Key Insights

The global cord blood banking market is poised for substantial expansion, driven by heightened awareness of stem cell therapies and their transformative potential across a spectrum of diseases. Projected to reach a market size of $19.13 billion by 2025, the industry anticipates a compound annual growth rate (CAGR) of 11.7% during the forecast period. This growth is primarily fueled by the increasing incidence of hematological disorders, genetic conditions, and immune deficiencies, which are spurring demand for cord blood stem cell preservation. Innovations in stem cell processing and storage technologies are also significantly contributing to market potential. Despite challenges posed by regulatory complexities and storage expenses, the expanding applications in regenerative medicine and continuous research into therapeutic capabilities are expected to propel market growth. The market is segmented by bank type (private, public, hybrid) and application (leukemia, genetic disorders, immune deficiencies, and others). Private banks currently hold a dominant market share, attributed to their enhanced accessibility and customized services. Geographically, North America and Asia Pacific demonstrate strong growth potential, supported by escalating healthcare expenditures and widespread awareness initiatives. Europe and other regions are also making significant contributions to overall market expansion. Vigorous competition among established entities like CSG-BIO, California Cryobank, and AlphaCord, alongside emerging players, is fostering innovation and improving accessibility to this critical life-saving technology.

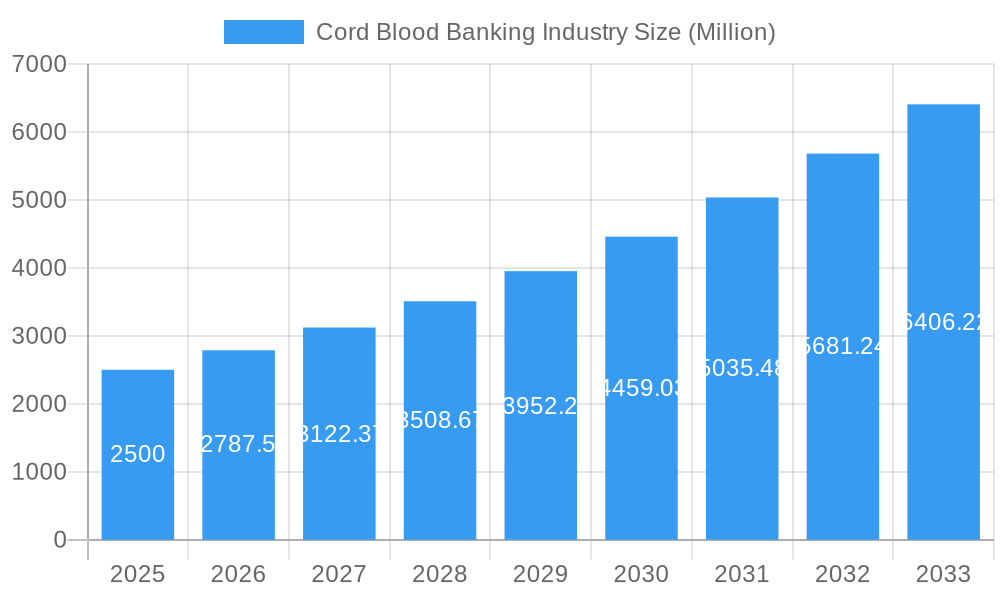

Cord Blood Banking Industry Market Size (In Billion)

Future growth in the cord blood banking sector will be intrinsically linked to the broadening clinical applications of stem cells and enhanced public comprehension of their benefits. Ongoing research into the therapeutic potential of cord blood, coupled with advancements in storage and transportation infrastructure, will continue to be key drivers of market expansion. Governmental support for stem cell research and the development of cost-effective banking solutions are anticipated to stimulate growth, particularly in emerging economies. Streamlined regulatory frameworks and improved quality control standards will foster a more stable and transparent market environment, further encouraging the adoption of this life-saving technology. This positive outlook highlights the enduring value and significant opportunities within the cord blood banking industry.

Cord Blood Banking Industry Company Market Share

Cord Blood Banking Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the global Cord Blood Banking industry, offering invaluable insights for stakeholders across the value chain. The study period covers 2019-2033, with 2025 as the base and estimated year. The report projects a market size of xx Million by 2033, driven by several key factors explored within.

Cord Blood Banking Industry Market Structure & Competitive Dynamics

The global cord blood banking market exhibits a moderately concentrated structure, with several key players commanding significant market share. The competitive landscape is characterized by a mix of private, public, and hybrid banking models. Innovation ecosystems are developing rapidly, spurred by advancements in cryopreservation technologies and cellular therapies. Regulatory frameworks vary across regions, influencing market access and operational procedures. Product substitutes, such as umbilical cord tissue banking, pose a competitive threat, while the increasing prevalence of genetic disorders and the rising demand for cell-based therapies are key growth drivers. M&A activity is moderate, with deal values ranging from xx Million to xx Million in recent years. Key players like CSG-BIO and Cryo-Cell International are actively shaping the market through strategic partnerships and facility expansions. Market share analysis reveals that the top 5 players account for approximately xx% of the global market.

- Market Concentration: Moderately concentrated

- Innovation Ecosystems: Rapidly developing

- Regulatory Frameworks: Regionally diverse

- M&A Activity: Moderate, with deal values ranging from xx Million to xx Million.

Cord Blood Banking Industry Industry Trends & Insights

The cord blood banking industry is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by increasing awareness of the therapeutic potential of cord blood stem cells, rising birth rates in key regions, and technological advancements in cryopreservation and stem cell processing. Market penetration remains relatively low in several emerging markets, presenting significant opportunities for expansion. Consumer preferences are shifting towards private banking options, driven by factors such as perceived higher quality control and personalized service. However, public and hybrid models continue to play a vital role, particularly in regions with robust government support. The industry faces challenges related to cost considerations, stringent regulatory compliance, and storage capacity limitations. Technological disruptions, such as the development of advanced cryopreservation techniques and automation in stem cell processing, are driving efficiency improvements and reducing operational costs.

Dominant Markets & Segments in Cord Blood Banking Industry

North America currently holds the dominant position in the cord blood banking market, driven by high healthcare expenditure, advanced infrastructure, and a strong regulatory framework. Within this region, the United States exhibits the largest market share.

Key Drivers of Regional Dominance:

- High Healthcare Expenditure: North America has significantly higher per capita spending on healthcare compared to other regions.

- Advanced Infrastructure: The presence of established research institutions, advanced healthcare facilities, and well-developed logistics networks supports market growth.

- Strong Regulatory Framework: Clear regulatory pathways encourage investment and foster market expansion.

Segment Dominance:

- Bank Type: The Private segment accounts for the largest market share, driven by the preference for personalized service and perceived higher quality control.

- Application: Leukemia treatment is currently the most significant application segment, although applications are expanding towards other areas like genetic disorders and immune deficiencies. The "Other Applications" segment is also growing significantly due to ongoing research and increasing clinical trials.

Cord Blood Banking Industry Product Innovations

Recent innovations focus on enhancing cryopreservation techniques to improve stem cell viability and minimize the risk of contamination. Automated processing systems are being introduced to streamline operations and reduce costs. New applications of cord blood stem cells are continually being explored, broadening the market’s therapeutic scope. Companies are emphasizing personalized services and customized storage options to meet increasing customer demands. The development of advanced genetic testing capabilities, linked to cord blood banking, provides additional value to customers and expands market opportunities.

Report Segmentation & Scope

This report segments the cord blood banking market across several key parameters:

Bank Type: Private, Public, Hybrid. The private segment is expected to grow at a CAGR of xx% during the forecast period, driven by rising disposable incomes and increased awareness of the benefits of private cord blood banking.

Application: Leukemia, Genetic Disorders, Immune Deficiencies, Other Applications. The "Other Applications" segment shows significant growth potential with new clinical applications being researched consistently.

Each segment’s analysis includes detailed growth projections, market sizes, and competitive dynamics.

Key Drivers of Cord Blood Banking Industry Growth

Technological advancements, including improvements in cryopreservation techniques and automated processing systems, are driving efficiency and cost reduction. Rising awareness of the therapeutic potential of cord blood stem cells and the increasing prevalence of treatable blood disorders are major growth catalysts. Favorable regulatory environments in several regions promote market expansion, while increasing disposable incomes and higher birth rates particularly in developing countries contribute to rising demand for private cord blood banking services.

Challenges in the Cord Blood Banking Industry Sector

The industry faces challenges such as stringent regulatory compliance requirements, which increase operational costs and complexity. Supply chain disruptions can affect the availability of crucial materials and equipment. Maintaining the viability and quality of stored cord blood requires significant investment in advanced infrastructure and highly trained personnel. Intense competition among established players and the emergence of new entrants create price pressures and necessitate continuous innovation to remain competitive. The high cost of cord blood banking remains a barrier to adoption for a segment of the population.

Leading Players in the Cord Blood Banking Industry Market

- CSG-BIO

- California Cryobank Stem Cell Services LLC

- AlphaCord LLC

- PerkinElmer Inc (ViaCord LLC)

- Singapore Cord Blood Bank

- CBR Systems Inc

- Cordlife Group Limited

- Global Cord Blood Corporation

- Cord Blood Foundation (Smart Cells International)

- ATCC

- Cryo-Cell International

- FamiCord

Key Developments in Cord Blood Banking Industry Sector

- March 2022: Cryo-Cell International, Inc. announces a new 56,000 sq ft facility, expanding its cryopreservation and cold storage services with the launch of "ExtraVault".

- February 2021: Cryo-Cell enters into a license agreement with Duke University, aiming to become a vertically integrated cellular therapy company.

Strategic Cord Blood Banking Industry Market Outlook

The cord blood banking industry is poised for continued growth, driven by advancements in stem cell research, expanding clinical applications, and rising consumer awareness. Strategic opportunities exist in emerging markets with high birth rates and untapped potential. Companies focused on technological innovation, superior quality control, personalized service offerings, and strategic partnerships will be best positioned to capture market share and drive future growth. The integration of advanced technologies like AI and machine learning will also play a crucial role in improving efficiency and expanding the applications of cord blood banking.

Cord Blood Banking Industry Segmentation

-

1. Bank Type

- 1.1. Private

- 1.2. Public

- 1.3. Hybrid

-

2. Application

- 2.1. Leukaemia

- 2.2. Genetic Disorders

- 2.3. Immune Deficiencies

- 2.4. Other Applications

Cord Blood Banking Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Cord Blood Banking Industry Regional Market Share

Geographic Coverage of Cord Blood Banking Industry

Cord Blood Banking Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Burden of Genetic Diseases; Increased Government Initiatives to Create Awareness

- 3.3. Market Restrains

- 3.3.1. Small Size of Study Population and Ethical Concerns; Highly Expensive Collection and Storage Procedures

- 3.4. Market Trends

- 3.4.1. Leukaemia Segment is Expected to Hold the Major Market Share in the Cord Blood Banking Services Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cord Blood Banking Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Bank Type

- 5.1.1. Private

- 5.1.2. Public

- 5.1.3. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Leukaemia

- 5.2.2. Genetic Disorders

- 5.2.3. Immune Deficiencies

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Bank Type

- 6. North America Cord Blood Banking Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Bank Type

- 6.1.1. Private

- 6.1.2. Public

- 6.1.3. Hybrid

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Leukaemia

- 6.2.2. Genetic Disorders

- 6.2.3. Immune Deficiencies

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Bank Type

- 7. Europe Cord Blood Banking Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Bank Type

- 7.1.1. Private

- 7.1.2. Public

- 7.1.3. Hybrid

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Leukaemia

- 7.2.2. Genetic Disorders

- 7.2.3. Immune Deficiencies

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Bank Type

- 8. Asia Pacific Cord Blood Banking Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Bank Type

- 8.1.1. Private

- 8.1.2. Public

- 8.1.3. Hybrid

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Leukaemia

- 8.2.2. Genetic Disorders

- 8.2.3. Immune Deficiencies

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Bank Type

- 9. Middle East and Africa Cord Blood Banking Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Bank Type

- 9.1.1. Private

- 9.1.2. Public

- 9.1.3. Hybrid

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Leukaemia

- 9.2.2. Genetic Disorders

- 9.2.3. Immune Deficiencies

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Bank Type

- 10. South America Cord Blood Banking Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Bank Type

- 10.1.1. Private

- 10.1.2. Public

- 10.1.3. Hybrid

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Leukaemia

- 10.2.2. Genetic Disorders

- 10.2.3. Immune Deficiencies

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Bank Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CSG-BIO

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 California Cryobank Stem Cell Services LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AlphaCord LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PerkinElmer Inc (ViaCord LLC)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Singapore Cord Blood Bank

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CBR Systems Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cordlife Group Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Global Cord Blood Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cord Blood Foundation (Smart Cells International)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ATCC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Cryo-Cell International

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 FamiCord*List Not Exhaustive

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 CSG-BIO

List of Figures

- Figure 1: Global Cord Blood Banking Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Cord Blood Banking Industry Revenue (billion), by Bank Type 2025 & 2033

- Figure 3: North America Cord Blood Banking Industry Revenue Share (%), by Bank Type 2025 & 2033

- Figure 4: North America Cord Blood Banking Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Cord Blood Banking Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Cord Blood Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Cord Blood Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Cord Blood Banking Industry Revenue (billion), by Bank Type 2025 & 2033

- Figure 9: Europe Cord Blood Banking Industry Revenue Share (%), by Bank Type 2025 & 2033

- Figure 10: Europe Cord Blood Banking Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Cord Blood Banking Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Cord Blood Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Cord Blood Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Cord Blood Banking Industry Revenue (billion), by Bank Type 2025 & 2033

- Figure 15: Asia Pacific Cord Blood Banking Industry Revenue Share (%), by Bank Type 2025 & 2033

- Figure 16: Asia Pacific Cord Blood Banking Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Cord Blood Banking Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Cord Blood Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Cord Blood Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Cord Blood Banking Industry Revenue (billion), by Bank Type 2025 & 2033

- Figure 21: Middle East and Africa Cord Blood Banking Industry Revenue Share (%), by Bank Type 2025 & 2033

- Figure 22: Middle East and Africa Cord Blood Banking Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: Middle East and Africa Cord Blood Banking Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East and Africa Cord Blood Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East and Africa Cord Blood Banking Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Cord Blood Banking Industry Revenue (billion), by Bank Type 2025 & 2033

- Figure 27: South America Cord Blood Banking Industry Revenue Share (%), by Bank Type 2025 & 2033

- Figure 28: South America Cord Blood Banking Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: South America Cord Blood Banking Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Cord Blood Banking Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: South America Cord Blood Banking Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cord Blood Banking Industry Revenue billion Forecast, by Bank Type 2020 & 2033

- Table 2: Global Cord Blood Banking Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Cord Blood Banking Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Cord Blood Banking Industry Revenue billion Forecast, by Bank Type 2020 & 2033

- Table 5: Global Cord Blood Banking Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Cord Blood Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Cord Blood Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Cord Blood Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Cord Blood Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Cord Blood Banking Industry Revenue billion Forecast, by Bank Type 2020 & 2033

- Table 11: Global Cord Blood Banking Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Cord Blood Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Cord Blood Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Cord Blood Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Cord Blood Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Cord Blood Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Cord Blood Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Cord Blood Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Cord Blood Banking Industry Revenue billion Forecast, by Bank Type 2020 & 2033

- Table 20: Global Cord Blood Banking Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 21: Global Cord Blood Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 22: China Cord Blood Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Cord Blood Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: India Cord Blood Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Cord Blood Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: South Korea Cord Blood Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Cord Blood Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Cord Blood Banking Industry Revenue billion Forecast, by Bank Type 2020 & 2033

- Table 29: Global Cord Blood Banking Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 30: Global Cord Blood Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: GCC Cord Blood Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: South Africa Cord Blood Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Cord Blood Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Cord Blood Banking Industry Revenue billion Forecast, by Bank Type 2020 & 2033

- Table 35: Global Cord Blood Banking Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 36: Global Cord Blood Banking Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Cord Blood Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Cord Blood Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Cord Blood Banking Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cord Blood Banking Industry?

The projected CAGR is approximately 11.7%.

2. Which companies are prominent players in the Cord Blood Banking Industry?

Key companies in the market include CSG-BIO, California Cryobank Stem Cell Services LLC, AlphaCord LLC, PerkinElmer Inc (ViaCord LLC), Singapore Cord Blood Bank, CBR Systems Inc, Cordlife Group Limited, Global Cord Blood Corporation, Cord Blood Foundation (Smart Cells International), ATCC, Cryo-Cell International, FamiCord*List Not Exhaustive.

3. What are the main segments of the Cord Blood Banking Industry?

The market segments include Bank Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.13 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Burden of Genetic Diseases; Increased Government Initiatives to Create Awareness.

6. What are the notable trends driving market growth?

Leukaemia Segment is Expected to Hold the Major Market Share in the Cord Blood Banking Services Market.

7. Are there any restraints impacting market growth?

Small Size of Study Population and Ethical Concerns; Highly Expensive Collection and Storage Procedures.

8. Can you provide examples of recent developments in the market?

In March 2022, Cryo-Cell International, Inc. reported that it has entered into a purchase contract for a recently constructed, 56,000 sq ft facility located in the Regional Commerce Center within the Research Triangle, NC, with the closure subject to customary conditions. This facility is expected to grow Cryo-cryopreservation Cell's and cold storage business by launching a new service, ExtraVault.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cord Blood Banking Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cord Blood Banking Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cord Blood Banking Industry?

To stay informed about further developments, trends, and reports in the Cord Blood Banking Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence