Key Insights

The China agricultural biologicals market is projected for significant expansion, reaching an estimated $18.44 billion by 2025 and demonstrating a robust compound annual growth rate (CAGR) of 13.7% from 2025 to 2033. This growth is primarily driven by escalating consumer demand for pesticide-free and organic produce, compelling a shift towards sustainable farming methods and increased adoption of biopesticides and biofertilizers. Stringent government regulations targeting the reduction of conventional agricultural chemical impacts further favor the biologicals sector. Heightened awareness of the adverse effects of chemical pesticides on human health and ecosystems also fuels market acceleration. The market segments by crop type, including cash crops, horticultural crops, and row crops, with crop nutrition and other biopesticides as key functional segments. Leading entities such as Valent Biosciences, Biolchim, and Novozymes are investing in R&D and product diversification to meet the evolving needs of China's agricultural industry. Future growth will be influenced by biopesticide technology advancements, farmer education, and supportive government initiatives.

China Agricultural Biologicals Market Market Size (In Billion)

Despite a positive growth trajectory, the market encounters challenges. The comparatively higher cost of biologicals versus conventional chemical inputs poses a barrier to widespread adoption, especially for smallholder farmers. Inconsistent efficacy of certain biopesticides necessitates further research to optimize performance. Additionally, underdeveloped infrastructure and distribution networks in specific regions can impede product accessibility. Nevertheless, continuous innovation, technological progress, and supportive government policies are expected to mitigate these challenges, ensuring consistent market growth throughout the forecast period. China's extensive agricultural landscape, coupled with a growing emphasis on sustainable and eco-friendly farming, positions it as a highly promising market for agricultural biologicals.

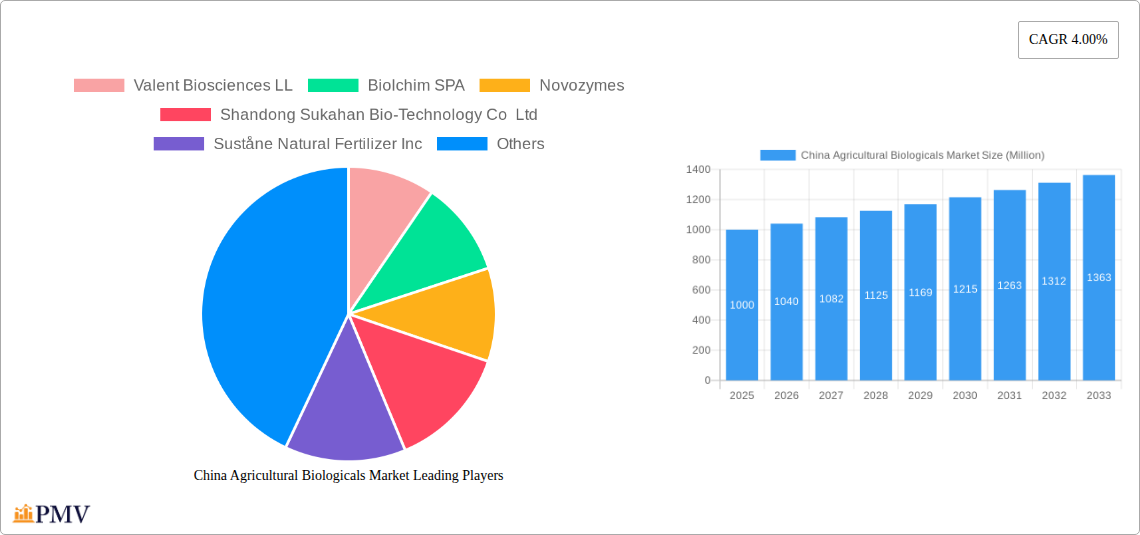

China Agricultural Biologicals Market Company Market Share

This comprehensive report delivers an in-depth analysis of the China Agricultural Biologicals Market, providing critical insights for stakeholders in the agricultural biotechnology sector. The analysis covers the period 2019-2033, with 2025 serving as the base year and the forecast period spanning 2025-2033. Market segmentation includes crop types (cash crops, horticultural crops, row crops) and functions (crop nutrition, other biopesticides). The market is forecasted to achieve a substantial size of $18.44 billion in 2025, with a projected CAGR of 13.7% during the forecast period.

China Agricultural Biologicals Market Market Structure & Competitive Dynamics

The China Agricultural Biologicals market exhibits a moderately concentrated structure, with both multinational corporations and domestic players vying for market share. Key players include Valent Biosciences LL, Biolchim SPA, Novozymes, Shandong Sukahan Bio-Technology Co Ltd, Suståne Natural Fertilizer Inc, Haifa Group, Genliduo Bio-tech Corporation Ltd, Trade Corporation International, Biobest Group NV, and Henan Jiyuan Baiyun Industry Co Ltd. Market share is largely determined by product innovation, distribution networks, and brand recognition. The innovation ecosystem is dynamic, with ongoing research and development efforts focused on improving efficacy, reducing environmental impact, and developing novel biopesticides and biostimulants.

The regulatory framework in China is evolving, with increasing emphasis on biosafety and environmental protection. This necessitates compliance with stringent regulations and rigorous testing protocols. While chemical pesticides remain prevalent, the growing awareness of their environmental and health consequences fuels the substitution towards biological alternatives. End-user trends indicate a growing preference for sustainable and environmentally friendly agricultural practices, driving demand for biologicals. Recent M&A activities within the sector are characterized by strategic acquisitions aiming to expand product portfolios and market reach. Though precise deal values are not publicly available for all transactions, the total value of M&A activity in the sector between 2020 and 2024 is estimated at xx Million.

China Agricultural Biologicals Market Industry Trends & Insights

The China Agricultural Biologicals market is experiencing robust growth, driven by several key factors. The rising awareness of the harmful effects of chemical pesticides on human health and the environment is a significant driver, pushing farmers towards adopting more sustainable practices. Government initiatives promoting sustainable agriculture and supporting the development of the biopesticide industry further accelerate market expansion. Technological advancements, such as improved formulations and application methods, are enhancing the efficacy and cost-effectiveness of biologicals. Consumer preferences are shifting towards organically produced food, stimulating demand for organically certified crops that necessitate biopesticides and biostimulants. Intensifying competition among market players fosters innovation and keeps prices competitive. The market penetration of biopesticides is increasing, with a projected xx% penetration rate by 2033, fueled by the favorable regulatory landscape and heightened consumer awareness. The market’s CAGR over the forecast period is projected at xx%.

Dominant Markets & Segments in China Agricultural Biologicals Market

The Chinese agricultural biologicals market is geographically diverse, with significant regional variations in demand and adoption rates. However, the most dominant segment remains the Row Crops segment, driven by the large acreage under cultivation and the increasing need for effective pest and disease management.

Row Crops: The large-scale cultivation of major crops like rice, wheat, and corn drives high demand for biologicals focused on pest and disease control and crop nutrition. Government support programs for these crops further contribute to this segment's dominance.

Horticultural Crops: The growing demand for high-quality fruits and vegetables, particularly in urban areas, fuels the demand for biopesticides and biostimulants in this segment.

Cash Crops: The high economic value associated with cash crops like cotton and soybeans influences the adoption of biologicals to maximize yields and quality.

Crop Nutrition: This segment's growth is underpinned by the demand for sustainable crop fertilization practices. Biostimulants play a crucial role in improving nutrient uptake and crop resilience.

Other Biopesticides: This segment includes a diverse range of biocontrol agents targeting specific pests and diseases, showcasing continuous innovation in the sector. Growing awareness of the benefits of biopesticides compared to conventional chemical alternatives also fuels the growth of this segment.

Economic policies promoting sustainable agriculture, advancements in research and development leading to the introduction of novel products, and improvements in infrastructure supporting efficient distribution networks are major contributing factors in this segment's growth.

China Agricultural Biologicals Market Product Innovations

Recent years have witnessed significant product innovations in the China Agricultural Biologicals market, with a focus on developing more effective and environmentally friendly solutions. Technological advancements such as the use of nanotechnology for targeted delivery of active ingredients and the development of biopesticides with improved efficacy against specific pests and diseases are transforming the industry. New formulations have significantly enhanced the shelf life and storage capabilities of biological products, ensuring their stability and effectiveness during transportation and application. This drives wider adoption across diverse agricultural regions.

Report Segmentation & Scope

This report segments the China Agricultural Biologicals Market by crop type (cash crops, horticultural crops, row crops) and function (crop nutrition, other biopesticides). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. The market size for cash crops is projected to reach xx Million by 2033, with a CAGR of xx%. The horticultural crops segment is expected to reach xx Million, with a CAGR of xx%. The row crops segment, the largest, is projected to reach xx Million by 2033, exhibiting a CAGR of xx%. Within the function segment, the Crop Nutrition segment is expected to grow significantly due to the increasing demand for sustainable fertilization methods, reaching xx Million by 2033 with a CAGR of xx%, while the Other Biopesticides segment is poised to reach xx Million by 2033, growing at a CAGR of xx%. Competitive landscapes are analyzed for each segment.

Key Drivers of China Agricultural Biologicals Market Growth

The growth of the China Agricultural Biologicals market is fueled by several key factors. The increasing awareness of the negative environmental and health impacts of chemical pesticides is driving a strong shift toward environmentally friendly alternatives. Supportive government policies promoting sustainable agriculture, coupled with significant investments in research and development, further enhance market growth. The expanding organic farming sector, with a growing preference for organic food products, increases the demand for biopesticides and biostimulants. Technological advancements, improving product efficacy and application methods, also contribute positively to market expansion.

Challenges in the China Agricultural Biologicals Market Sector

The China Agricultural Biologicals market faces certain challenges. The relatively high cost of biologicals compared to chemical alternatives can hinder adoption, particularly among smallholder farmers. The efficacy of some biologicals can be affected by environmental factors, limiting their widespread applicability. Ensuring consistent product quality and establishing robust distribution networks are crucial for wider market penetration. Regulatory hurdles and stringent approval processes for new products can delay market entry. Finally, competition from established chemical pesticide companies can also pose a challenge for smaller biopesticide manufacturers.

Leading Players in the China Agricultural Biologicals Market Market

- Valent Biosciences LL

- Biolchim SPA

- Novozymes

- Shandong Sukahan Bio-Technology Co Ltd

- Suståne Natural Fertilizer Inc

- Haifa Group

- Genliduo Bio-tech Corporation Ltd

- Trade Corporation International

- Biobest Group NV

- Henan Jiyuan Baiyun Industry Co Ltd

Key Developments in China Agricultural Biologicals Market Sector

- August 2021: A new biocontrol agent, Trichogramma chilonis (a parasitic wasp), was released to control Chilo suppressalis (rice stem borer) in Xinyang, Henan Province, covering up to 333 hectares of paddy fields. This development highlights the increasing focus on biological pest control solutions.

- September 2021: Tradecorp launched Biimore worldwide, a biostimulant derived from plant fermentation. This launch underscores the growing market for biostimulants and demonstrates the potential for innovative product development in the sector.

Strategic China Agricultural Biologicals Market Market Outlook

The China Agricultural Biologicals market presents substantial growth opportunities. The increasing demand for sustainable agricultural practices, coupled with government support and technological advancements, will drive substantial market expansion. Strategic partnerships and collaborations between research institutions, agricultural companies, and government agencies are crucial for accelerating the development and adoption of innovative biological solutions. Focusing on research and development, expanding distribution networks, and improving product accessibility will be critical to capture the significant market potential. The market is set for continued expansion and innovation, with a promising future outlook.

China Agricultural Biologicals Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

China Agricultural Biologicals Market Segmentation By Geography

- 1. China

China Agricultural Biologicals Market Regional Market Share

Geographic Coverage of China Agricultural Biologicals Market

China Agricultural Biologicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns

- 3.3. Market Restrains

- 3.3.1. High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 3.4. Market Trends

- 3.4.1. Increased Food Demand and Need for Increased Agricultural Food Productivity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Agricultural Biologicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Valent Biosciences LL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Biolchim SPA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Novozymes

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Shandong Sukahan Bio-Technology Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Suståne Natural Fertilizer Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Haifa Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Genliduo Bio-tech Corporation Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trade Corporation International

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Biobest Group NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Henan Jiyuan Baiyun Industry Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Valent Biosciences LL

List of Figures

- Figure 1: China Agricultural Biologicals Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Agricultural Biologicals Market Share (%) by Company 2025

List of Tables

- Table 1: China Agricultural Biologicals Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: China Agricultural Biologicals Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: China Agricultural Biologicals Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: China Agricultural Biologicals Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: China Agricultural Biologicals Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: China Agricultural Biologicals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: China Agricultural Biologicals Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: China Agricultural Biologicals Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: China Agricultural Biologicals Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: China Agricultural Biologicals Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: China Agricultural Biologicals Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: China Agricultural Biologicals Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Agricultural Biologicals Market?

The projected CAGR is approximately 13.7%.

2. Which companies are prominent players in the China Agricultural Biologicals Market?

Key companies in the market include Valent Biosciences LL, Biolchim SPA, Novozymes, Shandong Sukahan Bio-Technology Co Ltd, Suståne Natural Fertilizer Inc, Haifa Group, Genliduo Bio-tech Corporation Ltd, Trade Corporation International, Biobest Group NV, Henan Jiyuan Baiyun Industry Co Ltd.

3. What are the main segments of the China Agricultural Biologicals Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.44 billion as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns.

6. What are the notable trends driving market growth?

Increased Food Demand and Need for Increased Agricultural Food Productivity.

7. Are there any restraints impacting market growth?

High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants.

8. Can you provide examples of recent developments in the market?

September 2021: Tradecorp launched Biimore worldwide, a biostimulant obtained from a plant fermentation process. Biimore is made up of a unique combination of primary and secondary compounds, L-α amino acids, vitamins, sugars, and traces of other natural compounds.August 2021: The company released a new biocontrol agent, Trichogramma chilonis, a parasitic wasp to cover up to 333 hectares of paddy field to control Chilo suppressalis (rice stem borer) in Xinyang of the Henan Province, China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Agricultural Biologicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Agricultural Biologicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Agricultural Biologicals Market?

To stay informed about further developments, trends, and reports in the China Agricultural Biologicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence