Key Insights

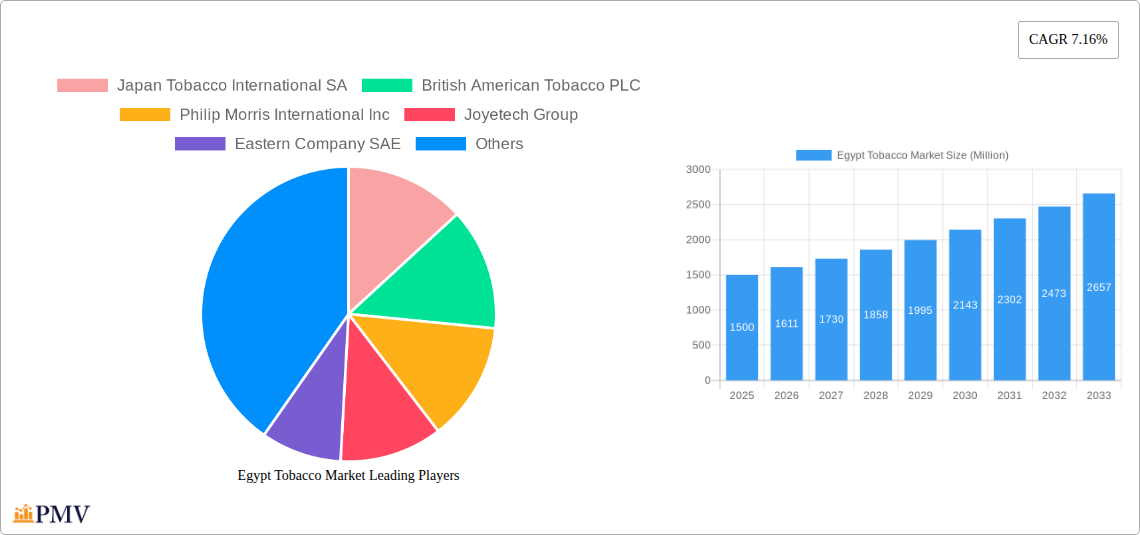

The Egypt tobacco market, exhibiting a Compound Annual Growth Rate (CAGR) of 7.16%, presents a dynamic landscape shaped by several key factors. While precise market size data for 2025 is absent, leveraging the 7.16% CAGR and assuming a reasonable base year value (considering regional market averages and population size), we can project significant growth. The market is segmented by product type (cigarettes, cigars, cigarillos, pipes, e-cigarettes/HTPs), end-user (male, female), and distribution channel (supermarkets, convenience stores, specialty tobacco stores, others). Growth drivers include rising disposable incomes among certain demographics, established smoking habits, and the continued presence of traditional tobacco products despite the rise of e-cigarettes. However, stringent government regulations aimed at curbing tobacco consumption, including increased taxation and advertising restrictions, act as significant restraints. The increasing popularity of e-cigarettes and heated tobacco products (HTPs) presents both an opportunity and a challenge, potentially cannibalizing traditional tobacco sales while also creating a new market segment. The competitive landscape includes both international giants like Japan Tobacco International, British American Tobacco, and Philip Morris International, along with local players. Regional variations within Egypt's diverse geography may also impact market dynamics.

Egypt Tobacco Market Market Size (In Billion)

The projected growth trajectory indicates a consistently expanding market throughout the forecast period (2025-2033). Further analysis would necessitate detailed regional breakdowns within Egypt to understand market penetration and consumer preferences more precisely. The dominance of cigarettes within the product segments is anticipated to continue in the near future, although the e-cigarette/HTP segment is expected to exhibit faster growth rates. Marketing strategies are likely to focus on targeting different segments with tailored product offerings and distribution channels. The ongoing interplay between government regulations and consumer demand will significantly determine the future trajectory of the Egyptian tobacco market. Understanding this balance is crucial for stakeholders to effectively navigate the opportunities and challenges ahead.

Egypt Tobacco Market Company Market Share

Egypt Tobacco Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Egypt tobacco market, covering the period from 2019 to 2033. It offers a detailed examination of market structure, competitive dynamics, industry trends, segment performance, and future growth prospects, incorporating key developments and challenges. The report is essential for industry players, investors, and researchers seeking actionable insights into this dynamic market.

Egypt Tobacco Market Market Structure & Competitive Dynamics

The Egyptian tobacco market exhibits a moderately concentrated structure, dominated by a few major international and domestic players. Key players such as Japan Tobacco International SA, British American Tobacco PLC, Philip Morris International Inc, Eastern Company SAE, and Imperial Brands PLC compete fiercely, leveraging established brands and distribution networks. The market’s innovation ecosystem is relatively nascent compared to global counterparts, with innovation primarily focused on product diversification (e.g., e-cigarettes) and adapting to evolving consumer preferences.

The regulatory framework significantly impacts market dynamics. Government policies on taxation, advertising, and health regulations influence consumer behavior and company strategies. Product substitutes, such as vaping products and nicotine pouches, pose a growing challenge, although their market penetration remains relatively low. End-user trends show a gradual shift towards healthier alternatives, particularly among younger demographics, though the traditional cigarette segment still dominates. Recent M&A activities, such as Philip Morris' USD 450 Million investment in a new license (June 2022), indicate a strong commitment to expanding market share and production capabilities. The value of this transaction, and other smaller M&A deals, collectively contribute to market consolidation and influence the competitive landscape. Market share data indicates that Eastern Company SAE holds a significant share of the domestic cigarette market (xx%), followed by British American Tobacco (xx%) and Philip Morris International (xx%).

Egypt Tobacco Market Industry Trends & Insights

The Egypt tobacco market is expected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by several factors. Rising disposable incomes, particularly among the burgeoning middle class, fuel increased tobacco consumption. However, this growth is tempered by increasing health awareness campaigns, stricter regulations, and the rise of alternative nicotine products. Technological disruptions are visible in the growing adoption of e-cigarettes and Heated Tobacco Products (HTPs), presenting both opportunities and threats to traditional cigarette manufacturers. Consumer preferences show a continued dominance of cigarettes, despite a gradual shift towards less harmful alternatives. The competitive landscape remains intense, with major players constantly adapting their strategies to address changing consumer demands and regulatory pressures. Market penetration of e-cigarettes and HTPs is estimated at xx% in 2025, projected to reach xx% by 2033. This growth is further influenced by government policies and the actions of established players like Philip Morris International Inc, who are actively entering the e-cigarette manufacturing sector.

Dominant Markets & Segments in Egypt Tobacco Market

- Leading Product Type: Cigarettes remain the dominant product type, capturing the largest market share (xx%) due to established consumer habits and affordability.

- Leading End User: Males continue to represent the primary consumer base (xx%), though female consumption is also increasing (xx%).

- Leading Distribution Channel: Convenience/small grocery stores provide the widest reach (xx%), followed by specialty tobacco stores (xx%) and supermarkets/hypermarkets (xx%).

The dominance of cigarettes is largely attributed to deep-rooted cultural norms and the relatively lower cost compared to other tobacco products. The prevalence of convenience stores underscores the importance of widespread accessibility in driving consumption. Economic policies influencing consumer purchasing power and infrastructure development play a critical role in facilitating the distribution network. The growth of e-cigarettes and HTPs, while relatively small, offers a new area of potential competition and growth, dependent on regulatory frameworks and consumer acceptance.

Egypt Tobacco Market Product Innovations

Recent product developments focus on innovative nicotine delivery systems, such as e-cigarettes and HTPs. These innovations are driven by consumer demand for less harmful alternatives and regulatory pressures aimed at reducing smoking-related health issues. The competitive advantage lies in delivering a satisfying experience while minimizing the health risks associated with traditional cigarettes. Technological trends indicate a gradual shift towards personalized and technologically advanced tobacco and nicotine products. This includes developments in e-liquid flavors, advanced heating technologies, and personalized vaping devices.

Report Segmentation & Scope

The report segments the Egypt tobacco market by product type (cigarettes, cigars, cigarillos, cigar pipes, e-cigarettes/HTPs), end-user (male, female), and distribution channel (supermarket/hypermarket, convenience/small grocery stores, specialty/tobacco stores, other distribution channels). Each segment's market size, growth projections, and competitive dynamics are analyzed separately. The cigarette segment is projected to maintain significant growth throughout the forecast period; while the e-cigarette/HTP segment, despite its smaller current market share, is anticipated to demonstrate substantial growth due to technological advancements and shifting consumer preferences.

Key Drivers of Egypt Tobacco Market Growth

Key drivers include the growing adult population, rising disposable incomes fueling increased spending on tobacco products, and established distribution networks. The influx of international players further stimulates growth through product diversification and improved marketing strategies. Additionally, relatively lower tobacco taxation compared to some neighboring countries contributes to market expansion.

Challenges in the Egypt Tobacco Market Sector

Challenges include stringent health regulations, increasing health awareness campaigns discouraging tobacco use, and the growing popularity of alternative nicotine products. Supply chain disruptions, particularly in times of global economic instability, can impact the availability and pricing of tobacco products. Intense competition among both domestic and international players creates pricing pressures and impacts profitability. Government policies and taxes may further limit growth.

Leading Players in the Egypt Tobacco Market Market

- Japan Tobacco International SA

- British American Tobacco PLC

- Philip Morris International Inc

- Joyetech Group

- Eastern Company SAE

- Innokin Technology Co Ltd

- J Well France SARL

- Imperial Brands PLC

Key Developments in Egypt Tobacco Market Sector

- December 2021: Eastern Company and Al-Mansour International Distribution Company signed a distribution agreement to manufacture Davidoff Evolve cigarettes.

- June 2022: Philip Morris paid about USD 450 Million for a new license to manufacture traditional and electronic cigarettes.

- September 2022: Philip Morris' UTC subsidiary will begin manufacturing products for the Egyptian market; existing production by Eastern Co. will continue until stock is depleted.

Strategic Egypt Tobacco Market Market Outlook

The future of the Egypt tobacco market hinges on navigating the evolving regulatory landscape, consumer preferences, and the emergence of alternative nicotine products. Strategic opportunities lie in investing in innovative products, particularly in the e-cigarette and HTP segments. Adapting to changing consumer trends, emphasizing harm reduction strategies, and establishing strong distribution networks are crucial for long-term success. The market presents opportunities for companies willing to adapt to evolving consumer preferences and regulatory changes. Furthermore, collaborations and strategic partnerships can help navigate the complexities of the market and gain a competitive edge.

Egypt Tobacco Market Segmentation

-

1. Product Type

- 1.1. Cigarettes

- 1.2. Cigar, Cigarillos, and Cigar Pipes

- 1.3. E-Cigarette/HTP's

-

2. End User

- 2.1. Male

- 2.2. Female

-

3. Distribution Channel

- 3.1. Supermarket/Hypermarket

- 3.2. Convenience/Small Grocery Stores

- 3.3. Specialty/Tobacco Stores

- 3.4. Other Distribution Channels

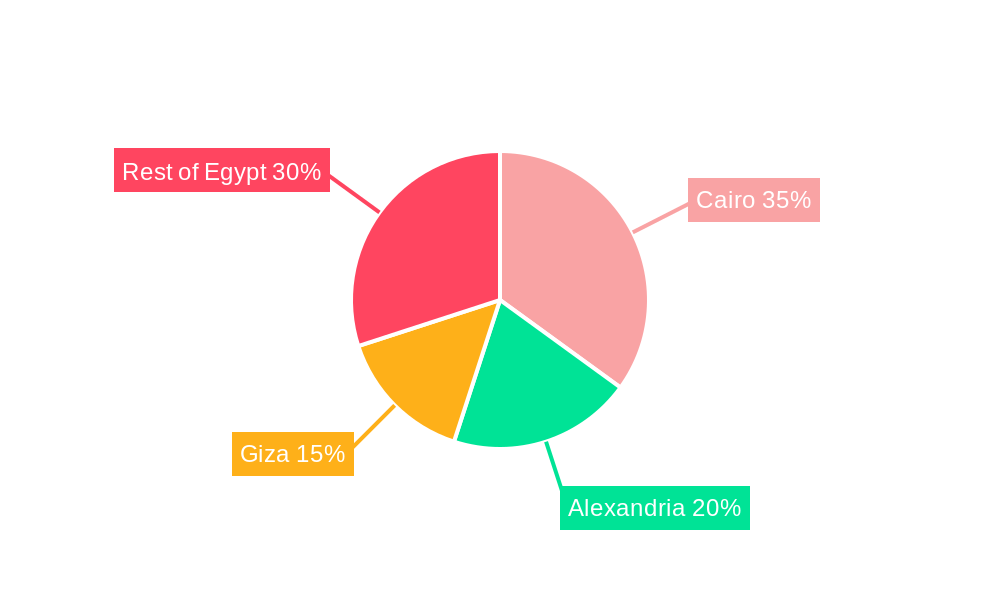

Egypt Tobacco Market Segmentation By Geography

- 1. Egypt

Egypt Tobacco Market Regional Market Share

Geographic Coverage of Egypt Tobacco Market

Egypt Tobacco Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumption of Tobacco is Rising as Cigarette Segment is Growing at a Significant Pace; Strong Penetration of Retail Distribution Network

- 3.3. Market Restrains

- 3.3.1. Growing Awareness about the Harmful effects of Tobacco Products to Hamper Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Consumption of Cigarettes across the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Egypt Tobacco Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cigarettes

- 5.1.2. Cigar, Cigarillos, and Cigar Pipes

- 5.1.3. E-Cigarette/HTP's

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Male

- 5.2.2. Female

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarket/Hypermarket

- 5.3.2. Convenience/Small Grocery Stores

- 5.3.3. Specialty/Tobacco Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Egypt

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Japan Tobacco International SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 British American Tobacco PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Philip Morris International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Joyetech Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eastern Company SAE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Innokin Technology Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 J Well France SARL*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Imperial Brands PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Japan Tobacco International SA

List of Figures

- Figure 1: Egypt Tobacco Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Egypt Tobacco Market Share (%) by Company 2025

List of Tables

- Table 1: Egypt Tobacco Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Egypt Tobacco Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Egypt Tobacco Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: Egypt Tobacco Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Egypt Tobacco Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: Egypt Tobacco Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 7: Egypt Tobacco Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 8: Egypt Tobacco Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Egypt Tobacco Market?

The projected CAGR is approximately 7.16%.

2. Which companies are prominent players in the Egypt Tobacco Market?

Key companies in the market include Japan Tobacco International SA, British American Tobacco PLC, Philip Morris International Inc, Joyetech Group, Eastern Company SAE, Innokin Technology Co Ltd, J Well France SARL*List Not Exhaustive, Imperial Brands PLC.

3. What are the main segments of the Egypt Tobacco Market?

The market segments include Product Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Consumption of Tobacco is Rising as Cigarette Segment is Growing at a Significant Pace; Strong Penetration of Retail Distribution Network.

6. What are the notable trends driving market growth?

Rising Consumption of Cigarettes across the Country.

7. Are there any restraints impacting market growth?

Growing Awareness about the Harmful effects of Tobacco Products to Hamper Market Growth.

8. Can you provide examples of recent developments in the market?

September 2022: Philip Morris announced that its United Tobacco Co. (UTC) subsidiary would begin manufacturing its products for the Egyptian market. Philip Morris' cigarettes will continue to be manufactured by Eastern Co. until its production stock is depleted.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Egypt Tobacco Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Egypt Tobacco Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Egypt Tobacco Market?

To stay informed about further developments, trends, and reports in the Egypt Tobacco Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence