Key Insights

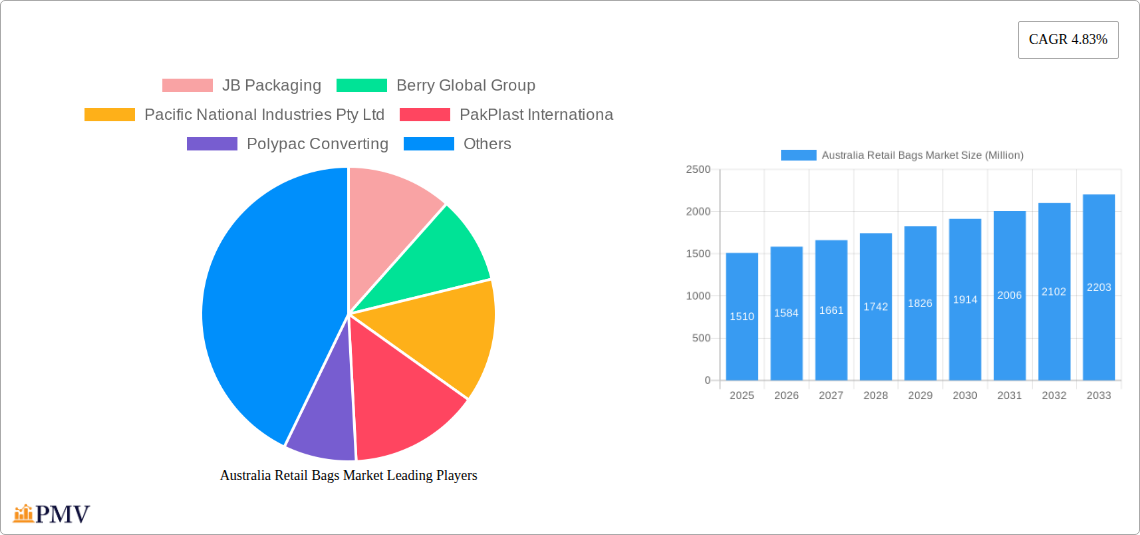

The Australian retail bags market, valued at $1.51 billion in 2025, is projected to experience robust growth, driven by a rising e-commerce sector and increasing consumer demand for sustainable packaging solutions. The market's Compound Annual Growth Rate (CAGR) of 4.83% from 2019 to 2024 indicates a consistent upward trajectory. Key growth drivers include the increasing popularity of online shopping, leading to a surge in demand for convenient and protective packaging. Furthermore, the growing awareness of environmental concerns is fueling demand for eco-friendly retail bags made from recycled materials like rPET and biodegradable natural fabrics. This trend is particularly pronounced in the foodservice and grocery sectors, where consumers are actively seeking sustainable alternatives to traditional plastic bags. While the shift towards sustainability presents opportunities, challenges remain, including fluctuating raw material prices and the need for effective waste management solutions to mitigate environmental impact. The market is segmented by material (paper & natural fabrics, plastic – HDPE, LDPE, PP, rPET, etc.) and end-user industry (foodservice, grocery, industrial, hospitality, and others). Major players like JB Packaging, Berry Global Group, and Pacific National Industries Pty Ltd are competing to meet the evolving needs of the market. The forecast period (2025-2033) anticipates continued expansion, fueled by innovative product development and expanding retail landscapes.

Australia Retail Bags Market Market Size (In Billion)

The competitive landscape is characterized by both established players and emerging companies focusing on specialized niches. Companies are increasingly adopting sustainable practices and investing in research and development to create innovative and environmentally friendly packaging solutions. Future growth will likely be influenced by government regulations regarding plastic bag usage, changes in consumer behavior, and technological advancements in packaging materials and manufacturing processes. The market's segmentation presents lucrative opportunities for companies focusing on specific materials and end-user industries. The continued growth in e-commerce, particularly in the grocery sector, presents a significant opportunity for specialized packaging solutions tailored for efficient delivery and preservation of goods. Successful companies will be those that are able to effectively navigate the challenges and capitalize on the growing demand for sustainable and innovative retail bag solutions.

Australia Retail Bags Market Company Market Share

Australia Retail Bags Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Australian retail bags market, encompassing market size, segmentation, competitive landscape, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and businesses operating within or looking to enter this dynamic sector. The report leverages extensive data and analysis to offer actionable intelligence, identifying key opportunities and challenges. Market values are presented in Millions.

Australia Retail Bags Market Market Structure & Competitive Dynamics

The Australian retail bags market exhibits a moderately concentrated structure, with several key players dominating various segments. Market share is largely influenced by production capacity, brand recognition, and distribution networks. Innovation is crucial, with companies continually developing sustainable and functional bag solutions. The regulatory landscape, particularly concerning environmental regulations and plastic reduction initiatives, significantly impacts market dynamics. Product substitution, driven by eco-conscious consumer preferences, is a growing factor, favoring biodegradable and recyclable materials. M&A activity has been relatively low in recent years, with deal values averaging xx Million annually. However, increased focus on sustainability might trigger consolidation in the future. End-user trends reflect a growing demand for customized, aesthetically pleasing bags aligning with brand image.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Innovation Ecosystems: Focus on sustainable materials (rPET, recycled paper), improved functionalities (e.g., resealable closures), and customized designs.

- Regulatory Frameworks: Stringent environmental regulations drive the adoption of eco-friendly materials and packaging practices.

- Product Substitutes: Growing market penetration of reusable bags and biodegradable alternatives.

- End-User Trends: Increasing demand for custom-printed bags and eco-friendly options.

- M&A Activity: Low, with average annual deal values of xx Million (2019-2024).

Australia Retail Bags Market Industry Trends & Insights

The Australian retail bags market is experiencing steady growth, driven by the expanding retail sector and increasing consumer spending. The CAGR for the period 2019-2024 was approximately xx%, and is projected to reach xx% during the forecast period (2025-2033). Technological advancements, particularly in material science and manufacturing processes, are fostering the development of more sustainable and efficient packaging solutions. Consumer preferences are shifting towards eco-friendly and ethically sourced products, influencing material choices and packaging designs. Intense competition necessitates continuous innovation and strategic partnerships to maintain a competitive edge. Market penetration of sustainable bags is increasing, though the transition from traditional plastics remains gradual.

Dominant Markets & Segments in Australia Retail Bags Market

The grocery sector is the dominant end-user industry for retail bags in Australia, representing approximately xx% of market value. This is followed by the foodservice sector (xx%), with other sectors (industrial, hospitality, etc.) holding smaller market shares. Within materials, plastic bags still hold a significant share (xx%), but the market is witnessing substantial growth in the adoption of paper and natural fabric bags (xx%), driven by sustainability concerns.

By Material:

- Plastic (HDPE, LDPE, PP, rPET, etc.): High volume usage in grocery and foodservice. Dominant market share due to cost-effectiveness and versatility. Growth is hindered by environmental regulations.

- Paper and Natural Fabric: Growing rapidly due to increasing environmental awareness and consumer demand for sustainable alternatives. Higher production costs limit widespread adoption.

By End-user Industry:

- Grocery: Largest segment due to high volume of packaged goods and consumer demand. Growth is influenced by supermarket chains’ sustainability initiatives.

- Foodservice: Significant segment driven by takeaway food packaging needs. Growth is linked to the quick-service restaurant (QSR) industry's expansion.

Key Drivers:

- Strong retail sector growth.

- Increasing consumer spending.

- Growing focus on sustainable packaging.

- Government regulations promoting recyclability.

Australia Retail Bags Market Product Innovations

Recent innovations in the Australian retail bags market focus on enhancing sustainability, functionality, and aesthetics. Recyclable and compostable materials are gaining traction, alongside advancements in bag designs to improve durability and recyclability. Technological advancements in printing techniques enable customized designs that enhance brand appeal. The market is seeing a rise in innovative closures and features, catering to consumer needs for convenience and product freshness. These innovations cater to both environmental concerns and consumer expectations.

Report Segmentation & Scope

This report segments the Australian retail bags market by material (Paper and Natural Fabric, Plastic (HDPE, LDPE, PP, rPET, etc.)) and end-user industry (Foodservice, Grocery, Industrial, Hospitality, Other End-user Industries). Each segment’s growth projections, market size (in Millions), and competitive landscape are analyzed in detail. The report provides a comprehensive overview of the market's current state and future trajectories.

Key Drivers of Australia Retail Bags Market Growth

Several factors drive the growth of the Australian retail bags market: the increasing popularity of online shopping and e-commerce leading to higher packaging demand; a growing preference for convenient, pre-packaged goods; stringent regulations promoting sustainable packaging alternatives; and the emergence of innovative bag materials like rPET and biodegradable plastics. These factors collectively contribute to significant market expansion.

Challenges in the Australia Retail Bags Market Sector

The Australian retail bags market faces challenges including fluctuating raw material prices, increasing production costs associated with sustainable materials, stringent environmental regulations placing pressure on manufacturers to adopt eco-friendly practices, and intense competition from both domestic and international players. These factors can affect overall market profitability.

Leading Players in the Australia Retail Bags Market Market

- JB Packaging

- Berry Global Group (Berry Global Group)

- Pacific National Industries Pty Ltd

- PakPlast International

- Polypac Converting

- Detmold Group

- Gispac

- United Paper

- PrimePac

- Bag People Australia

Key Developments in Australia Retail Bags Market Sector

- March 2024: Visy launched recyclable paper bags made in Australia, reducing single-use plastics.

- April 2024: W23 Global launched a USD 125 Million VC fund to invest in innovative grocery retail start-ups focused on sustainability.

Strategic Australia Retail Bags Market Market Outlook

The Australian retail bags market is poised for sustained growth, driven by the ongoing shift towards sustainability and innovation in packaging materials. Strategic opportunities exist for companies focusing on eco-friendly solutions, customized bag designs, and efficient supply chains. Companies adapting to changing consumer preferences and regulatory frameworks are expected to gain a competitive edge. The market presents significant potential for expansion and investment in the coming years.

Australia Retail Bags Market Segmentation

-

1. Material

- 1.1. Paper and Natural Fabric

- 1.2. Plastic (HDPE, LDPE, PP, rPET, etc.)

-

2. End-user Industry

- 2.1. Foodservice

- 2.2. Grocery

- 2.3. Industrial

- 2.4. Hospitality

- 2.5. Other End-user Industries

Australia Retail Bags Market Segmentation By Geography

- 1. Australia

Australia Retail Bags Market Regional Market Share

Geographic Coverage of Australia Retail Bags Market

Australia Retail Bags Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growing Demand for Unit-sized Bags is Expected to Drive Growth; Legislative Changes will Propel the Growth of Paper-based Bags (State-wise Ban on Plastic Bags <35 microns)

- 3.3. Market Restrains

- 3.3.1. Near and Medium-term Dependence on Material Prices and the Dynamic Nature of the End-user Demand Expected to Pose Challenges; Anticipated Barriers to Entry for New Entrants Posed by Incumbents who have Established Partnerships with Retailers in the Country

- 3.4. Market Trends

- 3.4.1. Paper and Natural Fabric to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Retail Bags Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Paper and Natural Fabric

- 5.1.2. Plastic (HDPE, LDPE, PP, rPET, etc.)

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Foodservice

- 5.2.2. Grocery

- 5.2.3. Industrial

- 5.2.4. Hospitality

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JB Packaging

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Berry Global Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pacific National Industries Pty Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PakPlast Internationa

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Polypac Converting

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Detmold Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gispac

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 United Paper

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PrimePac

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bag People Australia

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JB Packaging

List of Figures

- Figure 1: Australia Retail Bags Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Retail Bags Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Retail Bags Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Australia Retail Bags Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Australia Retail Bags Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australia Retail Bags Market Revenue Million Forecast, by Material 2020 & 2033

- Table 5: Australia Retail Bags Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Australia Retail Bags Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Retail Bags Market?

The projected CAGR is approximately 4.83%.

2. Which companies are prominent players in the Australia Retail Bags Market?

Key companies in the market include JB Packaging, Berry Global Group, Pacific National Industries Pty Ltd, PakPlast Internationa, Polypac Converting, Detmold Group, Gispac, United Paper, PrimePac, Bag People Australia.

3. What are the main segments of the Australia Retail Bags Market?

The market segments include Material, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.51 Million as of 2022.

5. What are some drivers contributing to market growth?

The Growing Demand for Unit-sized Bags is Expected to Drive Growth; Legislative Changes will Propel the Growth of Paper-based Bags (State-wise Ban on Plastic Bags <35 microns).

6. What are the notable trends driving market growth?

Paper and Natural Fabric to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Near and Medium-term Dependence on Material Prices and the Dynamic Nature of the End-user Demand Expected to Pose Challenges; Anticipated Barriers to Entry for New Entrants Posed by Incumbents who have Established Partnerships with Retailers in the Country.

8. Can you provide examples of recent developments in the market?

April 2024 - W23 Global unites five major players in the global grocery arena. Ahold Delhaize (operating in the US, Europe, and Indonesia), Tesco (based in the UK, ROI, and Europe), Woolworths Group (hailing from Australia and New Zealand), Empire Company Limited/Sobeys Inc. (representing Canada), and Shoprite Group (focused on Africa). This collaborative effort has birthed a new retail venture capital (VC) fund, aiming to invest USD125 million into the most innovative start-ups and scale-ups worldwide over the next five years. These investments are specifically targeted at revolutionizing the grocery retail landscape and tackling its sustainability challenges head-on.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Retail Bags Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Retail Bags Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Retail Bags Market?

To stay informed about further developments, trends, and reports in the Australia Retail Bags Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence