Key Insights

The global Corporate Trademark Registration Service market is experiencing robust expansion, projected to reach USD 14.23 billion in 2025, with a significant Compound Annual Growth Rate (CAGR) of 9.01% during the forecast period of 2025-2033. This growth is propelled by several critical factors. The increasing globalization of businesses, coupled with a heightened awareness among SMEs and large enterprises regarding the importance of brand protection and intellectual property rights, is a primary driver. As companies expand their operations across borders, securing trademarks becomes paramount to prevent infringement and maintain brand integrity. Furthermore, the surge in digital commerce and the rise of new product launches across various sectors necessitate efficient and comprehensive trademark registration processes. Technological advancements, including AI-powered search tools and streamlined online filing systems, are also enhancing the efficiency and accessibility of these services, attracting a wider customer base. The market is further bolstered by evolving regulatory landscapes that encourage IP protection.

Corporate Trademark Registration Service Market Size (In Billion)

The market is segmented by application into SMEs and Large Enterprises, with both segments demonstrating substantial demand. SMEs, in particular, are increasingly recognizing the value of trademark registration for establishing credibility and securing market share, despite potential budget constraints. Large enterprises, on the other hand, require sophisticated services for managing extensive trademark portfolios across multiple jurisdictions. By service type, Trademark Search Services and Trademark Monitoring Services are the dominant segments, reflecting the continuous need for thorough due diligence before registration and ongoing vigilance against potential infringements. While the market exhibits strong growth, potential challenges include the complexity and cost associated with international trademark registration in some regions, and the need for continuous adaptation to evolving legal frameworks and digital threats. However, the overarching trend of businesses prioritizing brand security and IP assets ensures a dynamic and expanding future for the corporate trademark registration service sector.

Corporate Trademark Registration Service Company Market Share

This in-depth report delivers a strategic analysis of the global Corporate Trademark Registration Service market. Covering the historical period from 2019 to 2024, a base year of 2025, and a forecast period extending to 2033, this study offers unparalleled insights into market dynamics, emerging trends, and competitive landscapes. With a projected market size valued in the billions, this report is essential for legal professionals, IP strategists, business leaders, and investors seeking to navigate the complexities of intellectual property protection and leverage trademark registration for sustainable business growth. The report meticulously examines key segments including SMEs and Large Enterprises, alongside service types such as Trademark Search Services, Trademark Monitoring Services, and Others, providing actionable intelligence to inform strategic decision-making.

Corporate Trademark Registration Service Market Structure & Competitive Dynamics

The global Corporate Trademark Registration Service market exhibits a moderate to high level of fragmentation, with a significant number of established players and emerging service providers vying for market share. Market concentration is influenced by the varying needs of Small and Medium-sized Enterprises (SMEs) versus Large Enterprises, with specialized offerings catering to each segment. Innovation ecosystems are thriving, driven by advancements in AI-powered trademark search tools and blockchain for secure record-keeping, projected to contribute to an innovation investment of over $1 billion within the forecast period. Regulatory frameworks, while largely standardized globally, present complexities that favor experienced service providers. Product substitutes, such as in-house legal departments and basic online form submissions, are less comprehensive and carry higher risks for complex global portfolios. End-user trends point towards an increasing demand for end-to-end IP management solutions, encompassing search, registration, monitoring, and enforcement. Mergers and acquisitions (M&A) activities are anticipated to accelerate, with an estimated M&A deal value exceeding $500 million by 2030, as larger entities seek to consolidate market presence and acquire cutting-edge technologies. Leading companies like LegalZoom and Bizee often compete on price and accessibility for SMEs, while Anaqua and Clarivate (CPA Global) dominate the enterprise segment with sophisticated portfolio management solutions.

Corporate Trademark Registration Service Industry Trends & Insights

The Corporate Trademark Registration Service industry is experiencing robust growth, primarily driven by the escalating globalization of businesses and the increasing recognition of intellectual property as a critical corporate asset. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period (2025–2033), translating to a market valuation projected to surpass $10 billion by 2033. This growth is underpinned by several key factors. Firstly, the proliferation of e-commerce and digital platforms has amplified the need for stringent trademark protection to safeguard brand identity and prevent infringement in the online space. Secondly, a growing awareness among businesses, particularly SMEs, about the invaluable role of trademarks in building brand equity, fostering customer loyalty, and securing market advantage is a significant catalyst. Technologically, the integration of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing trademark search processes, enabling more efficient and accurate identification of potential conflicts and reducing the time and cost associated with traditional methods. Advanced analytics and predictive tools are becoming indispensable for proactive trademark monitoring. Consumer preferences are shifting towards brands with strong, recognizable identities, compelling businesses to invest more heavily in securing and protecting their trademarks. The competitive landscape is characterized by intense rivalry, with established players continuously innovating to offer more comprehensive and user-friendly services. This includes the development of integrated platforms that offer trademark search, registration, renewal, and monitoring functionalities, alongside dispute resolution support. Market penetration for specialized IP management software is expected to reach over 60% among large enterprises by 2030. The increasing complexity of international trademark laws and registration procedures also necessitates expert guidance, further fueling the demand for professional services. The rise of the gig economy and the increasing number of startups also contribute to the sustained demand for accessible and cost-effective trademark registration solutions. Furthermore, the report anticipates increased investment in cloud-based solutions and data security measures to protect sensitive client information, with estimated investments in cybersecurity exceeding $500 million annually by 2030.

Dominant Markets & Segments in Corporate Trademark Registration Service

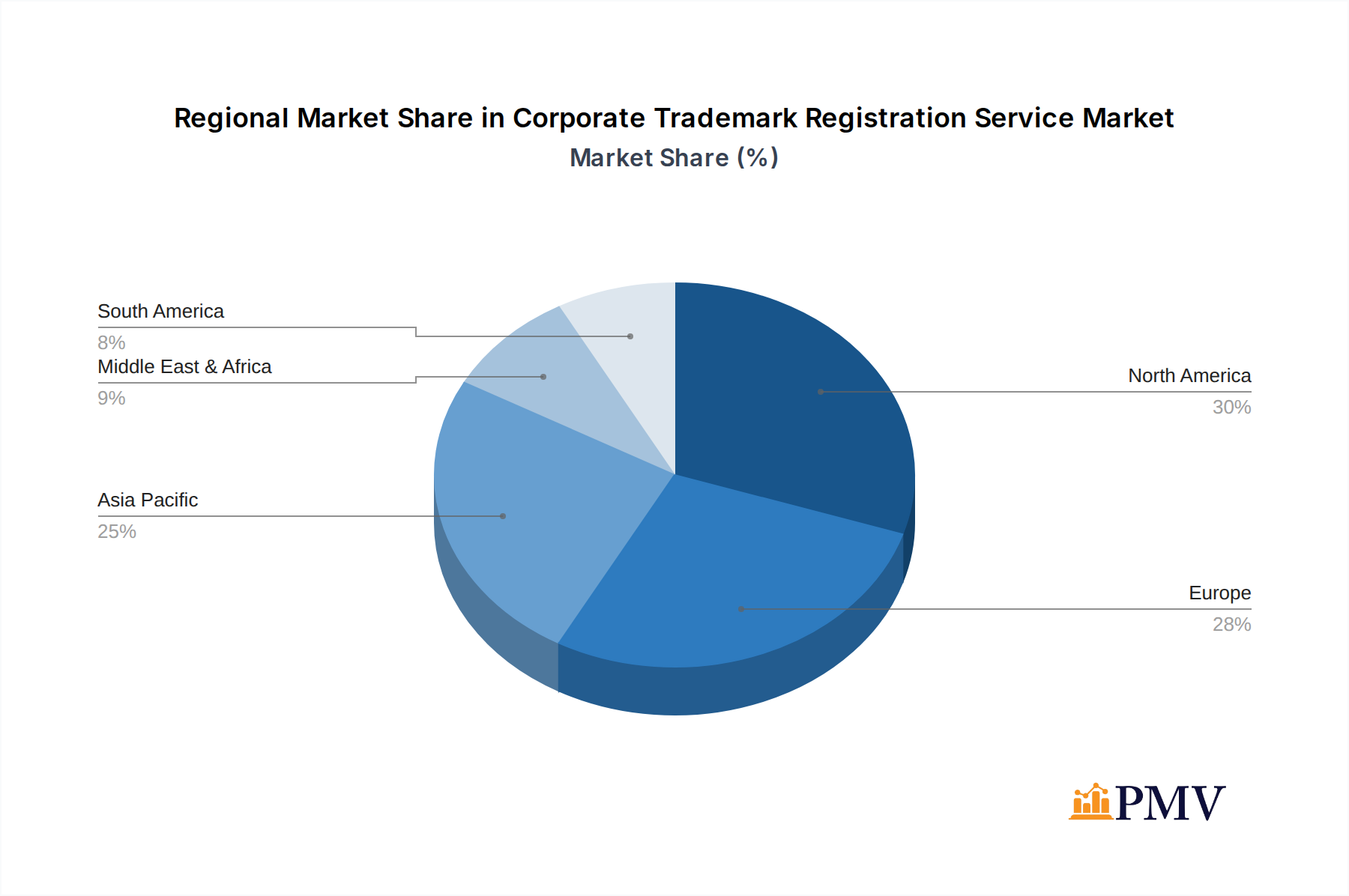

The Corporate Trademark Registration Service market is characterized by distinct dominant regions and segments, driven by a confluence of economic policies, regulatory environments, and business infrastructure.

- Dominant Region: North America, particularly the United States, currently leads the market in terms of revenue and adoption of sophisticated trademark registration services. This dominance is attributed to its mature economy, strong legal framework for intellectual property protection, and a high concentration of innovative businesses across various sectors. The presence of numerous established IP law firms and service providers further solidifies its position.

- Dominant Segment (Application): SMEs

- Key Drivers: The SME segment represents a significant growth engine due to the increasing number of new business formations and the growing realization among small business owners of the importance of brand protection.

- Dominance Analysis: While large enterprises often manage extensive global portfolios, the sheer volume of SMEs creates a substantial demand for cost-effective and accessible trademark registration services. Service providers focusing on streamlined online processes, affordable pricing, and educational resources are particularly successful in capturing this market. The accessibility of platforms like LegalZoom and Rocket Lawyer caters directly to the needs of this segment, making trademark registration less daunting.

- Dominant Segment (Type): Trademark Search Services

- Key Drivers: Thorough trademark searches are the foundational step in the registration process, essential for avoiding conflicts and ensuring the validity of a mark.

- Dominance Analysis: The critical nature of preliminary trademark searches makes them a consistently high-demand service. Advances in AI and database management have made these searches more efficient and accurate, driving their widespread adoption. Companies like MaxVal Group and Murgitroyd offer robust search capabilities that are integral to their broader service offerings, catering to both proactive brand protection and due diligence.

Corporate Trademark Registration Service Product Innovations

Product innovations in the Corporate Trademark Registration Service market are primarily focused on enhancing efficiency, accuracy, and user experience. The integration of AI and machine learning algorithms for sophisticated trademark clearance searches and predictive infringement analysis is a significant trend. Cloud-based portfolio management systems are becoming standard, offering seamless access and collaboration for global trademark portfolios. Innovations also include AI-driven automated renewal reminders and proactive monitoring systems that alert businesses to potential infringements in real-time. These advancements aim to reduce manual effort, minimize errors, and provide businesses with a more proactive and strategic approach to IP protection, ensuring market fit for evolving business needs.

Report Segmentation & Scope

This report segments the Corporate Trademark Registration Service market comprehensively to provide detailed insights into specific areas of growth and opportunity.

- Application: SMEs This segment focuses on the unique trademark registration needs of Small and Medium-sized Enterprises. It analyzes the market size, projected growth rates, and competitive dynamics, highlighting service providers that offer scalable and affordable solutions tailored to smaller businesses, with an estimated market size of over $4 billion by 2033.

- Application: Large Enterprises This segment examines the complex trademark portfolio management requirements of large corporations. It details market share, growth trajectories, and competitive strategies for services catering to extensive international filings, high-volume renewals, and sophisticated IP strategy, with an estimated market size exceeding $6 billion by 2033.

- Type: Trademark Search Services This segment covers the market for preliminary and comprehensive trademark searches. It includes analysis of market size, growth drivers, and competitive landscapes for services that ensure the registrability and uniqueness of new marks, with an estimated market share of 40% within the overall service type segment.

- Type: Trademark Monitoring Services This segment delves into the market for ongoing tracking of trademark usage and potential infringements. It provides insights into market size, adoption rates, and key technologies employed in brand protection strategies, with an estimated market share of 35% within the overall service type segment.

- Type: Others This segment encompasses related services such as trademark renewal, international registration (e.g., Madrid Protocol), IP consulting, and enforcement support. It analyzes the market size and growth potential of these ancillary services, contributing to the remaining market share.

Key Drivers of Corporate Trademark Registration Service Growth

The growth of the Corporate Trademark Registration Service market is propelled by several key factors. The increasing recognition of intellectual property as a core business asset, essential for brand valuation and competitive advantage, is a primary driver. Globalization and the expansion of e-commerce necessitate robust trademark protection across multiple jurisdictions to prevent online infringement and counterfeiting. Technological advancements, particularly AI-driven search and monitoring tools, are enhancing efficiency and accuracy, making professional services more attractive. Favorable government initiatives and evolving intellectual property laws in emerging economies are also fostering market expansion. For instance, countries are actively strengthening their IP protection regimes to attract foreign investment, thereby increasing the demand for registration services. The projected growth is further bolstered by an estimated increase in global IP filings by 10% annually.

Challenges in the Corporate Trademark Registration Service Sector

Despite robust growth, the Corporate Trademark Registration Service sector faces several challenges. Regulatory hurdles and the complexity of international trademark laws can be a significant barrier, particularly for SMEs with limited resources. The intense competitive landscape, with numerous players offering similar services, can lead to price wars and reduced profit margins. Supply chain issues, though less direct, can impact the availability of specialized legal expertise required for complex cases. Furthermore, the evolving threat landscape of cybercrime and data breaches necessitates significant investment in robust security measures, which can be a substantial cost for service providers. The estimated annual cost for cybersecurity enhancements across the industry is projected to reach over $300 million by 2027.

Leading Players in the Corporate Trademark Registration Service Market

- LegalZoom

- Bizee

- Anaqua

- Acumass

- Northwest Registered Agent

- MaxVal Group

- Clarivate (CPA Global)

- Dennemeyer

- Murgitroyd

- Questel

- Rocket Lawyer

- JPG Legal

- Computer Packages Inc

- NovumIP (Novagraaf & PAVIS)

- MyCorporation

- IP Centrum Limited

- Trademark Plus

- Incfile

- Inc Authority

Key Developments in Corporate Trademark Registration Service Sector

- 2023/01: Launch of AI-powered predictive trademark search tools by several leading providers, enhancing accuracy and speed.

- 2023/04: Acquisition of a mid-sized IP management software company by a major player to expand its service portfolio.

- 2023/08: Increased focus on blockchain integration for secure and transparent trademark registration records.

- 2024/02: Emergence of specialized services for NFTs and metaverse trademarks, reflecting evolving digital asset protection needs.

- 2024/07: Global IP offices report a surge in trademark applications from emerging technology sectors.

Strategic Corporate Trademark Registration Service Market Outlook

The strategic outlook for the Corporate Trademark Registration Service market remains highly positive, driven by continuous innovation and increasing global demand for brand protection. Growth accelerators include the ongoing digitalization of business operations, the expansion of global trade, and the rising awareness of IP value. Future market potential lies in the development of more integrated, AI-driven platforms offering end-to-end IP lifecycle management solutions. Strategic opportunities exist in catering to niche markets such as the metaverse and the burgeoning sector of sustainability certifications. Companies that can offer transparent pricing, superior customer service, and cutting-edge technological solutions will be best positioned to capitalize on the projected market expansion, with an estimated cumulative market growth exceeding $20 billion over the forecast period.

Corporate Trademark Registration Service Segmentation

-

1. Application

- 1.1. SMEs

- 1.2. Large Enterprises

-

2. Type

- 2.1. Trademark Search Services

- 2.2. Trademark Monitoring Services

- 2.3. Others

Corporate Trademark Registration Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Corporate Trademark Registration Service Regional Market Share

Geographic Coverage of Corporate Trademark Registration Service

Corporate Trademark Registration Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Corporate Trademark Registration Service Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. SMEs

- 5.1.2. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Trademark Search Services

- 5.2.2. Trademark Monitoring Services

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Corporate Trademark Registration Service Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. SMEs

- 6.1.2. Large Enterprises

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Trademark Search Services

- 6.2.2. Trademark Monitoring Services

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Corporate Trademark Registration Service Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. SMEs

- 7.1.2. Large Enterprises

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Trademark Search Services

- 7.2.2. Trademark Monitoring Services

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Corporate Trademark Registration Service Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. SMEs

- 8.1.2. Large Enterprises

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Trademark Search Services

- 8.2.2. Trademark Monitoring Services

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Corporate Trademark Registration Service Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. SMEs

- 9.1.2. Large Enterprises

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Trademark Search Services

- 9.2.2. Trademark Monitoring Services

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Corporate Trademark Registration Service Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. SMEs

- 10.1.2. Large Enterprises

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Trademark Search Services

- 10.2.2. Trademark Monitoring Services

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 LegalZoom

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bizee

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Anaqua

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Acumass

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Northwest Registered Agent

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MaxVal Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Clarivate (CPA Global)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dennemeyer

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Murgitroyd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Questel

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rocket Lawyer

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 JPG Legal

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Computer Packages Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 NovumIP (Novagraaf & PAVIS)

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 MyCorporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 IP Centrum Limited

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Northwest Registered Agent LLC

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Trademark Plus

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Incfile

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Inc Authority

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 LegalZoom

List of Figures

- Figure 1: Global Corporate Trademark Registration Service Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Corporate Trademark Registration Service Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Corporate Trademark Registration Service Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Corporate Trademark Registration Service Revenue (billion), by Type 2025 & 2033

- Figure 5: North America Corporate Trademark Registration Service Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Corporate Trademark Registration Service Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Corporate Trademark Registration Service Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Corporate Trademark Registration Service Revenue (billion), by Application 2025 & 2033

- Figure 9: South America Corporate Trademark Registration Service Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Corporate Trademark Registration Service Revenue (billion), by Type 2025 & 2033

- Figure 11: South America Corporate Trademark Registration Service Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Corporate Trademark Registration Service Revenue (billion), by Country 2025 & 2033

- Figure 13: South America Corporate Trademark Registration Service Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Corporate Trademark Registration Service Revenue (billion), by Application 2025 & 2033

- Figure 15: Europe Corporate Trademark Registration Service Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Corporate Trademark Registration Service Revenue (billion), by Type 2025 & 2033

- Figure 17: Europe Corporate Trademark Registration Service Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Corporate Trademark Registration Service Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Corporate Trademark Registration Service Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Corporate Trademark Registration Service Revenue (billion), by Application 2025 & 2033

- Figure 21: Middle East & Africa Corporate Trademark Registration Service Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Corporate Trademark Registration Service Revenue (billion), by Type 2025 & 2033

- Figure 23: Middle East & Africa Corporate Trademark Registration Service Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Corporate Trademark Registration Service Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa Corporate Trademark Registration Service Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Corporate Trademark Registration Service Revenue (billion), by Application 2025 & 2033

- Figure 27: Asia Pacific Corporate Trademark Registration Service Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Corporate Trademark Registration Service Revenue (billion), by Type 2025 & 2033

- Figure 29: Asia Pacific Corporate Trademark Registration Service Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Corporate Trademark Registration Service Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific Corporate Trademark Registration Service Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Corporate Trademark Registration Service Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Corporate Trademark Registration Service Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Global Corporate Trademark Registration Service Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Corporate Trademark Registration Service Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Corporate Trademark Registration Service Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Corporate Trademark Registration Service Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Corporate Trademark Registration Service Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Corporate Trademark Registration Service Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Corporate Trademark Registration Service Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Corporate Trademark Registration Service Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Corporate Trademark Registration Service Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Global Corporate Trademark Registration Service Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Corporate Trademark Registration Service Revenue billion Forecast, by Application 2020 & 2033

- Table 29: Global Corporate Trademark Registration Service Revenue billion Forecast, by Type 2020 & 2033

- Table 30: Global Corporate Trademark Registration Service Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global Corporate Trademark Registration Service Revenue billion Forecast, by Application 2020 & 2033

- Table 38: Global Corporate Trademark Registration Service Revenue billion Forecast, by Type 2020 & 2033

- Table 39: Global Corporate Trademark Registration Service Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Corporate Trademark Registration Service Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Corporate Trademark Registration Service?

The projected CAGR is approximately 9.01%.

2. Which companies are prominent players in the Corporate Trademark Registration Service?

Key companies in the market include LegalZoom, Bizee, Anaqua, Acumass, Northwest Registered Agent, MaxVal Group, Clarivate (CPA Global), Dennemeyer, Murgitroyd, Questel, Rocket Lawyer, JPG Legal, Computer Packages Inc, NovumIP (Novagraaf & PAVIS), MyCorporation, IP Centrum Limited, Northwest Registered Agent, LLC, Trademark Plus, Incfile, Inc Authority.

3. What are the main segments of the Corporate Trademark Registration Service?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.23 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Corporate Trademark Registration Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Corporate Trademark Registration Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Corporate Trademark Registration Service?

To stay informed about further developments, trends, and reports in the Corporate Trademark Registration Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence