Key Insights

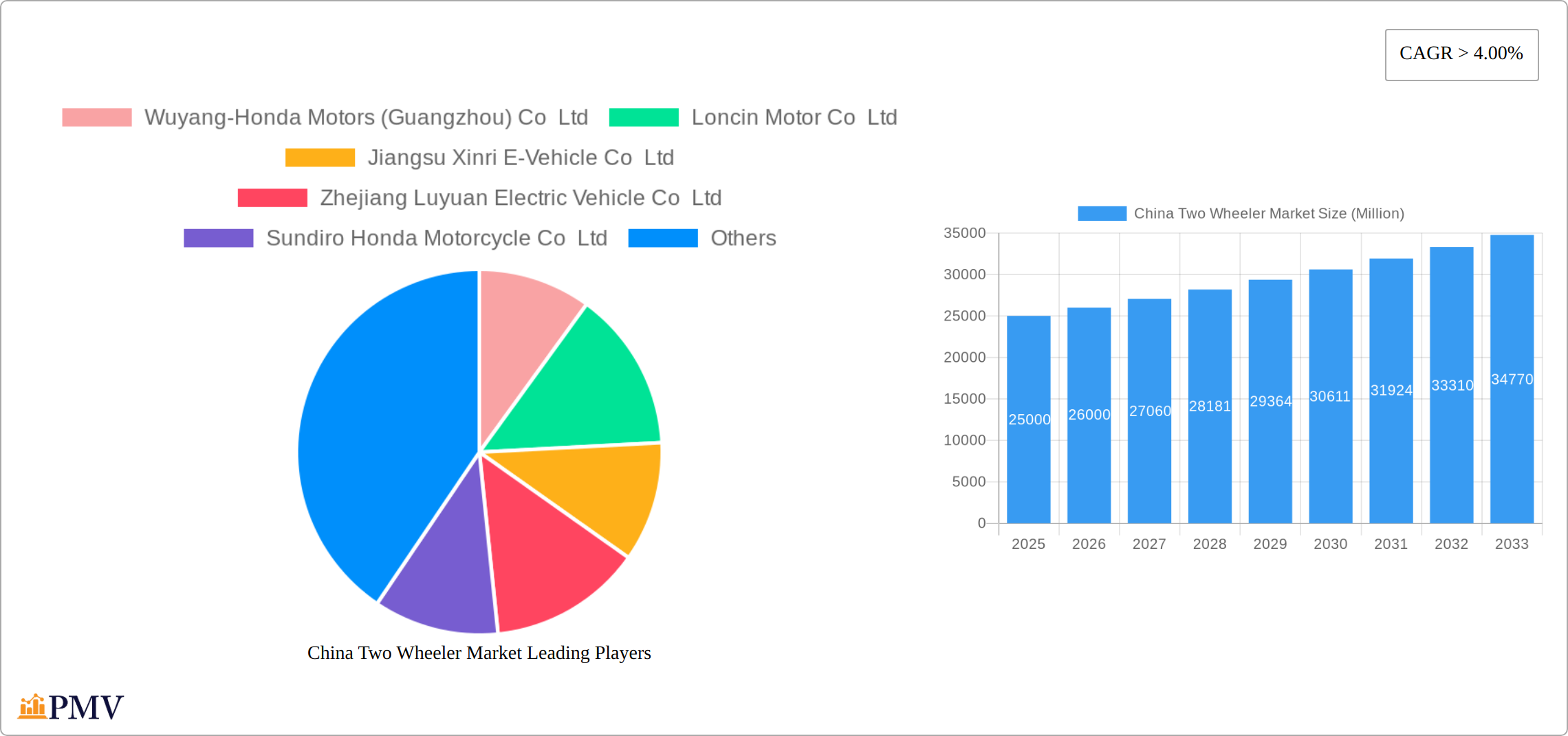

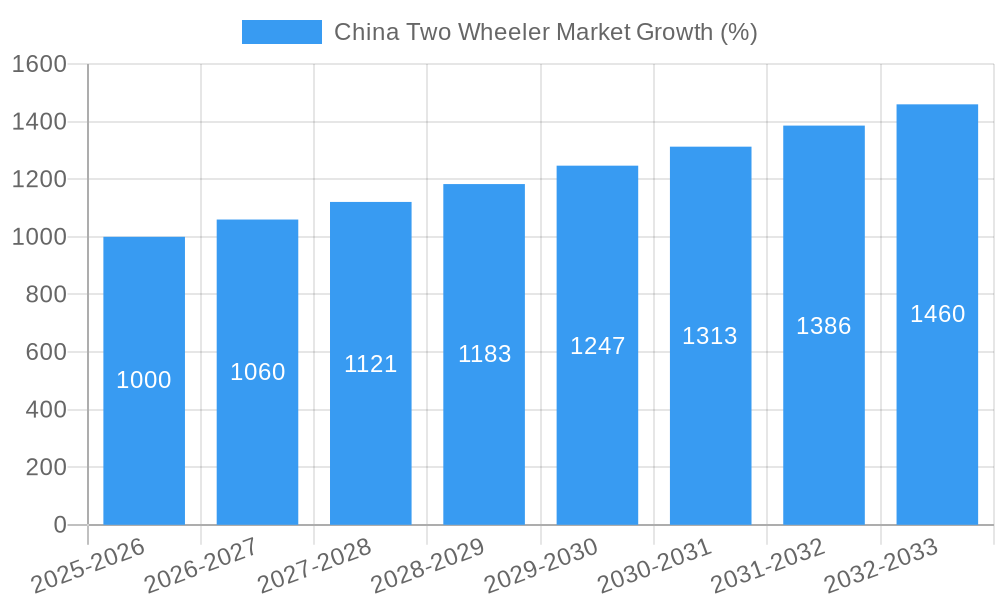

The China two-wheeler market, a significant global player, exhibits robust growth potential, driven by increasing urbanization, rising disposable incomes, and a burgeoning middle class seeking convenient and affordable personal transportation. The market's Compound Annual Growth Rate (CAGR) exceeding 4% indicates a sustained expansion trajectory, projected to continue through 2033. The market segmentation reveals a dynamic interplay between traditional Internal Combustion Engine (ICE) vehicles and the rapidly growing Hybrid and Electric Vehicle (HEV/EV) segment. Government initiatives promoting electric mobility and stricter emission regulations are accelerating the adoption of HEV/EV two-wheelers, presenting significant opportunities for manufacturers. However, challenges remain, including fluctuating raw material prices, intense competition, and the need for continued infrastructure development to support the wider adoption of electric vehicles. Key players like Wuyang-Honda, Loncin, and Jiangsu Xinri are strategically positioning themselves to capitalize on these trends, focusing on innovation, technological advancements, and expanding their product portfolios to cater to diverse consumer needs. The historical period (2019-2024) likely showcased a steady growth, influenced by pre-existing market trends, which laid the foundation for the strong growth projected in the forecast period (2025-2033). The base year of 2025 provides a crucial benchmark to measure future progress against established market realities.

The competitive landscape is characterized by both established players and emerging companies vying for market share. Successful companies will need to demonstrate a strong understanding of consumer preferences, technological adaptability, and effective supply chain management. Further growth hinges on factors such as the successful integration of electric vehicle charging infrastructure, continued government support, and the ongoing development of affordable and technologically advanced two-wheelers that meet the evolving demands of the Chinese consumer. Analyzing specific regional variations within China would offer more granular insights into market dynamics and growth potential within the vast Chinese market. While the exact market size for 2025 is not provided, a reasonable estimation can be made using the provided CAGR and assuming a certain base market size in 2019 – this would need to be confirmed by other resources for precise figures. However, given the CAGR and the industry trends, it’s safe to assume a substantial market value in the billions of USD for 2025.

China Two Wheeler Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the China two-wheeler market, covering the period from 2019 to 2033. It offers actionable insights into market size, growth drivers, competitive dynamics, and future trends, equipping stakeholders with the knowledge needed to navigate this dynamic sector. The report includes detailed segmentation by propulsion type (ICE and Hybrid & Electric Vehicles), and profiles key players such as Wuyang-Honda, Loncin Motor, and Jiangsu Xinri. The base year for this report is 2025, with estimations for 2025 and a forecast period extending to 2033. The historical period covered is 2019-2024. This analysis leverages extensive market research to provide precise data and predictions for informed decision-making.

China Two Wheeler Market Market Structure & Competitive Dynamics

The China two-wheeler market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. Market share data for 2024 suggests that the top five players held approximately xx% of the market, while the remaining xx% was distributed among numerous smaller players. This indicates opportunities for both consolidation and niche market penetration. The competitive landscape is characterized by intense rivalry, driven by factors such as price competition, technological advancements, and brand loyalty. Innovation ecosystems are relatively well-developed, especially in electric vehicle technology, with government support encouraging R&D and the adoption of cleaner transportation solutions. China's regulatory framework plays a vital role, shaping production standards, emission norms, and safety regulations, significantly influencing market dynamics. The prevalence of product substitutes, particularly public transportation in urban areas, puts pressure on two-wheeler manufacturers to offer competitive pricing and attractive features. End-user trends reveal a growing preference for electric and hybrid vehicles, driven by environmental concerns and government incentives. Significant M&A activity has been observed, with deal values in the xx Million range in recent years, reflecting the industry’s consolidation and expansion strategies. These activities often involve technology acquisitions and strategic partnerships to enhance competitiveness. Further analysis reveals that the market is affected by shifting consumer preference toward fuel-efficient and eco-friendly options along with stringent regulatory environment.

- Market Concentration: Top 5 players hold approximately xx% of market share in 2024.

- M&A Activity: Deal values in the xx Million range observed in recent years.

- Innovation: Focus on electric and hybrid technologies, driven by government support.

- Regulatory Framework: Stringent emission and safety standards influence market dynamics.

China Two Wheeler Market Industry Trends & Insights

The China two-wheeler market is witnessing robust growth, driven by several key factors. The increasing urbanization and rising disposable incomes are fueling demand for personal mobility solutions, particularly in rural areas with limited public transportation. Technological advancements in electric vehicle (EV) technology are attracting consumers seeking environmentally friendly and cost-effective options. Government initiatives promoting electric mobility, including subsidies and tax benefits, significantly boost EV adoption rates. Consumer preferences are shifting towards fuel-efficient and technologically advanced vehicles, with features like smart connectivity and advanced safety systems gaining traction. The competitive landscape is marked by intense rivalry among domestic and international manufacturers, leading to continuous product innovation and price competition. The Compound Annual Growth Rate (CAGR) for the market during the forecast period (2025-2033) is estimated at xx%, while market penetration of electric two-wheelers is projected to reach xx% by 2033. This signifies considerable growth potential, yet competitive dynamics remain intense, requiring adaptation and innovation from players. The influence of fluctuating fuel prices, evolving consumer behavior, and government policies significantly affect the market's trajectory.

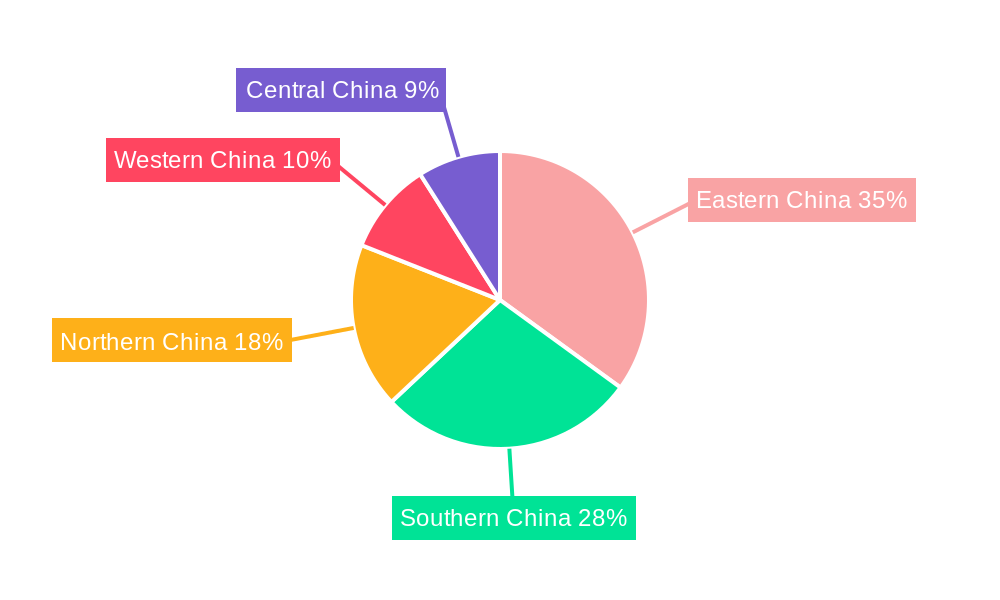

Dominant Markets & Segments in China Two Wheeler Market

The eastern and southern regions of China dominate the two-wheeler market, driven by higher population density, robust economic activity, and well-developed infrastructure. This geographical distribution is further influenced by increased urbanization and better public transportation facilities. This dominance is amplified by the high concentration of urban populations and industrial hubs in these areas which create higher demand for personal transportation. While the western and northern regions contribute, they lag due to lower economic activity and infrastructure gaps. In terms of propulsion type, the ICE (Internal Combustion Engine) segment currently holds a larger market share compared to the hybrid and electric vehicle (EV) segment. However, the latter is experiencing rapid growth, driven by government incentives and increasing environmental awareness.

Key Drivers for Dominant Regions:

- High population density

- Strong economic activity

- Well-developed infrastructure

- Government support for EV adoption

Key Drivers for Dominant Segment (ICE):

- Established market presence

- Lower initial purchase cost compared to EVs

- Wider availability of refueling infrastructure

Key Drivers for Dominant Segment (Hybrid & EV):

- Government incentives and subsidies

- Growing environmental awareness

- Technological advancements making EVs more affordable and efficient

China Two Wheeler Market Product Innovations

Recent years have witnessed significant innovation in the China two-wheeler market, with a notable focus on electric and hybrid technologies. Manufacturers are incorporating advanced features such as smart connectivity, improved battery technology (including the recent introduction of sodium-ion batteries), and enhanced safety systems. These advancements aim to enhance the overall user experience, improve efficiency, and cater to the evolving consumer preferences. The market is also witnessing the integration of artificial intelligence (AI) and internet of things (IoT) technologies to enhance features like navigation and vehicle diagnostics. This focus on technological innovation is critical in maintaining competitiveness and meeting evolving demands in the two-wheeler market.

Report Segmentation & Scope

This report segments the China two-wheeler market primarily by propulsion type:

ICE (Internal Combustion Engine): This segment comprises traditional petrol-powered two-wheelers. Growth is expected to moderate during the forecast period due to increasing environmental concerns and government regulations. Competitive dynamics in this segment are characterized by price competition and fuel efficiency improvements.

Hybrid and Electric Vehicles (EVs): This segment encompasses hybrid and fully electric two-wheelers. It is projected to exhibit significant growth, fueled by government support, technological advancements, and increasing consumer preference for environmentally friendly options. Competitive dynamics within this segment are intense, driven by technological innovation and battery technology improvements.

Key Drivers of China Two Wheeler Market Growth

Several factors contribute to the growth of the China two-wheeler market. Firstly, the expanding middle class and rising disposable incomes drive demand for personal transportation, especially in regions with limited public transportation. Secondly, government initiatives promoting electric mobility, such as subsidies and infrastructure development, significantly boost EV adoption. Thirdly, technological advancements continually improve the performance, efficiency, and affordability of two-wheelers, both ICE and electric. The increasing urbanization further fuels the demand for efficient and affordable last-mile transportation solutions, creating a favorable market environment for two-wheeler manufacturers.

Challenges in the China Two Wheeler Market Sector

The China two-wheeler market faces challenges including stringent emission regulations that require continuous technological advancements to meet compliance standards. This leads to increased production costs and pressure on profit margins. Supply chain disruptions, particularly concerning raw materials and components, pose a significant risk to production and market stability. Furthermore, intense competition from both domestic and international players requires continuous innovation and efficient cost management. These factors require strategic adjustments from companies within the sector.

Leading Players in the China Two Wheeler Market Market

- Wuyang-Honda Motors (Guangzhou) Co Ltd

- Loncin Motor Co Ltd

- Jiangsu Xinri E-Vehicle Co Ltd

- Zhejiang Luyuan Electric Vehicle Co Ltd

- Sundiro Honda Motorcycle Co Ltd

- Zongshen Industrial Group Co Ltd

- Jiangmen Grand River Group Co Ltd (Jiangmen Dachangjiang Group Co Ltd)

- Luoyang Northern Enterprises Group Co Ltd

- Lifan Technology (Group) Co Ltd

- JINYI Motor (China) Investment Co Ltd (Jinyi Vehicle Industry Co Ltd)

- Guangzhou Dayun Motorcycle Co Ltd

Key Developments in China Two Wheeler Market Sector

- July 2023: Sunra, a Chinese electric vehicle manufacturer, launched a mass-produced two-wheeled EV with sodium-ion batteries. This signals a significant technological advancement in the EV sector.

- August 2023: Multi-matrix publicity activities deepened the global deployment of SUNRA electric vehicles, indicating a push towards international expansion.

- August 2023: Loncin GM and Lingyun Intelligent formed a win-win cooperation to jointly create intelligent self-balancing motorcycle products, showcasing innovation in motorcycle technology.

Strategic China Two Wheeler Market Market Outlook

The future of the China two-wheeler market appears bright, driven by sustained economic growth, increasing urbanization, and the ongoing transition towards electric mobility. Strategic opportunities exist for manufacturers who can effectively adapt to evolving consumer preferences, embrace technological advancements, and navigate the complexities of the regulatory landscape. The market's growth trajectory will be significantly shaped by government policies promoting sustainable transportation and the continuing development of innovative EV technologies. This creates a dynamic but promising space for both established players and new entrants.

China Two Wheeler Market Segmentation

-

1. Propulsion Type

- 1.1. Hybrid and Electric Vehicles

- 1.2. ICE

China Two Wheeler Market Segmentation By Geography

- 1. China

China Two Wheeler Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Trend of Yacht Tourism

- 3.3. Market Restrains

- 3.3.1. Higher Rentals During Peak Season

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Two Wheeler Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Hybrid and Electric Vehicles

- 5.1.2. ICE

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Wuyang-Honda Motors (Guangzhou) Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Loncin Motor Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jiangsu Xinri E-Vehicle Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zhejiang Luyuan Electric Vehicle Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sundiro Honda Motorcycle Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zongshen Industrial Group Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jiangmen Grand River Group Co Ltd (Jiangmen Dachangjiang Group Co Ltd )

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Luoyang Northern Enterprises Group Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Lifan Technology (Group) Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 JINYI Motor (China) Investment Co Ltd (Jinyi Vehicle Industry Co Ltd )

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Guangzhou Dayun Motorcycle Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Wuyang-Honda Motors (Guangzhou) Co Ltd

List of Figures

- Figure 1: China Two Wheeler Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Two Wheeler Market Share (%) by Company 2024

List of Tables

- Table 1: China Two Wheeler Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Two Wheeler Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 3: China Two Wheeler Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: China Two Wheeler Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: China Two Wheeler Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 6: China Two Wheeler Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Two Wheeler Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the China Two Wheeler Market?

Key companies in the market include Wuyang-Honda Motors (Guangzhou) Co Ltd, Loncin Motor Co Ltd, Jiangsu Xinri E-Vehicle Co Ltd, Zhejiang Luyuan Electric Vehicle Co Ltd, Sundiro Honda Motorcycle Co Ltd, Zongshen Industrial Group Co Ltd, Jiangmen Grand River Group Co Ltd (Jiangmen Dachangjiang Group Co Ltd ), Luoyang Northern Enterprises Group Co Ltd, Lifan Technology (Group) Co Ltd, JINYI Motor (China) Investment Co Ltd (Jinyi Vehicle Industry Co Ltd ), Guangzhou Dayun Motorcycle Co Ltd.

3. What are the main segments of the China Two Wheeler Market?

The market segments include Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Surge in Trend of Yacht Tourism.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Higher Rentals During Peak Season.

8. Can you provide examples of recent developments in the market?

August 2023: Multi-matrix Publicity Activities Deepen the Global Deployment of SUNRA Electric VehiclesAugust 2023: Win-win cooperation丨Loncin GM and Lingyun Intelligent jointly create intelligent self-balancing motorcycle products.July 2023: Recently, Sunra, a Chinese electric vehicle manufacturer, launched the mass-produced two-wheeled EV with sodium-ion batteries, bringing the concept to reality.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Two Wheeler Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Two Wheeler Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Two Wheeler Market?

To stay informed about further developments, trends, and reports in the China Two Wheeler Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence