Key Insights

The global e-cigarette market, including automatic and manual devices and diverse product types, is projected for substantial expansion. The market is anticipated to reach $988.7 billion by 2025, growing at a Compound Annual Growth Rate (CAGR) of 2.6% from the base year 2025. This growth is propelled by increasing awareness of traditional cigarette health risks, driving consumers toward perceived safer alternatives. Technological innovation is also a key driver, with advanced, personalized e-cigarette designs catering to evolving consumer preferences. Aggressive marketing by industry leaders further stimulates market penetration. However, stricter regulations on sales and advertising, alongside public health debates on long-term vaping effects, present significant market restraints. Segmentation by device type (automatic, manual) and product category (disposable, rechargeable, personalized vaporizers) offers opportunities for targeted product development and marketing. North America and Asia Pacific, particularly China, are expected to dominate market share due to high consumer demand and robust manufacturing capabilities.

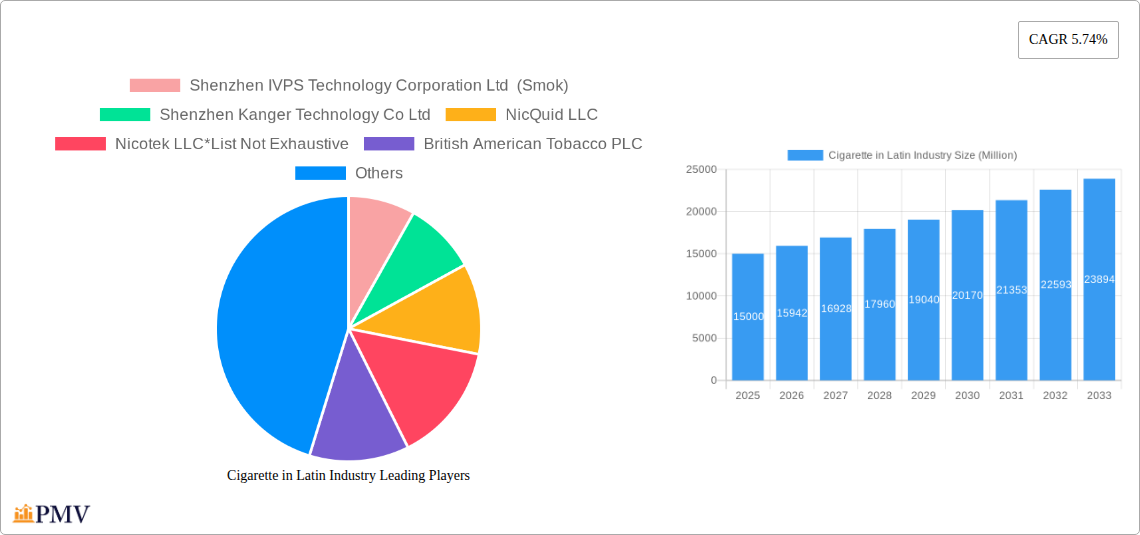

Cigarette in Latin Industry Market Size (In Billion)

The competitive environment features established tobacco companies diversifying into the e-cigarette sector alongside specialized manufacturers, fostering intense competition. Companies are prioritizing innovation, brand development, and strategic alliances to secure market leadership. Sustained success in this dynamic market hinges on effectively navigating regulatory complexities and addressing public health considerations, in conjunction with consumer demand and technological advancements.

Cigarette in Latin Industry Company Market Share

Cigarette in Latin American Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Cigarette in Latin American Industry, offering invaluable insights for businesses, investors, and stakeholders seeking to navigate this dynamic market. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The total market size is estimated at xx Million in 2025, projecting significant growth by 2033. The study incorporates historical data (2019-2024) to provide a robust understanding of market trends and future projections.

Cigarette in Latin American Industry Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the Latin American cigarette market, considering market concentration, innovation, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. The market is characterized by a mix of large multinational corporations and smaller, regional players.

Market Concentration: The market exhibits moderate concentration, with a few dominant players holding significant market share (xx%). However, a growing number of smaller companies, particularly in the e-cigarette segment, are emerging.

Innovation Ecosystems: Significant innovation is driven by the development of new e-cigarette technologies, such as improved battery life, flavor profiles, and safer vaping systems. This is fueled by both large established players and smaller, agile startups.

Regulatory Frameworks: Varying regulatory frameworks across Latin American countries significantly impact market dynamics. Stricter regulations in some countries are driving innovation in safer alternatives, while less regulated markets see higher competition and possibly more aggressive marketing tactics.

Product Substitutes: The rise of e-cigarettes and other smoke-free products represents a significant substitute for traditional cigarettes, impacting the market share of conventional tobacco products. Further, the industry is exploring heated tobacco products as another alternative.

End-User Trends: Consumer preferences are shifting towards products perceived as less harmful, influencing demand for e-cigarettes and heated tobacco products. Health concerns and changing lifestyles are major drivers of this trend.

M&A Activities: The market has witnessed a number of M&A activities, with large players consolidating their positions and smaller players seeking strategic partnerships. The total value of M&A deals in the period 2019-2024 was estimated at xx Million. These deals reflect the industry's dynamic nature and the ongoing struggle for market share. Specific deal values are xx Million.

Cigarette in Latin American Industry Industry Trends & Insights

The Latin American cigarette industry is undergoing a period of significant transformation. Market growth is being driven by several factors including:

Rising Disposable Incomes: Increased disposable incomes in several Latin American countries are contributing to higher cigarette consumption, especially in developing economies, though this is counteracted by shifting consumer preference toward healthier options.

Technological Disruptions: The introduction of e-cigarettes and heated tobacco products presents a major technological disruption. This is reshaping the traditional cigarette market, prompting major players to diversify and innovate.

Consumer Preferences: Consumer preferences are shifting towards products perceived as safer alternatives to traditional cigarettes, like e-cigarettes and heated tobacco products. This shift is partially influenced by rising health awareness and concerns about the long-term effects of traditional smoking.

Competitive Dynamics: The competitive landscape is intensifying with increased participation from both established players and new entrants in the e-cigarette and heated tobacco segments. This competition fuels innovation and pricing pressure within the overall market.

CAGR: The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%.

Market Penetration: The market penetration of e-cigarettes and other smoke-free products is steadily increasing and is expected to reach xx% by 2033.

Dominant Markets & Segments in Cigarette in Latin American Industry

Brazil, Mexico, and Argentina are the leading markets in the Latin American cigarette industry due to their large populations and relatively high per capita consumption. However, the growth of e-cigarette usage and heated tobacco products is increasing faster in other regions. This section explores the segment dominance based on product type and battery mode:

Leading Regions/Countries:

- Brazil: High population density, established smoking culture, and moderate regulation drives high market size.

- Mexico: Similar to Brazil, significant population and cultural habits contribute to high market volume.

- Argentina: While smaller than Brazil and Mexico, Argentina showcases a notable per capita consumption rate.

Dominant Segments:

- Battery Mode: Automatic e-cigarettes are gaining popularity due to their ease of use, while manual e-cigarettes continue to have a significant market share. This is largely dependent on pricing.

- Product Type: Disposable models demonstrate significant growth due to their convenience, however, rechargeable cartomizers continue to hold a considerable part of the market share due to a lower initial cost. Personalized vaporizers account for a smaller yet growing market share among experienced vapers.

Key Drivers of Segment Dominance:

- Economic Policies: Government taxation and regulation heavily influence market dynamics in different countries, thus shaping consumer behavior and product accessibility.

- Infrastructure: Retail distribution networks and access to technology play a crucial role in market penetration, especially for newer products like e-cigarettes.

Cigarette in Latin American Industry Product Innovations

The cigarette industry is witnessing a wave of product innovations, primarily focused on e-cigarettes and heated tobacco products. Technological advancements are improving battery life, vapor production, and flavor profiles. Companies are continuously striving to create more user-friendly and aesthetically pleasing devices. The market fit of these innovations hinges on regulatory approvals, consumer acceptance, and pricing strategies. These innovations cater to a growing demand for alternatives perceived as less harmful than traditional cigarettes. This also fuels competition, forcing legacy players to rapidly innovate and adapt.

Report Segmentation & Scope

This report segments the Latin American cigarette market based on:

Battery Mode:

Automatic E-cigarettes: This segment is expected to grow at a CAGR of xx% during the forecast period due to its user-friendliness. Competitive dynamics are strong with numerous players vying for market share.

Manual E-cigarettes: This segment maintains a stable market share, driven by consumers who prefer more control over their vaping experience. Competitive intensity is similar to the automatic segment.

Product Type:

Completely Disposable Models: This is a fast-growing segment, driven by convenience and affordability. The high level of disposable waste is an environmental concern.

Rechargeable but Disposable Cartomizers: This segment offers a balance between cost and convenience, maintaining a sizable market share. Competition is intense, with a focus on better battery life and flavor variety.

Personalized Vaporizers: This segment caters to experienced vapers, offering customization and advanced features. Growth is steady, driven by consumer preference for advanced vaping options.

Key Drivers of Cigarette in Latin American Industry Growth

The growth of the Latin American cigarette industry is fueled by several factors. Rising disposable incomes in many parts of Latin America are increasing the purchasing power of consumers. Technological innovations in e-cigarettes and other alternative products are driving market expansion. Favorable regulatory environments in some Latin American countries are also supporting industry growth.

Challenges in the Cigarette in Latin American Industry Sector

The Latin American cigarette industry faces several challenges. Stricter regulations and taxation policies in several countries are limiting market growth. Supply chain disruptions and the increasing cost of raw materials pose a significant threat to profitability. Intense competition, especially from new entrants in the e-cigarette sector, puts pressure on pricing and profit margins.

Leading Players in the Cigarette in Latin American Industry Market

- Shenzhen IVPS Technology Corporation Ltd (Smok)

- Shenzhen Kanger Technology Co Ltd

- NicQuid LLC

- Nicotek LLC

- British American Tobacco PLC

- Innokin Technology

- Philip Morris International Inc

- Japan Tobacco Inc

- NJOY Inc

- International Vapor Group

Key Developments in Cigarette in Latin American Industry Sector

- August 2022: SMOK launched its SOLUS 2 series, emphasizing improved vaping experiences and cost-effectiveness.

- May 2022: Innokin Technology partnered with Aquios Labs to launch the water-based vaporizer 'Lota,' utilizing water-based e-liquid.

- August 2021: Philip Morris International Inc launched IQOS ILUMA, a tobacco heating system with induction heating technology.

Strategic Cigarette in Latin American Industry Market Outlook

The future of the Latin American cigarette market is marked by significant growth potential. The continued development and adoption of smoke-free alternatives, coupled with changing consumer preferences, will drive market transformation. Strategic opportunities exist for companies to invest in research and development of innovative products, establish strong distribution networks, and adapt to evolving regulatory landscapes. The market shows promise for substantial growth, presenting lucrative avenues for companies that effectively leverage these opportunities.

Cigarette in Latin Industry Segmentation

-

1. Product Type

- 1.1. Completely Disposable Model

- 1.2. Rechargeable but Disposable Cartomizer

- 1.3. Personalized Vaporizer

-

2. Battery Mode

- 2.1. Automatic E-cigarette

- 2.2. Manual E-cigarette

-

3. Geography

- 3.1. Chile

- 3.2. Ecuador

- 3.3. Honduras

- 3.4. Paraguay

- 3.5. Costa Rica

- 3.6. Rest of Latin America

Cigarette in Latin Industry Segmentation By Geography

- 1. Chile

- 2. Ecuador

- 3. Honduras

- 4. Paraguay

- 5. Costa Rica

- 6. Rest of Latin America

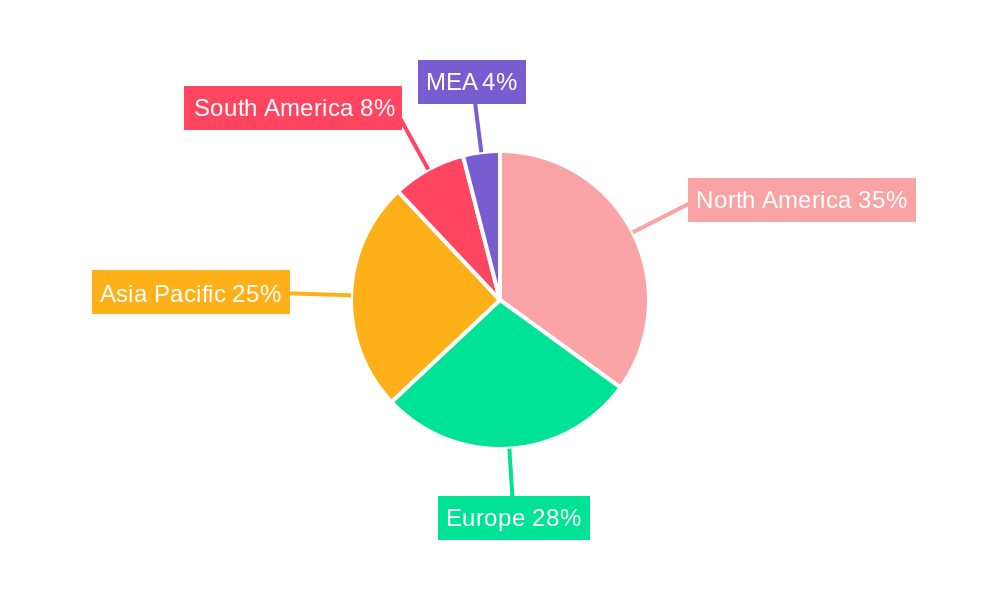

Cigarette in Latin Industry Regional Market Share

Geographic Coverage of Cigarette in Latin Industry

Cigarette in Latin Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Toward Healthy Lifestyle; Strategic Expansion by Health & Fitness Clubs

- 3.3. Market Restrains

- 3.3.1. Rise in Popularity of Outdoor Activities

- 3.4. Market Trends

- 3.4.1. Rising Prevalence of Smoking among Young Population

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Completely Disposable Model

- 5.1.2. Rechargeable but Disposable Cartomizer

- 5.1.3. Personalized Vaporizer

- 5.2. Market Analysis, Insights and Forecast - by Battery Mode

- 5.2.1. Automatic E-cigarette

- 5.2.2. Manual E-cigarette

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Chile

- 5.3.2. Ecuador

- 5.3.3. Honduras

- 5.3.4. Paraguay

- 5.3.5. Costa Rica

- 5.3.6. Rest of Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Chile

- 5.4.2. Ecuador

- 5.4.3. Honduras

- 5.4.4. Paraguay

- 5.4.5. Costa Rica

- 5.4.6. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Chile Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Completely Disposable Model

- 6.1.2. Rechargeable but Disposable Cartomizer

- 6.1.3. Personalized Vaporizer

- 6.2. Market Analysis, Insights and Forecast - by Battery Mode

- 6.2.1. Automatic E-cigarette

- 6.2.2. Manual E-cigarette

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Chile

- 6.3.2. Ecuador

- 6.3.3. Honduras

- 6.3.4. Paraguay

- 6.3.5. Costa Rica

- 6.3.6. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Ecuador Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Completely Disposable Model

- 7.1.2. Rechargeable but Disposable Cartomizer

- 7.1.3. Personalized Vaporizer

- 7.2. Market Analysis, Insights and Forecast - by Battery Mode

- 7.2.1. Automatic E-cigarette

- 7.2.2. Manual E-cigarette

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Chile

- 7.3.2. Ecuador

- 7.3.3. Honduras

- 7.3.4. Paraguay

- 7.3.5. Costa Rica

- 7.3.6. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Honduras Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Completely Disposable Model

- 8.1.2. Rechargeable but Disposable Cartomizer

- 8.1.3. Personalized Vaporizer

- 8.2. Market Analysis, Insights and Forecast - by Battery Mode

- 8.2.1. Automatic E-cigarette

- 8.2.2. Manual E-cigarette

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Chile

- 8.3.2. Ecuador

- 8.3.3. Honduras

- 8.3.4. Paraguay

- 8.3.5. Costa Rica

- 8.3.6. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Paraguay Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Completely Disposable Model

- 9.1.2. Rechargeable but Disposable Cartomizer

- 9.1.3. Personalized Vaporizer

- 9.2. Market Analysis, Insights and Forecast - by Battery Mode

- 9.2.1. Automatic E-cigarette

- 9.2.2. Manual E-cigarette

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Chile

- 9.3.2. Ecuador

- 9.3.3. Honduras

- 9.3.4. Paraguay

- 9.3.5. Costa Rica

- 9.3.6. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Costa Rica Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Completely Disposable Model

- 10.1.2. Rechargeable but Disposable Cartomizer

- 10.1.3. Personalized Vaporizer

- 10.2. Market Analysis, Insights and Forecast - by Battery Mode

- 10.2.1. Automatic E-cigarette

- 10.2.2. Manual E-cigarette

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Chile

- 10.3.2. Ecuador

- 10.3.3. Honduras

- 10.3.4. Paraguay

- 10.3.5. Costa Rica

- 10.3.6. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Latin America Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Completely Disposable Model

- 11.1.2. Rechargeable but Disposable Cartomizer

- 11.1.3. Personalized Vaporizer

- 11.2. Market Analysis, Insights and Forecast - by Battery Mode

- 11.2.1. Automatic E-cigarette

- 11.2.2. Manual E-cigarette

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Chile

- 11.3.2. Ecuador

- 11.3.3. Honduras

- 11.3.4. Paraguay

- 11.3.5. Costa Rica

- 11.3.6. Rest of Latin America

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Shenzhen IVPS Technology Corporation Ltd (Smok)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Shenzhen Kanger Technology Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 NicQuid LLC

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Nicotek LLC*List Not Exhaustive

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 British American Tobacco PLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Innokin Technology

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Philip Morris International Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Japan Tobacco Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 NJOY Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 International Vapor Group

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Shenzhen IVPS Technology Corporation Ltd (Smok)

List of Figures

- Figure 1: Global Cigarette in Latin Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Chile Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: Chile Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Chile Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 5: Chile Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 6: Chile Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 7: Chile Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Chile Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Chile Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Ecuador Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 11: Ecuador Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Ecuador Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 13: Ecuador Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 14: Ecuador Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 15: Ecuador Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Ecuador Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Ecuador Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Honduras Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Honduras Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Honduras Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 21: Honduras Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 22: Honduras Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 23: Honduras Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Honduras Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Honduras Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Paraguay Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Paraguay Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Paraguay Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 29: Paraguay Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 30: Paraguay Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 31: Paraguay Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Paraguay Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Paraguay Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Costa Rica Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 35: Costa Rica Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Costa Rica Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 37: Costa Rica Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 38: Costa Rica Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 39: Costa Rica Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Costa Rica Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Costa Rica Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of Latin America Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 43: Rest of Latin America Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Rest of Latin America Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 45: Rest of Latin America Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 46: Rest of Latin America Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 47: Rest of Latin America Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Rest of Latin America Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 49: Rest of Latin America Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 3: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global Cigarette in Latin Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 7: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 11: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 15: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 19: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 23: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 27: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cigarette in Latin Industry?

The projected CAGR is approximately 2.6%.

2. Which companies are prominent players in the Cigarette in Latin Industry?

Key companies in the market include Shenzhen IVPS Technology Corporation Ltd (Smok), Shenzhen Kanger Technology Co Ltd, NicQuid LLC, Nicotek LLC*List Not Exhaustive, British American Tobacco PLC, Innokin Technology, Philip Morris International Inc, Japan Tobacco Inc, NJOY Inc, International Vapor Group.

3. What are the main segments of the Cigarette in Latin Industry?

The market segments include Product Type, Battery Mode, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 988.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Inclination Toward Healthy Lifestyle; Strategic Expansion by Health & Fitness Clubs.

6. What are the notable trends driving market growth?

Rising Prevalence of Smoking among Young Population.

7. Are there any restraints impacting market growth?

Rise in Popularity of Outdoor Activities.

8. Can you provide examples of recent developments in the market?

August 2022: SMOK, the brand from Shenzhen IVPS Technology, which specializes in the research, development, production, and sale of e-cigarettes, launched its new SOLUS 2 series. After nearly 200 days in development, the SOLUS 2 has come to represent improved vaping experiences and cost-effectiveness for vapers worldwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cigarette in Latin Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cigarette in Latin Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cigarette in Latin Industry?

To stay informed about further developments, trends, and reports in the Cigarette in Latin Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence