Key Insights

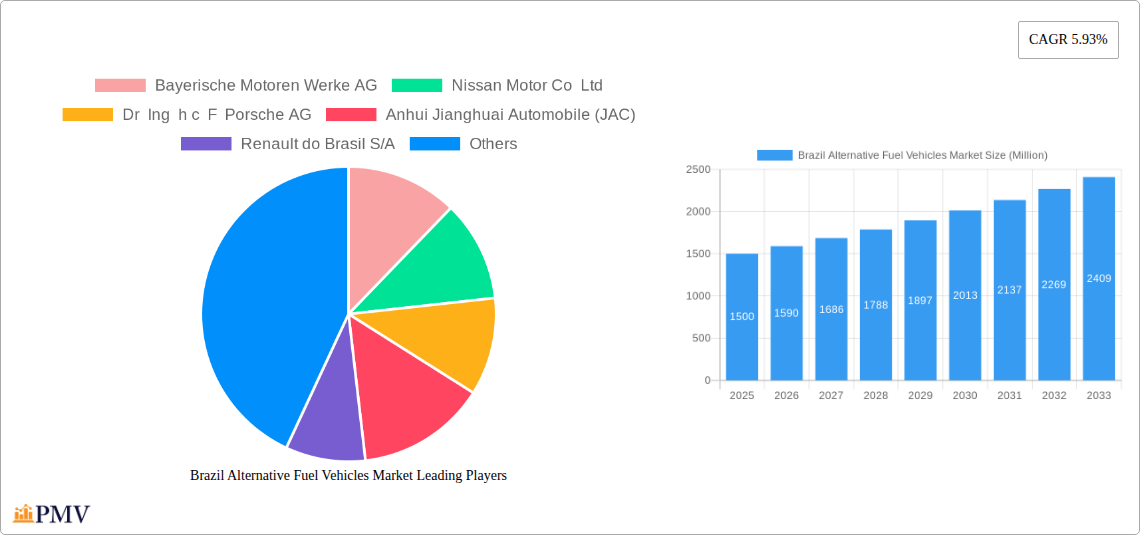

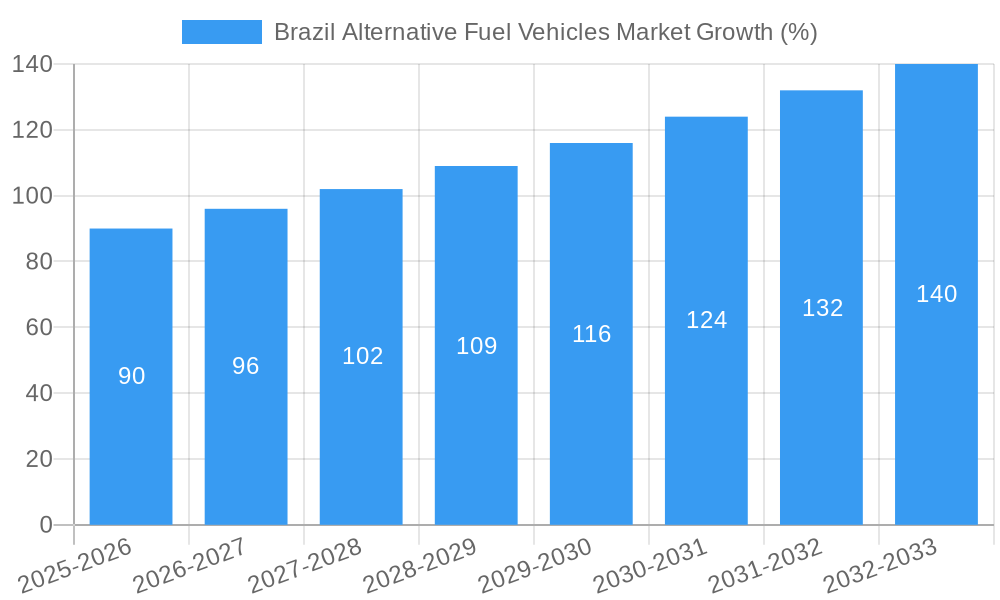

The Brazil alternative fuel vehicle (AFV) market is experiencing robust growth, driven by increasing environmental concerns, government incentives promoting sustainable transportation, and rising fuel costs. The market's Compound Annual Growth Rate (CAGR) of 5.93% from 2019 to 2024 indicates a significant upward trajectory. While precise market size data for 2025 is unavailable, extrapolating from the historical CAGR and considering the accelerating adoption of electric vehicles (EVs) globally, a reasonable estimate for the 2025 market size would fall within the range of $1-2 billion (assuming a base value between $500 million and $1 billion in 2019), depending on the specific market segment. Key market segments include medium-duty commercial trucks (with a strong focus on two-wheelers for last-mile delivery), and alternative fuel categories including Battery Electric Vehicles (BEVs), Fuel Cell Electric Vehicles (FCEVs), Hybrid Electric Vehicles (HEVs), and Plug-in Hybrid Electric Vehicles (PHEVs). The growing presence of major automotive manufacturers like BMW, Nissan, Porsche, JAC, Renault, Volvo, BYD, Audi, Toyota, and Chery in the Brazilian market indicates a strong competitive landscape. The market's growth is being further propelled by advancements in battery technology, decreasing EV prices, and expanding charging infrastructure.

However, challenges remain. High initial purchase costs of AFVs, limited charging infrastructure outside major urban centers, and a lack of public awareness regarding the benefits of AFVs are some of the key restraints. Despite these obstacles, the long-term outlook for the Brazilian AFV market remains positive. Government policies aimed at reducing carbon emissions and improving air quality, coupled with technological advancements and increased consumer demand for environmentally friendly vehicles, are expected to drive continued expansion throughout the forecast period (2025-2033). The focus on commercial vehicles, particularly two-wheelers, suggests a significant opportunity for last-mile delivery solutions to contribute to the market's growth within the broader context of e-commerce expansion and urban logistics.

Brazil Alternative Fuel Vehicles Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the burgeoning Brazil Alternative Fuel Vehicles (AFV) market, offering invaluable insights for stakeholders across the automotive, energy, and investment sectors. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report leverages extensive primary and secondary research to provide accurate market sizing and detailed forecasts across various segments.

Brazil Alternative Fuel Vehicles Market Structure & Competitive Dynamics

The Brazilian AFV market exhibits a moderately concentrated structure, with established global players like Bayerische Motoren Werke AG, Nissan Motor Co Ltd, Dr Ing h c F Porsche AG, and Toyota Motor Corporation holding significant market share. However, the entry of Chinese manufacturers like BYD Auto Co Ltd and Chery Automobile Co Ltd is intensifying competition. The market is characterized by a dynamic innovation ecosystem, fueled by government incentives and growing consumer demand for sustainable transportation.

Regulatory frameworks, including evolving emission standards and tax benefits for electric vehicles (EVs), are key drivers. The market also witnesses substitution from conventional fuel vehicles, particularly in the two-wheeler segment. End-user trends are shifting towards environmentally friendly options, driven by increasing environmental awareness. While M&A activity remains relatively low compared to global markets, the potential for strategic partnerships and acquisitions is significant, especially in areas like battery technology and charging infrastructure. The overall market share distribution in 2024 is estimated as follows: Established players (45%), Chinese entrants (30%), other players (25%). The total M&A deal value in the historical period (2019-2024) is estimated at $xx Million.

Brazil Alternative Fuel Vehicles Market Industry Trends & Insights

The Brazil AFV market is poised for significant growth, driven by several factors. Government initiatives promoting electric mobility, coupled with increasing fuel prices and growing environmental concerns, are accelerating the adoption of alternative fuel vehicles. Technological advancements, particularly in battery technology and charging infrastructure, are also playing a crucial role. The market is experiencing a technological disruption, shifting from hybrid electric vehicles (HEVs) to battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). Consumer preferences are increasingly favoring EVs due to their environmental benefits and cost savings in the long run. However, challenges like limited charging infrastructure and high initial purchase costs remain. The CAGR for the forecast period (2025-2033) is projected to be xx%, with BEVs experiencing the fastest growth. Market penetration of EVs is expected to reach xx% by 2033.

Dominant Markets & Segments in Brazil Alternative Fuel Vehicles Market

The BEV segment is expected to dominate the Brazilian AFV market, driven by decreasing battery costs, improved range, and government incentives. The two-wheeler segment is also exhibiting strong growth, due to affordability and ease of use.

Key Drivers for BEV Dominance:

- Government subsidies and tax breaks.

- Increasing consumer awareness of environmental benefits.

- Technological advancements leading to improved battery performance and range.

- Expanding charging infrastructure, though still limited.

Key Drivers for Two-Wheeler Segment Growth:

- Lower initial investment compared to four-wheelers.

- Increased usage in urban areas for last-mile delivery and commuting.

- Government initiatives focusing on electrification of two-wheelers.

The Southeastern region of Brazil is likely to lead the market due to higher population density, better infrastructure, and strong economic activity. While other regions lag behind due to limited infrastructure and lower disposable incomes, government initiatives aim to bridge the regional disparities.

Brazil Alternative Fuel Vehicles Market Product Innovations

Recent innovations focus on enhancing battery technology, extending driving range, and improving charging times. Manufacturers are also focusing on developing affordable and accessible AFVs, catering to a wider range of consumers. Technological trends are pointing towards solid-state batteries, which promise increased energy density and safety. This market fit improves the affordability and accessibility of AFVs.

Report Segmentation & Scope

This report segments the Brazilian AFV market across various parameters:

Vehicle Type: Two-wheelers, passenger vehicles, commercial vehicles (including medium-duty trucks). Commercial vehicles are projected to grow at a CAGR of xx%, driven by fleet electrification initiatives.

Fuel Category: BEV, PHEV, HEV, FCEV. BEVs are expected to capture the largest market share.

Regions: This report covers various Brazilian regions, analyzing the regional disparities and their implications for market growth.

Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail within the report.

Key Drivers of Brazil Alternative Fuel Vehicles Market Growth

The growth of the Brazilian AFV market is propelled by several factors, including government policies promoting sustainable transportation, the rising cost of conventional fuels, and growing environmental concerns amongst consumers. Technological advancements in battery technology and charging infrastructure are also contributing to increased adoption rates. Furthermore, the burgeoning e-commerce sector is driving the demand for electric delivery vehicles.

Challenges in the Brazil Alternative Fuel Vehicles Market Sector

Despite the significant growth potential, the Brazilian AFV market faces several challenges. These include the limited charging infrastructure in many regions, the high initial cost of AFVs compared to conventional vehicles, and the dependence on imported components for battery production, thus exposing the market to global supply chain disruptions. Regulatory hurdles, while evolving positively, can still create uncertainty for investors. The impact of these challenges is estimated to result in a xx% reduction in overall market growth in 2025 compared to the projected growth without these factors.

Leading Players in the Brazil Alternative Fuel Vehicles Market Market

- Bayerische Motoren Werke AG

- Nissan Motor Co Ltd

- Dr Ing h c F Porsche AG

- Anhui Jianghuai Automobile (JAC)

- Renault do Brasil S/A

- Volvo Group

- BYD Auto Co Ltd

- Audi AG

- Toyota Motor Corporation

- Chery Automobile Co Ltd

Key Developments in Brazil Alternative Fuel Vehicles Market Sector

August 2023: BYD introduced the new all-electric BYD SEAL D-segment sedan to European consumers. Deliveries are to commence in Q4 2023. This signals BYD's growing global presence and could influence the Brazilian market.

August 2023: Toyota Argentina announced expansion of its Conversions area for customized vehicles. This indicates potential for broader adaptability and specialized AFV offerings in Brazil.

August 2023: BYD showcased 6 electric vehicles and its DENZA sub-brand at IAA Mobility 2023. This signifies BYD's commitment to expanding its EV portfolio and may influence its strategy in the Brazilian market.

Strategic Brazil Alternative Fuel Vehicles Market Market Outlook

The Brazilian AFV market holds significant long-term potential. Continued government support, technological advancements, and increasing consumer demand are expected to drive substantial growth over the forecast period. Strategic opportunities exist for companies focusing on battery technology, charging infrastructure, and the development of cost-effective AFVs catering to the specific needs of the Brazilian market. The market is poised for significant expansion, particularly in the BEV and two-wheeler segments.

Brazil Alternative Fuel Vehicles Market Segmentation

-

1. Vehicle Type

-

1.1. Commercial Vehicles

- 1.1.1. Buses

- 1.1.2. Heavy-duty Commercial Trucks

- 1.1.3. Light Commercial Pick-up Trucks

- 1.1.4. Light Commercial Vans

- 1.1.5. Medium-duty Commercial Trucks

- 1.2. Two-Wheelers

-

1.1. Commercial Vehicles

-

2. Fuel Category

- 2.1. BEV

- 2.2. FCEV

- 2.3. HEV

- 2.4. PHEV

Brazil Alternative Fuel Vehicles Market Segmentation By Geography

- 1. Brazil

Brazil Alternative Fuel Vehicles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.93% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasingly Focused On Reducing Vehicle Weight To Improve Fuel Efficiency; Cost-effectiveness

- 3.3. Market Restrains

- 3.3.1. Competitiveness Of Alternative Materials

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Alternative Fuel Vehicles Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Commercial Vehicles

- 5.1.1.1. Buses

- 5.1.1.2. Heavy-duty Commercial Trucks

- 5.1.1.3. Light Commercial Pick-up Trucks

- 5.1.1.4. Light Commercial Vans

- 5.1.1.5. Medium-duty Commercial Trucks

- 5.1.2. Two-Wheelers

- 5.1.1. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Fuel Category

- 5.2.1. BEV

- 5.2.2. FCEV

- 5.2.3. HEV

- 5.2.4. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bayerische Motoren Werke AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nissan Motor Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dr Ing h c F Porsche AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Anhui Jianghuai Automobile (JAC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Renault do Brasil S/A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Volvo Grou

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BYD Auto Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Audi AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Toyota Motor Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Chery Automobile Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bayerische Motoren Werke AG

List of Figures

- Figure 1: Brazil Alternative Fuel Vehicles Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Alternative Fuel Vehicles Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Alternative Fuel Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Alternative Fuel Vehicles Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 3: Brazil Alternative Fuel Vehicles Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 4: Brazil Alternative Fuel Vehicles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Brazil Alternative Fuel Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Alternative Fuel Vehicles Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 7: Brazil Alternative Fuel Vehicles Market Revenue Million Forecast, by Fuel Category 2019 & 2032

- Table 8: Brazil Alternative Fuel Vehicles Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Alternative Fuel Vehicles Market?

The projected CAGR is approximately 5.93%.

2. Which companies are prominent players in the Brazil Alternative Fuel Vehicles Market?

Key companies in the market include Bayerische Motoren Werke AG, Nissan Motor Co Ltd, Dr Ing h c F Porsche AG, Anhui Jianghuai Automobile (JAC), Renault do Brasil S/A, Volvo Grou, BYD Auto Co Ltd, Audi AG, Toyota Motor Corporation, Chery Automobile Co Ltd.

3. What are the main segments of the Brazil Alternative Fuel Vehicles Market?

The market segments include Vehicle Type, Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasingly Focused On Reducing Vehicle Weight To Improve Fuel Efficiency; Cost-effectiveness.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competitiveness Of Alternative Materials.

8. Can you provide examples of recent developments in the market?

August 2023: BYD introduced the new all-electric BYD SEAL D-segment sedan to European consumers. Deliveries of the BYD SEAL will commence in Q4 2023, and final prices will be announced later.August 2023: Toyota Argentina announced that as it begins production of the Hiace in 2024 at its plant in Zárate, it will continue and enlarge the mission of the Conversions area, dedicated to designing and producing vehicles adapted to the specific needs of multiple customers.August 2023: BYD announced that it will present 6 electric vehicles alongside a display of new technologies at the IAA Mobility 2023. It will also present its luxury sub-brand, DENZA, to European audiences for the first time.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Alternative Fuel Vehicles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Alternative Fuel Vehicles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Alternative Fuel Vehicles Market?

To stay informed about further developments, trends, and reports in the Brazil Alternative Fuel Vehicles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence