Key Insights

The Asia Pacific HR professional services market, valued at $123.62 million in 2025, is projected to experience robust growth, driven by several key factors. The increasing adoption of digital HR technologies, a burgeoning need for specialized HR expertise in areas like talent acquisition and employee engagement, and the region's expanding and diversifying workforce are all contributing to market expansion. Furthermore, a growing awareness of the importance of effective HR practices in driving business performance and attracting top talent fuels demand for professional services. Companies are increasingly outsourcing HR functions to focus on core competencies, further propelling market growth. While regulatory changes and economic fluctuations could pose some challenges, the overall trend indicates a positive outlook. The market is segmented based on service type (e.g., recruitment, compensation & benefits, training & development), industry vertical (e.g., technology, finance, healthcare), and company size. Major players like Adecco Group, Randstad, and ManpowerGroup hold significant market share, competing on service offerings, technology integration, and global reach. The forecast period (2025-2033) suggests sustained expansion, with a compound annual growth rate (CAGR) of 8.63%, indicating substantial opportunities for growth and investment.

Asia Pacific HR Professional Services Market Size (In Million)

The competitive landscape is characterized by both established global players and regional specialists. These companies are constantly adapting their strategies to cater to the unique needs of diverse markets within the Asia Pacific region. Growth is likely to be uneven across different countries, influenced by economic conditions, digital infrastructure, and regulatory environments. Nevertheless, the long-term growth trajectory remains positive, supported by the region's economic development and evolving business landscape. Significant opportunities exist for companies specializing in emerging technologies like AI-powered recruitment and HR analytics. The market's future growth hinges on the continuous adaptation of service offerings to emerging trends and the ability to effectively address the evolving needs of businesses in a dynamic environment.

Asia Pacific HR Professional Services Company Market Share

Asia Pacific HR Professional Services Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia Pacific HR professional services market, offering invaluable insights for businesses operating within or seeking to enter this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report projects market trends through 2033, leveraging data from the historical period (2019-2024). The report analyzes market size, growth drivers, challenges, and competitive dynamics, providing actionable intelligence to help you make informed strategic decisions. The total market value is projected to reach xx Million by 2033.

Asia Pacific HR Professional Services Market Structure & Competitive Dynamics

The Asia Pacific HR professional services market exhibits a moderately concentrated structure, with several multinational giants and a plethora of regional players vying for market share. Top players such as Adecco Group, Randstad, ManpowerGroup, Kelly Services, Hays, Robert Half, Allegis Group, Hudson, Michael Page, and Mercer dominate the landscape, influencing market trends and competitive dynamics. Market concentration is estimated at xx%, with the top five players collectively holding approximately xx Million in revenue in 2025. Innovation ecosystems are vibrant, with significant investment in HR technology driving advancements in areas such as recruitment automation, talent management, and employee engagement platforms. The regulatory framework varies across countries, influencing compliance costs and business strategies. Product substitutes, such as in-house HR teams and freelance platforms, pose a competitive challenge, particularly for smaller firms. End-user trends reflect increasing demand for specialized services, data-driven insights, and flexible staffing solutions. M&A activity has been robust in recent years, with deal values exceeding xx Million in the last five years. Key M&A activities include:

- Strategic acquisitions to expand service offerings and geographic reach.

- Consolidation among smaller firms to gain scale and efficiency.

- Investments in technology companies to enhance capabilities.

Asia Pacific HR Professional Services Industry Trends & Insights

The Asia Pacific HR professional services market is experiencing robust growth, fueled by a confluence of factors. While precise CAGR projections require further specification of the forecast period (e.g., 2025-2033), the market is undeniably expanding due to the increasing adoption of sophisticated HR technologies, a surge in demand for specialized talent across diverse sectors, escalating labor costs, and a heightened focus on optimizing employee experience. This evolution is significantly shaped by technological advancements. AI-powered recruitment tools, data analytics platforms, and other innovative solutions are streamlining HR processes, improving efficiency, and enabling more data-driven decision-making. Furthermore, evolving consumer preferences are driving demand for flexible and customized HR solutions, emphasizing personalized talent acquisition and development programs tailored to individual needs and organizational goals. This trend contributes to the anticipated increase in HR technology market penetration. The competitive landscape remains dynamic, with organizations investing heavily in innovation and service differentiation to secure a competitive edge in this rapidly evolving market. The increasing sophistication of client needs, coupled with technological advancements and shifting business priorities, further accelerates market growth. Specific quantifiable data on CAGR and market penetration would strengthen this analysis.

Dominant Markets & Segments in Asia Pacific HR Professional Services

Within the Asia Pacific region, China, India, and Australia are the leading markets for HR professional services. These markets are characterized by rapid economic growth, a large and growing workforce, and increasing investments in human capital.

- China: Key drivers include rapid economic expansion, significant foreign direct investment, and a growing demand for skilled professionals across various sectors.

- India: A large and young workforce, coupled with a burgeoning IT sector, fuels the demand for recruitment and talent management services.

- Australia: A robust economy, coupled with favorable government policies supporting skills development, drives demand.

Detailed dominance analysis reveals that the recruitment segment holds the largest market share, followed by talent management and HR consulting. This is attributed to the persistent need for efficient talent acquisition and the growing complexity of managing a diverse and dispersed workforce.

Asia Pacific HR Professional Services Product Innovations

The HR professional services landscape is undergoing a significant transformation driven by cutting-edge innovations. AI-driven recruitment platforms are optimizing candidate selection processes, predictive analytics enhance talent management strategies, and virtual reality training solutions are creating immersive and engaging learning experiences for employees. The integration of big data and machine learning is refining talent acquisition, improving workforce planning accuracy, and empowering organizations to make more strategic and data-driven HR decisions. Specific examples of innovative solutions and their impact on key HR metrics would further strengthen this section.

Report Segmentation & Scope

This report provides a comprehensive segmentation of the Asia Pacific HR professional services market, analyzing key aspects such as service type (Recruitment, Talent Management, HR Consulting, Payroll & Benefits Administration), organization size (Small and Medium Enterprises (SMEs), Large Enterprises), industry (IT, BFSI, Healthcare, Manufacturing, Retail, and others), and country-specific variations. The report delivers detailed growth projections, market sizing, and competitive landscape analysis for each segment, highlighting the diverse needs and opportunities within each vertical. The varying growth rates across segments are influenced by economic conditions, technological advancements, and regulatory changes within their respective industries and geographic locations. A brief overview of key findings for each segment would improve reader understanding.

Key Drivers of Asia Pacific HR Professional Services Growth

The growth of the Asia Pacific HR professional services market is propelled by several key factors, including:

- Technological advancements: AI, machine learning, and big data analytics are transforming HR practices, increasing efficiency and enabling data-driven decisions.

- Economic growth: The expanding economies of several Asian countries drive demand for skilled professionals and HR services.

- Regulatory changes: New labor laws and compliance requirements create a need for specialized HR expertise.

- Globalization: Increased international trade and investment create demand for cross-border HR solutions.

Challenges in the Asia Pacific HR Professional Services Sector

The Asia Pacific HR professional services sector faces several significant challenges:

- Intense Competition: The market is characterized by a large number of players, including established multinational corporations and agile newcomers, creating a highly competitive environment.

- Regulatory Complexities: Navigating the diverse and often complex labor laws across the Asia-Pacific region presents significant compliance challenges and increases operational costs.

- Talent Scarcity: A persistent shortage of skilled HR professionals, particularly those with specialized expertise in emerging technologies, limits the industry's capacity to meet the growing demand. This talent scarcity drives up salaries, impacting service costs.

- Economic Fluctuations: Economic downturns and regional economic disparities can significantly impact demand for HR services, creating volatility in the market.

- Data Privacy and Security: Increasingly stringent data privacy regulations necessitate robust security measures and compliance frameworks, adding to operational complexity and costs.

Leading Players in the Asia Pacific HR Professional Services Market

Key Developments in Asia Pacific HR Professional Services Sector

- July 2023: Kelly Services announced a strategic restructuring to enhance efficiency and effectiveness, impacting its operational model and market positioning.

- May 2024: ManpowerGroup's return as a Platinum Partner at VivaTech underscores its commitment to the tech sector and signifies its strategic focus on innovation.

Strategic Asia Pacific HR Professional Services Market Outlook

The Asia Pacific HR professional services market is poised for continued growth, driven by technological innovation, economic expansion, and evolving workforce dynamics. Strategic opportunities exist for companies that can leverage technology to deliver efficient and customized solutions, adapt to changing regulatory landscapes, and effectively manage talent acquisition and retention challenges. Focusing on specialized niche markets and delivering data-driven insights will provide a competitive advantage in this rapidly growing market. Investment in technology and strategic partnerships will be crucial for success in this evolving landscape.

Asia Pacific HR Professional Services Segmentation

-

1. Provider Type

- 1.1. Consulting Companies

- 1.2. Software-as-a-Service Providers Companies

-

2. Function Type

- 2.1. Recruitment and Talent Acquisition

- 2.2. Benefits and Claims Management

- 2.3. Workforce Planning and Analytics

- 2.4. Payroll And Compensation Management

- 2.5. Other Functions

-

3. End-user Industry

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. IT & Telecom

- 3.4. Manufacturing

- 3.5. Retail

- 3.6. Government

- 3.7. Other Industries

-

4. Geography

-

4.1. Asia-Pacific

- 4.1.1. China

- 4.1.2. India

- 4.1.3. Japan

- 4.1.4. Australia

- 4.1.5. Rest of Asia-Pacific

-

4.1. Asia-Pacific

Asia Pacific HR Professional Services Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. Australia

- 1.5. Rest of Asia Pacific

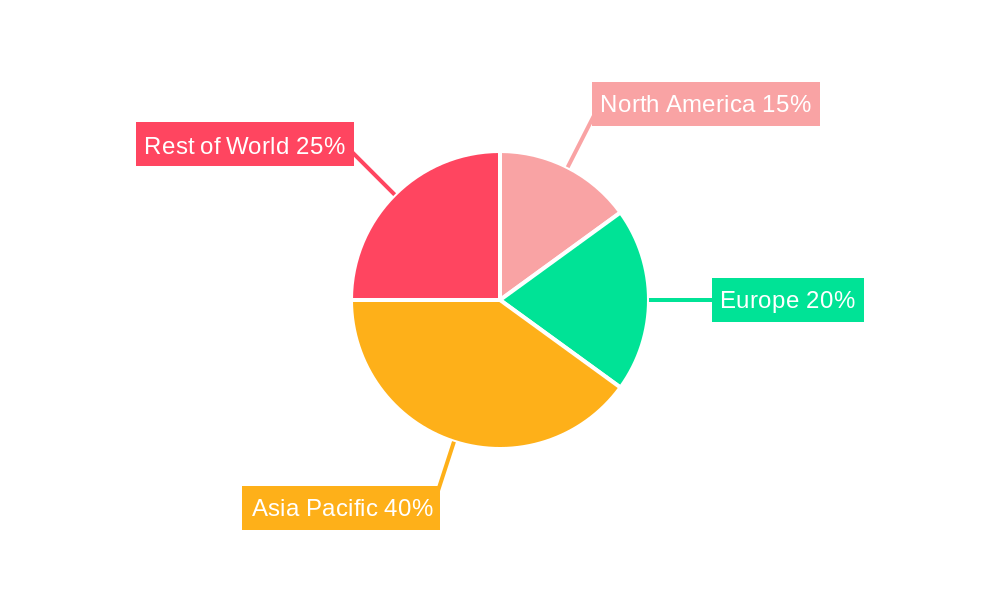

Asia Pacific HR Professional Services Regional Market Share

Geographic Coverage of Asia Pacific HR Professional Services

Asia Pacific HR Professional Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Focus on Talent Acquisition and Retention; Adoption of Technology is Driving Demand for HR Services

- 3.3. Market Restrains

- 3.3.1. Growing Focus on Talent Acquisition and Retention; Adoption of Technology is Driving Demand for HR Services

- 3.4. Market Trends

- 3.4.1. Recruitment and Talent Acquisition is the Largest Segment in the Market Studied

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia Pacific HR Professional Services Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Provider Type

- 5.1.1. Consulting Companies

- 5.1.2. Software-as-a-Service Providers Companies

- 5.2. Market Analysis, Insights and Forecast - by Function Type

- 5.2.1. Recruitment and Talent Acquisition

- 5.2.2. Benefits and Claims Management

- 5.2.3. Workforce Planning and Analytics

- 5.2.4. Payroll And Compensation Management

- 5.2.5. Other Functions

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. IT & Telecom

- 5.3.4. Manufacturing

- 5.3.5. Retail

- 5.3.6. Government

- 5.3.7. Other Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Asia-Pacific

- 5.4.1.1. China

- 5.4.1.2. India

- 5.4.1.3. Japan

- 5.4.1.4. Australia

- 5.4.1.5. Rest of Asia-Pacific

- 5.4.1. Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Provider Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Adecco Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Randstad

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ManpowerGroup

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kelly Services

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hays

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Robert Half

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Allegis Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hudson

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Michael Page

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mercer

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Adecco Group

List of Figures

- Figure 1: Global Asia Pacific HR Professional Services Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Asia Pacific HR Professional Services Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by Provider Type 2025 & 2033

- Figure 4: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by Provider Type 2025 & 2033

- Figure 5: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by Provider Type 2025 & 2033

- Figure 6: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by Provider Type 2025 & 2033

- Figure 7: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by Function Type 2025 & 2033

- Figure 8: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by Function Type 2025 & 2033

- Figure 9: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by Function Type 2025 & 2033

- Figure 10: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by Function Type 2025 & 2033

- Figure 11: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by End-user Industry 2025 & 2033

- Figure 12: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by End-user Industry 2025 & 2033

- Figure 13: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by Geography 2025 & 2033

- Figure 16: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by Geography 2025 & 2033

- Figure 17: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by Geography 2025 & 2033

- Figure 19: Asia Pacific Asia Pacific HR Professional Services Revenue (Million), by Country 2025 & 2033

- Figure 20: Asia Pacific Asia Pacific HR Professional Services Volume (Billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Asia Pacific HR Professional Services Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Asia Pacific HR Professional Services Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 2: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 3: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Function Type 2020 & 2033

- Table 4: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Function Type 2020 & 2033

- Table 5: Global Asia Pacific HR Professional Services Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Asia Pacific HR Professional Services Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Geography 2020 & 2033

- Table 9: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Provider Type 2020 & 2033

- Table 12: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Provider Type 2020 & 2033

- Table 13: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Function Type 2020 & 2033

- Table 14: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Function Type 2020 & 2033

- Table 15: Global Asia Pacific HR Professional Services Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Asia Pacific HR Professional Services Volume Billion Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Geography 2020 & 2033

- Table 19: Global Asia Pacific HR Professional Services Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Asia Pacific HR Professional Services Volume Billion Forecast, by Country 2020 & 2033

- Table 21: China Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: China Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: India Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Australia Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Asia Pacific HR Professional Services Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Asia Pacific HR Professional Services Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific HR Professional Services?

The projected CAGR is approximately 8.63%.

2. Which companies are prominent players in the Asia Pacific HR Professional Services?

Key companies in the market include Adecco Group, Randstad, ManpowerGroup, Kelly Services, Hays, Robert Half, Allegis Group, Hudson, Michael Page, Mercer.

3. What are the main segments of the Asia Pacific HR Professional Services?

The market segments include Provider Type, Function Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 123.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Focus on Talent Acquisition and Retention; Adoption of Technology is Driving Demand for HR Services.

6. What are the notable trends driving market growth?

Recruitment and Talent Acquisition is the Largest Segment in the Market Studied.

7. Are there any restraints impacting market growth?

Growing Focus on Talent Acquisition and Retention; Adoption of Technology is Driving Demand for HR Services.

8. Can you provide examples of recent developments in the market?

May 2024: ManpowerGroup is set to reaffirm its status as a critical contributor to the 8th edition of Europe's largest startup and tech event, VivaTech, by returning as a Platinum Partner.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific HR Professional Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific HR Professional Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific HR Professional Services?

To stay informed about further developments, trends, and reports in the Asia Pacific HR Professional Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence