Key Insights

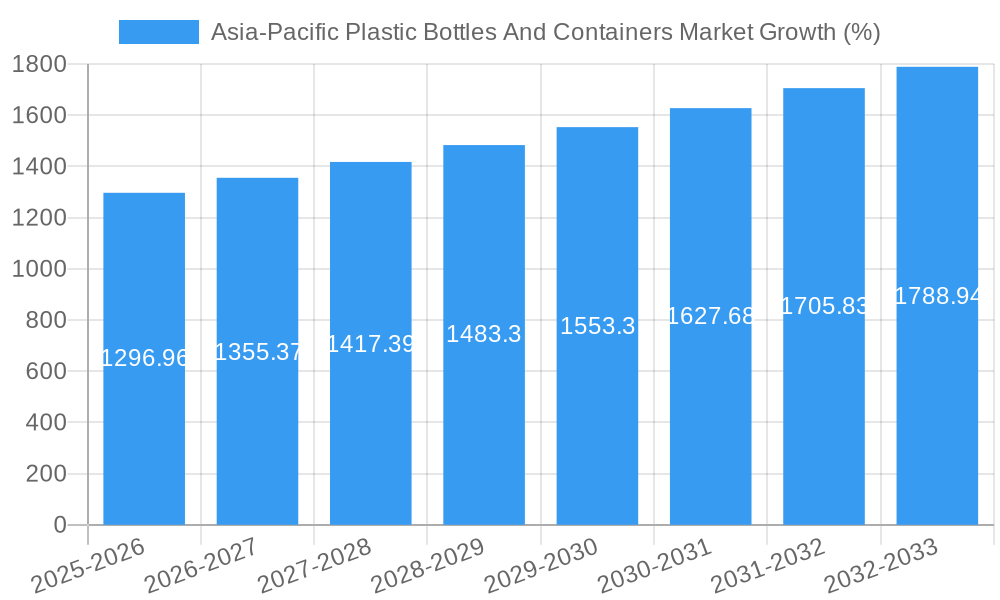

The Asia-Pacific plastic bottles and containers market, valued at $28.28 billion in 2025, is projected to experience robust growth, driven by increasing demand from the food and beverage industries, expanding e-commerce, and a surge in consumer packaged goods (CPGs). The region's burgeoning population, rapid urbanization, and rising disposable incomes fuel this demand. Key growth drivers include the lightweight nature of plastic, its cost-effectiveness, and its versatility in packaging various products. However, the market faces challenges from growing environmental concerns surrounding plastic waste and increasing regulations promoting sustainable alternatives. The dominance of PET and PP as raw materials reflects their superior properties for packaging various products. While China and India are the largest markets, other Southeast Asian nations are emerging as significant contributors. Competitive pressures among established players like Mauser Packaging Solutions, Berry Global Inc., and Alpla Group, alongside local manufacturers, are intensifying. The market segmentation by raw material and end-use vertical allows for a nuanced understanding of growth potential within specific niches, such as specialized food packaging or pharmaceutical containers. The forecast period (2025-2033) anticipates a continuation of this growth trajectory, though the rate may moderate slightly due to regulatory pressures and the growing adoption of sustainable packaging solutions. Innovation in recycled plastics and biodegradable alternatives will be crucial factors influencing market dynamics in the coming years.

The ongoing shift towards sustainable practices in the Asia-Pacific region presents both challenges and opportunities. While environmental concerns are leading to stricter regulations on plastic waste, it also stimulates innovation in recycled plastic content and biodegradable alternatives. Companies are investing in research and development to produce more environmentally friendly packaging, aligning with the growing consumer preference for sustainable products. This trend could lead to a shift in material usage within the market, with a greater share for recycled PET and other eco-friendly materials. The competitive landscape will continue to be dynamic, with companies focusing on improving their product offerings, supply chain efficiency, and sustainable practices to secure market share. Geographic expansion into emerging markets within Southeast Asia will also be a key strategy for both multinational and regional players. Successfully navigating these challenges and capitalizing on the emerging opportunities will require a strategic approach that balances market growth with sustainability concerns.

Asia-Pacific Plastic Bottles and Containers Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific plastic bottles and containers market, covering market size, growth drivers, competitive landscape, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for businesses operating in or seeking to enter this dynamic market.

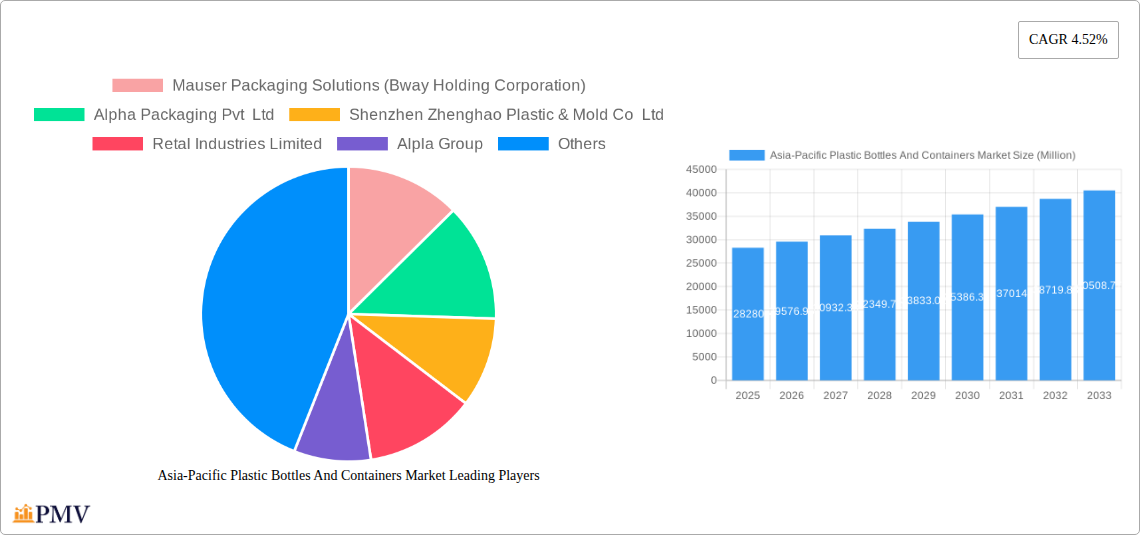

Asia-Pacific Plastic Bottles and Containers Market Market Structure & Competitive Dynamics

The Asia-Pacific plastic bottles and containers market exhibits a moderately concentrated structure, with several key players commanding significant market share. The market's competitive dynamics are shaped by factors such as innovation in materials and manufacturing processes, evolving regulatory frameworks addressing plastic waste, and the increasing adoption of sustainable packaging solutions. Significant mergers and acquisitions (M&A) activities further influence market consolidation and competitive positioning.

For instance, the recent acquisition of Oricon Enterprises Limited's plastics packaging business by Manjushree Technopack (USD 62.97 Million) signifies a trend towards consolidation and expansion of market players. This deal demonstrates the pursuit of operational synergies, enhanced product portfolios (including caps, closures, and preforms), and strengthened customer relationships within the beverage sector.

Market share data for key players (estimated 2025):

- Mauser Packaging Solutions (Bway Holding Corporation): xx%

- Alpha Packaging Pvt Ltd: xx%

- Shenzhen Zhenghao Plastic & Mold Co Ltd: xx%

- Retal Industries Limited: xx%

- Alpla Group: xx%

- Manjushree Technopack Limite: xx%

- Greiner Packaging International GmbH: xx%

- Pact Group Holdings Limited: xx%

- Berry Global Inc: xx%

- Gerresheimer AG: xx%

- Zhejiang Xinlei Packaging Co Ltd: xx%

The competitive landscape is further influenced by:

- Innovation Ecosystems: Companies are investing heavily in R&D to develop lighter, more sustainable, and recyclable plastic containers.

- Regulatory Frameworks: Governments across the Asia-Pacific region are implementing stricter regulations on plastic waste management, influencing packaging choices and material selection.

- Product Substitutes: The increasing popularity of alternative packaging materials, such as glass, paper, and biodegradable plastics, presents a challenge to the dominance of plastic.

- End-User Trends: Growing demand from the food and beverage industry and the healthcare sector, as well as the rise in e-commerce, drives market growth.

The overall market value in 2025 is estimated at USD xx Million, with a projected CAGR of xx% during the forecast period (2025-2033).

Asia-Pacific Plastic Bottles and Containers Market Industry Trends & Insights

The Asia-Pacific plastic bottles and containers market is experiencing robust growth, driven by several key factors. Rising disposable incomes, urbanization, and changing lifestyles are fueling demand for packaged goods across various sectors. Technological advancements in plastic manufacturing and packaging design are also contributing to market expansion. The increasing preference for convenience and on-the-go consumption further boosts the demand for plastic bottles and containers.

However, growing environmental concerns related to plastic waste are prompting the adoption of sustainable packaging practices. This includes the development of lightweight, recyclable, and biodegradable plastic containers. Furthermore, stringent government regulations on plastic waste management are pushing manufacturers to adopt eco-friendly packaging solutions.

The market is characterized by a complex interplay of factors influencing growth trajectory:

- Market Growth Drivers: Increased consumption of packaged foods and beverages, expansion of e-commerce, and growth of the healthcare sector.

- Technological Disruptions: Advancements in lightweighting technologies, recycled content incorporation, and biodegradable polymers.

- Consumer Preferences: A shift toward sustainable packaging options and convenience-focused products.

- Competitive Dynamics: Intense competition among established players and the emergence of new entrants focusing on innovation and sustainability.

The market exhibits a significant CAGR of xx% throughout the historical period (2019-2024) and is projected to maintain a healthy CAGR of xx% from 2025 to 2033. Market penetration of recycled PET in the packaging industry is increasing steadily, although it remains a significant opportunity for growth.

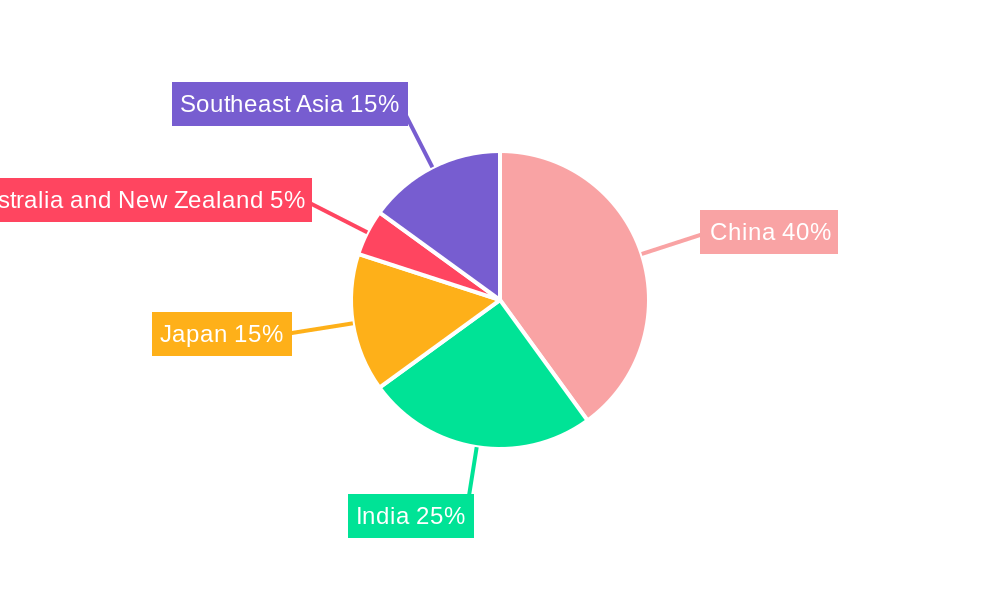

Dominant Markets & Segments in Asia-Pacific Plastic Bottles And Containers Market

Dominant Regions/Countries:

China: China holds the largest market share in the Asia-Pacific region, driven by its vast population, booming economy, and rapidly expanding consumer goods market. Key drivers include robust industrial growth, favorable government policies promoting domestic manufacturing, and a highly developed infrastructure supporting packaging production and distribution.

India: India is another rapidly growing market, propelled by a large and young population, increasing disposable incomes, and rising demand for packaged food and beverages. The key driver is the growing middle class and increased urbanization.

Southeast Asia: This region experiences significant growth due to expanding economies, rising urbanization, and increasing foreign investment in the consumer goods sector.

Dominant Segments:

By Raw Materials: Polyethylene Terephthalate (PET) currently dominates the market, primarily driven by its superior clarity, strength, and recyclability. However, Polypropylene (PP) is gaining traction due to its versatility and cost-effectiveness.

By End-user Vertical: The beverage industry holds the largest market share, followed by food and pharmaceuticals. The continued growth of e-commerce and the increasing popularity of ready-to-eat meals further fuel this trend.

Asia-Pacific Plastic Bottles And Containers Market Product Innovations

Recent innovations focus on enhancing recyclability, reducing environmental impact, and improving product performance. This includes the development of lighter-weight bottles, increased use of recycled materials, and the incorporation of biodegradable polymers. These innovations are driven by consumer demand for sustainable packaging and tightening environmental regulations. New barrier technologies are also being developed to enhance the shelf life of packaged products. The market also sees an uptick in the use of smart packaging technology.

Report Segmentation & Scope

The report segments the Asia-Pacific plastic bottles and containers market based on raw materials (PET, PP, LDPE, HDPE, Other), end-user vertical (Beverages, Food, Cosmetics, Pharmaceuticals, Household Care, Other), and country (China, India, Japan, Australia & New Zealand, Southeast Asia). Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics. For instance, the PET segment is expected to maintain a significant market share due to its widespread use in the beverage sector. The food segment is projected to experience substantial growth, driven by the rising demand for convenience food products. China and India are expected to dominate the market based on their respective population size and economic growth. Growth projections for each segment will be detailed within the main report.

Key Drivers of Asia-Pacific Plastic Bottles And Containers Market Growth

The market's growth is primarily propelled by:

- Rising Disposable Incomes: Increased purchasing power across the region leads to higher consumption of packaged goods.

- Urbanization: A large percentage of populations shift to urban centers, which increases demand for convenience packaging.

- Technological Advancements: Innovation in materials and manufacturing processes leads to more efficient and sustainable packaging solutions.

- E-commerce Growth: The burgeoning e-commerce sector boosts the demand for packaging for online deliveries.

Challenges in the Asia-Pacific Plastic Bottles And Containers Market Sector

Significant challenges facing the market include:

- Environmental Concerns: Growing awareness of plastic pollution and its environmental impact is forcing manufacturers to adopt more sustainable packaging practices.

- Regulatory Scrutiny: Stringent government regulations on plastic waste management and recycling are adding to the operational cost.

- Fluctuating Raw Material Prices: Volatility in the prices of petrochemicals affects production costs and profitability.

- Supply Chain Disruptions: Geopolitical uncertainties and logistic challenges impact production and distribution.

Leading Players in the Asia-Pacific Plastic Bottles and Containers Market Market

- Mauser Packaging Solutions (Bway Holding Corporation)

- Alpha Packaging Pvt Ltd

- Shenzhen Zhenghao Plastic & Mold Co Ltd

- Retal Industries Limited

- Alpla Group

- Manjushree Technopack Limite

- Greiner Packaging International GmbH

- Pact Group Holdings Limited

- Berry Global Inc

- Gerresheimer AG

- Zhejiang Xinlei Packaging Co Ltd

Key Developments in Asia-Pacific Plastic Bottles and Containers Market Sector

- April 2024: Manjushree Technopack's acquisition of Oricon Enterprises Limited's plastics packaging business (USD 62.97 Million) expands its capacity and product portfolio.

- February 2024: Sinopec Yangzi relaunches its PP manufacturing facility in China, increasing PP production capacity by 80,000 annually.

Strategic Asia-Pacific Plastic Bottles and Containers Market Market Outlook

The Asia-Pacific plastic bottles and containers market holds significant growth potential, driven by continuous urbanization, rising disposable incomes, and expanding e-commerce. Strategic opportunities lie in the development of sustainable and innovative packaging solutions, utilizing recycled materials and exploring biodegradable alternatives. Companies that focus on efficiency, sustainability, and adaptability to evolving regulatory landscapes are expected to thrive in this dynamic market. Investment in advanced technologies and R&D will play a critical role in shaping the future of the industry.

Asia-Pacific Plastic Bottles And Containers Market Segmentation

-

1. Raw Materials

- 1.1. Polyethylene Terephthalate (PET)

- 1.2. Polypropylene (PP)

- 1.3. Low-Density Polyethylene (LDPE)

- 1.4. High-Density Polyethylene (HDPE)

- 1.5. Other Raw Materials

-

2. End-user Vertical

-

2.1. Beverages

- 2.1.1. Bottled Water

- 2.1.2. Carbonated Soft Drinks

- 2.1.3. Dairy-based

- 2.1.4. Other Beverages

- 2.2. Food

- 2.3. Cosmetics

- 2.4. Pharmaceuticals

- 2.5. Household Care

- 2.6. Other End-user Verticals

-

2.1. Beverages

Asia-Pacific Plastic Bottles And Containers Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Plastic Bottles And Containers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.52% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Lightweight Packaging Methods; Changing Demographic and Lifestyle Factors

- 3.3. Market Restrains

- 3.3.1. Growing Environmental Concerns Over the Use of Plastics

- 3.4. Market Trends

- 3.4.1. Polyethylene Terephthalate (PET) Segment Holds Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Plastic Bottles And Containers Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Raw Materials

- 5.1.1. Polyethylene Terephthalate (PET)

- 5.1.2. Polypropylene (PP)

- 5.1.3. Low-Density Polyethylene (LDPE)

- 5.1.4. High-Density Polyethylene (HDPE)

- 5.1.5. Other Raw Materials

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Beverages

- 5.2.1.1. Bottled Water

- 5.2.1.2. Carbonated Soft Drinks

- 5.2.1.3. Dairy-based

- 5.2.1.4. Other Beverages

- 5.2.2. Food

- 5.2.3. Cosmetics

- 5.2.4. Pharmaceuticals

- 5.2.5. Household Care

- 5.2.6. Other End-user Verticals

- 5.2.1. Beverages

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Raw Materials

- 6. China Asia-Pacific Plastic Bottles And Containers Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Plastic Bottles And Containers Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Plastic Bottles And Containers Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Plastic Bottles And Containers Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Plastic Bottles And Containers Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Plastic Bottles And Containers Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Plastic Bottles And Containers Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Mauser Packaging Solutions (Bway Holding Corporation)

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Alpha Packaging Pvt Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Shenzhen Zhenghao Plastic & Mold Co Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Retal Industries Limited

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Alpla Group

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Manjushree Technopack Limite

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Greiner Packaging International GmbH

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Pact Group Holdings Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Berry Global Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Gerresheimer AG

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Zhejiang Xinlei Packaging Co Ltd

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Mauser Packaging Solutions (Bway Holding Corporation)

List of Figures

- Figure 1: Asia-Pacific Plastic Bottles And Containers Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Plastic Bottles And Containers Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Plastic Bottles And Containers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Plastic Bottles And Containers Market Revenue Million Forecast, by Raw Materials 2019 & 2032

- Table 3: Asia-Pacific Plastic Bottles And Containers Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: Asia-Pacific Plastic Bottles And Containers Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific Plastic Bottles And Containers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific Plastic Bottles And Containers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific Plastic Bottles And Containers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific Plastic Bottles And Containers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific Plastic Bottles And Containers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific Plastic Bottles And Containers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific Plastic Bottles And Containers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific Plastic Bottles And Containers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific Plastic Bottles And Containers Market Revenue Million Forecast, by Raw Materials 2019 & 2032

- Table 14: Asia-Pacific Plastic Bottles And Containers Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 15: Asia-Pacific Plastic Bottles And Containers Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia-Pacific Plastic Bottles And Containers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia-Pacific Plastic Bottles And Containers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia-Pacific Plastic Bottles And Containers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia-Pacific Plastic Bottles And Containers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia-Pacific Plastic Bottles And Containers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: New Zealand Asia-Pacific Plastic Bottles And Containers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Indonesia Asia-Pacific Plastic Bottles And Containers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia Asia-Pacific Plastic Bottles And Containers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore Asia-Pacific Plastic Bottles And Containers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand Asia-Pacific Plastic Bottles And Containers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam Asia-Pacific Plastic Bottles And Containers Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines Asia-Pacific Plastic Bottles And Containers Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Plastic Bottles And Containers Market?

The projected CAGR is approximately 4.52%.

2. Which companies are prominent players in the Asia-Pacific Plastic Bottles And Containers Market?

Key companies in the market include Mauser Packaging Solutions (Bway Holding Corporation), Alpha Packaging Pvt Ltd, Shenzhen Zhenghao Plastic & Mold Co Ltd, Retal Industries Limited, Alpla Group, Manjushree Technopack Limite, Greiner Packaging International GmbH, Pact Group Holdings Limited, Berry Global Inc, Gerresheimer AG, Zhejiang Xinlei Packaging Co Ltd.

3. What are the main segments of the Asia-Pacific Plastic Bottles And Containers Market?

The market segments include Raw Materials, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.28 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Lightweight Packaging Methods; Changing Demographic and Lifestyle Factors.

6. What are the notable trends driving market growth?

Polyethylene Terephthalate (PET) Segment Holds Major Market Share.

7. Are there any restraints impacting market growth?

Growing Environmental Concerns Over the Use of Plastics.

8. Can you provide examples of recent developments in the market?

April 2024 - Manjushree Technopack revealed its plan to acquire the plastics packaging business of Oricon Enterprises Limited for an enterprise value of INR 520 crore (USD 62.97 million). The acquired business includes Oriental Containers, a manufacturer of plastic caps and closures and preforms mostly used in beverages. Two manufacturing plants located in Goa and Odisha are part of the acquisition. The combined business is set to have a wider array of molds, machines, and SKUs strengthen unit economics due to operational synergies, and deepen key customer relationships.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Plastic Bottles And Containers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Plastic Bottles And Containers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Plastic Bottles And Containers Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Plastic Bottles And Containers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence