Key Insights

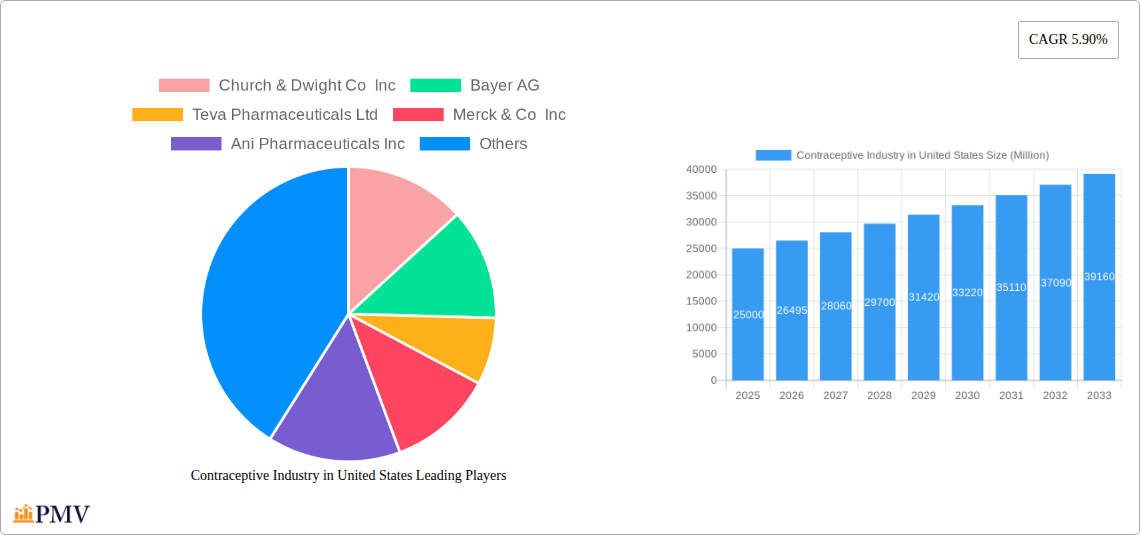

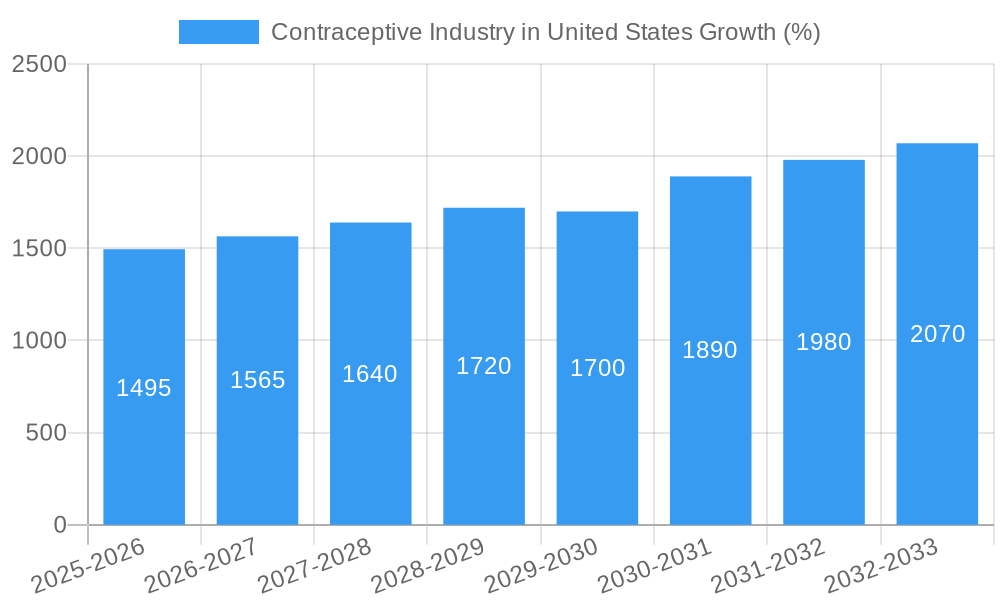

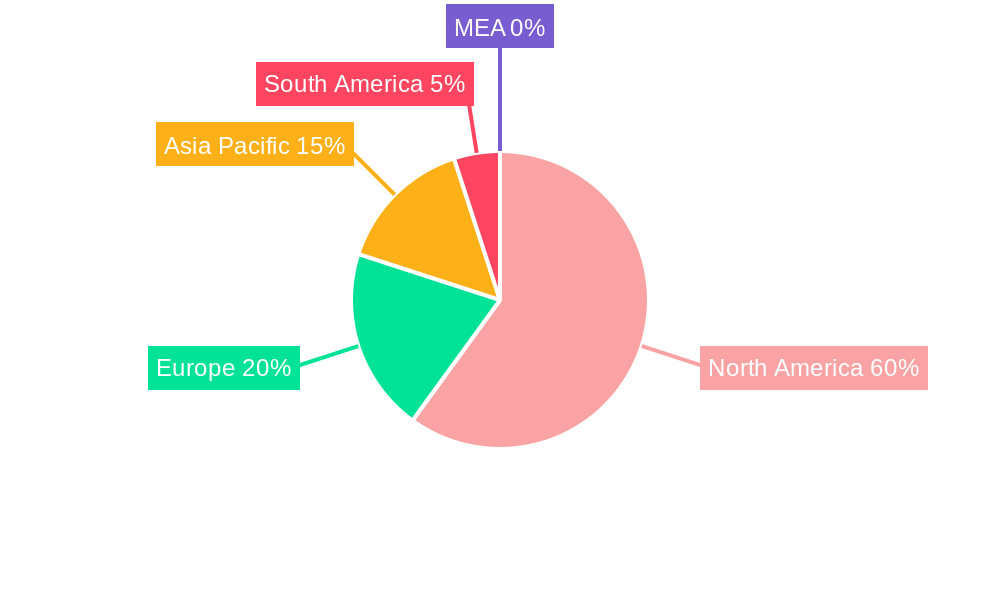

The U.S. contraceptive market, a significant segment of the global reproductive healthcare industry, is characterized by robust growth and evolving consumer preferences. Driven by factors such as increased awareness of family planning, government initiatives promoting reproductive health access, and the expanding role of telehealth, the market is projected to experience continued expansion. The market's value, while not explicitly stated, can be reasonably estimated based on the global CAGR of 5.90% and the known regional breakdown. Considering North America's dominant position in the global market, the U.S. likely accounts for a substantial portion—perhaps 40-50%—of this value. This suggests a substantial market size in the billions of dollars. Key segments within the U.S. market include injectable contraceptives (with further segmentation by device and gender), and various drug-based options. Competition is fierce, with major pharmaceutical companies like Johnson & Johnson, Pfizer, and Merck & Co. vying for market share alongside smaller players specializing in specific contraceptive technologies. Trends indicate a growing demand for long-acting reversible contraceptives (LARCs), such as IUDs and implants, owing to their high effectiveness and reduced need for frequent intervention. Conversely, challenges include the ongoing debate surrounding contraceptive access and affordability, which could potentially constrain market growth in certain demographics.

Further analysis reveals the significant impact of pricing strategies and insurance coverage on market penetration. The availability of generic versions of certain contraceptives and the increasing prevalence of telehealth platforms providing virtual consultations and access to contraceptives have contributed to shaping the market landscape. Future growth will likely be influenced by advancements in contraceptive technology, the evolving regulatory environment concerning reproductive healthcare, and ongoing shifts in societal attitudes towards family planning. The continued focus on patient education and access to comprehensive reproductive healthcare services will play a crucial role in shaping the trajectory of the U.S. contraceptive market in the coming years.

Contraceptive Industry in the United States: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the US contraceptive market, offering crucial insights for stakeholders across the industry. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. The analysis incorporates data from the historical period (2019-2024) and leverages extensive primary and secondary research to deliver accurate market sizing and future projections. This report is invaluable for manufacturers, distributors, investors, and regulatory bodies seeking a complete understanding of this dynamic market. Key companies analyzed include Church & Dwight Co Inc, Bayer AG, Teva Pharmaceuticals Ltd, Merck & Co Inc, Ani Pharmaceuticals Inc, Agile Therapeutics, Johnson & Johnson Ltd, Allergan PLC, Fuji Latex Co Ltd, and Pfizer Inc. The market segmentation includes analysis across Contraceptive Injectable (by device, by gender: male/female), and by product type (drugs).

Contraceptive Industry in United States Market Structure & Competitive Dynamics

The US contraceptive market exhibits a moderately concentrated structure with several multinational corporations and smaller specialized firms competing. Market share is primarily held by established pharmaceutical giants, while smaller companies focus on niche products and innovative technologies. Innovation ecosystems are dynamic, fueled by ongoing R&D efforts to improve efficacy, safety, and user experience. The regulatory landscape, overseen by the FDA, is rigorous, impacting product approvals and market entry. Substitutes include natural family planning methods, impacting overall market growth. End-user trends increasingly favor convenience, discreet options, and personalized healthcare solutions. Mergers and acquisitions (M&A) activity has been moderate, with deal values averaging xx Million in the last five years.

- Market Concentration: High concentration among major players, with the top 5 companies holding approximately xx% of the market share in 2025.

- M&A Activity: Significant M&A activity observed in 2021-2024, primarily driven by strategic acquisitions by larger players. Total deal value estimated at xx Million.

- Regulatory Framework: FDA approval process remains a significant barrier to entry for new products and technologies.

Contraceptive Industry in United States Industry Trends & Insights

The US contraceptive market is experiencing steady growth, driven by factors such as increased female participation in the workforce, rising awareness of reproductive health, and evolving societal attitudes towards contraception. The Compound Annual Growth Rate (CAGR) is projected to be xx% during 2025-2033. Technological disruptions, such as the development of long-acting reversible contraceptives (LARCs) and digital health platforms, are transforming the industry. Consumer preferences are shifting towards more convenient and discreet options, along with a growing demand for personalized healthcare solutions. The competitive landscape remains dynamic with ongoing innovation and product diversification, resulting in increased market penetration of newer products.

Dominant Markets & Segments in Contraceptive Industry in United States

The female segment of the contraceptive market dominates the US market, accounting for approximately xx% of the total market value in 2025. Within the injectable contraceptives, the long-acting reversible contraceptive (LARC) segment holds the highest market share and is experiencing the fastest growth.

- Key Drivers for Female Segment Dominance:

- High demand for long-term and effective contraceptive methods.

- Increased awareness of reproductive health and family planning.

- Government initiatives and healthcare programs promoting access to contraception.

- Dominant Contraceptive Injectable Device: IUDs hold the largest market share, primarily due to their high efficacy and long-term effectiveness.

- Market Size (2025): The total market value for female contraceptives is estimated at xx Million.

Contraceptive Industry in United States Product Innovations

Recent product innovations include advancements in long-acting reversible contraceptives (LARCs) like improved IUD designs and next-generation implants. Furthermore, there’s a surge in development of non-hormonal options and personalized contraceptive solutions. These innovations offer improved efficacy, reduced side effects, and enhanced user experience, significantly impacting market competitiveness. The incorporation of digital technologies for personalized contraceptive counseling and tracking adds a further layer of innovation.

Report Segmentation & Scope

This report segments the US contraceptive market by:

- Contraceptive Injectable: This segment includes various devices and delivery methods, offering different durations of effectiveness and user preferences. The market size for this segment in 2025 is estimated at xx Million, with a projected CAGR of xx% during the forecast period.

- By Gender: The market is further divided into male and female segments. The female segment is significantly larger, driven by the greater demand for contraception among women.

- By Product: This segment encompasses various contraceptive drugs and methods, including pills, patches, rings, injections, and implants. Significant variations in market share exist among these products due to differences in efficacy, convenience, and side effects.

Key Drivers of Contraceptive Industry in United States Growth

Several factors contribute to the growth of the US contraceptive market. These include:

- Technological advancements: Development of more effective, convenient, and user-friendly contraceptive methods.

- Economic factors: Increased disposable incomes and healthcare insurance coverage.

- Regulatory support: Government initiatives aimed at increasing access to contraception.

- Changing social attitudes: Greater acceptance of contraception and sexual health awareness among both men and women.

Challenges in the Contraceptive Industry in United States Sector

The US contraceptive industry faces several challenges, including:

- Regulatory hurdles: Strict FDA regulations and approval processes can delay the launch of new products.

- Supply chain disruptions: Global supply chain issues can impact the availability of contraceptive products.

- Competitive pressures: Intense competition among established and emerging players.

- Access limitations: Unequal access to contraception, particularly among low-income populations, remains a significant barrier. This limits overall market penetration.

Leading Players in the Contraceptive Industry in the United States Market

- Church & Dwight Co Inc

- Bayer AG

- Teva Pharmaceuticals Ltd

- Merck & Co Inc

- Ani Pharmaceuticals Inc

- Agile Therapeutics

- Johnson & Johnson Ltd

- Allergan PLC

- Fuji Latex Co Ltd

- Pfizer Inc

Key Developments in Contraceptive Industry in United States Sector

- January 2023: FDA approves a new extended-release contraceptive implant.

- June 2022: A major pharmaceutical company announces a strategic partnership to expand distribution channels for LARCs.

- October 2021: A significant merger occurs within the contraceptive industry, consolidating market share and resources.

Strategic Contraceptive Industry in United States Market Outlook

The US contraceptive market presents significant growth potential, driven by continuous innovation, rising healthcare expenditure, and increasing demand for personalized solutions. Strategic opportunities lie in developing advanced contraceptive technologies, focusing on underserved populations, and improving access through digital health platforms. Further research into non-hormonal options and male contraceptives holds significant potential for future market expansion and improved healthcare outcomes. Expanding into telemedicine and direct-to-consumer models may provide competitive advantages to forward-thinking companies.

Contraceptive Industry in United States Segmentation

-

1. Products

-

1.1. By Drugs

- 1.1.1. Oral Contraceptives

- 1.1.2. Topical Contraceptives

- 1.1.3. Contraceptive Injectable

-

1.2. By Device

- 1.2.1. Condoms

- 1.2.2. Diaphragms

- 1.2.3. Cervical Caps

- 1.2.4. Sponges

- 1.2.5. Vaginal Rings

- 1.2.6. IUDs

- 1.2.7. Other Devices

-

1.1. By Drugs

-

2. Gender

- 2.1. Male

- 2.2. Female

-

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

- 3.1.3. Mexico

-

3.1. North America

Contraceptive Industry in United States Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

Contraceptive Industry in United States REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Rate of Unintended Pregnancies; Rise in Government Initiatives

- 3.3. Market Restrains

- 3.3.1. ; Side Effects Associated with the Use of Contraceptive Drugs and Devices

- 3.4. Market Trends

- 3.4.1. Condoms are Expected to Dominate the Contraceptive Devices Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Contraceptive Industry in United States Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Products

- 5.1.1. By Drugs

- 5.1.1.1. Oral Contraceptives

- 5.1.1.2. Topical Contraceptives

- 5.1.1.3. Contraceptive Injectable

- 5.1.2. By Device

- 5.1.2.1. Condoms

- 5.1.2.2. Diaphragms

- 5.1.2.3. Cervical Caps

- 5.1.2.4. Sponges

- 5.1.2.5. Vaginal Rings

- 5.1.2.6. IUDs

- 5.1.2.7. Other Devices

- 5.1.1. By Drugs

- 5.2. Market Analysis, Insights and Forecast - by Gender

- 5.2.1. Male

- 5.2.2. Female

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.1.3. Mexico

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Products

- 6. North America Contraceptive Industry in United States Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 6.1.3 Mexico

- 7. Europe Contraceptive Industry in United States Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 Germany

- 7.1.2 United Kingdom

- 7.1.3 France

- 7.1.4 Spain

- 7.1.5 Italy

- 7.1.6 Spain

- 7.1.7 Belgium

- 7.1.8 Netherland

- 7.1.9 Nordics

- 7.1.10 Rest of Europe

- 8. Asia Pacific Contraceptive Industry in United States Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 China

- 8.1.2 Japan

- 8.1.3 India

- 8.1.4 South Korea

- 8.1.5 Southeast Asia

- 8.1.6 Australia

- 8.1.7 Indonesia

- 8.1.8 Phillipes

- 8.1.9 Singapore

- 8.1.10 Thailandc

- 8.1.11 Rest of Asia Pacific

- 9. South America Contraceptive Industry in United States Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 Brazil

- 9.1.2 Argentina

- 9.1.3 Peru

- 9.1.4 Chile

- 9.1.5 Colombia

- 9.1.6 Ecuador

- 9.1.7 Venezuela

- 9.1.8 Rest of South America

- 10. North America Contraceptive Industry in United States Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Mexico

- 11. MEA Contraceptive Industry in United States Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United Arab Emirates

- 11.1.2 Saudi Arabia

- 11.1.3 South Africa

- 11.1.4 Rest of Middle East and Africa

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Church & Dwight Co Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Bayer AG

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Teva Pharmaceuticals Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Merck & Co Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Ani Pharmaceuticals Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Agile Therapeutics

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Johnson & Johnson Ltd*List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Allergan PLC

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Fuji Latex Co Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Pfizer Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Church & Dwight Co Inc

List of Figures

- Figure 1: Global Contraceptive Industry in United States Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Contraceptive Industry in United States Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Contraceptive Industry in United States Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Contraceptive Industry in United States Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Contraceptive Industry in United States Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Contraceptive Industry in United States Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Contraceptive Industry in United States Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Contraceptive Industry in United States Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Contraceptive Industry in United States Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Contraceptive Industry in United States Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Contraceptive Industry in United States Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Contraceptive Industry in United States Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Contraceptive Industry in United States Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Contraceptive Industry in United States Revenue (Million), by Products 2024 & 2032

- Figure 15: North America Contraceptive Industry in United States Revenue Share (%), by Products 2024 & 2032

- Figure 16: North America Contraceptive Industry in United States Revenue (Million), by Gender 2024 & 2032

- Figure 17: North America Contraceptive Industry in United States Revenue Share (%), by Gender 2024 & 2032

- Figure 18: North America Contraceptive Industry in United States Revenue (Million), by Geography 2024 & 2032

- Figure 19: North America Contraceptive Industry in United States Revenue Share (%), by Geography 2024 & 2032

- Figure 20: North America Contraceptive Industry in United States Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Contraceptive Industry in United States Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Contraceptive Industry in United States Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Contraceptive Industry in United States Revenue Million Forecast, by Products 2019 & 2032

- Table 3: Global Contraceptive Industry in United States Revenue Million Forecast, by Gender 2019 & 2032

- Table 4: Global Contraceptive Industry in United States Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Global Contraceptive Industry in United States Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Contraceptive Industry in United States Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Contraceptive Industry in United States Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Belgium Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Netherland Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Nordics Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Contraceptive Industry in United States Revenue Million Forecast, by Country 2019 & 2032

- Table 22: China Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Japan Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: India Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Korea Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Southeast Asia Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Australia Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Indonesia Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Phillipes Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Singapore Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Thailandc Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Asia Pacific Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global Contraceptive Industry in United States Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Brazil Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Argentina Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Peru Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Chile Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Colombia Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Ecuador Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Venezuela Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of South America Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Contraceptive Industry in United States Revenue Million Forecast, by Country 2019 & 2032

- Table 43: United States Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Canada Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Mexico Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Contraceptive Industry in United States Revenue Million Forecast, by Country 2019 & 2032

- Table 47: United Arab Emirates Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Saudi Arabia Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Africa Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Middle East and Africa Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Contraceptive Industry in United States Revenue Million Forecast, by Products 2019 & 2032

- Table 52: Global Contraceptive Industry in United States Revenue Million Forecast, by Gender 2019 & 2032

- Table 53: Global Contraceptive Industry in United States Revenue Million Forecast, by Geography 2019 & 2032

- Table 54: Global Contraceptive Industry in United States Revenue Million Forecast, by Country 2019 & 2032

- Table 55: United States Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Canada Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Mexico Contraceptive Industry in United States Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Contraceptive Industry in United States?

The projected CAGR is approximately 5.90%.

2. Which companies are prominent players in the Contraceptive Industry in United States?

Key companies in the market include Church & Dwight Co Inc, Bayer AG, Teva Pharmaceuticals Ltd, Merck & Co Inc, Ani Pharmaceuticals Inc, Agile Therapeutics, Johnson & Johnson Ltd*List Not Exhaustive, Allergan PLC, Fuji Latex Co Ltd, Pfizer Inc.

3. What are the main segments of the Contraceptive Industry in United States?

The market segments include Products, Gender, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Rate of Unintended Pregnancies; Rise in Government Initiatives.

6. What are the notable trends driving market growth?

Condoms are Expected to Dominate the Contraceptive Devices Market.

7. Are there any restraints impacting market growth?

; Side Effects Associated with the Use of Contraceptive Drugs and Devices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Contraceptive Industry in United States," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Contraceptive Industry in United States report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Contraceptive Industry in United States?

To stay informed about further developments, trends, and reports in the Contraceptive Industry in United States, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence