Key Insights

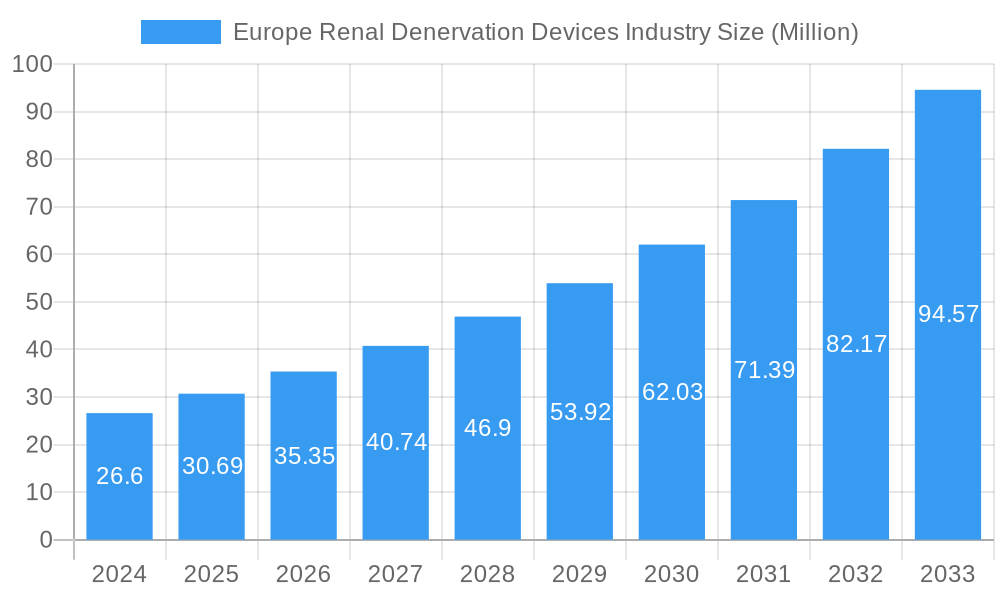

The European Renal Denervation Devices market is poised for significant expansion, driven by increasing prevalence of hypertension and a growing demand for minimally invasive treatment options. With a projected market size of $26.6 million in 2024, the industry is expected to witness robust growth at a Compound Annual Growth Rate (CAGR) of 15.4% over the forecast period of 2025-2033. This upward trajectory is underpinned by advancements in radiofrequency, ultrasound, and micro-infusion technologies, offering enhanced efficacy and safety profiles for patients suffering from resistant hypertension. Key players like Medtronic PLC, Symple Surgical, and Boston Scientific Corporation are actively investing in research and development, further stimulating market dynamism and introducing innovative solutions that address unmet clinical needs. The growing awareness among healthcare professionals and patients about the benefits of renal denervation as an alternative to lifelong medication is also a crucial factor contributing to market penetration.

Europe Renal Denervation Devices Industry Market Size (In Million)

The European landscape for renal denervation devices is characterized by a strong focus on technological innovation and clinical validation. The market size of $26.6 million in 2024 is set to surge, fueled by the escalating burden of cardiovascular diseases across the region. The 15.4% CAGR reflects a strong adoption rate, particularly in Germany, the United Kingdom, and France, where healthcare systems are receptive to adopting novel therapeutic approaches. While the market is experiencing rapid growth, potential restraints such as reimbursement challenges and the need for extensive long-term clinical data may present hurdles. However, the ongoing integration of advanced technologies and the expanding pipeline of next-generation devices are expected to mitigate these challenges, solidifying the market's strong growth trajectory. The diverse range of technologies, from established radiofrequency-based systems to emerging ultrasound and micro-infusion techniques, ensures a competitive environment and caters to a broad spectrum of patient needs.

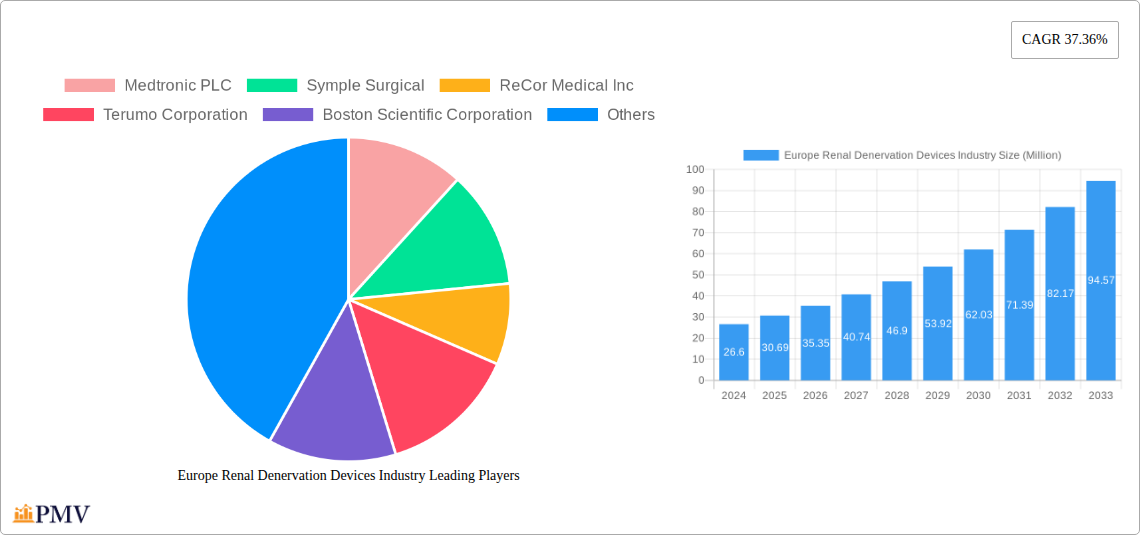

Europe Renal Denervation Devices Industry Company Market Share

This comprehensive report provides an in-depth analysis of the Europe Renal Denervation Devices Industry, offering critical insights into market dynamics, technological advancements, competitive landscapes, and future growth projections. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period of 2025–2033, this report leverages historical data from 2019–2024 to deliver actionable intelligence for stakeholders. We delve into the burgeoning market for renal denervation (RDN) systems designed to treat resistant hypertension by reducing sympathetic nerve activity in the renal arteries. The market is characterized by significant innovation, evolving regulatory pathways, and increasing adoption driven by the unmet need for effective hypertension management solutions. This report will equip you with the knowledge to navigate this rapidly developing sector, identify key opportunities, and mitigate potential challenges.

Europe Renal Denervation Devices Industry Market Structure & Competitive Dynamics

The Europe Renal Denervation Devices Industry exhibits a moderately concentrated market structure, with a few key players dominating innovation and market share. Medtronic PLC currently holds a significant market position, bolstered by its extensive R&D and established distribution networks. Symple Surgical, ReCor Medical Inc, Terumo Corporation, Boston Scientific Corporation, Mercator MedSystems, Abbott (St Jude Medical Inc), and Cordis are also active participants, each vying for market supremacy through product differentiation and strategic partnerships. The innovation ecosystem is vibrant, driven by ongoing clinical trials and the pursuit of novel therapeutic approaches. Regulatory frameworks, particularly those governed by the European Medicines Agency (EMA) and national competent authorities, play a crucial role in shaping market access and product approvals. Product substitutes, such as antihypertensive medications and other interventional procedures, present a competitive challenge, although RDN offers a distinct mechanism of action. End-user trends indicate a growing preference for minimally invasive procedures with favorable long-term outcomes for resistant hypertension patients. Mergers and acquisitions (M&A) activity, with estimated deal values in the range of tens to hundreds of millions of Euros, are anticipated as larger companies seek to consolidate their portfolios and acquire innovative technologies. The market share of leading players is estimated to be within the 20-40% range for key innovators.

Europe Renal Denervation Devices Industry Industry Trends & Insights

The Europe Renal Denervation Devices Industry is experiencing robust growth, driven by an increasing global prevalence of hypertension and the growing demand for alternative treatment modalities beyond traditional pharmacotherapy. The estimated Compound Annual Growth Rate (CAGR) for the forecast period is projected to be in the double digits, likely between 12% and 18%, reflecting the immense unmet medical need and the expanding clinical evidence supporting renal denervation. Market penetration for RDN procedures is still in its nascent stages but is expected to accelerate significantly as regulatory approvals broaden and physician awareness increases. Technological disruptions are at the forefront of this market's evolution. Innovations are focused on improving procedural efficacy, safety profiles, and ease of use for clinicians. The development of next-generation devices that offer more precise nerve ablation, enhanced patient comfort, and reduced complication rates is a key trend. Consumer preferences are shifting towards less invasive and more durable solutions for chronic conditions like hypertension. Patients are actively seeking treatments that offer a sustained reduction in blood pressure with minimal side effects, making RDN an attractive proposition. Competitive dynamics are intensifying, with companies heavily investing in clinical research to generate robust data that can support regulatory submissions and demonstrate superior outcomes. The landscape is characterized by fierce competition in securing intellectual property, establishing strong clinical partnerships, and building efficient commercialization strategies. The market is poised for substantial expansion as RDN transitions from investigational status to a mainstream treatment option for a broader patient population. The total market size is projected to reach several billion Euros by the end of the forecast period.

Dominant Markets & Segments in Europe Renal Denervation Devices Industry

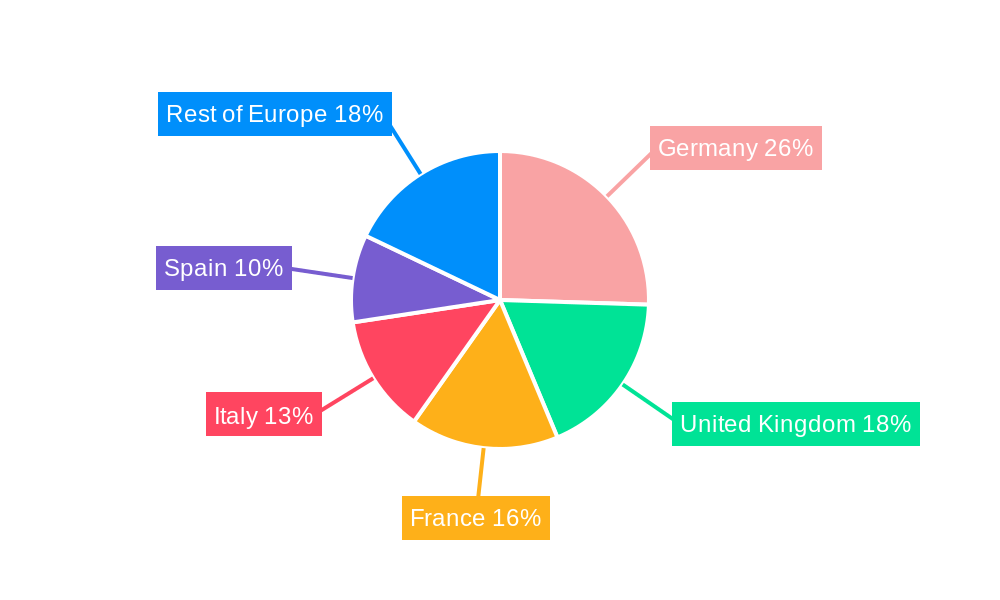

Within the Europe Renal Denervation Devices Industry, Western Europe, particularly Germany, France, the United Kingdom, and Italy, currently dominates the market. This leadership is attributed to several key drivers, including robust healthcare infrastructure, a high incidence of lifestyle-related diseases like hypertension, strong reimbursement policies for innovative medical devices, and a concentration of leading research institutions and medical professionals. Economic policies in these nations often favor the adoption of advanced medical technologies through dedicated funding streams and supportive regulatory pathways for novel therapies.

- Germany: Leads due to its advanced healthcare system, a high prevalence of cardiovascular diseases, and proactive adoption of new medical technologies. The country's strong economic standing also facilitates investment in R&D and market access initiatives. Reimbursement structures are generally favorable for evidence-based interventional procedures.

- United Kingdom: Benefits from the National Health Service (NHS) which, despite budgetary constraints, prioritizes evidence-based treatments and technological advancements. The presence of world-renowned research centers and a large patient pool contribute to its market significance.

- France & Italy: Exhibit strong growth driven by increasing awareness of hypertension management options and an aging population susceptible to cardiovascular issues. Investments in healthcare modernization and a growing base of interventional cardiologists further propel these markets.

Technology Segment Dominance:

The Radiofrequency-based technology segment is currently the most dominant within the Europe Renal Denervation Devices Industry. This dominance stems from its established track record, extensive clinical data generated over years of research and trials, and widespread physician familiarity with radiofrequency energy delivery in other cardiovascular interventions.

- Radiofrequency-based:

- Key Drivers: Extensive clinical evidence from trials like the SYMPLICITY HTN trials, established safety and efficacy profiles, familiarity among interventional cardiologists, and robust reimbursement support in many European countries.

- Dominance Analysis: The widespread availability of radiofrequency RDN systems and the significant body of peer-reviewed literature supporting its use have solidified its market leadership. Companies like Medtronic have heavily invested in developing and refining their radiofrequency-based systems, contributing to their widespread adoption. The procedural predictability and the ability to achieve consistent therapeutic outcomes are major advantages.

The Ultrasound-based technology segment is emerging as a significant contender, showcasing promising results in recent trials and offering potential advantages in terms of targeted nerve ablation and reduced risk of collateral damage. While currently holding a smaller market share than radiofrequency, its growth trajectory is steep.

- Ultrasound-based:

- Key Drivers: Potential for highly precise and targeted nerve ablation, lower risk of damage to surrounding renal artery structures, and novel mechanism of action that may overcome limitations of existing technologies.

- Dominance Analysis: This segment is gaining traction due to its innovative approach. Companies are actively conducting trials to gather data that supports its adoption. The ability to achieve denervation with potentially greater safety margins is a key selling point.

The Micro-infusion-based technology segment represents a nascent but promising area of development. These systems aim to deliver ablative agents directly to the renal nerves. While still in early stages of development and clinical validation, this segment holds the potential for disruptive innovation.

- Micro-infusion-based:

- Key Drivers: Novel approach to nerve ablation, potential for improved safety and efficacy profiles, and the possibility of treating a broader range of patients.

- Dominance Analysis: This segment is characterized by ongoing research and development. Its future market penetration will depend on the successful completion of clinical trials and demonstration of clear advantages over established technologies.

Europe Renal Denervation Devices Industry Product Innovations

Product innovations in the Europe Renal Denervation Devices Industry are primarily focused on enhancing the precision, safety, and efficacy of renal denervation procedures. Companies are developing systems with advanced imaging guidance, improved catheter designs for better anatomical targeting, and more sophisticated energy delivery mechanisms. The development of single-shot devices that can achieve denervation with a single application, as well as systems capable of performing multi-level denervation in a single procedure, represents a significant technological leap. These innovations aim to reduce procedure times, minimize invasiveness, and improve patient outcomes, thereby expanding the patient population eligible for RDN and enhancing its competitive advantage over alternative treatments.

Report Segmentation & Scope

This report segments the Europe Renal Denervation Devices Industry by technology. The primary segments analyzed are:

- Radiofrequency-based: This segment encompasses devices that utilize radiofrequency energy to ablate renal nerves. These systems have a significant market presence due to established clinical data and physician familiarity. Growth projections for this segment remain strong, driven by ongoing adoption and refinement of existing technologies.

- Ultrasound-based: This segment focuses on devices that employ ultrasound energy for renal nerve ablation. This is a rapidly growing segment with significant potential for future market share expansion, driven by its innovative approach to precision and safety.

- Micro-infusion-based: This segment represents emerging technologies that utilize micro-infusion of agents to achieve renal denervation. While currently a smaller segment, it holds promise for future innovation and market disruption.

The scope of this report covers the market size, growth trends, competitive landscape, and technological advancements within these segments across key European countries.

Key Drivers of Europe Renal Denervation Devices Industry Growth

The Europe Renal Denervation Devices Industry is propelled by several key growth drivers. The escalating global burden of resistant hypertension, a condition where blood pressure remains high despite the use of three or more antihypertensive medications, creates a substantial unmet medical need. Technological advancements, such as the development of more precise and user-friendly RDN devices, are making the procedure more attractive to both clinicians and patients. Favorable reimbursement policies in several European countries, coupled with increasing physician awareness and acceptance of RDN as a viable treatment option, are further accelerating market adoption. The growing body of clinical evidence from large-scale trials demonstrating the safety and efficacy of RDN in lowering blood pressure and reducing cardiovascular risk is a critical factor. Furthermore, the aging European population, which is more prone to chronic diseases like hypertension, contributes to an expanding patient pool.

Challenges in the Europe Renal Denervation Devices Industry Sector

Despite the promising growth, the Europe Renal Denervation Devices Industry faces several challenges. Regulatory hurdles remain a significant restraint, with stringent approval processes and the need for extensive clinical validation to demonstrate long-term safety and efficacy. The initial high cost of RDN procedures and devices can also pose a barrier to widespread adoption, particularly in healthcare systems with tighter budget constraints. Competition from established antihypertensive medications, which are often more affordable and widely prescribed, presents a persistent challenge. Furthermore, while clinical evidence is growing, ongoing research is needed to fully understand the long-term impact of RDN and to establish clear guidelines for patient selection. Supply chain complexities and the need for specialized training for interventionalists can also impact market penetration.

Leading Players in the Europe Renal Denervation Devices Industry Market

- Medtronic PLC

- Symple Surgical

- ReCor Medical Inc

- Terumo Corporation

- Boston Scientific Corporation

- Mercator MedSystems

- Abbott (St Jude Medical Inc )

- Cordis

Key Developments in Europe Renal Denervation Devices Industry Sector

- November 2022: Medtronic PLC, the Ireland-headquartered medical device company, submitted the final module of the renal denervation Symplicity Spyral Premarket Approval (PMA) package to the US FDA for review and approval.

- May 2022: Medtronic announced the data showcasing the benefits of the Symplicity Spyral Renal Denervation (RDN) system for managing blood pressure at the EuroPCR 2022.

Strategic Europe Renal Denervation Devices Industry Market Outlook

The strategic outlook for the Europe Renal Denervation Devices Industry is exceptionally positive, characterized by significant growth accelerators. The continued expansion of clinical evidence base, demonstrating superior efficacy and safety profiles of RDN compared to medical management alone for select patient groups, will be a primary growth driver. Favorable reimbursement decisions in key European markets are anticipated to unlock substantial market potential, driving increased procedural volumes. Strategic partnerships between RDN device manufacturers and healthcare providers will foster wider adoption and streamline patient pathways. Furthermore, ongoing technological innovations, particularly in the development of more refined and less invasive RDN systems, will broaden the applicability of the procedure and enhance its appeal. The shift towards value-based healthcare models in Europe also favors RDN, as it offers a potentially cost-effective solution for managing chronic hypertension and reducing long-term cardiovascular complications, thereby presenting a compelling opportunity for market expansion and leadership.

Europe Renal Denervation Devices Industry Segmentation

-

1. Technology

- 1.1. Radiofrequency-based

- 1.2. Ultrasound-based

- 1.3. Micro-infusion-based

Europe Renal Denervation Devices Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Renal Denervation Devices Industry Regional Market Share

Geographic Coverage of Europe Renal Denervation Devices Industry

Europe Renal Denervation Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Hypertension; Long Lasting Effect of the Procedure

- 3.3. Market Restrains

- 3.3.1. Painful Procedure; Stringent Approval Process for Renal Denervation Devices and Reimbursement Systems

- 3.4. Market Trends

- 3.4.1. The Ultrasound-based Segment is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Renal Denervation Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Radiofrequency-based

- 5.1.2. Ultrasound-based

- 5.1.3. Micro-infusion-based

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Germany

- 5.2.2. United Kingdom

- 5.2.3. France

- 5.2.4. Italy

- 5.2.5. Spain

- 5.2.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Germany Europe Renal Denervation Devices Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Radiofrequency-based

- 6.1.2. Ultrasound-based

- 6.1.3. Micro-infusion-based

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. United Kingdom Europe Renal Denervation Devices Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Radiofrequency-based

- 7.1.2. Ultrasound-based

- 7.1.3. Micro-infusion-based

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. France Europe Renal Denervation Devices Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Radiofrequency-based

- 8.1.2. Ultrasound-based

- 8.1.3. Micro-infusion-based

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Italy Europe Renal Denervation Devices Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Radiofrequency-based

- 9.1.2. Ultrasound-based

- 9.1.3. Micro-infusion-based

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Spain Europe Renal Denervation Devices Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Radiofrequency-based

- 10.1.2. Ultrasound-based

- 10.1.3. Micro-infusion-based

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Rest of Europe Europe Renal Denervation Devices Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 11.1.1. Radiofrequency-based

- 11.1.2. Ultrasound-based

- 11.1.3. Micro-infusion-based

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Medtronic PLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Symple Surgical

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 ReCor Medical Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Terumo Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Boston Scientific Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Mercator MedSystems

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Abbott (St Jude Medical Inc )

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Cordis

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Medtronic PLC

List of Figures

- Figure 1: Europe Renal Denervation Devices Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Renal Denervation Devices Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Renal Denervation Devices Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 2: Europe Renal Denervation Devices Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 3: Europe Renal Denervation Devices Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Europe Renal Denervation Devices Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 5: Europe Renal Denervation Devices Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 6: Europe Renal Denervation Devices Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 7: Europe Renal Denervation Devices Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Europe Renal Denervation Devices Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 9: Europe Renal Denervation Devices Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 10: Europe Renal Denervation Devices Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 11: Europe Renal Denervation Devices Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Europe Renal Denervation Devices Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 13: Europe Renal Denervation Devices Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 14: Europe Renal Denervation Devices Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 15: Europe Renal Denervation Devices Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Europe Renal Denervation Devices Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 17: Europe Renal Denervation Devices Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 18: Europe Renal Denervation Devices Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 19: Europe Renal Denervation Devices Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: Europe Renal Denervation Devices Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 21: Europe Renal Denervation Devices Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 22: Europe Renal Denervation Devices Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 23: Europe Renal Denervation Devices Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Europe Renal Denervation Devices Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Europe Renal Denervation Devices Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 26: Europe Renal Denervation Devices Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 27: Europe Renal Denervation Devices Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Europe Renal Denervation Devices Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Renal Denervation Devices Industry?

The projected CAGR is approximately 15.4%.

2. Which companies are prominent players in the Europe Renal Denervation Devices Industry?

Key companies in the market include Medtronic PLC, Symple Surgical, ReCor Medical Inc, Terumo Corporation, Boston Scientific Corporation, Mercator MedSystems, Abbott (St Jude Medical Inc ), Cordis.

3. What are the main segments of the Europe Renal Denervation Devices Industry?

The market segments include Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Hypertension; Long Lasting Effect of the Procedure.

6. What are the notable trends driving market growth?

The Ultrasound-based Segment is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Painful Procedure; Stringent Approval Process for Renal Denervation Devices and Reimbursement Systems.

8. Can you provide examples of recent developments in the market?

In November 2022, Medtronic PLC, the Ireland-headquartered medical device company, submitted the final module of the renal denervation Symplicity Spyral Premarket Approval (PMA) package to the US FDA for review and approval.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Renal Denervation Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Renal Denervation Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Renal Denervation Devices Industry?

To stay informed about further developments, trends, and reports in the Europe Renal Denervation Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence