2025 & 2033

- Figure 10: North America Forage Seeds Industry Revenue (billion), by Country 2025 & 2033

- Figure 11: North America Forage Seeds Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: South America Forage Seeds Industry Revenue (billion), by Breeding Technology 2025 & 2033

- Figure 13: South America Forage Seeds Industry Revenue Share (%), by Breeding Technology 2025 & 2033

- Figure 14: South America Forage Seeds Industry Revenue (billion), by Crop 2025 & 2033

- Figure 15: South America Forage Seeds Industry Revenue Share (%), by Crop 2025 & 2033

- Figure 16: South America Forage Seeds Industry Revenue (billion), by Breeding Technology 2025 & 2033

- Figure 17: South America Forage Seeds Industry Revenue Share (%), by Breeding Technology 2025 & 2033

- Figure 18: South America Forage Seeds Industry Revenue (billion), by Crop 2025 & 2033

- Figure 19: South America Forage Seeds Industry Revenue Share (%), by Crop 2025 & 2033

- Figure 20: South America Forage Seeds Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: South America Forage Seeds Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Europe Forage Seeds Industry Revenue (billion), by Breeding Technology 2025 & 2033

- Figure 23: Europe Forage Seeds Industry Revenue Share (%), by Breeding Technology 2025 & 2033

- Figure 24: Europe Forage Seeds Industry Revenue (billion), by Crop 2025 & 2033

- Figure 25: Europe Forage Seeds Industry Revenue Share (%), by Crop 2025 & 2033

- Figure 26: Europe Forage Seeds Industry Revenue (billion), by Breeding Technology 2025 & 2033

- Figure 27: Europe Forage Seeds Industry Revenue Share (%), by Breeding Technology 2025 & 2033

- Figure 28: Europe Forage Seeds Industry Revenue (billion), by Crop 2025 & 2033

- Figure 29: Europe Forage Seeds Industry Revenue Share (%), by Crop 2025 & 2033

- Figure 30: Europe Forage Seeds Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Europe Forage Seeds Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East & Africa Forage Seeds Industry Revenue (billion), by Breeding Technology 2025 & 2033

- Figure 33: Middle East & Africa Forage Seeds Industry Revenue Share (%), by Breeding Technology 2025 & 2033

- Figure 34: Middle East & Africa Forage Seeds Industry Revenue (billion), by Crop 2025 & 2033

- Figure 35: Middle East & Africa Forage Seeds Industry Revenue Share (%), by Crop 2025 & 2033

- Figure 36: Middle East & Africa Forage Seeds Industry Revenue (billion), by Breeding Technology 2025 & 2033

- Figure 37: Middle East & Africa Forage Seeds Industry Revenue Share (%), by Breeding Technology 2025 & 2033

- Figure 38: Middle East & Africa Forage Seeds Industry Revenue (billion), by Crop 2025 & 2033

- Figure 39: Middle East & Africa Forage Seeds Industry Revenue Share (%), by Crop 2025 & 2033

- Figure 40: Middle East & Africa Forage Seeds Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East & Africa Forage Seeds Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Asia Pacific Forage Seeds Industry Revenue (billion), by Breeding Technology 2025 & 2033

- Figure 43: Asia Pacific Forage Seeds Industry Revenue Share (%), by Breeding Technology 2025 & 2033

- Figure 44: Asia Pacific Forage Seeds Industry Revenue (billion), by Crop 2025 & 2033

- Figure 45: Asia Pacific Forage Seeds Industry Revenue Share (%), by Crop 2025 & 2033

- Figure 46: Asia Pacific Forage Seeds Industry Revenue (billion), by Breeding Technology 2025 & 2033

- Figure 47: Asia Pacific Forage Seeds Industry Revenue Share (%), by Breeding Technology 2025 & 2033

- Figure 48: Asia Pacific Forage Seeds Industry Revenue (billion), by Crop 2025 & 2033

- Figure 49: Asia Pacific Forage Seeds Industry Revenue Share (%), by Crop 2025 & 2033

- Figure 50: Asia Pacific Forage Seeds Industry Revenue (billion), by Country 2025 & 2033

- Figure 51: Asia Pacific Forage Seeds Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Forage Seeds Industry Revenue billion Forecast, by Breeding Technology 2020 & 2033

- Table 2: Global Forage Seeds Industry Revenue billion Forecast, by Crop 2020 & 2033

- Table 3: Global Forage Seeds Industry Revenue billion Forecast, by Breeding Technology 2020 & 2033

- Table 4: Global Forage Seeds Industry Revenue billion Forecast, by Crop 2020 & 2033

- Table 5: Global Forage Seeds Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Forage Seeds Industry Revenue billion Forecast, by Breeding Technology 2020 & 2033

- Table 7: Global Forage Seeds Industry Revenue billion Forecast, by Crop 2020 & 2033

- Table 8: Global Forage Seeds Industry Revenue billion Forecast, by Breeding Technology 2020 & 2033

- Table 9: Global Forage Seeds Industry Revenue billion Forecast, by Crop 2020 & 2033

- Table 10: Global Forage Seeds Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Forage Seeds Industry Revenue billion Forecast, by Breeding Technology 2020 & 2033

- Table 15: Global Forage Seeds Industry Revenue billion Forecast, by Crop 2020 & 2033

- Table 16: Global Forage Seeds Industry Revenue billion Forecast, by Breeding Technology 2020 & 2033

- Table 17: Global Forage Seeds Industry Revenue billion Forecast, by Crop 2020 & 2033

- Table 18: Global Forage Seeds Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Forage Seeds Industry Revenue billion Forecast, by Breeding Technology 2020 & 2033

- Table 23: Global Forage Seeds Industry Revenue billion Forecast, by Crop 2020 & 2033

- Table 24: Global Forage Seeds Industry Revenue billion Forecast, by Breeding Technology 2020 & 2033

- Table 25: Global Forage Seeds Industry Revenue billion Forecast, by Crop 2020 & 2033

- Table 26: Global Forage Seeds Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 27: United Kingdom Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Germany Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Italy Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Spain Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Russia Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Benelux Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Nordics Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Global Forage Seeds Industry Revenue billion Forecast, by Breeding Technology 2020 & 2033

- Table 37: Global Forage Seeds Industry Revenue billion Forecast, by Crop 2020 & 2033

- Table 38: Global Forage Seeds Industry Revenue billion Forecast, by Breeding Technology 2020 & 2033

- Table 39: Global Forage Seeds Industry Revenue billion Forecast, by Crop 2020 & 2033

- Table 40: Global Forage Seeds Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Turkey Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Israel Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: GCC Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: North Africa Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East & Africa Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: Global Forage Seeds Industry Revenue billion Forecast, by Breeding Technology 2020 & 2033

- Table 48: Global Forage Seeds Industry Revenue billion Forecast, by Crop 2020 & 2033

- Table 49: Global Forage Seeds Industry Revenue billion Forecast, by Breeding Technology 2020 & 2033

- Table 50: Global Forage Seeds Industry Revenue billion Forecast, by Crop 2020 & 2033

- Table 51: Global Forage Seeds Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 52: China Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: India Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Korea Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: ASEAN Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Oceania Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Rest of Asia Pacific Forage Seeds Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Forage Seeds Industry?

The projected CAGR is approximately 9.8%.

2. Which companies are prominent players in the Forage Seeds Industry?

Key companies in the market include RAGT Group, Land O’Lakes Inc, DLF, Bayer AG, S&W Seed Co, Royal Barenbrug Group, KWS SAAT SE & Co KGaA, Advanta Seeds - UPL, Ampac Seed Company, Corteva Agriscience.

3. What are the main segments of the Forage Seeds Industry?

The market segments include Breeding Technology, Crop, Breeding Technology, Crop.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand For Landscaping Maintenance; Adoption of Green Spaces and Green Roofs.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Shortage of Labor In Landscaping; High Maintenance Cost of Lawn Mowers.

8. Can you provide examples of recent developments in the market?

March 2023: PGG Wrightson Seeds, a subsidiary of DLF, successfully developed the new GT07 phalaris variety. This variety exhibits greater persistence and market potential, particularly under Australia's changing climate conditions. The development of GT07 was made possible through collaboration with CSIRO's breeding program.March 2023: Barenbrug entered an agreement to acquire the UK seed specialist Watson Group, which is expected to enable Barenbrug to continue growing in the grass-seed marketplace in the United Kingdom.March 2023: DLF expanded its presence in New Zealand by opening a new seed processing and storage facility. This strategic investment aims to enhance seed processing capabilities and improve storage capacity in the country, allowing DLF to better serve the agricultural sector and meet the growing demand for high-quality seeds in New Zealand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Forage Seeds Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Forage Seeds Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Forage Seeds Industry?

To stay informed about further developments, trends, and reports in the Forage Seeds Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence