Key Insights

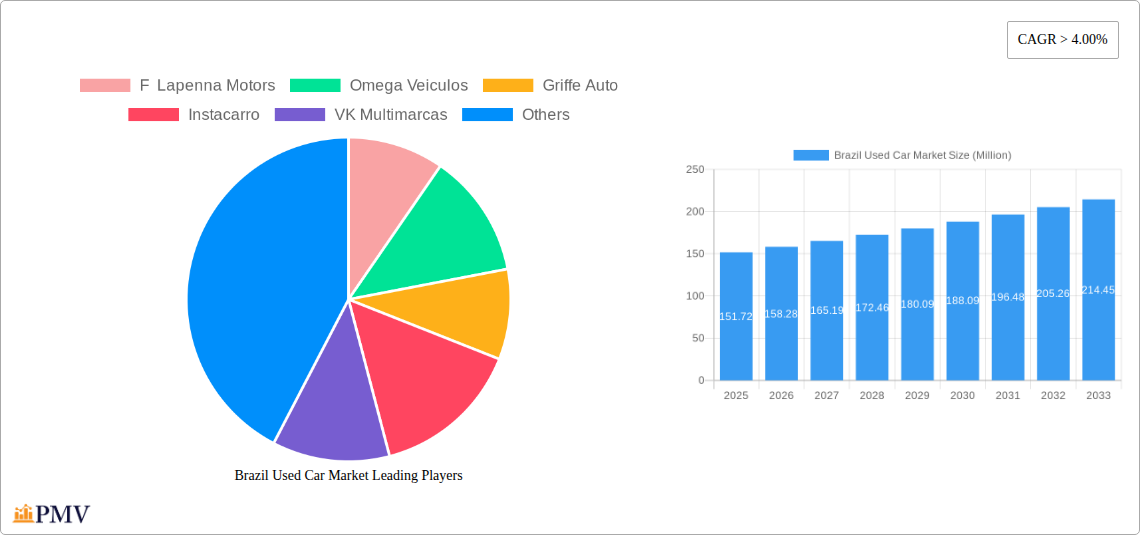

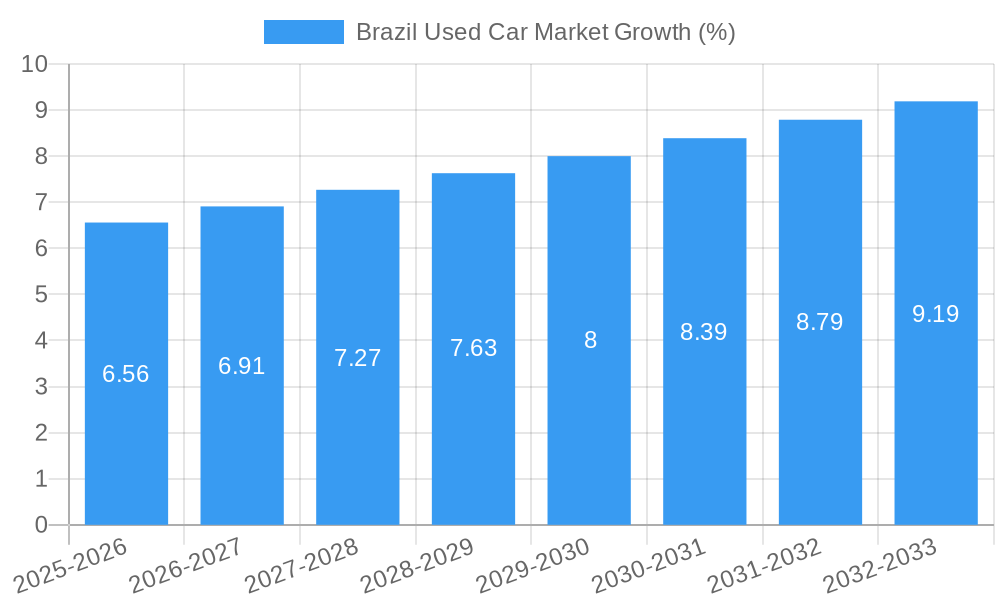

The Brazilian used car market, valued at $151.72 million in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 4.00% from 2025 to 2033. This expansion is fueled by several key factors. Increasing vehicle ownership in a growing Brazilian middle class, coupled with a preference for more affordable used vehicles compared to new cars, significantly boosts demand. Furthermore, improved financing options and a burgeoning online used car market are making purchasing used cars more accessible and convenient for consumers. The market is segmented by vehicle type (hatchbacks, sedans, SUVs, and MPVs) and vendor type (organized and unorganized dealerships). The presence of numerous established players like KAVAK and Instacarro, alongside smaller, independent dealerships, reflects the market's diverse landscape. However, economic fluctuations and potential shifts in consumer preferences towards electric vehicles could present challenges to this growth trajectory. Competition amongst dealerships and the need for efficient inventory management also pose potential restraints. The market's future growth will likely depend on maintaining consumer confidence, adapting to evolving technological trends, and effectively addressing potential economic headwinds.

The organized sector, characterized by established dealerships and online platforms, is expected to witness faster growth compared to the unorganized sector due to greater transparency, better quality assurance, and more reliable financing options. The SUV and MPV segments are projected to experience higher growth rates than hatchbacks and sedans, driven by evolving consumer preferences towards larger, more versatile vehicles. Geographical variations in market growth are expected, with higher growth potential in urban areas and regions with strong economic activity. Strategic initiatives such as improved customer service, enhanced online platforms, and targeted marketing campaigns will be crucial for businesses to effectively compete and capitalize on the growth opportunities within the Brazilian used car market. Continuous adaptation to evolving consumer preferences and addressing challenges related to vehicle condition and financing will be vital for sustained market success.

Brazil Used Car Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Brazil used car market, encompassing market structure, competitive dynamics, industry trends, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report offers invaluable insights for industry stakeholders, investors, and researchers. We project a robust market growth trajectory, fueled by key factors detailed within. The report leverages extensive data analysis to offer actionable intelligence and strategic recommendations. The market size is projected to reach xx Million by 2033.

Brazil Used Car Market Structure & Competitive Dynamics

The Brazilian used car market exhibits a complex interplay of organized and unorganized players, with varying degrees of market concentration. While large players like Kavak are making significant inroads, a fragmented landscape persists, particularly within the unorganized sector. This report analyzes market concentration through metrics such as Herfindahl-Hirschman Index (HHI) and market share distribution across key players like F Lapenna Motors, Omega Veiculos, Griffe Auto, Instacarro, VK Multimarcas, Ronaldo Veiculos, JacMotors, Auto Sold Seminovos, Milano Multimarcas, KAVAK, Guaibaca, and AR Box Multimarcas. We examine the influence of regulatory frameworks, including those concerning vehicle inspections and emissions standards, on market dynamics. The impact of substitute products, such as ride-hailing services and public transportation, is also considered. Furthermore, we explore prevalent end-user trends, such as the growing preference for online platforms and the increasing demand for certified pre-owned vehicles. Finally, the report includes an analysis of recent M&A activities in the sector, focusing on deal values and their implications for market consolidation. The total M&A deal value in the analyzed period (2019-2024) is estimated to be xx Million.

- Market Concentration: Moderate to low, with significant fragmentation in the unorganized sector.

- Innovation Ecosystems: Growing adoption of digital platforms and fintech solutions.

- Regulatory Frameworks: Influence vehicle inspections, emissions, and sales processes.

- Product Substitutes: Ride-sharing services and public transport pose a competitive threat.

- End-User Trends: Increasing preference for online purchasing and certified pre-owned cars.

- M&A Activity: Several significant acquisitions have taken place, driving consolidation.

Brazil Used Car Market Industry Trends & Insights

The Brazilian used car market is characterized by significant growth, driven by factors like increasing urbanization, rising disposable incomes, and a preference for more affordable transportation options compared to new vehicles. Technological disruptions, particularly the rise of online marketplaces and digital financing options, are reshaping the industry landscape. Consumer preferences are shifting towards certified pre-owned vehicles, backed by warranties and assurances. Competitive dynamics are marked by intense competition among both organized and unorganized players, with the entry of international players like Kavak intensifying the rivalry. This report provides a detailed analysis of these trends, examining market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. It provides insights into the Compound Annual Growth Rate (CAGR) of the market over the study period and market penetration of different segments. The projected CAGR from 2025 to 2033 is estimated to be xx%.

Dominant Markets & Segments in Brazil Used Car Market

The Southeast region of Brazil, particularly São Paulo, is expected to remain the dominant market due to factors such as higher population density, greater disposable income, and robust infrastructure. The Sports Utility Vehicle (SUV) segment is projected to experience substantial growth, driven by increasing consumer preference for spacious and versatile vehicles. Within the vendor landscape, the organized sector is witnessing faster growth compared to the unorganized sector, fueled by the increasing adoption of online platforms, digital marketing, and financing solutions.

- Key Drivers for Southeast Region Dominance:

- Higher population density

- Greater disposable income levels

- Well-developed transportation and logistics infrastructure

- Strong economic activity

- Key Drivers for SUV Segment Growth:

- Growing preference for larger vehicles

- Increasing disposable income

- Improved road infrastructure

- Key Drivers for Organized Sector Growth:

- Growing online platforms and digital marketing

- Increased availability of financing options

- Higher trust and reliability associated with organized dealers

Brazil Used Car Market Product Innovations

The used car market is experiencing significant product innovation. Several companies are offering certified pre-owned vehicles with warranties and extended service plans to enhance consumer trust. Online marketplaces are introducing advanced features, such as virtual inspections, financing options, and transparent pricing. Technological advancements, such as AI-powered valuation tools and data analytics, are improving efficiency and transparency across the value chain. These innovations are enhancing the customer experience and promoting trust.

Report Segmentation & Scope

This report segments the Brazil used car market by vehicle type (Hatchbacks, Sedan, SUVs, Multi-Purpose Vehicles (MPVs)) and by vendor type (Organized, Unorganized). Each segment's growth projections, market sizes, and competitive dynamics are analyzed. Growth forecasts are provided for each segment for the forecast period (2025-2033). The competitive landscape is examined, considering the presence of both national and international players, their market share, and their strategies.

- By Vehicle Type: Detailed analysis of the market size and growth prospects for Hatchbacks, Sedans, SUVs, and MPVs.

- By Vendor Type: Assessment of the market share and growth potential of both organized and unorganized players.

Key Drivers of Brazil Used Car Market Growth

Several key factors are driving growth in the Brazilian used car market. Economic factors, including rising disposable incomes and affordable financing options, contribute significantly. Technological advancements, such as the adoption of online platforms and digital financing, are boosting market access and efficiency. Furthermore, favorable government policies and infrastructure improvements support market expansion.

Challenges in the Brazil Used Car Market Sector

The Brazilian used car market faces several challenges. Regulatory hurdles and bureaucratic processes can create inefficiencies. Supply chain issues, including vehicle availability and logistics, can impact market operations. Intense competition, especially with the emergence of new players, presents another challenge. The lack of standardized vehicle history reports can also create trust issues for buyers. These factors collectively impact market growth and profitability. The impact of these challenges on market growth is estimated at xx Million annually.

Leading Players in the Brazil Used Car Market Market

- F Lapenna Motors

- Omega Veiculos

- Griffe Auto

- Instacarro

- VK Multimarcas

- Ronaldo Veiculos

- JacMotors

- Auto Sold Seminovos

- Milano Multimarcas

- KAVAK

- Guaibaca

- AR Box Multimarcas

Key Developments in Brazil Used Car Market Sector

- February 2022: Kavak invests BRL 550 Million (USD 104,961,832) in its Rio de Janeiro expansion.

- March 2022: InstaCarro achieves BRL 4 Million (USD 763,359) in sales through its BNPL vertical.

Strategic Brazil Used Car Market Market Outlook

The Brazilian used car market holds significant growth potential. Continued economic expansion, technological innovation, and strategic investments are poised to drive future growth. Opportunities exist for companies to leverage digital technologies, expand into underserved markets, and offer innovative financing solutions. The market's future depends on addressing regulatory hurdles and enhancing consumer trust. Strategic partnerships and acquisitions will likely play a crucial role in shaping the market landscape.

Brazil Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchbacks

- 1.2. Sedan

- 1.3. Sports Utility Vehicles and Multi-Purpose Vehicles

-

2. Vendor

- 2.1. Organized

- 2.2. Unorganized

Brazil Used Car Market Segmentation By Geography

- 1. Brazil

Brazil Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Online Marketplaces & Platforms Driving Market; Others

- 3.3. Market Restrains

- 3.3.1 Technology Advances

- 3.3.2 Older Used Cars May Lack the Latest Features

- 3.4. Market Trends

- 3.4.1. The Rise of E-Commerce and Online Technologies Set to Amplify the Growth of the Used Car Market-

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Used Car Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchbacks

- 5.1.2. Sedan

- 5.1.3. Sports Utility Vehicles and Multi-Purpose Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Vendor

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 F Lapenna Motors

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Omega Veiculos

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Griffe Auto

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Instacarro

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 VK Multimarcas

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ronaldo Veiculos

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 JacMotors

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Auto Sold Seminovos

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Milano Multimarcas

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 KAVAK

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Guaibaca

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 AR Box Multimarcas

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 F Lapenna Motors

List of Figures

- Figure 1: Brazil Used Car Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Used Car Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Brazil Used Car Market Revenue Million Forecast, by Vendor 2019 & 2032

- Table 4: Brazil Used Car Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Brazil Used Car Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Used Car Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 7: Brazil Used Car Market Revenue Million Forecast, by Vendor 2019 & 2032

- Table 8: Brazil Used Car Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Used Car Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Brazil Used Car Market?

Key companies in the market include F Lapenna Motors, Omega Veiculos, Griffe Auto, Instacarro, VK Multimarcas, Ronaldo Veiculos, JacMotors, Auto Sold Seminovos, Milano Multimarcas, KAVAK, Guaibaca, AR Box Multimarcas.

3. What are the main segments of the Brazil Used Car Market?

The market segments include Vehicle Type, Vendor.

4. Can you provide details about the market size?

The market size is estimated to be USD 151.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Online Marketplaces & Platforms Driving Market; Others.

6. What are the notable trends driving market growth?

The Rise of E-Commerce and Online Technologies Set to Amplify the Growth of the Used Car Market-.

7. Are there any restraints impacting market growth?

Technology Advances. Older Used Cars May Lack the Latest Features.

8. Can you provide examples of recent developments in the market?

March 2022: InstaCarro, a prominent player in Brazil's pre-owned cars marketplace, swiftly achieved sales of BRL 4 million (USD 763,359) via its buy now, pay later (BNPL) vertical. Functioning as a digital intermediary linking sellers and dealers within the Brazilian used car domain, InstaCarro strategically introduced BNPL as its inaugural financial service offering. This strategic move, executed slightly over three months ago, demonstrates the platform's commitment to innovation and customer-centric financial solutions. It underscores its vision to enhance its array of services for its extensive network of over 4,000 dealers. The innovation of Argentine entrepreneur Luca Cafici and InstaCarro's adoption of BNPL showcases its proactive approach to modernizing the automotive marketing landscape.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Used Car Market?

To stay informed about further developments, trends, and reports in the Brazil Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence