Key Insights

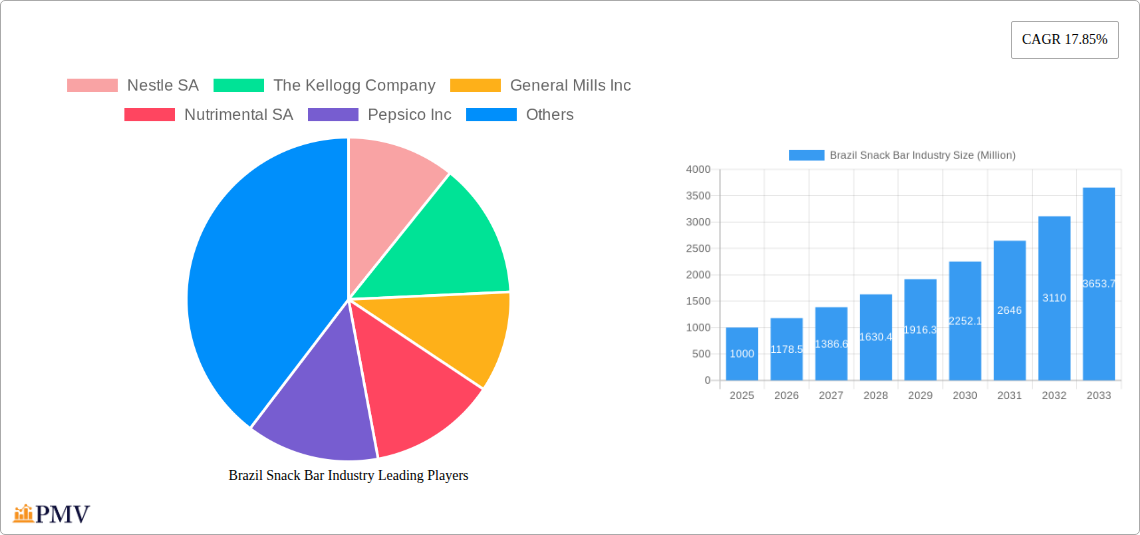

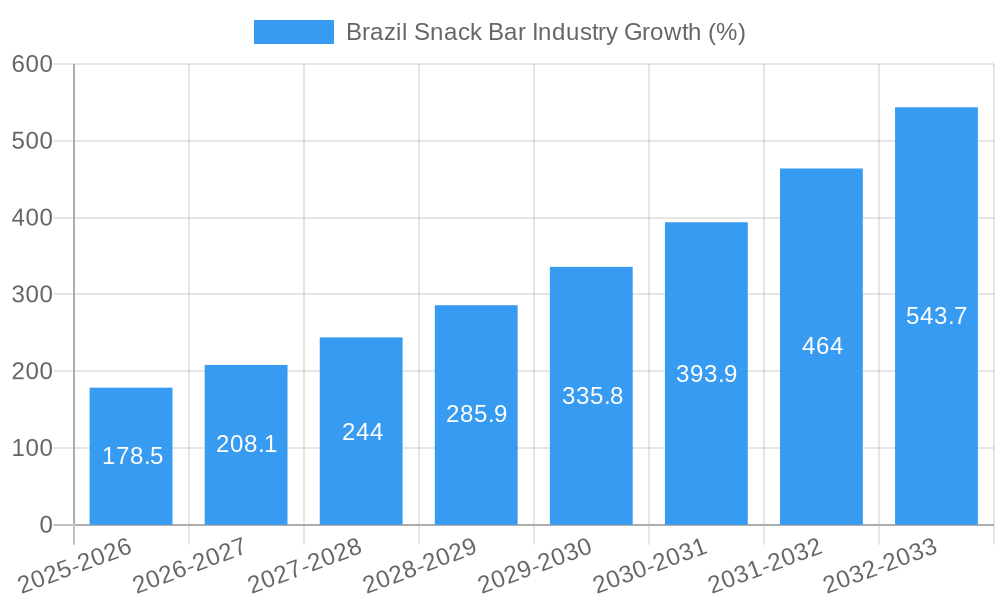

The Brazilian snack bar market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 17.85% from 2025 to 2033. This significant growth is driven by several key factors. The rising disposable incomes of the Brazilian population, coupled with evolving consumer preferences towards convenient and on-the-go snacking options, are major contributors. Health-conscious consumers are increasingly seeking nutritious and functional snack bars, fueling the demand for energy bars and other cereal-based options. Furthermore, the expanding retail landscape, particularly the growth of online retail channels and supermarkets/hypermarkets, offers wider accessibility to a diverse range of snack bars, further boosting market expansion. The market segmentation reveals a strong preference for cereal bars, with energy bars and other snack bars also contributing significantly to the overall market volume. Key players like Nestlé SA, Kellogg's, and General Mills, along with regional brands, are actively competing within this dynamic landscape, launching innovative products and engaging in strategic marketing campaigns to capture market share.

However, despite the positive outlook, the market faces certain challenges. Fluctuating raw material prices, particularly for key ingredients like grains and nuts, can impact profitability and product pricing. Furthermore, intense competition among established brands and the emergence of smaller, niche players requires continuous innovation and effective brand building to maintain a competitive edge. Nevertheless, the long-term prospects for the Brazilian snack bar market remain strong, driven by sustained economic growth, evolving consumer lifestyles, and the potential for further product diversification to cater to specific dietary needs and preferences. The market's dynamic nature necessitates a proactive approach from players, encompassing strategic product development, robust supply chain management, and targeted marketing strategies to capitalize on the ongoing growth opportunities.

Brazil Snack Bar Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the Brazil snack bar industry, covering market size, segmentation, competitive landscape, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report offers invaluable insights for businesses, investors, and industry stakeholders seeking to understand and navigate this dynamic market. The forecast period extends from 2025 to 2033, while historical data covers 2019-2024. The report includes detailed analysis of key players such as Nestle SA, The Kellogg Company, General Mills Inc, Nutrimental SA, Pepsico Inc, M Dias Branco SA, Mars Incorporated, Alfred Ritter GmbH & Co KG Levitta, Mondelez International Inc, and Nature Foodtech, though the list is not exhaustive.

Brazil Snack Bar Industry Market Structure & Competitive Dynamics

The Brazilian snack bar market is characterized by a moderately concentrated landscape, with major multinational players and significant domestic brands competing for market share. Market concentration is estimated at xx%, with the top 5 players holding approximately xx% of the market in 2024. The industry exhibits a dynamic innovation ecosystem, with ongoing product development focusing on healthier options, functional ingredients, and convenient formats. Regulatory frameworks concerning labeling, ingredients, and advertising influence product development and marketing strategies. The market faces competition from substitute products like cookies, biscuits, and other confectionery items. Consumer preferences are increasingly shifting towards healthier, functional, and convenient snack options, driving innovation in the industry. Mergers and acquisitions (M&A) activity has been notable, impacting market dynamics and consolidating market power. For example, Mondelez's acquisition of Clif Bar had a significant impact on market share distribution. Deal values in recent years have averaged approximately xx Million USD, highlighting the significant investment in the sector.

Brazil Snack Bar Industry Industry Trends & Insights

The Brazilian snack bar market is experiencing robust growth, driven by rising disposable incomes, changing lifestyles, and increasing urbanization. The market is projected to register a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. Technological advancements in production and packaging are enhancing efficiency and product quality. Consumer preferences are evolving towards healthier and functional snack bars with increased protein, fiber, and other beneficial nutrients. The market penetration rate for snack bars is currently estimated at xx% and is expected to increase significantly due to rising consumer awareness of health and wellness. Competitive dynamics remain intense, with major players focusing on product innovation, brand building, and strategic partnerships to gain a competitive edge. The market shows strong potential for further growth, particularly in niche segments like organic and gluten-free snack bars. The increasing adoption of online retail channels is also a key driver for market growth.

Dominant Markets & Segments in Brazil Snack Bar Industry

Dominant Distribution Channel: Supermarkets/Hypermarkets hold the largest market share due to their extensive reach and established distribution networks. Convenience stores represent a growing segment benefiting from their high foot traffic and impulsive purchase nature.

Dominant Product Type: Cereal bars maintain a dominant position due to their wide acceptance and availability. However, the energy bar segment showcases rapid growth, driven by health-conscious consumers.

Key Drivers: Brazil's expanding middle class, increasing urbanization, and rising demand for convenience foods drive market dominance in these segments. Government initiatives to improve infrastructure and retail logistics also play a crucial role. The strong growth potential lies in the energy bar segment within the supermarkets/hypermarkets channel.

The dominance of supermarkets and hypermarkets can be attributed to their widespread availability, strong brand presence, and effective promotional activities. Convenience stores cater to busy lifestyles and offer quick purchase options, while the growth of specialist stores highlights the increasing consumer demand for niche and premium snack bars. The growth of e-commerce will be driven by factors such as increasing internet penetration and improving logistics.

Brazil Snack Bar Industry Product Innovations

The Brazilian snack bar industry is witnessing significant product innovation, with a focus on healthier formulations, functional ingredients, and convenient formats. New product launches emphasize natural ingredients, high protein content, and unique flavor profiles catering to evolving consumer preferences. Technological advancements in processing and packaging are improving product quality and shelf life. Companies are investing in research and development to create innovative snack bars that meet the specific needs and demands of the Brazilian market. The integration of technology in production enhances efficiency and cost-effectiveness.

Report Segmentation & Scope

This report segments the Brazil snack bar market by distribution channel (Supermarkets/Hypermarkets, Convenience Stores, Specialist Stores, Online Retail Stores, Other Distribution Channels) and product type (Cereal Bar, Energy Bar, Other Snack Bar). Each segment is analyzed based on market size, growth rate, and competitive dynamics. Growth projections for each segment are provided, taking into account consumer preferences, technological advancements, and market trends. The competitive landscape within each segment is analyzed in detail to illustrate the strategies employed by various players for gaining market share.

Key Drivers of Brazil Snack Bar Industry Growth

The growth of the Brazilian snack bar market is propelled by several key factors. Rising disposable incomes and a growing middle class are boosting consumer spending on convenient and readily available food products. Changing lifestyles and urbanization are increasing the demand for on-the-go snacking options. Furthermore, the increasing awareness of health and wellness is driving demand for functional snack bars with added nutritional value. Government support for food processing and distribution infrastructure plays a significant role in facilitating industry growth.

Challenges in the Brazil Snack Bar Industry Sector

Despite promising growth prospects, the Brazilian snack bar market faces certain challenges. Fluctuating raw material prices and supply chain disruptions can impact production costs and profitability. Intense competition from established players and new entrants requires companies to constantly innovate and differentiate their offerings. Moreover, stringent regulatory requirements related to food safety and labeling add complexity to operations. These factors require companies to implement effective strategies to mitigate risks and maintain competitiveness. The average impact of these challenges on annual revenue is estimated to be around xx Million.

Leading Players in the Brazil Snack Bar Industry Market

- Nestle SA

- The Kellogg Company

- General Mills Inc

- Nutrimental SA

- Pepsico Inc

- M Dias Branco SA

- Mars Incorporated

- Alfred Ritter GmbH & Co KG Levitta

- Mondelēz International Inc

- Nature Foodtech

Key Developments in Brazil Snack Bar Industry Sector

August 2022: Mondelez announced the acquisition of Clif & Bar, significantly expanding its snack bar portfolio in Brazil and globally. This acquisition enhanced Mondelez's market position and product offerings.

February 2022: Nestlé Brasil launched new fruit and nut energy bars, aligning with its commitment to healthy product lines and supporting local organizations like Gerando Falcões. This launch broadened Nestlé's product range and strengthened its brand image.

October 2022: Nutrata premiered its Match Protein Bar, showcasing innovation in the Brazilian snack bar market with a focus on whole foods and layered flavors. This launch introduced a new competitive offering, emphasizing product differentiation.

Strategic Brazil Snack Bar Industry Market Outlook

The Brazilian snack bar market holds significant potential for future growth, driven by evolving consumer preferences and increasing demand for convenient, healthy, and functional snack options. Strategic opportunities exist for companies to capitalize on market trends by focusing on product innovation, expanding distribution channels, and targeting niche segments. Companies that invest in research and development, build strong brands, and adapt to changing consumer demands will be well-positioned to succeed in this dynamic market. The increasing adoption of e-commerce channels also presents a significant growth opportunity for players willing to invest in digital marketing and logistics.

Brazil Snack Bar Industry Segmentation

-

1. Product Type

-

1.1. Cereal Bar

- 1.1.1. Granola/Muesli Bar

- 1.1.2. Other Cereal Bars

- 1.2. Energy Bar

- 1.3. Other Snack Bar

-

1.1. Cereal Bar

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

Brazil Snack Bar Industry Segmentation By Geography

- 1. Brazil

Brazil Snack Bar Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 17.85% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Awareness Regarding Natural Products; Growing Demand for Anthocyanin in Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Synthetic Food Colorant

- 3.4. Market Trends

- 3.4.1. Hectic Lifestyle Propelling the Demand for Convenient Food and On-the-go Snacking

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Snack Bar Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cereal Bar

- 5.1.1.1. Granola/Muesli Bar

- 5.1.1.2. Other Cereal Bars

- 5.1.2. Energy Bar

- 5.1.3. Other Snack Bar

- 5.1.1. Cereal Bar

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Nestle SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Kellogg Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 General Mills Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nutrimental SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pepsico Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 M Dias Branco SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mars Incorporated

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alfred Ritter Gmbh & Co Kg Levitta

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mondelēz International Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nature Foodtech*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Nestle SA

List of Figures

- Figure 1: Brazil Snack Bar Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Snack Bar Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazil Snack Bar Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Snack Bar Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Brazil Snack Bar Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Brazil Snack Bar Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Brazil Snack Bar Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Snack Bar Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Brazil Snack Bar Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Brazil Snack Bar Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Snack Bar Industry?

The projected CAGR is approximately 17.85%.

2. Which companies are prominent players in the Brazil Snack Bar Industry?

Key companies in the market include Nestle SA, The Kellogg Company, General Mills Inc, Nutrimental SA, Pepsico Inc, M Dias Branco SA, Mars Incorporated, Alfred Ritter Gmbh & Co Kg Levitta, Mondelēz International Inc, Nature Foodtech*List Not Exhaustive.

3. What are the main segments of the Brazil Snack Bar Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Awareness Regarding Natural Products; Growing Demand for Anthocyanin in Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Hectic Lifestyle Propelling the Demand for Convenient Food and On-the-go Snacking.

7. Are there any restraints impacting market growth?

Easy Availability of Synthetic Food Colorant.

8. Can you provide examples of recent developments in the market?

August 2022: Mondelez announced the acquisition of Clif & Bar, which offers snack bars across various regions, including Brazil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Snack Bar Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Snack Bar Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Snack Bar Industry?

To stay informed about further developments, trends, and reports in the Brazil Snack Bar Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence