Key Insights

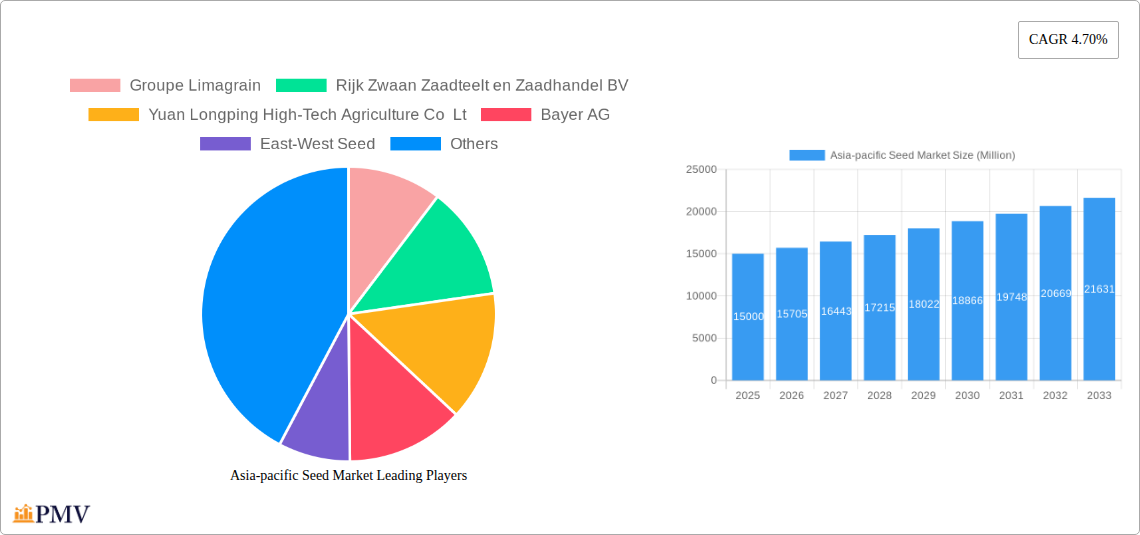

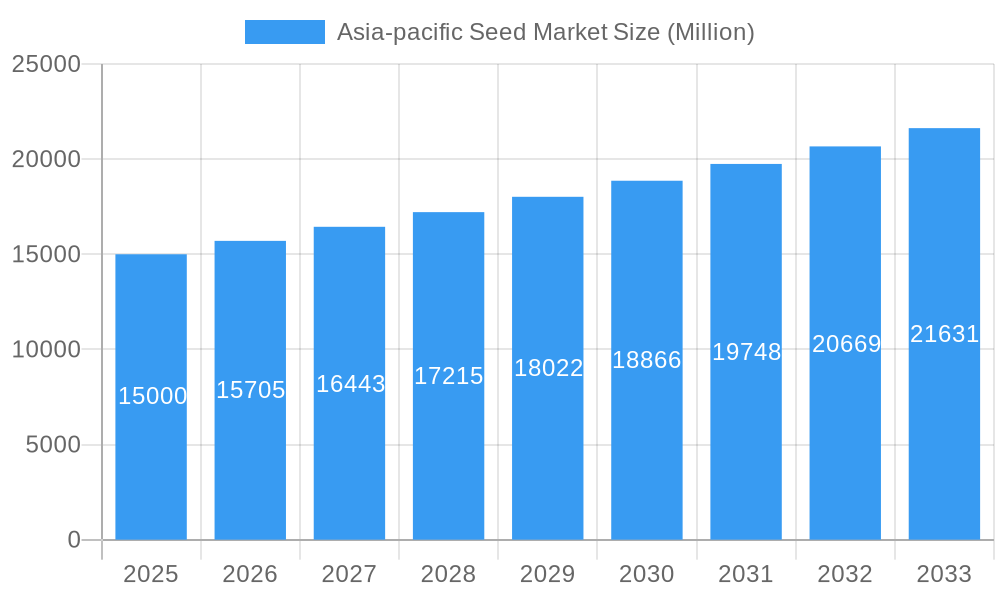

The Asia-Pacific seed market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.70% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the rising demand for food security across rapidly growing populations in countries like India, China, and Indonesia is pushing farmers towards higher-yielding and disease-resistant seed varieties. Secondly, increasing government initiatives promoting sustainable agriculture and technological advancements in seed breeding (hybrids, genetically modified crops) are contributing to market growth. The shift towards protected cultivation, particularly in countries like Japan and South Korea, further enhances the market's potential. Finally, growing awareness among farmers regarding improved seed quality and its positive impact on crop yield and profitability is bolstering market adoption. Within the region, China and India are anticipated to remain the largest markets, due to their extensive agricultural land and substantial farming communities. However, other Southeast Asian nations are witnessing significant growth spurred by investments in agricultural infrastructure and technological adoption. While the market faces challenges like climate change variability affecting crop yields and fluctuating commodity prices, the overall positive growth trajectory remains firmly in place, driven by strong underlying demand and continuous technological advancements.

Asia-pacific Seed Market Market Size (In Billion)

Despite the promising growth prospects, the Asia-Pacific seed market faces some restraints. These include the inconsistent agricultural infrastructure across the region, particularly in less developed nations, limiting the effectiveness of high-yielding seed varieties. Furthermore, the dependence on weather patterns and the vulnerability to climate change impacts (droughts, floods) poses a significant risk to crop yields, indirectly affecting seed demand. Competition among numerous multinational and regional players also exerts pressure on pricing and market share. Nonetheless, the market's inherent strength, driven by the increasing need for food security and the ongoing focus on agricultural modernization, positions it for sustained expansion in the forecast period. Segment-wise, row crops and hybrid breeding technologies are expected to dominate, with a gradual increase in the adoption of protected cultivation techniques across the region.

Asia-pacific Seed Market Company Market Share

Asia-Pacific Seed Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific seed market, covering the period from 2019 to 2033. It offers actionable insights into market dynamics, competitive landscapes, and future growth prospects, empowering stakeholders to make informed strategic decisions. The report segments the market by crop type, breeding technology, cultivation mechanism, country, and other key parameters, providing granular data for effective market analysis. With a base year of 2025 and a forecast period spanning 2025-2033, this report is an essential resource for businesses operating in or planning to enter the dynamic Asia-Pacific seed market. The market is estimated to be valued at xx Million in 2025.

Asia-Pacific Seed Market Market Structure & Competitive Dynamics

The Asia-Pacific seed market exhibits a moderately concentrated structure, with a few multinational corporations and several regional players vying for market share. Market concentration is influenced by factors such as economies of scale, research and development capabilities, and distribution networks. The market’s innovation ecosystem is vibrant, driven by continuous efforts to develop improved seed varieties with higher yields, disease resistance, and adaptability to changing climatic conditions. Regulatory frameworks vary across countries, impacting market access and product registration. While there are some substitutes available (e.g., traditional seed saving practices), the demand for high-quality, high-yielding seeds remains strong. End-user trends are shifting towards a preference for advanced hybrid seeds and those with improved traits like herbicide tolerance and pest resistance. Mergers and acquisitions (M&A) activity has been moderate in recent years, with deal values ranging from xx Million to xx Million, primarily driven by strategies to expand market reach and product portfolios. Major players such as Bayer AG and Syngenta Group have played a significant role in shaping the market structure through strategic acquisitions. Key players' market share varies, with the top five companies holding an estimated xx% of the total market.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Ecosystem: Highly active, focusing on improved yields and disease resistance.

- Regulatory Frameworks: Varied across countries, impacting market access.

- M&A Activity: Moderate, with deal values ranging from xx Million to xx Million.

Asia-Pacific Seed Market Industry Trends & Insights

The Asia-Pacific seed market is experiencing significant growth, driven by factors such as rising demand for food security, increasing agricultural productivity, and growing adoption of modern farming practices. The market's Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected to be xx%. Technological disruptions, including advancements in biotechnology and precision agriculture, are transforming the seed industry. Consumer preferences are shifting towards higher-yielding, climate-resilient, and disease-resistant seed varieties. The competitive landscape is characterized by intense competition among both global and regional players, leading to continuous innovation and product diversification. Market penetration of hybrid seeds is increasing across various crop types, signifying a growing adoption of advanced agricultural technologies. The market is also witnessing an increased focus on sustainable agricultural practices, which is driving the demand for seeds that are environmentally friendly and efficient.

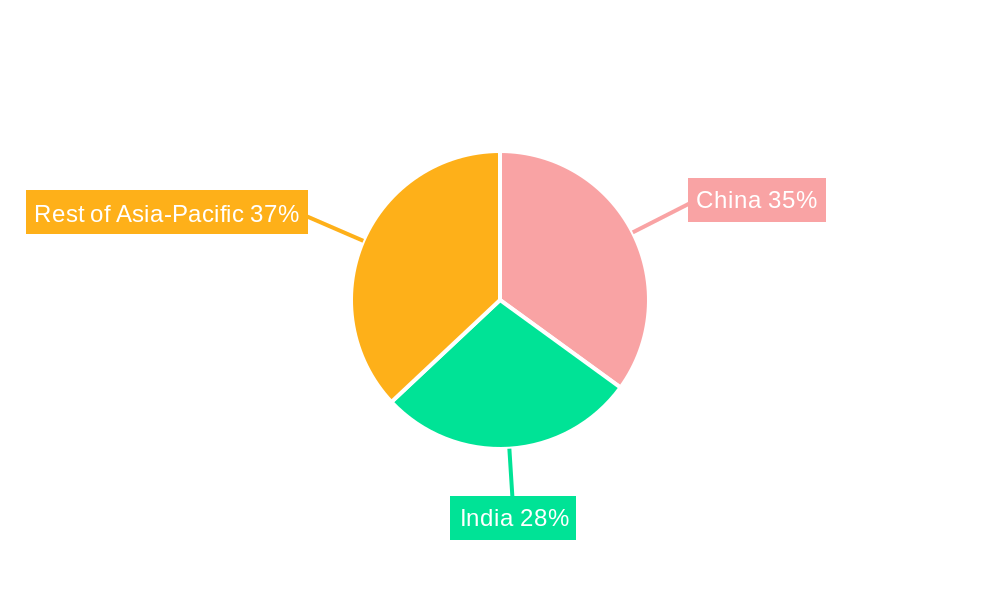

Dominant Markets & Segments in Asia-Pacific Seed Market

China and India dominate the Asia-Pacific seed market due to their vast agricultural lands and large populations. Other significant markets include Indonesia, Australia, and Vietnam. Within the market segments, row crops (e.g., rice, corn, and wheat) constitute the largest segment, owing to their extensive cultivation and high demand. Hybrid seeds are the most preferred breeding technology, demonstrating the industry's preference for improved genetics and high yields. Open field cultivation remains the dominant method, although protected cultivation is steadily gaining traction, especially in high-value crop production. Pulses and vegetables also contribute significantly to the market.

- Key Drivers for Dominant Markets:

- China: Large agricultural land, government support for agricultural development, and high demand for food.

- India: Large population, increasing agricultural productivity, and government initiatives promoting improved seeds.

- Indonesia: Growing demand for food security, favorable climatic conditions, and expanding agricultural infrastructure.

- Australia: High agricultural output, significant investment in agricultural research, and advanced farming technologies.

- Vietnam: Rising agricultural production, significant export potential, and growing adoption of modern farming practices.

The dominance of these markets is supported by economic policies promoting agricultural growth, robust infrastructure development for efficient seed distribution, and the presence of strong local seed companies and distribution channels.

Asia-Pacific Seed Market Product Innovations

Recent innovations in the Asia-Pacific seed market include the development of herbicide-tolerant varieties, disease-resistant hybrids, and seeds with improved nutritional content. Technological trends such as CRISPR-Cas9 gene editing are revolutionizing seed breeding, allowing for the development of seeds with superior traits. The market fit for these innovations is strong, given the increasing need for sustainable and climate-resilient agriculture. New product launches, such as the BASF’s Xitavo soybean seeds and Pacific Seeds’ canola varieties, reflect this trend towards enhanced yield and stress tolerance.

Report Segmentation & Scope

This report segments the Asia-Pacific seed market across various dimensions:

Crop Type: Row Crops, Pulses, Vegetables, Other Unclassified Vegetables. Each segment presents unique growth projections and market dynamics, with row crops currently dominating market share.

Breeding Technology: Hybrids, Conventional. The hybrid segment is the fastest-growing, reflecting a strong preference for improved genetic traits.

Cultivation Mechanism: Open Field, Protected Cultivation. Open field cultivation holds the larger market share, but protected cultivation is showing promising growth, particularly in high-value vegetables.

Country: Australia, Bangladesh, China, India, Indonesia, Japan, Myanmar, Pakistan, Philippines, Thailand, Vietnam, Rest of Asia-Pacific. Each country offers unique market opportunities and challenges due to varying regulatory landscapes, climates, and agricultural practices.

Key Drivers of Asia-pacific Seed Market Growth

Several factors drive the growth of the Asia-Pacific seed market. These include rising demand for food driven by population growth, government initiatives promoting agricultural modernization, increasing adoption of advanced agricultural technologies like precision farming and biotechnology, and the rising awareness about climate change and the need for climate-resilient crops. Furthermore, the growing demand for higher-yielding and disease-resistant seeds fuels the market's expansion.

Challenges in the Asia-pacific Seed Market Sector

Challenges in the Asia-Pacific seed market include: varying regulatory frameworks across different countries, resulting in complexities in product registration and approval; supply chain disruptions impacting seed distribution; and intense competition from both established and emerging players, demanding continuous innovation. Climate change also poses a significant challenge, impacting crop yields and requiring the development of seeds that can withstand changing weather patterns. The impact of these factors can lead to variations in pricing and market access.

Leading Players in the Asia-Pacific Seed Market Market

- Groupe Limagrain

- Rijk Zwaan Zaadteelt en Zaadhandel BV

- Yuan Longping High-Tech Agriculture Co Ltd

- Bayer AG

- East-West Seed

- Syngenta Group

- Advanta Seeds - UPL

- Corteva Agriscience

- Bejo Zaden BV

- BASF SE

Key Developments in Asia-Pacific Seed Market Sector

July 2023: BASF expanded its Xitavo soybean seed portfolio with 11 new high-yielding varieties for the 2024 growing season, featuring Enlist E3 technology. This strengthens their position in the soybean seed market.

July 2023: Pacific Seeds (Advanta Seeds) introduced two new canola hybrid varieties in Australia, enhancing yield and disease resistance, and improving weed control flexibility. This expansion in the Australian market signals a strong focus on high-value crops.

August 2023: Bayer AG launched the herbicide-tolerant biotech corn Dekalb DK95R in Indonesia. This launch expands Bayer's presence in the Indonesian corn market and highlights the increasing adoption of biotechnological advancements in seed technology.

Strategic Asia-Pacific Seed Market Outlook

The Asia-Pacific seed market presents significant growth opportunities in the coming years. Continued focus on research and development, strategic alliances, and expansion into new markets will be crucial for success. The increasing adoption of advanced technologies, coupled with a growing awareness of sustainable agriculture, will shape market dynamics. Players who adapt to changing consumer preferences and invest in developing climate-resilient seed varieties are poised to capture significant market share. The long-term outlook remains positive, with substantial growth expected across various segments and geographies.

Asia-pacific Seed Market Segmentation

-

1. Breeding Technology

-

1.1. Hybrids

- 1.1.1. Non-Transgenic Hybrids

- 1.1.2. Herbicide Tolerant Hybrids

- 1.1.3. Insect Resistant Hybrids

- 1.1.4. Other Traits

- 1.2. Open Pollinated Varieties & Hybrid Derivatives

-

1.1. Hybrids

-

2. Cultivation Mechanism

- 2.1. Open Field

- 2.2. Protected Cultivation

-

3. Crop Type

-

3.1. Row Crops

-

3.1.1. Fiber Crops

- 3.1.1.1. Cotton

- 3.1.1.2. Other Fiber Crops

-

3.1.2. Forage Crops

- 3.1.2.1. Alfalfa

- 3.1.2.2. Forage Corn

- 3.1.2.3. Forage Sorghum

- 3.1.2.4. Other Forage Crops

-

3.1.3. Grains & Cereals

- 3.1.3.1. Rice

- 3.1.3.2. Wheat

- 3.1.3.3. Other Grains & Cereals

-

3.1.4. Oilseeds

- 3.1.4.1. Canola, Rapeseed & Mustard

- 3.1.4.2. Soybean

- 3.1.4.3. Sunflower

- 3.1.4.4. Other Oilseeds

- 3.1.5. Pulses

-

3.1.1. Fiber Crops

-

3.2. Vegetables

-

3.2.1. Brassicas

- 3.2.1.1. Cabbage

- 3.2.1.2. Carrot

- 3.2.1.3. Cauliflower & Broccoli

- 3.2.1.4. Other Brassicas

-

3.2.2. Cucurbits

- 3.2.2.1. Cucumber & Gherkin

- 3.2.2.2. Pumpkin & Squash

- 3.2.2.3. Other Cucurbits

-

3.2.3. Roots & Bulbs

- 3.2.3.1. Garlic

- 3.2.3.2. Onion

- 3.2.3.3. Potato

- 3.2.3.4. Other Roots & Bulbs

-

3.2.4. Solanaceae

- 3.2.4.1. Chilli

- 3.2.4.2. Eggplant

- 3.2.4.3. Tomato

- 3.2.4.4. Other Solanaceae

-

3.2.5. Unclassified Vegetables

- 3.2.5.1. Asparagus

- 3.2.5.2. Lettuce

- 3.2.5.3. Okra

- 3.2.5.4. Peas

- 3.2.5.5. Spinach

- 3.2.5.6. Other Unclassified Vegetables

-

3.2.1. Brassicas

-

3.1. Row Crops

-

4. Breeding Technology

-

4.1. Hybrids

- 4.1.1. Non-Transgenic Hybrids

- 4.1.2. Herbicide Tolerant Hybrids

- 4.1.3. Insect Resistant Hybrids

- 4.1.4. Other Traits

- 4.2. Open Pollinated Varieties & Hybrid Derivatives

-

4.1. Hybrids

-

5. Cultivation Mechanism

- 5.1. Open Field

- 5.2. Protected Cultivation

-

6. Crop Type

-

6.1. Row Crops

-

6.1.1. Fiber Crops

- 6.1.1.1. Cotton

- 6.1.1.2. Other Fiber Crops

-

6.1.2. Forage Crops

- 6.1.2.1. Alfalfa

- 6.1.2.2. Forage Corn

- 6.1.2.3. Forage Sorghum

- 6.1.2.4. Other Forage Crops

-

6.1.3. Grains & Cereals

- 6.1.3.1. Rice

- 6.1.3.2. Wheat

- 6.1.3.3. Other Grains & Cereals

-

6.1.4. Oilseeds

- 6.1.4.1. Canola, Rapeseed & Mustard

- 6.1.4.2. Soybean

- 6.1.4.3. Sunflower

- 6.1.4.4. Other Oilseeds

- 6.1.5. Pulses

-

6.1.1. Fiber Crops

-

6.2. Vegetables

-

6.2.1. Brassicas

- 6.2.1.1. Cabbage

- 6.2.1.2. Carrot

- 6.2.1.3. Cauliflower & Broccoli

- 6.2.1.4. Other Brassicas

-

6.2.2. Cucurbits

- 6.2.2.1. Cucumber & Gherkin

- 6.2.2.2. Pumpkin & Squash

- 6.2.2.3. Other Cucurbits

-

6.2.3. Roots & Bulbs

- 6.2.3.1. Garlic

- 6.2.3.2. Onion

- 6.2.3.3. Potato

- 6.2.3.4. Other Roots & Bulbs

-

6.2.4. Solanaceae

- 6.2.4.1. Chilli

- 6.2.4.2. Eggplant

- 6.2.4.3. Tomato

- 6.2.4.4. Other Solanaceae

-

6.2.5. Unclassified Vegetables

- 6.2.5.1. Asparagus

- 6.2.5.2. Lettuce

- 6.2.5.3. Okra

- 6.2.5.4. Peas

- 6.2.5.5. Spinach

- 6.2.5.6. Other Unclassified Vegetables

-

6.2.1. Brassicas

-

6.1. Row Crops

Asia-pacific Seed Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-pacific Seed Market Regional Market Share

Geographic Coverage of Asia-pacific Seed Market

Asia-pacific Seed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-pacific Seed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 5.1.1. Hybrids

- 5.1.1.1. Non-Transgenic Hybrids

- 5.1.1.2. Herbicide Tolerant Hybrids

- 5.1.1.3. Insect Resistant Hybrids

- 5.1.1.4. Other Traits

- 5.1.2. Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1. Hybrids

- 5.2. Market Analysis, Insights and Forecast - by Cultivation Mechanism

- 5.2.1. Open Field

- 5.2.2. Protected Cultivation

- 5.3. Market Analysis, Insights and Forecast - by Crop Type

- 5.3.1. Row Crops

- 5.3.1.1. Fiber Crops

- 5.3.1.1.1. Cotton

- 5.3.1.1.2. Other Fiber Crops

- 5.3.1.2. Forage Crops

- 5.3.1.2.1. Alfalfa

- 5.3.1.2.2. Forage Corn

- 5.3.1.2.3. Forage Sorghum

- 5.3.1.2.4. Other Forage Crops

- 5.3.1.3. Grains & Cereals

- 5.3.1.3.1. Rice

- 5.3.1.3.2. Wheat

- 5.3.1.3.3. Other Grains & Cereals

- 5.3.1.4. Oilseeds

- 5.3.1.4.1. Canola, Rapeseed & Mustard

- 5.3.1.4.2. Soybean

- 5.3.1.4.3. Sunflower

- 5.3.1.4.4. Other Oilseeds

- 5.3.1.5. Pulses

- 5.3.1.1. Fiber Crops

- 5.3.2. Vegetables

- 5.3.2.1. Brassicas

- 5.3.2.1.1. Cabbage

- 5.3.2.1.2. Carrot

- 5.3.2.1.3. Cauliflower & Broccoli

- 5.3.2.1.4. Other Brassicas

- 5.3.2.2. Cucurbits

- 5.3.2.2.1. Cucumber & Gherkin

- 5.3.2.2.2. Pumpkin & Squash

- 5.3.2.2.3. Other Cucurbits

- 5.3.2.3. Roots & Bulbs

- 5.3.2.3.1. Garlic

- 5.3.2.3.2. Onion

- 5.3.2.3.3. Potato

- 5.3.2.3.4. Other Roots & Bulbs

- 5.3.2.4. Solanaceae

- 5.3.2.4.1. Chilli

- 5.3.2.4.2. Eggplant

- 5.3.2.4.3. Tomato

- 5.3.2.4.4. Other Solanaceae

- 5.3.2.5. Unclassified Vegetables

- 5.3.2.5.1. Asparagus

- 5.3.2.5.2. Lettuce

- 5.3.2.5.3. Okra

- 5.3.2.5.4. Peas

- 5.3.2.5.5. Spinach

- 5.3.2.5.6. Other Unclassified Vegetables

- 5.3.2.1. Brassicas

- 5.3.1. Row Crops

- 5.4. Market Analysis, Insights and Forecast - by Breeding Technology

- 5.4.1. Hybrids

- 5.4.1.1. Non-Transgenic Hybrids

- 5.4.1.2. Herbicide Tolerant Hybrids

- 5.4.1.3. Insect Resistant Hybrids

- 5.4.1.4. Other Traits

- 5.4.2. Open Pollinated Varieties & Hybrid Derivatives

- 5.4.1. Hybrids

- 5.5. Market Analysis, Insights and Forecast - by Cultivation Mechanism

- 5.5.1. Open Field

- 5.5.2. Protected Cultivation

- 5.6. Market Analysis, Insights and Forecast - by Crop Type

- 5.6.1. Row Crops

- 5.6.1.1. Fiber Crops

- 5.6.1.1.1. Cotton

- 5.6.1.1.2. Other Fiber Crops

- 5.6.1.2. Forage Crops

- 5.6.1.2.1. Alfalfa

- 5.6.1.2.2. Forage Corn

- 5.6.1.2.3. Forage Sorghum

- 5.6.1.2.4. Other Forage Crops

- 5.6.1.3. Grains & Cereals

- 5.6.1.3.1. Rice

- 5.6.1.3.2. Wheat

- 5.6.1.3.3. Other Grains & Cereals

- 5.6.1.4. Oilseeds

- 5.6.1.4.1. Canola, Rapeseed & Mustard

- 5.6.1.4.2. Soybean

- 5.6.1.4.3. Sunflower

- 5.6.1.4.4. Other Oilseeds

- 5.6.1.5. Pulses

- 5.6.1.1. Fiber Crops

- 5.6.2. Vegetables

- 5.6.2.1. Brassicas

- 5.6.2.1.1. Cabbage

- 5.6.2.1.2. Carrot

- 5.6.2.1.3. Cauliflower & Broccoli

- 5.6.2.1.4. Other Brassicas

- 5.6.2.2. Cucurbits

- 5.6.2.2.1. Cucumber & Gherkin

- 5.6.2.2.2. Pumpkin & Squash

- 5.6.2.2.3. Other Cucurbits

- 5.6.2.3. Roots & Bulbs

- 5.6.2.3.1. Garlic

- 5.6.2.3.2. Onion

- 5.6.2.3.3. Potato

- 5.6.2.3.4. Other Roots & Bulbs

- 5.6.2.4. Solanaceae

- 5.6.2.4.1. Chilli

- 5.6.2.4.2. Eggplant

- 5.6.2.4.3. Tomato

- 5.6.2.4.4. Other Solanaceae

- 5.6.2.5. Unclassified Vegetables

- 5.6.2.5.1. Asparagus

- 5.6.2.5.2. Lettuce

- 5.6.2.5.3. Okra

- 5.6.2.5.4. Peas

- 5.6.2.5.5. Spinach

- 5.6.2.5.6. Other Unclassified Vegetables

- 5.6.2.1. Brassicas

- 5.6.1. Row Crops

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Groupe Limagrain

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rijk Zwaan Zaadteelt en Zaadhandel BV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yuan Longping High-Tech Agriculture Co Lt

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bayer AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 East-West Seed

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Syngenta Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Advanta Seeds - UPL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Corteva Agriscience

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bejo Zaden BV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Groupe Limagrain

List of Figures

- Figure 1: Asia-pacific Seed Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-pacific Seed Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-pacific Seed Market Revenue Million Forecast, by Breeding Technology 2020 & 2033

- Table 2: Asia-pacific Seed Market Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 3: Asia-pacific Seed Market Revenue Million Forecast, by Cultivation Mechanism 2020 & 2033

- Table 4: Asia-pacific Seed Market Volume Kiloton Forecast, by Cultivation Mechanism 2020 & 2033

- Table 5: Asia-pacific Seed Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 6: Asia-pacific Seed Market Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 7: Asia-pacific Seed Market Revenue Million Forecast, by Breeding Technology 2020 & 2033

- Table 8: Asia-pacific Seed Market Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 9: Asia-pacific Seed Market Revenue Million Forecast, by Cultivation Mechanism 2020 & 2033

- Table 10: Asia-pacific Seed Market Volume Kiloton Forecast, by Cultivation Mechanism 2020 & 2033

- Table 11: Asia-pacific Seed Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 12: Asia-pacific Seed Market Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 13: Asia-pacific Seed Market Revenue Million Forecast, by Region 2020 & 2033

- Table 14: Asia-pacific Seed Market Volume Kiloton Forecast, by Region 2020 & 2033

- Table 15: Asia-pacific Seed Market Revenue Million Forecast, by Breeding Technology 2020 & 2033

- Table 16: Asia-pacific Seed Market Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 17: Asia-pacific Seed Market Revenue Million Forecast, by Cultivation Mechanism 2020 & 2033

- Table 18: Asia-pacific Seed Market Volume Kiloton Forecast, by Cultivation Mechanism 2020 & 2033

- Table 19: Asia-pacific Seed Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 20: Asia-pacific Seed Market Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 21: Asia-pacific Seed Market Revenue Million Forecast, by Breeding Technology 2020 & 2033

- Table 22: Asia-pacific Seed Market Volume Kiloton Forecast, by Breeding Technology 2020 & 2033

- Table 23: Asia-pacific Seed Market Revenue Million Forecast, by Cultivation Mechanism 2020 & 2033

- Table 24: Asia-pacific Seed Market Volume Kiloton Forecast, by Cultivation Mechanism 2020 & 2033

- Table 25: Asia-pacific Seed Market Revenue Million Forecast, by Crop Type 2020 & 2033

- Table 26: Asia-pacific Seed Market Volume Kiloton Forecast, by Crop Type 2020 & 2033

- Table 27: Asia-pacific Seed Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Asia-pacific Seed Market Volume Kiloton Forecast, by Country 2020 & 2033

- Table 29: China Asia-pacific Seed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: China Asia-pacific Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 31: Japan Asia-pacific Seed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Japan Asia-pacific Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 33: South Korea Asia-pacific Seed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: South Korea Asia-pacific Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 35: India Asia-pacific Seed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: India Asia-pacific Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 37: Australia Asia-pacific Seed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Australia Asia-pacific Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 39: New Zealand Asia-pacific Seed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: New Zealand Asia-pacific Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 41: Indonesia Asia-pacific Seed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Indonesia Asia-pacific Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 43: Malaysia Asia-pacific Seed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Malaysia Asia-pacific Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 45: Singapore Asia-pacific Seed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Singapore Asia-pacific Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 47: Thailand Asia-pacific Seed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Thailand Asia-pacific Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 49: Vietnam Asia-pacific Seed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Vietnam Asia-pacific Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

- Table 51: Philippines Asia-pacific Seed Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Philippines Asia-pacific Seed Market Volume (Kiloton) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-pacific Seed Market?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the Asia-pacific Seed Market?

Key companies in the market include Groupe Limagrain, Rijk Zwaan Zaadteelt en Zaadhandel BV, Yuan Longping High-Tech Agriculture Co Lt, Bayer AG, East-West Seed, Syngenta Group, Advanta Seeds - UPL, Corteva Agriscience, Bejo Zaden BV, BASF SE.

3. What are the main segments of the Asia-pacific Seed Market?

The market segments include Breeding Technology, Cultivation Mechanism, Crop Type, Breeding Technology, Cultivation Mechanism, Crop Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

August 2023: Bayer AG launched the herbicide-tolerant biotech corn Dekalb DK95R in Banggo village, Manggalewa district, Dompu Regency, West Nusa Tenggara, Indonesia.July 2023: BASF expanded its Xitavo soybean seed portfolio with the addition of its 11 new high-yielding varieties for the 2024 growing season, featuring the Enlist E3 technology to combat difficult weeds.July 2023: Pacific Seeds, a subsidiary of Advanta Seeds, introduced two new canola hybrid varieties, Hyola Defender CT and Hayola Continuum CL, to the Australian market. These varieties offer high-yield performance, strong disease resistance, elevated oil content, and enhanced weed control flexibility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-pacific Seed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-pacific Seed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-pacific Seed Market?

To stay informed about further developments, trends, and reports in the Asia-pacific Seed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence