Key Insights

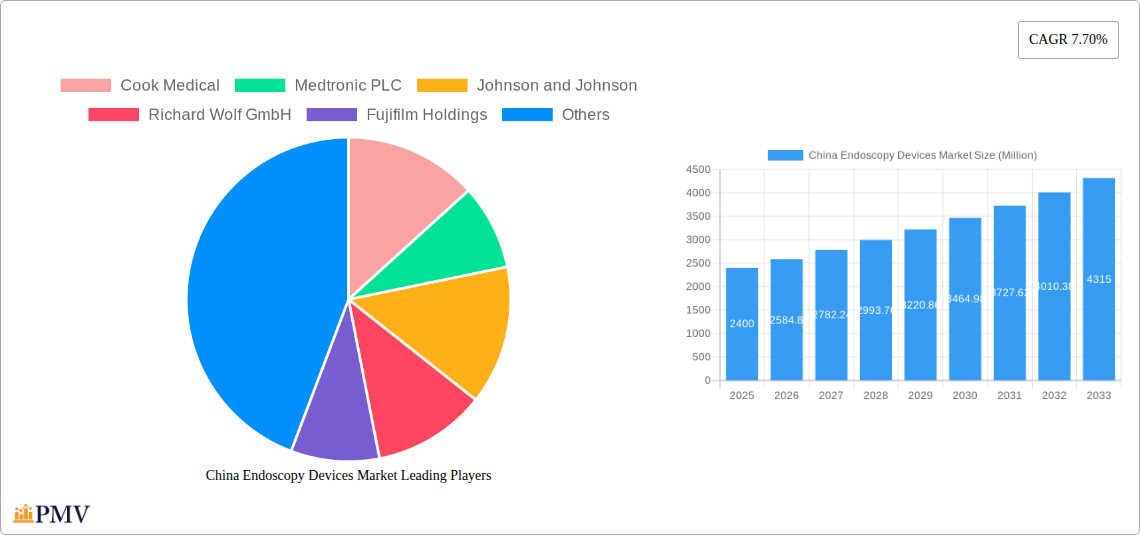

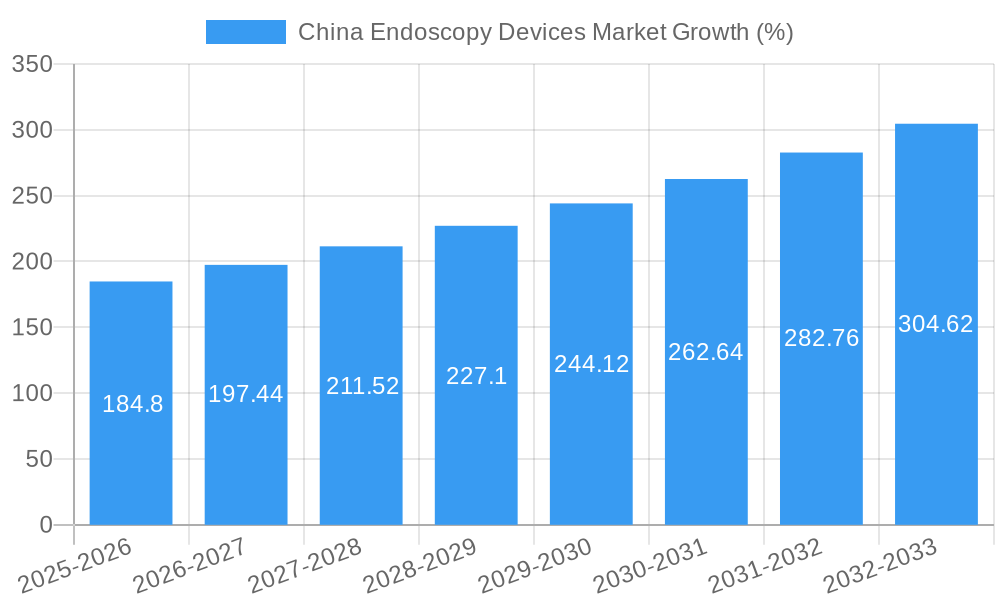

The China endoscopy devices market, valued at $2.40 billion in 2025, is projected to experience robust growth, driven by a rising prevalence of chronic diseases requiring minimally invasive procedures, increasing geriatric population, and expanding healthcare infrastructure. A Compound Annual Growth Rate (CAGR) of 7.70% from 2025 to 2033 indicates a significant market expansion. Key growth drivers include advancements in endoscopy technology, such as robotic-assisted endoscopes and improved visualization equipment, leading to enhanced diagnostic accuracy and minimally invasive surgical capabilities. The increasing adoption of these advanced devices across various specialties, including gastroenterology, pulmonology, and cardiology, further fuels market growth. While government regulations and healthcare reimbursement policies might present some challenges, the overall market outlook remains positive, driven by strong demand and technological innovation.

The market segmentation reveals a strong presence of endoscopes and robot-assisted endoscopy devices within the "Type of Device" category. Gastroenterology and pulmonology dominate the application segment due to the high volume of procedures in these areas. Major players like Cook Medical, Medtronic, Johnson & Johnson, and Olympus Corporation are shaping the competitive landscape through product innovation and strategic partnerships. The market's expansion in China is further fueled by increasing investments in healthcare infrastructure, government initiatives promoting minimally invasive surgeries, and growing awareness among the population regarding the benefits of endoscopy. While precise figures for individual segments are not provided, the available data points to a healthy and growing market with significant potential for continued expansion throughout the forecast period.

China Endoscopy Devices Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China endoscopy devices market, offering invaluable insights for stakeholders across the medical device industry. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, and the historical period encompasses 2019-2024. This report leverages extensive market research to project a robust growth trajectory for the China endoscopy devices market, outlining key opportunities and potential challenges. The market size is projected to reach xx Million by 2033.

China Endoscopy Devices Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the China endoscopy devices market, evaluating market concentration, innovation ecosystems, regulatory frameworks, and M&A activities. The market is moderately consolidated, with key players holding significant market share, but with ample room for smaller innovative companies. Major players include Cook Medical, Medtronic PLC, Johnson & Johnson, Richard Wolf GmbH, Fujifilm Holdings, Conmed Corporation, Stryker Corporation, KARL STORZ SE & Co KG, Boston Scientific Corporation, and Olympus Corporation. However, the list is not exhaustive and includes several other significant players.

- Market Concentration: The top 5 players currently hold approximately xx% of the market share.

- Innovation Ecosystems: A robust ecosystem exists, supported by government initiatives and collaborations between established companies and startups.

- Regulatory Frameworks: Stringent regulatory requirements influence market entry and product approvals, impacting market dynamics.

- Product Substitutes: Limited direct substitutes exist, but advancements in alternative imaging technologies could pose future challenges.

- End-User Trends: Increasing demand from hospitals and clinics drives market growth, fueled by rising healthcare expenditure and an aging population.

- M&A Activities: The market witnessed xx Million in M&A activity between 2019 and 2024, indicating considerable consolidation and strategic investment in the sector. Several strategic partnerships and joint ventures are shaping the market structure.

China Endoscopy Devices Market Industry Trends & Insights

The China endoscopy devices market is experiencing significant growth, driven by several factors. The market is expected to register a CAGR of xx% during the forecast period (2025-2033). Technological advancements, particularly in minimally invasive surgical techniques and advanced imaging capabilities, are a key driver. Growing prevalence of chronic diseases such as gastrointestinal cancers and increased demand for minimally invasive procedures contribute to market expansion. Rising healthcare expenditure and government initiatives supporting healthcare infrastructure development further bolster market growth. Consumer preferences are shifting towards high-quality, technologically advanced endoscopy devices offering better outcomes and patient experiences. Intense competition among established players and emerging companies drives innovation and shapes market dynamics. Market penetration of advanced endoscopy devices remains relatively low, offering significant growth opportunities.

Dominant Markets & Segments in China Endoscopy Devices Market

The Gastroenterology segment dominates the applications market, driven by the high prevalence of gastrointestinal diseases. The Endoscopes segment holds the largest market share within the device type category, with continued growth expected from the increasing adoption of advanced endoscopes.

- By Type of Device:

- Endoscopes: High market share due to widespread use in various procedures.

- Robot-assisted Endoscopes: Growing segment with significant future potential, driven by technological advancements.

- Other Endoscopic Operative Devices: Visualization equipment holds a significant market share, complementing other devices.

- By Application:

- Gastroenterology: Largest segment, driven by high incidence of gastrointestinal diseases.

- Pulmonology, Orthopedic Surgery, Cardiology, ENT Surgery, Gynecology, Neurology, Other Applications: These segments exhibit steady growth, influenced by specific procedure needs and technological advancements.

Key drivers for dominance include:

- Economic Policies: Government initiatives supporting healthcare infrastructure development.

- Infrastructure: Increasing availability of well-equipped hospitals and clinics.

- Technological Advancements: Innovations in minimally invasive procedures and imaging techniques.

China Endoscopy Devices Market Product Innovations

Recent product innovations focus on enhanced image quality, minimally invasive designs, and improved ease of use. The integration of advanced imaging technologies, such as artificial intelligence, is enhancing diagnostic capabilities. Single-use endoscopes are gaining traction, addressing infection control concerns. These innovations cater to the growing demand for improved patient outcomes and efficient healthcare delivery.

Report Segmentation & Scope

This report segments the China endoscopy devices market by type of device (endoscopes, robot-assisted endoscopes, and other endoscopic operative devices) and by application (gastroenterology, pulmonology, orthopedic surgery, cardiology, ENT surgery, gynecology, neurology, and other applications). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. The market is segmented based on these categories to provide a comprehensive understanding of the different trends and market dynamics within each segment. Growth projections for each segment are based on various factors like technological advancements, regulatory environment, and market trends. Competitive dynamics are analyzed by identifying key players and analyzing their market share and competitive strategies.

Key Drivers of China Endoscopy Devices Market Growth

Several factors fuel the growth of the China endoscopy devices market. Technological advancements, particularly in minimally invasive surgery and imaging techniques, are significant drivers. The rising prevalence of chronic diseases requiring endoscopic procedures contributes to increased demand. Government initiatives promoting healthcare infrastructure development and increased healthcare spending also play a crucial role. Furthermore, a growing awareness of minimally invasive procedures among both patients and medical professionals boosts market growth.

Challenges in the China Endoscopy Devices Market Sector

The China endoscopy devices market faces challenges such as stringent regulatory requirements for product approvals, which can cause delays in market entry. Supply chain disruptions and increasing competition from both domestic and international players also pose significant challenges. Price sensitivity and the need for robust after-sales service represent additional obstacles. These challenges can influence market growth and profitability for various companies within the market.

Leading Players in the China Endoscopy Devices Market Market

- Cook Medical

- Medtronic PLC

- Johnson & Johnson

- Richard Wolf GmbH

- Fujifilm Holdings

- Conmed Corporation

- Stryker Corporation

- KARL STORZ SE & Co KG

- Boston Scientific Corporation

- Olympus Corporation

Key Developments in China Endoscopy Devices Market Sector

- March 2023: Scivita Medical Technology Co., Ltd. and Boston Scientific signed a strategic agreement for Scivita's Single-Use Percutaneous Choledochoscope, signifying a significant partnership boosting market penetration.

- January 2023: AXA Hong Kong and Macau opened the "AXA Designated Endoscopy and Day Surgery Centre," expanding access to endoscopic procedures and influencing market growth through improved patient access and convenience.

Strategic China Endoscopy Devices Market Outlook

The China endoscopy devices market exhibits significant future potential, driven by continued technological advancements, rising healthcare expenditure, and an increasing prevalence of chronic diseases. Strategic opportunities exist for companies focusing on innovation, particularly in areas such as minimally invasive surgery, AI-powered diagnostics, and single-use devices. Companies adopting proactive strategies for regulatory compliance and establishing strong distribution networks will gain a competitive edge in this rapidly expanding market.

China Endoscopy Devices Market Segmentation

-

1. Type of Device

-

1.1. Endoscopes

- 1.1.1. Rigid Endoscope

- 1.1.2. Flexible Endoscope

- 1.1.3. Capsule Endoscope

- 1.1.4. Robot-assisted Endoscope

-

1.2. Endoscopic Operative Device

- 1.2.1. Irrigation/Suction System

- 1.2.2. Access Device

- 1.2.3. Wound Protector

- 1.2.4. Insufflation Device

- 1.2.5. Operative Manual Instrument

- 1.2.6. Other Endoscopic Operative Devices

-

1.3. Visualization Equipment

- 1.3.1. Endoscopic Camera

- 1.3.2. SD Visualization System

- 1.3.3. HD Visualization System

-

1.1. Endoscopes

-

2. Application

- 2.1. Gastroenterology

- 2.2. Pulmonology

- 2.3. Orthopedic Surgery

- 2.4. Cardiology

- 2.5. ENT Surgery

- 2.6. Gynecology

- 2.7. Neurology

- 2.8. Other Applications

China Endoscopy Devices Market Segmentation By Geography

- 1. China

China Endoscopy Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Preference for Minimally-invasive Surgeries; Increasing Use of Endoscopy for Treatment and Diagnosis; Technological Advancements Leading to Enhanced Applications

- 3.3. Market Restrains

- 3.3.1. Infections Caused by Few Endoscopes

- 3.4. Market Trends

- 3.4.1. Capsule Endoscopy Segment is Expected to Witness Rapid Growth Over the Forecast Period in the China Endoscopy Devices Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Endoscopy Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Endoscopes

- 5.1.1.1. Rigid Endoscope

- 5.1.1.2. Flexible Endoscope

- 5.1.1.3. Capsule Endoscope

- 5.1.1.4. Robot-assisted Endoscope

- 5.1.2. Endoscopic Operative Device

- 5.1.2.1. Irrigation/Suction System

- 5.1.2.2. Access Device

- 5.1.2.3. Wound Protector

- 5.1.2.4. Insufflation Device

- 5.1.2.5. Operative Manual Instrument

- 5.1.2.6. Other Endoscopic Operative Devices

- 5.1.3. Visualization Equipment

- 5.1.3.1. Endoscopic Camera

- 5.1.3.2. SD Visualization System

- 5.1.3.3. HD Visualization System

- 5.1.1. Endoscopes

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gastroenterology

- 5.2.2. Pulmonology

- 5.2.3. Orthopedic Surgery

- 5.2.4. Cardiology

- 5.2.5. ENT Surgery

- 5.2.6. Gynecology

- 5.2.7. Neurology

- 5.2.8. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Cook Medical

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Medtronic PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Johnson and Johnson

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Richard Wolf GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fujifilm Holdings

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Conmed Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Stryker Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 KARL STORZ SE & Co KG*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Boston Scientific Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Olympus Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cook Medical

List of Figures

- Figure 1: China Endoscopy Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Endoscopy Devices Market Share (%) by Company 2024

List of Tables

- Table 1: China Endoscopy Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Endoscopy Devices Market Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 3: China Endoscopy Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: China Endoscopy Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Endoscopy Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Endoscopy Devices Market Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 7: China Endoscopy Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: China Endoscopy Devices Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Endoscopy Devices Market?

The projected CAGR is approximately 7.70%.

2. Which companies are prominent players in the China Endoscopy Devices Market?

Key companies in the market include Cook Medical, Medtronic PLC, Johnson and Johnson, Richard Wolf GmbH, Fujifilm Holdings, Conmed Corporation, Stryker Corporation, KARL STORZ SE & Co KG*List Not Exhaustive, Boston Scientific Corporation, Olympus Corporation.

3. What are the main segments of the China Endoscopy Devices Market?

The market segments include Type of Device, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Preference for Minimally-invasive Surgeries; Increasing Use of Endoscopy for Treatment and Diagnosis; Technological Advancements Leading to Enhanced Applications.

6. What are the notable trends driving market growth?

Capsule Endoscopy Segment is Expected to Witness Rapid Growth Over the Forecast Period in the China Endoscopy Devices Market.

7. Are there any restraints impacting market growth?

Infections Caused by Few Endoscopes.

8. Can you provide examples of recent developments in the market?

March 2023: Scivita Medical Technology Co., Ltd. and Boston Scientific signed an official Strategic Agreement for Scivita's Single-Use Percutaneous Choledochoscope. Through this business cooperation and distribution agreement, Scivita Medical and Boston Scientific intend to establish a long-term partnership in commercializing, marketing, and promoting Scivita's Single-Use Percutaneous Choledochoscope in China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Endoscopy Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Endoscopy Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Endoscopy Devices Market?

To stay informed about further developments, trends, and reports in the China Endoscopy Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence