Key Insights

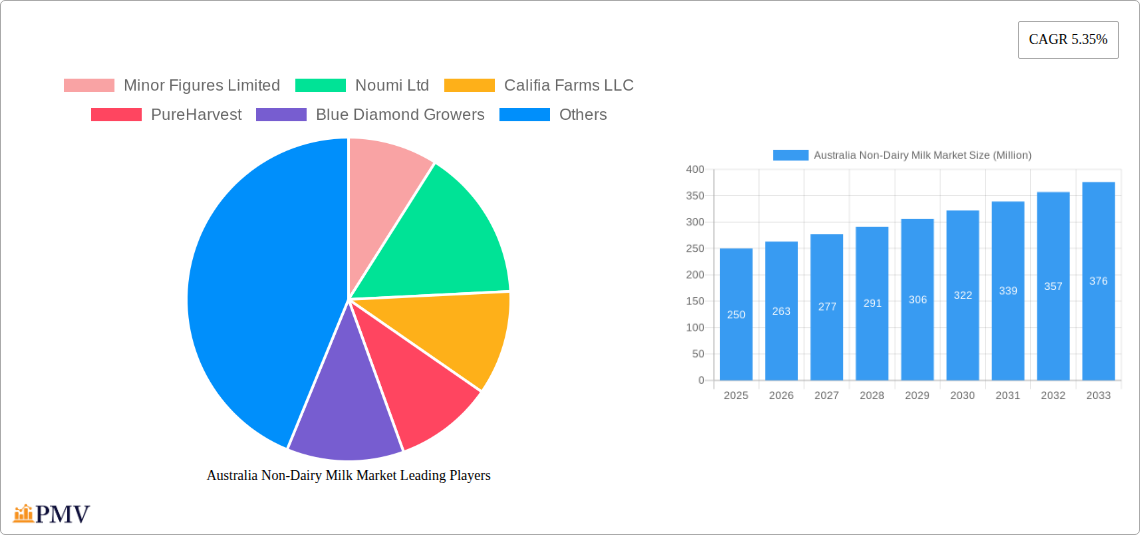

The Australian non-dairy milk market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.35% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing consumer awareness of the health benefits associated with plant-based diets, coupled with rising concerns about lactose intolerance and animal welfare, are significantly boosting demand. The growing popularity of vegan and flexitarian lifestyles further contributes to market growth. Furthermore, the expanding availability of diverse non-dairy milk options, encompassing almond, cashew, coconut, hazelnut, oat, and soy milk, caters to a wider range of consumer preferences and dietary needs. Product innovation, such as the introduction of fortified and flavored varieties, enhances market appeal. Distribution channels are also evolving, with a strong presence in both off-trade (supermarkets, grocery stores) and on-trade (cafes, restaurants) sectors. Leading brands like Oatly, Minor Figures, Califia Farms, and others are driving competition and innovation within this dynamic market.

However, certain restraints could potentially impede market growth. Price fluctuations in raw materials, particularly nuts and grains, can impact production costs and profitability. Consumer perceptions about the nutritional value and taste of non-dairy milks compared to traditional cow's milk might also pose a challenge. Nevertheless, ongoing product development and marketing efforts focused on highlighting the health benefits and versatility of non-dairy milks are expected to mitigate these challenges and sustain the market's positive trajectory. The Australian market's focus on sustainability and ethical sourcing will likely drive further growth in the coming years, favoring brands committed to environmentally friendly practices. The dominance of key players and the emergence of smaller niche brands ensure a competitive yet diverse marketplace.

Australia Non-Dairy Milk Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australia non-dairy milk market, offering invaluable insights for businesses, investors, and stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market structure, competitive dynamics, industry trends, and future growth prospects. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Australia Non-Dairy Milk Market Market Structure & Competitive Dynamics

The Australian non-dairy milk market exhibits a moderately concentrated structure, with key players like Oatly Group AB, Vitasoy International Holdings Ltd, and Sanitarium Health and Wellbeing Company holding significant market share. However, the presence of numerous smaller players and emerging brands signifies a dynamic competitive landscape. The market is characterized by a robust innovation ecosystem, driven by the constant development of new product types, flavors, and functionalities to cater to evolving consumer preferences. Regulatory frameworks, particularly those related to labeling and food safety, play a crucial role in shaping market dynamics. The availability of substitute products, such as traditional dairy milk and other plant-based beverages, poses a competitive challenge. Consumer trends, including increasing health consciousness and a growing preference for sustainable and ethical products, are influencing market growth. Mergers and acquisitions (M&A) activity has been moderate in recent years, with deal values ranging from xx Million to xx Million. Some key characteristics include:

- Market Concentration: Moderate, with a few dominant players and numerous smaller brands.

- Innovation: Strong focus on new product development (e.g., functional milks, specialized blends).

- Regulatory Framework: Stringent food safety and labeling regulations.

- Substitutes: Traditional dairy milk and other plant-based beverages.

- End-User Trends: Growing demand for healthy, sustainable, and ethically sourced products.

- M&A Activity: Moderate activity with deal values ranging from xx Million to xx Million.

Australia Non-Dairy Milk Market Industry Trends & Insights

The Australian non-dairy milk market is experiencing robust growth, fueled by several key factors. The rising awareness of the health benefits associated with plant-based diets, coupled with the increasing adoption of vegan and vegetarian lifestyles, is a primary driver. Technological advancements in production processes have led to improvements in product quality, shelf life, and affordability. Consumer preferences are shifting towards products with added nutritional value, such as those fortified with vitamins and minerals. Intense competition among brands is driving innovation and fostering the development of unique product offerings. Market penetration is high in urban areas, but significant growth potential remains in regional and rural markets. The market growth is further driven by:

- Health and Wellness: Growing consumer interest in plant-based diets and health-conscious lifestyles.

- Sustainability: Increasing demand for environmentally friendly products and sustainable sourcing practices.

- Technological Advancements: Improvements in production efficiency and product quality.

- Product Innovation: Development of new flavors, varieties, and functional benefits.

- Changing Consumer Preferences: Demand for more convenient, nutritious, and ethically sourced options.

Dominant Markets & Segments in Australia Non-Dairy Milk Market

The Off-Trade distribution channel dominates the Australian non-dairy milk market, accounting for xx% of total sales in 2025. This dominance is attributed to the widespread availability of non-dairy milk products in supermarkets, grocery stores, and other retail outlets. Oat milk is currently the most popular product type, followed by almond milk and soy milk. This segment's growth is driven by factors such as:

- Off-Trade Channel: High accessibility through supermarkets and other retail channels.

- Oat Milk: Consumer preference due to perceived health benefits and creamy texture.

- Almond Milk: Popular due to its mild flavor and versatility.

- Soy Milk: Established presence and wide availability.

Within the product type segment, the key drivers for Oat Milk's dominance include its creamy texture, perceived health benefits (like fiber content), and versatility in various applications. Almond milk benefits from its mild flavor, making it adaptable to various culinary uses. Soy milk maintains its position due to its long-standing presence in the market and established consumer base.

Australia Non-Dairy Milk Market Product Innovations

Recent product innovations focus on enhancing taste, texture, and nutritional value. New products feature unique flavor profiles, improved creaminess, and added nutrients like protein and vitamins. Technological advancements are leading to the development of more sustainable and efficient production methods. Companies are also focusing on developing products that better cater to specific dietary needs and preferences, such as lactose-free, gluten-free, and allergen-free options.

Report Segmentation & Scope

This report segments the Australian non-dairy milk market based on:

- Distribution Channel: Off-Trade (supermarkets, grocery stores, etc.) and On-Trade (cafes, restaurants, etc.). The Off-Trade segment holds the largest market share. The On-Trade segment is expected to grow at a xx% CAGR during the forecast period, driven by increasing adoption by cafes and restaurants.

- Product Type: Almond Milk, Cashew Milk, Coconut Milk, Hazelnut Milk, Oat Milk, and Soy Milk. Oat milk is the leading segment, followed by almond milk and soy milk. Each segment is experiencing unique growth patterns based on consumer preferences and product innovation.

Key Drivers of Australia Non-Dairy Milk Market Growth

Several factors contribute to the growth of the Australian non-dairy milk market. Increasing health awareness and the adoption of plant-based diets are key drivers. Technological advancements in production and processing are leading to improved product quality and affordability. Government initiatives promoting sustainable and ethical food production further support market expansion. Finally, the rising demand for convenient and versatile food options fuels market growth.

Challenges in the Australia Non-Dairy Milk Market Sector

The Australian non-dairy milk market faces challenges like fluctuating raw material prices impacting profitability. Intense competition and the emergence of new players create pressure on pricing and market share. Maintaining consistent product quality and addressing potential allergen concerns are vital operational issues.

Leading Players in the Australia Non-Dairy Milk Market Market

- Minor Figures Limited

- Noumi Ltd

- Califia Farms LLC

- PureHarvest

- Blue Diamond Growers

- Oatly Group AB

- Vitasoy International Holdings Ltd

- Sanitarium Health and Wellbeing Company

Key Developments in Australia Non-Dairy Milk Market Sector

- August 2022: Vitasoy launched a new barista milk series in Southeast Asia, designed for coffee applications. This expansion into the food service industry could significantly boost Vitasoy's market share.

- September 2022: Vitasoy launched its Plant+ range of plant-based milk, including oat and almond varieties with low sugar, high calcium, and zero cholesterol, in Australia. This launch caters to the growing demand for healthier and more nutritious non-dairy milk options.

- September 2022: Vitasoy launched the Vitasoy Plant+ range in Singapore. This expansion into new markets highlights the increasing global appeal of plant-based milk alternatives.

Strategic Australia Non-Dairy Milk Market Market Outlook

The Australian non-dairy milk market presents significant growth opportunities, driven by escalating consumer demand and product innovation. Strategic partnerships, investments in research and development, and expansion into new market segments are crucial for success. Companies that effectively address consumer preferences for health, sustainability, and convenience are poised to capture a greater market share in the years to come. The focus on functional benefits and targeted marketing strategies will be key differentiators.

Australia Non-Dairy Milk Market Segmentation

-

1. Product Type

- 1.1. Almond Milk

- 1.2. Cashew Milk

- 1.3. Coconut Milk

- 1.4. Hazelnut Milk

- 1.5. Oat Milk

- 1.6. Soy Milk

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Retail

- 2.1.3. Specialist Retailers

- 2.1.4. Supermarkets and Hypermarkets

- 2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 2.2. On-Trade

-

2.1. Off-Trade

Australia Non-Dairy Milk Market Segmentation By Geography

- 1. Australia

Australia Non-Dairy Milk Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.35% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages

- 3.3. Market Restrains

- 3.3.1. Competition from Substitute Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Non-Dairy Milk Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Almond Milk

- 5.1.2. Cashew Milk

- 5.1.3. Coconut Milk

- 5.1.4. Hazelnut Milk

- 5.1.5. Oat Milk

- 5.1.6. Soy Milk

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Retail

- 5.2.1.3. Specialist Retailers

- 5.2.1.4. Supermarkets and Hypermarkets

- 5.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Minor Figures Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Noumi Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Califia Farms LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PureHarvest

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Blue Diamond Growers

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oatly Group AB

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vitasoy International Holdings Lt

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sanitarium Health and Wellbeing Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Minor Figures Limited

List of Figures

- Figure 1: Australia Non-Dairy Milk Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Non-Dairy Milk Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Non-Dairy Milk Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Non-Dairy Milk Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Australia Non-Dairy Milk Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Australia Non-Dairy Milk Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Australia Non-Dairy Milk Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Australia Non-Dairy Milk Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: Australia Non-Dairy Milk Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Australia Non-Dairy Milk Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Non-Dairy Milk Market?

The projected CAGR is approximately 5.35%.

2. Which companies are prominent players in the Australia Non-Dairy Milk Market?

Key companies in the market include Minor Figures Limited, Noumi Ltd, Califia Farms LLC, PureHarvest, Blue Diamond Growers, Oatly Group AB, Vitasoy International Holdings Lt, Sanitarium Health and Wellbeing Company.

3. What are the main segments of the Australia Non-Dairy Milk Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition from Substitute Products.

8. Can you provide examples of recent developments in the market?

September 2022: Vitasoy launched a plant-based milk range Plant+, which includes oat and almond milk varieties with zero cholesterol, low sugar, and high calcium.September 2022: Vitasoy launched the Vitasoy Plant+ range of plant milk in the Singaporean market. These plant-based milk products are available in almond, oat, and soy varieties and are high in calcium and low in sugar with zero cholesterol.August 2022: Vitasoy launched new barista milk series in Southeast Asia, specially designed for coffee.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Non-Dairy Milk Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Non-Dairy Milk Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Non-Dairy Milk Market?

To stay informed about further developments, trends, and reports in the Australia Non-Dairy Milk Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence