Key Insights

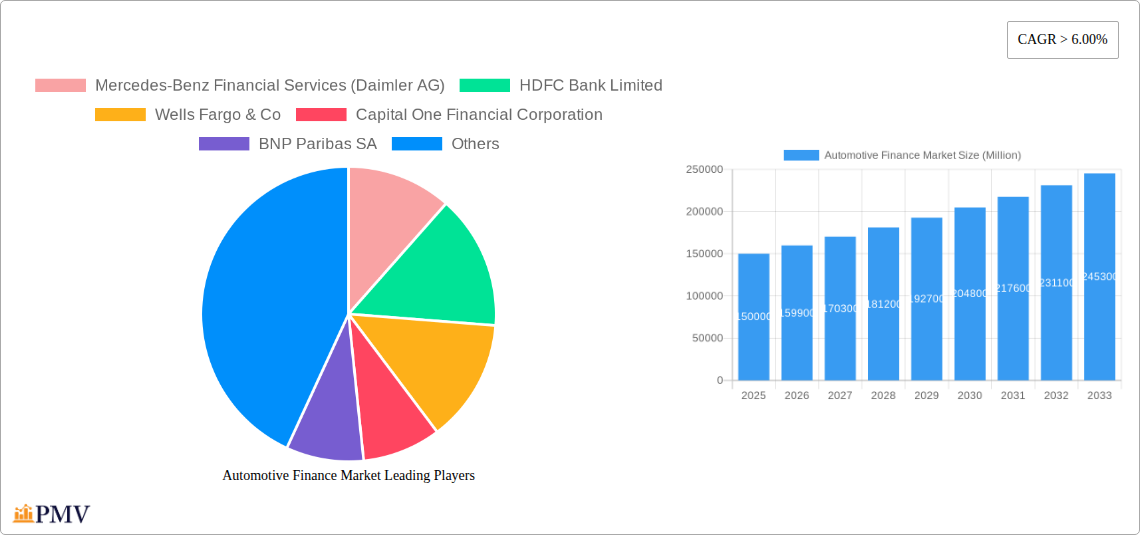

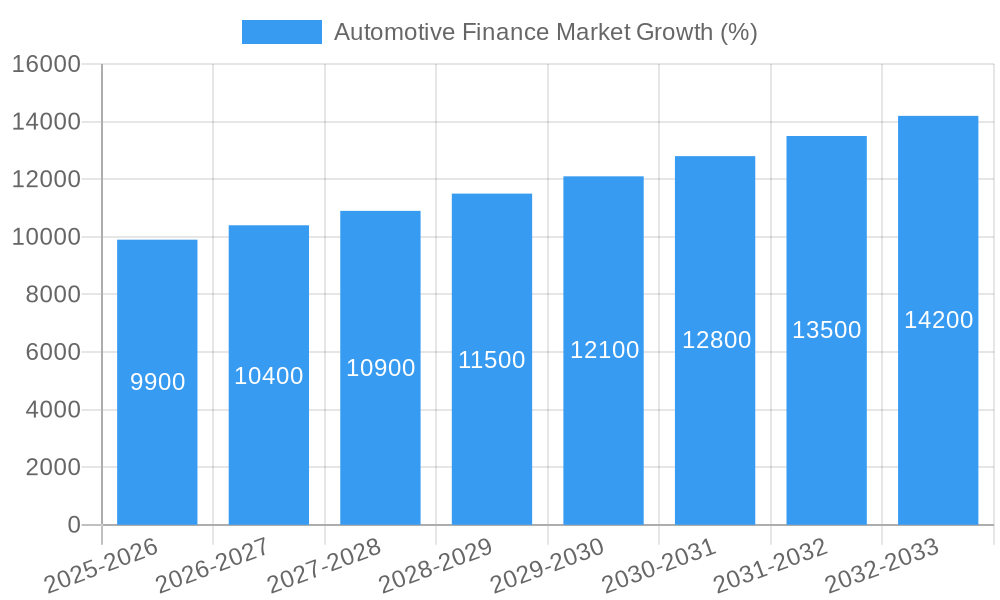

The automotive finance market, valued at approximately $XX million in 2025, is experiencing robust growth, projected to maintain a CAGR exceeding 6.00% from 2025 to 2033. This expansion is fueled by several key drivers. The rising popularity of vehicle ownership, particularly in developing economies, significantly boosts demand for financing options. Furthermore, the increasing availability of diverse financing products, including innovative digital lending platforms and flexible repayment schemes tailored to varied customer needs, contributes to market growth. The shift towards purchasing new vehicles, propelled by technological advancements and consumer preference for advanced features, further fuels demand within the automotive finance sector. The market is segmented across vehicle types (passenger cars and commercial vehicles), financing sources (OEMs, banks, credit unions, and financial institutions), and vehicle age (new and used). The competitive landscape includes both established global players like Mercedes-Benz Financial Services and HDFC Bank, and regional banks and financial institutions. Competition is fierce, with companies vying for market share through competitive pricing, innovative product offerings, and expanded digital capabilities.

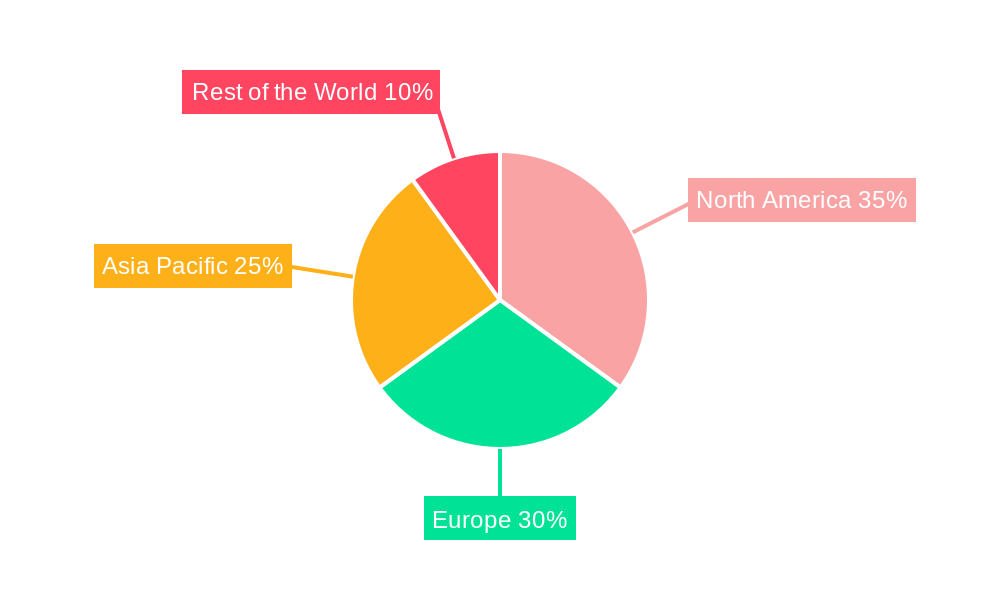

Despite the positive outlook, certain restraints influence market trajectory. Economic fluctuations and changes in interest rates can impact consumer borrowing capacity and affect demand. Stringent regulatory compliance requirements and credit risk assessment complexities represent operational challenges for lenders. Additionally, increasing competition from alternative financing models and the adoption of subscription-based mobility services could potentially moderate market expansion in the long run. However, the overall growth trajectory remains positive, particularly driven by emerging markets and technological innovation within the financial sector, suggesting a robust and expanding automotive finance landscape over the forecast period. Geographic segmentation reveals a substantial market presence across North America, Europe, and Asia-Pacific, with emerging markets presenting significant growth potential.

Automotive Finance Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the global Automotive Finance Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The report’s xx Million USD market valuation offers a granular understanding of market segmentation, competitive dynamics, and future growth projections.

Automotive Finance Market Structure & Competitive Dynamics

The Automotive Finance Market exhibits a moderately concentrated structure, with key players like Mercedes-Benz Financial Services, HDFC Bank, and Wells Fargo commanding significant market share. The market is characterized by intense competition, driven by factors such as technological innovation, evolving consumer preferences, and stringent regulatory frameworks. The competitive landscape is further shaped by mergers and acquisitions (M&A) activities, with deal values reaching xx Million USD in recent years. For instance, the acquisition of KWY Technology by Volkswagen Finance in 2021 highlights the strategic importance of digital platforms in enhancing customer experience and streamlining loan processing. The increasing adoption of digital finance technologies is disrupting the traditional model, fostering innovation in areas like online lending platforms and digital payment gateways. Substitute products, such as leasing options and peer-to-peer lending platforms, are also influencing the market dynamics. End-user trends, notably the shift towards electric vehicles (EVs) and the growing preference for subscription models, further contribute to the complexity of the competitive landscape. Analyzing market share data from 2024, we find that top players hold approximately xx% of the total market. Future trends will involve an increased focus on sustainable financing solutions and fintech integration.

Automotive Finance Market Industry Trends & Insights

The global Automotive Finance Market is projected to experience significant growth, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors, including rising vehicle sales, particularly in emerging economies, and the increasing penetration of consumer credit. Technological advancements, such as the rise of digital lending platforms and fintech solutions, are streamlining the financing process, improving customer experience, and driving market expansion. Consumer preferences are shifting towards flexible financing options, including leasing and balloon payment plans, influencing the product offerings of automotive finance companies. The market's competitive dynamics are shaped by the continuous innovation in financial products and services. The expanding scope of online lending, enhanced data analytics for risk assessment, and the increasing integration of AI and ML are transforming market operations. Market penetration of digital lending platforms continues to improve steadily, showing an estimated increase of xx percentage points over the forecast period. These developments are boosting the sector’s overall efficiency and accessibility while influencing consumer behaviour and increasing market penetration.

Dominant Markets & Segments in Automotive Finance Market

The Automotive Finance Market is geographically diverse, with significant presence across various regions. However, North America and Asia-Pacific currently hold the largest market shares due to high vehicle sales and robust financial systems.

Leading Region: North America exhibits dominance in the market due to high vehicle ownership rates and established financial infrastructure. Key growth drivers include favorable economic conditions and the prevalence of advanced financial technologies.

Leading Segment: The new vehicle segment dominates the market due to higher financing amounts and stringent credit requirements. The passenger car segment holds a larger market share compared to commercial vehicles, driven by increased consumer demand.

Source Type Dominance: OEMs (Original Equipment Manufacturers) and banks hold a significant share, providing various financing options and leveraging their established customer base. However, the influence of financial institutions is also growing, offering specialized financing solutions and diversifying the market.

Key Drivers:

- Favorable economic policies stimulating vehicle sales.

- Well-developed financial infrastructure and consumer credit availability.

- Government incentives for new vehicle purchases (especially EVs).

- Robust digital infrastructure supporting the growth of online lending.

Automotive Finance Market Product Innovations

Recent innovations in the automotive finance sector focus on enhancing customer experience and operational efficiency through digitalization. This includes the development of online loan applications, mobile-based financing platforms, and AI-powered risk assessment tools. These advancements streamline the lending process, reduce processing times, and allow for more personalized financial solutions. The integration of blockchain technology offers potential for greater transparency and security in transactions. Furthermore, innovative financing products like subscription models and flexible lease options cater to the evolving consumer preferences, expanding market reach and product differentiation.

Report Segmentation & Scope

This report segments the Automotive Finance Market based on several key parameters:

Vehicle Type: Passenger Cars and Commercial Vehicles. The passenger car segment holds a larger market share. The commercial vehicle segment exhibits slower but steady growth influenced by the state of the logistics sector.

Type: New Vehicle and Used Vehicle. The new vehicle segment currently holds a larger market share but the used vehicle segment is expected to grow at a faster rate in the forecast period.

Source Type: OEMs, Banks, Credit Unions, and Financial Institutions. Each segment offers distinct financing solutions with varying market shares and growth prospects. OEMs benefit from direct customer relationships, while banks and financial institutions benefit from diversified portfolios.

Key Drivers of Automotive Finance Market Growth

Several factors drive the growth of the Automotive Finance Market. Firstly, the increasing affordability of vehicles through financing options stimulates demand. Secondly, economic growth and rising disposable incomes, especially in developing countries, empower more consumers to access vehicle loans. Lastly, technological advancements, such as digital lending platforms and AI-driven risk assessment, enhance efficiency and accessibility within the market. Government incentives promoting vehicle purchases, especially for environmentally friendly vehicles, further fuel market expansion.

Challenges in the Automotive Finance Market Sector

The Automotive Finance Market faces several challenges. Stringent regulatory requirements and compliance costs can impact profitability. Fluctuations in interest rates and economic downturns can influence consumer borrowing behaviour and default rates. Furthermore, intense competition among various financial institutions necessitates continuous innovation and efficient operational management to maintain a competitive edge. Supply chain disruptions in the automotive industry can affect vehicle production and sales, impacting the overall demand for automotive financing.

Leading Players in the Automotive Finance Market Market

- Mercedes-Benz Financial Services (Daimler AG)

- HDFC Bank Limited

- Wells Fargo & Co

- Capital One Financial Corporation

- BNP Paribas SA

- Ally Financial Inc

- Volkswagen AG

- ICBC (Industrial and Commercial Bank of India)

- Hitachi Capital Asia Pacific Pte Ltd

- Bank of China

- Mahindra Financ

- Standard Bank Group Ltd

- HSBC Holdings PLC

- Toyota Financial Services

- Bank of America Corporation

Key Developments in Automotive Finance Market Sector

March 2022: Santander Consumer USA partnered with AutoFi Inc. to create a digital car-buying solution, enhancing customer experience and streamlining the financing process. This significantly impacts market dynamics by improving efficiency and accessibility.

March 2022: CIG Motors partnered with Polaris Bank Limited to offer automotive financing solutions in Nigeria, expanding market reach in a developing economy. This increases market penetration in a previously underserved region.

January 2021: Volkswagen Finance Pvt. Ltd. acquired a majority stake in KUWY Technology Service Pvt Ltd., aiming to accelerate loan processing and improve customer services through digital platforms. This development demonstrates the growing importance of technology in enhancing efficiency and competitiveness.

Strategic Automotive Finance Market Market Outlook

The future of the Automotive Finance Market is bright, driven by the ongoing technological advancements, increasing vehicle sales globally, and the shift towards sustainable mobility solutions. The market offers lucrative opportunities for companies capable of providing innovative financing solutions, leveraging data analytics, and catering to evolving consumer preferences. Strategic partnerships, product diversification, and expansion into new geographical markets are key to success in this dynamic and competitive landscape. The increasing integration of fintech and the adoption of alternative financing methods will shape future market trends.

Automotive Finance Market Segmentation

-

1. Type

- 1.1. New Vehicle

- 1.2. Used Vehicle

-

2. Source Type

- 2.1. OEMs

- 2.2. Banks

- 2.3. Credit Unions

- 2.4. Financial Institutions

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

Automotive Finance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East

Automotive Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in demand for Safety Features in Vehicles

- 3.3. Market Restrains

- 3.3.1. High Costs Associated With The Feature

- 3.4. Market Trends

- 3.4.1. Banks Across the World to Gain Significant Prominence During Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Finance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. New Vehicle

- 5.1.2. Used Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Source Type

- 5.2.1. OEMs

- 5.2.2. Banks

- 5.2.3. Credit Unions

- 5.2.4. Financial Institutions

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Automotive Finance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. New Vehicle

- 6.1.2. Used Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Source Type

- 6.2.1. OEMs

- 6.2.2. Banks

- 6.2.3. Credit Unions

- 6.2.4. Financial Institutions

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Automotive Finance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. New Vehicle

- 7.1.2. Used Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Source Type

- 7.2.1. OEMs

- 7.2.2. Banks

- 7.2.3. Credit Unions

- 7.2.4. Financial Institutions

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Automotive Finance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. New Vehicle

- 8.1.2. Used Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Source Type

- 8.2.1. OEMs

- 8.2.2. Banks

- 8.2.3. Credit Unions

- 8.2.4. Financial Institutions

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Automotive Finance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. New Vehicle

- 9.1.2. Used Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Source Type

- 9.2.1. OEMs

- 9.2.2. Banks

- 9.2.3. Credit Unions

- 9.2.4. Financial Institutions

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Cars

- 9.3.2. Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Automotive Finance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Automotive Finance Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Rest of Europe

- 12. Asia Pacific Automotive Finance Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 Japan

- 12.1.3 India

- 12.1.4 South Korea

- 12.1.5 Rest of Asia Pacific

- 13. Rest of the World Automotive Finance Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 South America

- 13.1.2 Middle East

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Mercedes-Benz Financial Services (Daimler AG)

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 HDFC Bank Limited

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Wells Fargo & Co

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Capital One Financial Corporation

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 BNP Paribas SA

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Ally Financial Inc

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Volkswagen AG

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 ICBC (Industrial and Commercial Bank of India)

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Hitachi Capital Asia Pacific Pte Ltd

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Bank of China

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Mahindra Financ

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Standard Bank Group Ltd

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 HSBC Holdings PLC

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 Toyota Financial Services

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.15 Bank of America Corporation

- 14.2.15.1. Overview

- 14.2.15.2. Products

- 14.2.15.3. SWOT Analysis

- 14.2.15.4. Recent Developments

- 14.2.15.5. Financials (Based on Availability)

- 14.2.1 Mercedes-Benz Financial Services (Daimler AG)

List of Figures

- Figure 1: Global Automotive Finance Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Automotive Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Automotive Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Automotive Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Automotive Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Automotive Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Automotive Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Automotive Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Automotive Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Automotive Finance Market Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Automotive Finance Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Automotive Finance Market Revenue (Million), by Source Type 2024 & 2032

- Figure 13: North America Automotive Finance Market Revenue Share (%), by Source Type 2024 & 2032

- Figure 14: North America Automotive Finance Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 15: North America Automotive Finance Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 16: North America Automotive Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Automotive Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Automotive Finance Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Automotive Finance Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Automotive Finance Market Revenue (Million), by Source Type 2024 & 2032

- Figure 21: Europe Automotive Finance Market Revenue Share (%), by Source Type 2024 & 2032

- Figure 22: Europe Automotive Finance Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 23: Europe Automotive Finance Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 24: Europe Automotive Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Automotive Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Automotive Finance Market Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Pacific Automotive Finance Market Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Automotive Finance Market Revenue (Million), by Source Type 2024 & 2032

- Figure 29: Asia Pacific Automotive Finance Market Revenue Share (%), by Source Type 2024 & 2032

- Figure 30: Asia Pacific Automotive Finance Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 31: Asia Pacific Automotive Finance Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 32: Asia Pacific Automotive Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Automotive Finance Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Automotive Finance Market Revenue (Million), by Type 2024 & 2032

- Figure 35: Rest of the World Automotive Finance Market Revenue Share (%), by Type 2024 & 2032

- Figure 36: Rest of the World Automotive Finance Market Revenue (Million), by Source Type 2024 & 2032

- Figure 37: Rest of the World Automotive Finance Market Revenue Share (%), by Source Type 2024 & 2032

- Figure 38: Rest of the World Automotive Finance Market Revenue (Million), by Vehicle Type 2024 & 2032

- Figure 39: Rest of the World Automotive Finance Market Revenue Share (%), by Vehicle Type 2024 & 2032

- Figure 40: Rest of the World Automotive Finance Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Automotive Finance Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Automotive Finance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Automotive Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Automotive Finance Market Revenue Million Forecast, by Source Type 2019 & 2032

- Table 4: Global Automotive Finance Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 5: Global Automotive Finance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Automotive Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Automotive Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Automotive Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: South Korea Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Asia Pacific Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Automotive Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: South America Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Middle East Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Automotive Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Global Automotive Finance Market Revenue Million Forecast, by Source Type 2019 & 2032

- Table 26: Global Automotive Finance Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 27: Global Automotive Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United States Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Canada Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of North America Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Automotive Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Global Automotive Finance Market Revenue Million Forecast, by Source Type 2019 & 2032

- Table 33: Global Automotive Finance Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 34: Global Automotive Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Germany Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: United Kingdom Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: France Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Automotive Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global Automotive Finance Market Revenue Million Forecast, by Source Type 2019 & 2032

- Table 41: Global Automotive Finance Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 42: Global Automotive Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: China Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: India Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: South Korea Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global Automotive Finance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 49: Global Automotive Finance Market Revenue Million Forecast, by Source Type 2019 & 2032

- Table 50: Global Automotive Finance Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 51: Global Automotive Finance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: South America Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Middle East Automotive Finance Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Finance Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Automotive Finance Market?

Key companies in the market include Mercedes-Benz Financial Services (Daimler AG), HDFC Bank Limited, Wells Fargo & Co, Capital One Financial Corporation, BNP Paribas SA, Ally Financial Inc, Volkswagen AG, ICBC (Industrial and Commercial Bank of India), Hitachi Capital Asia Pacific Pte Ltd, Bank of China, Mahindra Financ, Standard Bank Group Ltd, HSBC Holdings PLC, Toyota Financial Services, Bank of America Corporation.

3. What are the main segments of the Automotive Finance Market?

The market segments include Type, Source Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in demand for Safety Features in Vehicles.

6. What are the notable trends driving market growth?

Banks Across the World to Gain Significant Prominence During Forecast Period.

7. Are there any restraints impacting market growth?

High Costs Associated With The Feature.

8. Can you provide examples of recent developments in the market?

March 2022: Santander Consumer USA Inc. (a subsidiary of Santander Holdings USA Inc.) partnered with AutoFi Inc. to develop a digital car-buying solution for the former company. This solution will include mobile, desktop, and in-dealership tools that will help find cars within the consumer budget, streamline the financing process, and allow customers to procure vehicles as per their requirements.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Finance Market?

To stay informed about further developments, trends, and reports in the Automotive Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence