Key Insights

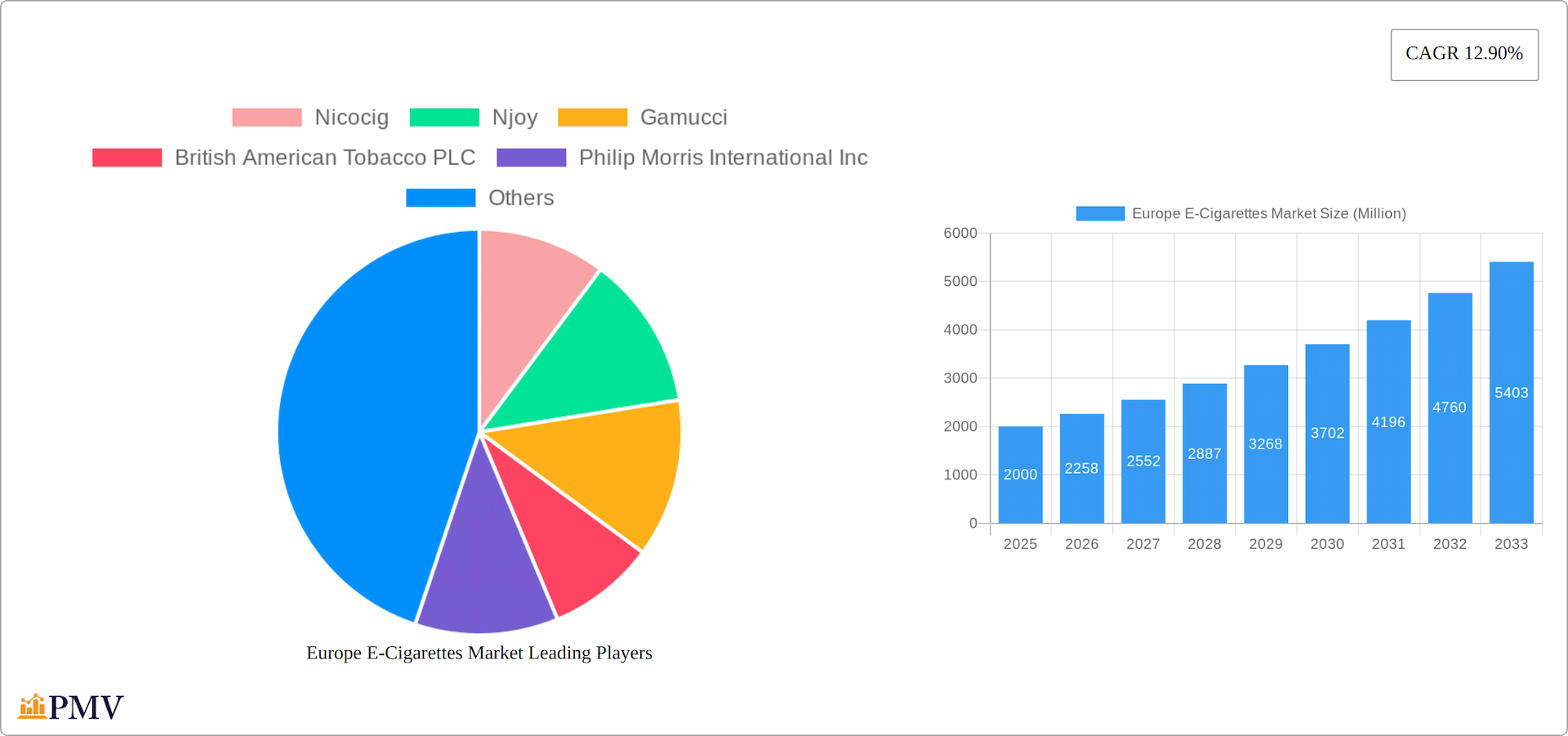

The European e-cigarette market is projected to reach $27.691 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 12.9% from the base year 2025. This robust growth is propelled by increasing consumer awareness of e-cigarettes as a harm reduction alternative to traditional smoking, coupled with a rising prevalence of vaping among younger demographics. Market expansion is further stimulated by continuous product innovation, including the development of personalized and technologically advanced devices such as rechargeable vaporizers. The diverse product portfolio, ranging from convenient disposable models to sophisticated customizable vaporizers, caters to a broad consumer base. However, market growth may be moderated by evolving regulatory landscapes, including flavor restrictions and stricter advertising policies across European nations. These regulations are expected to drive innovation within compliance boundaries.

Europe E-Cigarettes Market Market Size (In Billion)

Key market players include established tobacco companies such as British American Tobacco PLC, Philip Morris International Inc., Imperial Brands PLC, Japan Tobacco Inc., and Altria Group Inc., alongside dedicated e-cigarette brands like Nicocig, Njoy, Gamucci, J Well France SARL, Aquios Labs, BecoVape, and Blu Cigs. This competitive environment fosters continuous innovation and strategic marketing. Regional variations in consumer preferences and regulatory frameworks across Germany, France, Italy, the UK, the Netherlands, Sweden, and the rest of Europe contribute to market segmentation and differential growth trajectories. The forecast period (2025-2033) is anticipated to witness market consolidation as smaller players adapt to regulatory pressures and larger entities leverage economies of scale. A growing emphasis on sustainable and ethically sourced components will also influence the industry's future direction.

Europe E-Cigarettes Market Company Market Share

Europe E-Cigarettes Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe e-cigarettes market, encompassing market size, segmentation, competitive landscape, and future growth projections from 2019 to 2033. The study period covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033). This report is crucial for businesses, investors, and policymakers seeking to understand and navigate this rapidly evolving market. Key segments, including product types and battery modes, are meticulously analyzed to reveal growth opportunities and challenges. The report also highlights significant market developments and profiles leading players, providing actionable insights for strategic decision-making.

Europe E-Cigarettes Market Market Structure & Competitive Dynamics

The European e-cigarette market presents a dynamic and multifaceted landscape, featuring a blend of established multinational corporations and agile, innovative smaller players. While several dominant players hold significant market share, resulting in a moderately concentrated market, substantial opportunities remain for niche businesses. This competitive arena is fueled by a robust innovation ecosystem, constantly evolving through advancements in battery technology, e-liquid formulations, and device design. However, navigating this market requires careful consideration of the diverse and often stringent regulatory frameworks that vary considerably across European nations, directly influencing market access and product availability. Competitive pressures also stem from substitute products, including traditional cigarettes and other nicotine delivery systems. Crucially, evolving end-user preferences, particularly regarding specific product types, features, and functionalities, profoundly shape market trends. The market has also witnessed significant mergers and acquisitions (M&A) activity, with major players strategically consolidating their positions and expanding their portfolios through acquisitions. The total M&A deal value from 2019-2024 is estimated at [Insert Updated Value] Million. Key market share holders in 2024 included:

- British American Tobacco PLC: [Insert Updated Percentage]%

- Philip Morris International Inc: [Insert Updated Percentage]%

- Imperial Brands PLC: [Insert Updated Percentage]%

- Other Players: [Insert Updated Percentage]%

Europe E-Cigarettes Market Industry Trends & Insights

The European e-cigarette market is demonstrating robust and sustained growth, driven by a confluence of factors. The increasing awareness of the significant health risks associated with traditional smoking is accelerating the adoption of e-cigarettes as a potentially reduced-risk alternative. This trend is further amplified by continuous technological advancements enhancing the functionality, safety profile, and overall consumer appeal of e-cigarette devices. Consumer preferences are continuously evolving, revealing a growing demand for devices offering superior vapor production, extended battery life, and a broader spectrum of flavors. The competitive intensity remains high, with companies actively launching innovative products and employing aggressive marketing strategies. The market is projected to experience a compound annual growth rate (CAGR) of [Insert Updated CAGR]% during the forecast period (2025-2033). Market penetration is anticipated to reach [Insert Updated Percentage]% by 2033, highlighting considerable future growth potential. The emergence of innovative technologies, such as heated tobacco products, is further reshaping the competitive landscape. These interconnected trends collectively contribute to a dynamic and highly competitive market environment.

Dominant Markets & Segments in Europe E-Cigarettes Market

The UK, Germany, and France remain the leading markets within the European e-cigarette sector. Their dominance is attributed to a combination of factors:

- High consumer adoption rates: A substantial portion of adult smokers in these countries have transitioned to e-cigarettes.

- Established regulatory frameworks: Although varying in specifics, these markets generally benefit from relatively clear and stable regulatory environments, fostering business growth.

- Strong distribution networks: Well-developed retail channels and robust online platforms ensure widespread e-cigarette accessibility.

Segment analysis reveals that the Completely Disposable Model exhibits the most rapid growth, primarily driven by its convenience and affordability. Simultaneously, Personalized Vaporizers are gaining traction, fueled by the increasing preference for customization options.

- Product Type Dominance:

- Completely Disposable Model: Key Drivers include superior convenience, affordability, and ease of access.

- Rechargeable but Disposable Cartomizer: Attracts consumers seeking a balance between convenience and cost-effectiveness.

- Personalized Vaporizer: Driven by user preference for customization and control, offering a tailored vaping experience.

- Battery Mode Dominance:

- Automatic E-cigarette: Simplicity and ease-of-use attract a large consumer base.

- Manual E-cigarette: Appeals to experienced vapers who value greater control and customization over their vaping experience.

Europe E-Cigarettes Market Product Innovations

Recent years have witnessed significant innovation in the European e-cigarette market. The development of water-based e-liquid technology, as showcased by Aquios Labs, represents a notable advancement, potentially enhancing the vaping experience and addressing concerns about the long-term health effects of traditional e-liquids. Similarly, the introduction of improved heated tobacco products, such as Imperial Brands’ Pulze 2.0, reflects a trend toward potentially reduced-harm alternatives to traditional cigarettes. These innovations are shaping consumer preferences and driving market growth. Furthermore, disposable e-cigarette models continue to innovate with new flavors and enhanced designs.

Report Segmentation & Scope

This report provides a detailed segmentation of the Europe e-cigarettes market based on:

Product Type: Completely Disposable Model, Rechargeable but Disposable Cartomizer, Personalized Vaporizer. Each segment exhibits unique growth trajectories and competitive dynamics. The Completely Disposable Model segment is projected to experience the highest CAGR ([Insert Updated CAGR]%) over the forecast period due to its convenience and affordability.

Battery Mode: Automatic E-cigarette and Manual E-cigarette. The Automatic E-cigarette segment commands a larger market share, reflecting its broader user appeal.

Key Drivers of Europe E-Cigarettes Market Growth

Several key factors drive the growth of the Europe e-cigarettes market:

- Health concerns regarding traditional cigarettes: Growing awareness of the severe health consequences associated with smoking is prompting consumers to seek alternatives.

- Technological advancements: Continuous improvements in e-cigarette technology, such as improved battery life, flavor delivery, and device aesthetics.

- Favorable regulatory environments (in some regions): Clearer regulations in some parts of Europe facilitate market entry and expansion for e-cigarette companies.

- Increasing consumer acceptance: E-cigarettes are gaining wider social acceptance as a viable alternative to conventional cigarettes.

Challenges in the Europe E-Cigarettes Market Sector

Despite significant growth, the European e-cigarette market faces various challenges:

- Stringent regulations and evolving legislation: Varying regulatory landscapes across European countries create complexities for manufacturers and distributors.

- Negative public perception: Ongoing debates about the potential health risks of vaping contribute to negative public perception in some regions.

- Intense competition: The market is highly competitive, with numerous players vying for market share.

- Supply chain disruptions: Potential disruptions in raw material sourcing and manufacturing can impact product availability and pricing.

Leading Players in the Europe E-Cigarettes Market Market

- Nicocig

- Njoy

- Gamucci

- British American Tobacco PLC

- Philip Morris International Inc

- J Well France SARL

- Japan Tobacco Inc

- Aquios Labs

- BecoVape

- Blu Cigs

- Imperial Brands PLC

- Altria Group Inc

Key Developments in Europe E-Cigarettes Market Sector

- November 2021: Imperial Blue launched heated cigarette products in the Czech Republic, signaling expansion into next-generation products and diversification strategies.

- March 2022: BAT launched Vuse Go, a disposable e-cigarette, in the UK, expanding its product portfolio and targeting a key market segment.

- February 2023: Imperial Brands launched Pulze 2.0, an upgraded heated tobacco device, in Italy, Poland, the Czech Republic, and Greece, highlighting innovation in reduced-harm product offerings.

- March 2023: Aquios Labs launched a water-based e-liquid technology in collaboration with Innokin Technology, introducing a novel approach to e-liquid formulation and potentially impacting the market with a new technology.

- [Add other relevant key developments with dates and brief descriptions]

Strategic Europe E-Cigarettes Market Market Outlook

The European e-cigarette market presents considerable future growth potential. Continued innovation in product design, flavor profiles, and technological advancements will be key to attracting new consumers and maintaining market share. Strategic partnerships and acquisitions will also shape market dynamics. Companies focused on developing reduced-harm products and navigating the evolving regulatory landscape will be best positioned for success. The market is expected to witness continued expansion, driven by changing consumer preferences and technological advancements. Companies focusing on sustainability and ethical sourcing will also gain a competitive advantage.

Europe E-Cigarettes Market Segmentation

-

1. Product Type

- 1.1. Completely Disposable Model

- 1.2. Rechargeable but Disposable Cartomizer

- 1.3. Personalized Vaporizer

-

2. Battery Mode

- 2.1. Automatic E-Cigarette

- 2.2. Manual E-Cigarette

Europe E-Cigarettes Market Segmentation By Geography

- 1. United Kingdom

- 2. France

- 3. Germany

- 4. Italy

- 5. Russia

- 6. Spain

- 7. Rest of Europe

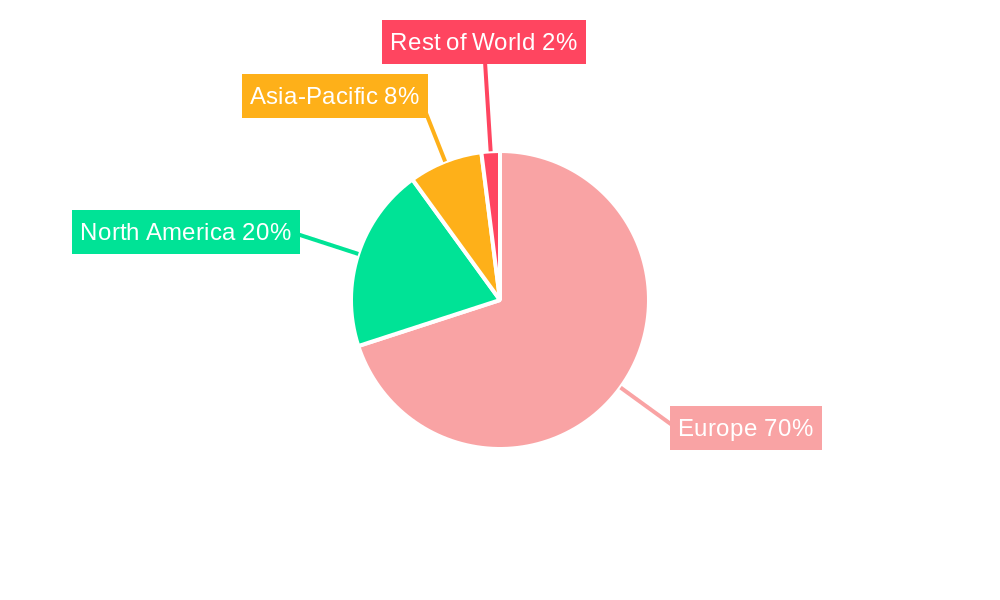

Europe E-Cigarettes Market Regional Market Share

Geographic Coverage of Europe E-Cigarettes Market

Europe E-Cigarettes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Social Media Marketing; Lower-risk Factor Associated with the Use of E-Cigarettes Compared to Conventional/Combustible Cigarettes

- 3.3. Market Restrains

- 3.3.1. Government Initiatives to Ban Disposable E-Cigarettes

- 3.4. Market Trends

- 3.4.1. Rising Dual-Use E-Cigarette Among Consumers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Completely Disposable Model

- 5.1.2. Rechargeable but Disposable Cartomizer

- 5.1.3. Personalized Vaporizer

- 5.2. Market Analysis, Insights and Forecast - by Battery Mode

- 5.2.1. Automatic E-Cigarette

- 5.2.2. Manual E-Cigarette

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. France

- 5.3.3. Germany

- 5.3.4. Italy

- 5.3.5. Russia

- 5.3.6. Spain

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United Kingdom Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Completely Disposable Model

- 6.1.2. Rechargeable but Disposable Cartomizer

- 6.1.3. Personalized Vaporizer

- 6.2. Market Analysis, Insights and Forecast - by Battery Mode

- 6.2.1. Automatic E-Cigarette

- 6.2.2. Manual E-Cigarette

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. France Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Completely Disposable Model

- 7.1.2. Rechargeable but Disposable Cartomizer

- 7.1.3. Personalized Vaporizer

- 7.2. Market Analysis, Insights and Forecast - by Battery Mode

- 7.2.1. Automatic E-Cigarette

- 7.2.2. Manual E-Cigarette

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Germany Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Completely Disposable Model

- 8.1.2. Rechargeable but Disposable Cartomizer

- 8.1.3. Personalized Vaporizer

- 8.2. Market Analysis, Insights and Forecast - by Battery Mode

- 8.2.1. Automatic E-Cigarette

- 8.2.2. Manual E-Cigarette

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Italy Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Completely Disposable Model

- 9.1.2. Rechargeable but Disposable Cartomizer

- 9.1.3. Personalized Vaporizer

- 9.2. Market Analysis, Insights and Forecast - by Battery Mode

- 9.2.1. Automatic E-Cigarette

- 9.2.2. Manual E-Cigarette

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Russia Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Completely Disposable Model

- 10.1.2. Rechargeable but Disposable Cartomizer

- 10.1.3. Personalized Vaporizer

- 10.2. Market Analysis, Insights and Forecast - by Battery Mode

- 10.2.1. Automatic E-Cigarette

- 10.2.2. Manual E-Cigarette

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Spain Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Completely Disposable Model

- 11.1.2. Rechargeable but Disposable Cartomizer

- 11.1.3. Personalized Vaporizer

- 11.2. Market Analysis, Insights and Forecast - by Battery Mode

- 11.2.1. Automatic E-Cigarette

- 11.2.2. Manual E-Cigarette

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Rest of Europe Europe E-Cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Completely Disposable Model

- 12.1.2. Rechargeable but Disposable Cartomizer

- 12.1.3. Personalized Vaporizer

- 12.2. Market Analysis, Insights and Forecast - by Battery Mode

- 12.2.1. Automatic E-Cigarette

- 12.2.2. Manual E-Cigarette

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Nicocig

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Njoy

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Gamucci

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 British American Tobacco PLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Philip Morris International Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 J Well France SARL

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Japan Tobacco Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Aquios Labs

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 BecoVape*List Not Exhaustive

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Blu Cigs

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Imperial Brands PLC

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Altria Group Inc

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Nicocig

List of Figures

- Figure 1: Europe E-Cigarettes Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe E-Cigarettes Market Share (%) by Company 2025

List of Tables

- Table 1: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 4: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 5: Europe E-Cigarettes Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe E-Cigarettes Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 10: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 11: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 15: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 16: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 17: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 19: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 21: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 22: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 23: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 27: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 28: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 29: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 31: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 32: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 33: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 34: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 35: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 37: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 38: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 39: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 40: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 41: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

- Table 43: Europe E-Cigarettes Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 44: Europe E-Cigarettes Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 45: Europe E-Cigarettes Market Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 46: Europe E-Cigarettes Market Volume K Units Forecast, by Battery Mode 2020 & 2033

- Table 47: Europe E-Cigarettes Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Europe E-Cigarettes Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe E-Cigarettes Market?

The projected CAGR is approximately 12.9%.

2. Which companies are prominent players in the Europe E-Cigarettes Market?

Key companies in the market include Nicocig, Njoy, Gamucci, British American Tobacco PLC, Philip Morris International Inc, J Well France SARL, Japan Tobacco Inc, Aquios Labs, BecoVape*List Not Exhaustive, Blu Cigs, Imperial Brands PLC, Altria Group Inc.

3. What are the main segments of the Europe E-Cigarettes Market?

The market segments include Product Type, Battery Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.691 billion as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Social Media Marketing; Lower-risk Factor Associated with the Use of E-Cigarettes Compared to Conventional/Combustible Cigarettes.

6. What are the notable trends driving market growth?

Rising Dual-Use E-Cigarette Among Consumers.

7. Are there any restraints impacting market growth?

Government Initiatives to Ban Disposable E-Cigarettes.

8. Can you provide examples of recent developments in the market?

March 2023: Aquios Labs, a Britain-based company, announced its new innovation, where it developed a water-based technology and launched a commercial product in cooperation with Innokin Technology to offer smokers a better smoking experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe E-Cigarettes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe E-Cigarettes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe E-Cigarettes Market?

To stay informed about further developments, trends, and reports in the Europe E-Cigarettes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence