Key Insights

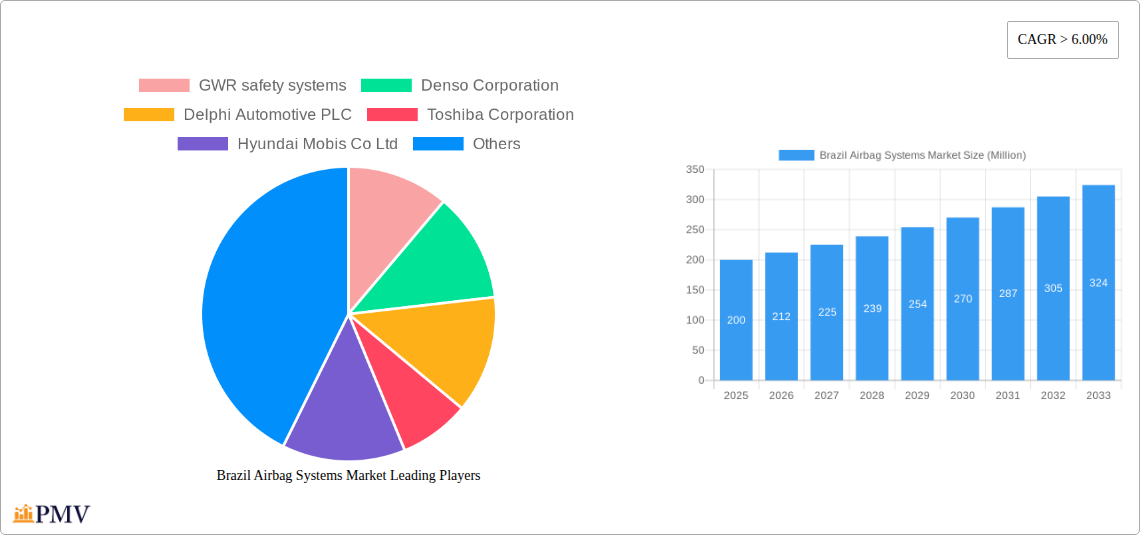

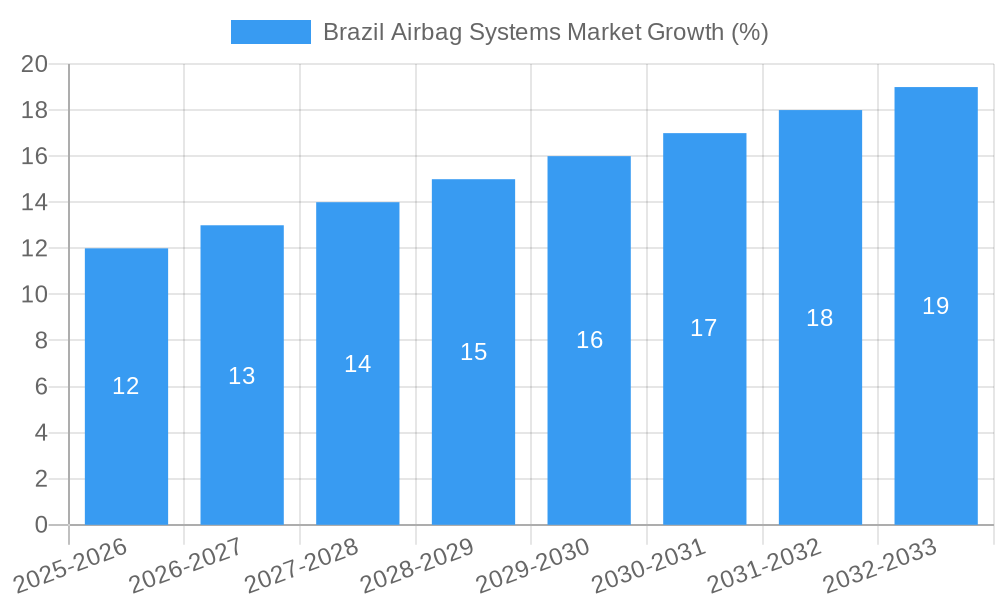

The Brazil airbag systems market, valued at approximately $200 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 6% from 2025 to 2033. This expansion is fueled by several key factors. Stringent government regulations mandating airbag installation in new vehicles are driving significant demand, particularly within the passenger vehicle segment which constitutes the largest share of the market. Furthermore, rising consumer awareness regarding vehicle safety and the increasing affordability of airbags are contributing to market growth. The growing adoption of advanced driver-assistance systems (ADAS) which often integrate airbags is also a significant driver. Growth is particularly strong in the OEM (Original Equipment Manufacturer) segment, reflecting the large-scale integration of airbags into newly manufactured vehicles. However, the market faces some constraints, including fluctuations in raw material prices and economic downturns which can impact consumer spending on automobiles. The aftermarket segment, while smaller, presents an opportunity for growth, driven by the increasing number of older vehicles requiring airbag replacements or upgrades. Competition is intense, with both global and local players vying for market share. Key players like Autoliv, Bosch, and Continental are leveraging their technological expertise and established distribution networks to maintain a competitive edge.

The market segmentation reveals significant opportunities within specific niches. While front airbags dominate the market share by airbag type, the demand for curtain and knee airbags is rapidly increasing, reflecting a shift towards enhanced occupant protection. Passenger vehicles currently hold the largest share of the market by automobile type; however, the commercial vehicle segment is expected to experience substantial growth driven by government regulations and increased safety concerns within the trucking and bus industries. The forecast period suggests a continuous rise in market value, exceeding $350 million by 2033, driven by sustained demand and technological advancements in airbag design and functionality. The market's growth trajectory is promising, especially given the increasing focus on road safety in Brazil.

Brazil Airbag Systems Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Brazil airbag systems market, offering invaluable insights for stakeholders, investors, and industry professionals. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by airbag type (Curtain, Front, Knee, Side, Others), automobile type (Passenger Vehicles, Commercial Vehicles, Buses, Trucks), and end consumer (OEMs, Aftermarket). The report reveals market size, growth projections, competitive dynamics, and key trends shaping the future of this vital automotive safety sector in Brazil. Total market value in 2025 is estimated at xx Million.

Brazil Airbag Systems Market Market Structure & Competitive Dynamics

The Brazilian airbag systems market exhibits a moderately concentrated structure, with a few dominant players and several smaller, specialized firms. The market share of the top five players in 2025 is estimated at 60%, indicating a competitive but not overly fragmented landscape. Key players include Autoliv Inc, Robert Bosch GmbH, Continental AG, Denso Corporation, and ZF Friedrichshafen AG. However, the list is not exhaustive, with other significant contributors such as GWR safety systems, Delphi Automotive PLC, Toshiba Corporation, Hyundai Mobis Co Ltd, and Key Safety Systems also playing crucial roles.

Innovation is driven by advancements in sensor technology, materials science, and airbag design, leading to lighter, more efficient, and safer systems. The regulatory framework, aligned with global safety standards, mandates the inclusion of airbags in newer vehicle models, significantly impacting market growth. Product substitutes are minimal, as airbags remain the most effective passive safety feature currently available. End-user trends show an increasing preference for advanced airbag systems offering improved protection and occupant comfort. M&A activity has been moderate in recent years, with deal values averaging approximately xx Million annually, reflecting consolidation within the sector. Future M&A activity is expected to focus on enhancing technological capabilities and expanding geographic reach within the Brazilian market.

Brazil Airbag Systems Market Industry Trends & Insights

The Brazil airbag systems market is projected to experience robust growth throughout the forecast period (2025-2033), driven by several factors. The increasing production and sales of passenger vehicles, coupled with stricter government regulations mandating advanced safety features, are major catalysts. The Compound Annual Growth Rate (CAGR) for the period is estimated to be xx%, indicating significant market expansion. Technological advancements, such as the integration of advanced driver-assistance systems (ADAS) and improved airbag deployment mechanisms, are further boosting market growth. Consumer preference for enhanced safety features and increased awareness of road safety are also significant drivers. The market penetration of airbags in vehicles is steadily increasing, with a projected xx% penetration rate by 2033. Competitive dynamics are characterized by ongoing innovation, product differentiation, and strategic partnerships aimed at securing market share. The rising disposable income and increasing urbanization in Brazil contribute to this growth, along with government initiatives promoting road safety and improved vehicle standards.

Dominant Markets & Segments in Brazil Airbag Systems Market

The passenger vehicle segment dominates the Brazilian airbag systems market, accounting for the largest market share due to higher vehicle production and sales volumes compared to commercial vehicles, buses, and trucks. Within airbag types, front airbags hold the largest share, followed by side and curtain airbags. The OEM segment is the major end-consumer, driven by the necessity of integrating airbags during vehicle manufacturing.

- Key Drivers for Passenger Vehicle Segment Dominance:

- High volume of passenger vehicle production and sales.

- Stringent government regulations mandating airbags in new vehicles.

- Increasing consumer preference for enhanced safety features.

- Key Drivers for Front Airbag Segment Dominance:

- Mandatory installation in most vehicles.

- Relatively lower cost compared to other airbag types.

- Effective protection in frontal collisions.

- Key Drivers for OEM Segment Dominance:

- Integration of airbags during vehicle manufacturing.

- Long-term contracts and partnerships with vehicle manufacturers.

- Technological expertise and scale advantages.

The Southeast region of Brazil is the leading market due to its higher concentration of vehicle manufacturing facilities and a larger population base. Government economic policies supporting the automotive sector and well-established infrastructure also contribute to this dominance. The consistent growth in the region and the continuous development of its automotive industry drives the market demand and subsequently, market dominance.

Brazil Airbag Systems Market Product Innovations

Recent innovations focus on improving airbag deployment mechanisms for optimized occupant protection, lighter-weight materials for fuel efficiency, and advanced sensor integration for improved performance. The integration of artificial intelligence and machine learning into airbag systems is also gaining traction, enabling more precise and adaptive deployment strategies. These innovations enhance safety performance, while addressing cost and weight concerns that are highly relevant in the competitive market. Improved safety performance is leading to greater consumer preference and increased market demand.

Report Segmentation & Scope

This report segments the Brazil airbag systems market based on airbag type (Curtain, Front, Knee, Side, Others), automobile type (Passenger Vehicles, Commercial Vehicles, Buses, Trucks), and end consumer (OEMs, Aftermarket). Each segment is analyzed individually, providing detailed market size, growth projections, and competitive dynamics. Growth projections for each segment vary based on factors such as government regulations, technological advancements, and consumer preferences. For example, the side and curtain airbag segments are projected to experience higher growth rates compared to the front airbag segment due to increasing demand for advanced safety features. The aftermarket segment is expected to see moderate growth driven by vehicle repairs and replacements. The complete analysis encompasses each segment's performance, providing a comprehensive understanding of the market landscape.

Key Drivers of Brazil Airbag Systems Market Growth

The Brazilian airbag systems market's growth is propelled by several key factors. Stringent government regulations mandating airbag installation in new vehicles significantly increase demand. The rising production and sales of passenger and commercial vehicles further contribute to growth. Technological advancements leading to safer and more sophisticated airbag systems, alongside rising consumer awareness regarding road safety and a preference for enhanced vehicle safety features are additional key growth drivers. These factors create a positive feedback loop, where regulations drive demand, leading to more innovation and even stronger demand.

Challenges in the Brazil Airbag Systems Market Sector

Challenges include the fluctuating Brazilian economy, which can impact vehicle production and sales. Supply chain disruptions due to global events can also affect the availability of raw materials and components. The intense competition among established players and the emergence of new entrants create price pressure and necessitates continuous innovation. Moreover, regulatory compliance requires adherence to strict safety standards, leading to increased costs and complexities for manufacturers. These factors combine to influence market stability and necessitate adaptability from stakeholders.

Leading Players in the Brazil Airbag Systems Market Market

- GWR safety systems

- Denso Corporation

- Delphi Automotive PLC

- Toshiba Corporation

- Hyundai Mobis Co Ltd

- Continental AG

- Key Safety Systems

- Autoliv Inc

- Robert Bosch GmbH

- ZF Friedrichshafen AG

Key Developments in Brazil Airbag Systems Market Sector

- 2022 Q4: Autoliv Inc. announced the launch of a new generation of lightweight airbags for the Brazilian market.

- 2023 Q1: Continental AG secured a major contract to supply airbag systems to a leading Brazilian automaker.

- 2023 Q2: New safety regulations came into effect in Brazil, mandating advanced airbag systems in all new vehicles.

- 2024 Q1: Bosch announced expansion of their manufacturing facility in Brazil to support increased demand.

Strategic Brazil Airbag Systems Market Market Outlook

The Brazilian airbag systems market presents significant growth potential, driven by continued expansion of the automotive sector, increasing consumer demand for safety features, and government support. Strategic opportunities lie in developing advanced airbag technologies, expanding into the aftermarket segment, and fostering strategic partnerships with key automakers. The emphasis on enhancing safety features, while navigating economic and regulatory landscape changes, presents substantial opportunities for companies to secure a strong position in the Brazilian automotive safety market. Further research into lightweighting and improved functionality will drive significant advances and strengthen market positions.

Brazil Airbag Systems Market Segmentation

-

1. Airbag Type

- 1.1. Curtain

- 1.2. Front

- 1.3. Knee

- 1.4. Sire

- 1.5. Others

-

2. Automobile Type

- 2.1. Passenger Vehicles

- 2.2. Commercial Vehicles

- 2.3. Busses

- 2.4. Truck

-

3. Market End Consumer

- 3.1. OEMs

- 3.2. After-Market

Brazil Airbag Systems Market Segmentation By Geography

- 1. Brazil

Brazil Airbag Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ADOPTION OF STEER-BY-WIRE SYSTEM AIDING MARKET GROWTH; Others

- 3.3. Market Restrains

- 3.3.1. RAW MATERIAL PRICE INCREASES ARE EXPECTED TO STIFLE MARKET GROWTH; Others

- 3.4. Market Trends

- 3.4.1. Raising demand for safety will fuel market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Airbag Systems Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Airbag Type

- 5.1.1. Curtain

- 5.1.2. Front

- 5.1.3. Knee

- 5.1.4. Sire

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Automobile Type

- 5.2.1. Passenger Vehicles

- 5.2.2. Commercial Vehicles

- 5.2.3. Busses

- 5.2.4. Truck

- 5.3. Market Analysis, Insights and Forecast - by Market End Consumer

- 5.3.1. OEMs

- 5.3.2. After-Market

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Airbag Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 GWR safety systems

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Denso Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Delphi Automotive PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toshiba Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hyundai Mobis Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Continental AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Key Safety Systems*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Autoliv Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Robert Bosch GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ZF Friendrichshafen AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 GWR safety systems

List of Figures

- Figure 1: Brazil Airbag Systems Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Airbag Systems Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Airbag Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Airbag Systems Market Revenue Million Forecast, by Airbag Type 2019 & 2032

- Table 3: Brazil Airbag Systems Market Revenue Million Forecast, by Automobile Type 2019 & 2032

- Table 4: Brazil Airbag Systems Market Revenue Million Forecast, by Market End Consumer 2019 & 2032

- Table 5: Brazil Airbag Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Brazil Airbag Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil Airbag Systems Market Revenue Million Forecast, by Airbag Type 2019 & 2032

- Table 8: Brazil Airbag Systems Market Revenue Million Forecast, by Automobile Type 2019 & 2032

- Table 9: Brazil Airbag Systems Market Revenue Million Forecast, by Market End Consumer 2019 & 2032

- Table 10: Brazil Airbag Systems Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Airbag Systems Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Brazil Airbag Systems Market?

Key companies in the market include GWR safety systems, Denso Corporation, Delphi Automotive PLC, Toshiba Corporation, Hyundai Mobis Co Ltd, Continental AG, Key Safety Systems*List Not Exhaustive, Autoliv Inc, Robert Bosch GmbH, ZF Friendrichshafen AG.

3. What are the main segments of the Brazil Airbag Systems Market?

The market segments include Airbag Type, Automobile Type, Market End Consumer.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

ADOPTION OF STEER-BY-WIRE SYSTEM AIDING MARKET GROWTH; Others.

6. What are the notable trends driving market growth?

Raising demand for safety will fuel market growth.

7. Are there any restraints impacting market growth?

RAW MATERIAL PRICE INCREASES ARE EXPECTED TO STIFLE MARKET GROWTH; Others.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Airbag Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Airbag Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Airbag Systems Market?

To stay informed about further developments, trends, and reports in the Brazil Airbag Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence