Key Insights

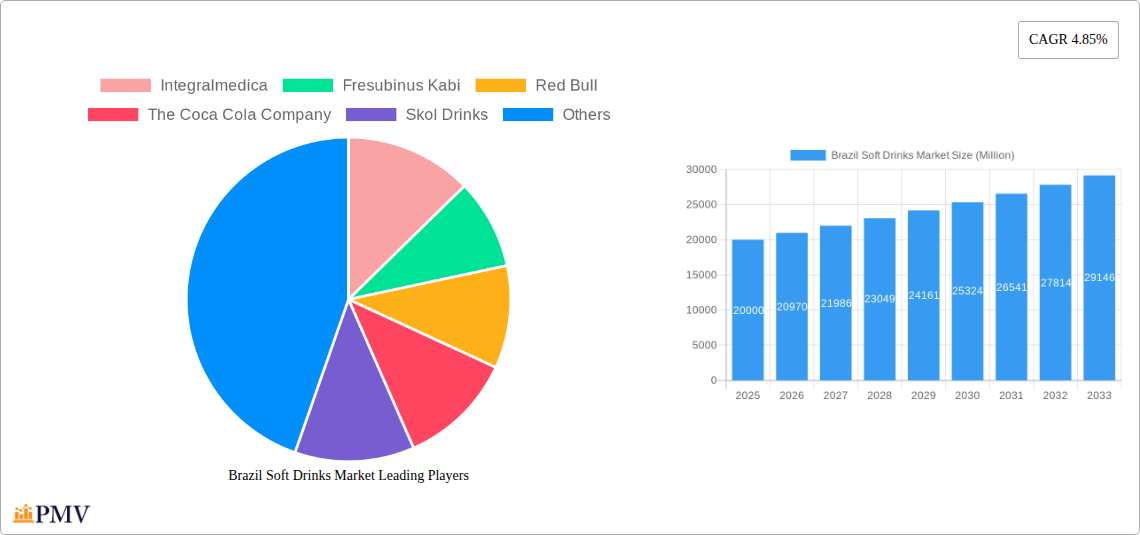

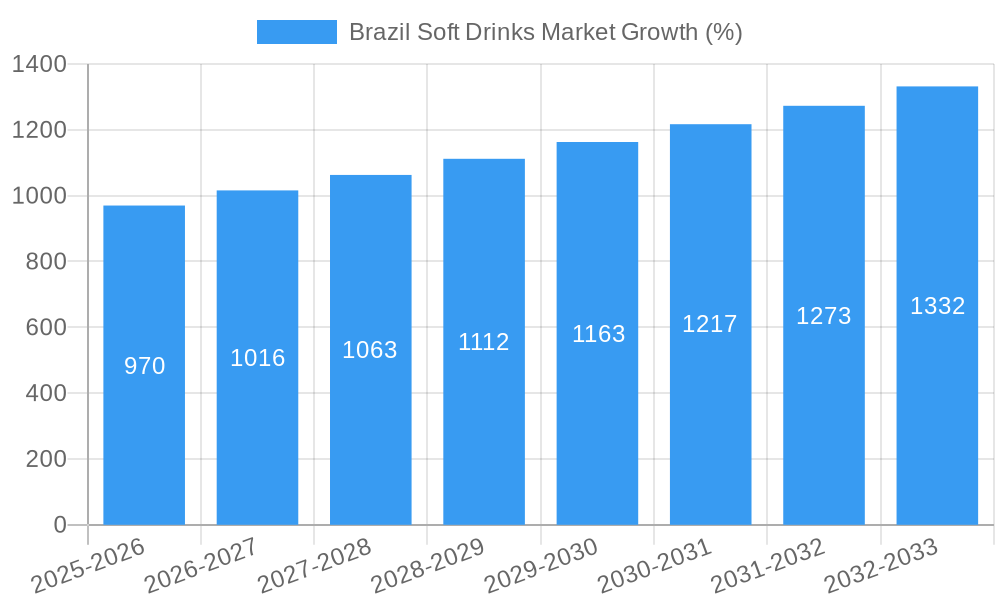

The Brazilian soft drinks market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a burgeoning population, rising disposable incomes, and increasing urbanization. A Compound Annual Growth Rate (CAGR) of 4.85% from 2025 to 2033 indicates a significant expansion of the market. Key drivers include the popularity of carbonated soft drinks, the growing demand for functional beverages (e.g., energy drinks), and the increasing penetration of modern retail channels. Consumer preferences are shifting towards healthier options, including low-sugar and natural alternatives, presenting both opportunities and challenges for established players. This trend is leading to increased innovation in product development, with companies focusing on reformulations and introducing new flavors to cater to evolving consumer demands. The market is segmented by product type (drinks, shots, mixers) and distribution channel (supermarkets/hypermarkets, convenience stores, specialist stores), with supermarkets and hypermarkets currently dominating the distribution landscape. Competition is intense, with both multinational giants like Coca-Cola and Red Bull, and strong local players like Ambev and Skol Drinks, vying for market share. The market is expected to see continued consolidation as larger companies acquire smaller players to enhance their market position. Challenges include fluctuating raw material prices, stringent regulations related to sugar content and labeling, and increasing health concerns around sugary drinks.

The forecast period (2025-2033) promises significant opportunities for growth within specific segments. The energy drink category is anticipated to exhibit particularly strong growth due to its association with active lifestyles and increasing consumption among young adults. The rise of e-commerce is also expected to influence distribution patterns, offering new avenues for growth for both established and emerging brands. Successful companies will need to strategically balance their product portfolios, embracing innovative offerings while maintaining strong brand recognition and efficient distribution networks to successfully navigate the evolving market dynamics in Brazil. Local players possess valuable knowledge of consumer preferences and distribution networks, giving them a competitive edge. However, larger multinationals benefit from greater resources and established global brand recognition.

Brazil Soft Drinks Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Brazil soft drinks market, offering invaluable insights for businesses, investors, and industry stakeholders. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report delves into market dynamics, competitive landscapes, and future growth prospects. The report utilizes rigorous research methodologies to provide accurate data and projections, making it an essential resource for understanding this dynamic market.

Brazil Soft Drinks Market Market Structure & Competitive Dynamics

The Brazilian soft drinks market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. Ambev and The Coca-Cola Company are key players, each commanding a substantial portion of the market (estimated xx% and xx% respectively in 2025). However, the market also features a diverse range of smaller players, including regional brands and niche players like Red Bull and Monster Beverage Corp, contributing to increased competition. The innovation ecosystem is relatively robust, with companies continually introducing new flavors, packaging formats, and functional beverages to cater to evolving consumer preferences.

Regulatory frameworks, while generally supportive of the industry, are subject to evolving health and environmental regulations impacting ingredient sourcing, packaging, and marketing. Product substitutes, such as bottled water and fruit juices, present a level of competition, particularly within the health-conscious consumer segment. End-user trends show a growing demand for healthier options, including low-sugar and natural beverages, driving innovation in this space. M&A activity has been moderate in recent years, with deal values averaging around xx Million in the past five years, largely driven by consolidation among smaller players.

Brazil Soft Drinks Market Industry Trends & Insights

The Brazil soft drinks market demonstrates steady growth, with a projected CAGR of xx% during the forecast period (2025-2033). Key growth drivers include rising disposable incomes, increasing urbanization, and a growing young population. Technological disruptions, such as e-commerce and advanced beverage dispensing systems, are transforming the distribution landscape and consumer experience. Consumer preferences are shifting towards healthier and more convenient options, leading to increased demand for low-sugar, functional beverages, and ready-to-drink (RTD) formats. Competitive dynamics are marked by intense price competition, focused branding, and innovation to attract and retain consumers in a demanding market. Market penetration for key product segments, such as carbonated soft drinks, is relatively high, but untapped potential exists in niche segments like functional beverages and premium drinks. The market’s penetration rate is currently estimated at approximately xx% in 2025, with substantial further expansion possible as per capita consumption rises.

Dominant Markets & Segments in Brazil Soft Drinks Market

The Southeast region of Brazil represents the largest and most dominant market within the country, driven by high population density, strong economic activity, and well-developed infrastructure.

- Key Drivers in the Southeast Region:

- High Population Density

- Robust Economic Activity

- Extensive Retail Infrastructure

- High disposable incomes

- Developed logistics and distribution networks

By product type, the Drinks segment currently dominates, with a market share of approximately xx% in 2025, fueled by the enduring popularity of carbonated soft drinks and flavored beverages. However, the functional drinks segment is expected to witness the fastest growth rate during the forecast period. In terms of distribution channels, supermarkets/hypermarkets remain the leading channel, accounting for xx% of total sales, followed by convenience stores.

Brazil Soft Drinks Market Product Innovations

Recent product innovations in the Brazilian soft drinks market are characterized by a focus on health and wellness, sustainability, and convenience. Companies are introducing new flavors, low-sugar and no-sugar options, functional beverages enhanced with vitamins and antioxidants, and innovative packaging formats. Technological trends, such as the use of advanced preservation techniques and sustainable packaging materials, are also influencing product development, addressing environmental concerns and boosting the appeal among eco-conscious consumers. This focus on innovation ensures that companies cater to changing consumer preferences and maintain a competitive edge in this dynamic market.

Report Segmentation & Scope

This report segments the Brazilian soft drinks market based on product type (Drinks, Shots, Mixers) and distribution channel (Supermarkets/Hypermarkets, Convenience Stores, Specialist Stores, Others).

By Product Type: The Drinks segment is further divided into carbonated soft drinks, fruit juices, and other beverages. Growth projections for each sub-segment are included in the report, accounting for market size and share of each respective segment, along with future competitive dynamics and evolving consumer demand trends.

By Distribution Channel: Each channel's market size, growth trajectory, competitive dynamics, and evolving role in the overall market are detailed in the report.

Key Drivers of Brazil Soft Drinks Market Growth

Several factors are driving growth in the Brazilian soft drinks market. Rising disposable incomes are empowering consumers to increase their spending on beverages, expanding the market's potential. Favorable demographic trends, with a substantial youth population, further bolster demand for soft drinks. Government policies promoting economic growth and infrastructural improvements support favorable business environments, facilitating market expansion.

Challenges in the Brazil Soft Drinks Market Sector

The Brazilian soft drinks market faces challenges, primarily in the form of intense competition and economic volatility. Fluctuations in raw material prices and currency exchange rates may affect production costs and profitability. Stringent health and environmental regulations, demanding stricter standards for ingredients and packaging, impose limitations on product development and require continual adjustments and compliance.

Leading Players in the Brazil Soft Drinks Market Market

- Integralmedica

- Fresubinus Kabi

- Red Bull

- The Coca Cola Company

- Skol Drinks

- Budweiser

- Beverages Grassi

- Petropolis Group

- Ambev

- Monster Beverage Corp

Key Developments in Brazil Soft Drinks Market Sector

- 2022 Q4: Ambev launched a new line of low-sugar beverages, significantly impacting market share of competitors and gaining preference among health-conscious consumers.

- 2023 Q1: The Coca-Cola Company implemented a nationwide marketing campaign focused on sustainability, positively influencing brand image and consumer perception.

- 2024 Q2: A merger between two smaller regional players consolidated market share and increased competitiveness in specific geographical areas.

Strategic Brazil Soft Drinks Market Market Outlook

The Brazilian soft drinks market holds significant potential for growth over the forecast period. Continued focus on innovation, targeting health-conscious consumers, expansion into new geographic areas, and leveraging e-commerce channels will shape future success. Companies that can effectively adapt to changing consumer preferences and leverage technological advancements are likely to thrive in this competitive landscape. Opportunities exist in functional beverages, sustainable packaging, and personalized drink options that cater to diverse consumer needs and preferences, presenting significant growth opportunities.

Brazil Soft Drinks Market Segmentation

-

1. Product Type

- 1.1. Drinks

- 1.2. Shots

- 1.3. Mixers

-

2. Distribution Channel

- 2.1. Supermarkets/ Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Store

- 2.4. Others

Brazil Soft Drinks Market Segmentation By Geography

- 1. Brazil

Brazil Soft Drinks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.85% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits

- 3.3. Market Restrains

- 3.3.1. Affordability of the Product is Restraining the Market's Growth

- 3.4. Market Trends

- 3.4.1. Rising Demand For Non-Alcoholic Beverages in Brazil

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Soft Drinks Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Drinks

- 5.1.2. Shots

- 5.1.3. Mixers

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/ Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Store

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Integralmedica

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fresubinus Kabi

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Red Bull

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Coca Cola Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Skol Drinks

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Budweiser

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Beverages Grassi*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Petropolis Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ambev

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Monster Beverage Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Integralmedica

List of Figures

- Figure 1: Brazil Soft Drinks Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Soft Drinks Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Soft Drinks Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Soft Drinks Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Brazil Soft Drinks Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Brazil Soft Drinks Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Brazil Soft Drinks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Soft Drinks Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Brazil Soft Drinks Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Brazil Soft Drinks Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Soft Drinks Market?

The projected CAGR is approximately 4.85%.

2. Which companies are prominent players in the Brazil Soft Drinks Market?

Key companies in the market include Integralmedica, Fresubinus Kabi, Red Bull, The Coca Cola Company, Skol Drinks, Budweiser, Beverages Grassi*List Not Exhaustive, Petropolis Group, Ambev, Monster Beverage Corp.

3. What are the main segments of the Brazil Soft Drinks Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits.

6. What are the notable trends driving market growth?

Rising Demand For Non-Alcoholic Beverages in Brazil.

7. Are there any restraints impacting market growth?

Affordability of the Product is Restraining the Market's Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Soft Drinks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Soft Drinks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Soft Drinks Market?

To stay informed about further developments, trends, and reports in the Brazil Soft Drinks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence