Key Insights

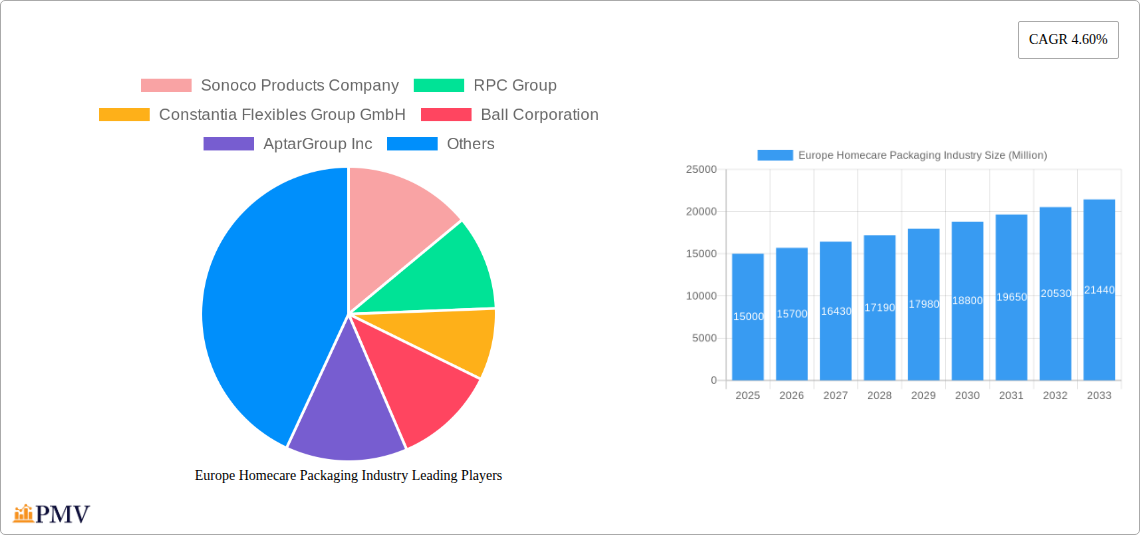

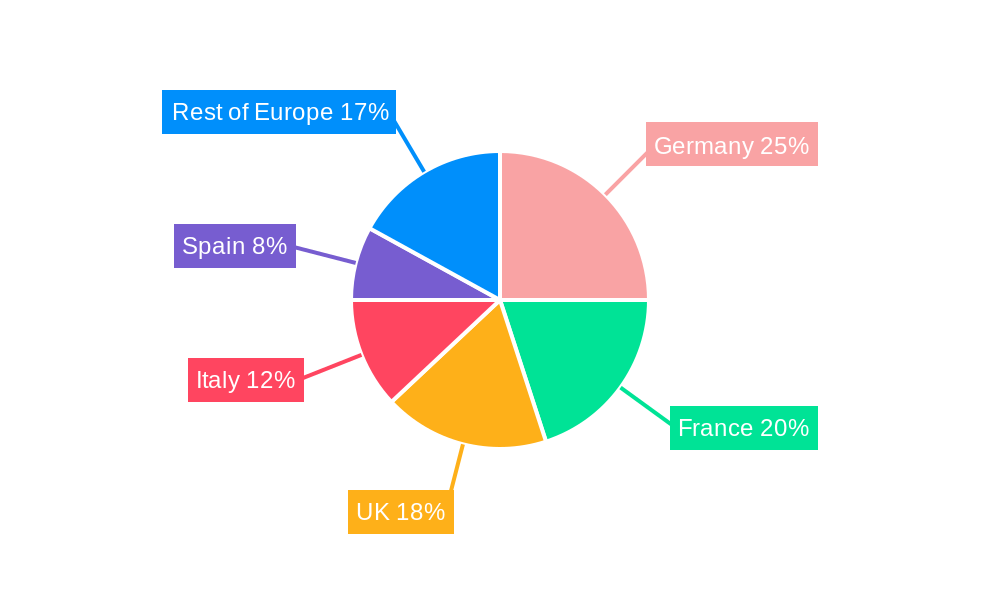

The European Homecare Packaging market, valued at approximately 20.3 billion in the base year 2025, is projected for substantial growth. Forecasted to expand at a compound annual growth rate (CAGR) of 0.4% from 2025 to 2033, this expansion is underpinned by increasing consumer demand for convenient and sustainable packaging. Eco-friendly materials such as recycled plastics and paper-based alternatives are gaining traction. The burgeoning e-commerce sector further fuels growth, necessitating protective and tamper-evident packaging solutions. Diverse homecare product segments, including dishwashing, laundry care, and personal toiletries, each require specialized packaging, creating avenues for innovation. Germany, France, and the UK represent the largest European markets, driven by high homecare product consumption and robust packaging industries. Growth is anticipated across all major European nations, influenced by evolving consumer preferences and regulatory mandates promoting sustainability.

Europe Homecare Packaging Industry Market Size (In Billion)

Competition is intense, with leading companies like Sonoco Products Company, RPC Group, and Amcor PLC focusing on material and design innovation to meet escalating consumer and environmental expectations. Market segmentation highlights significant opportunities. Plastic remains a dominant material due to its cost-effectiveness and versatility, though its environmental implications are driving the adoption of sustainable alternatives. Bottles and containers are the most common packaging types, followed by metal cans and cartons. The growing preference for convenience and smaller pack sizes significantly boosts the pouches segment, indicating considerable growth potential. While established players hold a dominant market share, smaller, specialized firms are carving out niches in sustainable and bespoke packaging solutions. Regulatory pressures concerning material recyclability and plastic reduction are actively reshaping the industry, encouraging investment in innovative, eco-friendly packaging technologies. The long-term outlook suggests a continued upward trajectory, subject to economic influences and global supply chain dynamics.

Europe Homecare Packaging Industry Company Market Share

Europe Homecare Packaging Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe homecare packaging industry, offering invaluable insights for businesses operating within this dynamic sector. The study period covers 2019-2033, with 2025 as the base and estimated year. The report forecasts market trends from 2025-2033, building upon historical data from 2019-2024. The market value is expressed in Millions throughout the report.

Europe Homecare Packaging Industry Market Structure & Competitive Dynamics

The European homecare packaging market exhibits a moderately concentrated structure, with several multinational corporations holding significant market share. Key players such as Sonoco Products Company, RPC Group, Constantia Flexibles Group GmbH, Ball Corporation, AptarGroup Inc, DS Smith PLC, Winpak Ltd, Amcor PLC, Can-Pack SA, Silgan Holdings, and ProAmpac (list not exhaustive) compete intensely, driving innovation and influencing pricing strategies. Market share analysis reveals that the top five players collectively account for approximately xx% of the total market revenue in 2025, while fragmentation is seen amongst smaller niche players. The innovation ecosystem is active, with companies investing heavily in Research & Development to develop sustainable and functional packaging solutions. Regulatory frameworks, particularly those focusing on sustainability and recyclability, are increasingly influencing packaging material choices and production processes. Significant M&A activity has also been observed, with deal values exceeding xx Million in the past five years. Examples include [Insert Specific M&A examples with deal values if available, otherwise use "Several strategic acquisitions and mergers have reshaped the competitive landscape"]. Consumer preference towards sustainable packaging is a key trend impacting material choices, favoring eco-friendly alternatives.

Europe Homecare Packaging Industry Industry Trends & Insights

The European homecare packaging market is experiencing robust growth, driven by factors such as increasing demand for convenient and user-friendly homecare products, rising disposable incomes, and changing consumer preferences. Technological advancements, such as the adoption of lightweighting techniques and smart packaging solutions, are further contributing to market expansion. The market is expected to achieve a CAGR of xx% during the forecast period (2025-2033). Consumer preferences are shifting towards sustainable and recyclable packaging, creating opportunities for companies offering eco-friendly alternatives. This trend is further fueled by stringent environmental regulations and growing consumer awareness about environmental issues. Market penetration of sustainable packaging materials like recycled plastics and paperboard is steadily increasing, with a projected xx% penetration by 2033. Intense competition among leading players continues to drive innovation and improve product quality and efficiency.

Dominant Markets & Segments in Europe Homecare Packaging Industry

The United Kingdom, Germany, and France represent the largest markets for homecare packaging in Europe, collectively accounting for approximately xx% of the total market revenue in 2025.

- Key Drivers for UK Dominance: Strong homecare industry, well-established infrastructure, and high consumer spending.

- Key Drivers for Germany Dominance: Large and mature homecare market, significant manufacturing capabilities, and robust supply chains.

- Key Drivers for France Dominance: High consumer demand for premium homecare products, and significant presence of major homecare brands.

The plastic segment dominates the material market, driven by its versatility and cost-effectiveness. However, increasing environmental concerns are boosting the growth of paper-based and other sustainable packaging alternatives. Bottles and containers remain the most widely used packaging type, but pouches and cartons are experiencing significant growth due to their lightweight nature and ease of use. The toiletries segment accounts for the largest share of product demand, followed by laundry care and dishwashing. Growth in all these segments is projected to be driven by factors such as population growth, increasing urbanization, and rising disposable incomes across different European countries.

Europe Homecare Packaging Industry Product Innovations

Recent product innovations include the development of lightweight, recyclable, and sustainable packaging solutions, responding to both environmental concerns and consumer preferences. Advances in barrier technologies ensure product protection, while smart packaging features enhance consumer experience. These innovations cater to the rising demand for environmentally conscious solutions, improving market fit and providing competitive advantages.

Report Segmentation & Scope

The report segments the European homecare packaging market by material (plastic, paper, metal, glass), type (bottles and containers, metal cans, cartons, pouches, other types), product (dishwashing, insecticides, laundry care, toiletries, polishes, air care, other products), and country (United Kingdom, France, Germany, Italy, Spain, Rest of Europe). Each segment’s growth projections, market size, and competitive dynamics are extensively analyzed, offering a granular understanding of the market landscape. For example, the plastic segment is projected to experience a CAGR of xx% during the forecast period, driven by its versatility and cost-effectiveness. However, the growth of the paper and other sustainable materials is expected to increase at a higher CAGR of xx% due to the environmental concerns.

Key Drivers of Europe Homecare Packaging Industry Growth

Growth in the European homecare packaging industry is driven by several key factors, including:

- Rising consumer demand for convenient and user-friendly homecare products: This is fueled by factors such as increasing disposable incomes and changing lifestyles.

- Growing awareness of sustainability issues: This is pushing companies to invest in eco-friendly packaging materials and technologies.

- Stringent environmental regulations: These regulations are motivating companies to reduce their environmental footprint and adopt sustainable packaging practices.

- Technological advancements: These advancements are leading to the development of more efficient and cost-effective packaging solutions.

Challenges in the Europe Homecare Packaging Industry Sector

The European homecare packaging industry faces several challenges, including:

- Fluctuating raw material prices: These price fluctuations can significantly impact the profitability of packaging manufacturers.

- Stringent environmental regulations: While driving innovation, these regulations also increase compliance costs for companies.

- Intense competition: The market is characterized by intense competition, requiring companies to constantly innovate and improve their offerings.

- Supply chain disruptions: Global events can cause significant disruptions to supply chains, leading to production delays and increased costs.

Leading Players in the Europe Homecare Packaging Industry Market

Key Developments in Europe Homecare Packaging Industry Sector

- March 2021: Dettol (Reckitt) launched a hygiene standards improvement program in partnership with CleanedUp, impacting demand for sanitizing solution packaging.

- May 2021: Unilever announced plans to convert its global toothpaste portfolio to recyclable tubes by 2025, driving demand for sustainable packaging solutions and collaborations with manufacturers like Amcor and EPL.

Strategic Europe Homecare Packaging Industry Market Outlook

The European homecare packaging market presents significant growth potential driven by the continued demand for innovative and sustainable packaging solutions. Opportunities exist for companies focusing on eco-friendly materials, lightweighting technologies, and smart packaging features. Strategic partnerships and collaborations within the industry will further accelerate innovation and market expansion. Companies that adapt to evolving consumer preferences and regulatory requirements are poised for success in this dynamic market.

Europe Homecare Packaging Industry Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Paper

- 1.3. Metal

- 1.4. Glass

-

2. Type

- 2.1. Bottles and Containers

- 2.2. Metal Cans

- 2.3. Cartons

- 2.4. Pouches

- 2.5. Other Types

-

3. Products

- 3.1. Dishwashing

- 3.2. Insecticides

- 3.3. Laundry Care

- 3.4. Toiletries

- 3.5. Polishes

- 3.6. Air Care

- 3.7. Other Products

Europe Homecare Packaging Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Homecare Packaging Industry Regional Market Share

Geographic Coverage of Europe Homecare Packaging Industry

Europe Homecare Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Product Innovation

- 3.2.2 Differentiation

- 3.2.3 and Branding; Rising Per Capita Income Positively Impacting the Purchase Power

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Plastic Material is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Homecare Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Paper

- 5.1.3. Metal

- 5.1.4. Glass

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Bottles and Containers

- 5.2.2. Metal Cans

- 5.2.3. Cartons

- 5.2.4. Pouches

- 5.2.5. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Products

- 5.3.1. Dishwashing

- 5.3.2. Insecticides

- 5.3.3. Laundry Care

- 5.3.4. Toiletries

- 5.3.5. Polishes

- 5.3.6. Air Care

- 5.3.7. Other Products

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sonoco Products Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 RPC Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Constantia Flexibles Group GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ball Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AptarGroup Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DS Smith PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Winpak Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amcor PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Can-Pack SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Silgan Holdings

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 ProAmpac*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Sonoco Products Company

List of Figures

- Figure 1: Europe Homecare Packaging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Homecare Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Homecare Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 2: Europe Homecare Packaging Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Europe Homecare Packaging Industry Revenue billion Forecast, by Products 2020 & 2033

- Table 4: Europe Homecare Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Homecare Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 6: Europe Homecare Packaging Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Europe Homecare Packaging Industry Revenue billion Forecast, by Products 2020 & 2033

- Table 8: Europe Homecare Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Homecare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Homecare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Homecare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Homecare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Homecare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Homecare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Homecare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Homecare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Homecare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Homecare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Homecare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Homecare Packaging Industry?

The projected CAGR is approximately 0.4%.

2. Which companies are prominent players in the Europe Homecare Packaging Industry?

Key companies in the market include Sonoco Products Company, RPC Group, Constantia Flexibles Group GmbH, Ball Corporation, AptarGroup Inc, DS Smith PLC, Winpak Ltd, Amcor PLC, Can-Pack SA, Silgan Holdings, ProAmpac*List Not Exhaustive.

3. What are the main segments of the Europe Homecare Packaging Industry?

The market segments include Material, Type, Products.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Product Innovation. Differentiation. and Branding; Rising Per Capita Income Positively Impacting the Purchase Power.

6. What are the notable trends driving market growth?

Plastic Material is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

March 2021 - Dettol (Reckitt) announced the launch of a new program to help businesses raise hygiene standards when they reopen in partnership with CleanedUp, which is known to supply simple and easy to install sanitizing solutions. The new partnership will offer businesses access to hygiene products, freehand sanitizer or wipe dispensers, and enhanced cleaning training materials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Homecare Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Homecare Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Homecare Packaging Industry?

To stay informed about further developments, trends, and reports in the Europe Homecare Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence