Key Insights

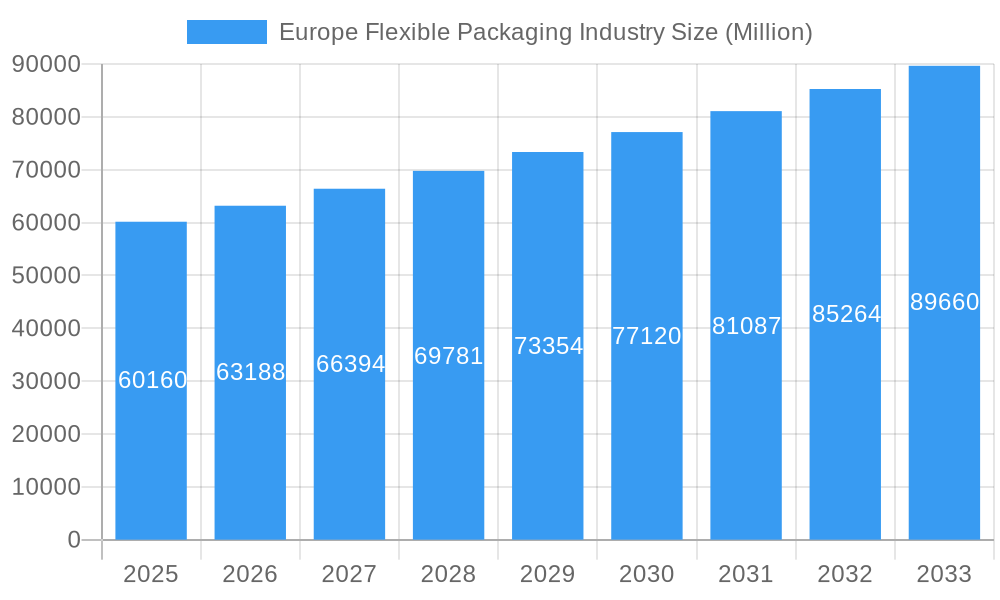

The European flexible packaging market, valued at €60.16 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.01% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for convenient and lightweight packaging solutions across diverse sectors like food and beverages, healthcare, and cosmetics fuels market growth. Furthermore, the rising adoption of sustainable and eco-friendly packaging materials, such as biodegradable polymers and recycled content, is a significant trend shaping the market landscape. Consumer preference for extended shelf life and improved product preservation also contribute to the market's expansion. However, fluctuating raw material prices and stringent regulatory compliance requirements pose challenges to the industry's growth trajectory. The market segmentation reveals a strong preference for Polyethene (PE) and Biaxially Oriented Polypropylene (BOPP) materials, with pouches and bags representing the dominant product types. Western Europe, particularly Germany, France, and the UK, holds a significant market share, although Eastern and Central Europe are emerging as promising growth regions. Competitive dynamics are shaped by a mix of multinational giants and regional players, each striving to innovate and capture market share through product diversification and strategic partnerships.

Europe Flexible Packaging Industry Market Size (In Billion)

The market's future hinges on overcoming several restraints. Fluctuations in oil prices directly impact the cost of plastic-based packaging materials, affecting profitability. Additionally, the industry faces increasing pressure to adopt sustainable practices and minimize environmental impact. This includes reducing plastic waste through improved recycling infrastructure and developing innovative biodegradable alternatives. Overcoming these challenges will require collaborative efforts across the value chain, including material suppliers, packaging converters, and brand owners, focusing on developing more eco-conscious and cost-effective solutions. The successful integration of advanced technologies like smart packaging and improved traceability systems will further contribute to growth in the coming years. The European flexible packaging market presents a compelling investment opportunity, given its strong growth prospects, but success will be contingent upon effective adaptation to the evolving regulatory landscape and sustainability concerns.

Europe Flexible Packaging Industry Company Market Share

Europe Flexible Packaging Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe flexible packaging industry, offering valuable insights for businesses, investors, and stakeholders. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth prospects. The study encompasses detailed segmentation by material type, product type, end-user verticals, and geography, offering granular data and actionable intelligence for informed decision-making. The report is structured to provide clear, concise information, avoiding placeholders and utilizing predicted values where necessary. The total market size is predicted to reach xx Million by 2033.

Europe Flexible Packaging Industry Market Structure & Competitive Dynamics

The European flexible packaging market exhibits a moderately consolidated structure, with a few large multinational players and numerous smaller regional companies. Market share is heavily influenced by M&A activity, with larger corporations consistently seeking to expand their product portfolios and geographic reach. The market concentration ratio (CR5) is estimated at xx%, indicating a moderate level of competition. Innovation ecosystems are crucial, with leading companies investing heavily in R&D to develop sustainable and technologically advanced packaging solutions. Regulatory frameworks, particularly concerning sustainability and food safety, significantly influence the industry. The increasing demand for eco-friendly alternatives to traditional plastics is driving innovation in biodegradable and compostable materials. Product substitution is evident, with a notable shift towards sustainable packaging materials and reusable options. Consumer trends increasingly favor convenience, tamper-evidence, and sustainability, creating new opportunities for flexible packaging companies. Significant M&A activity has shaped the market landscape, with deal values ranging from xx Million to xx Million in recent years. Examples include:

- Amcor's acquisition of Bemis Company (xx Million)

- Berry Global's expansion through strategic investments (xx Million)

Europe Flexible Packaging Industry Industry Trends & Insights

The European flexible packaging market is experiencing robust growth, driven by several key factors. The CAGR from 2019 to 2024 is estimated at xx%, and this growth is projected to continue at a xx% CAGR from 2025 to 2033. This growth is fueled by increasing demand across various end-use sectors, particularly food and beverages, healthcare, and cosmetics. Technological advancements, such as the development of advanced barrier films and sustainable materials, are further propelling market expansion. The rising adoption of e-commerce is also significantly contributing to market growth, due to the increased demand for convenient and protective packaging. Consumer preferences are shifting towards sustainable, recyclable, and convenient packaging solutions, putting pressure on manufacturers to adapt. Furthermore, the intense competition among key players is driving innovation and efficiency gains. Market penetration of sustainable flexible packaging is estimated at xx% and is anticipated to increase significantly by 2033.

Dominant Markets & Segments in Europe Flexible Packaging Industry

The food segment dominates the European flexible packaging market, with beverages and other food products representing the largest sub-segments. Within the geographical regions, Western Europe holds the largest market share, driven by high consumption levels and strong industrial presence. However, Eastern and Central Europe are witnessing significant growth, due to rising disposable incomes and expanding consumer base. By material type, Polyethene (PE) and Biaxially Oriented Polypropylene (BOPP) are the most widely used materials, reflecting their cost-effectiveness and versatility.

Key Drivers for Western Europe Dominance:

- Established manufacturing base

- Strong consumer demand

- High per capita consumption

- Well-developed infrastructure

- Favorable economic policies

Key Drivers for Growth in Eastern and Central Europe:

- Rising disposable incomes

- Expanding middle class

- Increasing demand for packaged goods

- Government initiatives to boost food processing and packaging industries

- Foreign investments

Pouches (stand-up, retort, and flat) represent the most popular product type, due to their versatility and convenience. The dominance of these segments stems from several factors, including their suitability for a wide range of products, convenience for consumers, and their cost-effectiveness for manufacturers.

Europe Flexible Packaging Industry Product Innovations

Significant advancements are occurring in flexible packaging materials, focusing on sustainability and enhanced barrier properties. Bio-based and compostable films are gaining traction, as are recyclable mono-material structures. Innovations also encompass active and intelligent packaging solutions, which offer improved food preservation and enhanced consumer experience. These advancements cater to the rising demand for sustainable packaging and ensure product integrity throughout the supply chain.

Report Segmentation & Scope

This report segments the Europe flexible packaging market across various dimensions, providing detailed analysis of each segment:

By End-user Verticals: Food (Beverage, Other Food Products), Healthcare and Pharmaceuticals, Cosmetics and Personal Care, Other End-user Verticals. Growth projections vary by sector, with food and beverage expected to maintain the highest growth rates. Competition is intense in each segment, driven by both established players and emerging innovators.

By Country: Western Europe (including key countries such as Germany, France, UK, Italy, and Spain), Eastern and Central Europe (including Poland, Czech Republic, and others). Market size varies significantly between these regions, with Western Europe holding a significant lead.

By Material Type: Polyethene (PE), Biaxially Oriented Polypropylene (BOPP), Cast Polypropylene (CPP), Polyvinyl Chloride (PVC), PET, Other Material Types (EVOH, EVA, PA, etc.). Material choice depends on the application and desired properties.

By Product Type: Pouches (Retort, Stand-up, Flat), Bags (Gusseted, Wicketed), Packaging Films, Other Product Types. Product type innovation is largely driven by improving sustainability, barrier performance, and convenience.

Key Drivers of Europe Flexible Packaging Industry Growth

Growth in the European flexible packaging market is propelled by a confluence of factors: the increasing demand for packaged goods across diverse sectors, the rise of e-commerce, and the growing focus on convenience and sustainability. Technological advancements, such as the development of biodegradable and compostable materials, are further contributing to market expansion. Favorable regulatory frameworks promoting recycling and reducing plastic waste create an environment for growth in the sector.

Challenges in the Europe Flexible Packaging Industry Sector

The European flexible packaging industry faces several challenges, including stringent environmental regulations and rising raw material costs. Supply chain disruptions and increasing competition from low-cost producers in Asia pose significant threats. Fluctuations in oil prices impact the cost of polymers, affecting profitability. Addressing these challenges necessitates strategic planning and adaptation by industry players.

Leading Players in the Europe Flexible Packaging Industry Market

- UFlex Limited

- Bak Ambalaj

- Gualapack SpA

- Di Mauro Flexible Packaging

- Bischof + Klein SE & Co KG

- CDM Packaging

- Schur Flexible

- Wipak Oy

- Mondi Group

- Danaflex Group

- Amcor PLC

- BERRY GLOBAL INC

- Aluflexpack Group

- Treofan group (Bc Jindal)

- Coveris Holdings

- Cellografica Gerosa SpA

- Constantia Flexibles

- ProAmpac LLC

- Sipospack

- Huhtamaki Oyj

- ePac Holdings LLC

- AL INVEST BA

Key Developments in Europe Flexible Packaging Industry Sector

April 2023: Berry Global announces the development of its International Center of Excellence and Circular Innovation Hub in Barcelona, Spain, focusing on sustainable packaging solutions. This signifies a major investment in sustainable innovation within the European market.

April 2022: Mondi launches new recyclable packaging solutions for the food industry at AnugaFoodTec, showcasing its commitment to sustainability and reducing food waste. This underlines the industry's increasing focus on eco-friendly practices.

Strategic Europe Flexible Packaging Industry Market Outlook

The European flexible packaging market presents significant growth opportunities, driven by sustainable packaging innovation and the rising demand for convenient and eco-friendly solutions. Strategic investments in R&D, focusing on sustainable materials and advanced technologies, will be crucial for success. Companies that can effectively address consumer demand for sustainable and convenient packaging while maintaining cost-efficiency are poised for significant growth in the coming years.

Europe Flexible Packaging Industry Segmentation

-

1. Material Type

- 1.1. Polyethene (PE)

- 1.2. Biaxially Oriented Polypropylene (BOPP)

- 1.3. Cast Polypropylene (CPP)

- 1.4. Polyvinyl Chloride (PVC)

- 1.5. PET

- 1.6. Other Material Types (EVOH, EVA, PA, etc.)

-

2. Product Type

- 2.1. Pouches

- 2.2. Bags (Gusseted and Wicketed)

-

2.3. Packaging Films

- 2.3.1. PE-based

- 2.3.2. BOPET

- 2.3.3. CPP and BOPP

- 2.3.4. PVC

- 2.3.5. Other Film Types

- 2.4. Other Product Types

-

3. End-user Verticals

-

3.1. Food

- 3.1.1. Frozen Food

- 3.1.2. Dairy Products

- 3.1.3. Fruits and Vegetables

- 3.1.4. Other Food Products

- 3.2. Beverage

- 3.3. Healthcare and Pharmaceuticals

- 3.4. Cosmetics and Personal Care

- 3.5. Other End-user verticals

-

3.1. Food

Europe Flexible Packaging Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Flexible Packaging Industry Regional Market Share

Geographic Coverage of Europe Flexible Packaging Industry

Europe Flexible Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Steady Rise in Demand for Processed Food; Move Toward Light Weighting Expected to Spur Volume Demand

- 3.3. Market Restrains

- 3.3.1. Dynamic Nature of Regulations in the Region

- 3.4. Market Trends

- 3.4.1. Food Segment is Expected to Drive the Flexible Packaging Market in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Flexible Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Polyethene (PE)

- 5.1.2. Biaxially Oriented Polypropylene (BOPP)

- 5.1.3. Cast Polypropylene (CPP)

- 5.1.4. Polyvinyl Chloride (PVC)

- 5.1.5. PET

- 5.1.6. Other Material Types (EVOH, EVA, PA, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches

- 5.2.2. Bags (Gusseted and Wicketed)

- 5.2.3. Packaging Films

- 5.2.3.1. PE-based

- 5.2.3.2. BOPET

- 5.2.3.3. CPP and BOPP

- 5.2.3.4. PVC

- 5.2.3.5. Other Film Types

- 5.2.4. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Verticals

- 5.3.1. Food

- 5.3.1.1. Frozen Food

- 5.3.1.2. Dairy Products

- 5.3.1.3. Fruits and Vegetables

- 5.3.1.4. Other Food Products

- 5.3.2. Beverage

- 5.3.3. Healthcare and Pharmaceuticals

- 5.3.4. Cosmetics and Personal Care

- 5.3.5. Other End-user verticals

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 UFlex Limited*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bak Ambalaj

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gualapack SpA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Di Mauro Flexible Packaging

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bischof + Klein SE & Co KG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CDM Packaging

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schur Flexible

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wipak Oy

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mondi Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Danaflex Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Amcor PLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 BERRY GLOBAL INC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Aluflexpack Group

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Treofan group (Bc Jindal)

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Coveris Holdings

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Cellografica Gerosa SpA

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Constantia Flexibles

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 ProAmpac LLC

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Sipospack

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Huhtamaki Oyj

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 ePac Holdings LLC

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 AL INVEST BA

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.1 UFlex Limited*List Not Exhaustive

List of Figures

- Figure 1: Europe Flexible Packaging Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Flexible Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Flexible Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Europe Flexible Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Europe Flexible Packaging Industry Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 4: Europe Flexible Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Flexible Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 6: Europe Flexible Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Europe Flexible Packaging Industry Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 8: Europe Flexible Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Flexible Packaging Industry?

The projected CAGR is approximately 5.01%.

2. Which companies are prominent players in the Europe Flexible Packaging Industry?

Key companies in the market include UFlex Limited*List Not Exhaustive, Bak Ambalaj, Gualapack SpA, Di Mauro Flexible Packaging, Bischof + Klein SE & Co KG, CDM Packaging, Schur Flexible, Wipak Oy, Mondi Group, Danaflex Group, Amcor PLC, BERRY GLOBAL INC, Aluflexpack Group, Treofan group (Bc Jindal), Coveris Holdings, Cellografica Gerosa SpA, Constantia Flexibles, ProAmpac LLC, Sipospack, Huhtamaki Oyj, ePac Holdings LLC, AL INVEST BA.

3. What are the main segments of the Europe Flexible Packaging Industry?

The market segments include Material Type, Product Type, End-user Verticals.

4. Can you provide details about the market size?

The market size is estimated to be USD 60.16 Million as of 2022.

5. What are some drivers contributing to market growth?

Steady Rise in Demand for Processed Food; Move Toward Light Weighting Expected to Spur Volume Demand.

6. What are the notable trends driving market growth?

Food Segment is Expected to Drive the Flexible Packaging Market in the Region.

7. Are there any restraints impacting market growth?

Dynamic Nature of Regulations in the Region.

8. Can you provide examples of recent developments in the market?

April 2023 - The ability to access innovative, sustainable packaging solutions is more important than ever as customers worldwide strive to shift to a circular, net-zero economy. Berry Global, which designs and produces innovative, sustainable packaging solutions, will begin developing its International Center of Excellence and Circular Innovation Hub in Barcelona, Spain, as early as the third quarter of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Flexible Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Flexible Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Flexible Packaging Industry?

To stay informed about further developments, trends, and reports in the Europe Flexible Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence