Key Insights

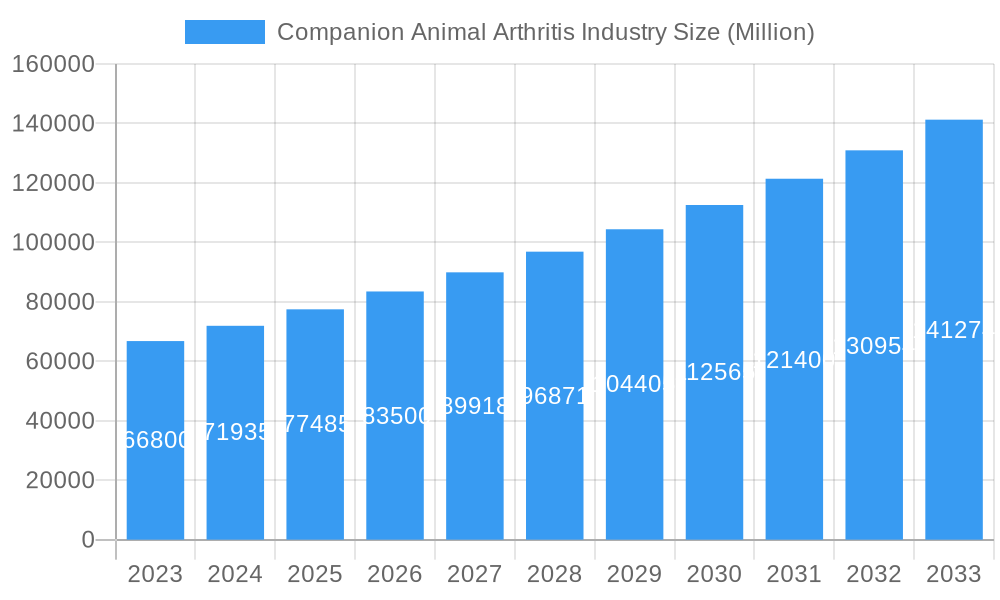

The Companion Animal Arthritis Industry is poised for significant expansion, with a projected market size of USD 66.8 billion in 2023, driven by an increasing pet ownership and a growing emphasis on pet well-being. This upward trajectory is further underscored by a robust Compound Annual Growth Rate (CAGR) of 7.28%, indicating sustained and healthy market expansion over the forecast period of 2025-2033. The rising incidence of arthritis in aging animal populations, coupled with advancements in veterinary diagnostics and therapeutic interventions, are key catalysts fueling this growth. Owners are increasingly willing to invest in advanced treatments, pain management solutions, and preventive care to ensure their beloved companions live longer, healthier, and more comfortable lives. This heightened owner awareness and expenditure are pivotal in shaping the market's future.

Companion Animal Arthritis Industry Market Size (In Billion)

The market segmentation reveals a dynamic landscape, with the Anti-Inflammatory drug class leading in adoption due to their direct impact on symptom management. However, the Nutraceutical Supplement segment is experiencing rapid growth, reflecting a proactive approach to joint health and a preference for natural, preventive solutions. Emerging trends indicate a shift towards personalized treatment plans, a greater focus on early diagnosis, and the integration of regenerative medicine into veterinary practices. While the market enjoys strong growth, certain factors such as the high cost of advanced treatments and limited access to specialized veterinary care in some regions can act as potential restraints. Nevertheless, the overall outlook remains highly positive, supported by continuous innovation and a deep-seated emotional bond between pet owners and their animals.

Companion Animal Arthritis Industry Company Market Share

Companion Animal Arthritis Industry Market Analysis Report: Comprehensive Insights and Future Outlook (2019-2033)

This in-depth report provides a comprehensive analysis of the global Companion Animal Arthritis Industry, a rapidly expanding sector driven by increasing pet ownership, rising awareness of animal health, and advancements in veterinary medicine. Our research forecasts the market to reach an estimated $XX billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. The study period spans from 2019–2033, with 2025 serving as the base and estimated year. This report is an indispensable resource for stakeholders seeking to understand the intricate market structure, identify growth opportunities, and navigate the competitive landscape of the veterinary orthopedics market, pet joint health supplements, and animal pain management solutions.

Companion Animal Arthritis Industry Market Structure & Competitive Dynamics

The Companion Animal Arthritis Industry exhibits a moderately concentrated market structure, characterized by a blend of large multinational corporations and emerging specialized players. Innovation ecosystems are vibrant, driven by significant investments in research and development for novel veterinary pharmaceutical products and nutraceuticals for pets. Regulatory frameworks, primarily overseen by veterinary medical associations and governmental bodies like the FDA and EMA, play a crucial role in product approval and market access, ensuring efficacy and safety for companion animals. Product substitutes, while present in the form of alternative therapies and lifestyle management, are increasingly being augmented by scientifically validated arthritis treatments for dogs and arthritis treatments for cats. End-user trends highlight a growing demand for preventative and therapeutic solutions that enhance the quality of life for aging pets, leading to a surge in the companion animal healthcare market. Mergers and acquisitions (M&A) activities, valued in the billions of dollars, are instrumental in consolidating market share and expanding product portfolios, with recent deals focusing on integrating advanced joint health ingredients and specialized veterinary drug delivery systems. The market share of leading players is closely monitored, with recent M&A deal values reflecting significant strategic investments within the pet care industry.

Companion Animal Arthritis Industry Industry Trends & Insights

The Companion Animal Arthritis Industry is experiencing robust growth, propelled by several key market growth drivers. The increasing humanization of pets, leading owners to invest more in their animals' well-being, is a primary catalyst. This trend translates into a higher demand for advanced veterinary pain management solutions and joint health supplements for dogs and cats. Technological disruptions are significantly reshaping the market, with advancements in diagnostic tools, personalized treatment plans, and novel pharmaceuticals for animal arthritis improving therapeutic outcomes. The development of regenerative medicine for pets and targeted drug therapies for osteoarthritis in animals are key areas of innovation. Consumer preferences are evolving towards holistic and natural approaches, boosting the adoption of nutraceutical supplements for pet joints alongside traditional anti-inflammatory drugs for animals. This shift reflects a desire for safer, long-term solutions to manage canine arthritis and feline arthritis. Competitive dynamics are intensifying, with companies differentiating themselves through product efficacy, brand reputation, and innovative marketing strategies. The market penetration of both prescription veterinary arthritis medications and over-the-counter joint support for pets is steadily increasing. The market is projected to witness a substantial CAGR of XX% over the forecast period, driven by the persistent need for effective arthritic condition management in pets.

Dominant Markets & Segments in Companion Animal Arthritis Industry

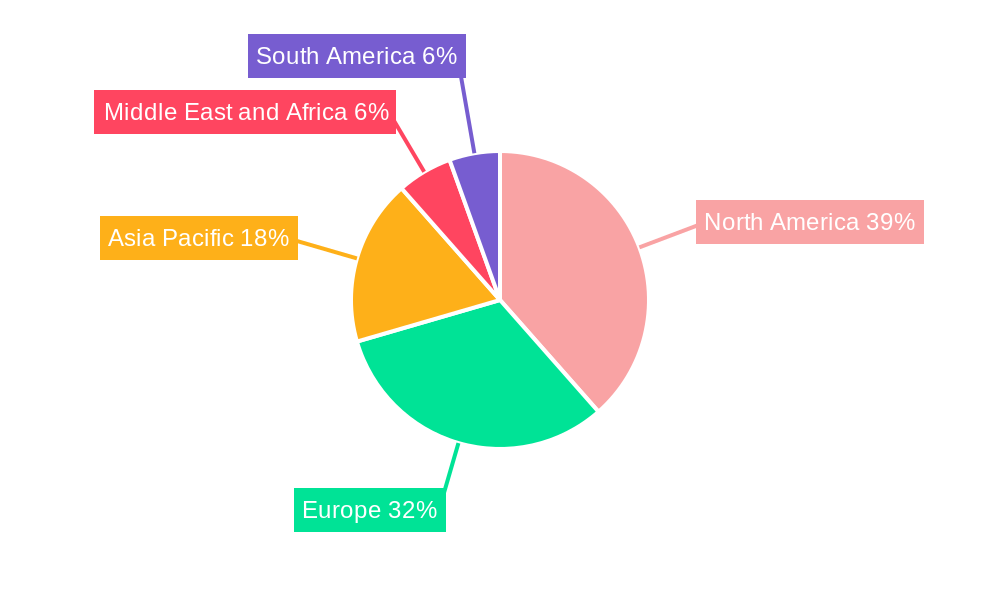

The Companion Animal Arthritis Industry sees North America emerge as a dominant market, driven by high pet ownership rates, significant disposable income allocated to pet care, and a strong emphasis on preventive healthcare for companion animals. Within North America, the United States holds a substantial market share due to its advanced veterinary infrastructure and high prevalence of canine arthritis and feline arthritis. Key drivers for this dominance include favorable economic policies supporting small businesses and pet-related industries, robust infrastructure for veterinary services, and a strong consumer willingness to spend on advanced pet therapeutics.

The Drug Class segmentation reveals that Nutraceutical Supplement holds a leading position, accounting for an estimated market share of XX% in 2025. This dominance is attributed to:

- Growing consumer preference for natural and preventive solutions: Pet owners are increasingly opting for joint health supplements for dogs and joint supplements for cats that offer long-term benefits with fewer side effects compared to traditional medications.

- Accessibility and affordability: Many nutraceuticals for pet joint health are available over-the-counter, making them more accessible to a wider consumer base.

- Perceived safety profile: The natural origin of ingredients in veterinary joint supplements often leads to a perception of enhanced safety, encouraging regular usage.

The Anti-Inflammatory drug class follows closely, with significant contributions from prescription veterinary NSAIDs and other anti-inflammatory medications for pets. The increasing diagnosis of osteoarthritis in pets and the need for potent pain relief drives demand in this segment.

The Others segment, encompassing regenerative therapies, pain management devices, and specialized diets, is a rapidly growing niche. Its growth is fueled by technological advancements and a demand for more targeted and innovative arthritis management solutions for pets.

Companion Animal Arthritis Industry Product Innovations

Product innovations within the Companion Animal Arthritis Industry are centered on enhancing efficacy, improving palatability, and offering targeted delivery mechanisms for joint health solutions for pets. Companies are developing novel formulations of glucosamine and chondroitin for dogs, advanced omega-3 fatty acid supplements for feline joint health, and sophisticated veterinary pain relief medications. A key trend is the development of combination therapies and regenerative treatments for canine arthritis, aiming to address multiple facets of the condition. Competitive advantages are being gained through scientifically validated ingredients, reduced side effects, and user-friendly administration methods for both dog arthritis treatments and cat arthritis treatments, thereby solidifying market fit.

Report Segmentation & Scope

This report segments the Companion Animal Arthritis Industry into key drug classes:

- Anti-Inflammatory: This segment encompasses prescription and over-the-counter veterinary anti-inflammatory drugs designed to reduce pain and inflammation associated with arthritis. Growth projections indicate a steady increase driven by the need for effective pain management, with an estimated market size of $XX billion in 2025 and a projected CAGR of XX%. Competitive dynamics are characterized by a few dominant pharmaceutical players and a growing number of generic alternatives.

- Nutraceutical Supplement: This segment includes a wide array of joint supplements for pets, such as glucosamine, chondroitin, MSM, and omega-3 fatty acids. The market size is estimated at $XX billion in 2025, with a strong projected CAGR of XX%. This segment's growth is fueled by consumer demand for natural and preventive solutions, leading to intense competition among supplement manufacturers.

- Others: This segment comprises emerging therapies like regenerative medicine, laser therapy, physical rehabilitation, and specialized veterinary diets. The market size is estimated at $XX billion in 2025, with the highest projected CAGR of XX%. This segment is characterized by innovation and a growing focus on holistic treatment approaches for pet joint conditions.

Key Drivers of Companion Animal Arthritis Industry Growth

Several factors are accelerating growth in the Companion Animal Arthritis Industry. The increasing prevalence of osteoarthritis in pets, particularly among aging animal populations, creates a sustained demand for effective joint health solutions. The "pet humanization" trend drives owners to invest significantly in their pets' well-being, pushing demand for premium veterinary care and arthritis treatments for dogs and cats. Advancements in veterinary diagnostics and treatment modalities, including novel pharmaceuticals for animal joint pain and regenerative therapies for pets, enhance therapeutic outcomes. Furthermore, rising disposable incomes in developing regions are expanding access to advanced pet healthcare, further fueling market expansion for animal arthritis management.

Challenges in the Companion Animal Arthritis Industry Sector

Despite its strong growth, the Companion Animal Arthritis Industry faces several challenges. Regulatory hurdles for new drug approvals, particularly for novel veterinary therapeutics, can be lengthy and costly. Supply chain disruptions, exacerbated by global events, can impact the availability and pricing of key raw materials for pet joint supplements and veterinary pharmaceuticals. Intense competitive pressures from both established and emerging players necessitate continuous innovation and marketing investment. Cost sensitivity among some pet owners can also limit the adoption of more expensive, advanced arthritis treatments for pets.

Leading Players in the Companion Animal Arthritis Industry Market

- Synflex America Inc

- Thorne Research Inc

- Matsun Nutrition

- Nutri-Vet LLC

- Vetalogica

- Elanco

- Liquid Health Inc

- Boehringer Ingelheim

- American Regent Inc

Key Developments in Companion Animal Arthritis Industry Sector

- November 2023: Elanco launches a new sustained-release NSAID for canine arthritis, improving dosing convenience and patient compliance.

- October 2023: Boehringer Ingelheim announces promising Phase III trial results for a novel monoclonal antibody treatment for feline arthritis, targeting specific inflammatory pathways.

- September 2023: Synflex America Inc expands its line of glucosamine supplements for horses, catering to the equine segment of the animal joint health market.

- August 2023: Thorne Research Inc introduces a new veterinary joint support formula with enhanced bioavailability of key ingredients for dogs.

- July 2023: Vetalogica launches a range of veterinary nutraceuticals for senior pets, focusing on comprehensive joint and mobility support.

- June 2023: Liquid Health Inc innovates with a new liquid formulation of joint support for cats, improving palatability and absorption.

- May 2023: Matsun Nutrition expands its co-packing services for pet joint supplements, supporting the growth of smaller brands in the industry.

- April 2023: American Regent Inc announces the acquisition of a niche veterinary pharmaceutical company specializing in pain management for companion animals.

Strategic Companion Animal Arthritis Industry Market Outlook

The Companion Animal Arthritis Industry presents a promising strategic market outlook, driven by an ever-increasing emphasis on pet health and longevity. Growth accelerators include the continued innovation in veterinary pharmaceutical R&D, the expansion of nutraceutical options for pet joint care, and the growing acceptance of regenerative therapies for animals. The market holds significant potential for companies that can offer scientifically validated, safe, and effective solutions that improve the quality of life for pets suffering from arthritis. Strategic opportunities lie in expanding product portfolios to cover a broader range of joint conditions in animals, investing in targeted marketing to educate pet owners, and exploring emerging markets with growing pet ownership rates. The long-term outlook for the companion animal orthopedic market remains exceptionally strong.

Companion Animal Arthritis Industry Segmentation

-

1. Drug Class

- 1.1. Anti-Inflammatory

- 1.2. Nutraceutical Supplement

- 1.3. Others

Companion Animal Arthritis Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Companion Animal Arthritis Industry Regional Market Share

Geographic Coverage of Companion Animal Arthritis Industry

Companion Animal Arthritis Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; High Prevalence of Canine Obesity and Motion Injuries; Increase in Awareness regarding Canine Health

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Treatment; Side Effects Associated with Treatment Errors

- 3.4. Market Trends

- 3.4.1. Anti-Inflammatory Drugs to Witness Healthy Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Companion Animal Arthritis Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 5.1.1. Anti-Inflammatory

- 5.1.2. Nutraceutical Supplement

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 6. North America Companion Animal Arthritis Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Drug Class

- 6.1.1. Anti-Inflammatory

- 6.1.2. Nutraceutical Supplement

- 6.1.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Drug Class

- 7. Europe Companion Animal Arthritis Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Drug Class

- 7.1.1. Anti-Inflammatory

- 7.1.2. Nutraceutical Supplement

- 7.1.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Drug Class

- 8. Asia Pacific Companion Animal Arthritis Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Drug Class

- 8.1.1. Anti-Inflammatory

- 8.1.2. Nutraceutical Supplement

- 8.1.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Drug Class

- 9. Middle East and Africa Companion Animal Arthritis Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Drug Class

- 9.1.1. Anti-Inflammatory

- 9.1.2. Nutraceutical Supplement

- 9.1.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Drug Class

- 10. South America Companion Animal Arthritis Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Drug Class

- 10.1.1. Anti-Inflammatory

- 10.1.2. Nutraceutical Supplement

- 10.1.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Drug Class

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Synflex America Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Thorne Research Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Matsun Nutrition

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nutri-Vet LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vetalogica

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Elanco

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Liquid Health Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Boehringer Ingelheim

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 American Regent Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Synflex America Inc

List of Figures

- Figure 1: Global Companion Animal Arthritis Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Companion Animal Arthritis Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Companion Animal Arthritis Industry Revenue (undefined), by Drug Class 2025 & 2033

- Figure 4: North America Companion Animal Arthritis Industry Volume (K Unit), by Drug Class 2025 & 2033

- Figure 5: North America Companion Animal Arthritis Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 6: North America Companion Animal Arthritis Industry Volume Share (%), by Drug Class 2025 & 2033

- Figure 7: North America Companion Animal Arthritis Industry Revenue (undefined), by Country 2025 & 2033

- Figure 8: North America Companion Animal Arthritis Industry Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America Companion Animal Arthritis Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Companion Animal Arthritis Industry Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Companion Animal Arthritis Industry Revenue (undefined), by Drug Class 2025 & 2033

- Figure 12: Europe Companion Animal Arthritis Industry Volume (K Unit), by Drug Class 2025 & 2033

- Figure 13: Europe Companion Animal Arthritis Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 14: Europe Companion Animal Arthritis Industry Volume Share (%), by Drug Class 2025 & 2033

- Figure 15: Europe Companion Animal Arthritis Industry Revenue (undefined), by Country 2025 & 2033

- Figure 16: Europe Companion Animal Arthritis Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe Companion Animal Arthritis Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Companion Animal Arthritis Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Companion Animal Arthritis Industry Revenue (undefined), by Drug Class 2025 & 2033

- Figure 20: Asia Pacific Companion Animal Arthritis Industry Volume (K Unit), by Drug Class 2025 & 2033

- Figure 21: Asia Pacific Companion Animal Arthritis Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 22: Asia Pacific Companion Animal Arthritis Industry Volume Share (%), by Drug Class 2025 & 2033

- Figure 23: Asia Pacific Companion Animal Arthritis Industry Revenue (undefined), by Country 2025 & 2033

- Figure 24: Asia Pacific Companion Animal Arthritis Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Asia Pacific Companion Animal Arthritis Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Companion Animal Arthritis Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Middle East and Africa Companion Animal Arthritis Industry Revenue (undefined), by Drug Class 2025 & 2033

- Figure 28: Middle East and Africa Companion Animal Arthritis Industry Volume (K Unit), by Drug Class 2025 & 2033

- Figure 29: Middle East and Africa Companion Animal Arthritis Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 30: Middle East and Africa Companion Animal Arthritis Industry Volume Share (%), by Drug Class 2025 & 2033

- Figure 31: Middle East and Africa Companion Animal Arthritis Industry Revenue (undefined), by Country 2025 & 2033

- Figure 32: Middle East and Africa Companion Animal Arthritis Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Middle East and Africa Companion Animal Arthritis Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Companion Animal Arthritis Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: South America Companion Animal Arthritis Industry Revenue (undefined), by Drug Class 2025 & 2033

- Figure 36: South America Companion Animal Arthritis Industry Volume (K Unit), by Drug Class 2025 & 2033

- Figure 37: South America Companion Animal Arthritis Industry Revenue Share (%), by Drug Class 2025 & 2033

- Figure 38: South America Companion Animal Arthritis Industry Volume Share (%), by Drug Class 2025 & 2033

- Figure 39: South America Companion Animal Arthritis Industry Revenue (undefined), by Country 2025 & 2033

- Figure 40: South America Companion Animal Arthritis Industry Volume (K Unit), by Country 2025 & 2033

- Figure 41: South America Companion Animal Arthritis Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: South America Companion Animal Arthritis Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Companion Animal Arthritis Industry Revenue undefined Forecast, by Drug Class 2020 & 2033

- Table 2: Global Companion Animal Arthritis Industry Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 3: Global Companion Animal Arthritis Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Companion Animal Arthritis Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global Companion Animal Arthritis Industry Revenue undefined Forecast, by Drug Class 2020 & 2033

- Table 6: Global Companion Animal Arthritis Industry Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 7: Global Companion Animal Arthritis Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Global Companion Animal Arthritis Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: United States Companion Animal Arthritis Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: United States Companion Animal Arthritis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 11: Canada Companion Animal Arthritis Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Canada Companion Animal Arthritis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: Mexico Companion Animal Arthritis Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Mexico Companion Animal Arthritis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Global Companion Animal Arthritis Industry Revenue undefined Forecast, by Drug Class 2020 & 2033

- Table 16: Global Companion Animal Arthritis Industry Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 17: Global Companion Animal Arthritis Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: Global Companion Animal Arthritis Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Germany Companion Animal Arthritis Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Companion Animal Arthritis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: United Kingdom Companion Animal Arthritis Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Companion Animal Arthritis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: France Companion Animal Arthritis Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: France Companion Animal Arthritis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Italy Companion Animal Arthritis Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy Companion Animal Arthritis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Spain Companion Animal Arthritis Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Spain Companion Animal Arthritis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Companion Animal Arthritis Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of Europe Companion Animal Arthritis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Global Companion Animal Arthritis Industry Revenue undefined Forecast, by Drug Class 2020 & 2033

- Table 32: Global Companion Animal Arthritis Industry Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 33: Global Companion Animal Arthritis Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: Global Companion Animal Arthritis Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 35: China Companion Animal Arthritis Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: China Companion Animal Arthritis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Japan Companion Animal Arthritis Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Japan Companion Animal Arthritis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: India Companion Animal Arthritis Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: India Companion Animal Arthritis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Australia Companion Animal Arthritis Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Australia Companion Animal Arthritis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: South Korea Companion Animal Arthritis Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: South Korea Companion Animal Arthritis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Rest of Asia Pacific Companion Animal Arthritis Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Companion Animal Arthritis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Global Companion Animal Arthritis Industry Revenue undefined Forecast, by Drug Class 2020 & 2033

- Table 48: Global Companion Animal Arthritis Industry Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 49: Global Companion Animal Arthritis Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 50: Global Companion Animal Arthritis Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: GCC Companion Animal Arthritis Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: GCC Companion Animal Arthritis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: South Africa Companion Animal Arthritis Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: South Africa Companion Animal Arthritis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Rest of Middle East and Africa Companion Animal Arthritis Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: Rest of Middle East and Africa Companion Animal Arthritis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Global Companion Animal Arthritis Industry Revenue undefined Forecast, by Drug Class 2020 & 2033

- Table 58: Global Companion Animal Arthritis Industry Volume K Unit Forecast, by Drug Class 2020 & 2033

- Table 59: Global Companion Animal Arthritis Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global Companion Animal Arthritis Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Brazil Companion Animal Arthritis Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Brazil Companion Animal Arthritis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Argentina Companion Animal Arthritis Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Argentina Companion Animal Arthritis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of South America Companion Animal Arthritis Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: Rest of South America Companion Animal Arthritis Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Companion Animal Arthritis Industry?

The projected CAGR is approximately 7.28%.

2. Which companies are prominent players in the Companion Animal Arthritis Industry?

Key companies in the market include Synflex America Inc, Thorne Research Inc, Matsun Nutrition, Nutri-Vet LLC, Vetalogica, Elanco, Liquid Health Inc, Boehringer Ingelheim, American Regent Inc.

3. What are the main segments of the Companion Animal Arthritis Industry?

The market segments include Drug Class.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; High Prevalence of Canine Obesity and Motion Injuries; Increase in Awareness regarding Canine Health.

6. What are the notable trends driving market growth?

Anti-Inflammatory Drugs to Witness Healthy Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

; High Cost of Treatment; Side Effects Associated with Treatment Errors.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Companion Animal Arthritis Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Companion Animal Arthritis Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Companion Animal Arthritis Industry?

To stay informed about further developments, trends, and reports in the Companion Animal Arthritis Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence