Key Insights

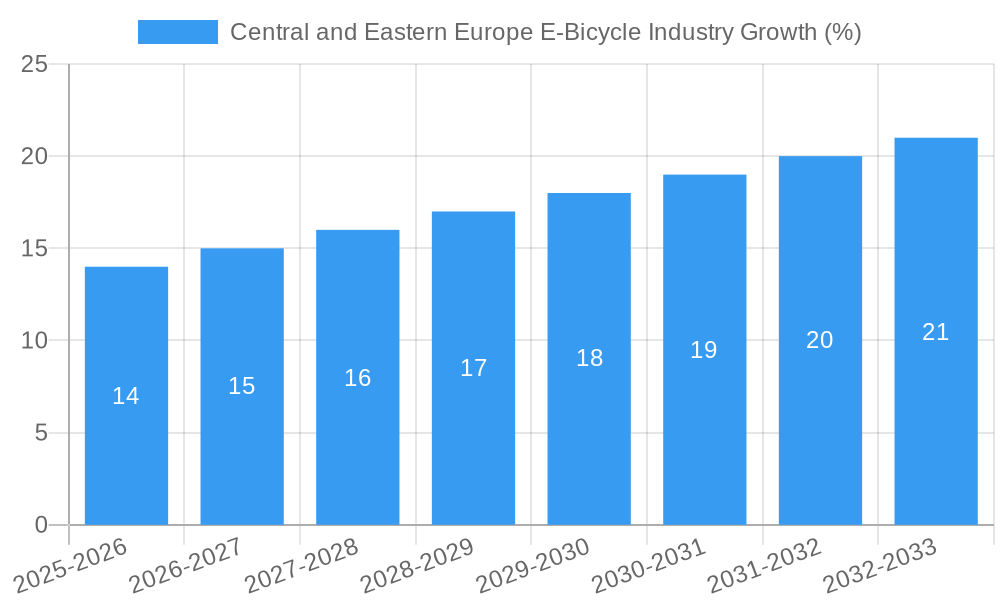

The Central and Eastern European e-bicycle market is experiencing robust growth, driven by increasing environmental awareness, government incentives promoting sustainable transportation, and rising disposable incomes. The market's expansion is fueled by a shift towards eco-friendly commuting options, particularly in urban areas grappling with traffic congestion and air pollution. The convenience and health benefits associated with e-bikes further contribute to their increasing popularity. While the exact market size for Central and Eastern Europe in 2025 is not provided, extrapolating from the given global CAGR of 5.67% and considering the region's growing adoption of sustainable technologies, a reasonable estimate for the 2025 market size would fall within the range of €200-€300 million. This estimate considers the potential for higher growth rates in this region compared to global averages, given the relatively lower penetration of e-bikes compared to Western Europe.

Growth is segmented primarily between motorcycles and scooters, with motorcycles likely holding a larger market share due to their suitability for longer distances and varied terrains. However, the scooter segment is expected to see significant growth due to its appeal for urban commuting. Key players are emerging within the region, both established international brands and local manufacturers catering to specific regional demands. However, challenges remain, including relatively high initial purchase costs compared to traditional bicycles, limited charging infrastructure in certain areas, and potential concerns about battery lifespan and maintenance. Overcoming these hurdles through government support for infrastructure development and innovative financing options will be crucial for further market expansion in the forecast period (2025-2033).

Central and Eastern Europe E-Bicycle Industry Market Report: 2019-2033

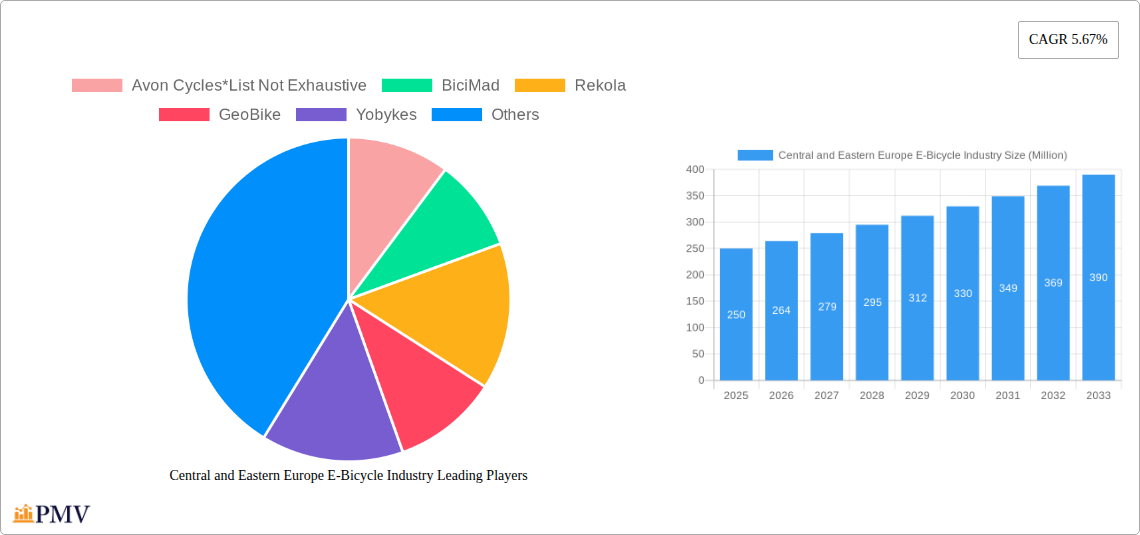

This comprehensive report provides a detailed analysis of the Central and Eastern European e-bicycle industry, offering invaluable insights for businesses, investors, and policymakers. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, while the historical period encompasses 2019-2024. We project a xx Million market value in 2025, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Key market segments include motorcycles and scooters. Leading companies such as Avon Cycles, BiciMad, Rekola, GeoBike, Yobykes, and VOI Scooter are analyzed in detail.

Central and Eastern Europe E-Bicycle Industry Market Structure & Competitive Dynamics

The Central and Eastern European e-bicycle market exhibits a moderately fragmented structure, with several key players competing alongside numerous smaller regional brands. Market concentration is relatively low, with the top 5 players holding an estimated xx% market share in 2025. Innovation ecosystems are developing, driven by both established manufacturers and agile startups focusing on specific niches. Regulatory frameworks vary across the region, influencing adoption rates and product specifications. Significant product substitutes include traditional bicycles and public transportation. End-user trends favor e-bikes offering convenience, sustainability, and affordability. Mergers and acquisitions (M&A) activity has been moderate, with deal values averaging xx Million in recent years. Notable transactions include (list any available M&A deals with values).

Central and Eastern Europe E-Bicycle Industry Industry Trends & Insights

The Central and Eastern European e-bicycle market is experiencing robust growth driven by several factors. Increasing environmental awareness is fueling consumer demand for sustainable transportation alternatives. Government initiatives promoting cycling infrastructure and offering incentives for e-bike purchases are further boosting market expansion. Technological advancements are leading to lighter, more efficient, and feature-rich e-bikes, enhancing their appeal to a wider range of consumers. The rising adoption of e-commerce platforms is simplifying the purchasing process and increasing accessibility. However, challenges remain, including concerns over battery lifespan and charging infrastructure limitations. Market penetration is currently estimated at xx% in 2025, with projections indicating significant growth in the coming years. Competitive dynamics are shaped by price competition, product differentiation, and branding strategies.

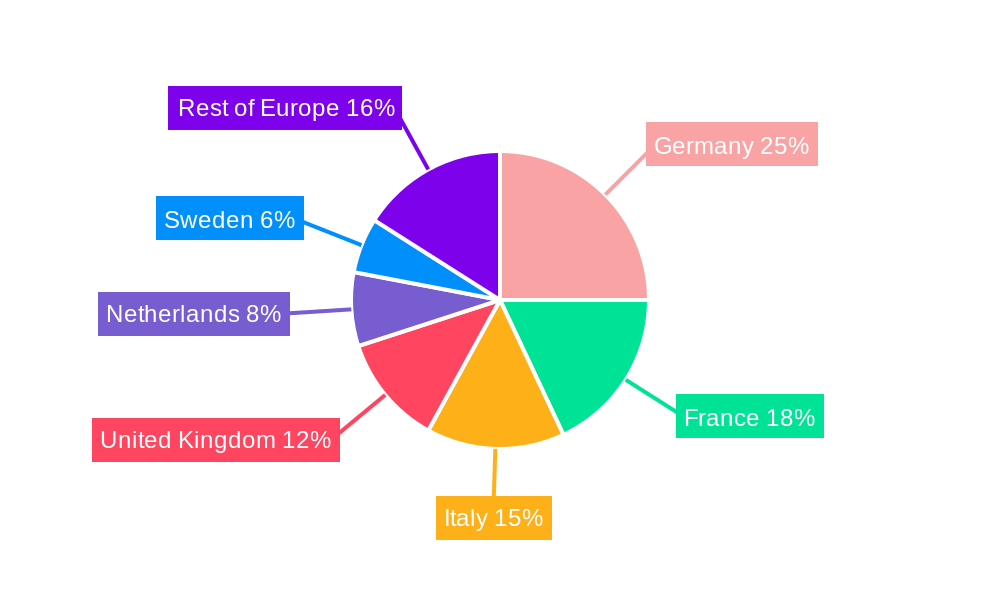

Dominant Markets & Segments in Central and Eastern Europe E-Bicycle Industry

While the market is growing across Central and Eastern Europe, Poland currently represents the largest national market, followed by Germany and Czech Republic. This dominance is driven by a combination of factors:

- Stronger economic performance: Higher disposable incomes in these countries fuel demand for premium e-bikes.

- Developed cycling infrastructure: Existing bike lanes and paths encourage e-bike usage.

- Government support: Incentive programs and supportive policies further stimulate market growth.

The scooter segment currently holds a larger market share than the motorcycle segment due to its lower price point and greater adaptability to urban environments. However, the motorcycle segment is anticipated to show faster growth in the coming years due to increased consumer interest in longer-range and higher-performance options.

Central and Eastern Europe E-bicycle Industry Product Innovations

Recent product innovations in the Central and Eastern European e-bike market focus on improved battery technology, enhanced connectivity features (GPS tracking, smartphone integration), and more robust and lightweight frames. Manufacturers are emphasizing customization options and developing specialized e-bikes for diverse applications, including cargo transport and off-road riding. These innovations address key market needs, enhancing the overall value proposition and increasing the appeal of e-bikes across various demographics.

Report Segmentation & Scope

This report segments the Central and Eastern European e-bicycle market based on two-wheeler type:

Motorcycles: This segment comprises e-motorcycles designed for longer distances and higher speeds. Market size is estimated at xx Million in 2025, projecting xx Million by 2033. Competitive intensity is moderate, with both established and emerging players competing.

Scooters: This segment encompasses e-scooters favored for their compact size and maneuverability within urban areas. The 2025 market size is estimated at xx Million, with projected growth to xx Million by 2033. This segment is characterized by higher competitive intensity due to the presence of numerous smaller players.

Key Drivers of Central and Eastern Europe E-Bicycle Industry Growth

Several factors are propelling the growth of the Central and Eastern European e-bicycle industry. Government incentives, such as tax breaks and subsidies, are significantly reducing the upfront cost of e-bike ownership. The increasing awareness of environmental concerns is driving consumer preference toward eco-friendly transportation options. Continuous technological advancements are resulting in more efficient, durable, and feature-rich e-bikes. The development of dedicated cycling infrastructure in major cities is improving the safety and convenience of e-bike commuting.

Challenges in the Central and Eastern Europe E-Bicycle Industry Sector

Despite the significant growth potential, the Central and Eastern European e-bicycle industry faces various challenges. The lack of standardized charging infrastructure in some regions poses a significant hurdle to wider adoption. Supply chain disruptions, particularly related to battery components, can impact production volumes and pricing. Intense price competition from both established and new entrants creates pressure on profit margins. Furthermore, stringent safety regulations and certification processes can increase the cost of bringing new products to market. The xx Million worth of import restrictions has impacted the industry.

Leading Players in the Central and Eastern Europe E-Bicycle Industry Market

- Avon Cycles

- BiciMad

- Rekola

- GeoBike

- Yobykes

- VOI Scooter

Key Developments in Central and Eastern Europe E-Bicycle Industry Sector

- January 2023: Government X announces new incentives for e-bike purchases.

- June 2022: Company Y launches a new model of high-performance e-motorcycle.

- October 2021: City Z invests in expanding its network of charging stations. (Include any other relevant developments with dates)

Strategic Central and Eastern Europe E-Bicycle Industry Market Outlook

The Central and Eastern European e-bicycle market presents significant growth opportunities for businesses willing to adapt to evolving consumer preferences and navigate the unique challenges of the region. Strategic focus should be on innovation in battery technology, expanding charging infrastructure, and leveraging government incentives to enhance market penetration. Expanding into underserved markets and focusing on niche applications, such as cargo transport and tourism, offers further potential for differentiation and revenue growth. The market is poised for continued expansion, driven by a confluence of technological, economic, and environmental factors.

Central and Eastern Europe E-Bicycle Industry Segmentation

-

1. Two-Wheeler Type

- 1.1. Motorcycles

- 1.2. Scooter

Central and Eastern Europe E-Bicycle Industry Segmentation By Geography

- 1. Hungary

- 2. Poland

- 3. Czech Republic

- 4. Others

Central and Eastern Europe E-Bicycle Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.67% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growth of The Global Automotive Turbocharger Market

- 3.3. Market Restrains

- 3.3.1. Increasing Complexity of Modern Vehicles

- 3.4. Market Trends

- 3.4.1. Rise in the Demand of Green Transportation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Central and Eastern Europe E-Bicycle Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 5.1.1. Motorcycles

- 5.1.2. Scooter

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Hungary

- 5.2.2. Poland

- 5.2.3. Czech Republic

- 5.2.4. Others

- 5.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 6. Hungary Central and Eastern Europe E-Bicycle Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 6.1.1. Motorcycles

- 6.1.2. Scooter

- 6.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 7. Poland Central and Eastern Europe E-Bicycle Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 7.1.1. Motorcycles

- 7.1.2. Scooter

- 7.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 8. Czech Republic Central and Eastern Europe E-Bicycle Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 8.1.1. Motorcycles

- 8.1.2. Scooter

- 8.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 9. Others Central and Eastern Europe E-Bicycle Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 9.1.1. Motorcycles

- 9.1.2. Scooter

- 9.1. Market Analysis, Insights and Forecast - by Two-Wheeler Type

- 10. Germany Central and Eastern Europe E-Bicycle Industry Analysis, Insights and Forecast, 2019-2031

- 11. France Central and Eastern Europe E-Bicycle Industry Analysis, Insights and Forecast, 2019-2031

- 12. Italy Central and Eastern Europe E-Bicycle Industry Analysis, Insights and Forecast, 2019-2031

- 13. United Kingdom Central and Eastern Europe E-Bicycle Industry Analysis, Insights and Forecast, 2019-2031

- 14. Netherlands Central and Eastern Europe E-Bicycle Industry Analysis, Insights and Forecast, 2019-2031

- 15. Sweden Central and Eastern Europe E-Bicycle Industry Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Europe Central and Eastern Europe E-Bicycle Industry Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Avon Cycles*List Not Exhaustive

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 BiciMad

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Rekola

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 GeoBike

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Yobykes

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 VOI Scooter

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.1 Avon Cycles*List Not Exhaustive

List of Figures

- Figure 1: Central and Eastern Europe E-Bicycle Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Central and Eastern Europe E-Bicycle Industry Share (%) by Company 2024

List of Tables

- Table 1: Central and Eastern Europe E-Bicycle Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Central and Eastern Europe E-Bicycle Industry Revenue Million Forecast, by Two-Wheeler Type 2019 & 2032

- Table 3: Central and Eastern Europe E-Bicycle Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Central and Eastern Europe E-Bicycle Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Central and Eastern Europe E-Bicycle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Central and Eastern Europe E-Bicycle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Central and Eastern Europe E-Bicycle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Central and Eastern Europe E-Bicycle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Central and Eastern Europe E-Bicycle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Central and Eastern Europe E-Bicycle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Central and Eastern Europe E-Bicycle Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Central and Eastern Europe E-Bicycle Industry Revenue Million Forecast, by Two-Wheeler Type 2019 & 2032

- Table 13: Central and Eastern Europe E-Bicycle Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Central and Eastern Europe E-Bicycle Industry Revenue Million Forecast, by Two-Wheeler Type 2019 & 2032

- Table 15: Central and Eastern Europe E-Bicycle Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Central and Eastern Europe E-Bicycle Industry Revenue Million Forecast, by Two-Wheeler Type 2019 & 2032

- Table 17: Central and Eastern Europe E-Bicycle Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Central and Eastern Europe E-Bicycle Industry Revenue Million Forecast, by Two-Wheeler Type 2019 & 2032

- Table 19: Central and Eastern Europe E-Bicycle Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Central and Eastern Europe E-Bicycle Industry?

The projected CAGR is approximately 5.67%.

2. Which companies are prominent players in the Central and Eastern Europe E-Bicycle Industry?

Key companies in the market include Avon Cycles*List Not Exhaustive, BiciMad, Rekola, GeoBike, Yobykes, VOI Scooter.

3. What are the main segments of the Central and Eastern Europe E-Bicycle Industry?

The market segments include Two-Wheeler Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

The Growth of The Global Automotive Turbocharger Market.

6. What are the notable trends driving market growth?

Rise in the Demand of Green Transportation.

7. Are there any restraints impacting market growth?

Increasing Complexity of Modern Vehicles.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Central and Eastern Europe E-Bicycle Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Central and Eastern Europe E-Bicycle Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Central and Eastern Europe E-Bicycle Industry?

To stay informed about further developments, trends, and reports in the Central and Eastern Europe E-Bicycle Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence