Key Insights

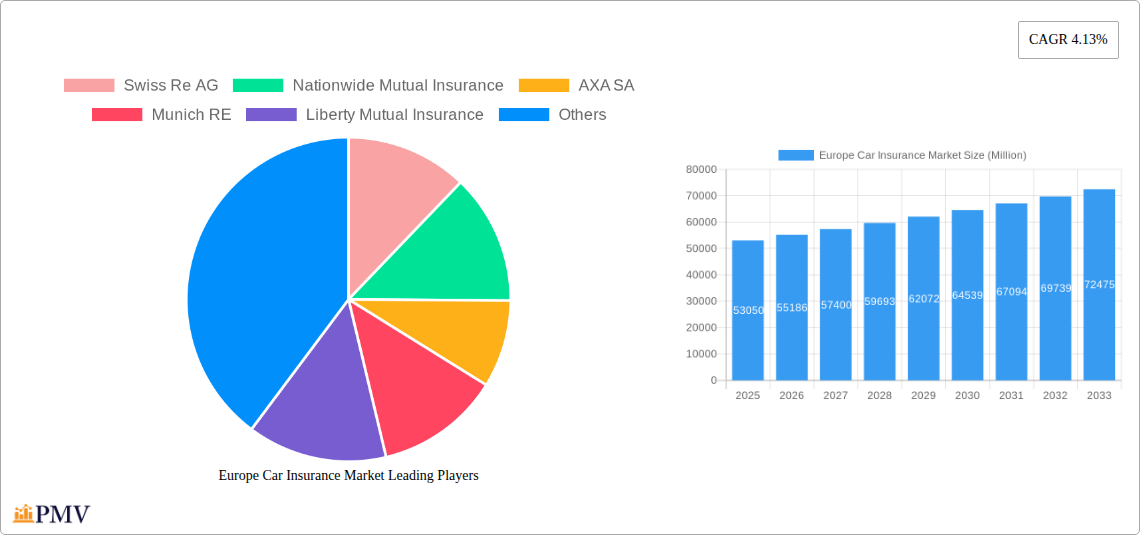

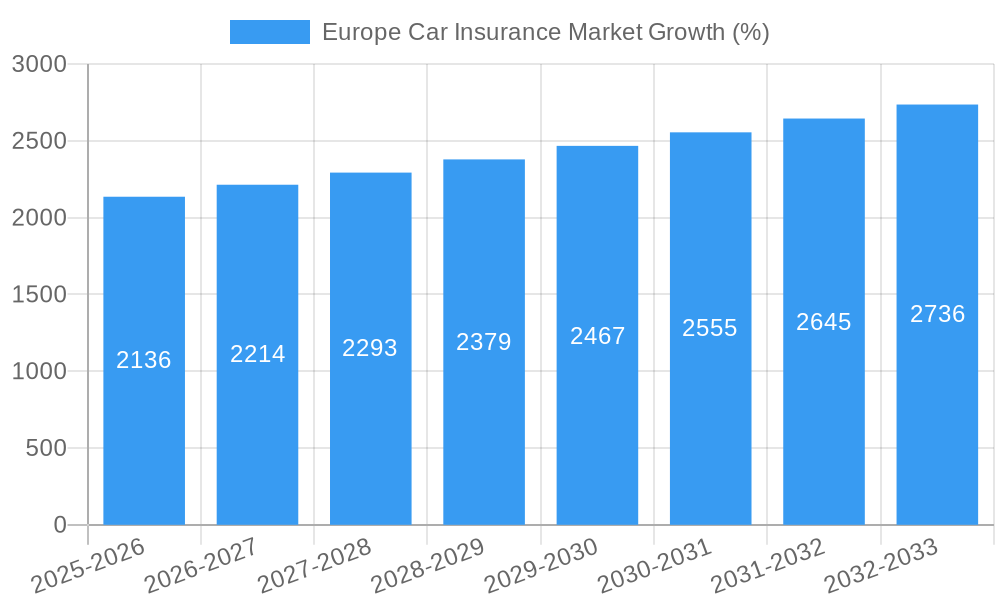

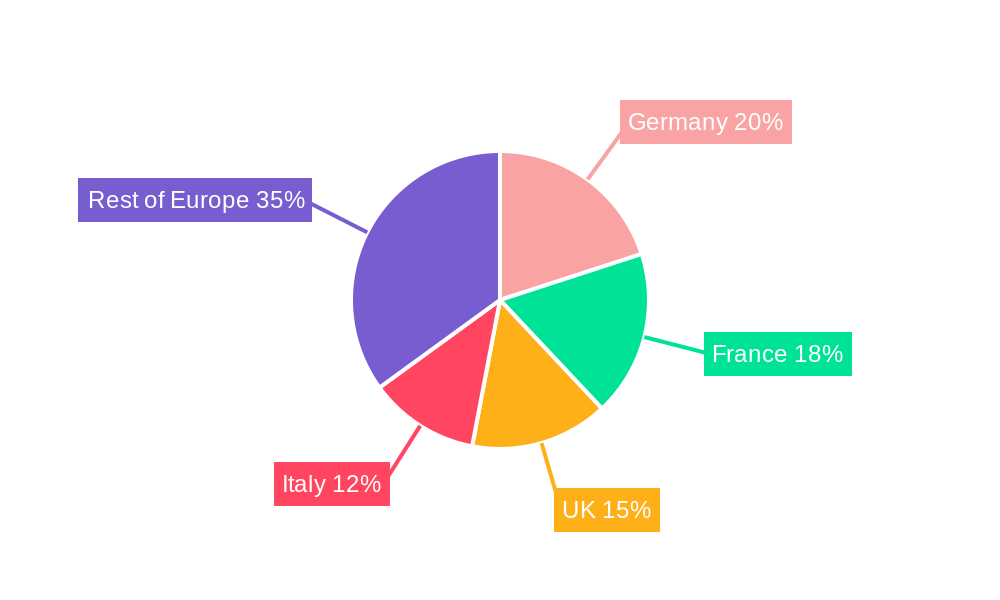

The European car insurance market, valued at €53.05 billion in 2025, is projected to experience steady growth, driven by factors such as rising car ownership, particularly in emerging economies within the region, increasing vehicle value necessitating more comprehensive coverage, and stricter government regulations mandating minimum insurance coverage. The market's compound annual growth rate (CAGR) of 4.13% from 2025 to 2033 indicates a consistent upward trajectory. Key segments contributing to this growth include third-party liability coverage, which remains a fundamental requirement, and comprehensive coverage, fueled by consumer preference for enhanced protection against unforeseen events. The distribution channel is evolving, with online platforms and direct-to-consumer models challenging the traditional dominance of agents and brokers, leading to increased competition and potential price adjustments. Germany, France, Italy, and the United Kingdom are major market players, reflecting their significant car ownership and economic strength. However, growth opportunities also exist in other European countries as car ownership expands and insurance penetration increases.

Growth is expected to be influenced by several factors. Economic fluctuations will impact consumer spending on insurance, with periods of economic uncertainty potentially leading to a decreased demand for optional coverage. Technological advancements, such as telematics and usage-based insurance, are disrupting the traditional insurance model, offering consumers personalized premiums based on driving behavior. This will increase market efficiency and transparency, while also potentially impacting traditional business models. Increased regulatory scrutiny and stricter data privacy regulations could increase operational costs for insurers. Finally, the competitive landscape, characterized by both established international players and smaller regional insurers, will continue to influence pricing and product innovation, influencing the overall market growth trajectory.

Europe Car Insurance Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Europe car insurance market, covering market structure, competitive dynamics, industry trends, segment performance, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for stakeholders across the value chain, including insurers, brokers, and technology providers. Market size is presented in Millions.

Europe Car Insurance Market Market Structure & Competitive Dynamics

The European car insurance market is characterized by a moderately concentrated structure, with a few major players holding significant market share. The market is influenced by stringent regulatory frameworks, evolving consumer preferences, and technological disruptions. Innovation ecosystems are dynamic, with InsurTech companies emerging and challenging traditional players. Product substitutes, such as peer-to-peer insurance models, are gaining traction. Mergers and acquisitions (M&A) are frequent, driving consolidation and reshaping the competitive landscape. For instance, in 2024, the total value of M&A deals in the European car insurance sector was estimated at xx Million. Key players are constantly seeking to enhance their technological capabilities and expand their product offerings to meet the evolving needs of consumers.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025.

- Innovation Ecosystems: Rapid growth of InsurTech start-ups offering innovative digital solutions.

- Regulatory Frameworks: Stringent regulations related to data privacy and consumer protection are shaping market practices.

- M&A Activity: High M&A activity leading to market consolidation and increased competition. The average deal size in 2024 was approximately xx Million.

Europe Car Insurance Market Industry Trends & Insights

The European car insurance market is witnessing robust growth, driven by factors such as rising vehicle ownership, increasing awareness of insurance benefits, and supportive government policies. Technological advancements, particularly in telematics and AI, are revolutionizing the sector, enabling personalized pricing and risk assessment. Consumer preferences are shifting toward digital channels and personalized products. This competitive environment pushes for continuous innovation and efficiency improvements. The market is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), with market penetration expected to reach xx% by 2033. The increasing adoption of telematics-based insurance is a significant trend, offering insurers granular data for accurate risk profiling and incentivized driving behaviors. Furthermore, the rise of embedded insurance within automotive purchasing processes is gaining momentum.

Dominant Markets & Segments in Europe Car Insurance Market

The German car insurance market holds the largest share within Europe, followed by the UK and France. Within the segments, the dominance shifts:

- By Coverage: Collision/Comprehensive/Other Optional Coverage holds a larger market share compared to Third-Party Liability Coverage, driven by consumer preference for broader protection.

- By Application: The Personal Vehicles segment dominates due to the widespread adoption of personal vehicles across the region.

- By Distribution Channel: Agents continue to be a dominant channel, although digital channels (banks, brokers, other online platforms) are showing significant growth.

Key Drivers of Market Dominance:

- Germany: Strong automotive industry, high vehicle ownership rates, and developed insurance infrastructure.

- UK: Large population, high vehicle density, and competitive insurance market.

- France: Significant vehicle ownership and well-established insurance sector.

Europe Car Insurance Market Product Innovations

The car insurance market is witnessing significant product innovation driven by technological advancements. Telematics-based insurance programs using connected car technology are becoming increasingly popular, allowing for personalized pricing based on driving behavior. Artificial intelligence (AI) and machine learning (ML) are being used to improve fraud detection, risk assessment, and claims processing. These innovations offer improved customer experience, reduced costs, and enhanced risk management capabilities for insurers.

Report Segmentation & Scope

This report segments the European car insurance market by coverage type (Third-Party Liability Coverage, Collision/Comprehensive/Other Optional Coverage), application (Personal Vehicles, Commercial Vehicles), and distribution channel (Agents, Banks, Brokers, Other Distribution Channel). Each segment’s market size, growth projections, and competitive dynamics are analyzed in detail. Growth projections are provided for each segment for the forecast period (2025-2033), with comprehensive market size data included.

Key Drivers of Europe Car Insurance Market Growth

Several factors are driving the growth of the Europe car insurance market, including:

- Rising Vehicle Ownership: Increased vehicle ownership across the region is boosting demand for insurance.

- Government Regulations: Mandatory insurance requirements in many European countries.

- Technological Advancements: Telematics, AI, and digitalization are enhancing insurance products and services.

Challenges in the Europe Car Insurance Market Sector

The Europe car insurance market faces several challenges:

- Intense Competition: The presence of numerous insurers leads to price wars and reduced profitability.

- Regulatory Changes: Evolving regulations and compliance requirements increase operational costs.

- Fraudulent Claims: High instances of fraudulent claims impact insurers’ profitability. Estimated losses due to fraudulent claims in 2024 were xx Million.

Leading Players in the Europe Car Insurance Market Market

- Swiss Re AG

- Nationwide Mutual Insurance

- AXA SA

- Munich RE

- Liberty Mutual Insurance

- Assicurazioni Generali SpA

- Allianz SE

- GEICO

- Chubb Ltd

- Porto Seguro S A

- List Not Exhaustive

Key Developments in Europe Car Insurance Market Sector

- June 2023: Allianz partnered with JLR and launched an embedded insurance program, "Simply Drive," offering complimentary coverage for the first month of vehicle ownership. This initiative aims to simplify the car buying process and enhance customer convenience.

- September 2022: AXA launched "Moja," a new digital car insurance brand, enabling customers to purchase insurance products and services via smartphones and tablets. This expansion into digital channels enhances customer accessibility and convenience.

Strategic Europe Car Insurance Market Market Outlook

The European car insurance market presents significant growth potential driven by increasing vehicle ownership, technological advancements, and evolving consumer preferences. Insurers who embrace digital transformation, invest in data analytics, and develop personalized products will be well-positioned to capitalize on emerging opportunities. The market is expected to witness continued consolidation through M&A activity, further shaping the competitive landscape. Strategic partnerships and collaborations between insurers and technology providers are crucial for driving innovation and delivering superior customer experiences.

Europe Car Insurance Market Segmentation

-

1. Coverage

- 1.1. Third-Party Liability Coverage

- 1.2. Collision/Comprehensive/Other Optional Coverage

-

2. Application

- 2.1. Personal Vehicles

- 2.2. Commercial Vehicles

-

3. Distribution Channel

- 3.1. Agents

- 3.2. Banks

- 3.3. Brokers

- 3.4. Other Distribution Channel

Europe Car Insurance Market Segmentation By Geography

- 1. Germany

- 2. UK

- 3. France

- 4. Switzerland

- 5. Rest of Europe

Europe Car Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.13% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Sales of Cars in Europe Drives The Market; Increase in Road Traffic Accidents Drives The Market

- 3.3. Market Restrains

- 3.3.1. Increase in Cost of Claims Made; Increase in False Claims and Scams

- 3.4. Market Trends

- 3.4.1. Increase In Online Sales Car Insurance

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Car Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 5.1.1. Third-Party Liability Coverage

- 5.1.2. Collision/Comprehensive/Other Optional Coverage

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Personal Vehicles

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Agents

- 5.3.2. Banks

- 5.3.3. Brokers

- 5.3.4. Other Distribution Channel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. UK

- 5.4.3. France

- 5.4.4. Switzerland

- 5.4.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 6. Germany Europe Car Insurance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Coverage

- 6.1.1. Third-Party Liability Coverage

- 6.1.2. Collision/Comprehensive/Other Optional Coverage

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Personal Vehicles

- 6.2.2. Commercial Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Agents

- 6.3.2. Banks

- 6.3.3. Brokers

- 6.3.4. Other Distribution Channel

- 6.1. Market Analysis, Insights and Forecast - by Coverage

- 7. UK Europe Car Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Coverage

- 7.1.1. Third-Party Liability Coverage

- 7.1.2. Collision/Comprehensive/Other Optional Coverage

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Personal Vehicles

- 7.2.2. Commercial Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Agents

- 7.3.2. Banks

- 7.3.3. Brokers

- 7.3.4. Other Distribution Channel

- 7.1. Market Analysis, Insights and Forecast - by Coverage

- 8. France Europe Car Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Coverage

- 8.1.1. Third-Party Liability Coverage

- 8.1.2. Collision/Comprehensive/Other Optional Coverage

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Personal Vehicles

- 8.2.2. Commercial Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Agents

- 8.3.2. Banks

- 8.3.3. Brokers

- 8.3.4. Other Distribution Channel

- 8.1. Market Analysis, Insights and Forecast - by Coverage

- 9. Switzerland Europe Car Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Coverage

- 9.1.1. Third-Party Liability Coverage

- 9.1.2. Collision/Comprehensive/Other Optional Coverage

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Personal Vehicles

- 9.2.2. Commercial Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Agents

- 9.3.2. Banks

- 9.3.3. Brokers

- 9.3.4. Other Distribution Channel

- 9.1. Market Analysis, Insights and Forecast - by Coverage

- 10. Rest of Europe Europe Car Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Coverage

- 10.1.1. Third-Party Liability Coverage

- 10.1.2. Collision/Comprehensive/Other Optional Coverage

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Personal Vehicles

- 10.2.2. Commercial Vehicles

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Agents

- 10.3.2. Banks

- 10.3.3. Brokers

- 10.3.4. Other Distribution Channel

- 10.1. Market Analysis, Insights and Forecast - by Coverage

- 11. Germany Europe Car Insurance Market Analysis, Insights and Forecast, 2019-2031

- 12. France Europe Car Insurance Market Analysis, Insights and Forecast, 2019-2031

- 13. Italy Europe Car Insurance Market Analysis, Insights and Forecast, 2019-2031

- 14. United Kingdom Europe Car Insurance Market Analysis, Insights and Forecast, 2019-2031

- 15. Netherlands Europe Car Insurance Market Analysis, Insights and Forecast, 2019-2031

- 16. Sweden Europe Car Insurance Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Europe Europe Car Insurance Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Swiss Re AG

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Nationwide Mutual Insurance

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 AXA SA

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Munich RE

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Liberty Mutual Insurance

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Assicurazioni Generali SpA

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Allianz SE

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 GEICO

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Chubb Ltd

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Porto Seguro S A**List Not Exhaustive

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Swiss Re AG

List of Figures

- Figure 1: Europe Car Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Car Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Car Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Car Insurance Market Revenue Million Forecast, by Coverage 2019 & 2032

- Table 3: Europe Car Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Car Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Europe Car Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Car Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Car Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Car Insurance Market Revenue Million Forecast, by Coverage 2019 & 2032

- Table 15: Europe Car Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Europe Car Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: Europe Car Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Car Insurance Market Revenue Million Forecast, by Coverage 2019 & 2032

- Table 19: Europe Car Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Europe Car Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 21: Europe Car Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Car Insurance Market Revenue Million Forecast, by Coverage 2019 & 2032

- Table 23: Europe Car Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Europe Car Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 25: Europe Car Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Europe Car Insurance Market Revenue Million Forecast, by Coverage 2019 & 2032

- Table 27: Europe Car Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Europe Car Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 29: Europe Car Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Europe Car Insurance Market Revenue Million Forecast, by Coverage 2019 & 2032

- Table 31: Europe Car Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Europe Car Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 33: Europe Car Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Car Insurance Market?

The projected CAGR is approximately 4.13%.

2. Which companies are prominent players in the Europe Car Insurance Market?

Key companies in the market include Swiss Re AG, Nationwide Mutual Insurance, AXA SA, Munich RE, Liberty Mutual Insurance, Assicurazioni Generali SpA, Allianz SE, GEICO, Chubb Ltd, Porto Seguro S A**List Not Exhaustive.

3. What are the main segments of the Europe Car Insurance Market?

The market segments include Coverage, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 53.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Sales of Cars in Europe Drives The Market; Increase in Road Traffic Accidents Drives The Market.

6. What are the notable trends driving market growth?

Increase In Online Sales Car Insurance.

7. Are there any restraints impacting market growth?

Increase in Cost of Claims Made; Increase in False Claims and Scams.

8. Can you provide examples of recent developments in the market?

June 2023: Allianz partnered with JLR and launched an embedded insurance program, Simply Drive service, which is available for every vehicle, offering clients the convenience of immediate and complimentary insurance coverage for the first month of ownership, making the purchase quicker and easier.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Car Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Car Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Car Insurance Market?

To stay informed about further developments, trends, and reports in the Europe Car Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence