Key Insights

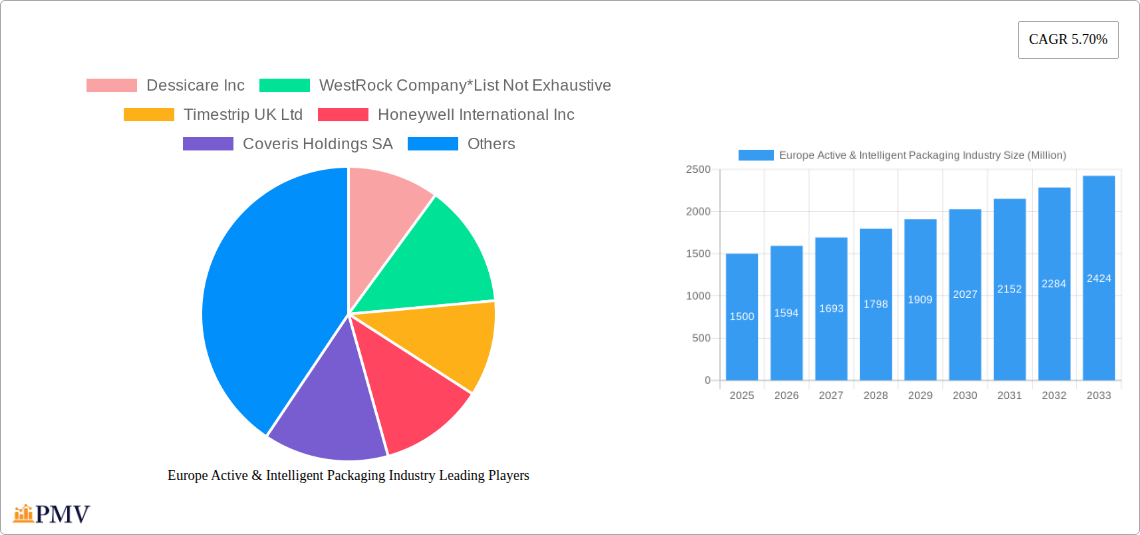

The European active and intelligent packaging market is experiencing robust growth, driven by increasing consumer demand for extended shelf life, improved product safety, and enhanced brand experience. A compound annual growth rate (CAGR) of 5.70% from 2019 to 2024 suggests a significant market expansion, projected to continue through 2033. Key drivers include the rising popularity of e-commerce, necessitating longer-lasting packaging solutions, and the growing focus on reducing food waste within the food and beverage sectors. The adoption of active and intelligent packaging technologies, such as oxygen scavengers, moisture absorbers, and time-temperature indicators, is also being fueled by stringent regulatory requirements for product safety and traceability. Market segmentation reveals a significant share held by the food and beverage industry, followed by healthcare and personal care, reflecting the critical role of packaging in preserving product quality and integrity across these sectors. Germany, France, and the United Kingdom represent the largest national markets within Europe, benefitting from strong manufacturing bases and established consumer markets. However, growth is anticipated across all major European countries, driven by technological advancements and increasing consumer awareness. Competition in the market is intense, with both multinational corporations and specialized companies vying for market share. The competitive landscape is characterized by ongoing innovation and strategic partnerships, as companies strive to develop differentiated offerings and expand their market reach. The market's future prospects remain positive, supported by ongoing technological advancements, growing consumer awareness of product safety and sustainability, and the persistent demand for improved supply chain efficiency.

Europe Active & Intelligent Packaging Industry Market Size (In Billion)

The projected market size for 2025, based on the provided CAGR and a logical estimation considering industry trends, is approximately €[Insert Estimated Market Size in Millions]. This figure is derived from extrapolating the growth trajectory established in the 2019-2024 period, factoring in anticipated market dynamics such as increasing adoption of active and intelligent packaging across various end-user verticals and the continued expansion of e-commerce. Further market segmentation reveals that the active packaging segment holds the largest market share, owing to the wider applications of technologies like oxygen scavengers and desiccant packaging compared to more specialized intelligent packaging solutions. Within the European context, the established food and beverage industry provides a significant market opportunity, although the healthcare sector exhibits considerable potential for future growth driven by the rising demand for secure and tamper-evident packaging for pharmaceuticals and medical devices.

Europe Active & Intelligent Packaging Industry Company Market Share

Europe Active & Intelligent Packaging Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Europe active and intelligent packaging industry, offering invaluable insights for businesses, investors, and stakeholders seeking to understand and capitalize on this dynamic market. The study period spans from 2019 to 2033, with 2025 as the base and estimated year, and a forecast period from 2025 to 2033. The historical period covered is 2019-2024. The report examines market size, segmentation, competitive landscape, key drivers, challenges, and future outlook, with a specific focus on active and intelligent packaging technologies across various end-user verticals in key European countries. The projected market value for 2033 is estimated at xx Million.

Europe Active & Intelligent Packaging Industry Market Structure & Competitive Dynamics

The European active and intelligent packaging market exhibits a moderately concentrated structure, with several multinational corporations holding significant market share. Market leaders like Amcor Ltd, Sealed Air Corporation, and Ball Corporation leverage their established global presence and technological expertise to maintain dominance. However, smaller, specialized companies are also emerging, particularly within niche applications. The industry landscape is characterized by ongoing innovation, driven by the demand for extended shelf life, improved product safety, and enhanced consumer experience.

Regulatory frameworks, including those concerning food safety and material recyclability, significantly influence market dynamics. Several key trends are shaping competition, including:

- Increased M&A activity: Recent years have witnessed several significant mergers and acquisitions, with deal values reaching xx Million in 2024. These consolidations reflect the industry's drive towards economies of scale and expanded product portfolios. For instance, the acquisition of Four04 Packaging Ltd by Coveris in 2021 exemplifies this trend.

- Growing importance of sustainability: Environmental concerns are pushing manufacturers to adopt more eco-friendly packaging materials and processes. This is driving innovation in biodegradable and compostable packaging solutions.

- Technological advancements: The ongoing development of advanced sensing technologies, including RFID and NFC, is creating new opportunities for intelligent packaging solutions.

The market share distribution is as follows (estimated 2024): Amcor Ltd (xx%), Sealed Air Corporation (xx%), Ball Corporation (xx%), with remaining share distributed among other players including Sonoco Products Company, Crown Holdings Inc, and numerous smaller companies. The competitive landscape is further complicated by the presence of both large multinational corporations and smaller, specialized firms. Product substitutions and their impact on market shares also remain a dynamic factor and further research is needed to provide a detailed outlook.

Europe Active & Intelligent Packaging Industry Industry Trends & Insights

The European active and intelligent packaging market is experiencing robust growth, fueled by several key factors. The market is projected to witness a CAGR of xx% during the forecast period (2025-2033). Several factors contribute to this growth:

- Increasing demand for fresh produce and convenience foods: This trend is driving the adoption of active packaging solutions that extend shelf life and maintain product quality.

- Rising consumer awareness of food safety and traceability: Intelligent packaging technologies offer enhanced traceability and provide consumers with real-time information about product freshness and authenticity.

- Growing e-commerce adoption: The rise of online grocery shopping is creating a need for packaging solutions that protect products during transit and maintain their quality.

- Technological advancements in sensor technology: Miniaturization and cost reduction of sensors are making intelligent packaging more accessible and cost-effective.

However, challenges such as high initial investment costs for some technologies, concerns about the environmental impact of certain packaging materials, and regulatory complexities are hindering wider market adoption. Despite these challenges, the market's long-term outlook remains positive, with continued innovation and a strong focus on sustainability expected to drive future growth. Market penetration of active packaging is currently at xx% in 2025 and is projected to reach xx% by 2033.

Dominant Markets & Segments in Europe Active & Intelligent Packaging Industry

The European active and intelligent packaging market is segmented by type (Active Packaging, Intelligent Packaging), end-user vertical (Food, Beverage, Healthcare, Personal Care, Other), and country (United Kingdom, Germany, France, Rest of Europe).

By Type: The Intelligent Packaging segment is projected to experience faster growth due to rising demand for product traceability and enhanced consumer engagement. Active packaging, however, maintains a larger market share due to its established presence in food preservation.

By End-user Vertical: The Food segment currently holds the largest market share, driven by the need to extend shelf life and improve food safety. The Healthcare segment is experiencing rapid growth, propelled by the demand for tamper-evident packaging and improved drug delivery systems.

By Country: The United Kingdom, Germany, and France are the leading markets, with the UK currently holding the largest share due to high consumer spending and a well-established food and beverage industry. The Rest of Europe segment shows promising growth potential.

Key Drivers by Country:

- United Kingdom: Strong consumer demand, advanced infrastructure, and stringent food safety regulations.

- Germany: Well-established manufacturing base, high technological advancement, and a focus on sustainability.

- France: Strong food and beverage industry, focus on innovation, and government support for sustainable packaging.

- Rest of Europe: Growing economies, increasing consumer disposable incomes, and the adoption of advanced packaging technologies.

Europe Active & Intelligent Packaging Industry Product Innovations

Recent years have witnessed significant advancements in active and intelligent packaging technologies. Amcor's introduction of a heat-sterilizable lidding technology for healthcare applications exemplifies the trend toward improved barrier properties and enhanced product protection. The development of biodegradable and compostable materials is addressing environmental concerns and meeting rising demand for sustainable solutions. Furthermore, the integration of smart sensors and connectivity features is creating opportunities for real-time product tracking and consumer engagement. These innovations cater to evolving consumer preferences for convenience, safety, and environmentally responsible products, contributing to strong market growth.

Report Segmentation & Scope

This report provides a detailed segmentation of the European active and intelligent packaging market across various parameters.

By Type: The report analyzes the Active Packaging and Intelligent Packaging segments, including their respective market sizes, growth projections, and competitive dynamics.

By End-user Vertical: The report covers Food, Beverage, Healthcare, Personal Care, and Other end-user verticals, providing insights into the specific needs and preferences of each segment.

By Country: The report examines the market in the United Kingdom, Germany, France, and the Rest of Europe, outlining the regional variations in market size, growth, and competitive intensity. Each segment's growth projections, market sizes, and competitive landscape are meticulously detailed within the report.

Key Drivers of Europe Active & Intelligent Packaging Industry Growth

Several factors are driving growth in the European active and intelligent packaging industry. Technological advancements, particularly in sensor technology and material science, are enabling the development of innovative packaging solutions. Increasing consumer demand for convenience, food safety, and product traceability is also contributing to market expansion. Furthermore, stringent regulations concerning food safety and environmental sustainability are pushing manufacturers to adopt more advanced and eco-friendly packaging materials and technologies. The rising e-commerce sector also presents new growth opportunities, demanding packaging solutions that can withstand the rigors of shipping and handling.

Challenges in the Europe Active & Intelligent Packaging Industry Sector

The industry faces several challenges. High initial investment costs associated with some active and intelligent packaging technologies can be a barrier to entry for smaller companies. Supply chain disruptions can affect the availability of raw materials and packaging components. Furthermore, the complexity of regulatory compliance across different European countries can create hurdles for manufacturers. Intense competition among established players also poses a challenge to smaller firms entering the market. These factors may negatively affect projected growth to a degree of xx% in the worst-case scenario.

Leading Players in the Europe Active & Intelligent Packaging Industry Market

- Dessicare Inc

- WestRock Company

- Timestrip UK Ltd

- Honeywell International Inc

- Coveris Holdings SA

- Sonoco Products Company

- Landec Corporation

- Ball Corporation

- Crown Holdings Inc

- BASF SE

- Graphic Packaging International LLC

- Sealed Air Corporation

- Amcor Ltd

Key Developments in Europe Active & Intelligent Packaging Industry Sector

- May 2021: Coveris acquires Four04 Packaging Ltd, strengthening its position in the fresh food and fruit packaging market.

- August 2021: Amcor launches a proprietary healthcare lidding technology, enhancing its product portfolio in the pharmaceutical packaging segment.

Strategic Europe Active & Intelligent Packaging Industry Market Outlook

The European active and intelligent packaging market is poised for significant growth over the coming years. Continued innovation in materials science, sensor technology, and packaging design will drive market expansion. The rising demand for sustainable and eco-friendly packaging solutions presents significant opportunities for businesses. Strategic partnerships and collaborations will be crucial for companies to navigate the competitive landscape and capitalize on the market’s potential. The focus on enhancing consumer experience through improved product traceability and information provision will also shape future market trends. The market is predicted to achieve xx Million in value by 2033.

Europe Active & Intelligent Packaging Industry Segmentation

-

1. Type

-

1.1. Active Packaging

- 1.1.1. Gas Scavengers/Emitters

- 1.1.2. Moisture Scavenger

- 1.1.3. Microwave Susceptors

- 1.1.4. Other Active Packaging Technologies

-

1.2. Intelligent Packaging

- 1.2.1. Coding and Markings

- 1.2.2. Antenna (RFID and NFC)

- 1.2.3. Sensors and Output Devices

- 1.2.4. Other Intelligent Packaging Technologies

-

1.1. Active Packaging

-

2. End-user Vertical

- 2.1. Food

- 2.2. Beverage

- 2.3. Healthcare

- 2.4. Personal Care

- 2.5. Other End-user Verticals

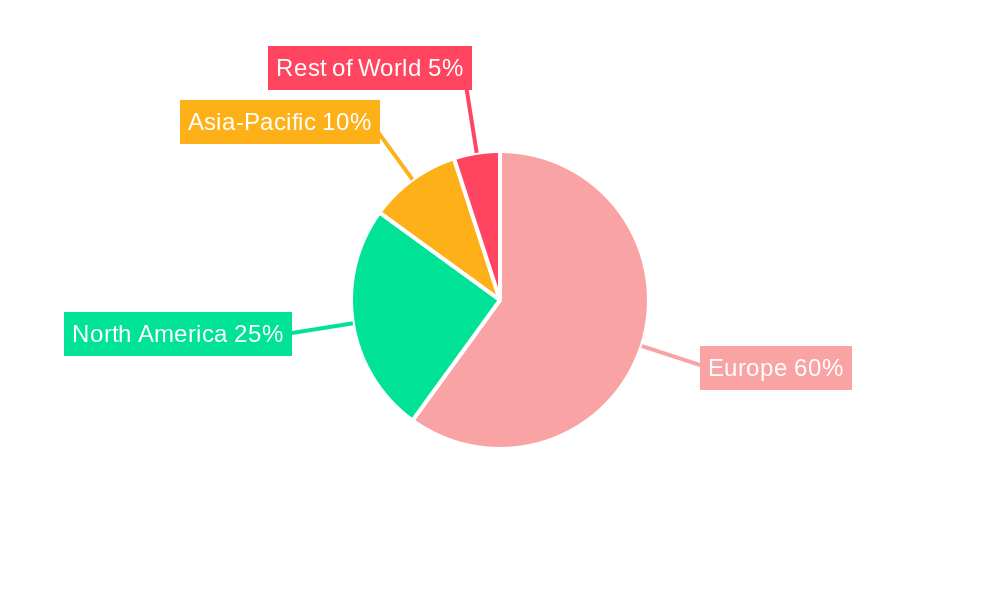

Europe Active & Intelligent Packaging Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Active & Intelligent Packaging Industry Regional Market Share

Geographic Coverage of Europe Active & Intelligent Packaging Industry

Europe Active & Intelligent Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Longer Shelf Life and Changing Consumer Lifestyle; Growing Demand for Fresh and Quality Food Products

- 3.3. Market Restrains

- 3.3.1. ; High Initial Cost for Research Activities

- 3.4. Market Trends

- 3.4.1. Healthcare Sector is Anticipated to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Active & Intelligent Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Active Packaging

- 5.1.1.1. Gas Scavengers/Emitters

- 5.1.1.2. Moisture Scavenger

- 5.1.1.3. Microwave Susceptors

- 5.1.1.4. Other Active Packaging Technologies

- 5.1.2. Intelligent Packaging

- 5.1.2.1. Coding and Markings

- 5.1.2.2. Antenna (RFID and NFC)

- 5.1.2.3. Sensors and Output Devices

- 5.1.2.4. Other Intelligent Packaging Technologies

- 5.1.1. Active Packaging

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Healthcare

- 5.2.4. Personal Care

- 5.2.5. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dessicare Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 WestRock Company*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Timestrip UK Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Honeywell International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Coveris Holdings SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sonoco Products Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Landec Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ball Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Crown Holdings Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Graphic Packaging International LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Sealed Air Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Amcor Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Dessicare Inc

List of Figures

- Figure 1: Europe Active & Intelligent Packaging Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Active & Intelligent Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Active & Intelligent Packaging Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Europe Active & Intelligent Packaging Industry Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 3: Europe Active & Intelligent Packaging Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Europe Active & Intelligent Packaging Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Europe Active & Intelligent Packaging Industry Revenue undefined Forecast, by End-user Vertical 2020 & 2033

- Table 6: Europe Active & Intelligent Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Active & Intelligent Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Active & Intelligent Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: France Europe Active & Intelligent Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Active & Intelligent Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Active & Intelligent Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Active & Intelligent Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Active & Intelligent Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Active & Intelligent Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Active & Intelligent Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Active & Intelligent Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Active & Intelligent Packaging Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Active & Intelligent Packaging Industry?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the Europe Active & Intelligent Packaging Industry?

Key companies in the market include Dessicare Inc, WestRock Company*List Not Exhaustive, Timestrip UK Ltd, Honeywell International Inc, Coveris Holdings SA, Sonoco Products Company, Landec Corporation, Ball Corporation, Crown Holdings Inc, BASF SE, Graphic Packaging International LLC, Sealed Air Corporation, Amcor Ltd.

3. What are the main segments of the Europe Active & Intelligent Packaging Industry?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Longer Shelf Life and Changing Consumer Lifestyle; Growing Demand for Fresh and Quality Food Products.

6. What are the notable trends driving market growth?

Healthcare Sector is Anticipated to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; High Initial Cost for Research Activities.

8. Can you provide examples of recent developments in the market?

May 2021 - Four04 Packaging Ltd was identified as an ideal partner for Coveris' strategic growth plans through a continuous market screening procedure. Packaging for fresh food and fruit, as well as bread, is a specialty of the company. It offers a product portfolio that ideally complements Coveris' existing product lines in these markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Active & Intelligent Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Active & Intelligent Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Active & Intelligent Packaging Industry?

To stay informed about further developments, trends, and reports in the Europe Active & Intelligent Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence