Key Insights

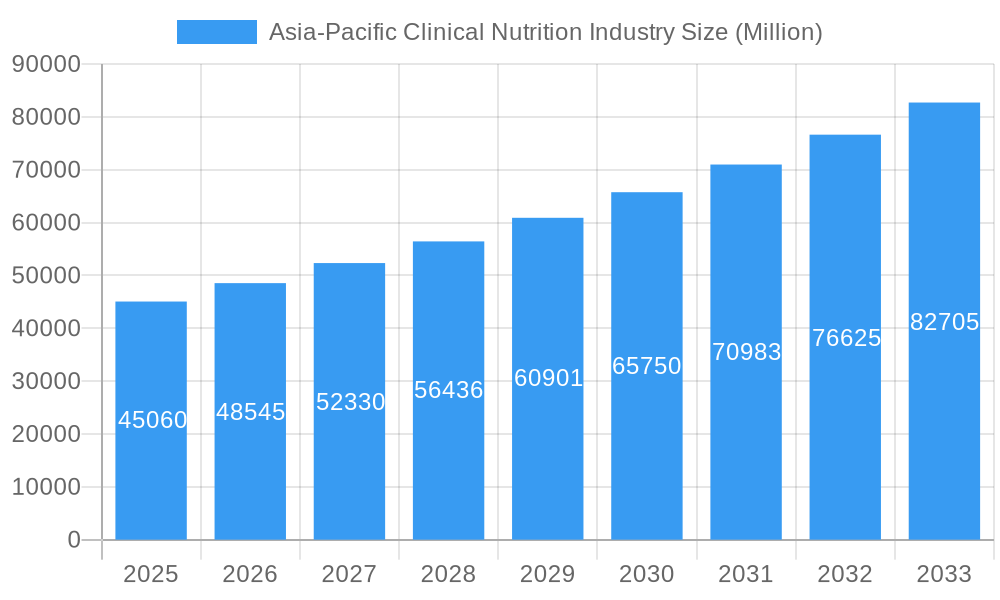

The Asia-Pacific Clinical Nutrition market is poised for significant expansion, projecting a market size of USD 45.06 billion in 2025 and a robust CAGR of 7.9% during the forecast period of 2025-2033. This growth is primarily fueled by increasing awareness of nutritional deficiencies, a rising prevalence of chronic diseases like malnutrition, metabolic disorders, and gastrointestinal issues, and the escalating demand for specialized nutritional support in cancer and neurological conditions. The region's expanding healthcare infrastructure, coupled with a growing elderly population and advancements in medical technology, further stimulates market penetration. Pediatric and adult populations are key consumer segments, with a particular focus on providing tailored nutritional solutions. Oral and enteral routes of administration are expected to dominate due to their cost-effectiveness and ease of use, although parenteral nutrition will see steady growth, especially in critical care settings.

Asia-Pacific Clinical Nutrition Industry Market Size (In Billion)

Geographically, the market is dynamic, with China, India, Japan, Australia, and South Korea leading the charge, driven by their large populations, increasing disposable incomes, and proactive government initiatives in public health and disease management. The "Rest of Asia-Pacific" region also presents substantial untapped potential. Key market players like Nestlé, Abbott, and Fresenius Kabi are heavily investing in research and development, product innovation, and strategic partnerships to capture market share. This competitive landscape fosters the introduction of advanced clinical nutrition products and services, addressing a wider spectrum of patient needs and contributing to improved health outcomes across the Asia-Pacific region. The market's resilience is further underscored by its strategic importance in managing the increasing burden of non-communicable diseases prevalent in these developing economies.

Asia-Pacific Clinical Nutrition Industry Company Market Share

Here's an SEO-optimized, detailed report description for the Asia-Pacific Clinical Nutrition Industry, designed to boost search visibility and engage industry audiences.

Report Title: Asia-Pacific Clinical Nutrition Industry Market Analysis: Growth, Trends, Opportunities & Forecast 2025-2033

Report Description:

Unlock the burgeoning potential of the Asia-Pacific clinical nutrition market, a dynamic sector projected to reach billions by 2033. This comprehensive report provides an in-depth analysis of the clinical nutrition industry in Asia-Pacific, offering critical insights for stakeholders seeking to capitalize on significant growth opportunities. Covering the historical period of 2019–2024 and a robust forecast period from 2025–2033, with a base year of 2025, this study delves into market structure, competitive dynamics, emerging trends, and dominant segments.

Navigate the complexities of clinical nutrition applications, including nutritional support in malnutrition, metabolic disorders, gastrointestinal diseases, neurological diseases, and cancer. Understand the crucial role of different routes of administration, such as oral and enteral nutrition and parenteral nutrition, and their impact on patient outcomes. This report meticulously examines key end-user segments, including pediatric clinical nutrition and adult clinical nutrition, across major geographies like China clinical nutrition market, Japan clinical nutrition market, India clinical nutrition market, Australia clinical nutrition market, South Korea clinical nutrition market, and the broader Rest of Asia-Pacific clinical nutrition.

Discover strategic market outlooks, key growth drivers, and prevailing challenges shaping the Asia-Pacific nutritional support market. Gain unparalleled visibility into the strategies of leading players such as Perrigo Company PLC, Fresenius Kabi, Baxter, Nestlé, Abbott, B Braun Melsungen AG, Mead Johnson, and Nutricia. Essential for manufacturers, distributors, healthcare providers, and investors, this report equips you with the actionable intelligence needed to thrive in this rapidly evolving Asia-Pacific medical nutrition landscape.

Asia-Pacific Clinical Nutrition Industry Market Structure & Competitive Dynamics

The Asia-Pacific clinical nutrition industry exhibits a moderate to high market concentration, with a few key global players dominating significant market share. Innovation ecosystems are rapidly evolving, driven by increasing R&D investments and a growing awareness of the benefits of specialized nutritional interventions. Regulatory frameworks, while diverse across countries, are gradually aligning with international standards, facilitating market access and product approvals. The presence of product substitutes is increasing, particularly from over-the-counter wellness supplements, posing a challenge to dedicated clinical nutrition products. End-user trends are shifting towards personalized nutrition and preventative healthcare, with a rising demand for products tailored to specific medical conditions and life stages. Mergers & Acquisitions (M&A) activities are notable, indicating consolidation and strategic expansion by major companies aiming to broaden their product portfolios and geographic reach. For instance, recent M&A deals in the broader healthcare and food sectors, valued in the billions, highlight the attractiveness of the nutrition segment. Market share analysis reveals that companies with established distribution networks and strong brand recognition in key markets like China and India hold a substantial advantage. The competitive landscape is characterized by both organic growth strategies and inorganic expansion through strategic partnerships and acquisitions, all contributing to a dynamic and competitive market environment.

Asia-Pacific Clinical Nutrition Industry Industry Trends & Insights

The Asia-Pacific clinical nutrition industry is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025–2033). This upward trajectory is primarily fueled by several intersecting trends. Aging populations across the region are leading to a higher prevalence of chronic diseases and malnutrition, thereby increasing the demand for specialized nutritional support. The growing awareness among healthcare professionals and consumers regarding the crucial role of clinical nutrition in disease management, recovery, and improving patient outcomes is a significant growth driver. Technological disruptions, including advancements in product formulation and delivery systems, are enabling more effective and palatable clinical nutrition products. The rise of personalized nutrition is a key trend, with a growing demand for tailored solutions based on individual genetic makeup, lifestyle, and specific health conditions. This is pushing manufacturers to invest in sophisticated research and development.

Consumer preferences are increasingly leaning towards evidence-based nutritional solutions, especially for managing conditions like diabetes, cancer, and gastrointestinal disorders. The increasing penetration of healthcare services and the expansion of hospital infrastructure in emerging economies within Asia-Pacific are also contributing to market expansion. Furthermore, government initiatives aimed at improving public health and reducing the burden of non-communicable diseases are indirectly boosting the clinical nutrition market. The competitive dynamics are intensifying, with both established multinational corporations and emerging local players vying for market share. Strategic collaborations between nutrition companies and healthcare providers are becoming more common, aiming to integrate clinical nutrition seamlessly into patient care pathways. The market is also seeing a rise in the development of foods for special medical purposes (FSMP), catering to a wide spectrum of medical needs. The shift towards home-based healthcare and the increasing acceptance of enteral feeding devices are further propelling market growth. Market penetration for clinical nutrition products, while still lower than in developed Western markets, is steadily increasing, indicating substantial untapped potential. The ongoing focus on preventative healthcare and the rising disposable incomes in many Asia-Pacific nations are creating a fertile ground for sustained market expansion.

Dominant Markets & Segments in Asia-Pacific Clinical Nutrition Industry

The China clinical nutrition market stands out as the dominant region within the Asia-Pacific clinical nutrition industry, driven by its massive population, increasing healthcare expenditure, and rising prevalence of chronic diseases. Economic policies in China that prioritize healthcare development and advancements in medical infrastructure have significantly boosted the demand for clinical nutrition products. Alongside China, India clinical nutrition market is emerging as a rapidly growing segment, fueled by a large patient base, improving healthcare access, and increasing awareness of specialized nutritional needs.

Route of Administration:

- Oral and Enteral Nutrition constitutes the largest segment. Key drivers include its cost-effectiveness, ease of administration, and suitability for a wide range of patients, from those with mild to moderate swallowing difficulties to individuals with gastrointestinal issues. The increasing availability of palatable oral supplements and the growth of home enteral nutrition services are further propelling this segment.

- Parenteral Nutrition follows, crucial for patients unable to absorb nutrients orally or enterally. Drivers include advancements in sterile manufacturing processes and the growing complexity of medical treatments in critical care settings, where parenteral nutrition is often indispensable.

Application:

- Nutritional Support in Malnutrition is a primary application, addressing the widespread issue of undernutrition in various patient populations, including the elderly and those suffering from chronic illnesses. Economic factors, coupled with a growing understanding of the detrimental effects of malnutrition on recovery, drive this segment.

- Nutritional Support in Cancer is a rapidly expanding application. Patients undergoing cancer therapies often experience significant weight loss and malnutrition, necessitating specialized nutritional interventions to improve tolerance to treatment and enhance survival rates.

- Nutritional Support in Gastrointestinal Diseases and Neurological Diseases are also significant contributors. Conditions like Inflammatory Bowel Disease (IBD), Irritable Bowel Syndrome (IBS), stroke, and neurodegenerative diseases often impair nutrient absorption or increase nutritional requirements, driving demand for tailored clinical nutrition.

- Nutritional Support in Metabolic Disorders and Nutritional Support in Other Diseases are growing segments, reflecting the increasing diagnosis of conditions like diabetes and the broader application of clinical nutrition in managing a diverse range of health challenges.

End User:

- Adult Clinical Nutrition represents the largest end-user segment due to the higher prevalence of chronic diseases and malnutrition in the adult population. The aging demographic in many Asia-Pacific countries strongly influences this dominance.

- Pediatric Clinical Nutrition is a critical and growing segment, focusing on addressing growth and developmental issues, prematurity, and specific pediatric illnesses. Innovations in infant formulas and specialized pediatric nutritional products are key drivers.

Geography:

- China dominates due to its vast population and increasing healthcare investments.

- India is a key growth market with its large underserved population and expanding healthcare infrastructure.

- Japan and South Korea represent mature markets with high per capita healthcare spending and a focus on quality of life for aging populations.

- Australia exhibits a developed healthcare system with a strong emphasis on evidence-based nutrition.

- Rest of Asia-Pacific presents varied growth opportunities, from rapidly developing economies to smaller, niche markets.

Asia-Pacific Clinical Nutrition Industry Product Innovations

Product innovations in the Asia-Pacific clinical nutrition industry are increasingly focused on enhancing efficacy, palatability, and patient convenience. Companies are developing advanced formulations for oral and enteral nutrition, featuring improved protein content, specialized micronutrient blends, and fiber enrichment to support gut health. Innovations in parenteral nutrition include novel lipid emulsions and amino acid profiles designed for specific patient needs, such as those with renal or hepatic impairment. The development of foods for special medical purposes (FSMP) tailored for nutritional support in cancer, neurological diseases, and gastrointestinal diseases is a significant trend. These products offer targeted nutritional benefits, aiding in symptom management and treatment adherence. Competitive advantages are being gained through the introduction of products with improved taste profiles, reduced allergenicity, and convenient packaging, catering to diverse end-user preferences, particularly in the pediatric and adult segments across key geographies like China, India, and Australia.

Report Segmentation & Scope

This report provides a granular analysis of the Asia-Pacific clinical nutrition industry, segmented by:

- Route of Administration: The market is divided into Oral and Enteral segments, focusing on products administered orally or via feeding tubes, and Parenteral nutrition, administered intravenously. Growth projections for Oral and Enteral are robust, driven by accessibility and cost-effectiveness, while Parenteral nutrition remains vital for critical care, with market sizes reflecting specialized patient needs.

- Application: Key applications analyzed include Nutritional Support in Malnutrition, Nutritional Support in Metabolic Disorders, Nutritional Support in Gastrointestinal Diseases, Nutritional Support in Neurological Diseases, Nutritional Support in Cancer, and Nutritional Support in Other Diseases. Each segment's market size and growth trajectory are detailed, reflecting the increasing demand for targeted therapies.

- End User: The market is further segmented into Pediatric and Adult end-users, with distinct growth forecasts and competitive dynamics for each, acknowledging the unique nutritional requirements and healthcare needs of these demographics.

- Geography: The report offers in-depth analysis for China, Japan, India, Australia, South Korea, and the Rest of Asia-Pacific. Market sizes and CAGR are projected for each region, highlighting their specific drivers and opportunities within the global clinical nutrition landscape.

Key Drivers of Asia-Pacific Clinical Nutrition Industry Growth

The Asia-Pacific clinical nutrition industry is propelled by several key drivers. Firstly, the rapidly aging population across the region leads to a higher incidence of chronic diseases and malnutrition, significantly increasing the demand for specialized nutritional interventions. Secondly, growing health consciousness and a better understanding of the preventative and therapeutic role of clinical nutrition among consumers and healthcare professionals are driving market penetration. Technological advancements in product formulation and delivery systems are enhancing product efficacy and patient compliance, offering new avenues for growth. Favorable government initiatives aimed at improving healthcare infrastructure and managing non-communicable diseases also play a crucial role. Finally, increasing disposable incomes and a rising middle class in many Asia-Pacific economies are translating into greater expenditure on healthcare and specialized nutritional products.

Challenges in the Asia-Pacific Clinical Nutrition Industry Sector

Despite its growth potential, the Asia-Pacific clinical nutrition industry faces several challenges. Regulatory hurdles and varying approval processes across different countries can delay market entry and increase compliance costs for manufacturers. Supply chain disruptions and the complexities of cold chain logistics for certain nutritional products can impact availability and affordability. Intense competition from both established global players and emerging local brands, often with aggressive pricing strategies, poses a significant challenge. Furthermore, a lack of widespread awareness and understanding of clinical nutrition among some healthcare providers and the general public, particularly in less developed regions, can hinder market adoption. The high cost of specialized clinical nutrition products can also be a barrier to access for a significant portion of the population in price-sensitive markets.

Leading Players in the Asia-Pacific Clinical Nutrition Industry Market

- Perrigo Company PLC

- Fresenius Kabi

- Baxter

- Nestlé

- Abbott

- B Braun Melsungen AG

- Mead Johnson

- Nutricia

Key Developments in Asia-Pacific Clinical Nutrition Industry Sector

- September 2022: H&H Group-owned Swisse, Australia's leading health, wellness, and beauty nutrition company, launched three new products in India, namely SwisseMe Melatonin Gummies, Biotin Gummies, and Plant Protein Powder. This expansion into the Indian market highlights a strategic focus on emerging economies and diversified product offerings.

- July 2022: Nestlé launched China's first Foods for Special Medical Purpose (FSMP) for patients suffering from tumor-related conditions after going through a five-year-long approval process from the Chinese regulator. This signifies a major step in bringing specialized, regulated medical nutrition solutions to the Chinese market and demonstrates Nestlé's commitment to addressing critical unmet medical needs.

Strategic Asia-Pacific Clinical Nutrition Industry Market Outlook

The strategic market outlook for the Asia-Pacific clinical nutrition industry is exceptionally promising, driven by sustained demand for specialized nutritional solutions across diverse applications and end-user segments. Growth accelerators include the continued expansion of healthcare infrastructure in emerging economies, the increasing focus on personalized nutrition, and advancements in product innovation catering to specific medical conditions. Strategic opportunities lie in capitalizing on the burgeoning pediatric clinical nutrition market and addressing the nutritional needs of the rapidly growing adult population, particularly those with cancer and gastrointestinal diseases. Companies that focus on robust R&D, strategic partnerships with healthcare providers, and localized market penetration strategies, especially in high-growth regions like India and China, are poised for significant market share gains and long-term success in this evolving Asia-Pacific medical nutrition landscape.

Asia-Pacific Clinical Nutrition Industry Segmentation

-

1. Route of Administration

- 1.1. Oral and Enteral

- 1.2. Parenteral

-

2. Application

- 2.1. Nutritional Support in Malnutrition

- 2.2. Nutritional Support in Metabolic Disorders

- 2.3. Nutritional Support in Gastrointestinal Diseases

- 2.4. Nutritional Support in Neurological Diseases

- 2.5. Nutritional Support in Cancer

- 2.6. Nutritional Support in Other Diseases

-

3. End User

- 3.1. Pediatric

- 3.2. Adult

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Australia

- 4.5. South Korea

- 4.6. Rest of Asia-Pacific

Asia-Pacific Clinical Nutrition Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. South Korea

- 6. Rest of Asia Pacific

Asia-Pacific Clinical Nutrition Industry Regional Market Share

Geographic Coverage of Asia-Pacific Clinical Nutrition Industry

Asia-Pacific Clinical Nutrition Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Metabolic Disorders; Increase in Geriatric Population in the Asia-Pacific Region; High Spending on Healthcare Along with Rise of Middle-class in Emerging Economies

- 3.3. Market Restrains

- 3.3.1. Unwillingness of Hospitals and In-house Pharmacies/Dispensaries to Maintain the Required Stock of Clinical Nutrition Products; Heterogeneous Nature Of Government Coverage/Reimbursement Across Countries

- 3.4. Market Trends

- 3.4.1. Oral and Enternal Segment is Expected to Hold a Significant Market Share in the Asia-Pacific Clinical Nutrition Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Clinical Nutrition Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 5.1.1. Oral and Enteral

- 5.1.2. Parenteral

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Nutritional Support in Malnutrition

- 5.2.2. Nutritional Support in Metabolic Disorders

- 5.2.3. Nutritional Support in Gastrointestinal Diseases

- 5.2.4. Nutritional Support in Neurological Diseases

- 5.2.5. Nutritional Support in Cancer

- 5.2.6. Nutritional Support in Other Diseases

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Pediatric

- 5.3.2. Adult

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. South Korea

- 5.4.6. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. Australia

- 5.5.5. South Korea

- 5.5.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 6. China Asia-Pacific Clinical Nutrition Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Route of Administration

- 6.1.1. Oral and Enteral

- 6.1.2. Parenteral

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Nutritional Support in Malnutrition

- 6.2.2. Nutritional Support in Metabolic Disorders

- 6.2.3. Nutritional Support in Gastrointestinal Diseases

- 6.2.4. Nutritional Support in Neurological Diseases

- 6.2.5. Nutritional Support in Cancer

- 6.2.6. Nutritional Support in Other Diseases

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Pediatric

- 6.3.2. Adult

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. Australia

- 6.4.5. South Korea

- 6.4.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Route of Administration

- 7. Japan Asia-Pacific Clinical Nutrition Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Route of Administration

- 7.1.1. Oral and Enteral

- 7.1.2. Parenteral

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Nutritional Support in Malnutrition

- 7.2.2. Nutritional Support in Metabolic Disorders

- 7.2.3. Nutritional Support in Gastrointestinal Diseases

- 7.2.4. Nutritional Support in Neurological Diseases

- 7.2.5. Nutritional Support in Cancer

- 7.2.6. Nutritional Support in Other Diseases

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Pediatric

- 7.3.2. Adult

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. Australia

- 7.4.5. South Korea

- 7.4.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Route of Administration

- 8. India Asia-Pacific Clinical Nutrition Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Route of Administration

- 8.1.1. Oral and Enteral

- 8.1.2. Parenteral

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Nutritional Support in Malnutrition

- 8.2.2. Nutritional Support in Metabolic Disorders

- 8.2.3. Nutritional Support in Gastrointestinal Diseases

- 8.2.4. Nutritional Support in Neurological Diseases

- 8.2.5. Nutritional Support in Cancer

- 8.2.6. Nutritional Support in Other Diseases

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Pediatric

- 8.3.2. Adult

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. Australia

- 8.4.5. South Korea

- 8.4.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Route of Administration

- 9. Australia Asia-Pacific Clinical Nutrition Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Route of Administration

- 9.1.1. Oral and Enteral

- 9.1.2. Parenteral

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Nutritional Support in Malnutrition

- 9.2.2. Nutritional Support in Metabolic Disorders

- 9.2.3. Nutritional Support in Gastrointestinal Diseases

- 9.2.4. Nutritional Support in Neurological Diseases

- 9.2.5. Nutritional Support in Cancer

- 9.2.6. Nutritional Support in Other Diseases

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Pediatric

- 9.3.2. Adult

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. Australia

- 9.4.5. South Korea

- 9.4.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Route of Administration

- 10. South Korea Asia-Pacific Clinical Nutrition Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Route of Administration

- 10.1.1. Oral and Enteral

- 10.1.2. Parenteral

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Nutritional Support in Malnutrition

- 10.2.2. Nutritional Support in Metabolic Disorders

- 10.2.3. Nutritional Support in Gastrointestinal Diseases

- 10.2.4. Nutritional Support in Neurological Diseases

- 10.2.5. Nutritional Support in Cancer

- 10.2.6. Nutritional Support in Other Diseases

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Pediatric

- 10.3.2. Adult

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. Japan

- 10.4.3. India

- 10.4.4. Australia

- 10.4.5. South Korea

- 10.4.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Route of Administration

- 11. Rest of Asia Pacific Asia-Pacific Clinical Nutrition Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Route of Administration

- 11.1.1. Oral and Enteral

- 11.1.2. Parenteral

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Nutritional Support in Malnutrition

- 11.2.2. Nutritional Support in Metabolic Disorders

- 11.2.3. Nutritional Support in Gastrointestinal Diseases

- 11.2.4. Nutritional Support in Neurological Diseases

- 11.2.5. Nutritional Support in Cancer

- 11.2.6. Nutritional Support in Other Diseases

- 11.3. Market Analysis, Insights and Forecast - by End User

- 11.3.1. Pediatric

- 11.3.2. Adult

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. China

- 11.4.2. Japan

- 11.4.3. India

- 11.4.4. Australia

- 11.4.5. South Korea

- 11.4.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Route of Administration

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Perrigo Company PLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Fresenius Kabi

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Baxter

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Nestlé

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Abbott

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 B Braun Melsungen AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Mead Johnson

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Nutricia

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Perrigo Company PLC

List of Figures

- Figure 1: Asia-Pacific Clinical Nutrition Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Clinical Nutrition Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Route of Administration 2020 & 2033

- Table 2: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 3: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 9: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 10: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Route of Administration 2020 & 2033

- Table 12: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 13: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 16: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 17: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 18: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 19: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Route of Administration 2020 & 2033

- Table 22: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 23: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 24: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 25: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 26: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 27: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Route of Administration 2020 & 2033

- Table 32: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 33: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 34: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 35: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 36: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 37: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 38: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Route of Administration 2020 & 2033

- Table 42: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 43: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 44: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 45: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 46: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 47: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 48: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 49: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 50: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Route of Administration 2020 & 2033

- Table 52: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 53: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 54: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 55: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 56: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 57: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 58: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 59: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Route of Administration 2020 & 2033

- Table 62: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 63: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 64: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 65: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 66: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 67: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 68: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 69: Asia-Pacific Clinical Nutrition Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 70: Asia-Pacific Clinical Nutrition Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Clinical Nutrition Industry?

The projected CAGR is approximately 7.9%.

2. Which companies are prominent players in the Asia-Pacific Clinical Nutrition Industry?

Key companies in the market include Perrigo Company PLC, Fresenius Kabi, Baxter, Nestlé, Abbott, B Braun Melsungen AG, Mead Johnson, Nutricia.

3. What are the main segments of the Asia-Pacific Clinical Nutrition Industry?

The market segments include Route of Administration, Application, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Metabolic Disorders; Increase in Geriatric Population in the Asia-Pacific Region; High Spending on Healthcare Along with Rise of Middle-class in Emerging Economies.

6. What are the notable trends driving market growth?

Oral and Enternal Segment is Expected to Hold a Significant Market Share in the Asia-Pacific Clinical Nutrition Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

Unwillingness of Hospitals and In-house Pharmacies/Dispensaries to Maintain the Required Stock of Clinical Nutrition Products; Heterogeneous Nature Of Government Coverage/Reimbursement Across Countries.

8. Can you provide examples of recent developments in the market?

September 2022: H&H Group-owned Swisse, Australia's leading health, wellness, and beauty nutrition company, launched three new products in India, namely SwisseMe Melatonin Gummies, Biotin Gummies, and Plant Protein Powder.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Clinical Nutrition Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Clinical Nutrition Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Clinical Nutrition Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Clinical Nutrition Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence