Key Insights

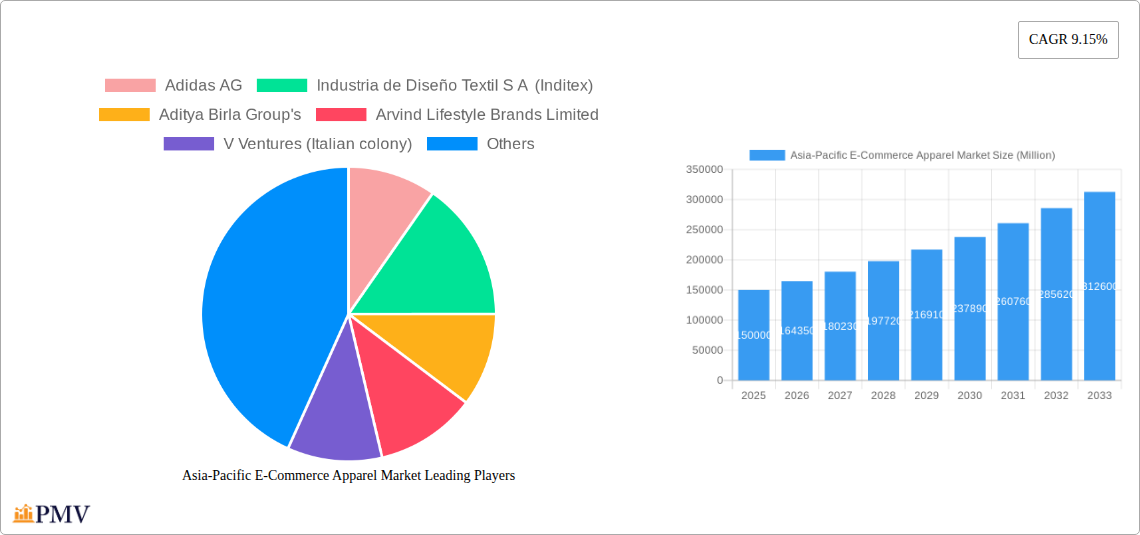

The Asia-Pacific e-commerce apparel market is poised for substantial expansion, driven by increasing internet and smartphone adoption, a growing middle class with enhanced purchasing power, and a clear consumer preference for online shopping convenience. The market, valued at approximately $779.3 billion in 2025, is projected to achieve a Compound Annual Growth Rate (CAGR) of 9.15% between 2025 and 2033. Key growth catalysts include the rising popularity of online marketplaces and social commerce, the widespread adoption of mobile e-commerce, and a growing demand for personalized shopping experiences. The region's diverse demographics and varied fashion preferences further contribute to market dynamism. Leading companies such as Adidas, Inditex, and Nike are capitalizing on technological innovations like AI-driven recommendations and virtual try-on solutions to boost customer engagement and sales. However, challenges persist, including uneven internet infrastructure in select areas, concerns regarding online security and fraud, and the complexities of cross-border logistics and returns, which may impede market growth.

Asia-Pacific E-Commerce Apparel Market Market Size (In Billion)

Market segmentation by product type (formal wear, casual wear, sportswear), end-user (men, women, children), and platform (third-party retailers, direct-to-consumer websites) highlights diverse market needs, offering specialized opportunities for niche players.

Asia-Pacific E-Commerce Apparel Market Company Market Share

Significant growth is anticipated in markets like China, India, and South Korea, characterized by high online retail penetration and a young, fashion-aware demographic. The competitive environment is fragmented, featuring both global leaders and local brands competing for market share. Effective strategies will necessitate an understanding of regional fashion trends, localized marketing approaches, and adaptability to evolving online consumer demands. To optimize growth, brands are prioritizing omnichannel strategies, robust logistics, and superior customer service to cultivate trust and loyalty in this increasingly competitive online apparel landscape. Investment in advanced data analytics and personalized marketing is also becoming crucial for success in this dynamic sector.

Asia-Pacific E-Commerce Apparel Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific e-commerce apparel market, offering invaluable insights for businesses, investors, and stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive data from the historical period (2019-2024) to project future market trends and opportunities. The report covers key segments including product type (formal wear, casual wear, sportswear, nightwear, other types), end-user (men, women, kids/children), and platform type (third-party retailer, company's own website). Leading players such as Adidas AG, Inditex, Aditya Birla Group, and Nike Inc. are analyzed in detail.

Asia-Pacific E-Commerce Apparel Market Market Structure & Competitive Dynamics

The Asia-Pacific e-commerce apparel market exhibits a dynamic competitive landscape characterized by a mix of established global players and burgeoning local brands. Market concentration is moderate, with a few dominant players holding significant market share, but a large number of smaller players also contributing significantly. Innovation ecosystems are vibrant, particularly in countries like China, India, and South Korea, driven by technological advancements and entrepreneurial activity. Regulatory frameworks vary across the region, impacting market access and operations. Product substitutes, such as secondhand clothing platforms and rental services, are gaining traction, challenging traditional apparel businesses. End-user trends are shifting towards personalized experiences, sustainable products, and increased demand for digitally native brands. M&A activity is frequent, with deal values reaching xx Million in recent years, reflecting consolidation efforts and expansion strategies of major players.

- Market Share: The top five players account for approximately xx% of the market share.

- M&A Activity: Significant M&A deals in the past five years have focused on expanding online presence and acquiring smaller, niche brands, with average deal values exceeding xx Million.

- Regulatory Landscape: Varying regulations across the region regarding data privacy, e-commerce taxation, and product labeling influence market dynamics.

Asia-Pacific E-Commerce Apparel Market Industry Trends & Insights

The Asia-Pacific e-commerce apparel market is experiencing robust growth, driven by several key factors. The rising adoption of smartphones and internet penetration in developing economies is fueling e-commerce expansion. Changing consumer preferences, particularly amongst millennials and Gen Z, favoring online shopping for convenience and diverse product offerings, significantly impact growth. Technological disruptions, including advancements in AI-powered personalization, augmented reality (AR) for virtual try-ons, and seamless omnichannel integration, are transforming the industry. The market is witnessing a shift towards sustainable and ethically sourced apparel, increasing demand for eco-friendly and transparent brands. The CAGR for the market during the forecast period is projected to be xx%, driven by increased disposable income, evolving fashion trends, and expanding logistics infrastructure. Market penetration continues to grow, particularly in rural areas, as access to affordable internet and e-commerce platforms widens. Competitive dynamics are intensifying with established brands facing increased pressure from digitally native brands and fast fashion retailers, leading to innovative marketing strategies and pricing models.

Dominant Markets & Segments in Asia-Pacific E-Commerce Apparel Market

China remains the dominant market in the Asia-Pacific e-commerce apparel sector, followed by India and Japan. The casual wear segment is the largest by product type, reflecting the region’s preference for relaxed and comfortable clothing. Women’s apparel dominates the end-user segment, while third-party retailers hold a larger share of the platform type market compared to company-owned websites.

- Key Drivers for China:

- Strong economic growth

- High internet and smartphone penetration

- Well-developed e-commerce infrastructure

- Large and fashion-conscious population.

- Key Drivers for India:

- Rapidly expanding middle class

- Increasing internet and smartphone usage

- Government initiatives promoting digital economy

- Rising popularity of online fashion brands.

- Dominant Segments: The analysis indicates that the Casual Wear segment holds the largest market share, driven by high consumer demand and diverse product offerings. The Women's segment in the end-user category leads due to higher online purchasing habits and wider product choices. Third-Party Retailers dominate the platform type segment due to their extensive reach and established logistics networks.

Asia-Pacific E-Commerce Apparel Market Product Innovations

The Asia-Pacific e-commerce apparel market is characterized by continuous product innovation, driven by technological advancements and changing consumer preferences. We see a rise in personalized clothing designs using AI and 3D body scanning, virtual try-on technology using augmented reality, and sustainable materials like recycled fabrics and organic cotton. These innovations are enhancing the customer experience and catering to the growing demand for sustainable and personalized apparel. Brands are focusing on developing innovative product features to gain a competitive advantage, such as smart clothing with integrated technology and customizable apparel.

Report Segmentation & Scope

This report provides detailed segmentation of the Asia-Pacific e-commerce apparel market based on product type, end-user, and platform type. Each segment is analyzed in detail, providing insights into growth projections, market size, and competitive dynamics.

- Product Type: Formal Wear, Casual Wear, Sportswear, Nightwear, Other Types (xx Million, xx Million, xx Million, xx Million, xx Million)

- End User: Men, Women, Kids/Children (xx Million, xx Million, xx Million)

- Platform Type: Third Party Retailer, Company's Own Website (xx Million, xx Million)

Each segment exhibits unique growth trajectories and competitive landscapes, offering valuable insights into potential opportunities and challenges within the overall market.

Key Drivers of Asia-Pacific E-Commerce Apparel Market Growth

Several key factors are driving the growth of the Asia-Pacific e-commerce apparel market. These include: the rapid growth of the middle class and increasing disposable incomes, expanding internet and smartphone penetration across the region, particularly in emerging economies, and the increasing adoption of online shopping as a preferred method of purchasing apparel. Government initiatives promoting digital commerce and improved logistics infrastructure further contribute to market expansion. The rising popularity of social media and influencer marketing is also playing a critical role in shaping consumer preferences and boosting online sales.

Challenges in the Asia-Pacific E-Commerce Apparel Market Sector

Despite its significant growth potential, the Asia-Pacific e-commerce apparel market faces several challenges. These include concerns around counterfeit products, stringent regulations surrounding data privacy and consumer protection, and logistical complexities associated with delivering goods across vast geographical areas with varying infrastructure levels. The high competition, particularly from established international brands and emerging local players, also poses a challenge. Supply chain disruptions and fluctuations in raw material costs can further impact profitability and market stability.

Leading Players in the Asia-Pacific E-Commerce Apparel Market Market

- Adidas AG

- Industria de Diseño Textil S A (Inditex)

- Aditya Birla Group

- Arvind Lifestyle Brands Limited

- V Ventures (Italian colony)

- Forever 21 Inc

- PVH Corp

- Raymond Group

- Hennes & Mauritz AB

- Fast Retailing Co Ltd

- BIBA Fashion Limited

- LVMH Moët Hennessy Louis Vuitton

- Nike Inc

Key Developments in Asia-Pacific E-Commerce Apparel Market Sector

- February 2023: Forever 21 relaunched in Japan as an upscale clothier, aiming for localization and focusing on 80% online sales.

- March 2023: Italian Colony launched its online store in India, offering affordable Italian fashion.

- March 2023: UNIQLO collaborated with Attack on Titan for a new line of t-shirts, featuring custom packaging for online orders.

- May 2023: Alessandro Vittore, a UK-based clothing company, announced its plans to enter the Indian market.

These developments highlight the dynamic nature of the market, with brands focusing on market expansion, product innovation, and localized strategies to capture market share.

Strategic Asia-Pacific E-Commerce Apparel Market Market Outlook

The Asia-Pacific e-commerce apparel market is poised for continued robust growth, driven by sustained economic growth, increasing internet penetration, and evolving consumer preferences. Strategic opportunities exist for brands focusing on personalization, sustainability, and technological innovation. Investment in advanced logistics and supply chain management will be crucial to enhance efficiency and meet growing demand. Brands focusing on omnichannel strategies and localized marketing approaches are likely to succeed in this highly competitive landscape. The market presents attractive opportunities for both established international players and agile local brands.

Asia-Pacific E-Commerce Apparel Market Segmentation

-

1. Product Type

- 1.1. Formal Wear

- 1.2. Casual Wear

- 1.3. Sportswear

- 1.4. Nightwear

- 1.5. Other Types

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Kids/Children

-

3. Platform Type

- 3.1. Third Party Retailer

- 3.2. Company's Own Website

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Australia

Asia-Pacific E-Commerce Apparel Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

Asia-Pacific E-Commerce Apparel Market Regional Market Share

Geographic Coverage of Asia-Pacific E-Commerce Apparel Market

Asia-Pacific E-Commerce Apparel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strong Growth of Fashion Marketplaces; Increasing Brand Advertisements on Social Media

- 3.3. Market Restrains

- 3.3.1. Competition from Traditional Brick-and-Mortar Retail

- 3.4. Market Trends

- 3.4.1. Strong Growth of Fashion Marketplaces

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Formal Wear

- 5.1.2. Casual Wear

- 5.1.3. Sportswear

- 5.1.4. Nightwear

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Kids/Children

- 5.3. Market Analysis, Insights and Forecast - by Platform Type

- 5.3.1. Third Party Retailer

- 5.3.2. Company's Own Website

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. Australia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Formal Wear

- 6.1.2. Casual Wear

- 6.1.3. Sportswear

- 6.1.4. Nightwear

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Kids/Children

- 6.3. Market Analysis, Insights and Forecast - by Platform Type

- 6.3.1. Third Party Retailer

- 6.3.2. Company's Own Website

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. Australia

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Japan Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Formal Wear

- 7.1.2. Casual Wear

- 7.1.3. Sportswear

- 7.1.4. Nightwear

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Kids/Children

- 7.3. Market Analysis, Insights and Forecast - by Platform Type

- 7.3.1. Third Party Retailer

- 7.3.2. Company's Own Website

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. Australia

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. India Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Formal Wear

- 8.1.2. Casual Wear

- 8.1.3. Sportswear

- 8.1.4. Nightwear

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Kids/Children

- 8.3. Market Analysis, Insights and Forecast - by Platform Type

- 8.3.1. Third Party Retailer

- 8.3.2. Company's Own Website

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. Australia

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Formal Wear

- 9.1.2. Casual Wear

- 9.1.3. Sportswear

- 9.1.4. Nightwear

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Men

- 9.2.2. Women

- 9.2.3. Kids/Children

- 9.3. Market Analysis, Insights and Forecast - by Platform Type

- 9.3.1. Third Party Retailer

- 9.3.2. Company's Own Website

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. Australia

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Adidas AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Industria de Diseño Textil S A (Inditex)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Aditya Birla Group's

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Arvind Lifestyle Brands Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 V Ventures (Italian colony)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Forever 21 Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 PVH Corp

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Raymond Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hennes & Mauritz AB

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Fast Retailing Co Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 BIBA Fashion Limited

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 LVMH Moët Hennessy Louis Vuitto

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Nike Inc

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Adidas AG

List of Figures

- Figure 1: Asia-Pacific E-Commerce Apparel Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific E-Commerce Apparel Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 4: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 9: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 13: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 14: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 19: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 23: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 24: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific E-Commerce Apparel Market?

The projected CAGR is approximately 9.15%.

2. Which companies are prominent players in the Asia-Pacific E-Commerce Apparel Market?

Key companies in the market include Adidas AG, Industria de Diseño Textil S A (Inditex), Aditya Birla Group's, Arvind Lifestyle Brands Limited, V Ventures (Italian colony), Forever 21 Inc, PVH Corp, Raymond Group, Hennes & Mauritz AB, Fast Retailing Co Ltd, BIBA Fashion Limited, LVMH Moët Hennessy Louis Vuitto, Nike Inc.

3. What are the main segments of the Asia-Pacific E-Commerce Apparel Market?

The market segments include Product Type, End User, Platform Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 779.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Strong Growth of Fashion Marketplaces; Increasing Brand Advertisements on Social Media.

6. What are the notable trends driving market growth?

Strong Growth of Fashion Marketplaces.

7. Are there any restraints impacting market growth?

Competition from Traditional Brick-and-Mortar Retail.

8. Can you provide examples of recent developments in the market?

May 2023: Alessandro Vittore, a United Kingdom-based clothing company, announced its plans to launch the brand in Indian Market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific E-Commerce Apparel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific E-Commerce Apparel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific E-Commerce Apparel Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific E-Commerce Apparel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence