Key Insights

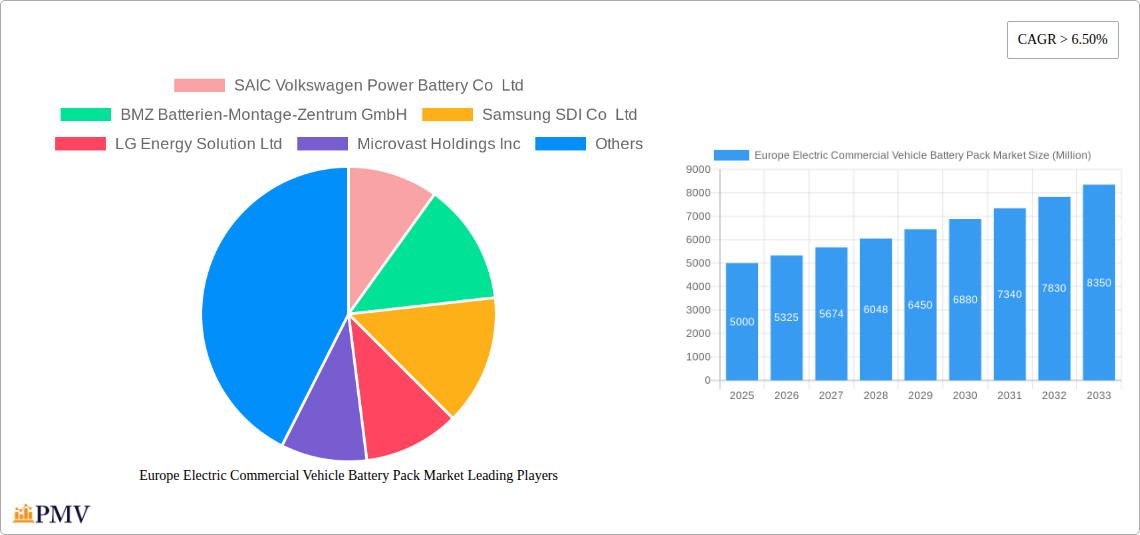

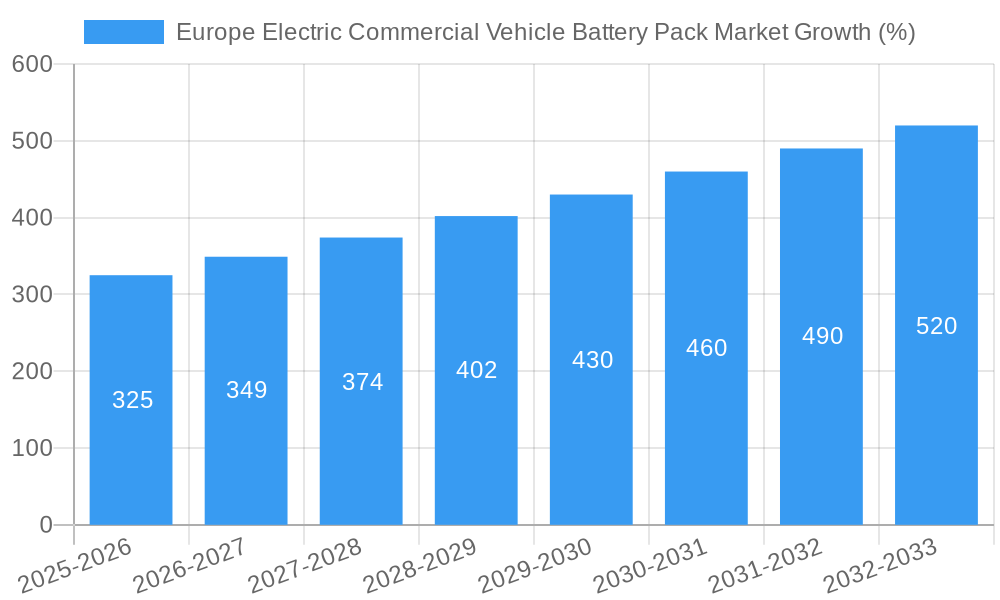

The European electric commercial vehicle (ECV) battery pack market is experiencing robust growth, driven by stringent emission regulations, increasing environmental awareness, and government incentives promoting electric mobility. The market, estimated at €XX million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) exceeding 6.5% from 2025 to 2033. Several factors contribute to this expansion. The burgeoning adoption of Battery Electric Vehicles (BEVs) across various commercial segments—buses, light commercial vehicles (LCVs), and medium & heavy-duty trucks (M&HDT)—is a primary driver. Technological advancements in battery chemistry, particularly the increasing prevalence of Lithium Iron Phosphate (LFP) and Nickel Manganese Cobalt (NMC) batteries offering improved energy density and cost-effectiveness, are further fueling market growth. Furthermore, the expanding charging infrastructure and evolving battery management systems (BMS) are enhancing the practicality and appeal of ECVs, supporting market expansion. Different battery capacities cater to diverse vehicle needs, with the 40 kWh to 80 kWh segment expected to dominate due to its balance of range and cost. Leading battery pack manufacturers like CATL, LG Energy Solution, and Samsung SDI are strategically investing in European production facilities to meet the surging demand, while companies like BMZ and Akasol are focusing on niche segments. Germany, France, and the UK represent key markets within Europe, benefiting from substantial government support and a well-established automotive industry.

However, challenges remain. High initial costs associated with ECVs and battery packs continue to hinder widespread adoption, particularly amongst smaller businesses. The availability and cost of critical raw materials, such as lithium and cobalt, pose potential supply chain disruptions and price volatility. Furthermore, concerns surrounding battery lifecycle management and recycling need to be addressed to ensure the long-term sustainability of the ECV battery pack market. Despite these restraints, the long-term outlook for the European ECV battery pack market remains positive, driven by technological innovation, supportive policies, and the growing need for sustainable transportation solutions. The market segmentation across battery chemistry (LFP, NCA, NMC), capacity (kWh ranges), form factor (cylindrical, pouch, prismatic), vehicle type (bus, LCV, M&HDT), and propulsion type (BEV, PHEV) provides ample opportunities for specialized players to thrive. Continued research and development in areas like solid-state batteries will further shape this dynamic and expanding market.

Europe Electric Commercial Vehicle Battery Pack Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Electric Commercial Vehicle Battery Pack Market, offering valuable insights for stakeholders across the EV value chain. The study covers the period 2019-2033, with a focus on the 2025-2033 forecast period and detailed analysis of the 2019-2024 historical period. The base year for the analysis is 2025. The report segments the market by battery chemistry, capacity, form factor, body type, propulsion type, manufacturing method, components, material type, and country, providing a granular understanding of market dynamics. Key players such as SAIC Volkswagen Power Battery Co Ltd, BMZ Batterien-Montage-Zentrum GmbH, Samsung SDI Co Ltd, and others are profiled, highlighting their strategies and market positions. The report projects a xx Million market value by 2033, presenting a compelling investment opportunity.

Europe Electric Commercial Vehicle Battery Pack Market Structure & Competitive Dynamics

The European electric commercial vehicle battery pack market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. However, the landscape is dynamic, characterized by ongoing innovation, strategic partnerships, and mergers and acquisitions (M&A) activity. Leading players are investing heavily in R&D, focusing on advancements in battery chemistry (like LFP, NCA, NCM, and NMC) to improve energy density, lifespan, and safety. Stringent regulatory frameworks, particularly concerning emissions and sustainability, are driving the adoption of electric commercial vehicles and, consequently, the demand for battery packs. The market is also witnessing increased competition from new entrants, particularly in the battery cell manufacturing segment.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025, indicating a moderately consolidated market.

- Innovation Ecosystems: Strong collaborations between battery manufacturers, vehicle OEMs, and material suppliers are driving innovation in battery technology.

- Regulatory Frameworks: EU regulations on CO2 emissions are significantly influencing the growth of the electric commercial vehicle market.

- Product Substitutes: While battery packs currently dominate, alternative energy storage technologies are being explored, although they represent a minor threat at present.

- End-User Trends: The increasing preference for electric commercial vehicles due to lower operating costs and environmental concerns is a key growth driver.

- M&A Activity: The past five years have witnessed several significant M&A deals, totaling an estimated xx Million in value, reflecting the industry's consolidation trend. Examples include (mention specific deals if available, otherwise indicate "specific deal data unavailable").

Europe Electric Commercial Vehicle Battery Pack Market Industry Trends & Insights

The European electric commercial vehicle battery pack market is experiencing robust growth, driven by a confluence of factors. The rising adoption of electric buses, light commercial vehicles (LCVs), and medium & heavy-duty trucks (M&HDTs) is a primary growth driver. Government incentives and supportive policies aimed at reducing carbon emissions are further accelerating market expansion. Technological advancements, particularly in battery chemistry and cell design (e.g., cylindrical, pouch, prismatic), are improving battery performance and reducing costs. However, challenges remain, including the availability of raw materials, supply chain complexities, and the need for improved charging infrastructure. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. Increased consumer awareness of environmental issues and the total cost of ownership advantages of EVs also contribute to market growth.

Dominant Markets & Segments in Europe Electric Commercial Vehicle Battery Pack Market

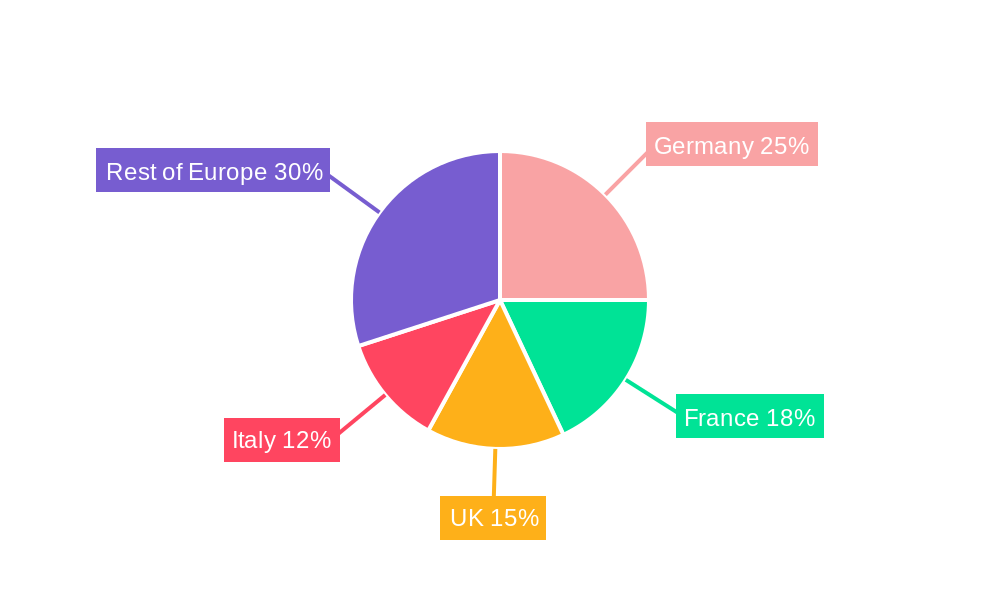

The German market currently holds the largest share of the European electric commercial vehicle battery pack market, driven by a robust automotive industry and strong government support for electric vehicle adoption. However, other countries like France, the UK, and the Nordic countries are experiencing rapid growth.

- Leading Region: Germany

- Key Drivers (Germany):

- Strong automotive industry presence.

- Government incentives and subsidies for electric vehicle adoption.

- Well-developed charging infrastructure.

- Leading Segments:

- Battery Chemistry: NMC and NCM are dominant, due to their high energy density.

- Capacity: The 40 kWh to 80 kWh segment is the largest, driven by the increasing demand for longer-range electric commercial vehicles.

- Battery Form: Prismatic battery packs dominate, due to their suitability for large-scale applications in commercial vehicles.

- Body Type: Buses are the currently the largest segment, followed by LCVs and M&HDTs which are projected to experience strong growth.

- Propulsion Type: BEVs represent the major share, though PHEVs are also gaining traction.

Detailed dominance analysis for other segments would follow a similar structure, comparing market share and growth drivers within each category (Battery Chemistry, Capacity, etc.).

Europe Electric Commercial Vehicle Battery Pack Market Product Innovations

Recent innovations focus on improving energy density, reducing cost, and enhancing safety. Advancements in battery chemistry (e.g., solid-state batteries), thermal management systems, and battery management systems (BMS) are driving improvements in battery performance and lifespan. The development of modular battery packs enables flexible configurations to suit diverse vehicle applications. The focus on sustainable materials and manufacturing processes is gaining momentum, reflecting growing concerns about environmental impact.

Report Segmentation & Scope

This report segments the Europe Electric Commercial Vehicle Battery Pack Market extensively:

- Battery Chemistry: LFP, NCA, NCM, NMC, Others (Growth projections and market size for each chemistry will be detailed in the full report)

- Capacity: Less than 15 kWh, 15 kWh to 40 kWh, 40 kWh to 80 kWh, Above 80 kWh (Growth projections and market size for each capacity range will be detailed in the full report)

- Battery Form: Cylindrical, Pouch, Prismatic (Growth projections and market size for each form factor will be detailed in the full report)

- Body Type: Bus, LCV, M&HDT (Growth projections and market size for each body type will be detailed in the full report)

- Propulsion Type: BEV, PHEV (Growth projections and market size for each propulsion type will be detailed in the full report)

- Method: Laser, Wire (Growth projections and market size for each method will be detailed in the full report)

- Component: Anode, Cathode, Electrolyte, Separator (Growth projections and market size for each component will be detailed in the full report)

- Material Type: Cobalt, Lithium, Manganese, Natural Graphite, Nickel, Other Materials (Growth projections and market size for each material type will be detailed in the full report)

- Country: France, Germany, Hungary, Italy, Poland, Sweden, UK, Rest-of-Europe (Growth projections and market size for each country will be detailed in the full report)

Key Drivers of Europe Electric Commercial Vehicle Battery Pack Market Growth

Several factors are propelling the growth of the European electric commercial vehicle battery pack market. These include:

- Stringent Emission Regulations: EU regulations are pushing for the adoption of cleaner vehicles.

- Government Incentives: Subsidies and tax breaks are making electric commercial vehicles more affordable.

- Technological Advancements: Improvements in battery technology are leading to better performance and lower costs.

- Growing Environmental Awareness: Increased consumer awareness of environmental issues is promoting the adoption of EVs.

Challenges in the Europe Electric Commercial Vehicle Battery Pack Market Sector

Despite the positive growth outlook, challenges persist:

- Raw Material Supply Chain Disruptions: The availability of critical materials like lithium and cobalt presents a significant challenge.

- High Initial Investment Costs: The high upfront cost of electric commercial vehicles remains a barrier for some operators.

- Limited Charging Infrastructure: The lack of sufficient charging infrastructure in some regions hinders wider adoption.

- Battery Lifespan and Degradation: Ensuring sufficient battery lifespan and managing degradation remain concerns.

Leading Players in the Europe Electric Commercial Vehicle Battery Pack Market Market

- SAIC Volkswagen Power Battery Co Ltd

- BMZ Batterien-Montage-Zentrum GmbH

- Samsung SDI Co Ltd

- LG Energy Solution Ltd

- Microvast Holdings Inc

- TOSHIBA Corp

- Contemporary Amperex Technology Co Ltd (CATL)

- Akasol AG

- BYD Company Ltd

- SK Innovation Co Ltd

- Panasonic Holdings Corporation

- NorthVolt AB

- SVOLT Energy Technology Co Ltd (SVOLT)

Key Developments in Europe Electric Commercial Vehicle Battery Pack Market Sector

- February 2023: LG Energy Solution announced a 50% increase in investment to 10 trillion won, expanding its global production capacity by 50% to 300 GWh. This significantly boosts the supply of battery packs for electric commercial vehicles.

- February 2023: LG Energy Solution launched the world's first battery passport, promoting transparency and sustainability within the battery value chain. This enhances consumer trust and potentially drives adoption.

- February 2023: LG Energy Solution and Freudenberg e-Power Systems signed a multi-year contract for the supply of 19 GWh of lithium-ion battery cell modules. This large-scale agreement demonstrates growing demand and strengthens the supply chain.

Strategic Europe Electric Commercial Vehicle Battery Pack Market Market Outlook

The European electric commercial vehicle battery pack market presents significant growth potential in the coming years. Continued technological advancements, supportive government policies, and rising environmental awareness will drive market expansion. Strategic opportunities exist for companies to focus on developing high-energy-density, cost-effective battery packs, expanding their manufacturing capacity, and securing supply chains. Investment in research and development, particularly in solid-state battery technology, will be crucial for maintaining a competitive edge. Furthermore, companies focusing on sustainability and circular economy principles will likely gain a strong market position.

Europe Electric Commercial Vehicle Battery Pack Market Segmentation

-

1. Body Type

- 1.1. Bus

- 1.2. LCV

- 1.3. M&HDT

-

2. Propulsion Type

- 2.1. BEV

- 2.2. PHEV

-

3. Battery Chemistry

- 3.1. LFP

- 3.2. NCA

- 3.3. NCM

- 3.4. NMC

- 3.5. Others

-

4. Capacity

- 4.1. 15 kWh to 40 kWh

- 4.2. 40 kWh to 80 kWh

- 4.3. Above 80 kWh

- 4.4. Less than 15 kWh

-

5. Battery Form

- 5.1. Cylindrical

- 5.2. Pouch

- 5.3. Prismatic

-

6. Method

- 6.1. Laser

- 6.2. Wire

-

7. Component

- 7.1. Anode

- 7.2. Cathode

- 7.3. Electrolyte

- 7.4. Separator

-

8. Material Type

- 8.1. Cobalt

- 8.2. Lithium

- 8.3. Manganese

- 8.4. Natural Graphite

- 8.5. Nickel

- 8.6. Other Materials

Europe Electric Commercial Vehicle Battery Pack Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Electric Commercial Vehicle Battery Pack Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand and Sales of Commercial Vehicles is Driving the Market for Hydraulic Systems

- 3.3. Market Restrains

- 3.3.1. Increasing Replacement of Conventional Hydraulic Systems with Fully-electric Hydraulic Systems Acts as a Restraint

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Electric Commercial Vehicle Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 5.1.1. Bus

- 5.1.2. LCV

- 5.1.3. M&HDT

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. BEV

- 5.2.2. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Battery Chemistry

- 5.3.1. LFP

- 5.3.2. NCA

- 5.3.3. NCM

- 5.3.4. NMC

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Capacity

- 5.4.1. 15 kWh to 40 kWh

- 5.4.2. 40 kWh to 80 kWh

- 5.4.3. Above 80 kWh

- 5.4.4. Less than 15 kWh

- 5.5. Market Analysis, Insights and Forecast - by Battery Form

- 5.5.1. Cylindrical

- 5.5.2. Pouch

- 5.5.3. Prismatic

- 5.6. Market Analysis, Insights and Forecast - by Method

- 5.6.1. Laser

- 5.6.2. Wire

- 5.7. Market Analysis, Insights and Forecast - by Component

- 5.7.1. Anode

- 5.7.2. Cathode

- 5.7.3. Electrolyte

- 5.7.4. Separator

- 5.8. Market Analysis, Insights and Forecast - by Material Type

- 5.8.1. Cobalt

- 5.8.2. Lithium

- 5.8.3. Manganese

- 5.8.4. Natural Graphite

- 5.8.5. Nickel

- 5.8.6. Other Materials

- 5.9. Market Analysis, Insights and Forecast - by Region

- 5.9.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 6. Germany Europe Electric Commercial Vehicle Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Electric Commercial Vehicle Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Electric Commercial Vehicle Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Electric Commercial Vehicle Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Electric Commercial Vehicle Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Electric Commercial Vehicle Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Electric Commercial Vehicle Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 SAIC Volkswagen Power Battery Co Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 BMZ Batterien-Montage-Zentrum GmbH

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Samsung SDI Co Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 LG Energy Solution Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Microvast Holdings Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 TOSHIBA Corp

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Contemporary Amperex Technology Co Ltd (CATL)

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Akasol AG

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 BYD Company Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 SK Innovation Co Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Panasonic Holdings Corporation

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 NorthVolt AB

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 SVOLT Energy Technology Co Ltd (SVOLT)

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.1 SAIC Volkswagen Power Battery Co Ltd

List of Figures

- Figure 1: Europe Electric Commercial Vehicle Battery Pack Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Electric Commercial Vehicle Battery Pack Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Electric Commercial Vehicle Battery Pack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Electric Commercial Vehicle Battery Pack Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 3: Europe Electric Commercial Vehicle Battery Pack Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 4: Europe Electric Commercial Vehicle Battery Pack Market Revenue Million Forecast, by Battery Chemistry 2019 & 2032

- Table 5: Europe Electric Commercial Vehicle Battery Pack Market Revenue Million Forecast, by Capacity 2019 & 2032

- Table 6: Europe Electric Commercial Vehicle Battery Pack Market Revenue Million Forecast, by Battery Form 2019 & 2032

- Table 7: Europe Electric Commercial Vehicle Battery Pack Market Revenue Million Forecast, by Method 2019 & 2032

- Table 8: Europe Electric Commercial Vehicle Battery Pack Market Revenue Million Forecast, by Component 2019 & 2032

- Table 9: Europe Electric Commercial Vehicle Battery Pack Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 10: Europe Electric Commercial Vehicle Battery Pack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 11: Europe Electric Commercial Vehicle Battery Pack Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Germany Europe Electric Commercial Vehicle Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Europe Electric Commercial Vehicle Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Europe Electric Commercial Vehicle Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: United Kingdom Europe Electric Commercial Vehicle Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Netherlands Europe Electric Commercial Vehicle Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Sweden Europe Electric Commercial Vehicle Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe Europe Electric Commercial Vehicle Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Europe Electric Commercial Vehicle Battery Pack Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 20: Europe Electric Commercial Vehicle Battery Pack Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 21: Europe Electric Commercial Vehicle Battery Pack Market Revenue Million Forecast, by Battery Chemistry 2019 & 2032

- Table 22: Europe Electric Commercial Vehicle Battery Pack Market Revenue Million Forecast, by Capacity 2019 & 2032

- Table 23: Europe Electric Commercial Vehicle Battery Pack Market Revenue Million Forecast, by Battery Form 2019 & 2032

- Table 24: Europe Electric Commercial Vehicle Battery Pack Market Revenue Million Forecast, by Method 2019 & 2032

- Table 25: Europe Electric Commercial Vehicle Battery Pack Market Revenue Million Forecast, by Component 2019 & 2032

- Table 26: Europe Electric Commercial Vehicle Battery Pack Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 27: Europe Electric Commercial Vehicle Battery Pack Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United Kingdom Europe Electric Commercial Vehicle Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Germany Europe Electric Commercial Vehicle Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: France Europe Electric Commercial Vehicle Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Italy Europe Electric Commercial Vehicle Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Spain Europe Electric Commercial Vehicle Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Netherlands Europe Electric Commercial Vehicle Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Belgium Europe Electric Commercial Vehicle Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Sweden Europe Electric Commercial Vehicle Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Norway Europe Electric Commercial Vehicle Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Poland Europe Electric Commercial Vehicle Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Denmark Europe Electric Commercial Vehicle Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Electric Commercial Vehicle Battery Pack Market?

The projected CAGR is approximately > 6.50%.

2. Which companies are prominent players in the Europe Electric Commercial Vehicle Battery Pack Market?

Key companies in the market include SAIC Volkswagen Power Battery Co Ltd, BMZ Batterien-Montage-Zentrum GmbH, Samsung SDI Co Ltd, LG Energy Solution Ltd, Microvast Holdings Inc, TOSHIBA Corp, Contemporary Amperex Technology Co Ltd (CATL), Akasol AG, BYD Company Ltd, SK Innovation Co Ltd, Panasonic Holdings Corporation, NorthVolt AB, SVOLT Energy Technology Co Ltd (SVOLT).

3. What are the main segments of the Europe Electric Commercial Vehicle Battery Pack Market?

The market segments include Body Type, Propulsion Type, Battery Chemistry, Capacity, Battery Form, Method, Component, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand and Sales of Commercial Vehicles is Driving the Market for Hydraulic Systems.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Replacement of Conventional Hydraulic Systems with Fully-electric Hydraulic Systems Acts as a Restraint.

8. Can you provide examples of recent developments in the market?

February 2023: LG Energy Solution will invest 10 trillion won this year, up 50 percent from 6.3 trillion won a year ago, and expand its global production capacity by 50 percent to 300 gigawatt hours (GWh).February 2023: LG Energy Solution is unlocking more sustainable battery value chain with the world's first battery passport.February 2023: LG Energy Solution and Freudenberg e-Power Systems have signed a multi-year contract for the supply of lithium-ion battery cell modules with a total capacity of 19 GWh.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Electric Commercial Vehicle Battery Pack Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Electric Commercial Vehicle Battery Pack Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Electric Commercial Vehicle Battery Pack Market?

To stay informed about further developments, trends, and reports in the Europe Electric Commercial Vehicle Battery Pack Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence